Market Overview:

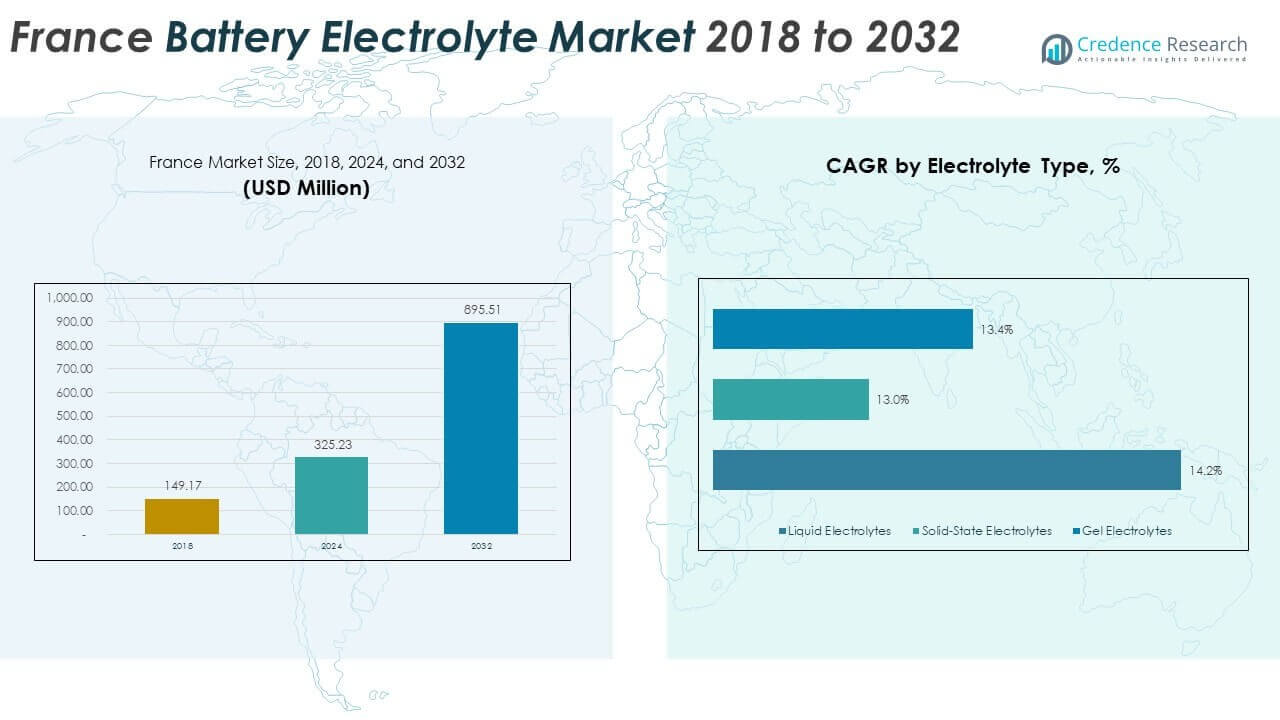

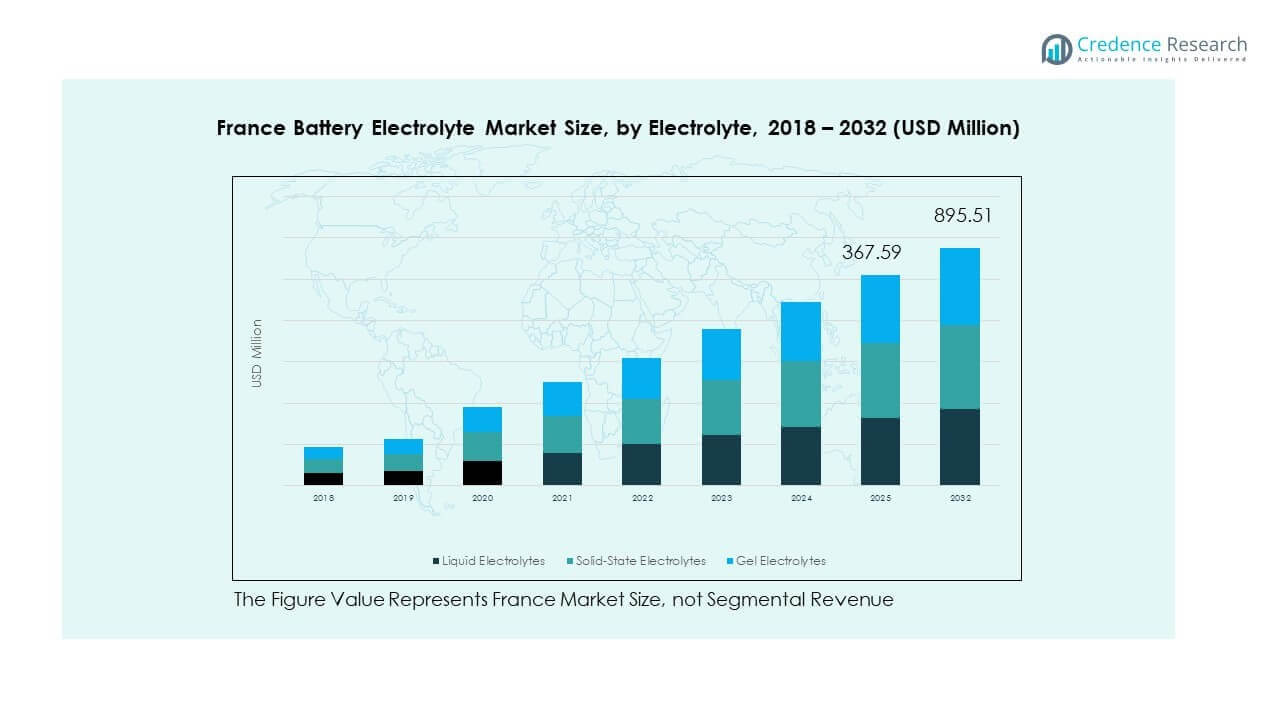

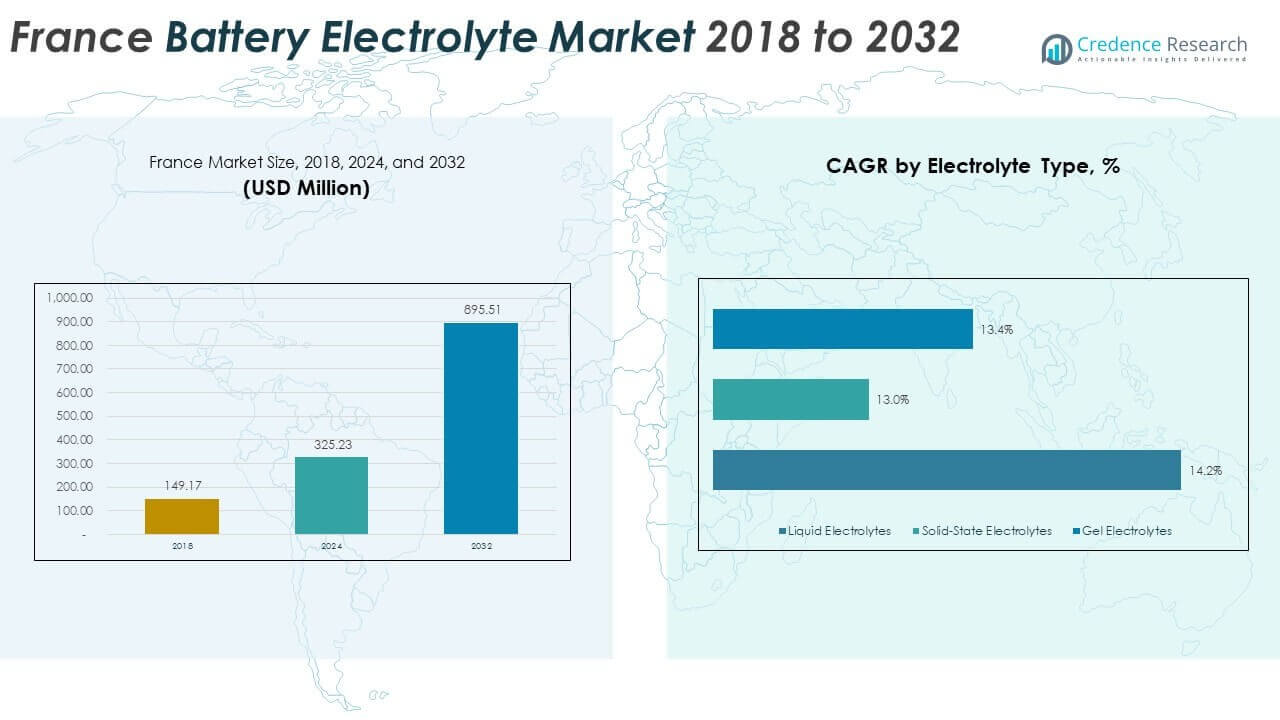

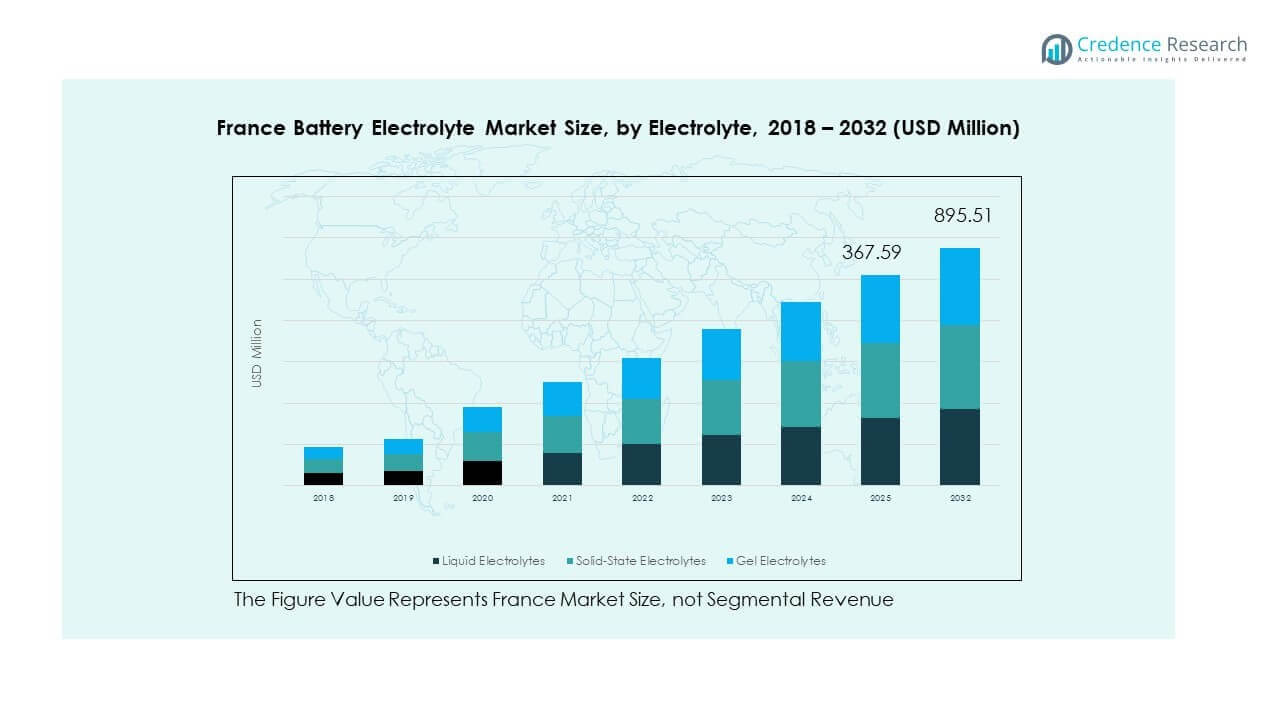

The France Battery Electrolyte Market size was valued at USD 149.17 million in 2018 to USD 325.23 million in 2024 and is anticipated to reach USD 895.51 million by 2032, at a CAGR of 13.50% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Battery Electrolyte Market Size 2024 |

USD 325.23 Million |

| France Battery Electrolyte Market, CAGR |

13.50% |

| France Battery Electrolyte Market Size 2032 |

USD 895.51 Million |

Growth in the France Battery Electrolyte Market is driven by rising demand for electric vehicles, expanding renewable energy storage, and supportive government policies. Increasing adoption of lithium-ion batteries in automotive and consumer electronics boosts market expansion. Investments in sustainable energy transition and advancements in electrolyte formulations further strengthen growth opportunities for both domestic and international players.

Regionally, Western Europe dominates the market due to advanced automotive industries and strong clean energy policies. France leads with large-scale EV adoption and significant research in next-generation batteries. Emerging growth is seen in Eastern Europe, supported by expanding industrial infrastructure and rising demand for energy storage solutions. This regional spread reflects the diverse pace of adoption, where developed nations drive innovation and emerging regions provide new market opportunities.

Market Insights:

- The France Battery Electrolyte Market was valued at USD 149.17 million in 2018, reached USD 325.23 million in 2024, and is projected to reach USD 895.51 million by 2032, growing at a CAGR of 13.50%.

- Western France led with 38% share in 2024, driven by automotive clusters and EV production. Northern France followed with 32%, supported by renewable storage projects. Southern and Eastern France together held 30%, benefiting from industrial diversification and port access.

- Eastern France is the fastest-growing region, leveraging cross-border trade advantages and renewable energy integration to expand its contribution to the France Battery Electrolyte Market.

- Liquid electrolytes accounted for the dominant segment in 2024, holding over 45% of market share due to widespread use in lithium-ion and lead acid batteries.

- Solid-state electrolytes captured around 35% share, reflecting rising adoption in advanced energy storage projects, while gel electrolytes held the remaining portion, focused on safety-driven niche applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Adoption of Electric Vehicles in France Driving Electrolyte Demand

The France Battery Electrolyte Market experiences strong growth due to rapid EV adoption nationwide. Government incentives and stricter carbon emission norms push consumers toward cleaner mobility. Automakers are expanding EV models, creating high demand for advanced electrolytes. It benefits from rising battery production capacity and strategic alliances with material suppliers. The focus on sustainable transportation ensures continued electrolyte innovation. France’s commitment to meeting EU climate targets further accelerates adoption. This dynamic strengthens both domestic manufacturers and foreign investors.

- For instance, AESC’s battery gigafactory in Douai, Hauts-de-France, which started operations in 2025, is set to produce lithium-ion batteries with a capacity of 9 GWh, powering approximately 200,000 electric vehicles annually, specifically supporting models like Renault’s ECHO 5 and 4Ever crossovers.

Expansion of Renewable Energy Storage Systems Enhancing Market Growth

Energy storage demand drives higher electrolyte consumption across solar and wind projects. France invests heavily in renewable capacity to reduce fossil fuel reliance. Battery energy storage systems play a central role in stabilizing intermittent renewable power. The France Battery Electrolyte Market grows stronger through large-scale storage deployments. It gains momentum from grid modernization projects and regional decarbonization strategies. Strong policy support and public investments expand industry prospects. Energy companies increasingly prioritize localized supply chains for electrolytes. These trends ensure steady market expansion.

- For instance, France’s grid operator RTE reported a record renewable energy curtailment of 1.7 terawatt-hours in 2024, highlighting the urgent need for battery energy storage systems. Over 8 GW of BESS (Battery Energy Storage Systems) projects have secured grid connection rights, reflecting large-scale storage implementation.

Technological Advancements in Electrolyte Formulations Supporting Efficiency Gains

Research in advanced electrolytes enhances battery performance, lifespan, and safety. Solid-state and gel-based electrolytes attract major research funding. The France Battery Electrolyte Market benefits from innovation in both academic and industrial labs. It sees strong interest in safer, high-voltage electrolyte solutions. Collaboration between research institutions and private companies strengthens commercialization efforts. Investments in recycling technologies help address sustainability challenges. Innovation attracts venture funding and boosts the competitive landscape. Research efforts continue to create value across mobility and storage applications.

Government Policies and Sustainability Targets Driving Industry Transformation

France promotes battery manufacturing through EU-backed initiatives and climate policies. The France Battery Electrolyte Market gains support from regulatory alignment with European Green Deal objectives. It benefits from tax credits, subsidies, and partnerships promoting local production. Policies encourage investments in eco-friendly electrolytes with reduced environmental impact. Manufacturers adopt circular economy strategies to meet regulatory standards. Energy independence goals further motivate large-scale domestic battery projects. Market participants align their R&D pipelines with government priorities. This synergy drives stronger long-term market growth.

Market Trends:

Shift Toward Solid-State and Advanced Electrolytes in Next-Generation Batteries

The France Battery Electrolyte Market is witnessing a steady shift toward solid-state designs. These advanced electrolytes reduce flammability risks and enhance battery life. Research centers and automotive firms lead initiatives for commercialization. It gains attention as industries move beyond conventional liquid electrolytes. Solid-state adoption aligns with global demand for higher energy density. Pilot projects in Europe encourage innovation in large-scale production. Manufacturers expand collaborations with research bodies to speed technology readiness. This trend supports safer and more efficient battery ecosystems.

- For instance, Blue Solutions is constructing a solid-state battery gigafactory in France with a projected annual production capacity of 25 GWh by 2030, representing batteries capable of powering up to 250,000 vehicles per year with 40% more autonomy than current lithium-ion batteries.

Integration of Recycling and Circular Economy Principles Across Supply Chains

Recycling of battery electrolytes is gaining strong relevance in France. The France Battery Electrolyte Market adapts to sustainability needs through eco-focused production. Companies explore recovery of lithium salts and electrolyte chemicals. It benefits from government-backed recycling frameworks and EU waste directives. Circular economy goals create long-term value for the market. Firms adopt closed-loop recycling to reduce dependency on raw imports. Strategic investments ensure compliance with environmental norms. This trend ensures future competitiveness in global markets.

- For example, Hydrovolt has announced plans to establish a battery recycling facility in France as of July 2024, focusing on recovering lithium and electrolyte materials to support sustainable battery manufacturing and reduce environmental impact.

Growing Role of Digitalization in Manufacturing and Supply Chain Optimization

Digital transformation shapes efficiency across the electrolyte market. The France Battery Electrolyte Market adopts smart monitoring and AI-driven process controls. It benefits from real-time production optimization and predictive quality systems. Industry players deploy automation to ensure scale and precision. Smart technologies enhance traceability across supply chains. Data-driven insights improve procurement and cost control. It also strengthens risk management for sourcing raw chemicals. These trends raise competitiveness and ensure reliable output.

Collaborative Ecosystem Between Automakers, Energy Firms, and Material Producers

Cross-sector partnerships emerge as a core market trend. The France Battery Electrolyte Market strengthens through alliances between automakers and energy firms. It gains value from joint research on advanced electrolyte formulations. Partnerships with academic institutions fuel faster knowledge transfer. Industry clusters encourage innovation in clean energy storage. Firms align projects to meet EV and grid storage targets. Joint investments enhance regional production capabilities. Collaboration supports resilience and accelerates technological leadership in Europe.

Market Challenges Analysis:

Supply Chain Vulnerabilities and Rising Dependence on Critical Raw Materials

The France Battery Electrolyte Market faces challenges from global supply chain disruptions. Limited access to lithium salts, fluorinated compounds, and solvents impacts stability. It struggles with raw material volatility and geopolitical risks. Heavy reliance on imports exposes the market to high costs. Companies face difficulties in securing long-term procurement contracts. Strategic stockpiling helps but adds to operational expenses. Rising global competition intensifies sourcing challenges further. This creates long-term concerns for production reliability.

High Costs of Innovation and Stringent Environmental Compliance Regulations

Innovation in electrolytes demands heavy research and testing investments. The France Battery Electrolyte Market encounters cost barriers in scaling new technologies. Compliance with EU environmental directives adds regulatory burdens. It must adhere to strict emissions and chemical safety standards. Delays in approvals hinder rapid commercialization of advanced formulations. Small and mid-sized enterprises struggle with capital-intensive requirements. Larger firms gain an advantage through better financial resources. This challenge creates uneven growth dynamics within the industry.

Market Opportunities:

Strong Government Backing and European Green Deal Driving Investments

The France Battery Electrolyte Market gains opportunities through strong government and EU support. National policies align with energy transition goals and EV adoption targets. It benefits from incentives for local production and sustainable technologies. Firms leverage funding from EU research initiatives. These programs encourage innovations in next-gen electrolytes. Policy frameworks reduce risks for investors and innovators. Supportive regulations strengthen long-term competitiveness of France in global markets.

Emerging Demand in Energy Storage and Industrial Applications Offering Expansion Scope

Beyond EVs, new opportunities arise in renewable and industrial storage. The France Battery Electrolyte Market benefits from solar and wind power integration. It supports demand for large-scale energy storage solutions. Industrial users seek efficient batteries for heavy-duty operations. This drives adoption of advanced electrolyte formulations. Emerging applications in aerospace and defense expand prospects further. Market participants gain by diversifying product offerings. Growth potential remains strong across multiple application sectors.

Market Segmentation Analysis:

By Electrolyte Type

The France Battery Electrolyte Market is shaped by three main electrolyte categories: liquid, solid-state, and gel electrolytes. Liquid electrolytes hold a strong presence due to their extensive use in commercial lithium-ion and lead acid batteries. Solid-state electrolytes gain momentum through research and pilot projects focused on safer, high-density energy storage. Gel electrolytes find niche adoption in applications requiring enhanced safety and flexible design. It reflects a shift toward innovation, where solid-state options are expected to become more dominant in the long term.

- For instance, firms like Arkema Global and BASF SE have advanced liquid electrolyte formulations tailored for lithium-ion batteries, while research collaborations such as Blue Solutions with CNRS and Sorbonne University focus on hybrid solid-state electrolyte developments enhancing autonomy and safety.

By Battery Type

Lithium-ion batteries dominate the landscape due to their critical role in electric vehicles and electronics. The France Battery Electrolyte Market strengthens around this segment with rising EV adoption. Lead acid batteries retain relevance in backup power and industrial uses. Flow batteries capture attention for renewable energy storage due to scalability. Other emerging battery chemistries offer scope for specialized applications, creating diverse opportunities for electrolyte suppliers. This mix supports balance between mature and evolving battery technologies.

- For instance, Stellantis partnered with CEA to develop next-generation lithium-ion battery cells tailored for EVs in France, intensifying R&D efforts to improve electrolyte efficiency and battery lifespan.

By Application

Automotive remains the leading application, driven by strong EV adoption and government support. The France Battery Electrolyte Market also sees significant demand from consumer electronics, where portable devices require reliable battery solutions. Energy storage grows rapidly, supported by renewable integration and grid modernization. Other industrial applications, including aerospace and defense, expand electrolyte usage in specialized areas. It reflects a diversified application base, with automotive and energy storage driving future demand while electronics sustain consistent growth.

Segmentation:

By Electrolyte Type

- Liquid Electrolytes

- Solid-State Electrolytes

- Gel Electrolytes

By Battery Type

- Lithium-ion

- Lead Acid

- Flow Battery

- Others

By Application

- Automotive

- Consumer Electronics

- Energy Storage

- Others

Regional Analysis:

Western France – Industrial and Automotive Hub Driving Market Growth

Western France holds the largest share in the France Battery Electrolyte Market, accounting for nearly 38% in 2024. The region benefits from a strong automotive cluster and well-established industrial base, making it a hub for EV production and battery research. It gains strength from major automotive OEMs and suppliers that invest in localized supply chains. Strong government support for clean mobility projects further boosts adoption of advanced electrolytes. Universities and research centers in the region enhance innovation and technology transfer. Western France remains a critical driver of long-term growth due to its concentration of industry leaders and innovation hubs.

Northern France – Strong Biotechnology and Energy Transition Investments

Northern France represents about 32% of the market share in 2024, driven by renewable energy projects and industrial modernization. The region actively develops battery energy storage systems to stabilize growing solar and wind power capacity. It benefits from strong infrastructure, logistics networks, and policy support that encourages energy transition projects. Local governments prioritize investment in battery technology to create jobs and reduce carbon dependency. The France Battery Electrolyte Market expands in this region as energy storage solutions become critical for grid reliability. Northern France also attracts foreign investments aimed at strengthening supply chains for sustainable technologies.

Southern and Eastern France – Emerging Markets with Expanding Potential

Southern and Eastern France together hold nearly 30% of the France Battery Electrolyte Market in 2024. These regions are emerging growth areas, supported by rising investments in renewable energy and consumer electronics manufacturing. It gains demand from new energy storage installations and industrial diversification projects. Southern France benefits from port infrastructure that facilitates raw material imports and exports. Eastern France aligns with EU border economies, providing strategic advantages for cross-border trade in advanced battery materials. Both regions are projected to expand their share as new projects in renewable integration, EV adoption, and industrial electrification take shape. This positions them as important contributors to the future market outlook.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BASF

- Mitsubishi Chemical Group

- 3M

- Targray Industries Inc

- Evonik Industries AG

- NEI Corporation

- Arkema Global

- Solvay SA

- Umicore SA

- Enchem

- Saft

Competitive Analysis:

The France Battery Electrolyte Market is highly competitive, with global chemical manufacturers and regional players competing for market leadership. Companies focus on innovation in electrolyte formulations to meet rising demand from electric vehicles, energy storage, and consumer electronics. It demonstrates strong rivalry as firms invest in R&D, expand local production capacities, and form strategic partnerships. Larger players such as BASF, Mitsubishi Chemical Group, and Evonik Industries leverage broad portfolios, while mid-tier companies emphasize niche applications and regional supply. Competitive intensity is further reinforced by sustainability mandates and cost pressures, encouraging differentiation through advanced technologies and circular economy solutions.

Recent Developments:

- In May 2025, BASF showcased a comprehensive range of innovative technologies for electromobility at The Battery Show Europe in Stuttgart, including tailor-made cathode active materials for high-performance lithium-ion batteries and solutions aimed at enhancing battery efficiency and sustainability.

- In August 2025, BASF, through its joint venture BASF Shanshan Battery Materials, delivered the first mass-produced cathode active materials for semi-solid-state batteries to WELION New Energy, marking a significant milestone towards the industrialization of next-generation solid-state batteries, featuring ultra-high nickel NCM cathode materials designed to improve energy density, safety, and battery life.

- Mitsubishi Chemical Group remains a key player in the France battery electrolyte market, although no very recent product launch or acquisition specifically in France was found within 2025. The group is generally known for ongoing investments and innovations in battery materials and electrolyte technologies as part of the global EV market expansion.

Report Coverage:

The research report offers an in-depth analysis based on electrolyte type, battery type, and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for electrolytes will expand with rising EV penetration across France.

- Solid-state electrolyte adoption will accelerate with pilot projects moving toward commercialization.

- Recycling frameworks will increase the role of recovered electrolyte materials.

- Strategic alliances between automakers and chemical firms will strengthen.

- Consumer electronics will maintain steady electrolyte demand across portable devices.

- Energy storage growth will enhance opportunities in renewable integration.

- Western France will remain a hub for automotive-related electrolyte demand.

- Regulatory alignment with EU Green Deal will drive sustainable innovations.

- Gel electrolytes will see niche growth in safety-sensitive applications.

- Investments in R&D will continue to reshape the competitive landscape.