| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Latin America Industrial Fasteners Market Size 2024 |

USD 4990.71 Million |

| Latin America Industrial Fasteners Market, CAGR |

5.03% |

| Latin America Industrial Fasteners Market Size 2032 |

USD 7392.91 Million |

Market Overview:

The Latin America Industrial Fasteners Market is projected to grow from USD 4990.71 million in 2024 to an estimated USD 7392.91 million by 2032, with a compound annual growth rate (CAGR) of 5.03% from 2024 to 2032.

Key drivers propelling the market include robust growth in the automotive and construction sectors, which are significant consumers of industrial fasteners. The automotive industry demands high-strength, lightweight fasteners for vehicle assembly, while the construction sector requires durable fasteners for infrastructure projects. As these industries continue to expand, the demand for reliable, high-quality fasteners is set to grow significantly. Additionally, the adoption of advanced materials such as high-strength steel and alloys is enhancing the performance and durability of fasteners, further stimulating market growth. These technological advancements are driving manufacturers to produce more efficient fastener solutions, which are increasingly being adopted across various industries.

Brazil stands as the dominant player in the Latin American industrial fasteners market, accounting for a substantial share of the regional revenue. The country’s well-established manufacturing base, particularly in automotive, construction, and oil and gas industries, drives significant demand for fasteners. This, in turn, boosts the local production and consumption of fasteners. Argentina is anticipated to experience the highest growth rate in the region, fueled by increasing industrial activities and infrastructure projects. As Argentina’s industrial landscape grows, the demand for fasteners in sectors such as construction and automotive is likely to expand. Other countries such as Mexico and Colombia also contribute to the market’s expansion, supported by urbanization and industrialization trends. These nations are witnessing increasing infrastructure projects and a growing manufacturing base, which will likely drive future demand for industrial fasteners in the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Latin American industrial fasteners market is projected to grow from USD 4.99 billion in 2024 to USD 7.39 billion by 2032, at a CAGR of 5.03% from 2024 to 2032.

- The Global Industrial Fasteners Market is projected to grow from USD 98,826 million in 2024 to USD 158,987.23 million by 2032, registering a robust CAGR of 6.12%.

- The automotive sector is a key driver, with increasing vehicle production in Brazil and Mexico driving the demand for high-strength, lightweight fasteners.

- The construction sector is seeing a significant surge, fueled by urbanization and government initiatives, which increases the demand for durable fasteners for infrastructure projects.

- The adoption of advanced materials like high-strength steel and alloys is enhancing fastener performance and durability, which is propelling market growth across various industries.

- Brazil dominates the market due to its strong manufacturing base, particularly in automotive, construction, and oil and gas industries, leading to high fastener consumption.

- Argentina is expected to witness the highest growth rate, driven by increasing industrial activities and infrastructure projects, particularly in construction and automotive sectors.

- The expansion of the oil and gas industry in Brazil and Venezuela is fueling demand for specialized fasteners, particularly in offshore platforms and drilling rigs.

Market Drivers:

Growing Demand from Automotive Sector

The automotive sector plays a crucial role in driving the growth of the Latin American industrial fasteners market. The region’s automotive industry is expanding, particularly in countries such as Brazil and Mexico, where there is a strong presence of automotive manufacturing. For instance, according to the Mexican Association of the Automotive Industry (AMIA), over 3.5 million vehicles were produced in Mexico in 2023, each requiring thousands of specialized fasteners for assembly and safety-critical applications. As vehicle production increases, the need for high-strength, lightweight fasteners to secure components and ensure vehicle safety is rising. Fasteners used in vehicle assembly must meet stringent quality and performance standards, particularly in terms of durability and resistance to corrosion. As the demand for more fuel-efficient and environmentally friendly vehicles grows, there is a parallel need for fasteners that can withstand higher stresses and temperatures, further boosting market demand.

Infrastructure Development and Construction Boom

Another key driver of market growth is the increasing demand for industrial fasteners from the construction sector. Latin America is witnessing a surge in infrastructure development, driven by urbanization and government initiatives in both developed and emerging economies. As construction projects grow in scale and complexity, the demand for reliable and durable fasteners becomes more critical. These fasteners are used in everything from high-rise buildings to transportation infrastructure such as bridges and roads. The construction boom in countries like Brazil, Argentina, and Mexico is expected to continue, further fueling the need for high-quality fasteners designed to withstand the rigorous demands of large-scale construction projects.

