Market Overview

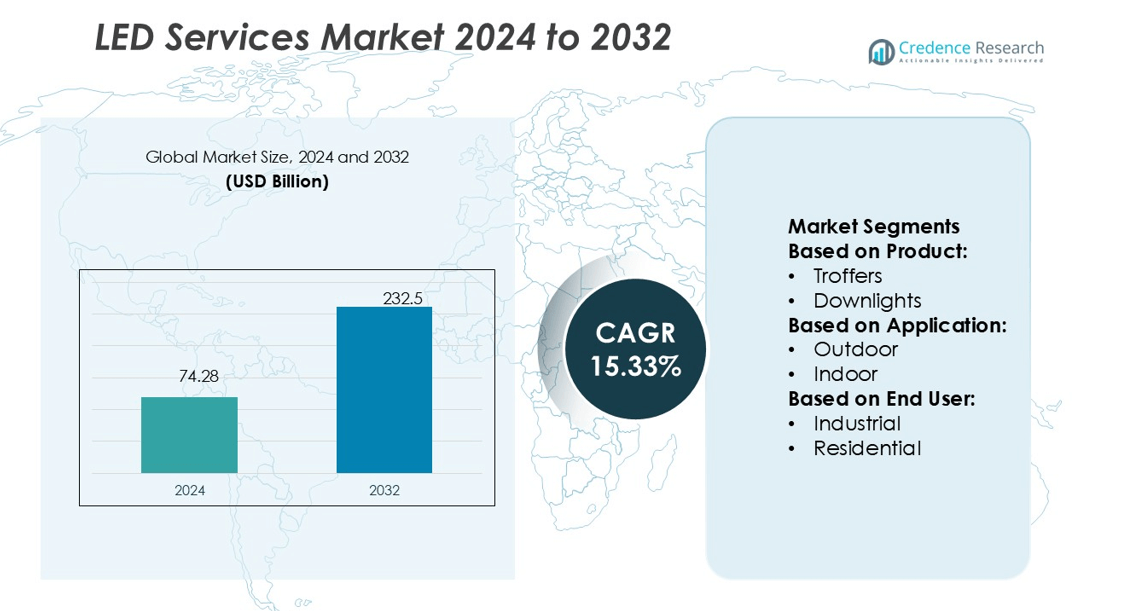

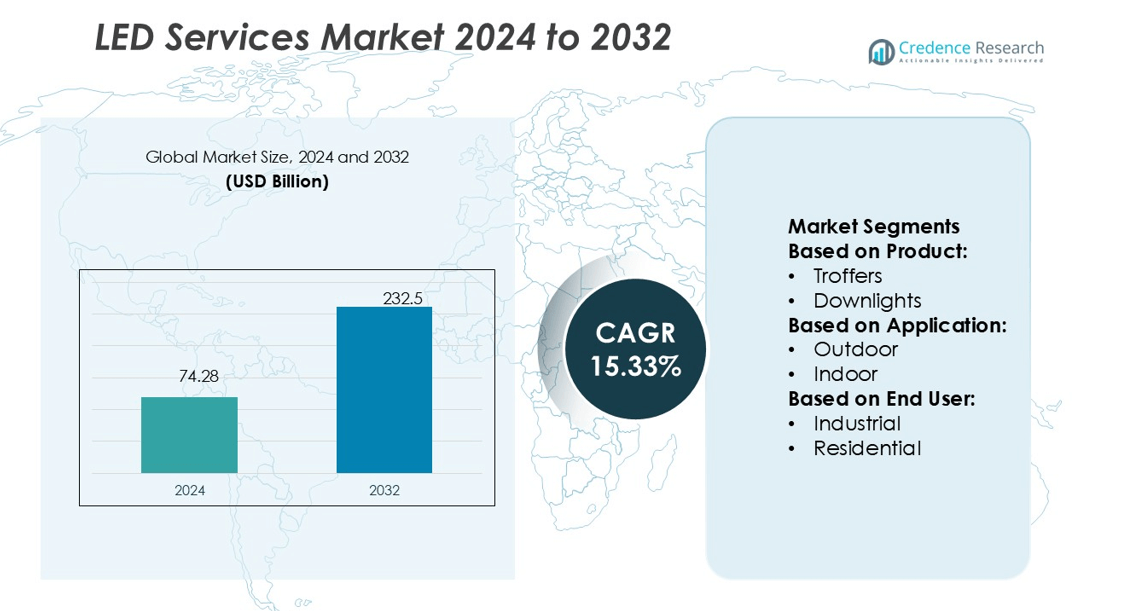

LED Services Market size was valued USD 74.28 billion in 2024 and is anticipated to reach USD 232.5 billion by 2032, at a CAGR of 15.33% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| LED Services Market Size 2024 |

USD 74.28 billion |

| LED Services Market, CAGR |

15.33% |

| LED Services Market Size 2032 |

USD 232.5 billion |

The LED services market features strong competition from leading companies such as Acuity Brands, Inc., Cree Lighting USA LLC, Dialight, Halonix Technologies Private Limited, Hubbell, LSI Industries Inc., Nanoleaf, Panasonic Corporation, SAVANT TECHNOLOGIES LLC, and Seoul Semiconductor Co., Ltd. These players focus on energy-efficient solutions, smart lighting integration, and sustainable innovations to strengthen their global presence. Asia-Pacific leads the market with a commanding 34% share in 2024, driven by rapid urbanization, large-scale infrastructure projects, and government-backed initiatives promoting energy conservation. The region’s strong manufacturing base and cost advantages further consolidate its leadership.

Market Insights

- The LED services market size reached USD 74.28 billion in 2024 and will grow to USD 232.5 billion by 2032 at a CAGR of 15.33%.

- Energy efficiency, cost savings, and government initiatives are the key drivers boosting adoption across residential, commercial, and industrial sectors.

- Smart lighting integration, IoT-enabled solutions, and sustainability practices are shaping market trends, with companies focusing on innovation and eco-friendly designs.

- High initial investment costs and compatibility issues with older infrastructure remain restraints, particularly in price-sensitive and developing markets.

- Asia-Pacific leads with 34% market share in 2024, followed by North America at 27% and Europe at 25%, while the commercial segment dominates end-user adoption with 38% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

In the LED services market, luminaires dominate the product segment with 41% market share in 2024. Luminaires lead due to their wide use in offices, industrial setups, and urban infrastructure projects. Growing demand for smart and connected lighting systems also accelerates adoption. Troffers and downlights follow as key contributors, benefiting from retrofitting programs and energy-efficiency regulations in commercial spaces. Streetlights gain momentum from government-led smart city initiatives, while lamps, including T-lamps and A-lamps, serve the residential market with cost-effective replacement solutions. Continuous upgrades in design and performance sustain segmental growth.

- For instance, SunLike LEDs have a very high color rendering index, with some versions achieving a CRI of 95 or higher. This indicates that they reproduce colors more accurately and vibrantly than conventional LEDs. Some product lines may reach up to CRI 97 or 98.

By Application

The indoor application segment holds a larger market share of 62% in 2024, driven by strong residential and commercial installations. Rising adoption of LED solutions in offices, retail outlets, and educational facilities has strengthened dominance. Indoor usage benefits from low power consumption, long lifespan, and enhanced aesthetic appeal of modern LED designs. Outdoor applications, including streetlights, stadiums, and parking facilities, are expanding quickly due to urbanization and government-led public infrastructure upgrades. Smart lighting solutions integrated with sensors and IoT platforms further support outdoor growth, though indoor applications continue to lead due to higher replacement demand.

- For instance, Dialight has deployed over a million industrial LED fixtures globally. Its Vigilant® High Bay luminaires, including models with up to 71,000 lumens at up to 155 lumens per watt, can achieve significant energy savings, with some applications reporting over 65% reduction in energy consumption compared to conventional lighting systems.

By End-User

The commercial segment dominates the end-user category with 38% market share in 2024, supported by large-scale adoption in office complexes, retail spaces, and hospitality establishments. Businesses prioritize LED lighting for energy savings, reduced maintenance, and sustainability compliance. Industrial applications grow steadily as factories and warehouses adopt high-efficiency luminaires for improved visibility and safety standards. The residential segment contributes strongly, boosted by government subsidies, consumer awareness of energy bills, and a growing preference for modern lighting aesthetics. Other end-users, including institutional and public sector facilities, provide additional opportunities as urban expansion and infrastructure development continue.

Key Growth Drivers

Energy Efficiency and Cost Savings

The primary growth driver in the LED services market is the increasing focus on energy efficiency and cost reduction. LEDs consume nearly 75% less energy compared to traditional lighting, enabling significant savings for households and businesses. Governments across major economies are implementing energy-efficiency mandates, pushing wider adoption. Corporate buyers also align with sustainability goals by investing in long-life LED solutions that reduce maintenance costs. These combined benefits make LEDs the preferred choice across residential, commercial, and industrial applications, driving rapid market penetration.

- For instance, Hubbell’s Protecta X LED luminaire offers a system life exceeding 120,000 hours at 25 °C and claims 50% energy savings compared to fluorescent alternatives in field deployment.

Government Policies and Incentives

Supportive government policies and incentives strongly accelerate LED services market growth. Several countries are phasing out incandescent and fluorescent lamps, replacing them with energy-efficient LED alternatives. Subsidy programs and rebate schemes for residential and commercial installations further improve affordability. National-level initiatives such as smart city projects integrate LED lighting into urban infrastructure, ensuring large-scale demand. These programs not only expand market adoption but also create opportunities for service providers to deliver integrated lighting solutions. Policy-driven momentum remains critical in shaping market expansion globally.

- For instance, Aculux 5° Precision Spot delivery 32,000 CPCB (candela per beam) from a 3-inch aperture, offering beam control in demanding environments.

Technological Advancements in Smart Lighting

Rapid innovation in smart and connected lighting solutions is another major driver. Integration of IoT, sensors, and wireless controls enhances functionality by enabling automation, dimming, and remote management. Smart LEDs contribute to improved energy management and personalized user experiences in both residential and commercial spaces. The growing trend of smart homes, coupled with digital building infrastructure, accelerates demand. Companies are investing heavily in R&D to introduce AI-driven lighting systems and human-centric designs. These advancements not only enhance efficiency but also strengthen the long-term adoption of LED services worldwide.

Key Trends & Opportunities

Rising Demand for Smart Cities

The LED services market benefits significantly from global smart city initiatives. Urban planners increasingly integrate connected LED streetlights, offering not only illumination but also energy monitoring and data collection capabilities. These systems reduce municipal energy costs while improving safety and traffic management. Growing adoption of 5G and IoT enhances opportunities for LED service providers to deliver multifunctional urban infrastructure. Smart city investments in Asia-Pacific, Europe, and North America create strong demand, positioning LEDs as an integral component of modern city planning and infrastructure development.

- For instance, LSI’s AirLink Blue system uses a Bluetooth mesh network that lets fixtures autonomously dim or switch based on motion and daylight. Multiple fixtures can be grouped together, with some sensors capable of controlling up to 150 fixtures in a coordinated fashion.

Sustainability and Circular Economy Practices

Sustainability emerges as a key trend in the LED services market, with manufacturers adopting recyclable materials and eco-friendly production methods. Circular economy practices such as refurbishment, reusability, and responsible disposal of lighting components are gaining traction. Corporate buyers and consumers increasingly prioritize eco-conscious brands aligned with ESG goals. Green building certifications and carbon reduction initiatives further reinforce demand for sustainable LED services. These practices create opportunities for companies to differentiate through environmentally responsible solutions, boosting competitiveness and aligning with global environmental regulations.

- For instance, Panasonic’s circular plastics project recovers 17,000 tonnes per year via cascade recycling and 8,000 tonnes per year via horizontal recycling, feeding back into appliances and components.

Key Challenges

High Initial Investment Costs

Despite long-term cost savings, the high upfront cost of LED installations remains a key challenge. Many residential and small commercial users hesitate to adopt due to budget constraints, particularly in developing economies. Although government subsidies help, limited awareness and financing options restrict adoption. Service providers face the challenge of convincing customers about the return on investment. Until costs reduce further through large-scale manufacturing and supply chain optimization, upfront pricing remains a barrier to faster penetration, especially in price-sensitive markets.

Technical and Compatibility Issues

Another challenge lies in technical limitations and compatibility concerns. Retrofitting LEDs into older infrastructures often requires additional equipment or system upgrades, raising complexity and cost. Compatibility issues with existing dimmers, controls, or wiring can reduce efficiency or create functional problems. Additionally, inconsistent quality in low-cost products creates performance issues, undermining consumer confidence. The need for skilled professionals to install and maintain advanced smart lighting systems further increases barriers. Addressing these technical challenges is crucial to ensure consistent performance and maintain customer trust in LED services.

Regional Analysis

North America

North America holds a 27% market share in the global LED services market in 2024, supported by strong regulatory mandates and widespread adoption of energy-efficient solutions. The United States leads the region, driven by high demand in commercial and industrial sectors. Government programs promoting sustainable lighting and replacement of conventional fixtures accelerate adoption. Canada follows with significant uptake in smart city initiatives and residential retrofitting projects. Continuous technological upgrades and corporate ESG commitments further enhance market growth. The region also benefits from mature infrastructure and consumer awareness, solidifying its position as a key market contributor.

Europe

Europe commands 25% of the LED services market in 2024, fueled by stringent energy efficiency policies and rapid transition to sustainable solutions. Countries such as Germany, the UK, and France lead with extensive adoption in commercial buildings and public infrastructure. The EU’s regulatory framework banning inefficient lighting technologies has been instrumental in shaping demand. Growing investment in smart lighting solutions and green building certifications further strengthens the regional market. The push toward carbon neutrality and circular economy practices also encourages manufacturers and service providers to innovate. These factors collectively make Europe a strong player in global LED services.

Asia-Pacific

Asia-Pacific dominates the LED services market with a 34% market share in 2024, led by China, Japan, and India. Rapid urbanization, large-scale infrastructure projects, and government-backed smart city programs significantly drive demand. China remains the largest contributor due to extensive manufacturing capacity, cost advantages, and aggressive adoption in both residential and commercial sectors. India shows strong growth fueled by energy-saving initiatives and government subsidies. Rising consumer awareness and high adoption of smart home solutions also support market expansion. With a combination of scale, affordability, and policy support, Asia-Pacific continues to lead global LED services growth.

Latin America

Latin America accounts for 7% of the LED services market in 2024, with Brazil and Mexico being the primary growth centers. The region’s adoption is supported by energy-efficiency programs and growing replacement demand for traditional lighting in residential and commercial spaces. Brazil drives demand with government initiatives promoting sustainable lighting in public infrastructure. Mexico follows with strong urban development and industrial applications. However, limited financing options and high upfront costs remain barriers to faster growth. Despite these challenges, rising awareness and gradual policy support provide opportunities for LED service providers to expand across the region.

Middle East & Africa

The Middle East & Africa region captures 7% market share in 2024, driven by growing investments in smart city projects and commercial infrastructure. The UAE and Saudi Arabia lead with large-scale adoption in urban development, hospitality, and retail sectors. Government policies focusing on energy conservation and diversification from traditional power sources also strengthen demand. Africa, though smaller in contribution, shows potential with increasing electrification and urban expansion. High initial costs and limited consumer awareness slow adoption, yet opportunities remain strong in high-income urban centers. The region’s ongoing infrastructure development ensures steady growth in LED services.

Market Segmentations:

By Product:

By Application:

By End User:

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The LED services market is highly competitive, with key players including Nanoleaf, Hubbell, Halonix Technologies Private Limited, SAVANT TECHNOLOGIES LLC, Acuity Brands, Inc., LSI Industries Inc., Panasonic Corporation, Cree Lighting USA LLC, Dialight, and Seoul Semiconductor Co., Ltd. The LED services market is characterized by strong competition, driven by continuous innovation, regulatory support, and rising demand for energy-efficient lighting. Companies in the market prioritize product differentiation through smart lighting integration, sustainable solutions, and advanced design features. Growing adoption of IoT-enabled systems and connected platforms has reshaped service offerings, creating opportunities in residential, commercial, and industrial sectors. The shift toward eco-friendly practices and circular economy models further influences competitive strategies, with firms focusing on recyclable materials and long-lasting products. Investments in research and development, alongside strategic partnerships and regional expansion, remain critical to sustaining market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nanoleaf

- Hubbell

- Halonix Technologies Private Limited

- SAVANT TECHNOLOGIES LLC

- Acuity Brands, Inc.

- LSI Industries Inc.

- Panasonic Corporation

- Cree Lighting USA LLC

- Dialight

- Seoul Semiconductor Co., Ltd.

Recent Developments

- In July 2025, Access Fixtures, a leading manufacturer of high-performance commercial, industrial, and sports LED lighting, launched a new online calculator and comprehensive guide focused on LED light amperage.

- In April 2025, VueReal announced a significant expansion of its Reference Design Kit (RDK) portfolio with new industry-specific bundles. Purpose-built for automotive and consumer electronics, the vertical RDKs are designed to fast-track microLED product development and commercialization with unprecedented speed and integration readiness.

- In February 2025, Cree LED, a Penguin Solutions brand, unveiled the new XLamp XP-L Photo Red S Line LEDs, a groundbreaking advancement in horticulture lighting technology.

- In January 2024, Halonix Technologies, one of the fastest-growing electrical firms in India, today unveiled its ‘Wall De-Light – Spiritual Series’ LED lights as a tribute to the country’s rich spiritual tradition.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The LED services market will expand with rising global demand for energy-efficient lighting.

- Smart lighting solutions will gain traction through integration with IoT and automation systems.

- Government energy policies and subsidies will continue to drive large-scale adoption.

- Indoor applications will maintain dominance, supported by strong residential and commercial demand.

- Outdoor installations will increase with smart city and infrastructure development projects.

- Sustainability practices and recyclable materials will shape future product innovations.

- Advancements in semiconductor technologies will improve LED performance and durability.

- Commercial and industrial sectors will remain the largest end-user contributors.

- Emerging economies will provide growth opportunities through rapid urbanization and electrification.

- Strategic partnerships and R&D investments will strengthen competitiveness across global markets.