Market Overview

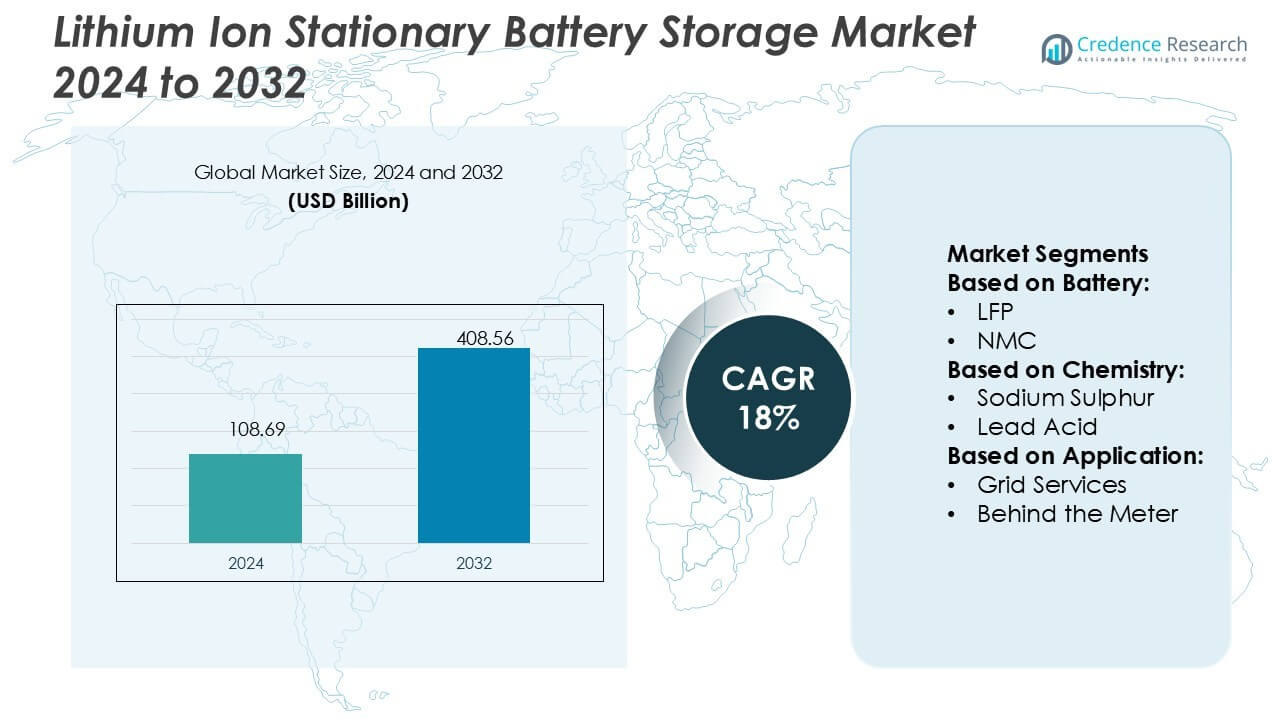

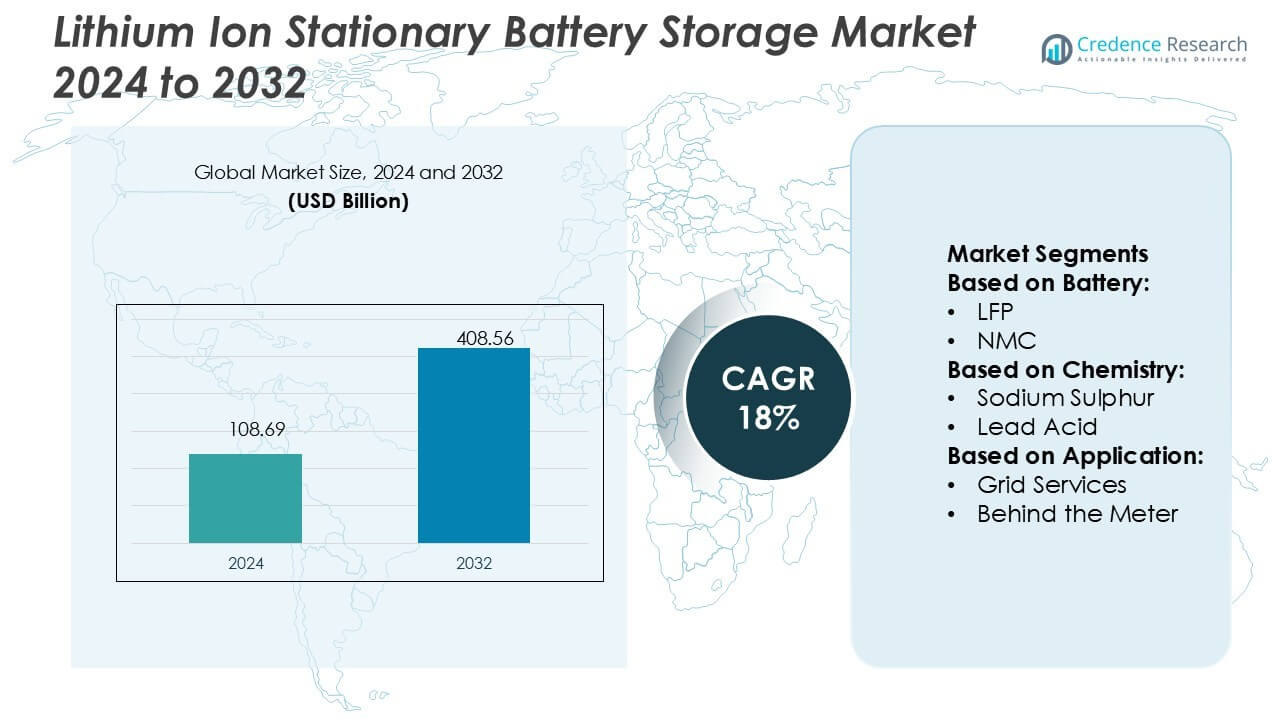

Lithium Ion Stationary Battery Storage Market size was valued USD 108.69 billion in 2024 and is anticipated to reach USD 408.56 billion by 2032, at a CAGR of 18% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lithium Ion Stationary Battery Storage Market Size 2024 |

USD 108.69 Billion |

| Lithium Ion Stationary Battery Storage Market, CAGR |

18% |

| Lithium Ion Stationary Battery Storage Market Size 2032 |

USD 408.56 Billion |

The lithium-ion stationary battery storage market is driven by prominent players including Exide Technologies, LG Chem, Leclanché SA, Johnson Controls, GS Yuasa International Ltd, Siemens Energy, Tesla, Panasonic Corporation, Hitachi Energy Ltd., and Toshiba Corporation. These companies focus on advancing battery technologies, scaling production, and forming strategic partnerships to expand their global reach. Their efforts are directed toward improving energy density, reducing costs, and enhancing safety features to meet rising demand from grid services, behind-the-meter, and off-grid applications. Asia-Pacific leads the market with a 34% share in 2024, supported by large-scale manufacturing capacity, government-backed renewable integration, and strong investments in grid modernization, positioning the region as the global hub for lithium-ion stationary storage adoption.

Market Insights

- The Lithium Ion Stationary Battery Storage Market was valued at USD 108.69 billion in 2024 and will reach USD 408.56 billion by 2032, growing at a CAGR of 18%.

- Rising renewable energy integration, declining battery costs, and government incentives act as strong market drivers, boosting demand across utility, commercial, and residential applications.

- Key trends include the shift toward LFP chemistry for grid-scale projects, increasing hybrid storage adoption, and growing focus on recycling and second-life battery solutions.

- Competitive dynamics are shaped by leading players such as Exide Technologies, LG Chem, Leclanché SA, Johnson Controls, GS Yuasa International Ltd, Siemens Energy, Tesla, Panasonic Corporation, Hitachi Energy Ltd., and Toshiba Corporation, with strategies focused on scaling production, safety innovation, and strategic partnerships.

