Market Overview:

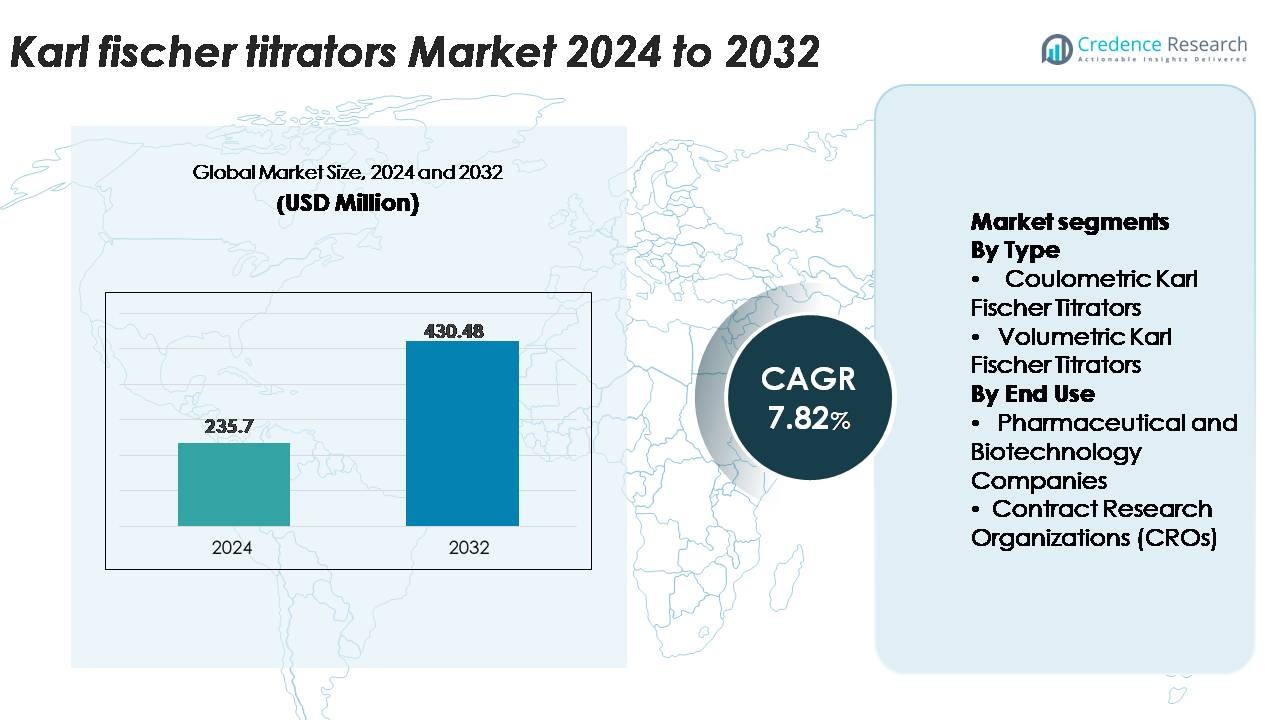

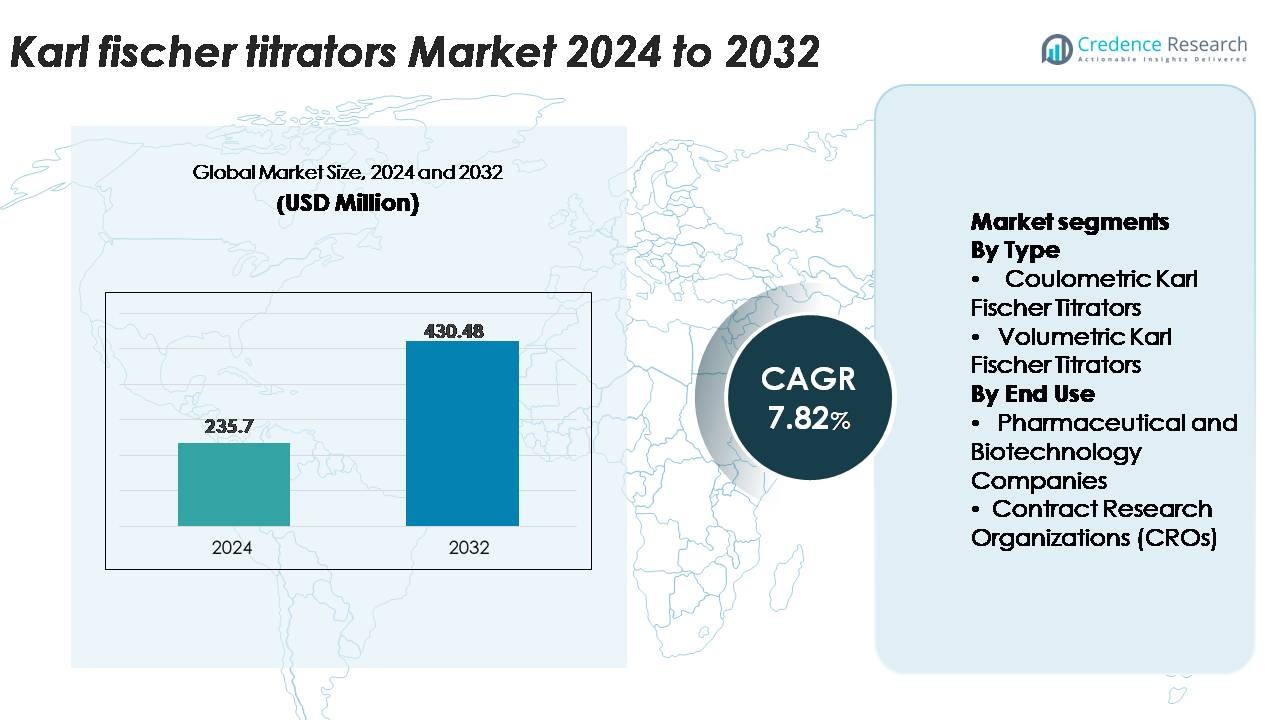

The global Karl Fischer Titrators Market was valued at USD 235.7 million in 2024 and is projected to reach USD 430.48 million by 2032, expanding at a CAGR of 7.82% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Karl Fischer Titrators Market Size 2024 |

USD 235.7 Million |

| Karl Fischer Titrators Market, CAGR |

7.82% |

| Karl Fischer Titrators Market Size 2032 |

USD 430.48 Million |

The Karl Fischer titrators market is shaped by leading analytical instrument manufacturers such as Thermo Fisher, METTLER TOLEDO, HACH, Xylem, HANNA Instruments, Hanon, HIRANUMA, Infitek, Koehler Instrument Company, and Kyoto Electronics Manufacturing, each offering advanced coulometric and volumetric systems tailored for high-precision moisture analysis. These companies compete through innovations in automation, reagent management, and compliance-ready software. North America emerges as the dominant regional market, holding an estimated 32% share, driven by stringent regulatory standards, strong pharmaceutical manufacturing, and extensive adoption of high-accuracy analytical technologies across quality-control environments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Karl Fischer titrators market reached USD 235.7 million in 2024 and is projected to hit USD 430.48 million by 2032, registering a 7.82% CAGR, supported by expanding demand for precise moisture analysis across critical industries.

- Rising regulatory pressure in pharmaceuticals, specialty chemicals, and food testing continues to drive adoption, with coulometric titrators holding the largest segment share due to their high sensitivity for low-moisture samples.

- Market trends highlight rapid automation, hybrid KF platforms, and increasing usage in emerging sectors such as battery materials and biologics, enhancing accuracy, throughput, and compliance.