Adoption of Advanced Materials

The adoption of advanced materials such as high-strength steel, alloys, and corrosion-resistant coatings is significantly influencing the demand for industrial fasteners in Latin America. As industries across the region continue to evolve, there is an increasing need for fasteners that offer enhanced durability and performance in challenging environments. The marine sector, for example, increasingly relies on stainless steel and coated fasteners to withstand corrosion and harsh weather, particularly in shipbuilding and offshore platforms. These materials provide a higher degree of reliability and extend the lifespan of fasteners, especially in industries such as automotive, construction, and energy. The growing trend towards advanced materials is helping manufacturers develop innovative fastener solutions that are lightweight, resistant to corrosion, and capable of performing under extreme conditions, thereby supporting market growth.

Expansion of the Oil and Gas Industry

The oil and gas industry is another prominent driver of the industrial fasteners market in Latin America. As countries in the region such as Brazil and Venezuela continue to expand their oil and gas production capabilities, the demand for specialized fasteners used in offshore platforms, drilling rigs, and pipeline installations is growing. Fasteners used in these sectors must be highly resistant to environmental factors like extreme temperatures, corrosion, and high pressures. The continued exploration and extraction activities in the region, along with growing investments in energy infrastructure, will lead to an ongoing demand for high-quality fasteners designed to meet the specific needs of the oil and gas industry.

Market Trends:

Shift Toward Automation and Robotics

One of the key trends shaping the Latin American industrial fasteners market is the growing adoption of automation and robotics in manufacturing and assembly processes. Automation is increasingly being used in industries such as automotive, electronics, and aerospace, where high precision and efficiency are required. Fasteners are essential components in these automated systems, ensuring secure and reliable operations. As robots and automated systems take on more complex tasks, there is a rising demand for advanced fasteners that can perform under high-speed and high-precision conditions. The trend towards automation is expected to continue, driving innovation in fastener technologies and increasing demand for specialized fasteners that support these advanced manufacturing processes.

Focus on Sustainability and Eco-friendly Materials

Sustainability has become a significant focus for industries in Latin America, and the industrial fasteners market is no exception. There is an increasing emphasis on using eco-friendly materials and manufacturing processes to minimize environmental impact. For instance, companies like YKK Mexicana and YKK Snap Fasteners Manufactura Mexico have established comprehensive reuse-recycle programs, sending both hazardous and non-hazardous waste to government-approved facilities and recycling materials such as plastic, paper, and cardboard. Fastener manufacturers are exploring the use of recyclable materials, such as stainless steel and aluminum, and developing solutions that meet the growing demand for sustainable products. Additionally, the rise of green building standards and regulations in the construction sector is encouraging the use of sustainable fasteners that contribute to the overall environmental goals of construction projects. This trend reflects a global movement towards sustainability and is gaining traction in the Latin American market as companies seek to align their operations with eco-conscious practices.

Technological Advancements in Fastener Design

The design of industrial fasteners has evolved significantly with advancements in technology. Manufacturers in Latin America are increasingly investing in research and development to create fasteners that offer enhanced functionality, such as resistance to high temperatures, corrosion, and wear. The introduction of 3D printing technology is also revolutionizing the way fasteners are designed and produced, allowing for greater precision and customization. For instance, global automakers investing in Latin America often bring advanced production methods and sophisticated assembly lines, which require fasteners engineered for high performance and durability. This technological shift is leading to the creation of more efficient and durable fasteners, which are critical for industries like automotive, construction, and energy. The ability to produce customized fasteners that meet the specific needs of a project or application is expected to drive further innovation and growth in the market.

Growth of E-commerce and Online Sales Channels

The expansion of e-commerce is another significant trend influencing the Latin American industrial fasteners market. As more businesses turn to online platforms for purchasing industrial components, including fasteners, the market is witnessing a shift towards digital sales channels. Online marketplaces and e-commerce platforms are offering convenience and accessibility, allowing businesses to source fasteners from suppliers across the globe. This trend is especially prominent among small and medium-sized enterprises (SMEs) that may not have access to traditional distribution channels. The rise of online sales platforms is expected to increase competition among fastener suppliers while providing end-users with a wider range of options and the ability to compare prices, leading to a more efficient and transparent market.

Market Challenges Analysis:

Fluctuating Raw Material Prices

One of the major challenges facing the Latin American industrial fasteners market is the fluctuating prices of raw materials, such as steel, aluminum, and other alloys. These materials are essential for the production of high-quality fasteners, and their prices can vary significantly due to factors such as global supply chain disruptions, trade policies, and changes in demand. Volatility in raw material costs can lead to unpredictable production expenses for manufacturers, which in turn affects their pricing strategies. This makes it difficult for companies to maintain consistent profit margins, particularly in a competitive market where cost efficiency is crucial.

Economic Instability

Economic instability in certain Latin American countries is another key restraint affecting the industrial fasteners market. Many countries in the region are prone to fluctuations in their economic conditions, including inflation, exchange rate volatility, and government policy changes. These factors can have a direct impact on the demand for industrial fasteners, as businesses may reduce investment in large-scale projects during periods of economic uncertainty. Additionally, economic instability can affect the overall purchasing power of consumers and businesses, limiting the growth potential of industries such as automotive and construction, which are major consumers of fasteners.

Regulatory and Compliance Challenges

In South America, the fragmented regulatory landscape creates significant hurdles for fastener manufacturers. For example, Brazil has implemented evolving safety regulations that now mandate the use of specific fastener grades and materials for critical infrastructure and construction applications. Meanwhile, other countries in the region may have less stringent or different standards, requiring manufacturers to adapt their products and documentation for each market1. This lack of harmonization increases compliance costs and operational complexity, especially for companies exporting across borders.

Competition from Low-Cost Imports

The industrial fasteners market in Latin America also faces significant competition from low-cost imports, particularly from Asia. These imports often offer lower prices due to cheaper labor and material costs in their countries of origin. Local manufacturers may struggle to compete on price, which puts pressure on them to either lower their prices or improve the quality of their products. This competitive pressure can limit profit margins and hinder the growth of domestic fastener manufacturers in the region.

Market Opportunities:

The Latin American industrial fasteners market presents significant opportunities driven by ongoing infrastructure development and industrial growth across the region. As urbanization accelerates in countries like Brazil, Mexico, and Argentina, there is a rising demand for fasteners in construction projects, including residential, commercial, and transportation infrastructure. This demand is expected to increase as governments continue to invest in large-scale infrastructure projects to boost economic development. Moreover, the region’s automotive sector is also experiencing growth, particularly in Mexico, which is becoming a major hub for automotive manufacturing in North America. The expanding automotive production capacity offers an opportunity for fastener manufacturers to cater to the growing need for high-quality, durable fasteners in vehicle assembly.

Another key opportunity lies in the adoption of advanced technologies and materials. As industries in Latin America seek to enhance efficiency and sustainability, there is an increasing demand for innovative fasteners that offer superior performance, such as corrosion-resistant coatings, lightweight alloys, and high-strength materials. These advanced solutions cater to various sectors, including energy, aerospace, and manufacturing. Additionally, the shift towards sustainable building practices in the construction industry presents opportunities for fastener manufacturers to develop eco-friendly solutions. The growing trend toward automation in manufacturing processes also creates a demand for precision-engineered fasteners, positioning the market for technological advancements and increased production capacity to meet evolving industry needs.

Market Segmentation Analysis:

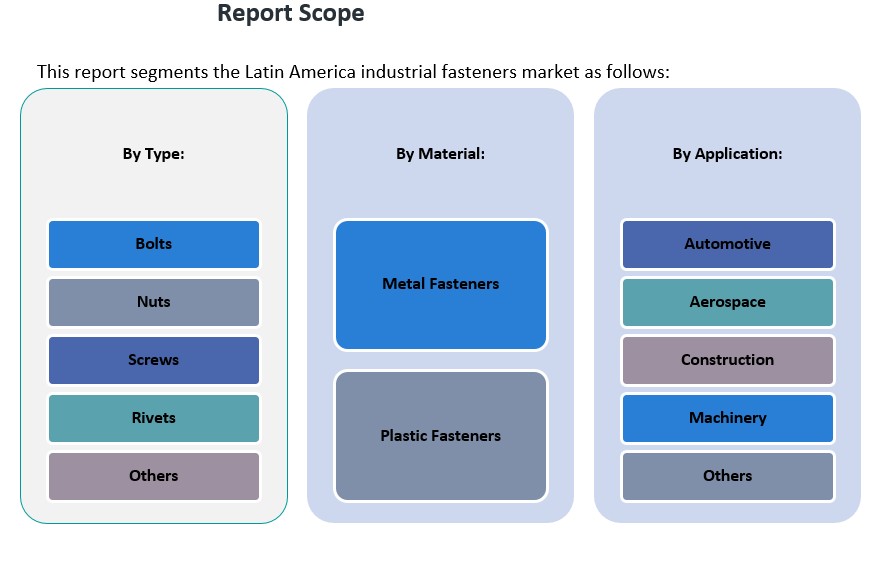

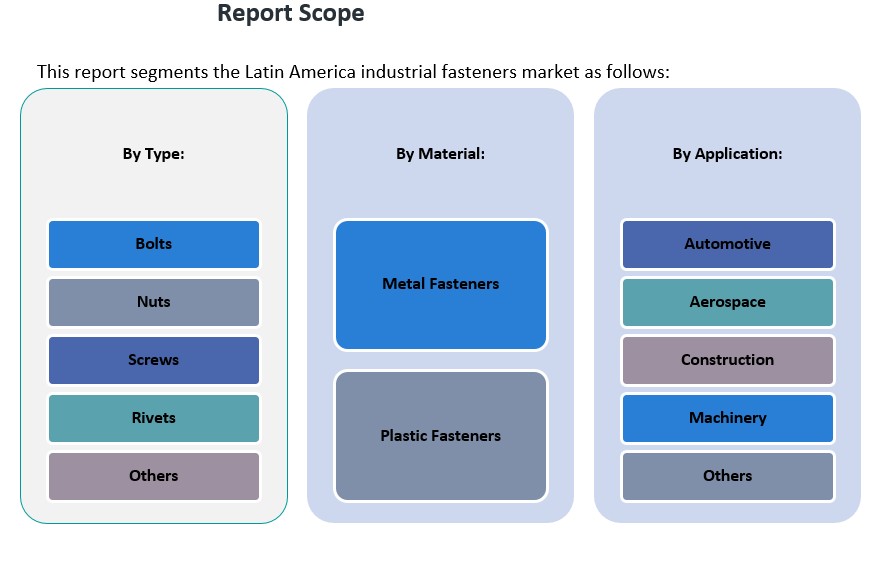

The Latin American industrial fasteners market is segmented by type, application, and material, each catering to specific industrial needs.

By Type:

The market is primarily dominated by bolts, nuts, screws, and rivets. Bolts and screws are widely used in various applications due to their versatility and strength. Nuts are integral to securing bolts and screws, making them essential in industries like automotive and construction. Rivets, while less common, are used in applications where welding is impractical, especially in aerospace and heavy machinery. The “Others” segment includes specialized fasteners used in unique industrial processes.

By Application:

The automotive sector holds the largest share, driven by the region’s expanding automotive manufacturing base, especially in countries like Mexico and Brazil. Fasteners are used in vehicle assembly, ensuring safety and performance. The aerospace sector also contributes significantly, with fasteners used in aircraft assembly and maintenance. The construction industry, characterized by large-scale infrastructure projects, uses a substantial amount of fasteners for buildings, roads, and bridges. Additionally, machinery applications require durable fasteners for the assembly of industrial equipment and machinery.

By Material:

Metal fasteners dominate the market due to their strength, durability, and suitability for demanding applications. Metal fasteners are used across automotive, construction, and aerospace industries. Plastic fasteners are gaining traction in applications where weight reduction and corrosion resistance are prioritized, particularly in industries like aerospace and electronics. The demand for both materials is influenced by the specific requirements of industries and their focus on durability, cost-efficiency, and performance.

Segmentation:

By Type Segment:

- Bolts

- Nuts

- Screws

- Rivets

- Others

By Application Segment:

- Automotive

- Aerospace

- Construction

- Machinery

- Others

By Material Segment:

- Metal Fasteners

- Plastic Fasteners

Regional Analysis:

The Latin American industrial fasteners market is characterized by diverse regional dynamics, with significant contributions from countries such as Brazil, Mexico, Argentina, and Colombia. These countries have well-established industrial sectors that drive demand for fasteners, primarily in automotive, construction, and oil and gas industries. The market in the region is projected to witness steady growth, fueled by increased infrastructure development, automotive manufacturing, and technological advancements in materials and manufacturing processes.

Brazil

Brazil holds the largest market share in the Latin American industrial fasteners market, accounting for approximately 40% of the total regional revenue. The country’s industrial base is diverse, with prominent automotive, construction, and energy sectors that are major consumers of fasteners. Brazil’s automotive industry, in particular, is a key driver, with local and international manufacturers producing a significant volume of vehicles each year. Additionally, the government’s investment in large-scale infrastructure projects and energy production, particularly in the oil and gas sector, further supports the demand for high-quality fasteners. The Brazilian market is expected to continue its dominant position due to the ongoing expansion of these industries and the growing demand for durable, high-performance fasteners.

Mexico

Mexico is another significant player in the region, holding around 30% of the market share. The country has become a manufacturing hub for North America, particularly in the automotive sector, which is one of the largest consumers of fasteners. Mexico’s proximity to the United States and its participation in trade agreements like the USMCA (United States-Mexico-Canada Agreement) have spurred investments in manufacturing facilities, driving the demand for industrial fasteners. Additionally, the growth of Mexico’s construction and energy sectors presents further opportunities for fastener suppliers. With an increasing focus on technological innovation and sustainability in these industries, Mexico’s market is expected to grow at a steady pace.

Argentina and Colombia

Argentina and Colombia, though smaller markets compared to Brazil and Mexico, are witnessing increasing demand for industrial fasteners, contributing to the overall market growth. Argentina’s market share is approximately 15%, driven by the growth in construction and manufacturing industries, particularly in Buenos Aires and other urban centers. The country’s emphasis on infrastructure development, combined with a rising automotive sector, is expected to fuel the demand for fasteners in the coming years.

Colombia accounts for roughly 10% of the market share in Latin America. The country’s growing focus on infrastructure projects, including transportation and energy, is leading to an increase in fastener consumption. Additionally, Colombia’s developing automotive and construction industries are contributing to market expansion, offering opportunities for fastener suppliers to meet the rising demand for durable and reliable fasteners.

Key Player Analysis:

- Fontana Gruppo

- MacLean-Fogg Company

- Agrati Group

- TR Fastenings

- Infasco

- Vimi Fasteners S.p.A.

- Birmingham Fastener

- Ciser – Companhia Industrial de Parafusos

- Metalac

- Sika AG

Competitive Analysis:

The Latin American industrial fasteners market is highly competitive, with several key players dominating the market landscape. Leading manufacturers in the region include large multinational companies such as Stanley Black & Decker, Fastenal, and Würth Group, which offer a wide range of fastener solutions across automotive, construction, and manufacturing sectors. These companies benefit from strong distribution networks, technological advancements, and a broad product portfolio, enabling them to cater to diverse market needs. Additionally, regional players like Grupo Orma and Tecumseh offer localized fastener solutions, often focusing on specific industries such as automotive and energy. These companies differentiate themselves by providing tailored products that meet the unique requirements of the Latin American market, including durability, corrosion resistance, and cost-effectiveness.The competitive landscape is further intensified by the increasing number of local manufacturers and distributors, leading to pricing pressures and a focus on continuous innovation to maintain market share.

Recent Developments:

- In February 2025, Fontana Gruppo completed the acquisition of a majority stake in Right Tight Fasteners Pvt. Ltd., a leading Indian manufacturer of high-strength special bolts and fasteners. This move strengthens Fontana Gruppo’s localization strategy and enhances its presence in key global markets, including Latin America, by leveraging expanded manufacturing capabilities and technological expertise.

- In May 2024, MacLean-Fogg Company announced the acquisition of Mallard Manufacturing, a specialist in gravity flow storage solutions. This partnership is designed to broaden MacLean-Fogg’s manufacturing platform and diversify its reach into new sectors, supporting further growth in the Americas, including Latin America.

Market Concentration & Characteristics:

The Latin American industrial fasteners market exhibits a moderate level of concentration, with a mix of global and regional players driving competition. Large multinational corporations, such as Stanley Black & Decker, Fastenal, and Würth Group, hold significant market share due to their extensive product portfolios, established brand reputation, and robust distribution networks across the region. These companies leverage economies of scale and technological innovations to maintain competitive advantage. On the other hand, regional players like Grupo Orma and Tecumseh focus on providing customized fastener solutions for local industries, catering to specific needs such as corrosion resistance and high-strength materials. While these players hold smaller market shares compared to global giants, they benefit from a deeper understanding of the regional market dynamics and consumer preferences. The market is characterized by increasing competition, continuous product innovation, and an emphasis on cost-effective, durable solutions. Local manufacturers are also focusing on sustainable materials and eco-friendly production practices to meet growing environmental demands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and Material. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Latin American industrial fasteners market is expected to grow at a steady pace due to increased infrastructure development across key countries.

- Mexico’s expanding automotive industry will continue to drive demand for high-quality fasteners in vehicle manufacturing.

- Brazil’s ongoing investment in energy, construction, and manufacturing sectors will fuel market growth.

- The rising focus on automation and robotics will create new opportunities for precision fasteners in manufacturing processes.

- Sustainability trends will push manufacturers to adopt eco-friendly materials and improve production processes.

- Increased adoption of high-strength, corrosion-resistant materials will enhance the performance of fasteners in demanding applications.

- Emerging economies in the region, like Argentina and Colombia, will witness rapid industrialization, boosting fastener demand.

- Technological advancements, including 3D printing, will influence the design and customization of fasteners.

- E-commerce platforms will expand the market by providing easier access to industrial fastener suppliers.

- Competitive pressures will drive continuous innovation, with manufacturers focusing on cost-effective, high-performance solutions.