Market Overview:

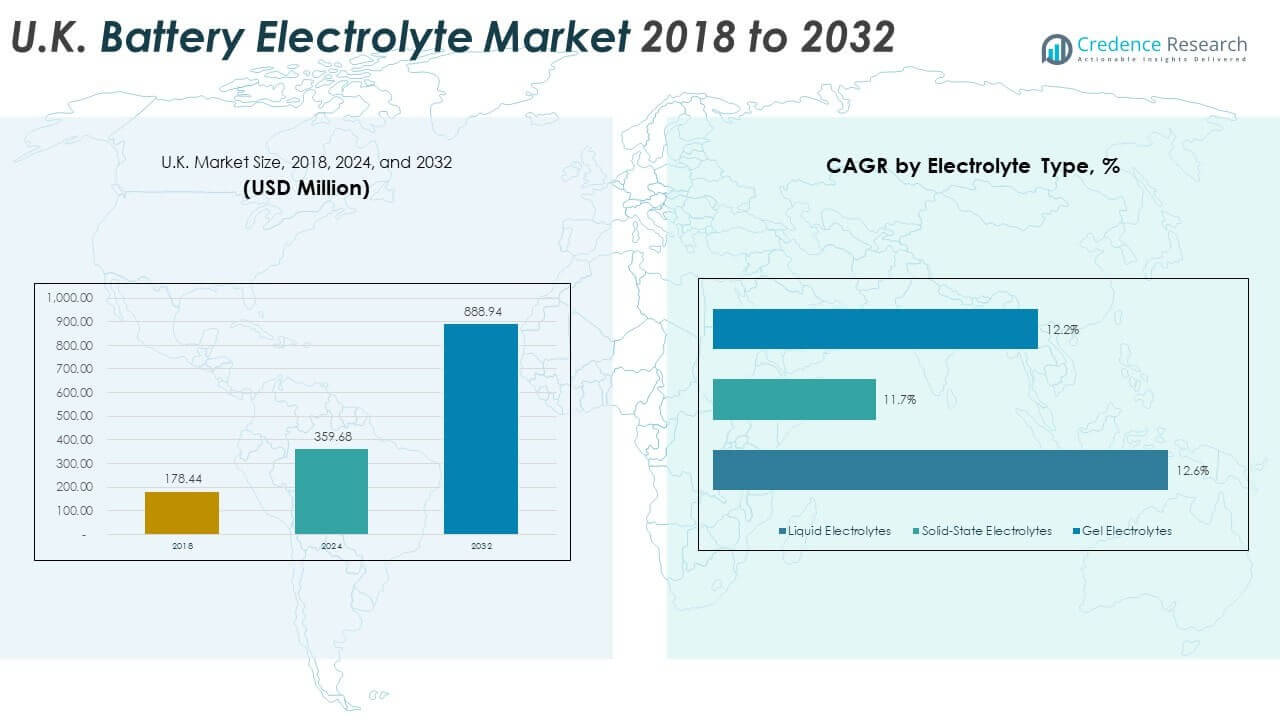

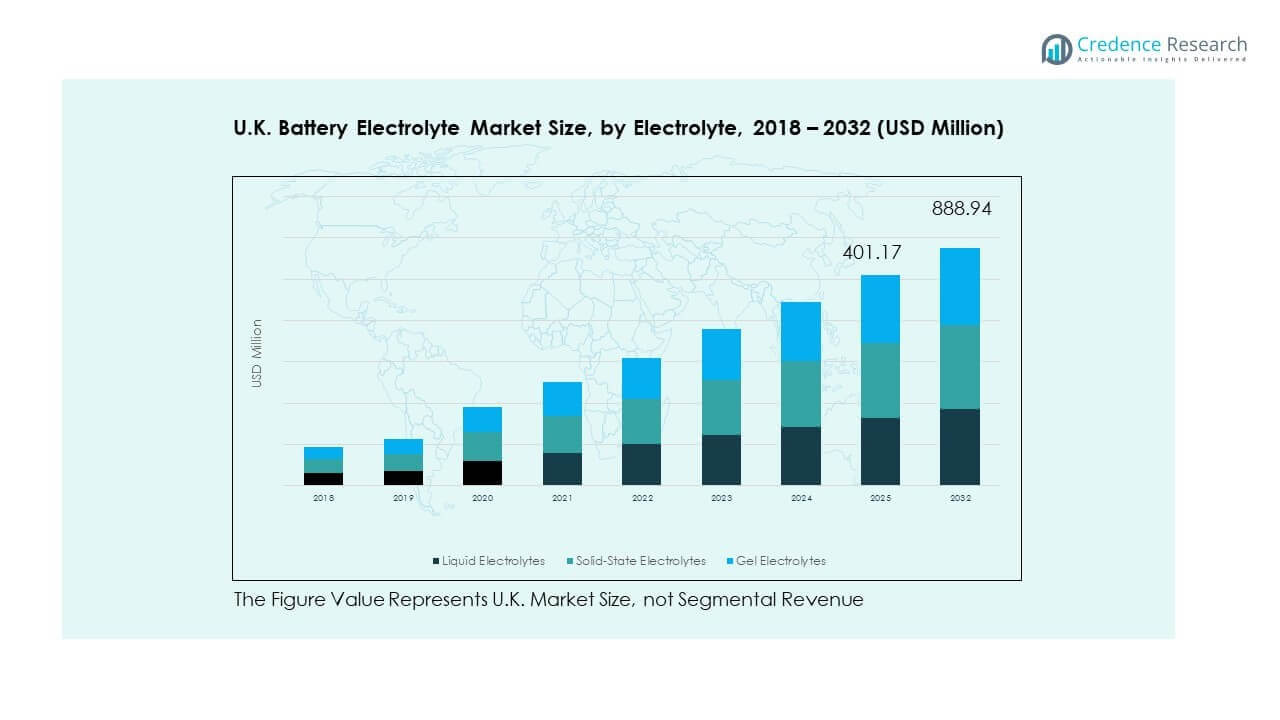

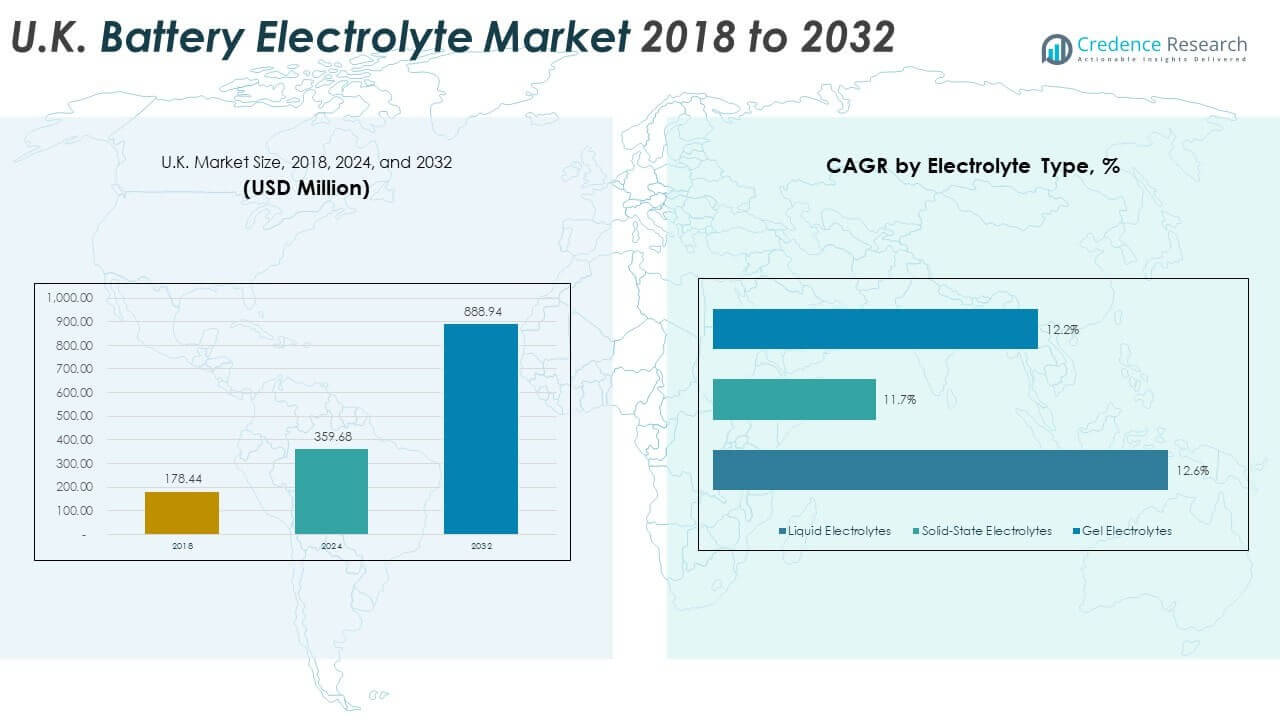

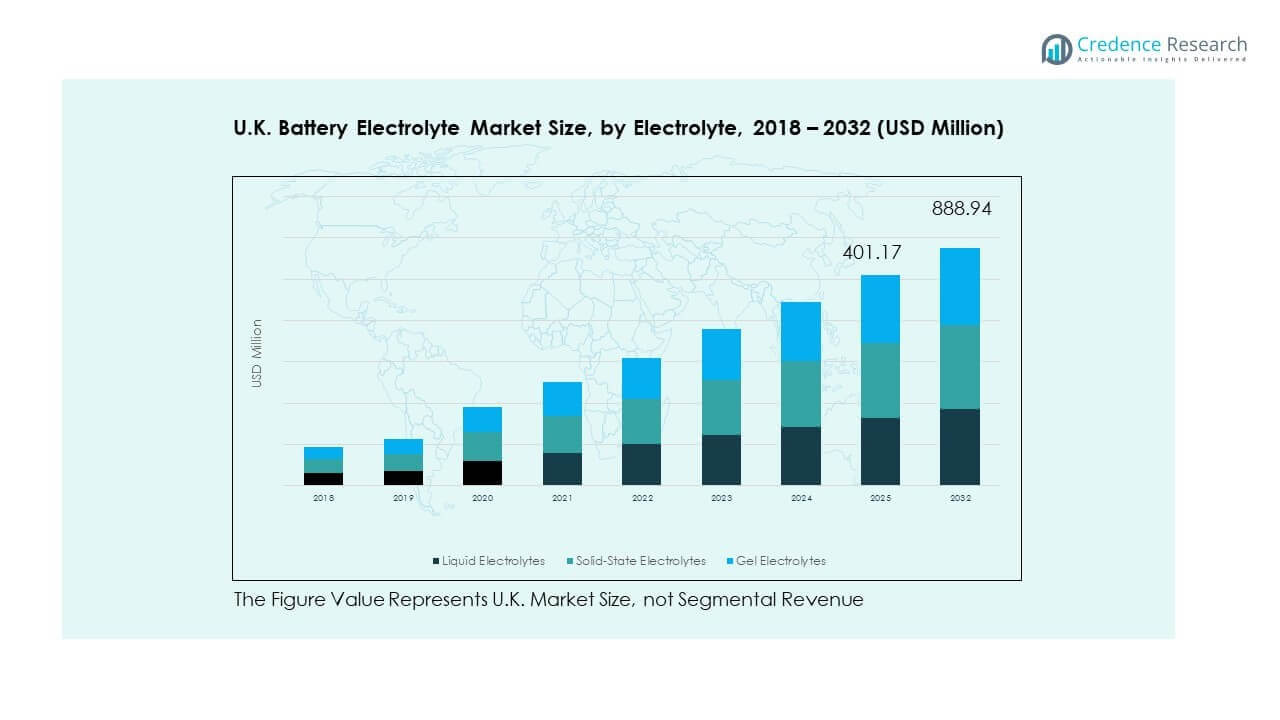

The U.K. Battery Electrolyte Market size was valued at USD 178.44 million in 2018 to USD 359.68 million in 2024 and is anticipated to reach USD 888.94 million by 2032, at a CAGR of 11.97% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.K. Battery Electrolyte Market Size 2024 |

USD 359.68 Million |

| U.K. Battery Electrolyte Market, CAGR |

11.97% |

| U.K. Battery Electrolyte Market Size 2032 |

USD 888.94 Million |

The market growth is driven by the rising adoption of electric vehicles, increasing demand for energy storage solutions, and government initiatives supporting clean energy transitions. Expanding renewable energy integration into the grid creates a strong need for efficient battery storage systems. Continuous advancements in battery technologies enhance performance, while growing investment in research and development accelerates the commercialization of safer and more sustainable electrolytes. Environmental regulations that encourage reduced carbon emissions further boost demand for innovative electrolyte solutions across automotive and industrial applications.

The U.K. plays a central role in shaping the regional market due to its strong focus on electric mobility and renewable integration. European countries such as Germany and France are leading in production and adoption, supported by robust automotive and energy storage industries. Meanwhile, emerging markets in Eastern Europe are witnessing growing investment in battery manufacturing, driven by supportive policies and rising demand. The U.K.’s strategic position, advanced infrastructure, and innovation-led ecosystem ensure its continued growth in the European landscape.

Market Insights:

Market Insights:

- The U.K. Battery Electrolyte Market was valued at USD 178.44 million in 2018, reached USD 359.68 million in 2024, and is projected to hit USD 888.94 million by 2032, expanding at a CAGR of 11.97%.

- England led with 55% share in 2024, supported by advanced automotive production, strong R&D, and growing gigafactory investments, while Scotland followed with 20% due to renewable integration, and Wales contributed 15% through green mobility projects.

- Northern Ireland, with 10% share, is the fastest-growing region, driven by renewable adoption, supportive policies, and cross-border energy collaborations with Ireland.

- In 2024, liquid electrolytes dominated the U.K. Battery Electrolyte Market with around 52% share, benefiting from established use in lithium-ion and lead-acid batteries.

- Solid-state electrolytes captured close to 30% share, driven by rising demand for safer, high-performance solutions, while gel electrolytes accounted for the remaining portion, serving niche applications in portable electronics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Electric Vehicle Adoption and Rising Demand for Efficient Battery Electrolytes

The U.K. Battery Electrolyte Market is expanding rapidly due to the sharp increase in electric vehicle adoption. Strong government policies promoting zero-emission mobility strengthen demand for high-performance battery components. Automakers are scaling production capacities to meet strict carbon reduction targets. Electrolyte producers are responding with advanced formulations to support extended driving ranges. Rising consumer preference for sustainable mobility strengthens the need for safer and more efficient electrolytes. The automotive industry’s shift toward electrification creates long-term opportunities for innovation. It is expected to witness continued investment in R&D. Continuous EV adoption drives consistent growth in this segment.

- For instance, in 2024, 381,970 electric vehicles were sold in the UK, with Tesla’s Model Y leading sales at 32,862 units, reflecting strong demand for reliable battery technologies.

Integration of Renewable Energy Systems Driving Energy Storage Expansion

Growing renewable energy penetration strengthens the role of advanced batteries in grid management. Electrolytes are critical for improving battery storage reliability and efficiency. Government projects focusing on solar and wind capacity highlight the urgency for scalable storage solutions. Utilities are increasingly adopting advanced battery technologies to stabilize fluctuating energy supply. The U.K. Battery Electrolyte Market benefits from this transition, reinforcing steady product demand. It supports energy independence while aligning with climate goals. Electrolyte manufacturers continue developing safer chemistries to enable large-scale energy storage. The market’s link with renewable integration enhances long-term resilience. Storage adoption creates steady electrolyte consumption across applications.

- For instance, EDF Renewables is advancing over 300MW of battery storage projects across the UK, enhancing grid stability and renewable integration capacity.

Supportive Government Regulations and Policy-Driven Adoption of Clean Technologies

Government-backed incentives encourage investments in battery technologies and local production. Strict emission reduction policies promote cleaner energy storage solutions across industries. Tax benefits and subsidies further accelerate the adoption of innovative electrolyte technologies. The U.K. Battery Electrolyte Market gains from strategic initiatives focused on green industrial growth. It enables manufacturers to expand capabilities while addressing sustainability targets. Regulatory bodies are pushing the adoption of advanced formulations that comply with safety standards. Research institutions partner with industries to develop high-performance solutions. Continuous policy support ensures long-term market stability. Legislative frameworks safeguard market expansion against regulatory uncertainty.