- Asia-Pacific leads with 34% share, followed by North America at 27% and Europe at 24%, while grid services dominate applications with 60% share, highlighting strong reliance on storage for grid stability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Battery

The lithium-ion battery segment dominates the stationary storage market, holding over 65% share in 2024. Its strong position comes from superior energy density, longer cycle life, and falling production costs driven by economies of scale. Sub-chemistries like LFP and NMC further enhance performance flexibility across applications. While alternatives such as sodium sulphur and flow batteries gain attention for large-scale or niche deployments, lithium-ion continues to lead adoption for both utility and distributed storage projects, supported by continuous innovation and robust supply chains.

- For instance, Exide Technologies has already deployed over 100 MWh of lithium-ion systems across its stationary storage projects. Exide introduced the Solition Mega Three containerized module with 3.4 MWh capacity and liquid cooling.

By Chemistry

Among lithium-ion chemistries, LFP (Lithium Iron Phosphate) is the leading sub-segment, accounting for 55% share in 2024. LFP dominates due to high thermal stability, long cycle durability, and competitive cost advantage over NMC. These characteristics make it preferred for grid-scale and behind-the-meter installations. NMC, with 38% share, remains prominent in high-energy density applications but faces cost and supply risks linked to cobalt and nickel. Growing safety standards and sustainability regulations further strengthen LFP’s leadership in the chemistry landscape, fueling widespread integration across renewable energy storage systems.

- For instance, LG Energy Solution (LG Chem’s battery arm) opened a U.S. LFP battery plant in Holland, Michigan, with 16.5 GWh annual capacity for LFP battery cells.They later ramped U.S. LFP lines toward 17 GWh annual output.

By Application

Grid services represent the dominant application, capturing 60% market share in 2024. Utilities and transmission operators increasingly rely on lithium-ion systems to provide frequency regulation, load balancing, and peak shaving, ensuring grid reliability amid rising renewable penetration. Behind-the-meter storage follows, supported by commercial and residential users seeking energy cost savings and backup power. Off-grid applications, though smaller, are growing in remote and developing regions. The dominance of grid services reflects large-scale investments, policy incentives, and the urgent need for flexible storage to stabilize renewable-driven power networks.

Key Growth Drivers

Rising Renewable Energy Integration

The rapid deployment of renewable energy sources such as solar and wind is a major driver for lithium-ion stationary battery storage. As renewable generation increases, grid operators face challenges in balancing supply and demand due to variable output. Lithium-ion systems provide flexible storage, ensuring energy availability during peak demand and low generation periods. Governments and utilities invest heavily in renewable-linked storage projects to enhance grid reliability. This direct link between renewable adoption and storage deployment continues to strengthen market expansion across developed and emerging economies.

- For instance, Leclanché is providing a 43.6 MWh lithium-ion battery energy storage system integrated with 35.7 MW of solar capacity in St. Kitts. Following an amended power purchase agreement and construction commencing.

Declining Battery Costs and Efficiency Gains

The consistent decline in lithium-ion battery costs has accelerated market growth. Economies of scale, driven by EV adoption and large-scale manufacturing, significantly reduce production expenses. At the same time, advancements in materials and design improve energy density, safety, and cycle life. These improvements enhance cost-effectiveness and operational performance for grid and behind-the-meter applications. As levelized cost of storage drops, lithium-ion becomes the preferred technology over alternatives. Cost competitiveness paired with superior technical capabilities fuels adoption across both commercial and utility-scale deployments.

- For instance, Johnson Controls launched a Lithium-Ion Risk Prevention System that detects battery off-gases at concentrations as low as 1 part per million (ppm), with a response time under 5 seconds, enabling early shutdown of affected cells.

Supportive Government Policies and Incentives

Government support through subsidies, tax incentives, and regulatory mandates plays a crucial role in driving lithium-ion stationary storage adoption. Many countries introduce policies to integrate storage with renewable energy projects, ensuring grid stability and decarbonization targets. For example, energy storage mandates and incentive programs directly benefit lithium-ion installations due to their proven scalability. Additionally, funding initiatives for smart grid modernization increase storage investments. The alignment of policy frameworks with climate goals ensures long-term growth opportunities, positioning lithium-ion as a central enabler of global energy transition strategies.

Key Trends & Opportunities

Shift Toward LFP Chemistry in Utility-Scale Projects

A key trend in the market is the rising adoption of Lithium Iron Phosphate (LFP) chemistry for utility-scale projects. LFP’s cost advantage, thermal stability, and long cycle life make it suitable for grid services. Utilities increasingly prefer LFP over NMC, particularly for large deployments, due to safety and sustainability concerns. Manufacturers expand LFP production capacity to meet growing demand. This trend creates opportunities for scaling renewable-linked energy storage systems while reducing risks associated with raw material sourcing and regulatory pressures around cobalt and nickel use.

- For instance, GS Yuasa recently secured a 50 MWh battery energy storage order (the Tsunokobaru BESS) slated for commission in 2026, signaling its push into large-scale deployments.

Emergence of Hybrid Storage Solutions

The market is also witnessing a shift toward hybrid energy storage solutions that combine lithium-ion with alternative technologies like flow batteries or supercapacitors. Hybrid systems enhance performance by addressing limitations such as discharge duration or cycle life. For instance, pairing lithium-ion with long-duration storage technologies enables better integration of renewables into the grid. This creates opportunities for diversified applications across utility, commercial, and industrial sectors. Growing demand for advanced, flexible, and resilient systems positions hybrid configurations as a strategic growth avenue for market participants.

- For instance, Siemens Gamesa (part of Siemens Energy) tested a hybrid system at the La Plana R&D site using a 400 kWh vanadium redox flow battery paired with existing lithium-ion units, integrated under a hybrid controller managing wind and solar inputs.

Key Challenges

Supply Chain Volatility of Critical Materials

The lithium-ion stationary battery storage market faces supply chain risks due to dependence on critical materials like lithium, cobalt, and nickel. Fluctuating prices, limited availability, and geopolitical issues create uncertainty for manufacturers. Raw material concentration in specific regions heightens vulnerability to disruptions. These challenges increase production costs and hinder scalability. Companies are exploring recycling initiatives and alternative chemistries to reduce dependency, yet short-term reliance remains high. Managing material sourcing sustainably and diversifying supply chains are critical to ensuring stable market growth and profitability.

Safety Concerns and Technical Risks

Despite advancements, lithium-ion batteries face ongoing safety challenges such as thermal runaway, fire hazards, and degradation risks. Large-scale installations amplify these risks, raising concerns among regulators and utilities. Failures in storage systems can result in costly downtime, reputational damage, and stricter compliance requirements. While technologies like advanced battery management systems improve safety, the risks remain significant. Manufacturers must continue investing in research and strict quality standards. Addressing these safety concerns effectively will be vital for market acceptance and expansion across critical energy infrastructure.

Regional Analysis

North America

North America holds 27% share of the lithium-ion stationary battery storage market in 2024. The region benefits from strong renewable energy integration, government incentives, and large-scale storage projects. The United States leads adoption, driven by policies such as the Inflation Reduction Act and state-level mandates. Canada also invests in grid modernization and renewable-linked storage. Utilities prioritize storage for frequency regulation, peak shaving, and renewable balancing. The presence of advanced manufacturers and strong R&D infrastructure further supports growth. Rising EV battery production also creates cost synergies that strengthen the market’s competitive edge in the region.

Europe

Europe accounts for 24% share of the lithium-ion stationary battery storage market in 2024. Growth is supported by the European Union’s renewable targets and strong carbon neutrality commitments. Countries like Germany, the UK, and France invest heavily in grid-scale storage to stabilize intermittent wind and solar output. Supportive regulations and funding programs accelerate installations, especially in decentralized and behind-the-meter applications. The region also emphasizes sustainability, fueling demand for chemistries such as LFP with lower environmental impact. Strong collaboration between utilities, technology providers, and policymakers ensures Europe remains a key driver of storage innovation and deployment.

Asia-Pacific

Asia-Pacific dominates the global market, capturing 34% share in 2024. China leads the region with large-scale manufacturing, aggressive renewable deployment, and government-backed storage mandates. Japan and South Korea focus on advanced storage technologies and export-driven growth, while India scales up storage for renewable integration and rural electrification. Rapid industrialization and urbanization increase electricity demand, boosting reliance on grid stability solutions. Cost advantages from large production hubs make lithium-ion storage highly competitive in the region. With ambitious climate goals and infrastructure investments, Asia-Pacific is positioned as the largest and fastest-growing market for lithium-ion stationary battery storage.

Latin America

Latin America holds 8% share of the lithium-ion stationary battery storage market in 2024. The region’s growth is primarily driven by renewable energy expansion, particularly solar and wind projects in Brazil, Chile, and Mexico. Governments support storage integration to improve grid reliability and reduce fossil fuel dependence. While adoption remains in the early stages compared to larger regions, increasing investment in clean energy infrastructure strengthens growth prospects. Utility-scale projects dominate installations, supported by international partnerships and financing. As costs decline and renewable penetration rises, lithium-ion storage is expected to gain wider traction across Latin America.

Middle East & Africa

The Middle East & Africa region represents 7% share of the lithium-ion stationary battery storage market in 2024. Countries such as the UAE and Saudi Arabia invest in renewable-linked storage to support ambitious energy transition programs. Africa, led by South Africa and Kenya, leverages lithium-ion solutions for off-grid and mini-grid applications, addressing rural electrification challenges. High solar potential creates opportunities for storage integration across both grid and distributed systems. Although adoption is at a nascent stage, government-led initiatives, falling costs, and foreign investments are set to accelerate deployment, making the region an emerging growth frontier in the market.

Market Segmentations:

By Battery:

By Chemistry:

By Application:

- Grid Services

- Behind the Meter

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the lithium-ion stationary battery storage market features leading players such as Exide Technologies, LG Chem, Leclanché SA, Johnson Controls, GS Yuasa International Ltd, Siemens Energy, Tesla, Panasonic Corporation, Hitachi Energy Ltd., and Toshiba Corporation. The competitive landscape of the lithium-ion stationary battery storage market is shaped by innovation, large-scale manufacturing, and strategic collaborations. Companies focus on expanding production capacity, improving battery efficiency, and developing safer chemistries to meet growing demand. Significant investment is directed toward grid-scale solutions, behind-the-meter applications, and renewable energy integration projects. Research and development in areas such as thermal management, battery management systems, and recycling technologies strengthens long-term competitiveness. Partnerships with utilities and governments also play a key role in scaling deployment. Collectively, these strategies drive market growth and reinforce lithium-ion storage as a core enabler of global energy transition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Exide Technologies

- LG Chem

- Leclanché SA

- Johnson Controls

- GS Yuasa International Ltd

- Siemens Energy

- Tesla

- Panasonic Corporation

- Hitachi Energy Ltd.

- Toshiba Corporation

Recent Developments

- In February 2025, Gridstore a utility scale battery energy storage system developer acquired a 150MW/300 MWh battery storage project from Texas. The project will be operational in 2026. The acquisition will help the company to expand its geo presence in Texas.

- In July 2024, Exide announced the launch of its advanced AGM battery in its lead-acid battery line for starting, light, and ignition (SLI) applications. The new product is designed to offer optimal performance for automotive services.

- In June 2024, BASF Stationary Energy Storage s subsidiary of BASF and NGK a Japanese ceramic manufacturer in partnership launched next generation sodium sulfur batteries “NAS Model L24”. The new battery has longer shelf life and better management towards higher temperature.

- In September 2023, EnerVenue launched its next-generation Energy Storage Vessels (ESVs), which feature metal-hydrogen battery technology capable of more than 30,000 cycles. This breakthrough technology offers a long lifespan, making it a significant contributor to advancing the energy storage industry.

Report Coverage

The research report offers an in-depth analysis based on Battery, Chemistry, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly with rising renewable energy integration across global grids.

- Advancements in LFP chemistry will drive safer and cost-effective large-scale deployments.

- Grid-scale storage will dominate demand as utilities prioritize stability and flexibility.

- Behind-the-meter adoption will rise with increasing energy independence goals for businesses and homes.

- Recycling and second-life battery solutions will become central to sustainable supply chains.

- Hybrid storage systems combining lithium-ion with other technologies will gain wider adoption.

- Policy incentives and government mandates will continue to accelerate storage deployment worldwide.

- Supply chain diversification will reduce risks linked to critical material shortages.

- Declining costs and efficiency gains will strengthen competitiveness against alternative storage technologies.

- Emerging markets in Latin America, Middle East, and Africa will provide new growth opportunities.