Market Overview:

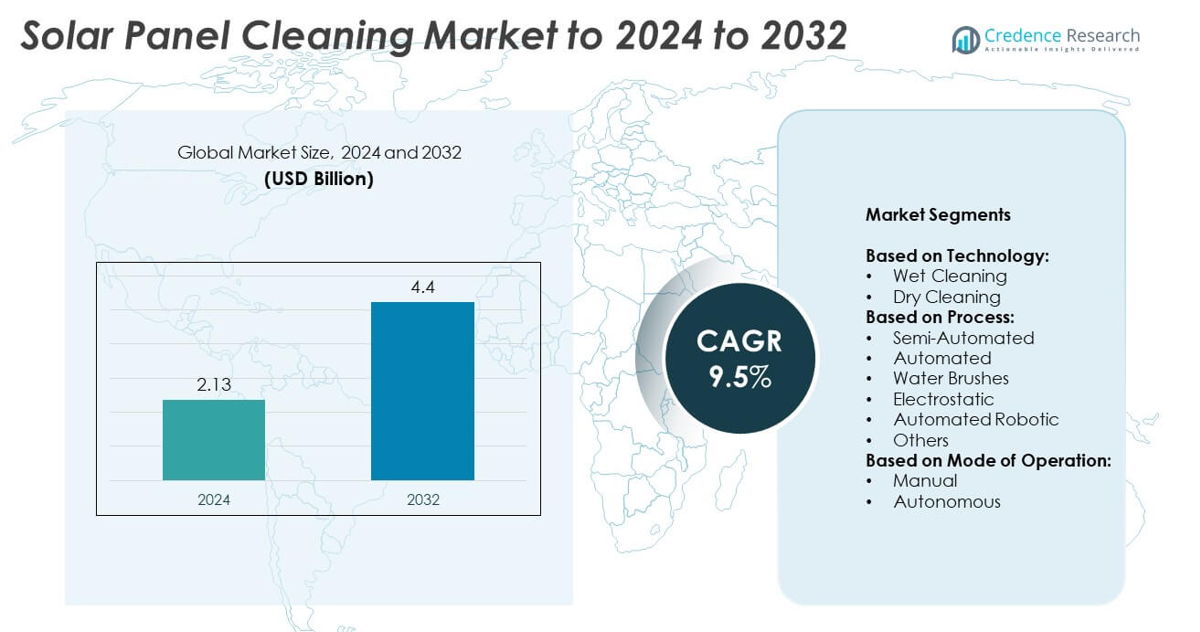

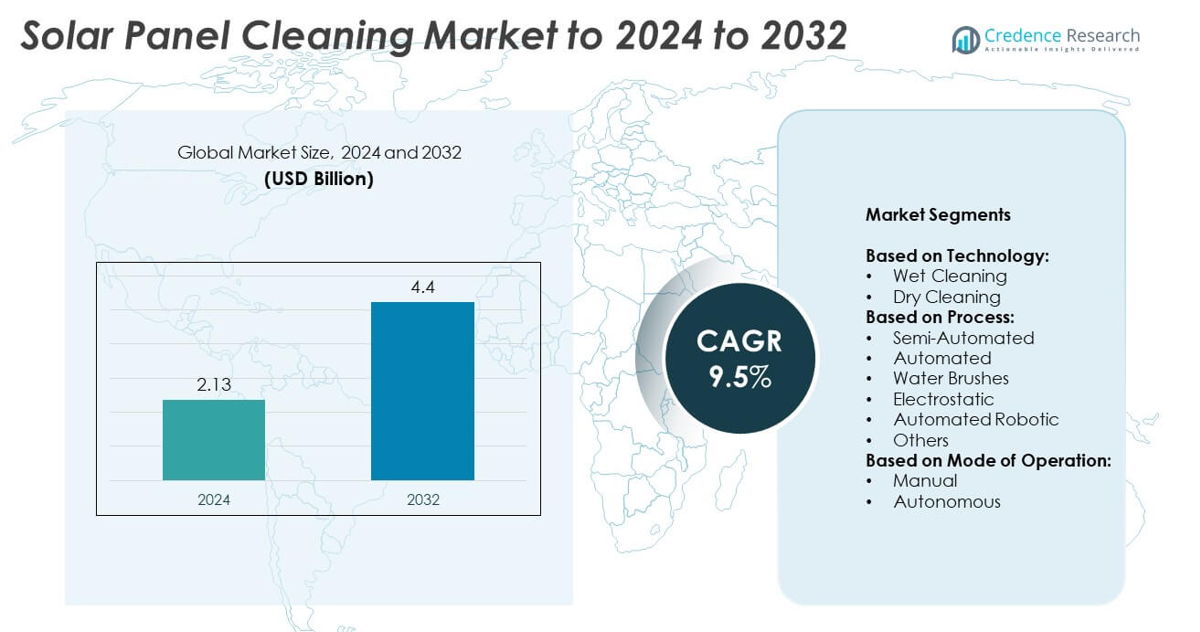

The Solar Panel Cleaning market size was valued at USD 2.13 Billion in 2024 and is anticipated to reach USD 4.4 Billion by 2032, at a CAGR of 9.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solar Panel Cleaning Market Size 2024 |

USD 2.13 Billion |

| Solar Panel Cleaning Market, CAGR |

9.5% |

| Solar Panel Cleaning Market Size 2032 |

USD 4.4 Billion |

The solar panel cleaning market is characterized by strong competition among key players such as Miraikikai, Ecoppia, Sharp, Clean Solar Solutions, Karcher, Airtouch Solar, Solbright, Premier Solar Cleaning, Pacific Panel Cleaners, and Saint Gobain. These companies are focusing on advanced technologies, including robotic and waterless cleaning systems, to address efficiency optimization and water scarcity challenges. Strategic partnerships, service expansions, and product innovation remain central to their growth strategies. Regionally, North America led the market in 2024, accounting for 35% of the global share, supported by large-scale solar installations, favorable government policies, and high adoption of automated cleaning solutions.

Market Insights

- The solar panel cleaning market was valued at USD 2.13 Billion in 2024 and is projected to reach USD 4.4 Billion by 2032, growing at a CAGR of 9.5%.

- Rising solar power installations and the urgent need to maintain panel efficiency are key drivers boosting demand for advanced cleaning technologies.

- Automation and waterless solutions are major trends, with robotic cleaning systems gaining traction due to cost-effectiveness, efficiency, and minimal water usage.

- Competition is intensifying as global and regional players focus on innovation, eco-friendly systems, and partnerships to strengthen their market positions.

- North America led with 35% share in 2024, followed by Asia Pacific at 28% and Europe at 25%, while wet cleaning dominated technology segmentation with over 60% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

The wet cleaning segment dominated the solar panel cleaning market in 2024, accounting for over 60% of the market share. Its dominance comes from its proven ability to remove dust, bird droppings, and stubborn debris that significantly reduce solar efficiency. Regions with high dust levels and large-scale solar farms favor wet cleaning, as water-based solutions deliver consistent results and extend panel life. Rising adoption of water-saving technologies, including recycled and minimal-use systems, further supports this segment’s growth. In contrast, dry cleaning methods are gaining traction in water-scarce regions but remain secondary in adoption.

- For instance, Kärcher iSolar 800 uses a 800 mm brush head and requires 290–345 GPH water flow for wet cleaning.

By Process

Automated robotic cleaning led the process segment in 2024, capturing around 45% of the market share. This leadership is driven by its ability to provide efficient, cost-effective, and labor-free cleaning for utility-scale solar installations. Automated robots reduce water consumption and ensure minimal downtime, making them highly attractive for large solar farms in arid zones. Semi-automated and electrostatic processes are growing steadily but lack the scalability of robotic systems. Increasing government incentives for renewable efficiency and the rising need for maintenance-free solutions are accelerating the adoption of automated robotic cleaning across both developed and emerging solar markets.

- For instance, Noor Abu Dhabi operates a robotic, waterless cleaning system with over 1,400 robots that travel daily to clean its more than 3.3 million solar panels.

By Mode of Operation

The manual mode of operation held the largest share in 2024, contributing nearly 55% to the market. This dominance is due to its wide usage across small- and medium-scale solar installations, particularly in residential and commercial rooftops. Manual cleaning remains cost-effective and flexible, especially in regions with limited access to advanced technologies. However, the autonomous segment is expanding quickly as solar farms scale up, requiring precision and reduced labor costs. Advances in AI-enabled robotics and automation technologies are expected to drive autonomous cleaning, though manual cleaning continues to dominate in price-sensitive applications.

Market Overview

Rising Solar Power Installations

The rapid increase in solar power capacity worldwide is a key growth driver for the solar panel cleaning market. Governments and private investors continue to expand large-scale solar farms, boosting the need for reliable cleaning solutions to maintain efficiency. Dust, dirt, and debris accumulation can reduce output by up to 30%, making cleaning essential. As countries target renewable energy goals, including net-zero commitments, the demand for cleaning technologies is expected to surge, ensuring consistent power generation and extending the operational life of solar assets.

- For instance, in 2023, LONGi Green Energy reported shipping 125.42 GW of monocrystalline silicon wafers and 67.52 GW of monocrystalline modules.

Focus on Efficiency Optimization

Growing emphasis on maximizing energy output from solar panels is driving adoption of advanced cleaning technologies. Automated and robotic cleaning systems are increasingly deployed to ensure minimal downtime and water usage while delivering consistent results. These solutions not only reduce operational costs but also enhance return on investment for solar projects. As solar installations scale to utility levels, efficiency optimization becomes critical, positioning advanced cleaning systems as integral to long-term profitability and sustainability of solar infrastructure.

- For instance, First Solar operates multiple solar module manufacturing facilities in Ohio, and as of 2024, their combined operational nameplate capacity in the state was approximately 6 GWDC, with plans to add an additional 0.9 GWDC later that year.

Water Scarcity Concerns

Water scarcity in arid and semi-arid regions is shaping the solar panel cleaning market as a key growth driver. Traditional wet cleaning methods are being replaced with water-efficient or waterless technologies such as electrostatic and robotic systems. Solar projects in desert regions, which are prone to heavy dust deposition, are adopting these alternatives to sustain output while conserving resources. Innovations in dry cleaning and water recycling systems further address this challenge, making eco-friendly cleaning solutions a priority in sustainable solar power generation strategies.

Key Trends & Opportunities

Automation and Robotics Adoption

A major trend in the solar panel cleaning market is the rise of automation and robotics. Utility-scale projects are increasingly relying on robotic systems that offer waterless or minimal-water cleaning, reducing costs and labor dependency. These technologies also enable frequent, consistent cleaning, enhancing overall panel efficiency. Opportunities lie in integrating AI and IoT for predictive maintenance and real-time monitoring, offering operators better control over energy output. As smart solar farms expand, robotic cleaning will emerge as a standard feature in solar operations globally.

- For instance, as of mid-2023, Ecoppia had announced partnerships for cleaning robots for multiple projects, with a total of approximately 4 GW.

Eco-Friendly and Waterless Solutions

Growing demand for sustainable cleaning practices is creating opportunities for eco-friendly and waterless technologies. Companies are focusing on electrostatic, brush-based, and air-blowing systems that minimize water use, catering to regions with strict environmental regulations. This trend aligns with broader green energy initiatives and corporate sustainability goals. Waterless solutions also reduce operational constraints in remote or arid areas where water availability is limited. As solar adoption accelerates in such geographies, eco-friendly cleaning systems are expected to capture a larger market share.

- For instance, the Noor Abu Dhabi solar park in Sweihan, a facility with a capacity of 1,177 MW and over 3.2 million solar panels, uses a fleet of robotic cleaners for waterless cleaning.

Key Challenges

High Initial Investment

One of the key challenges in the solar panel cleaning market is the high upfront cost of automated and robotic systems. While these solutions reduce long-term operational expenses, their adoption is often limited in small-scale and residential projects. Price-sensitive markets continue to rely on manual cleaning methods, slowing technology penetration. The challenge lies in bridging the cost gap through affordable innovations or financing models, ensuring that advanced cleaning systems become accessible to diverse users, including small solar operators and emerging economies.

Operational Limitations in Extreme Conditions

Solar panel cleaning technologies often face performance challenges in extreme weather conditions. Automated systems may struggle with heavy sandstorms, intense heat, or freezing environments, impacting reliability. Manual cleaning, though flexible, exposes workers to safety risks in large-scale installations. These operational limitations can reduce efficiency and increase maintenance costs for solar farm operators. Developing resilient, weather-adaptive technologies is critical to overcoming this challenge, ensuring consistent cleaning performance across diverse geographies and climate conditions.

Regional Analysis

North America

North America held the largest share of the solar panel cleaning market in 2024, accounting for 35%. The region benefits from large-scale solar installations across the U.S. and Canada, where maintaining efficiency is a priority for investors and operators. Adoption of automated and robotic cleaning systems is high, supported by advanced technology infrastructure and strong focus on renewable energy targets. Government incentives for solar expansion and rising demand for clean energy further drive adoption of efficient cleaning solutions. Dust accumulation in arid zones like the southwestern U.S. also accelerates demand for water-saving and robotic cleaning technologies.

Europe

Europe captured 25% of the solar panel cleaning market in 2024, driven by its commitment to the EU Green Deal and net-zero targets. Countries such as Germany, Spain, and Italy have extensive solar capacity, making panel cleaning essential for optimal performance. Adoption of eco-friendly and waterless cleaning technologies is strong due to strict environmental regulations. Solar operators in Europe emphasize sustainability, increasing demand for automated systems that conserve water and reduce labor costs. Growing investments in utility-scale solar farms, combined with government support, continue to strengthen Europe’s market presence, particularly in countries with high solar irradiation.

Asia Pacific

Asia Pacific accounted for 28% of the solar panel cleaning market in 2024, making it the fastest-growing regional segment. Countries such as China, India, and Japan are expanding solar power projects to meet rising energy needs and climate goals. High dust accumulation in regions like India drives adoption of both manual and robotic cleaning systems. Government initiatives promoting renewable energy and cost-effective operations boost the market further. Rapid urbanization and industrial expansion also support growth, as large solar farms are established to address rising electricity demand. Increasing investments in advanced cleaning solutions enhance regional competitiveness.

Latin America

Latin America held 6% of the solar panel cleaning market in 2024, supported by emerging solar projects in Brazil, Chile, and Mexico. The region benefits from abundant sunlight, which has spurred investments in renewable energy infrastructure. Manual cleaning methods dominate due to cost sensitivity and smaller-scale solar installations, although automated solutions are gaining traction in large utility projects. Government-backed solar initiatives, combined with favorable climatic conditions, create opportunities for growth. However, limited access to advanced technologies and higher capital costs challenge widespread adoption. The market is gradually shifting toward eco-friendly solutions, especially in areas facing water scarcity.

Middle East and Africa

The Middle East and Africa accounted for 6% of the solar panel cleaning market in 2024. The region’s vast desert areas experience heavy dust and sand deposition, making cleaning a critical requirement for solar farms. Countries such as the UAE, Saudi Arabia, and South Africa are leading adopters, driven by ambitious renewable energy targets. Robotic and waterless cleaning systems are increasingly favored due to severe water scarcity in desert environments. While adoption remains concentrated in large projects, rising investments in solar capacity are expected to expand demand. The focus on sustainable cleaning practices enhances long-term market opportunities.

Market Segmentations:

By Technology:

- Wet Cleaning

- Dry Cleaning

By Process:

- Semi-Automated

- Automated

- Water Brushes

- Electrostatic

- Automated Robotic

- Others

By Mode of Operation:

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The solar panel cleaning market is shaped by a diverse group of players, including Miraikikai, Solar Cleaning Machinery, Sharp, Clean Solar Solutions, Ecoppia, Solbright, Indisolar Products, Premier Solar Cleaning, Pacific Panel Cleaners, Airtouch Solar, Solar Service Professional, Saint Gobain, and Karcher. These companies compete through technology innovation, product diversification, and service reliability to meet the rising demand for efficient cleaning solutions. Their strategies focus on automation, waterless systems, and eco-friendly technologies to address growing concerns over water scarcity and high operational costs. Market participants are expanding their reach by targeting utility-scale solar farms while also catering to residential and commercial segments. Collaborations, mergers, and technological advancements strengthen their market positions. Continuous investments in robotics and AI-driven solutions are further enhancing efficiency, scalability, and cost-effectiveness. As solar capacity expands worldwide, competitive rivalry is expected to intensify, with companies aiming to differentiate through innovation, sustainability, and performance-driven services.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Miraikikai

- Solar Cleaning Machinery

- Sharp

- Clean Solar Solutions

- Ecoppia

- Solbright

- Indisolar Products

- Premier Solar Cleaning

- Pacific Panel Cleaners

- Airtouch Solar

- Solar Service Professional

- Saint Gobain

- Karcher

Recent Developments

- In 2023, Karcher launched a complete range of solar panel cleaning solutions in India, including high-pressure cleaners and specialized cleaning detergents.

- In 2023, Ecoppia announced significant growth, including partnerships with major solar developers in the Middle East and North America for its water-free robotic panel cleaning systems, and also secured new contracts to expand its services in India.

- In 2023, Airtouch Solar launched the water-free, self-cleaning Airtouch AT 4.0 solution for utility-scale solar plants.

Report Coverage

The research report offers an in-depth analysis based on Technology, Process, Mode of Operation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as global solar power installations increase.

- Automated robotic cleaning systems will gain wider adoption in utility-scale projects.

- Waterless and eco-friendly cleaning technologies will become a preferred choice in arid regions.

- Manual cleaning will continue to dominate small-scale residential and commercial applications.

- AI and IoT integration will enhance predictive maintenance and cleaning efficiency.

- Demand for autonomous cleaning systems will rise with large-scale solar farm growth.

- Emerging economies will drive significant market expansion through renewable energy initiatives.

- Strict environmental regulations will boost adoption of sustainable cleaning solutions.

- Investment in R&D will lead to advanced technologies reducing operational costs.

- Partnerships between solar farm operators and cleaning solution providers will strengthen market growth.