Market Overview:

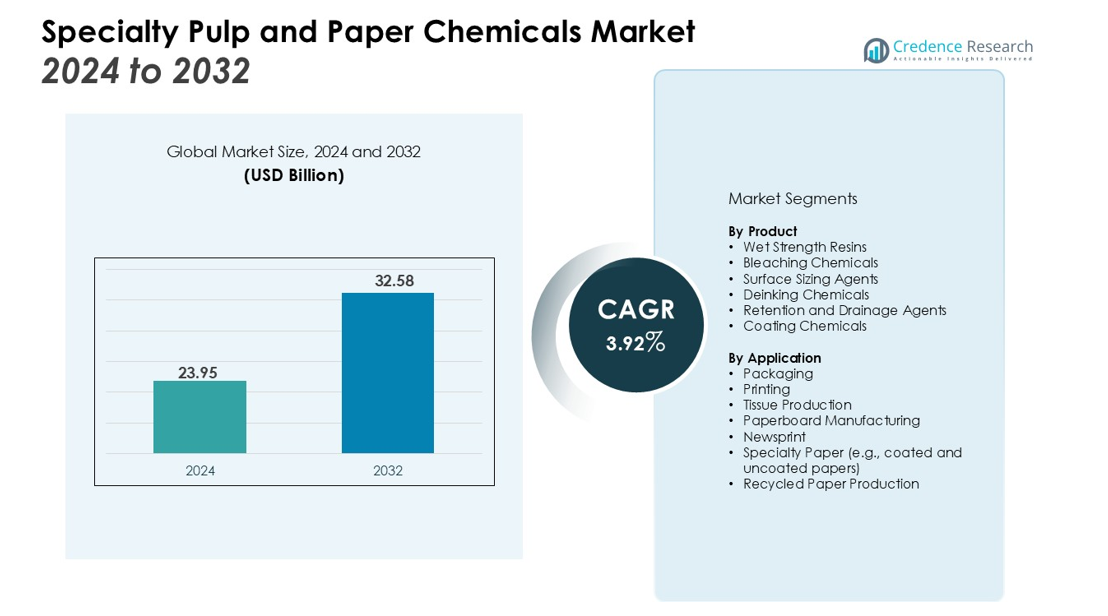

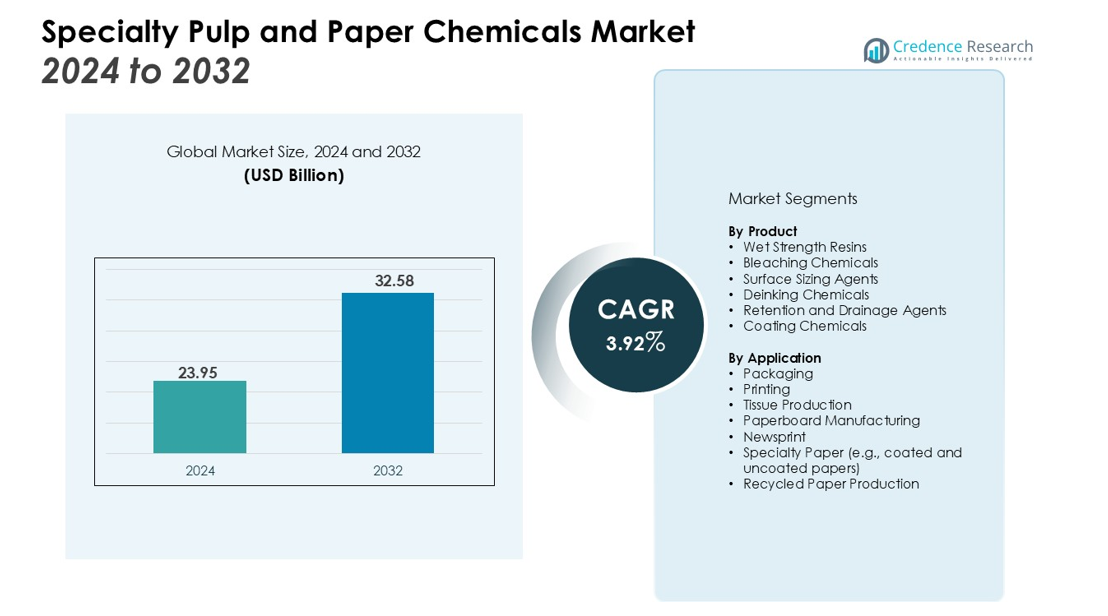

The Specialty Pulp and Paper Chemicals Market size was valued at USD 23.95 billion in 2024 and is anticipated to reach USD 32.58 billion by 2032, at a CAGR of 3.92% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Specialty Pulp and Paper Chemicals Market Size 2024 |

USD 23.95 billion |

| Specialty Pulp and Paper Chemicals Market, CAGR |

3.92% |

| Specialty Pulp and Paper Chemicals Market Size 2032 |

USD 32.58 billion |

Key drivers of market growth include the growing emphasis on sustainability in the pulp and paper industry, the need for cost-effective solutions, and the demand for high-performance products such as wet strength resins, bleaching chemicals, and surface sizing agents. Additionally, the shift towards recycled paper production and the increasing adoption of advanced technologies like nanotechnology are fueling demand for innovative specialty chemicals. Regulatory pressures related to environmental impact are further propelling the market toward eco-friendly solutions, such as biodegradable and low-toxicity chemicals. The rising consumer preference for sustainable packaging and environmentally friendly products is also significantly influencing market trends.

Regionally, North America and Europe are the leading markets for specialty pulp and paper chemicals, driven by the presence of large-scale paper production facilities and stringent environmental regulations. The Asia-Pacific region is anticipated to witness the fastest growth due to increasing industrialization and rising paper consumption in countries like China and India. Additionally, the expanding e-commerce sector in the region is further driving the demand for paper-based packaging solutions.

Market Insights:

- The Specialty Pulp and Paper Chemicals market was valued at USD 23.95 billion in 2024 and is expected to reach USD 32.58 billion by 2032, growing at a CAGR of 3.92% during the forecast period.

- The demand for eco-friendly and sustainable products is rising, pushing the pulp and paper industry to adopt greener practices and develop biodegradable, recyclable, and low-toxic chemicals for paper production.

- Technological advancements, including nanotechnology and new chemical formulations, are driving market growth by improving paper quality, production efficiency, and reducing waste.

- The growing shift towards recycled paper production is fueling the market, with specialty chemicals playing a crucial role in enhancing the deinking process and ensuring high-quality recycled paper products.

- Stringent environmental regulations globally are forcing manufacturers to adopt sustainable practices, creating demand for eco-friendly solutions such as biodegradable and low-toxicity chemicals in the pulp and paper industry.

- The fluctuating raw material prices and supply chain disruptions are posing challenges, increasing production costs and impacting the profitability of chemical manufacturers in the pulp and paper industry.

- North America and Europe hold significant market shares of 35% and 30%, respectively, driven by sustainability initiatives, while the Asia-Pacific region is expected to witness the fastest growth due to industrialization and rising paper consumption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Eco-Friendly and Sustainable Products

The Specialty Pulp and Paper Chemicals market is experiencing strong growth due to the increasing demand for eco-friendly and sustainable products. Consumers and businesses are prioritizing environmentally conscious solutions, which is pushing the pulp and paper industry to adopt greener practices. The demand for chemicals that enable the production of recyclable, biodegradable, and low-toxic paper products is higher than ever. Companies are focusing on developing environmentally responsible chemicals, such as biodegradable wet strength agents and deinking chemicals for recycled paper, to align with the sustainability trend.

- For instance, Kemira has advanced its sustainable offerings by launching 2 new ISCC PLUS certified biomass-balanced polymers for the paper industry, including the market’s first certified PAE-based wet strength resins.

Technological Advancements and Innovation in Chemical Solutions

Innovation plays a significant role in the market’s growth. The advancement of technologies such as nanotechnology and new chemical formulations has enabled the development of high-performance specialty chemicals. These chemicals improve the quality, durability, and functional properties of paper products. Specialty Pulp and Paper Chemicals are now more effective in enhancing production efficiency, reducing waste, and meeting the growing demand for high-quality paper products, especially in packaging and printing industries.

Growing Demand for Recycled Paper Products

The shift toward recycled paper production is another key driver of market growth. With increasing environmental concerns, companies are focusing on the use of recycled paper for various applications. Specialty Pulp and Paper Chemicals play a crucial role in making the recycling process more efficient by improving the deinking process and ensuring the desired quality of the final product. This trend is expected to continue, as the demand for sustainable packaging solutions rises across industries such as food and beverages and e-commerce.

Regulatory Pressures for Sustainable Practices

Stringent environmental regulations are forcing the pulp and paper industry to adopt sustainable practices. Governments and regulatory bodies worldwide are enforcing policies that limit the use of harmful chemicals and encourage the adoption of greener alternatives. Specialty Pulp and Paper Chemicals are designed to meet these regulatory requirements, offering companies eco-friendly solutions that align with global sustainability goals. Compliance with such regulations helps businesses reduce environmental impact while maintaining product quality.

- For instance, to align with global sustainability frameworks, UPM, a biomaterials company with production plants in 11 countries, has participated in the Science Based Targets Network (SBTN) pilot to validate its nature-related environmental targets.

Market Trends:

Shift Towards Eco-Friendly and Biodegradable Chemicals

A significant trend in the Specialty Pulp and Paper Chemicals market is the growing shift towards eco-friendly and biodegradable chemical solutions. The increasing emphasis on sustainability has led pulp and paper manufacturers to prioritize the use of chemicals that have minimal environmental impact. Biodegradable wet-strength resins, low-toxicity bleaching agents, and other sustainable alternatives are gaining popularity. These chemicals not only help reduce the carbon footprint of paper production but also support companies in meeting the stringent environmental regulations in various regions. The push for biodegradable and recyclable paper products, driven by consumer preferences and global environmental policies, further accelerates the demand for these innovative chemicals. As a result, the market is seeing a rise in the development and adoption of greener chemicals that align with eco-conscious trends in packaging and consumer goods.

- For instance, Nouryon provides Eka® ClO₂, a primary bleaching agent for modern, eco-friendly paper pulp manufacturing. This chlorine dioxide is typically utilized as an aqueous solution at a concentration of 8–11 grams per liter, which is effective for elemental chlorine-free bleaching processes.

Increasing Adoption of Advanced Technologies for Improved Efficiency

The adoption of advanced technologies such as nanotechnology and automation is becoming a key trend in the Specialty Pulp and Paper Chemicals market. These technologies enable the development of high-performance chemicals that enhance paper quality and production efficiency. Nanomaterials, for example, improve paper strength, water resistance, and printing quality without compromising environmental standards. Moreover, automation in chemical applications ensures precise formulation and usage, reducing waste and improving cost-effectiveness. The increasing focus on process optimization and the demand for high-quality paper products in industries like packaging and printing is driving the adoption of these technologies. This trend is expected to continue as manufacturers seek to achieve better performance and sustainability with their chemical formulations.

- For instance, Domtar’s partner, CelluForce, operates one of the world’s largest nanocellulose plants, with an upgraded production capacity of 300 tons per year to supply this advanced material for various applications.

Market Challenges Analysis:

Fluctuating Raw Material Prices and Supply Chain Disruptions

One of the significant challenges facing the Specialty Pulp and Paper Chemicals market is the volatility of raw material prices. The pulp and paper industry relies on a range of chemicals that depend on natural resources and petrochemicals. Price fluctuations in these raw materials can lead to increased production costs and impact the profitability of chemical manufacturers. Moreover, supply chain disruptions, driven by geopolitical issues, transportation challenges, or natural disasters, can further exacerbate the issue, delaying deliveries and affecting production schedules. The cost and availability of raw materials have a direct influence on the overall market dynamics and could hinder the growth of the industry if not managed efficiently.

Stringent Regulatory Compliance and Environmental Impact

Another challenge for the Specialty Pulp and Paper Chemicals market is navigating stringent regulatory frameworks. Governments worldwide are implementing increasingly rigorous regulations concerning the use of chemicals in the paper production process, particularly regarding environmental impact. Manufacturers must invest in research and development to create chemical solutions that comply with these regulations while maintaining performance standards. These compliance requirements can result in higher costs and extended timeframes for product approval. Furthermore, the demand for eco-friendly solutions places pressure on chemical manufacturers to balance sustainability with cost-effectiveness, creating additional complexity in their operations.

Market Opportunities:

Growing Demand for Sustainable Packaging Solutions

One of the key opportunities in the Specialty Pulp and Paper Chemicals market lies in the growing demand for sustainable packaging solutions. With increasing consumer awareness and regulatory pressure, industries are shifting towards eco-friendly packaging alternatives. Specialty chemicals that enable the production of recyclable, biodegradable, and low-toxic paper products are essential in meeting these demands. The increasing popularity of sustainable packaging in sectors such as food, e-commerce, and consumer goods provides a significant market opportunity. Companies focused on developing environmentally friendly chemicals, such as biodegradable wet-strength resins and eco-friendly deinking agents, are well-positioned to capture market share in this evolving segment.

Technological Advancements Driving Innovation in Chemical Solutions

Technological advancements offer another significant opportunity for growth in the Specialty Pulp and Paper Chemicals market. The application of emerging technologies like nanotechnology and bio-based chemicals enables the development of high-performance chemicals that improve paper quality and production efficiency. These innovations can enhance paper strength, water resistance, and printability while reducing the environmental footprint. The growing need for specialized chemical formulations in high-demand sectors such as packaging, printing, and labeling presents a promising avenue for chemical manufacturers to expand their product offerings. Companies that invest in technology-driven solutions can gain a competitive edge in the market.

Market Segmentation Analysis:

By Product

The Specialty Pulp and Paper Chemicals market is segmented by product types, with wet strength resins, bleaching chemicals, and surface sizing agents being the most prominent. Wet strength resins are essential for enhancing the strength of paper, especially in high-moisture environments. Bleaching chemicals are critical in whitening pulp, ensuring the production of high-quality paper. Surface sizing agents improve paper’s printability, smoothness, and strength. This segment is growing due to the increasing demand for high-performance paper products and the trend toward sustainable production, which encourages the development of eco-friendly chemical alternatives.

- For instance, Kemira’s FennoSize AS, a synthetic sizing agent, allows for over 90 percent immediate sizing development on paper machines.

By Application

The market is also segmented by application, with key industries such as packaging, printing, and tissue production driving demand for specialty chemicals. In packaging, the emphasis on recyclable and biodegradable solutions is growing rapidly, boosting demand for sustainable chemical products. The printing industry seeks chemicals that improve paper quality, enhance color retention, and reduce environmental impact. Tissue production also relies heavily on chemicals like wet strength resins to improve product durability. Specialty Pulp and Paper Chemicals are integral across these applications, where they contribute to improving product performance while meeting regulatory and environmental standards. The growing focus on sustainable packaging and eco-friendly solutions continues to support the expansion of this segment.

- For instance, in tissue production, a manufacturer using Nalco Water’s METRIX technology enhanced product performance by increasing the geometric mean tensile strength from 3,900 to 4,300 g/3, enabling the development of a higher-strength grade.

Segmentations:

By Product:

- Wet Strength Resins

- Bleaching Chemicals

- Surface Sizing Agents

- Deinking Chemicals

- Retention and Drainage Agents

- Coating Chemicals

By Application:

- Packaging

- Printing

- Tissue Production

- Paperboard Manufacturing

- Newsprint

- Specialty Paper (e.g., coated and uncoated papers)

- Recycled Paper Production

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America: Leading Market for Specialty Pulp and Paper Chemicals

North America holds a market share of 35% in the Specialty Pulp and Paper Chemicals market, driven by advanced paper production infrastructure and a strong focus on sustainability. The United States and Canada lead in adopting eco-friendly chemicals for paper manufacturing. The presence of key players in the chemical industry and stringent environmental regulations push manufacturers to innovate in the development of sustainable chemical solutions. The demand for recycled paper products and sustainable packaging solutions is rising, creating further opportunities for growth in this region. Investments in advanced technologies, such as nanotechnology and biodegradable chemicals, support market expansion.

Europe: Strong Focus on Sustainability and Environmental Regulations

Europe commands a 30% market share in the Specialty Pulp and Paper Chemicals market, driven by rigorous environmental policies and a strong emphasis on sustainability. The European Union’s focus on reducing carbon footprints and promoting recyclable materials is driving the demand for eco-friendly chemicals. Countries like Germany, Sweden, and Finland, known for their strong pulp and paper industries, are investing in sustainable chemical solutions. Specialty chemicals that enable paper recycling, improve energy efficiency, and reduce emissions are in high demand. Manufacturers in Europe are adopting technologies that help meet strict environmental standards, creating a competitive market for sustainable pulp and paper chemicals.

Asia-Pacific: Rapid Market Growth Fueled by Industrialization

The Asia-Pacific region holds a 25% share in the Specialty Pulp and Paper Chemicals market and is expected to experience the fastest growth. Countries like China, India, and Japan are driving demand for paper products due to rapid industrialization, urbanization, and growing populations. The region’s expanding manufacturing base and rising paper consumption across industries, such as packaging and printing, are creating significant opportunities for chemical suppliers. The push for environmentally friendly products and sustainable manufacturing practices in these countries accelerates the adoption of specialty chemicals. With increasing investments in the pulp and paper industry, the Asia-Pacific region is poised for rapid growth in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Specialty Pulp and Paper Chemicals market is highly competitive, with major players such as BASF, Dow Chemical, AkzoNobel, and Solvay leading the market due to their broad product portfolios and global presence. These companies focus on providing high-performance and sustainable chemical solutions to meet the growing demand for eco-friendly paper products. Regional players like Kemira and Evonik also play a crucial role by offering tailored solutions to meet specific market needs. The competitive landscape is driven by continuous innovation in chemical formulations, with an emphasis on improving production efficiency, reducing environmental impact, and complying with stringent regulatory standards. As the market shifts towards sustainability, competition remains intense, with companies investing in research and development to secure their position in this evolving industry.

Recent Developments:

- In April 2025, Ashland officially launched Collapeptyl™, a biofunctional collagen innovation for the skincare market.

- In August 2025, Buckman announced a joint venture with Atul to deliver advanced water treatment solutionsutions to the Indian and Sri Lankan markets.

Report Coverage:

The research report offers an in-depth analysis based on Product, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for sustainable and eco-friendly chemicals will continue to drive market growth.

- Innovation in biodegradable, recyclable, and low-toxicity chemicals will be a key focus for manufacturers.

- Advancements in nanotechnology will improve the quality and efficiency of paper products.

- Increased adoption of recycled paper production will create new opportunities for specialty chemicals.

- Strict environmental regulations will push the industry toward greener chemical solutions.

- The packaging sector, particularly sustainable packaging, will remain a major application area for specialty chemicals.

- The tissue production industry will continue to rely on wet strength resins and other specialty chemicals.

- Asia-Pacific will see significant market expansion due to rapid industrialization and growing paper consumption.

- North America and Europe will maintain leadership in the market due to stringent environmental policies and established infrastructure.

- Companies will focus on strategic collaborations, mergers, and acquisitions to strengthen their market position and innovate in chemical formulations.