Advancements in Electrolyte Chemistry and Continuous Technological Innovations

Ongoing R&D is fueling breakthroughs in electrolyte design, targeting enhanced performance and safety. Manufacturers are developing solid-state and gel-based electrolytes to replace conventional liquid systems. It ensures better thermal stability, reduced leakage, and longer lifecycle performance. The U.K. Battery Electrolyte Market benefits from strong collaborations between research institutes and private firms. Strategic partnerships accelerate the shift toward safer, high-capacity battery chemistries. Emerging solid-state technologies represent a key growth frontier. The focus on sustainability drives interest in bio-based and recyclable electrolyte materials. Continuous innovation secures a competitive edge in global markets. Research investments reinforce the U.K.’s position in advanced battery technology.

Market Trends:

Market Trends:

Rising Focus on Solid-State Electrolytes and Next-Generation Battery Platforms

The U.K. Battery Electrolyte Market is witnessing strong momentum toward solid-state battery adoption. Solid electrolytes are being developed to replace liquid formulations for improved safety. They minimize fire risks, leakage issues, and thermal instability in electric vehicles. Research institutions are prioritizing scalable production techniques to support industry demand. It fosters opportunities for cost reductions and commercialization within the next decade. Major manufacturers are investing in pilot projects to validate performance. The trend aligns with global interest in next-generation battery platforms. Continuous exploration of solid-state solutions shapes the direction of market evolution.

- For instance, in June 2025, the UK government announced a £452 million investment in a Battery Innovation Programme, with key delivery partners including the Faraday Institution and the UK Battery Industrialisation Centre (UKBIC), to develop next-generation technologies like solid-state batteries.

Emergence of Advanced Recycling Practices for Electrolyte Recovery and Sustainability

Recycling technologies are becoming essential for long-term industry growth and resource efficiency. Electrolyte recovery supports sustainable supply chains by minimizing material waste. The U.K. Battery Electrolyte Market is adapting to these practices, creating new revenue models. Companies are exploring closed-loop systems that reprocess spent electrolytes. It reduces environmental impact and enhances raw material security. Circular economy frameworks are gaining traction with strong regulatory backing. Manufacturers see recycling as both an environmental and financial opportunity. This trend also reduces dependence on imported raw materials. Sustainability becomes a central theme across the supply chain.

- For instance, Hydrovolt’s operational recycling plant recovers up to 95% of materials like cobalt, nickel, and lithium, significantly advancing circular supply pillar efforts.

Expanding Use of Advanced Simulation Tools for Electrolyte Performance Optimization

Electrolyte performance is being enhanced through advanced modeling and simulation technologies. Engineers use computational tools to optimize conductivity, stability, and lifespan. The U.K. Battery Electrolyte Market leverages digital innovations to reduce development costs. It enables faster testing of multiple chemistries before full-scale production. Artificial intelligence and machine learning enhance prediction accuracy. Simulation reduces risk by identifying flaws early in the design stage. Research labs collaborate with software developers for customized platforms. This approach improves efficiency in scaling new electrolytes. Digital transformation reshapes traditional R&D practices in the industry.

Growth of Strategic Collaborations Across Automotive, Energy, and Research Ecosystems

Collaborations are becoming vital to accelerate innovation and commercialization in battery technologies. Automakers, academic institutions, and chemical firms are pooling resources to advance electrolytes. The U.K. Battery Electrolyte Market thrives on such partnerships for faster breakthroughs. It strengthens the ecosystem by aligning expertise and capital. Cross-industry alliances speed up the path from laboratory to market. Governments also play a role by funding collaborative research initiatives. Start-ups gain from joint projects that reduce barriers to entry. Shared innovation reduces duplication of efforts across sectors. Collaboration enhances competitiveness at the international level.

Market Challenges Analysis:

High Production Costs, Raw Material Shortages, and Rising Supply Chain Complexity

The U.K. Battery Electrolyte Market faces challenges from high production costs and raw material dependence. Scarcity of lithium salts and specialty solvents raises supply chain risks. Fluctuating prices of critical chemicals add volatility to manufacturer margins. It creates obstacles for scalability and cost competitiveness. Import reliance further weakens domestic resilience against disruptions. Manufacturing complexity increases when adopting newer chemistries with higher safety demands. Scaling production while maintaining quality standards is difficult for smaller firms. Strategic supply chain diversification is critical to reduce reliance on imports. The challenge persists as demand expands across multiple sectors.

Regulatory Compliance, Safety Concerns, and Technical Limitations of Current Electrolytes

Safety concerns create barriers to widespread adoption, especially in high-energy-density systems. Stringent regulatory frameworks require compliance with evolving safety standards. It demands costly testing and certification processes for manufacturers. Electrolyte flammability and thermal instability raise performance concerns. The U.K. Battery Electrolyte Market must balance efficiency with strict safety norms. Technical limitations of liquid electrolytes delay the transition toward safer alternatives. Smaller firms find compliance challenging due to financial and technical constraints. Innovation is needed to overcome risks linked to electrolyte volatility. Regulatory hurdles slow down commercialization of new chemistries.

Market Opportunities:

Expansion of Domestic Manufacturing Capabilities and Growth in Localized Supply Chains

The U.K. Battery Electrolyte Market is positioned to benefit from expansion in domestic production. Localized supply chains reduce dependence on volatile global raw material markets. It creates resilience against international disruptions and trade restrictions. Investment in manufacturing hubs encourages job creation and regional development. Strategic incentives strengthen industry participation in electrolyte production. Opportunities emerge from aligning with U.K. climate policies promoting cleaner energy. Domestic facilities also attract foreign investment through strategic partnerships. Growth in localized capabilities enhances both competitiveness and self-reliance.

Commercialization of Sustainable and Next-Generation Electrolyte Formulations Across Applications

The shift toward sustainability is opening new prospects for eco-friendly electrolytes. The U.K. Battery Electrolyte Market benefits from demand for recyclable and bio-based materials. It creates avenues for companies to stand out in global supply chains. Next-generation formulations support the push for safer, high-performance batteries. Research-backed innovations find applications across mobility and grid-scale storage. Collaborations with universities accelerate the pace of commercialization. Adoption of sustainable chemistries strengthens the industry’s global appeal. Expanding applications broaden market prospects across diverse sectors.

Market Segmentation Analysis:

By Electrolyte Type

The U.K. Battery Electrolyte Market is segmented into liquid, solid-state, and gel electrolytes. Liquid electrolytes dominate due to their established use in lithium-ion and lead-acid batteries. Solid-state electrolytes are gaining momentum with growing interest in next-generation energy storage. They offer enhanced safety, higher energy density, and better thermal stability. Gel electrolytes provide flexibility in specific consumer electronics and portable devices. It continues to diversify as innovation accelerates across all types.

- For instance, while Nissan and MG Motor UK have traditionally used lithium-ion batteries with liquid electrolytes in their electric vehicles, they are actively transitioning to more advanced battery technologies like solid-state batteries to improve performance and safety. The move towards newer technology is in response to the growing market demand for better battery life, faster charging, and increased safety.

By Battery Type

The market is divided into lithium-ion, lead acid, flow battery, and others. Lithium-ion batteries hold the largest share, supported by strong demand from electric vehicles and portable electronics. Lead acid batteries remain relevant in automotive starter systems and backup power. Flow batteries are emerging in grid applications, offering long-duration storage benefits. It benefits from increasing investments in varied battery chemistries to meet sector-specific needs.

- For instance, while lithium-ion batteries dominate the UK’s EV battery market, a global analysis indicates their demand made up over 85% of EV batteries in 2024, likely reflecting a similar trend in the UK. Meanwhile, grid storage is supported by various projects, including the 300MW lithium-ion battery system connected to the National Grid’s Tilbury substation, which actually uses lithium-ion, not flow batteries.

By Application

Key applications include automotive, consumer electronics, energy storage, and others. Automotive leads due to rising electric vehicle adoption and government decarbonization initiatives. Consumer electronics continue to sustain steady demand for compact, high-efficiency batteries. Energy storage applications are expanding as renewable integration accelerates across the grid. It reflects strong alignment with clean energy targets and electrification goals across the U.K.

Segmentation:

Segmentation:

By Electrolyte Type

- Liquid Electrolytes

- Solid-State Electrolytes

- Gel Electrolytes

By Battery Type

- Lithium-ion

- Lead Acid

- Flow Battery

- Others

By Application

- Automotive

- Consumer Electronics

- Energy Storage

- Others

Regional Analysis:

England as the Leading Contributor with Strong Industrial Ecosystem

England accounts for nearly 55% share of the U.K. Battery Electrolyte Market, driven by its advanced automotive sector and robust manufacturing base. London, Birmingham, and Manchester host several R&D facilities focusing on energy storage and electric mobility. Strong policy support for net-zero targets pushes adoption of high-performance electrolytes across industries. Major automakers and technology firms in England invest in local supply chains to reduce reliance on imports. It benefits from strong infrastructure, skilled workforce, and innovation-led initiatives that accelerate commercialization of new electrolyte chemistries. Market leadership is expected to strengthen with continued investment in battery gigafactories.

Scotland Expanding Market Presence through Renewable Integration

Scotland holds around 20% share of the U.K. Battery Electrolyte Market, with growth anchored in renewable energy expansion. The country’s strong wind and hydroelectric capacity create a pressing need for efficient energy storage systems. Electrolyte demand rises as utilities adopt advanced battery technologies to stabilize intermittent renewable supply. Government programs supporting sustainable energy development strengthen investment in storage-related innovation. It is also seeing research institutions partner with private firms to develop advanced electrolytes tailored for grid-scale batteries. Scotland’s emphasis on clean energy integration ensures steady growth potential in the medium to long term.

Wales and Northern Ireland Emerging as Growth-Oriented Markets

Wales and Northern Ireland together represent about 25% share of the U.K. Battery Electrolyte Market, with each showing unique strengths. Wales benefits from industrial projects tied to green mobility and localized energy storage systems. Northern Ireland focuses on renewable adoption, supported by favorable regulatory frameworks and cross-border collaborations with Ireland. It is gaining momentum with pilot projects in grid storage and electric transportation. Both regions attract niche investments from start-ups and academic research, reinforcing their role as growth contributors. Market expansion in these regions highlights the balanced geographic footprint of the industry within the U.K.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The U.K. Battery Electrolyte Market is competitive, with global leaders and domestic innovators focusing on performance, sustainability, and safety. Established companies such as BASF, Mitsubishi Chemical, and Solvay SA strengthen their position through extensive product portfolios and research capabilities. Local firms like Ilika plc and LiNa Energy play a critical role in advancing solid-state technologies. Strategic alliances between chemical companies, automakers, and energy storage firms accelerate commercialization of next-generation electrolytes. It is characterized by intense R&D activity, regulatory compliance, and growing emphasis on localized supply chains. Market participants compete on innovation, reliability, and the ability to meet demand from automotive, energy, and consumer electronics sectors.

Recent Developments:

- In the U.K. battery electrolyte market, BASF delivered its first batches of mass-produced cathode active materials (CAM) for semi-solid-state batteries through its joint venture BASF Shanshan Battery Materials in collaboration with Beijing WELION New Energy Technology. This milestone was achieved starting from project initiation in August 2024, reaching mass production by September 2025.

- Mitsubishi Chemical, through its key subsidiary MU Ionic Solutions (MUIS), entered a significant patent license agreement in May 2025 with Contemporary Amperex Technology Co. Ltd. (CATL), granting CATL access to MUIS’s innovative lithium-ion battery patents, particularly a difluorophosphate-based cathode interfacial control technology (MP1 Technology).

Report Coverage:

The research report offers an in-depth analysis based on electrolyte type, battery type, and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for advanced electrolytes will rise with the expansion of electric vehicles in the U.K.

- Solid-state electrolyte adoption will accelerate, driven by performance and safety improvements.

- Research collaborations between universities and industry will strengthen innovation pipelines.

- Recycling and recovery practices for electrolytes will become critical to sustainability efforts.

- Energy storage projects will boost consumption of electrolytes across renewable integration.

- Domestic manufacturing hubs will expand, reducing dependence on imported raw materials.

- Regulatory standards will continue shaping the adoption of safer electrolyte chemistries.

- Consumer electronics will remain a consistent driver of compact, high-efficiency electrolytes.

- Investments in grid-scale battery solutions will widen the application base of electrolytes.

- The U.K. will emerge as a competitive hub for electrolyte innovation within Europe.

Market Insights:

Market Insights: Market Trends:

Market Trends: Segmentation:

Segmentation: