Market Overview

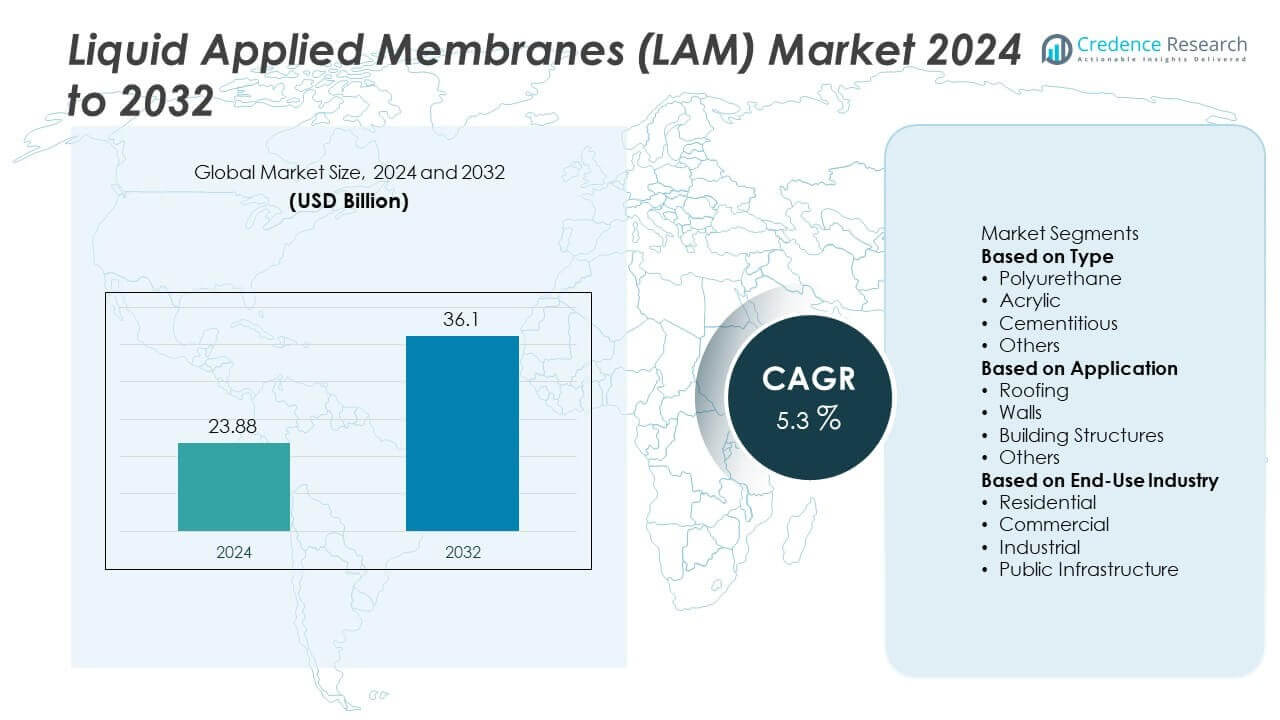

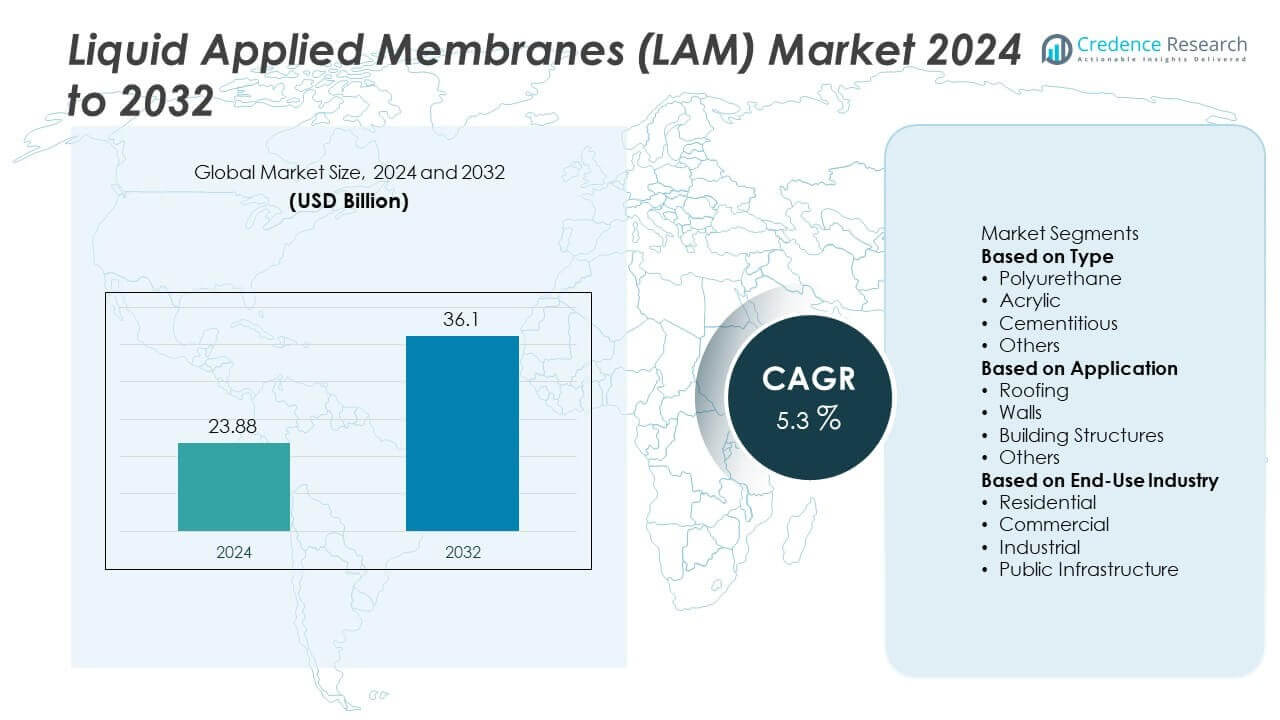

The Liquid Applied Membranes (LAM) market was valued at USD 23.88 billion in 2024 and is projected to reach USD 36.1 billion by 2032, expanding at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Liquid Applied Membranes (LAM) Market Size 2024 |

USD 23.88 Billion |

| Liquid Applied Membranes (LAM) Market, CAGR |

5.3% |

| Liquid Applied Membranes (LAM) Market Size 2032 |

USD 36.1 Billion |

The Liquid Applied Membranes (LAM) market is led by major players including Bostik, Soprema S.A.S., BASF SE, Kemper System America, Inc., Sika AG, Saint-Gobain, W.R. Meadows, GAF Materials Corporation (Standard Industries), Pazkar Ltd., and H.B. Fuller Construction Products Inc. These companies emphasize innovation in eco-friendly and high-performance waterproofing solutions to cater to diverse applications in construction and infrastructure. North America held the largest share at 34% in 2024, supported by strong construction activity and advanced building standards. Europe followed with 29% share, driven by strict regulatory frameworks, while Asia Pacific accounted for 25%, emerging as the fastest-growing region due to rapid urbanization and rising infrastructure investments.

Market Insights

Market Insights

- The Liquid Applied Membranes (LAM) market was valued at USD 23.88 billion in 2024 and is projected to reach USD 36.1 billion by 2032, growing at a CAGR of 5.3%.

- Rising construction activities and infrastructure development are driving demand, with LAM solutions favored for their seamless application, durability, and strong waterproofing performance across residential, commercial, and industrial projects.

- Market trends highlight growing adoption of eco-friendly, low-VOC, and hybrid membrane technologies, aligning with sustainable building practices and stricter environmental regulations.

- Leading companies include Bostik, Soprema S.A.S., BASF SE, Kemper System America, Inc., Sika AG, Saint-Gobain, W.R. Meadows, GAF Materials Corporation (Standard Industries), Pazkar Ltd., and H.B. Fuller Construction Products Inc., focusing on innovation and global expansion.

- Regionally, North America led with 34% share in 2024, followed by Europe at 29% and Asia Pacific at 25%, while the polyurethane type segment dominated with 36% share, supported by superior elasticity and performance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

In 2024, polyurethane membranes dominated the Liquid Applied Membranes market with a 36% share. Their leadership comes from superior elasticity, durability, and waterproofing properties, which make them suitable for diverse climatic conditions. Polyurethane membranes are widely used in roofing and underground structures due to their strong chemical resistance and seamless application. Growing urban infrastructure projects and rising demand for long-lasting waterproofing solutions further support this dominance. Continuous product innovations, such as low-VOC and eco-friendly formulations, are also boosting adoption, strengthening polyurethane’s leading position within the type segment of the market.

- For instance, BASF SE manufactures highly elastomeric polyurethane liquid membranes suitable for long-term roofing applications requiring resistance to thermal cycling and hydrostatic pressure.

By Application

The roofing segment held the largest share of the Liquid Applied Membranes market in 2024, capturing 42%. Roofs are highly exposed to weather extremes, making reliable waterproofing essential. LAM products provide seamless coverage, flexibility, and resistance to UV radiation, driving their widespread use in both residential and commercial roofing projects. Rising construction activities and increasing renovation of aging infrastructure also fuel demand. Moreover, the preference for liquid membranes over traditional sheet-based systems due to ease of application and reduced maintenance costs reinforces roofing as the leading application segment in the market.

- For instance, Sika AG’s Sarnafil AT FSH is a self-healing sheet membrane, not a liquid-applied one, which automatically seals minor cracks and punctures upon contact with water. Its water-reactive polymer technology prevents water ingress and, when used on high-value or critical assets like data centers, offers increased protection against damage from post-installation work.

By End-Use Industry

The residential sector led the Liquid Applied Membranes market in 2024 with a 40% share. Strong growth in urban housing projects and rising awareness of durable waterproofing solutions underpin this leadership. Homeowners and builders increasingly adopt LAM products for roofing, basements, balconies, and terraces to ensure long-term protection against leaks and dampness. Government-backed affordable housing schemes in emerging economies further drive adoption. Additionally, the ease of application and compatibility of LAM solutions with varied substrates make them a preferred choice in residential construction, ensuring this segment maintains its leading position in the market.

Key Growth Drivers

Rising Construction and Infrastructure Development

Rapid urbanization and large-scale infrastructure projects are driving demand for Liquid Applied Membranes. Growing residential, commercial, and public infrastructure construction increases the need for reliable waterproofing solutions. LAMs provide seamless application, durability, and strong resistance against water leakage, making them vital in roofing and structural protection. Government initiatives to upgrade aging infrastructure and expand housing projects further enhance market growth. As construction activities continue to expand globally, the adoption of advanced waterproofing solutions like LAMs is expected to remain a key growth driver in the market.

- For instance, W. R. Meadows liquid-applied waterproofing membranes have been successfully applied in major infrastructure projects, such as the Port of Portland Terminal and the Ottawa River Storage Tank, effectively reducing water infiltration risks and ensuring structural integrity.

Shift Toward Sustainable and Eco-Friendly Solutions

Increasing focus on sustainability is significantly driving LAM adoption. Manufacturers are developing low-VOC, solvent-free, and environmentally friendly formulations to comply with green building standards. These eco-friendly membranes support certifications such as LEED, making them attractive for modern construction projects. Growing awareness among builders and consumers about sustainable materials further supports this trend. Governments and regulatory bodies promoting green construction also encourage the use of safer, energy-efficient waterproofing solutions. This shift toward eco-friendly LAM products enhances market penetration and aligns with long-term sustainability goals.

- For instance, Saint-Gobain has introduced various solvent-free liquid applied membranes with low or zero VOC content, offering improved jobsite safety, sustainability, and benefits like faster curing times under certain conditions.

Advantages Over Traditional Waterproofing Systems

LAMs are increasingly replacing traditional sheet-based waterproofing systems due to superior performance and ease of application. Their seamless finish eliminates weak points at joints, reducing leakage risks. High flexibility, chemical resistance, and suitability for irregular surfaces make them a preferred choice in complex structures. In addition, LAMs reduce installation time and long-term maintenance costs, offering better value for both residential and commercial applications. These advantages make liquid membranes an ideal solution for modern construction needs, fueling adoption across diverse end-use industries and driving consistent market expansion.