- Competitive activity intensifies as Thermo Fisher, METTLER TOLEDO, Kyoto Electronics, HIRANUMA, and Xylem expand product capabilities, while cost of maintenance and operator skill requirements remain key restraints affecting smaller laboratories.

- Regionally, North America leads with 32%, followed by Europe at 28% and Asia-Pacific at 26%, supported by strong QC infrastructure and rising manufacturing of moisture-sensitive products.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

Coulometric Karl Fischer titrators represent the dominant segment, accounting for the largest market share due to their superior sensitivity in detecting trace-level moisture, often down to 1 µg H₂O, making them indispensable for high-purity chemicals, pharmaceuticals, and battery materials. Their compact design, lower reagent consumption, and rapid analysis cycles drive strong adoption in laboratories handling low-moisture samples. Volumetric titrators continue to expand in applications requiring higher moisture quantification, but the shift toward ultra-low water content testing in advanced manufacturing reinforces the leadership of coulometric systems across global quality-control environments.

- For instance, METTLER TOLEDO’s C30S Coulometric KF Titrator achieves a detection resolution of 1 µg H₂O and has a low background drift value (typically <2 µg/min) to enable precise moisture analysis in semiconductor and electrolyte materials.

By End Use

Pharmaceutical and biotechnology companies hold the dominant market share, driven by stringent water-content specifications in APIs, biologics, excipients, and lyophilized formulations. Regulatory frameworks such as USP <921> and ICH guidelines reinforce the need for precise Karl Fischer methods, prompting high installation rates in GMP-compliant analytical labs. Contract research organizations (CROs) show accelerating adoption as outsourcing of stability studies, formulation analytics, and method validation increases. However, the extensive in-house QC infrastructure and continuous batch-release testing requirements in pharma and biotech facilities ensure their sustained leadership in overall Karl Fischer titrator utilization.

- For instance, METTLER TOLEDO’s Karl Fischer Excellence line integrates the Stromboli Oven Sample Processor, which supports temperature ramps up to 300 °C with a controlled heating accuracy of \(\pm 3~^{\circ }\text{C}\), enabling validated moisture liberation for complex biopharmaceutical matrices.

Key Growth Drivers

Rising Regulatory Emphasis on Moisture Accuracy in Pharmaceuticals and Specialty Chemicals

Stringent regulatory frameworks continue to drive the adoption of Karl Fischer titration systems across pharmaceutical, biotechnology, and specialty chemical industries. Standards such as USP <921>, EP 2.5.12, and ICH Q6A mandate precise moisture quantification to ensure product stability, compliance, and batch consistency. This regulatory intensity expands procurement of both coulometric and volumetric systems for raw material inspection, in-process monitoring, and final product release. Growing global production of biotherapeutics, lyophilized injectables, and moisture-sensitive excipients further elevates demand for high-accuracy titrators. Companies increasingly standardize KF titration as a core analytical method, replacing loss-on-drying and capacitance-based approaches due to superior selectivity for water. As manufacturers widen quality-control coverage and adopt automated platforms with integrated reagent handling to reduce operator influence, regulatory accountability becomes a central force accelerating market expansion.

- For instance, T7 Titrator Excellence system offers the ability to determine water content down to 1 ppm (parts per million) when configured for Karl Fischer (KF) titration. When combined with the external LabX software, the system enables full compliance with 21 CFR Part 11 data integrity requirements across high-throughput QC workflows.

Expansion of High-Purity and Low-Moisture Manufacturing Segments

Industries producing high-purity materials—such as lithium battery components, semiconductors, polymers, and fine chemicals—require precise trace-moisture testing, directly boosting uptake of advanced KF titrators. Growth in lithium-ion battery production intensifies the need for moisture detection below 10 ppm, as even minimal water levels degrade electrolytes and diminish cell performance. Similarly, semiconductor fabrication processes demand ultra-low humidity validation for photoresists, solvents, and electronic-grade chemicals, positioning coulometric titrators as essential laboratory assets. As manufacturing tolerances tighten with the rise of next-generation materials, companies increasingly integrate KF systems into automated production QC workflows. Vendors also introduce micro-volume cells, improved oven interfaces, and sealed reagent systems to deliver better accuracy and contamination control. These technological advancements strengthen the market’s role in industries where moisture inconsistencies can cause product failure, production downtime, or compromised reliability.

- For instance, the Mettler Toledo C30 Karl Fischer Coulometer, widely used for battery-grade materials, enables high-resolution moisture detection down to 1 ppm (parts per million) or 1 µg H₂O. The instrument operates within a universal power supply range of 100–240 V to ensure stability across different laboratory power systems.

Shift Toward Automated, Digitally Integrated Analytical Laboratories

Laboratory modernization trends significantly enhance demand for Karl Fischer titrators equipped with automation, digital connectivity, and data-integrity features. Facilities across pharmaceuticals, food testing, petrochemicals, and research institutes invest in smart instrumentation that supports 21 CFR Part 11 compliance, secure audit trails, and centralized monitoring. Automated reagent dosing, real-time diagnostics, and AI-based drift correction reduce user dependency and enhance repeatability, addressing common challenges in manual titration workflows. Integration with LIMS and ERP platforms enables seamless data handling and regulatory adherence. As companies scale analytical throughput and move to high-frequency QC cycles, demand rises for multi-parameter systems capable of coupling KF titration with thermal or gas-phase extraction. This digital transformation aligns with global initiatives promoting predictive maintenance, remote monitoring, and standardized analytical environments, collectively accelerating the adoption of next-generation titration platforms.

Key Trends & Opportunities:

Growth of Moisture Analysis in Emerging Sectors such as Batteries, Biologics, and Green Chemicals

Emerging industries present new opportunities for Karl Fischer titration as moisture precision becomes critical in next-generation technologies. Battery manufacturers increasingly rely on coulometric titration to ensure ultra-dry electrolytes and cathode materials, supporting the growth of solid-state battery R&D. Biologic drug developers expand moisture testing in freeze-dried therapeutics and advanced delivery systems, creating specialized demand for oven-based KF interfaces. Meanwhile, the rise of bio-based polymers, green solvents, and sustainable chemicals requires moisture profiling to validate processing stability. These segments encourage the development of customized titration modules, higher-sensitivity cells, and automated solvent-handling systems. As global investments flow into energy storage, advanced therapeutics, and circular-chemistry materials, KF titrators gain new relevance beyond traditional petrochemical and pharmaceutical domains, unlocking long-term growth potential.

- For instance, Karl Fischer C20 Coulometer, used extensively in battery dry-room QC, achieves detection limits of 0.1 µg H₂O with a sealed generator electrode designed for operation in environments below 1% relative humidity, supporting electrolyte-grade materials testing.

Increasing Adoption of Hybrid and Automated Karl Fischer Platforms

A major trend reshaping the market is the adoption of hybrid systems that combine coulometric and volumetric capabilities within a single platform, enabling users to manage both ultra-low and high-moisture samples efficiently. Laboratory automation further supports this transition, with robotic sample changers, automated reagent replenishment, and digital calibration tools becoming more widespread. Vendors increasingly introduce deep-learning algorithms for drift stabilization, endpoint detection, and quality scoring, reducing operator skill dependency. The shift toward unattended, high-throughput workflows positions automated KF titration systems as a preferred solution for global QC laboratories. Additionally, integration with cloud-based analytics and instrument interconnectivity aligns with evolving data-governance standards, creating opportunities for vendors to deliver more modular and software-centric solutions.

- For instance, T9 KF platform integrates both coulometric and volumetric modes in a single unit and pairs with the InMotion™ robotic autosampler capable of handling 50–300 vials per sequence, enabling fully unattended workflows.

Key Challenges:

Operational Complexity and Skill Requirements in Moisture Analysis

Despite technological advancements, Karl Fischer titration remains an operator-sensitive technique that requires rigorous training, especially when handling reactive reagents and complex sample matrices. Errors in sample preparation, reagent deterioration, drift correction, and endpoint interpretation can significantly impact accuracy. Laboratories with high turnover or limited technical expertise often struggle to maintain consistency across operators, increasing reliance on frequent calibration and validation cycles. Moisture-sensitive samples, such as oils, polymers, and powders, may require oven methods or specialized extraction, introducing additional technical hurdles. These challenges elevate operational costs and can discourage adoption among smaller laboratories. Manufacturers continue to address this through automation and guided workflows, but achieving uniform global competency remains an obstacle to market penetration.

High Maintenance Demands and Reagent Handling Constraints

Karl Fischer titrators require ongoing maintenance due to the hygroscopic nature of reagents, sensitivity to contamination, and degradation risks during storage and use. Regular checks of seals, cathode cartridges, electrodes, and desiccants increase operational burden, particularly in high-humidity environments. Reagent sourcing, disposal, and safe handling also pose challenges, especially for facilities with strict environmental or safety protocols. System downtime associated with frequent reagent replacement or cell cleaning affects productivity in high-throughput labs. Additionally, oven-based KF methods require meticulous temperature control and proper ventilation, adding to infrastructure costs. These maintenance demands represent a persistent barrier for cost-sensitive end users and restrain broader adoption in emerging markets.

Regional Analysis:

North America

North America holds the largest market share at approximately 32%, driven by strong adoption of high-precision analytical instruments across pharmaceutical manufacturing, biotechnology research, petrochemical quality control, and food safety testing. The U.S. leads demand due to its extensive network of GMP-certified laboratories and high regulatory pressure from FDA and USP standards requiring validated moisture analysis. Increasing investments in biologics, specialty chemicals, and battery materials fuel uptake of coulometric systems for trace-level quantification. Canada shows steady growth through expansion of CRO capabilities and modernization of academic research labs, supporting broader market penetration.

Europe

Europe accounts for roughly 28% of the market, supported by stringent analytical guidelines under EMA, EP, and REACH, which mandate precise moisture testing across pharmaceuticals, chemicals, and environmental laboratories. Germany, Switzerland, and the U.K. lead adoption due to their advanced instrumentation ecosystems and dense concentration of QC-driven industries. The region’s strong focus on sustainable chemicals, lithium-ion battery gigafactories, and high-purity manufacturing further boosts demand for coulometric and hybrid KF systems. Ongoing investments in digital laboratory automation and compliance-driven workflows reinforce Europe’s strong position in Karl Fischer titration deployment.

Asia-Pacific

Asia-Pacific represents nearly 26% of global demand, driven by rapid expansion of pharmaceutical production, generic drug manufacturing, semiconductor fabrication, and battery-material processing. China, Japan, South Korea, and India demonstrate strong adoption as quality-control frameworks tighten and moisture-sensitive manufacturing scales. The region’s booming lithium-ion battery supply chain significantly boosts demand for high-sensitivity coulometric KF titrators capable of detecting moisture below 10 ppm. Government-led investments in biotech parks, chemical clusters, and academic research infrastructure further accelerate market growth, positioning Asia-Pacific as the fastest-growing region in high-precision moisture analysis.

Latin America

Latin America captures about 8% of the market, with expansion driven by pharmaceutical manufacturing, food and beverage quality testing, and chemical production. Brazil and Mexico dominate demand due to their rising regulatory enforcement and adoption of advanced laboratory instruments. Growth in agrochemical exports and biologics manufacturing encourages laboratories to transition from traditional moisture methods to Karl Fischer titration for higher precision. Increasing partnerships with global instrument manufacturers and modernization of QC facilities enhance regional penetration. However, budget constraints and slower technology refresh cycles keep the market’s pace moderate compared to developed regions.

Middle East & Africa

The Middle East & Africa region holds approximately 6% market share, supported by growing analytical requirements in petrochemicals, polymers, lubricants, and water-quality testing. GCC countries, led by Saudi Arabia and the UAE, show rising adoption due to industrial diversification and investments in high-specification testing laboratories. The pharmaceutical manufacturing presence in countries like South Africa and Egypt also contributes to KF titrator demand. Although adoption rates are lower due to limited laboratory automation and budget constraints, increasing regulatory alignment with international standards is gradually strengthening the region’s uptake of accurate moisture-analysis technologies.

Market Segmentations:

By Type

- Coulometric Karl Fischer Titrators

- Volumetric Karl Fischer Titrators

By End Use

- Pharmaceutical and Biotechnology Companies

- Contract Research Organizations (CROs)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the Karl Fischer titrators market is shaped by a mix of global analytical instrument leaders and specialized moisture-analysis technology providers, each competing on precision, automation, reliability, and regulatory compliance features. Key players such as Metrohm, Mettler Toledo, Hanna Instruments, Analytik Jena, Kyoto Electronics, and Hiranuma dominate through extensive product portfolios spanning coulometric, volumetric, and hybrid KF systems. Companies increasingly enhance system performance with automated reagent handling, integrated oven modules for complex matrices, and software platforms supporting 21 CFR Part 11 compliance and LIMS connectivity. Competitive differentiation also centers on micro-volume cells for ultra-low moisture detection, drift-reduction algorithms, and faster endpoint determination to improve throughput in high-volume QC laboratories. Strategic initiatives—including regional laboratory partnerships, technical training programs, and expansion of after-sales service networks—strengthen vendor positioning. As demand rises in pharmaceuticals, battery materials, petrochemicals, and fine chemicals, firms continue investing in innovation and workflow automation to capture emerging opportunities.

Key Player Analysis:

Recent Developments:

- In November 2025, METTLER TOLEDO unveiled the new X3 Series of bulk flow x-ray inspection systems, designed for contamination detection in loose-flow products. The company’s Karl Fischer titrators continue to be offered with advanced automation features, including the InMotion™ KF Oven Autosampler for high-throughput analysis.

- In February 2025, Thermo Fisher announced its acquisition of Solventum’s Purification and Filtration business for approximately $4.1 billion in cash. This acquisition, expected to close by the end of 2025, expands Thermo Fisher’s bioprocessing capabilities and strengthens its position in the high-growth bioprocessing market, indirectly supporting its analytical instruments portfolio.

- In July 2024, Hanon Instruments expanded the feature set of its existing Karl Fischer titrator series by upgrading its control firmware and electrode system for higher measurement stability.

Report Coverage:

The research report offers an in-depth analysis based on Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Future Outlook:

- Demand for Karl Fischer titrators will rise as industries increase precision moisture testing in pharmaceuticals, chemicals, and battery materials.

- Automation and AI-driven endpoint detection will enhance accuracy and reduce operator dependency across QC laboratories.

- Hybrid titration systems combining coulometric and volumetric capabilities will gain wider adoption for versatile sample handling.

- Digital integration with LIMS and cloud platforms will strengthen data integrity and regulatory compliance.

- Growth in biologics, lyophilized products, and advanced drug formulations will expand the use of oven-based KF methods.

- Semiconductor and lithium-ion battery manufacturing will drive demand for ultra-low moisture detection solutions.

- Compact, micro-volume titrators will see increasing adoption in space-constrained and high-throughput laboratories.

- Vendors will invest more in automated reagent handling and low-maintenance cell designs to reduce downtime.

- Expansion of CRO services will increase outsourced moisture-analysis workloads globally.

- Emerging markets will strengthen adoption as regulatory frameworks align with global analytical standards.

Market Segmentation Analysis:

Market Segmentation Analysis: