Market Overview

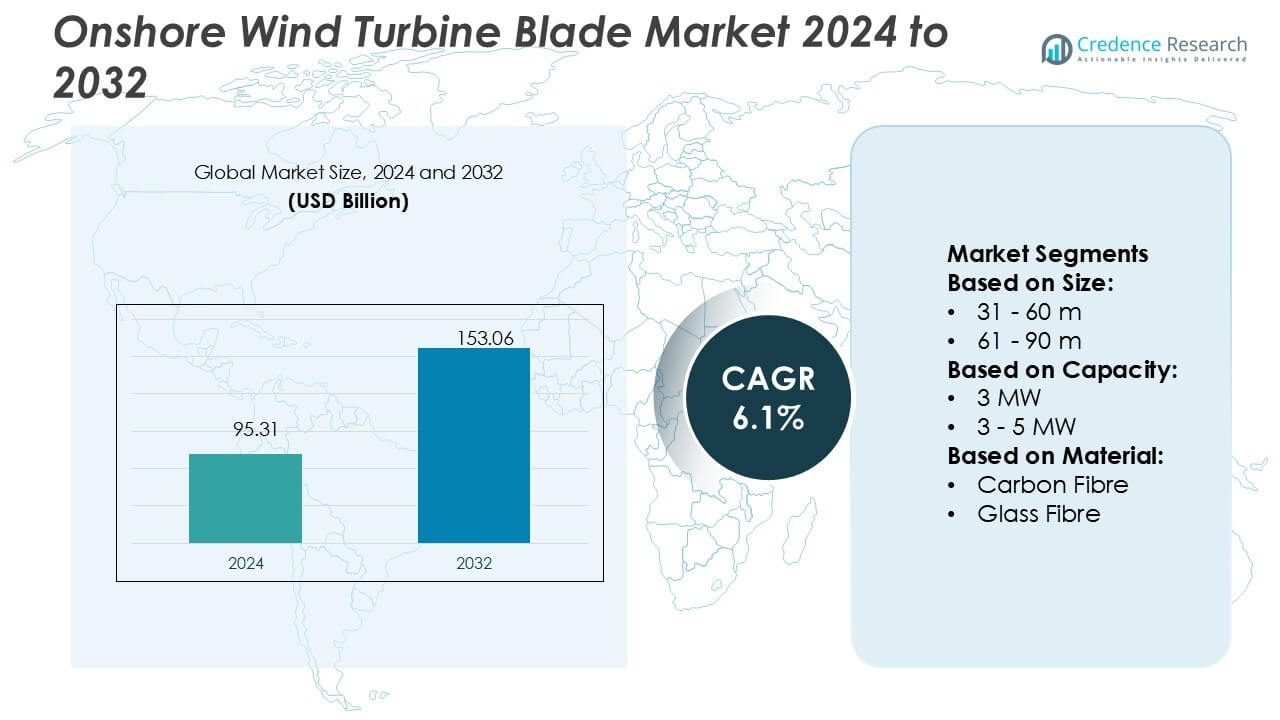

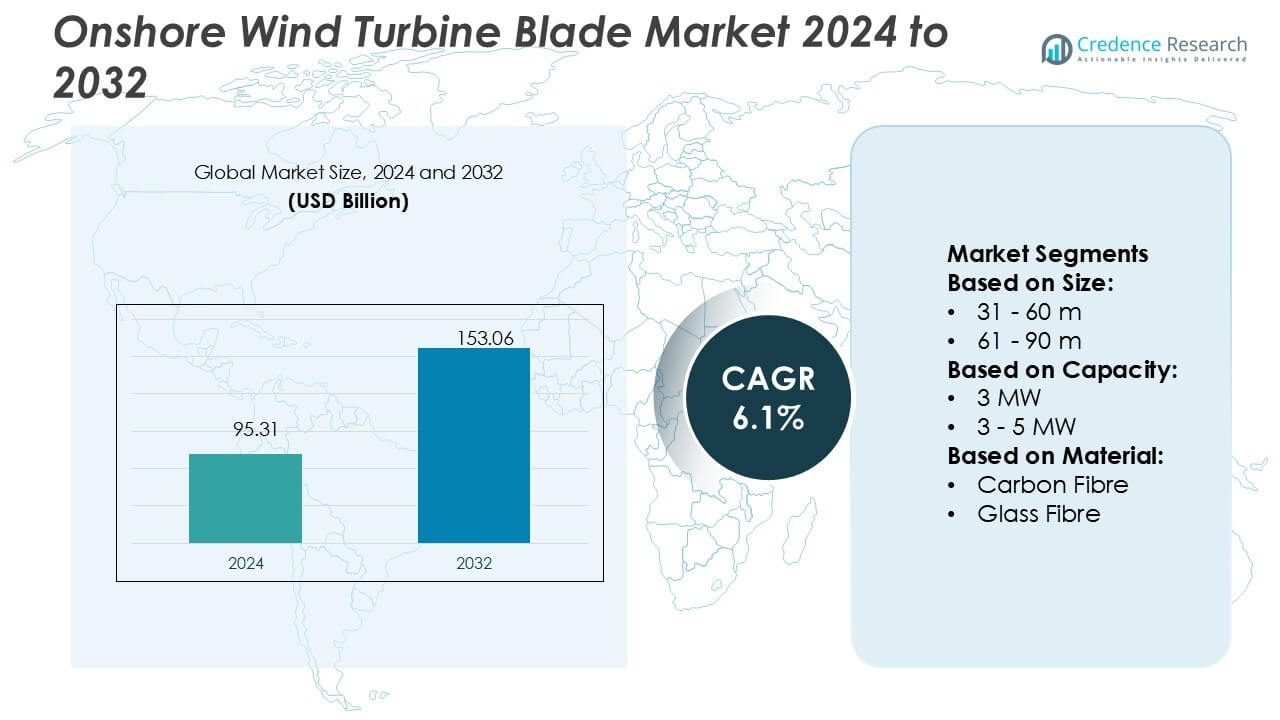

Onshore Wind Turbine Blade Market size was valued USD 95.31 billion in 2024 and is anticipated to reach USD 153.06 billion by 2032, at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Onshore Wind Turbine Blade Market Size 2024 |

USD 95.31 Billion |

| Onshore Wind Turbine Blade Market, CAGR |

6.1% |

| Onshore Wind Turbine Blade Market Size 2032 |

USD 153.06 Billion |

The onshore wind turbine blade market is driven by prominent players such as MFG Wind, Enercon GmbH, Siemens AG, Nordex SE, Acciona S.A., Gamesa Corporacion Technologica, LM Wind Power, Aeris Energy, EnBW, and Hitachi Power Solutions. These companies emphasize advanced blade technologies, sustainable materials, and regional manufacturing hubs to enhance efficiency and reduce costs. Strategic investments in longer, lightweight blades and digital monitoring systems strengthen their competitive edge. Asia-Pacific emerges as the leading region, commanding 34% share, supported by large-scale deployments in China and India, strong policy frameworks, and extensive local manufacturing capacity that ensures consistent market growth.

Market Insights

Market Insights

- The onshore wind turbine blade market was valued at USD 95.31 billion in 2024 and is projected to reach USD 153.06 billion by 2032, growing at a CAGR of 6.1%.

- Rising demand for renewable energy and supportive government policies drive adoption, with longer blades enabling higher efficiency and reduced energy costs.

- The market shows strong trends in lightweight composite materials and digital monitoring technologies, improving blade durability, performance, and operational reliability.

- High production and transportation costs, along with recycling challenges for traditional composites, remain key restraints impacting growth potential.

- Asia-Pacific leads with 34% share, followed by Europe at 29% and North America at 22%, while blades sized 61–90 meters and capacity range of 3–5 MW dominate segment shares, reinforcing demand for mid-to-large-scale wind projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Size

Blades sized between 61–90 meters dominate the onshore wind turbine blade market, holding 46% share. Their popularity stems from their ability to support larger turbines with higher energy yield. These blades maximize efficiency in moderate and high-wind regions, enabling cost-effective electricity production. Manufacturers also focus on aerodynamics and lightweight structures to ensure stability during operation. The growing deployment of utility-scale projects drives the demand for longer blades. Their capacity to improve output while lowering the levelized cost of energy (LCOE) remains a strong adoption driver.

- For instance, LM Wind Power (a GE Renewable Energy company) developed a 107-meter blade for offshore wind turbines, undergoing rigorous full-scale static and fatigue testing to ensure structural integrity, with data analyzed to predict blade behavior under variable wind conditions.

By Capacity

The 3–5 MW capacity segment leads the market with 41% share. These turbines strike a balance between power generation and cost efficiency, making them suitable for both developed and emerging markets. Their adaptability to varying wind conditions and compatibility with modern grid systems enhance their acceptance. Developers prefer this range due to its lower installation costs compared to higher-rated models. The rising shift toward mid-sized wind farms, supported by favorable policy frameworks, accelerates adoption. Improved durability and grid integration capabilities further strengthen the dominance of this segment.

- For instance, Enercon’s E-138 EP3 turbine is rated at 4.26 MW (nominal), and utilizes a direct-drive synchronous generator (gearless) architecture to reduce mechanical wear.

By Material

Glass fibre blades account for the largest share at 58% in the onshore wind turbine blade market. They remain the preferred choice due to their cost-effectiveness, ease of manufacturing, and mechanical strength. While carbon fibre offers superior stiffness and weight reduction, it carries higher production costs, limiting wider adoption. Glass fibre’s proven track record in durability and recyclability reinforces its position. Increasing investments in lightweight composite technologies enhance blade reliability. Demand is also driven by continuous R&D to improve fatigue resistance, making glass fibre the dominant material for scalable onshore wind applications.

Key Growth Drivers

Rising Demand for Renewable Energy

Global targets for carbon reduction and energy transition are fueling demand for onshore wind power. Governments and utilities are accelerating the deployment of wind projects to reduce dependence on fossil fuels. Wind turbine blades play a critical role in improving efficiency and lowering energy costs. Incentives, tax benefits, and renewable energy mandates encourage developers to invest in advanced blade technologies. The push for clean energy ensures continuous demand, positioning onshore wind turbine blades as a central component in achieving sustainable energy goals worldwide.

- For instance, Siemens Gamesa unveiled its “RecyclableBlade” composite blade measuring 81 meters, whose materials can be efficiently separated and reclaimed after decommissioning.

Advancements in Blade Design and Materials

Technological progress in blade design and composite materials drives market growth. Longer, lighter blades with improved aerodynamics enhance capacity factors and power output. Innovations such as modular designs and advanced resins improve fatigue resistance and extend service life. Manufacturers are also integrating automation and precision molding to reduce defects and optimize production costs. These innovations make blades more durable and adaptable to diverse wind conditions. Enhanced performance through advanced engineering ensures stronger adoption in large-scale projects, reinforcing the growth of the onshore wind turbine blade market.

- For instance, Nordex’s N175/6.X utilizes a single-piece rotor blade length of 85.7 m on the Delta4000 platform. In comprehensive testing, Nordex validated this rotor under static load and fatigue regimes over an 11-month program, verifying deflections, strains, and natural frequencies remain within design tolerances.

Expanding Utility-Scale Wind Projects

The global increase in utility-scale wind installations is a key growth driver. Larger projects require high-capacity turbines with longer blades, creating steady demand for advanced blade manufacturing. Countries in Asia, Europe, and North America are investing heavily in large wind farms to meet renewable targets. Developers prefer efficient blade technologies that deliver high output with reduced maintenance. The scaling up of wind energy infrastructure ensures consistent procurement of longer, reliable blades. This expansion of utility-scale projects directly boosts market growth by creating a stable demand pipeline.

Key Trends & Opportunities

Shift Toward Lightweight Composite Materials

The market is witnessing a shift toward advanced lightweight composites for blade production. Carbon fibre, though expensive, is gaining adoption in premium applications for its stiffness and weight reduction. Manufacturers are also experimenting with hybrid glass-carbon composites to balance cost and performance. This trend supports longer blade development, enhancing energy yield in low-wind regions. The opportunity lies in scaling cost-effective production methods, enabling wider use across mid-sized projects. Continued R&D in materials presents strong potential for innovation and competitive differentiation in the market.

- For instance, Acciona is building its Waste2Fiber® recycling plant in Navarra with processing capacity of 6,000 tons per year of composite blade material, using a proprietary thermal method that preserves reinforcing fiber properties.

Digitalization and Smart Manufacturing

Digital technologies are transforming blade design, testing, and manufacturing. Simulation tools enable precise aerodynamic optimization, while digital twins monitor blade health in real time. Automation in production reduces errors and increases efficiency, supporting cost reductions at scale. These technologies enhance predictive maintenance and improve operational reliability of wind farms. The opportunity lies in integrating smart solutions with manufacturing ecosystems to boost productivity. Adoption of Industry 4.0 practices creates competitive advantages for blade manufacturers and aligns with global sustainability goals in the wind energy sector.

- For instance, EnBW applies AI fault detection by processing “hundreds of thousands of data points per minute” per turbine. In He Dreiht, the rotor diameter is 236 m, enabling large swept area per turbine.

Key Challenges

High Production and Transportation Costs

Manufacturing large turbine blades requires significant investment in advanced equipment and composite materials. High costs limit accessibility for smaller developers and raise project capital expenditure. Transportation adds further complexity, as blades exceeding 60 meters demand specialized logistics and infrastructure. These cost burdens affect scalability in emerging markets with limited resources. Despite efficiency gains, cost management remains a challenge for widespread adoption. Reducing production and logistics costs through localized facilities and modular blade designs is essential to maintaining competitiveness in the global market.

Environmental and Recycling Concerns

Blade disposal and recyclability present major sustainability challenges. Traditional glass fibre composites are difficult to recycle, leading to landfill accumulation as older blades retire. This creates environmental concerns and regulatory pressure on manufacturers. Developing sustainable recycling methods and recyclable materials remains a slow process. The industry faces challenges in balancing durability, cost, and circularity. Without scalable recycling solutions, environmental compliance costs could rise, impacting profitability. Addressing end-of-life management through innovative processes and eco-friendly materials is critical for long-term market sustainability.

Regional Analysis

North America

North America holds 22% share in the onshore wind turbine blade market, driven by large-scale wind installations across the United States and Canada. Federal tax incentives, renewable portfolio standards, and state-level policies continue to support capacity expansion. The U.S. dominates regional growth with strong investments in Midwest and Texas wind corridors, while Canada focuses on diversifying its renewable mix. Local manufacturing capabilities and partnerships with global suppliers strengthen supply chains. Growing replacement demand for older blades also fuels adoption. Advancements in long-blade technologies enhance project efficiency, ensuring steady market expansion across the region.

Europe

Europe accounts for 29% share, positioning it as a leading market for onshore wind turbine blades. Strong regulatory frameworks such as the EU Green Deal and binding renewable energy targets drive investments in wind projects. Germany, Spain, and the UK dominate blade adoption through utility-scale installations. The region emphasizes sustainable materials and recycling solutions, aligning with environmental goals. Local manufacturers collaborate with research institutions to improve blade efficiency and durability. Offshore growth indirectly supports onshore innovation, further boosting technological advancements. Europe’s focus on decarbonization and grid modernization secures its continued leadership in blade demand.

Asia-Pacific

Asia-Pacific leads the market with 34% share, fueled by rapid wind energy adoption in China and India. Government-backed renewable programs and rising electricity demand in developing economies strengthen growth. China dominates with extensive blade manufacturing capacity and aggressive deployment of large-scale wind farms. India’s renewable policies and rising energy needs drive steady demand for mid-capacity turbines. Japan and Australia also expand installations to diversify energy sources. Favorable financing models and cost-effective production in the region create competitive advantages. Asia-Pacific’s dominance is further reinforced by strong local supply chains, ensuring blade availability for growing projects.

Latin America

Latin America captures 8% share in the onshore wind turbine blade market, with Brazil and Mexico as primary contributors. Supportive renewable policies, strong wind resources, and foreign investments fuel regional demand. Brazil leads installations with government auctions driving competitive tariffs for wind projects. Mexico continues to attract private investments despite regulatory uncertainties. Growing interest in Chile and Argentina further expands opportunities. Cost-effective labor and favorable land conditions support project viability. However, dependence on imports for advanced blades poses challenges. Rising energy diversification needs ensure sustained demand, making Latin America an emerging growth region for turbine blades.

Middle East & Africa

The Middle East & Africa region holds 7% share, with growing adoption in South Africa, Morocco, and Egypt. These countries leverage abundant wind resources to diversify energy generation and reduce reliance on fossil fuels. Government-led renewable initiatives and international funding accelerate project development. The Middle East, led by Saudi Arabia and the UAE, is gradually expanding wind energy portfolios as part of broader sustainability goals. Infrastructure limitations and high initial costs challenge growth, but rising interest in clean energy supports future demand. Expanding regional collaboration and technology transfer will enhance blade adoption across this market.

Market Segmentations:

By Size:

By Capacity:

By Material:

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The onshore wind turbine blade market is shaped by leading players including MFG Wind, Enercon GmbH, Siemens AG, Nordex SE, Acciona S.A., Gamesa Corporacion Technologica, LM Wind Power, Aeris Energy, EnBW, and Hitachi Power Solutions. The onshore wind turbine blade market is highly competitive, driven by continuous innovation, capacity expansion, and strategic collaborations. Manufacturers focus on developing longer and lighter blades using advanced composites to enhance energy output and reduce levelized cost of energy (LCOE). Investments in research and development emphasize durability, recyclability, and aerodynamic efficiency, aligning with global sustainability targets. Regional production hubs and localized supply chains help reduce logistics costs and support faster project execution. Additionally, digital technologies such as predictive maintenance and blade health monitoring are gaining traction, improving operational reliability and extending asset lifecycles.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- MFG Wind

- Enercon GmbH

- Siemens AG

- Nordex SE

- Acciona S.A.

- Gamesa Corporacion Technologica

- LM Wind Power

- Aeris Energy

- EnBW

- Hitachi Power Solutions

Recent Developments

- In May 2025, ZF Wind Power launched India’s largest 13.2MW test rig in Coimbatore. This modern test rig is used for comprehensive testing and validation of gearboxes and powertrains, ensuring they can withstand the rigorous demands of modern wind turbines.

- In May 2025, Senvion India launched the 3.1 M130 wind turbine, and the installation will begin across the country. It is developed to enhance control systems and also site-specific flexibility. It is engineered to maximise annual energy production under Indian wind conditions.

- In May 2025, Haventus and Sarens, the UK-based companies PSG, have developed a low-cost solution for the integration and launch of floating offshore wind turbines. The company said that the installations will be offshore and will also cut down the costs and accelerate floating offshore wind deployment.

- In April 2025, Enel, a global leader in renewable energy, launched ‘WinDesign. The goal of this is to develop turbine projects that blend more effortlessly into the landscapes that host them, thereby supporting a wider role for them in the energy transition.

Report Coverage

The research report offers an in-depth analysis based on Size, Capacity, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see growing adoption of longer blades to maximize energy generation.

- Advanced composite materials will gain traction for lighter and more durable blade designs.

- Digital twins and smart monitoring systems will improve blade performance and maintenance.

- Regional manufacturing expansion will reduce logistics challenges and support local projects.

- Recycling technologies will become a priority to address end-of-life blade management.

- Utility-scale wind projects will drive consistent demand for high-capacity turbine blades.

- Emerging economies will witness rising installations supported by favorable government policies.

- Hybrid material innovations will balance cost efficiency with structural performance.

- Collaborative R&D partnerships will accelerate innovation in blade design and aerodynamics.

- Sustainability goals will continue to shape investments in eco-friendly blade solutions.

Market Insights

Market Insights