Key Trends & Opportunities

Growing Adoption in Roofing Applications

Roofing continues to dominate as the largest application for LAMs, presenting strong opportunities for vendors. Increasing demand for flat and green roofs in urban housing projects has boosted the use of liquid membranes for reliable waterproofing. The ability of LAMs to withstand UV exposure, weather fluctuations, and structural movements makes them highly effective for roofs. Rising renovation and repair activities in developed economies further expand the roofing application market. As energy-efficient roofing solutions gain popularity, LAMs are expected to capture growing demand in both residential and commercial projects.

- For instance, Sika AG offers a range of high-performance liquid-applied membrane systems, such as the Sikalastic line, that are utilized in roofing projects globally. These membranes provide a seamless, highly elastic, and flexible waterproofing layer with excellent crack-bridging properties.

Technological Advancements and Product Innovation

Continuous advancements in product formulations are creating opportunities in the LAM market. Development of hybrid membranes with improved elasticity, crack-bridging, and faster curing times enhances performance in demanding applications. Manufacturers are also focusing on fire-resistant and reflective coatings to meet new safety and energy-efficiency standards. Integration of smart coatings that combine waterproofing with thermal insulation is another emerging trend. These innovations not only address safety and durability challenges but also align with sustainability targets, offering vendors an opportunity to differentiate products and strengthen market positioning.

- For instance, BASF SE developed a hybrid polyurethane membrane with an elongation range over 600% and tensile strength of 12 MPa, featuring fire-retardant and reflective properties, suitable for green building roofing systems, significantly cutting energy usage and enhancing safety.

Key Challenges

Fluctuating Raw Material Prices

Volatility in the prices of raw materials, such as bitumen, acrylics, and polyurethanes, poses a significant challenge to the LAM market. As many inputs are derived from petrochemicals, global oil price fluctuations directly impact production costs. This makes pricing strategies difficult for manufacturers and can reduce profit margins. Additionally, supply chain disruptions further intensify cost instability. Companies are focusing on adopting bio-based alternatives and efficient formulations, but dependency on petroleum-based inputs remains a barrier, limiting stable growth in the market.

Limited Awareness in Emerging Markets

Despite strong global adoption, awareness of LAM benefits remains limited in some emerging economies. Contractors and builders often continue to rely on traditional sheet-based membranes due to familiarity and lower upfront costs. Lack of technical expertise in applying LAMs can also restrict usage, particularly in rural construction markets. This challenge slows down penetration in regions with high construction activity potential. Addressing this gap requires stronger promotional campaigns, training programs, and partnerships with local contractors to build awareness and encourage widespread adoption of liquid membranes.

Regional Analysis

North America

North America dominated the Liquid Applied Membranes market in 2024, accounting for 34% share. The region’s leadership is supported by high construction activity in both residential and commercial sectors, along with strong adoption of advanced waterproofing technologies. The U.S. leads demand with rising renovation projects and adoption of sustainable building practices, while Canada follows with infrastructure upgrades. Increasing awareness of eco-friendly solutions and strict building codes drive the preference for liquid-applied systems. Strong presence of global manufacturers and demand for energy-efficient roofing further strengthen North America’s position as the leading regional market.

Europe

Europe held a 29% share of the Liquid Applied Membranes market in 2024, driven by stringent building regulations and energy efficiency standards. Countries such as Germany, France, and the UK lead adoption due to strong focus on sustainable construction and advanced waterproofing solutions. Renovation of aging infrastructure and demand for eco-friendly, low-VOC membranes support growth. Public infrastructure projects across the region, including transportation and institutional buildings, also contribute significantly. With the EU Green Deal encouraging sustainable practices, the region continues to expand its demand for liquid membranes across residential, commercial, and industrial applications.

Asia Pacific

Asia Pacific captured 25% share of the Liquid Applied Membranes market in 2024, emerging as the fastest-growing region. Strong construction growth in China, India, and Southeast Asia, coupled with rapid urbanization, drives demand for effective waterproofing solutions. Governments are heavily investing in housing and infrastructure, boosting adoption of liquid membranes across residential and public infrastructure projects. The region also benefits from growing awareness of advanced waterproofing technologies and presence of cost-competitive local manufacturers. Rising demand for energy-efficient, durable construction materials positions Asia Pacific as a key growth engine for the global LAM market.

