Market Overview:

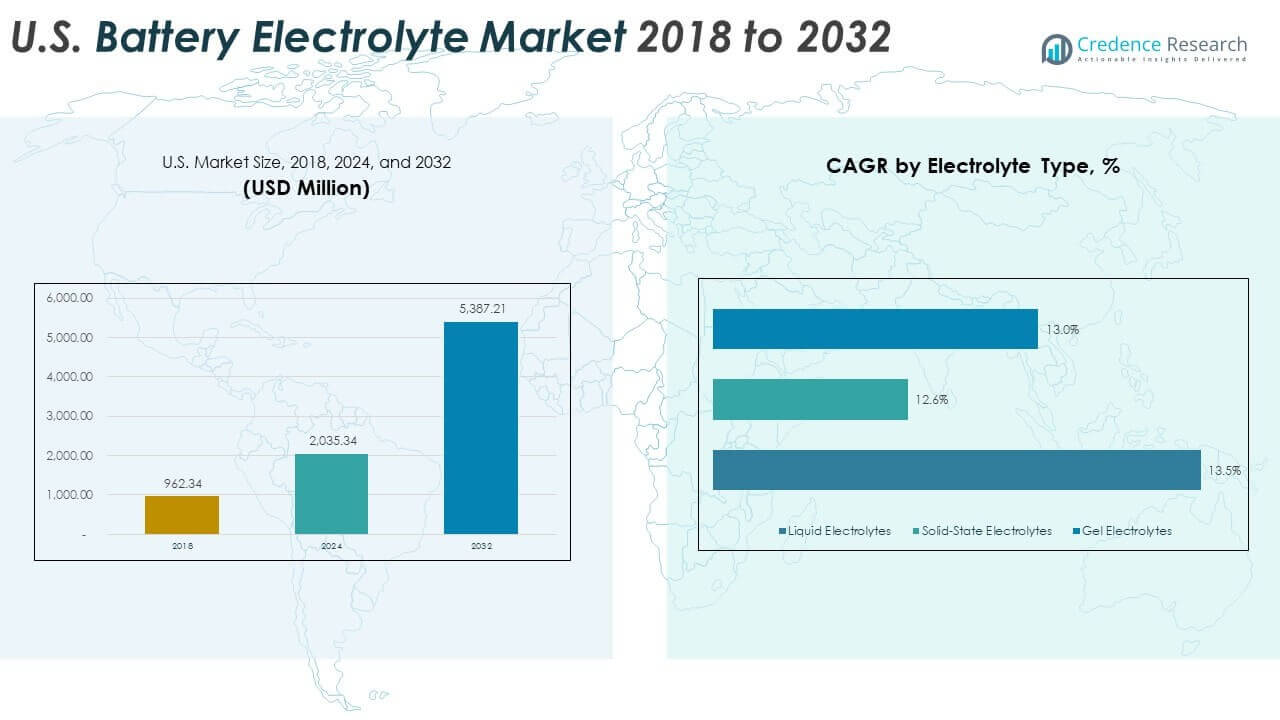

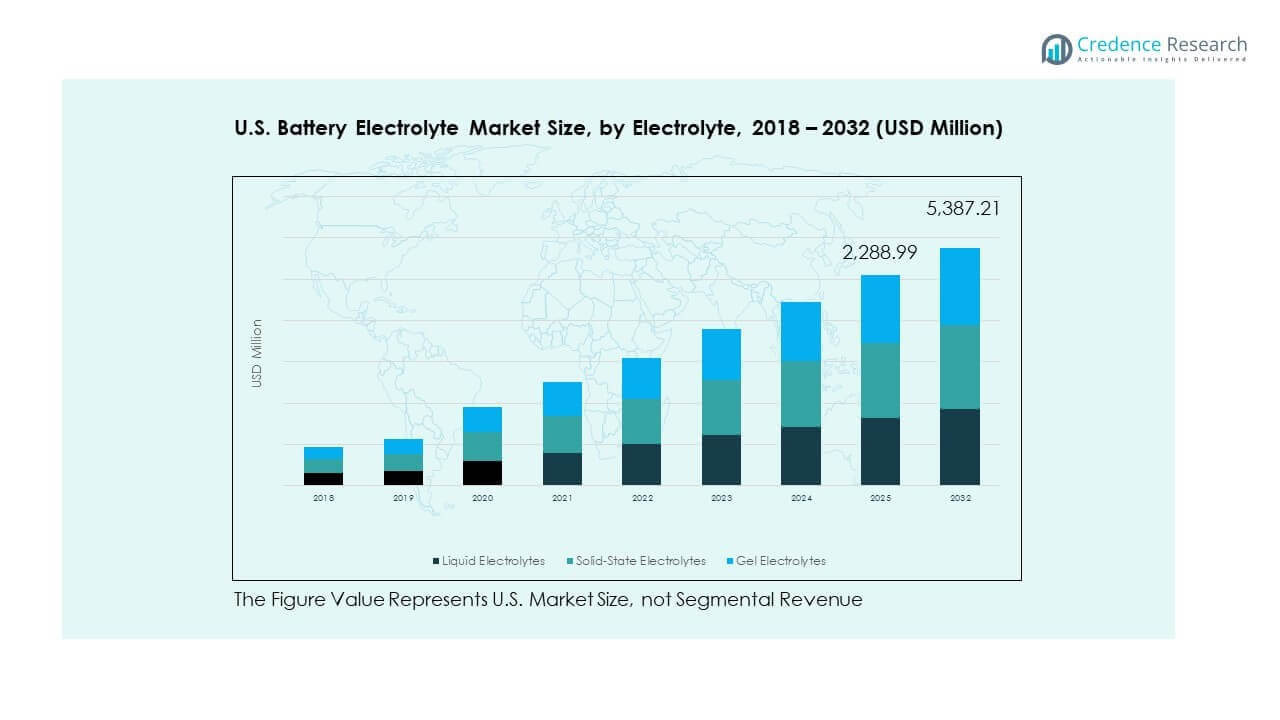

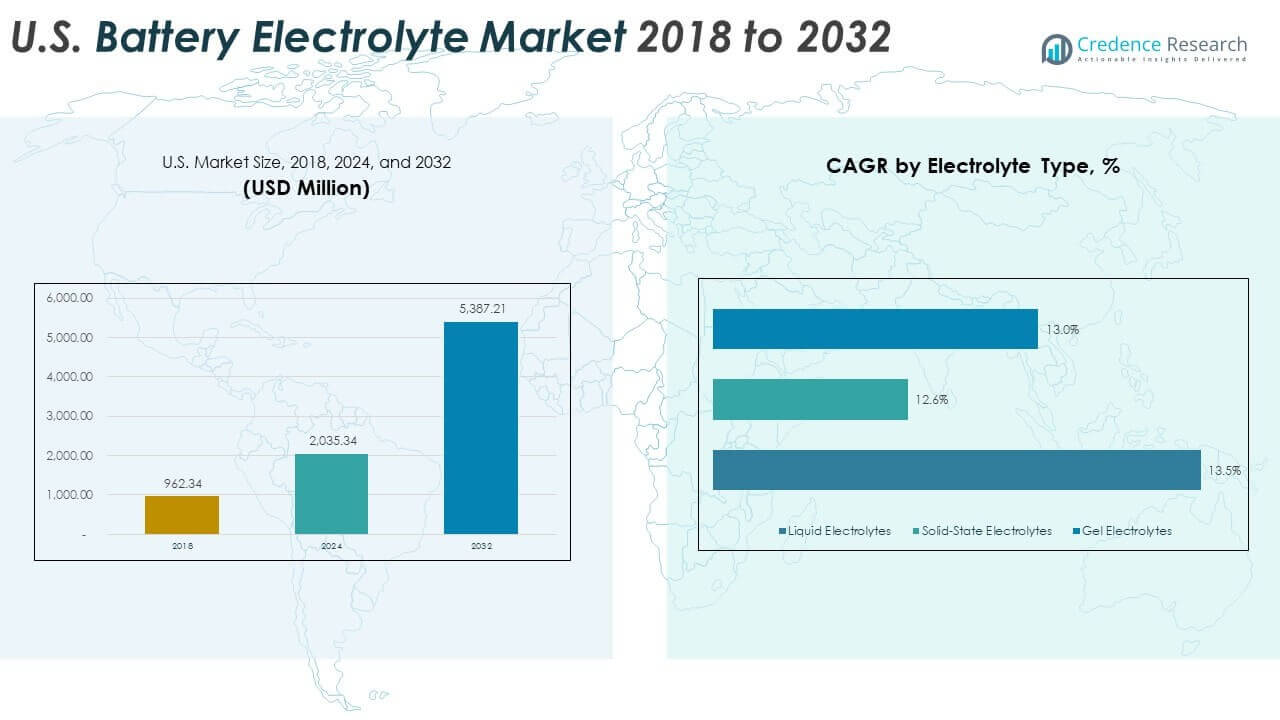

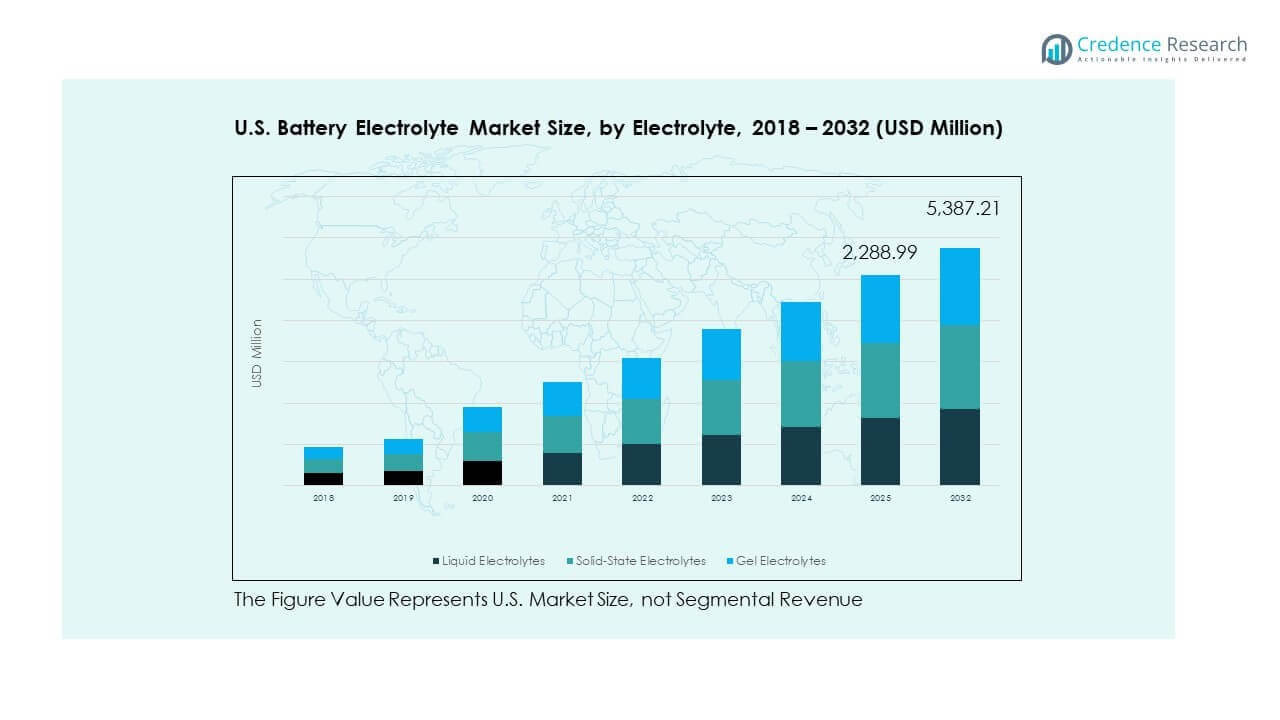

The U.S. Battery Electrolyte Market size was valued at USD 962.34 million in 2018 to USD 2,035.34 million in 2024 and is anticipated to reach USD 5,387.21 million by 2032, at a CAGR of 12.94% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Battery Electrolyte Market Size 2024 |

USD 2,035.34 Million |

| U.S. Battery Electrolyte Market , CAGR |

12.94% |

| U.S. Battery Electrolyte Market Size 2032 |

USD 5,387.21 Million |

The market is expanding as demand for electric vehicles and renewable energy storage solutions grows. Rising adoption of lithium-ion batteries in automotive and grid applications is driving electrolyte consumption. Ongoing advancements in electrolyte chemistry improve energy density, safety, and battery lifecycle, making them attractive for large-scale applications. Supportive government policies promoting clean energy and carbon reduction targets further accelerate the adoption of advanced batteries, fueling steady demand for electrolytes in the U.S.

Geographically, the U.S. market benefits from strong battery manufacturing clusters concentrated in states with established automotive and energy industries. Regions with high EV adoption rates and renewable energy projects dominate, while emerging states are catching up due to new investments in gigafactories and research facilities. Strategic partnerships between local manufacturers and global players also enhance regional competitiveness, making the U.S. one of the leading hubs for advanced electrolyte development worldwide.

Market Insights:

Market Insights:

- The U.S. Battery Electrolyte Market was valued at USD 962.34 million in 2018, reached USD 2,035.34 million in 2024, and is projected to hit USD 5,387.21 million by 2032, growing at a CAGR of 12.94%.

- Within the U.S., the Northeast, Midwest, West, and South all contribute, with the Midwest and West together leading the market due to gigafactory growth, EV adoption, and renewable energy projects.

- The South is emerging as the fastest-growing region, supported by new manufacturing facilities, state-backed investments, and expanding renewable integration.

- Liquid electrolytes dominated with 52% share in 2024, driven by their established role in lithium-ion and lead-acid batteries across automotive and storage.

- Solid-state electrolytes held 28% share in 2024, gaining momentum from automakers and energy storage developers seeking improved safety and performance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Adoption Of Electric Vehicles Across Consumer And Commercial Segments

The U.S. Battery Electrolyte Market is driven by the rapid growth of electric vehicles in consumer and commercial fleets. Automakers are increasing EV production to meet stricter emissions standards. Rising consumer awareness of sustainable mobility also fuels this demand. Charging infrastructure expansion across urban and semi-urban areas supports higher adoption. Battery manufacturers focus on improving electrolytes to enhance performance. It benefits from government incentives and tax rebates encouraging EV ownership. The synergy between policy, infrastructure, and consumer demand strengthens market growth.

- For instance, Fluence’s manufacturing expansion in Arizona with steel enclosures and battery management hardware, supporting over 20 GW of installed capacity, is verified by multiple news and company communications from 2025.

Growing Demand For Renewable Energy Storage And Backup Power Solutions

Energy storage systems integrated with solar and wind projects create strong electrolyte demand. Utilities adopt large-scale storage to stabilize grids and reduce reliance on fossil fuels. Backup power solutions for industries and households expand market scope. The U.S. government supports renewable integration through funding and regulations. Improved electrolyte efficiency allows longer storage cycles and higher safety. It is central to reducing carbon emissions and meeting climate goals. Renewable adoption ensures steady demand for advanced battery technologies. Continuous expansion in grid modernization projects accelerates this driver.

- For instance, QuantumScape’s solid-state battery demonstrating cycles with capacity loss and fast charging capabilities is documented in detailed tech articles and press releases from 2025.

Technological Advancements In Electrolyte Chemistry And Battery Performance

Research institutions and private firms innovate electrolyte materials to improve energy density. Liquid, solid-state, and gel-based electrolytes are under development. Advances aim to enhance safety, extend lifespan, and reduce costs. The U.S. Battery Electrolyte Market benefits from such innovation across industries. It drives competitiveness among local and global players. Faster commercialization of next-generation batteries increases adoption rates. Higher funding in R&D supports commercialization of new chemistries. This driver ensures continuous performance improvements and strengthens overall industry capability.

Supportive Government Policies And Incentives Driving Battery Manufacturing Growth

Federal and state-level incentives encourage large-scale battery production. Local manufacturing reduces reliance on imports and strengthens supply chains. The U.S. Battery Electrolyte Market gains from tax credits supporting EV and renewable projects. It is supported by funding initiatives for domestic gigafactories. Environmental policies favor adoption of sustainable and safe electrolyte technologies. Public-private partnerships expand research and production capacity. Strategic investments help accelerate battery innovation across industries. These policies directly contribute to increased adoption and long-term market expansion.

Market Trends:

Shift Toward Solid-State Electrolytes For Improved Safety And Energy Efficiency

The U.S. Battery Electrolyte Market is witnessing a transition toward solid-state electrolytes. Companies focus on enhancing safety by reducing flammability risks in lithium-ion batteries. Solid-state technology offers higher energy density compared to liquid-based alternatives. Research institutions and startups receive strong funding for pilot projects. It gains momentum as automakers test prototypes for EV integration. Large firms aim to commercialize these solutions within the decade. Solid-state electrolytes also provide longer battery lifespans. This trend positions the U.S. as a leader in next-generation battery development.

Integration Of Artificial Intelligence And Digital Tools In Battery Research

Digitalization is reshaping electrolyte innovation in laboratories and production facilities. AI-powered simulations help predict performance of new electrolyte formulations. Machine learning accelerates testing cycles and reduces development costs. The U.S. Battery Electrolyte Market leverages digital tools for precision-driven outcomes. It enables manufacturers to forecast degradation and improve lifecycle performance. Companies adopt digital twins for scaling processes with fewer risks. Collaboration between tech firms and battery producers increases adoption of these tools. This trend strengthens efficiency and shortens the time to market.

- For instance, BASF announced in August 2025 that its joint venture, BASF Shanshan Battery Materials, had delivered the first mass-produced Cathode Active Materials (CAM) for semi-solid-state batteries, collaborating with Beijing WELION New Energy Technology.

Growing Use Of Recycling And Circular Economy Practices In Battery Supply Chains

Recycling technologies for electrolytes are gaining importance in sustainable supply chains. Companies invest in processes that recover salts and solvents from used batteries. The U.S. Battery Electrolyte Market benefits from circular economy strategies that cut waste. It reduces dependency on imported raw materials and lowers costs. Policies supporting recycling create favorable conditions for new entrants. Startups emerge with advanced technologies for closed-loop systems. Automakers align with recyclers to secure stable supplies. This trend ensures sustainability while addressing supply chain vulnerabilities.

Collaborations Between Automakers, Research Institutions, And Chemical Producers

Strategic partnerships are becoming central to electrolyte innovation. Automakers partner with chemical companies to secure high-quality supplies. Universities play a vital role in developing advanced formulations. The U.S. Battery Electrolyte Market grows as partnerships accelerate commercialization. It enhances resource sharing and reduces development risks. Multinational firms expand R&D centers across the U.S. to work closely with local stakeholders. Government-backed collaborations encourage breakthroughs in performance and safety. This trend strengthens the competitiveness of the domestic ecosystem globally.

Market Challenges Analysis:

Market Challenges Analysis:

Supply Chain Constraints And Dependence On Imported Raw Materials

The U.S. Battery Electrolyte Market faces challenges due to limited availability of critical raw materials. Electrolyte production requires salts, solvents, and additives sourced globally. Supply chain disruptions increase costs and create production delays. It struggles with dependency on countries dominating lithium and chemical exports. Trade restrictions and geopolitical risks amplify this challenge. Domestic sourcing initiatives are still at an early stage. Companies face difficulties in maintaining consistent quality across imports. This creates uncertainty for scaling battery production at the required pace.

Safety, Regulatory Compliance, And High Manufacturing Costs Of Advanced Electrolytes

Stringent safety and environmental standards present compliance challenges for producers. Electrolyte formulations must meet fire resistance and stability requirements. The U.S. Battery Electrolyte Market faces cost barriers with advanced solid-state materials. It requires heavy investments in R&D and pilot-scale facilities. Achieving large-scale commercialization without compromising safety remains complex. Regulators closely monitor production processes to ensure consumer protection. Manufacturers balance between cost-effectiveness and meeting strict guidelines. This slows down adoption timelines for next-generation electrolyte technologies.

Market Opportunities:

Expansion Of Domestic Manufacturing Capacity And Investments In Gigafactories

The U.S. Battery Electrolyte Market has opportunities from rising gigafactory projects across multiple states. Automakers and energy companies invest heavily in localized supply chains. It benefits from reduced import dependency and faster delivery cycles. Government incentives for domestic production create favorable conditions for growth. New facilities increase demand for stable electrolyte supply. Local chemical producers expand capacity to meet these needs. This opportunity strengthens U.S. leadership in clean energy solutions. Long-term investments secure resilience and competitive advantage.

Innovation In Next-Generation Electrolytes For Electric Vehicles And Energy Storage

Research into next-generation electrolytes provides a major growth path. Solid-state, gel, and hybrid formulations promise higher safety and efficiency. The U.S. Battery Electrolyte Market gains from innovations targeted at EVs and renewable storage. It supports scaling technologies that meet diverse industrial requirements. Partnerships between startups and large firms accelerate product launches. Funding for R&D fosters continuous innovation in chemistry. These advancements enhance adoption across sectors. This creates long-term opportunities for sustained market expansion.

Market Segmentation Analysis:

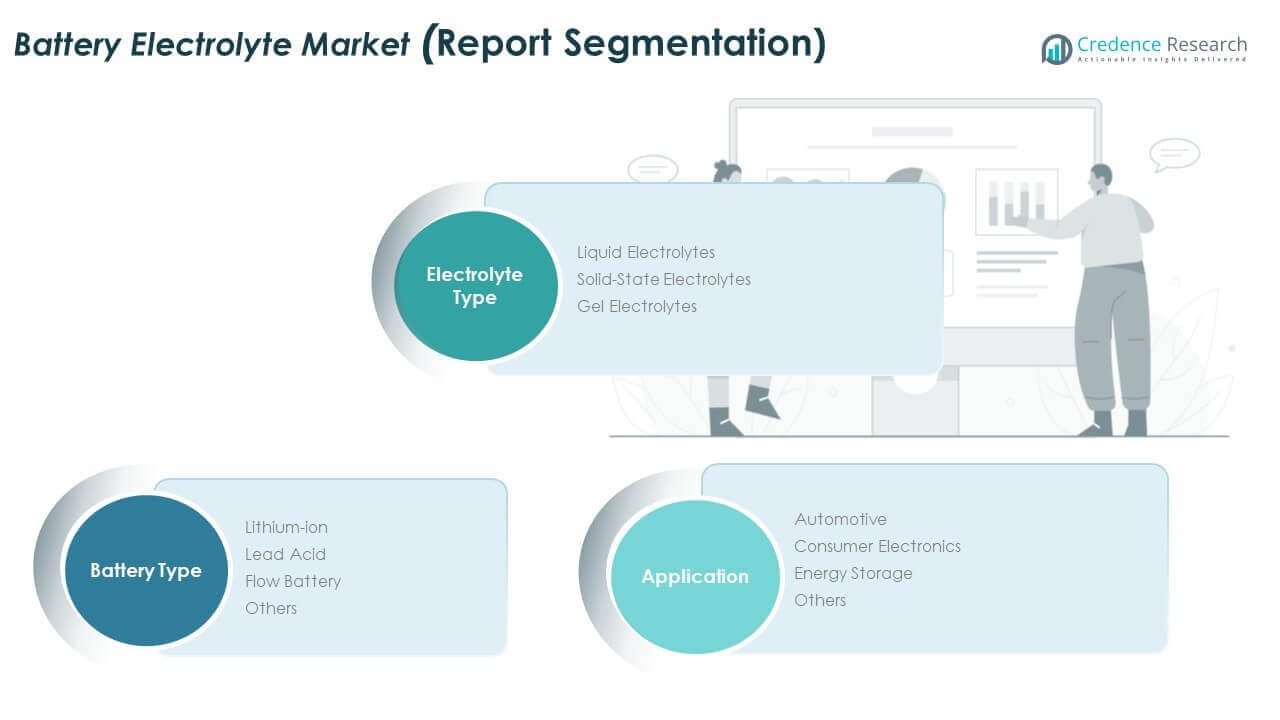

By Electrolyte Type

The U.S. Battery Electrolyte Market is segmented into liquid, solid-state, and gel electrolytes. Liquid electrolytes dominate due to their established use in lithium-ion and lead-acid batteries, offering cost-effectiveness and scalability. Solid-state electrolytes are gaining momentum, supported by improved safety and higher energy density. Gel electrolytes provide stability and flexibility for niche applications, particularly in consumer devices and specialized storage systems. It continues to evolve as research investments accelerate adoption of next-generation electrolytes that promise longer lifespan and reduced risks.

By Battery Type

Lithium-ion batteries account for the largest share, driven by electric vehicles and renewable energy storage. Lead-acid batteries maintain relevance in backup power and automotive starter applications. Flow batteries are emerging for large-scale storage projects, supported by their durability and efficiency in grid integration. Others include experimental chemistries under development for specific industrial uses. It benefits from diversification across battery types, securing growth opportunities in both mature and emerging segments.

- For instance, in March 2025, ESS Inc. supplied its iron flow batteries for a 200 MWh energy storage installation in California, enabling the system to provide up to 12 hours of daily discharge in support of solar grid integration.

By Application

Automotive leads due to surging EV adoption and government policies favoring clean mobility. Consumer electronics continue to contribute, with demand for smartphones, laptops, and portable devices requiring efficient electrolytes. Energy storage applications are expanding rapidly, driven by solar and wind integration across utilities. Others include defense, industrial, and medical uses that rely on specialized battery technologies. It strengthens its footprint across multiple industries, ensuring broad-based demand and steady revenue streams.

Segmentation:

Segmentation:

By Electrolyte Type

- Liquid Electrolytes

- Solid-State Electrolytes

- Gel Electrolytes

By Battery Type

- Lithium-ion

- Lead Acid

- Flow Battery

- Others

By Application

- Automotive

- Consumer Electronics

- Energy Storage

- Others

Regional Analysis:

Northeast – Established Market With Strong Technology Adoption

The U.S. Battery Electrolyte Market in the Northeast benefits from advanced infrastructure and strong adoption of electric vehicles. States such as New York and Massachusetts lead with supportive clean energy policies and investments in grid modernization. The region attracts funding for research institutions that develop innovative electrolyte formulations. It also benefits from collaborations between universities, startups, and automotive manufacturers. High population density creates steady demand for EV charging networks and storage systems. The Northeast maintains a leading share due to its focus on sustainability and policy-driven growth.

Midwest – Growing Hub For Manufacturing And Supply Chains

The Midwest holds a rising share of the U.S. Battery Electrolyte Market, supported by gigafactory developments in Michigan and Ohio. The presence of major automotive manufacturers drives large-scale adoption of advanced batteries. It also benefits from access to raw materials and centralized logistics, making supply chains efficient. Investments in renewable integration projects further enhance regional demand. The Midwest strengthens its position as a key hub for large-scale manufacturing of EV batteries and electrolytes. Ongoing state incentives ensure growth momentum and attract new entrants to the market.

West And South – Fastest Growing Regions With Expanding Projects

The West and South represent the fastest-growing regions within the U.S. Battery Electrolyte Market. California leads EV adoption due to stringent emission standards and a robust charging network. Texas has emerged as a hotspot for renewable energy storage, fueling electrolyte demand. The South benefits from new manufacturing facilities supported by federal and state funding. It continues to attract global companies establishing operations closer to end-use markets. These regions combine policy support, consumer demand, and industrial expansion, making them growth leaders in the U.S. market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Mitsubishi Chemical America

- East Penn Manufacturing

- 3M

- Targray Industries Inc

- NOHMs Technologies Inc

- NEI Corporation

- Advanced Electrolyte Technologies, LLC

- Solvay SA

- UNICOM Engineering, Inc

- Capchem

- Koura

Competitive Analysis:

The U.S. Battery Electrolyte Market is characterized by strong competition among global chemical producers, battery manufacturers, and specialized technology firms. Leading players focus on expanding their portfolios across liquid, solid-state, and gel electrolytes to meet diverse applications. It is shaped by investments in gigafactories, partnerships with automakers, and government-backed clean energy initiatives. Companies such as Mitsubishi Chemical America, East Penn Manufacturing, and 3M strengthen their positions through innovation and regional expansion. Startups and research-driven firms contribute by introducing next-generation electrolytes with improved performance and safety. Competition also intensifies with recycling firms entering the ecosystem to support sustainable supply chains. Strategic mergers, acquisitions, and R&D programs define the market’s direction, pushing firms to secure long-term contracts with EV manufacturers and energy storage providers. The competitive environment drives continuous innovation, making electrolyte advancements a central focus of the broader battery industry.

Recent Developments:

- In May 2025, Mitsubishi Chemical America (MU Ionic Solutions Corporation) entered a significant patent license agreement with Contemporary Amperex Technology Co., Limited (CATL), granting CATL access to Mitsubishi’s difluorophosphate-based cathode interfacial control technology (MP1 Technology) patents, aimed at enhancing lithium-ion battery performance and safety in electric vehicles.

- Capchem, a China-based electrolyte company active in the US market, announced in June 2023 plans for a $120 million electrolyte plant in Ohio, enhancing the US production capacity for battery electrolytes with expected operational impact ongoing in 2025.

Report Coverage:

The research report offers an in-depth analysis based on electrolyte type, battery type, and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The U.S. Battery Electrolyte Market will expand with increasing electric vehicle adoption supported by state and federal incentives.

- Growth will accelerate as renewable energy integration demands advanced storage solutions with efficient electrolytes.

- Solid-state electrolytes will gain traction due to safety benefits and higher energy density compared to conventional types.

- Strategic partnerships between automakers and chemical producers will strengthen supply security and product innovation.

- Recycling and circular economy practices will shape the market by reducing raw material dependency.

- Domestic gigafactory investments will create consistent demand for liquid and gel electrolytes in large-scale applications.

- Advancements in R&D will introduce hybrid electrolyte formulations tailored for diverse industrial and consumer uses.

- Regulatory policies focused on sustainability will encourage rapid adoption of eco-friendly and high-performance solutions.

- Collaboration between research institutions and startups will accelerate commercialization of next-generation electrolyte technologies.

- The market will maintain strong momentum, driven by multi-sector demand across automotive, electronics, and energy storage.

Market Insights:

Market Insights: Market Challenges Analysis:

Market Challenges Analysis: Segmentation:

Segmentation: