Market Overview

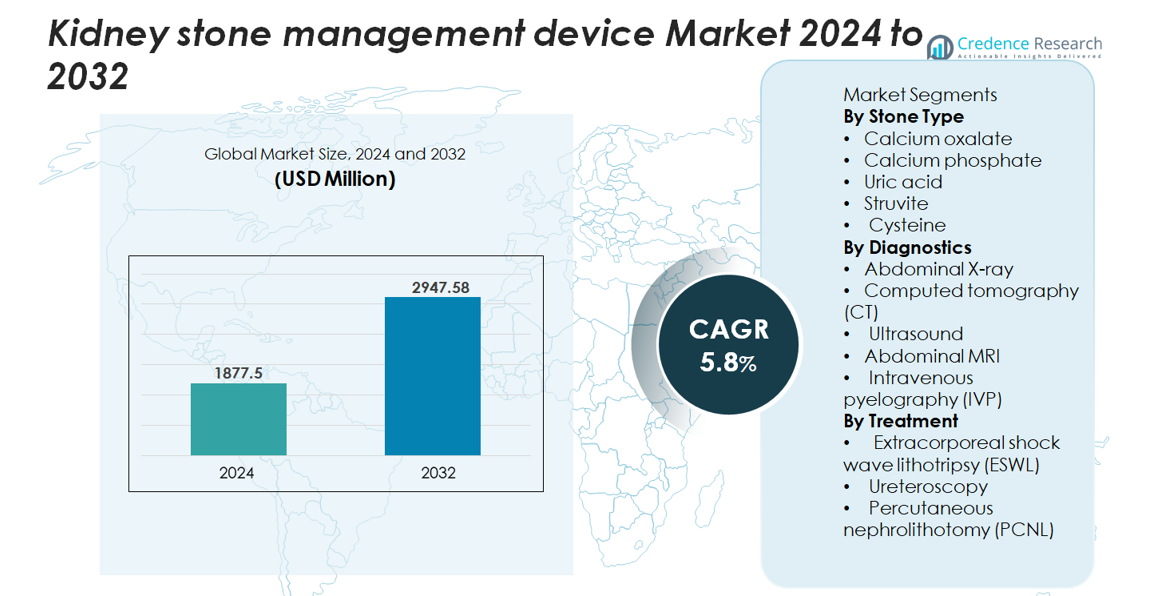

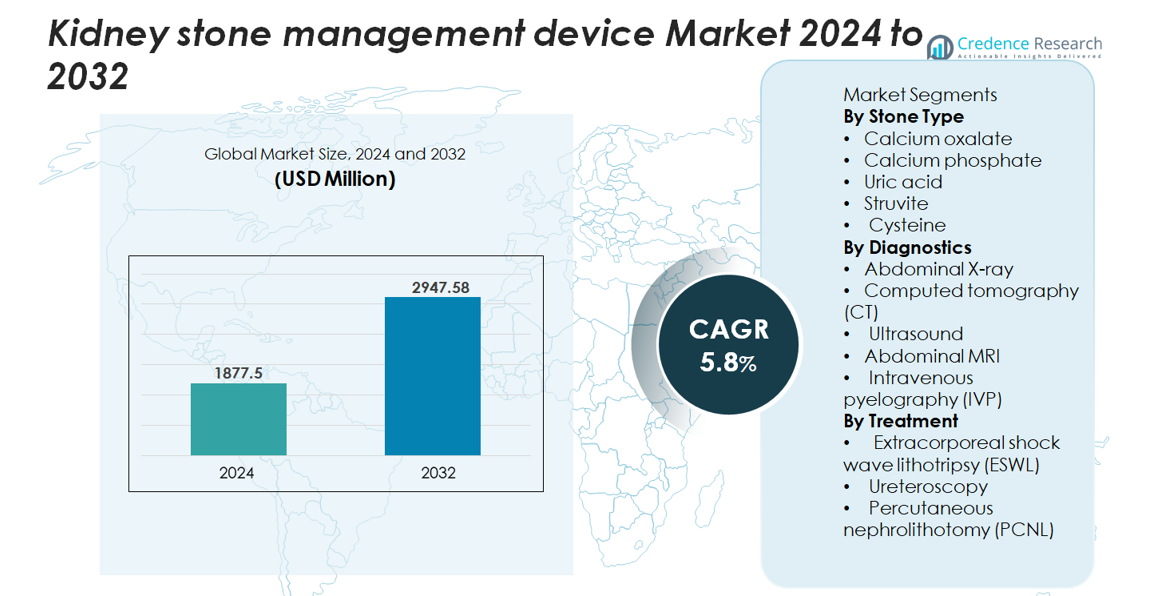

The global kidney stone management devices market was valued at USD 1,877.5 million in 2024 and is projected to reach USD 2,947.58 million by 2032, growing at a CAGR of 5.8% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Kidney Stone Management Device Market Size 2024 |

USD 1,877.5 million |

| Kidney Stone Management Device Market, CAGR |

5.8% |

| Kidney Stone Management Device Market Size 2032 |

USD 2,947.58 million |

The kidney stone management devices market is shaped by established global players including DirexGroup, Karl Storz GmbH, Coloplast A/S, Elmed Medical Systems, Cook Medical LLC, Dornier MedTech, Allengers Medical Systems Ltd, EDAP TMS S.A, Becton, Dickinson and Company, and Boston Scientific Corporation. These companies compete through advancements in ESWL platforms, digital ureteroscopes, high-precision laser lithotripsy systems, and integrated imaging technologies. North America leads the market with approximately 35–37% share, driven by strong healthcare infrastructure, high procedure volumes, and rapid adoption of minimally invasive technologies. Europe follows with 28–30% share, supported by well-established urology networks and continuous investment in advanced diagnostic and therapeutic systems.

Market Insights

- The global kidney stone management devices market was valued at USD 1,877.5 million in 2024 and is projected to reach USD 2,947.58 million by 2032, growing at a CAGR of 5.8% during the forecast period, supported by rising treatment volumes and sustained adoption of minimally invasive systems.

- Growing prevalence of metabolic disorders, increasing recurrence rates, and broader access to digital ureteroscopy, ESWL, and advanced laser lithotripsy continue to drive strong device demand across high-burden populations.

- Key trends include rapid uptake of thulium fiber lasers, expansion of disposable ureteroscopes, and integration of AI-enabled diagnostic support within CT and ultrasound platforms, enhancing precision and workflow efficiency.

- Competitive intensity remains high as leading players focus on device miniaturization, durability improvements, and outpatient-friendly platforms, though high capital costs and uneven access to advanced systems restrain broader penetration.

- Regionally, North America holds 35–37% share, followed by Europe with 28–30%, while Asia-Pacific grows fastest at 22–24%; segment-wise, ESWL dominates treatment, and CT leads diagnostics due to superior accuracy.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Stone Type

Calcium oxalate stones form the dominant sub-segment, accounting for the largest share due to their high global incidence and strong association with dietary patterns, metabolic abnormalities, and fluid imbalances. Their prevalence drives sustained demand for diagnostic imaging, preventive workflows, and minimally invasive removal technologies. Calcium phosphate and uric acid stones follow, supported by rising metabolic syndrome cases. Struvite and cysteine stones remain less common but require more advanced interventions due to their recurrence patterns and complexity, reinforcing the need for precision imaging and tailored device-based treatment systems.

- For example, Boston Scientific’s LithoVue™ digital flexible ureteroscope offers 270° dual-direction deflection for access to difficult intrarenal locations, including lower-pole stones. The device uses a CMOS digital imaging sensor with a 400 × 400-micron sensing element, providing clear visualization during ureteroscopy.

By Diagnostics

Computed tomography (CT) represents the dominant diagnostic sub-segment, holding the highest market share owing to its superior sensitivity, rapid acquisition speeds, and ability to detect stones as small as 1–2 mm. CT’s high diagnostic accuracy drives its adoption across emergency care and urology centers. Ultrasound maintains strong use as a radiation-free alternative for pregnant women and recurrent screeners, while abdominal X-ray and IVP show declining utilization. MRI remains limited but useful in complex cases. Overall, increasing imaging standardization and AI-assisted interpretation further enhance diagnostic precision and device selection.

- For example, Siemens Healthineers’ SOMATOM Force CT scanner provides a verified spatial resolution of 0.24 mm in high-resolution mode. This fine detail helps clinicians detect small renal calculi and assess subtle stone-associated changes with greater confidence.

By Treatment

Extracorporeal shock wave lithotripsy (ESWL) remains the dominant treatment sub-segment with the largest market share, driven by its non-invasive nature, outpatient suitability, and broad applicability for stones below moderate size thresholds. Advances in shock wave focusing, energy modulation, and real-time imaging continue to strengthen its role. Ureteroscopy is expanding rapidly due to improvements in digital flexible scopes and laser lithotripsy systems, while percutaneous nephrolithotomy (PCNL) remains essential for large or complex stones. The shift toward minimally invasive modalities and enhanced stone-free rates shapes ongoing device innovation across treatment platforms.

Key Growth Drivers

Rising Global Prevalence of Metabolic Disorders and Stone Recurrence

Growing incidence of metabolic disorders—including obesity, diabetes, and hyperuricemia—continues to elevate global kidney stone formation rates, significantly expanding demand for diagnostic and interventional devices. Recurrent stone formation, reported in nearly half of affected patients within 5–7 years, strengthens long-term device utilization across imaging, lithotripsy, ureteroscopy, and PCNL platforms. Increasing dietary risk factors such as high-sodium and high-protein intake further accelerate caseloads globally, especially in urban populations. This sustained rise in stone burden amplifies healthcare system investments in advanced urology suites and minimally invasive stone removal equipment, particularly in high-volume centers. As recurrence management becomes a core clinical mandate, the market benefits from consistent device replacement cycles, integration of monitoring technologies, and expanded adoption of stone prevention programs supported by precision diagnostics.

- For example, the Dornier Delta III lithotripter offers a controlled shock rate of up to 120 shocks per minute, with clinical guidelines often recommending 60–90 shocks per minute for better stone fragmentation. The system features an electromagnetic generator with selectable focal sizes, enabling clinicians to adjust the focal zone to stone depth and anatomy.

Technological Advancements in Minimally Invasive Stone Removal

Rapid advancements in minimally invasive urological technologies significantly drive growth by improving procedural safety, efficiency, and patient recovery. High-resolution digital ureteroscopes, enhanced laser lithotripsy systems, and miniaturized PCNL tools enable effective removal of stones with reduced trauma and shorter hospital stays. Innovations such as high-power Holmium:YAG and thulium fiber lasers provide superior fragmentation precision, allowing treatment of complex stone types with faster ablation speeds. Next-generation ESWL devices offer better energy modulation and image-guided targeting, enhancing stone-free rates. These advancements support greater procedural confidence among clinicians, expand treatable patient populations, and reduce dependence on open surgeries. As hospitals prioritize clinical outcomes and workflow optimization, advanced minimally invasive devices remain central to procurement strategies, accelerating market expansion.

- For instance, Olympus’s Soltive™ SuperPulsed Thulium Fiber Laser operates at frequencies up to 2,400 Hz with pulse energies up to 6 Joules, enabling high-speed dusting and reduced retropulsion during stone fragmentation

Expanded Access to Advanced Urology Care and Growing Infrastructure Investment

Greater availability of urology specialty centers, coupled with rising healthcare expenditure and infrastructure upgrades, is a major growth catalyst. Emerging economies are rapidly adopting modern imaging suites, laser lithotripsy systems, and integrated surgical platforms in response to increasing stone caseloads. Government-led investments in tertiary care hospitals, ambulatory surgical centers, and day-care urology facilities improve accessibility to timely diagnosis and treatment. Medical tourism further propels device demand in regions offering cost-effective minimally invasive stone management services. Additionally, training programs for urologists, improved reimbursement frameworks, and initiatives promoting early detection strengthen clinical capacity. As more facilities deploy advanced lithotripsy and endoscopic systems, device manufacturers experience sustained demand for both capital equipment and consumables, driving steady market expansion.

Key Trends & Opportunities

Growth of AI-Driven Diagnostics and Predictive Stone Management

Artificial intelligence and data-driven analytics are emerging as transformative trends in kidney stone management. AI-enhanced imaging tools improve stone detection accuracy, automatically classify stone burden, and assist clinicians in selecting optimal treatment pathways. Machine learning models capable of predicting recurrence based on metabolic profiles, imaging data, and patient history support preventive care strategies. Integration of AI into CT and ultrasound workflows enables faster interpretation and reduces diagnostic variability across clinical settings. These advancements create opportunities for device manufacturers to embed intelligent software into imaging systems, treatment consoles, and post-procedural monitoring tools. As precision urology gains prominence, the adoption of AI-enabled workflows is expected to grow substantially.

- For example, Siemens Healthineers’ AI-Rad Companion CT provides automated kidney segmentation as part of its abdominal organ analysis workflow. The software reduces manual contouring effort and supports consistent renal structure evaluation by applying standardized AI-driven measurement tools.

Increasing Adoption of Digital Ureteroscopy and Laser Innovation

Strong demand for digital ureteroscopes and advanced laser systems presents a significant opportunity for device manufacturers. Digital scopes offer superior visualization, improved maneuverability, and higher durability compared to fiber-optic models, enhancing treatment outcomes. Concurrent innovation in laser lithotripsy particularly thulium fiber and high-power Holmium lasers supports finer fragmentation, reduced retropulsion, and efficient dusting capabilities. Rising preference for disposable ureteroscopes reduces infection risk and supports high caseload environments. As facilities shift toward standardized, tech-enabled stone management ecosystems, vendors offering integrated digital endoscopy and laser platforms gain competitive advantage.

- For example, Karl Storz’s Flex-Xc digital ureteroscope features an integrated high-resolution CMOS imaging sensor and offers 270° bidirectional deflection for advanced intrarenal access. The design supports clear visualization and stable maneuverability during difficult stone-management procedures.

Expansion of Ambulatory and Outpatient Stone Treatment Models

The shift toward outpatient and ambulatory surgical models presents substantial market opportunities. Advances in ESWL, flexible ureteroscopy, and mini-PCNL enable same-day discharge for a large proportion of patients, reducing hospitalization needs and improving cost efficiency. Healthcare systems increasingly invest in ambulatory urology centers equipped with compact imaging systems, mobile lithotripters, and disposable endoscopic tools. This model aligns with payer focus on cost reduction and faster patient recovery, stimulating adoption of lightweight, portable, and workflow-friendly devices. Manufacturers offering compact platforms and rapid-turnover systems are poised for strong demand.

Key Challenges

High Device Costs and Uneven Access to Advanced Treatment Technologies

The high cost of advanced imaging systems, laser lithotripsy devices, and digital ureteroscopes remains a major barrier to widespread adoption, particularly in low- and middle-income regions. Capital-intensive equipment requires substantial investment in maintenance, training, and facility upgrades, limiting penetration in smaller hospitals and rural care centers. Reimbursement constraints for certain procedures further restrict financial feasibility for healthcare providers. Disposable devices, while beneficial for infection control, add recurring cost burdens. This financial disparity contributes to uneven access to optimal stone management technologies, reinforcing regional gaps in treatment standards and delaying adoption in resource-limited settings.

Device Complexity, Durability Issues, and Skills Shortages

The complexity of modern stone management devices, combined with durability concerns, poses a significant challenge for healthcare providers. Digital ureteroscopes and high-power laser systems require skilled operators to ensure safe and efficient use, yet trained urologists remain limited in many regions. Frequent repairs, scope fragility, and maintenance requirements increase operational costs and disrupt clinical workflows. Inadequate training in advanced endourological techniques can lead to inconsistent outcomes and higher complication risks. The growing technological sophistication of devices necessitates extensive clinician training, structured certification programs, and improved device resilience to support long-term adoption.

Regional Analysis

North America

North America leads the kidney stone management devices market with a 35–37% share, supported by high prevalence of metabolic disorders, strong diagnostic penetration, and widespread use of ESWL, flexible ureteroscopy, and advanced laser systems. The U.S. dominates due to well-established urology centers, rapid adoption of thulium fiber lasers, and early integration of AI-based CT and ultrasound analytics. Favorable reimbursement frameworks and increasing outpatient surgical volumes further strengthen demand. Growth is accelerated by the expansion of ambulatory surgical centers and continuous upgrades to minimally invasive treatment platforms across major hospital networks.

Europe

Europe holds a 28–30% market share, driven by robust clinical infrastructure, standardized urology guidelines, and consistent uptake of digital ureteroscopes and next-generation ESWL systems. Germany, France, and the U.K. anchor regional growth through strong imaging utilization and investment in high-precision laser lithotripsy platforms. Rising incidence of lifestyle-linked stone formation and structured care pathways support high procedure volumes across both public and private hospitals. The region’s commitment to early detection, coupled with continuous modernization of endourology suites, reinforces Europe’s role as a mature market with strong technological adoption.

Asia-Pacific

Asia-Pacific accounts for 22–24% of the global market and represents the fastest-growing region. Rising stone incidence driven by dehydration, dietary patterns, and urbanization fuels strong demand for diagnostic and minimally invasive treatment devices. China, India, and Japan are primary contributors, supported by expanding healthcare infrastructure, larger patient pools, and increased accessibility to ESWL and flexible ureteroscopy systems. Medical tourism in India, Singapore, and Thailand strengthens procedural volumes, while government-led investments and expanded urology training programs accelerate technology adoption across hospitals and specialty centers.

Latin America

Latin America captures a 6–7% share, reflecting steady advancement in urology services and increasing deployment of imaging and stone-removal technologies. Brazil and Mexico drive regional demand through growing private healthcare networks and modernization of tertiary hospitals. ESWL remains widely adopted due to its favorable cost profile, while flexible ureteroscopy and laser platforms are gradually expanding in larger metropolitan centers. Despite progress, regional disparities in reimbursement, clinician availability, and access to advanced technologies limit full market penetration. Ongoing healthcare upgrades continue to improve long-term device adoption.

Middle East & Africa

The Middle East & Africa region holds a 4–5% share, with growth concentrated in Gulf countries such as Saudi Arabia and the UAE, where strong investments in laser lithotripsy, digital ureteroscopy, and imaging suites drive adoption. Expanding specialty hospitals and rising medical tourism enhance procedural capacity. However, access remains limited across many African nations due to infrastructure gaps and high equipment costs. Private-sector expansion and government modernization initiatives are gradually improving availability of minimally invasive stone-management systems, supporting increasing device uptake across key markets.

Market Segmentations:

By Stone Type

- Calcium oxalate

- Calcium phosphate

- Uric acid

- Struvite

- Cysteine

By Diagnostics

- Abdominal X-ray

- Computed tomography (CT)

- Ultrasound

- Abdominal MRI

- Intravenous pyelography (IVP)

By Treatment

- Extracorporeal shock wave lithotripsy (ESWL)

- Ureteroscopy

- Percutaneous nephrolithotomy (PCNL)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the kidney stone management devices market is characterized by strong participation from global medical technology leaders specializing in minimally invasive urology, advanced imaging, and laser lithotripsy solutions. Companies such as Boston Scientific, Olympus Corporation, Karl Storz, Richard Wolf, Dornier MedTech, and Siemens Healthineers maintain significant influence through extensive product portfolios covering ESWL systems, digital ureteroscopes, high-power Holmium and thulium fiber lasers, and precision imaging platforms. Competition focuses on enhanced visualization, improved device durability, disposable endoscope solutions, and integrated treatment ecosystems that streamline clinical workflows. Strategic initiatives—including acquisitions, multi-center clinical evaluations, R&D investments, and expansion into fast-growing regions—reinforce market positioning. Vendors increasingly emphasize digital integration, AI-assisted diagnostics, and ergonomic device designs to differentiate offerings. The rise of ambulatory surgical centers, demand for flexible endoscopy, and shift toward cost-efficient outpatient treatments continue to shape competitive dynamics, favoring manufacturers with comprehensive, scalable, and technology-forward solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2024, Karl Storz GmbH announced an exclusive distribution agreement with Well Lead Medical for the ClearPetra suction-evacuation ureteral access sheath in the U.S.

- In April 2024, the company Dornier MedTech launched UroGPT™, an AI-powered large-language model platform aligned with its WPE Wellness™ system for stone-disease patients; 92.1 % of surveyed patients reported trusting WPE Wellness™ as much or more than major health websites.

Report Coverage

The research report offers an in-depth analysis based on Stone type, Diagnostics, Treatment and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of minimally invasive and outpatient stone management procedures will accelerate as hospitals prioritize faster recovery and lower procedural risks.

- AI-assisted imaging and predictive analytics will become integral to diagnostic pathways, improving detection accuracy and treatment selection.

- Digital ureteroscopy and disposable endoscopes will gain wider acceptance due to improved durability, infection control, and workflow efficiency.

- High-power Holmium and thulium fiber lasers will continue to replace older lithotripsy technologies, enhancing fragmentation precision.

- ESWL systems will evolve with better energy modulation and real-time imaging guidance to improve stone-free outcomes.

- Ambulatory surgical centers will expand their role in stone treatment, increasing demand for compact and mobile device platforms.

- Manufacturers will invest more in ergonomic designs and miniaturized instruments to enable safer and less traumatic interventions.

- Integration of remote monitoring tools and metabolic management programs will support long-term recurrence prevention.

- Emerging markets will experience rapid technology adoption as healthcare infrastructure and urology capacity improve.

- Competitive differentiation will shift toward fully integrated treatment ecosystems combining imaging, lasers, scopes, and digital platforms.