Market Overview

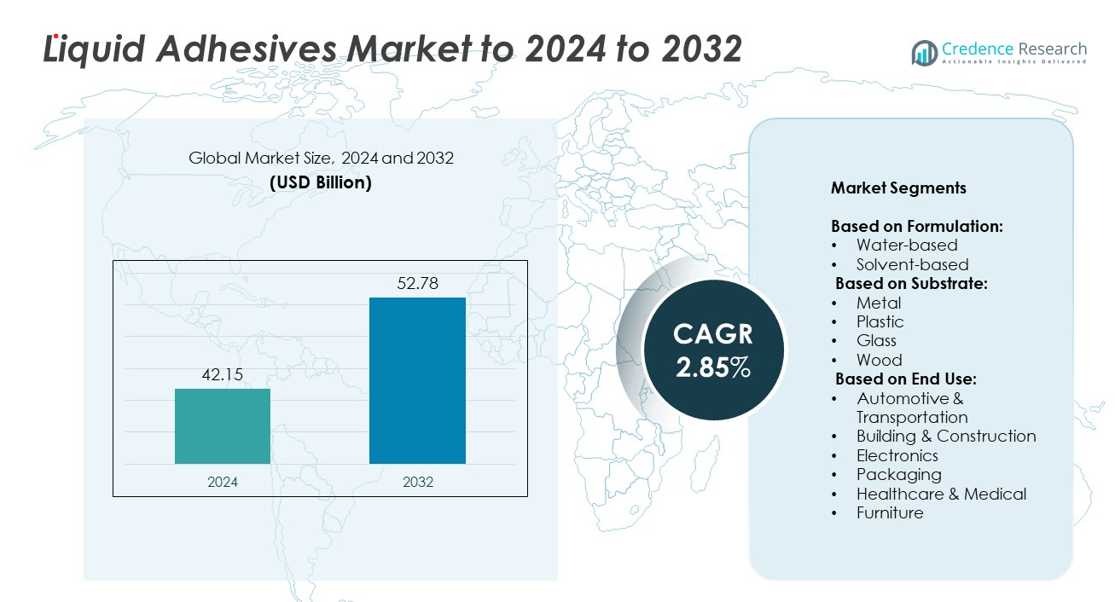

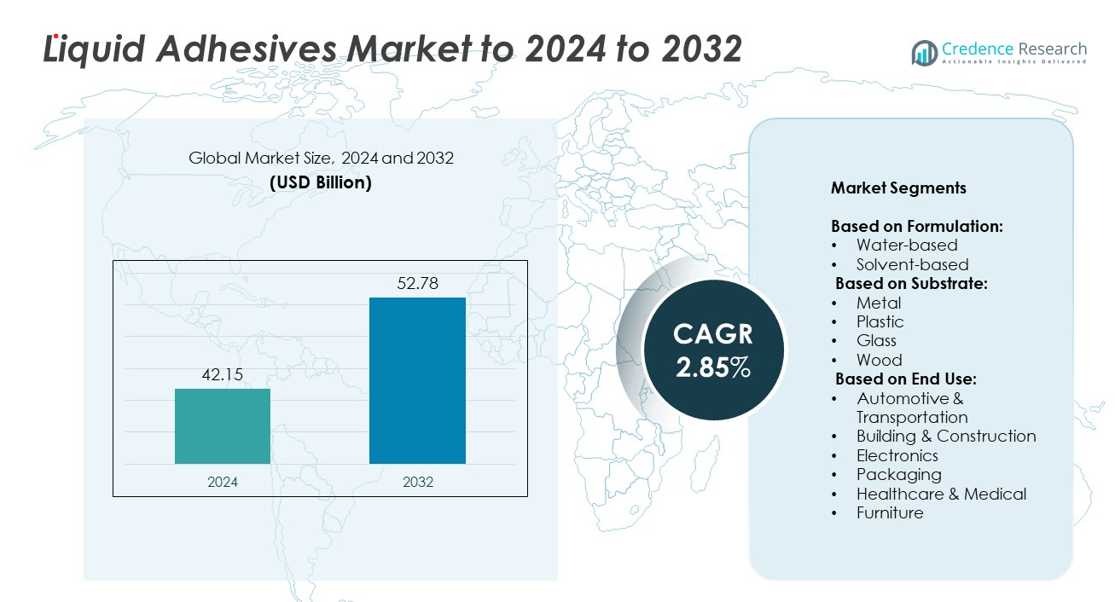

The Liquid Adhesives Market size was valued at USD 42.15 billion in 2024 and is anticipated to reach USD 52.78 billion by 2032, at a CAGR of 2.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Liquid Adhesives Market Size 2024 |

USD 42.15 billion |

| Liquid Adhesives Market, CAGR |

2.85% |

| Liquid Adhesives Market Size 2032 |

USD 52.78 billion |

The liquid adhesives market is shaped by leading companies such as 3M, Henkel AG & Co. KGaA, Dow Inc., H.B. Fuller Company, Bostik SA, Avery Dennison Corporation, and Huntsman Corporation, which maintain strong positions through innovation, product diversification, and global presence. These players emphasize eco-friendly formulations and advanced bonding technologies to cater to industries such as packaging, automotive, construction, and healthcare. Regionally, Asia Pacific leads the market with a 34% share in 2024, supported by rapid industrialization, rising packaging demand, and large-scale automotive production. North America follows with 28%, while Europe accounts for 24%, reflecting strong adoption in regulated and technology-driven industries.

Market Insights

- The liquid adhesives market size reached USD 42.15 billion in 2024 and will hit USD 52.78 billion by 2032, at a CAGR of 2.85%.

- Rising demand from the packaging sector, supported by e-commerce growth and consumer goods, is driving strong adoption.

- Water-based adhesives are trending as the preferred choice due to eco-friendly properties and strict VOC regulations.

- The market is moderately consolidated, with key players focusing on sustainable innovations, strategic acquisitions, and expansion in emerging markets.

- Asia Pacific led with 34% share in 2024, followed by North America at 28% and Europe at 24%, while packaging held over 35% of the global segment share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Formulation

The liquid adhesives market by formulation is divided into water-based and solvent-based types. Water-based adhesives dominated the segment in 2024, holding over 58% of the market share. Their growth is driven by eco-friendly properties, low volatile organic compound (VOC) emissions, and compliance with strict environmental regulations. Industries favor water-based formulations for their safer handling and strong bonding performance across substrates like paper, wood, and textiles. Increasing demand in packaging, construction, and furniture applications continues to strengthen their dominance over solvent-based alternatives.

- For instance, Henkel: Technomelt Supra 130 Cool is now produced with a minimum 20% lower cradle-to-gate CO₂ per kg of adhesive, while keeping the same bonding performance for packaging lines.

By Substrate

Among substrates, plastics held the largest market share in 2024, accounting for nearly 42%. The rise of plastic components in automotive, packaging, and electronics sectors supports this dominance. Adhesives designed for plastics deliver durability, flexibility, and resistance to stress, making them vital in lightweight product manufacturing. With packaging shifting to flexible formats and automotive designs prioritizing lighter parts, plastic substrates remain the leading area for liquid adhesive usage. Continuous innovation in adhesive chemistries further expands compatibility with diverse plastic materials.

- For instance, 3M: Scotch-Weld DP8805NS reaches 7 MPa overlap shear strength in ~9 minutes and shows tested lap-shear on plastics such as PVC 1,800 psi, ABS 1,200 psi, Polycarbonate 850 psi per data sheet.

By End Use

The packaging industry emerged as the dominant end-use segment, securing over 35% of the market share in 2024. Strong growth in e-commerce, consumer goods, and food packaging has created consistent demand for reliable and cost-effective bonding solutions. Liquid adhesives are valued for fast curing, strong seals, and application versatility across cardboard, plastic, and laminates. Additionally, sustainability trends drive innovation in recyclable packaging adhesives. With increasing global packaging production and stricter performance standards, the segment continues to lead adoption across end-use industries such as automotive, electronics, and healthcare.

Key Growth Drivers

Rising Demand from Packaging Industry

The packaging industry is the leading growth driver for the liquid adhesives market. Expanding e-commerce, consumer goods, and food packaging segments create steady demand for high-performance adhesives. Their ability to provide durable bonds, fast curing, and compatibility with diverse substrates makes them essential. Sustainability trends, such as recyclable packaging, further boost adoption. With packaging accounting for the highest end-use share, this sector continues to anchor overall market expansion.

- For instance, Arkema / Bostik launched its Kizen™ LIME adhesive in 2024 comprising at least 80% renewable ingredients.

Increasing Adoption in Automotive and Transportation

Automotive and transportation industries rely heavily on liquid adhesives for lightweight materials and structural bonding. Adhesives replace mechanical fasteners, reducing vehicle weight while enhancing performance and fuel efficiency. Growth in electric vehicle production amplifies demand for adhesives with heat resistance and durability. As automakers prioritize efficiency and safety, liquid adhesives remain integral in both conventional and next-generation vehicle designs, strengthening this segment’s contribution to overall market growth.

- For instance, DuPont’s BETAMATE 73312/73313 structural adhesive achieves 12.4 MPa lap shear strength on aluminum and steel substrates.

Shift Toward Environmentally Friendly Formulations

The industry is witnessing a major shift toward water-based adhesives due to regulatory and sustainability pressures. Governments worldwide enforce stricter restrictions on solvent-based formulations with high VOC emissions. Water-based adhesives offer safer handling, compliance benefits, and strong bonding performance, ensuring their growing dominance. Consumer demand for eco-friendly solutions also accelerates adoption across industries. This transition to sustainable adhesive technologies represents a key driver shaping the future growth of the market.

Key Trends & Opportunities

Integration of Advanced Chemistries

Manufacturers are innovating liquid adhesives with advanced chemistries to enhance adhesion, flexibility, and durability. Formulations with improved heat and chemical resistance are increasingly used in electronics, medical devices, and automotive applications. These advancements allow adhesives to meet evolving industry standards, opening opportunities in high-performance applications. Such product innovations expand market reach and drive differentiation among suppliers.

- For instance, Baxter states that more than 4 million patients worldwide have received Seprafilm Adhesion Barrier, and randomized trials showed 51% adhesion-free rate in treated patients versus 6% in controls in abdominal surgery.

Expansion in Healthcare and Medical Applications

Healthcare has become a growing opportunity for liquid adhesives, driven by demand for medical devices and disposable products. Adhesives are used in wound care, surgical instruments, and wearable devices, offering strong bonding with biocompatible properties. Rising healthcare expenditure and expanding medical device production enhance adoption. This trend positions healthcare as a promising sector for market players seeking growth beyond traditional industries like packaging and construction.

- For instance, Bostik disclosed that Kizen™ LIME avoids almost 100% carbon footprint when accounting for biogenic carbon uptake.

Key Challenges

Volatility in Raw Material Prices

The market faces pressure from fluctuating prices of raw materials such as petrochemicals and resins. Rising costs directly affect adhesive manufacturers’ margins and limit price competitiveness. Dependence on global supply chains further amplifies the impact of market volatility. Companies must adopt strategic sourcing and develop alternative raw materials to mitigate these risks, but the challenge remains persistent.

Stringent Environmental Regulations

Regulatory restrictions on solvent-based adhesives present a significant challenge for manufacturers. Compliance with evolving global standards on VOC emissions and chemical usage increases production costs and limits product flexibility. Smaller firms often struggle to invest in sustainable formulations or meet certifications. While regulations push the industry toward eco-friendly innovations, they also create compliance burdens, particularly for cost-sensitive markets.

Regional Analysis

North America

North America accounted for 28% of the global liquid adhesives market share in 2024, driven by strong demand in packaging, automotive, and construction sectors. The region benefits from advanced manufacturing technologies, high adoption of eco-friendly formulations, and significant investment in research and development. The United States remains the largest contributor due to the scale of its automotive and healthcare industries. Growth in e-commerce further boosts packaging applications. Canada and Mexico also contribute steadily, with increasing industrial and infrastructure activities supporting market expansion across the region.

Europe

Europe held 24% of the global liquid adhesives market share in 2024, supported by stringent environmental regulations that encourage the use of water-based adhesives. The region’s automotive, construction, and packaging industries represent major demand drivers. Germany, France, and the United Kingdom lead the adoption of advanced formulations for high-performance applications. The push toward sustainable materials, along with robust consumer goods demand, sustains market growth. Investments in healthcare and electronics further diversify opportunities, though regulatory compliance costs challenge smaller producers across the region.

Asia Pacific

Asia Pacific dominated the liquid adhesives market in 2024, securing 34% of the global share. Rapid industrialization, rising construction activities, and expanding automotive production fuel strong demand. China, India, and Japan remain key contributors, with packaging being the largest application segment. Growing e-commerce and consumer goods markets amplify usage in flexible packaging. Favorable government initiatives supporting manufacturing growth and infrastructure projects further enhance adoption. The region’s large-scale production capabilities also provide cost advantages, positioning Asia Pacific as the leading global hub for liquid adhesive demand and supply.

Latin America

Latin America accounted for 8% of the liquid adhesives market share in 2024, with Brazil and Mexico as the primary growth engines. The market benefits from rising packaging demand, particularly in food and beverages, and expanding automotive assembly operations. Construction projects across urban centers further contribute to market expansion. However, economic fluctuations and limited investment in advanced adhesive technologies slow adoption compared to developed regions. Despite these challenges, steady industrial growth and increasing e-commerce activity position Latin America as an emerging contributor to global market demand.

Middle East and Africa

The Middle East and Africa held 6% of the global liquid adhesives market share in 2024. Growth is primarily driven by building and construction activities supported by infrastructure development programs across the Gulf countries. Packaging demand in consumer goods and healthcare applications is also rising steadily. South Africa and the United Arab Emirates serve as key markets, while broader regional growth remains uneven due to economic and political instability. Nevertheless, expanding industrial sectors and government-led initiatives to diversify economies create new opportunities for adhesive manufacturers in this region.

Market Segmentations:

By Formulation:

- Water-based

- Solvent-based

By Substrate:

By End Use:

- Automotive & Transportation

- Building & Construction

- Electronics

- Packaging

- Healthcare & Medical

- Furniture

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the liquid adhesives market features leading players such as Beardow Adams, Huntsman Corporation, Avery Dennison Corporation, Henkel AG & Co. KGaA, Jowat SE, 3M Company, Pidilite Industries Ltd., Bostik SA, Mapei S.p.A., Dow Inc., DIC Corporation, and H.B. Fuller Company. The market is moderately consolidated, with global leaders maintaining a stronghold through diverse product portfolios and technological advancements. Companies focus on developing eco-friendly formulations to comply with environmental regulations and meet rising demand for sustainable solutions. Strategic initiatives such as acquisitions, regional expansions, and partnerships enhance global presence and customer reach. Innovation in water-based and high-performance adhesives tailored for industries like packaging, automotive, electronics, and healthcare drives competitiveness. Intense rivalry encourages continuous R&D investments, cost optimization, and product differentiation. The competition remains dynamic, shaped by shifting consumer needs, regulatory frameworks, and the growing emphasis on performance-driven, environmentally sustainable adhesive solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, 3M continues to position its 3M™ Scotch-Weld™ structural liquid adhesives (Epoxy, Acrylic, and Urethane) as essential solutions across demanding industrial sectors.

- In 2023, H.B. Fuller Company introduced Swiftmelt 1515-I, a bio-compatible liquid hot melt adhesive (a type of liquid adhesive when applied) compliant for the IMEA region (India, Middle East, Africa), underscoring a commitment to bio-based and environmentally responsible solutions to meet growing consumer and regulatory demand.

- In 2023, Bostik SA (Arkema Group) did the acquisition of Polytec PT. This move immediately expanded Bostik’s liquid adhesives portfolio to include highly specialized materials, such as thermally and electrically conductive liquid adhesives

Report Coverage

The research report offers an in-depth analysis based on Formulation, Substrate, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising demand in packaging and construction.

- Water-based adhesives will continue to replace solvent-based products.

- Automotive and transportation will drive adoption through lightweight material bonding.

- Healthcare applications will expand due to rising medical device production.

- Asia Pacific will maintain leadership with strong industrial and consumer demand.

- Technological innovations will enhance performance in electronics and high-stress uses.

- E-commerce growth will strengthen packaging adhesive consumption worldwide.

- Regulatory support will accelerate eco-friendly adhesive adoption across regions.

- Volatile raw material prices will influence production and pricing strategies.

- Strategic partnerships and R&D investments will shape competitive positioning.