Latin America

Latin America accounted for 7% share of the Liquid Applied Membranes market in 2024, with Brazil and Mexico leading adoption. Growing construction activities in urban centers and rising investments in public infrastructure projects support demand. Increasing awareness of waterproofing solutions for roofing and walls in residential and commercial projects fuels adoption. However, limited awareness in rural areas and cost sensitivity among contractors remain challenges. Despite these barriers, rising demand for affordable housing and modernization of public infrastructure present growth opportunities for liquid-applied membrane suppliers in the region.

Middle East & Africa

The Middle East & Africa represented 5% share of the Liquid Applied Membranes market in 2024. Growth is driven by rapid infrastructure development in the UAE and Saudi Arabia, including large-scale commercial and residential projects. Smart city initiatives and investments in public infrastructure projects further boost demand for advanced waterproofing solutions. In Africa, rising urbanization and housing needs are creating opportunities, particularly in South Africa and Nigeria. Although market penetration is lower compared to other regions, increasing construction activities and adoption of modern waterproofing practices support steady growth in this region.Top of Form

Market Segmentations:

By Type

- Polyurethane

- Acrylic

- Cementitious

- Others

By Application

- Roofing

- Walls

- Building Structures

- Others

By End-Use Industry

- Residential

- Commercial

- Industrial

- Public Infrastructure

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Liquid Applied Membranes (LAM) market is shaped by leading players such as Bostik, Soprema S.A.S., BASF SE, Kemper System America, Inc., Sika AG, Saint-Gobain, W.R. Meadows, GAF Materials Corporation (Standard Industries), Pazkar Ltd., and H.B. Fuller Construction Products Inc. These companies focus on developing advanced waterproofing solutions with superior elasticity, durability, and eco-friendly formulations to meet rising demand in residential, commercial, and infrastructure applications. Strategic initiatives include expanding product portfolios with low-VOC and sustainable membranes, strengthening global distribution networks, and engaging in partnerships and acquisitions to expand market reach. Players are also investing in R&D to introduce hybrid and high-performance membranes designed for extreme weather and complex structural requirements. With construction and renovation activities rising worldwide, competition intensifies as companies aim to deliver cost-effective, long-lasting, and regulatory-compliant solutions tailored to diverse regional needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bostik

- Soprema S.A.S.

- BASF SE

- Kemper System America, Inc.

- Sika AG

- Saint-Gobain

- R. Meadows

- GAF Materials Corporation (Standard Industries)

- Pazkar Ltd.

- B. Fuller Construction Products Inc.

Recent Developments

- In July 2025, W.R. Meadows launched a high-performance liquid-applied waterproofing membrane engineered for below-grade and roofing applications. The product demonstrated rapid curing times and high resistance to hydrostatic pressure, optimizing installation efficiency in commercial construction projects.

- In April 2024, Sika showcased “protective membranes” at Coverings 2024, emphasizing its liquid-applied waterproofing and crack-isolation systems.

- In 2024, Soprema launched a bio-based liquid applied membrane designed for green building certifications, focusing on sustainability and low environmental impact.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising demand for advanced waterproofing in construction.

- Polyurethane membranes will maintain dominance due to durability and superior performance.

- Roofing applications will continue to lead adoption supported by renovation and new construction projects.

- Residential sector demand will expand with urban housing and affordable housing initiatives.

- Eco-friendly and low-VOC formulations will gain wider acceptance under green building regulations.

- Technological innovations in hybrid and reflective membranes will enhance performance and adoption.

- Asia Pacific will emerge as the fastest-growing region with rapid urbanization and infrastructure growth.

- Strategic partnerships and acquisitions will strengthen global presence of key players.

- Renovation and refurbishment projects in developed markets will drive replacement demand.

- Adoption in public infrastructure projects will rise with government investments in modern facilities.

Market Insights

Market Insights