Market Overview:

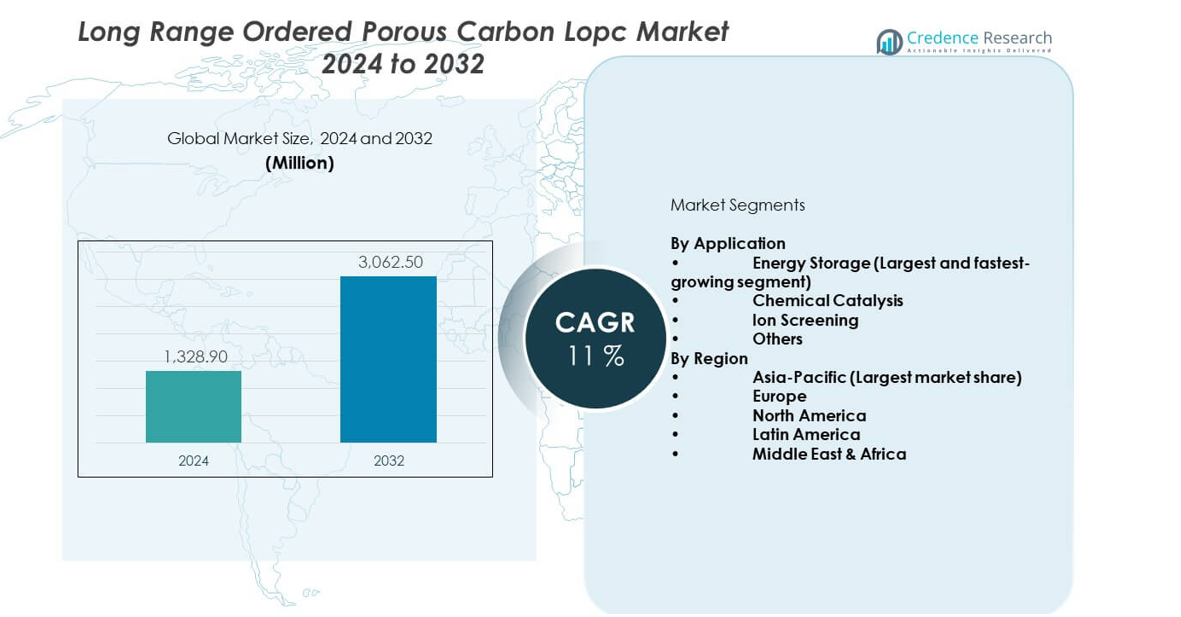

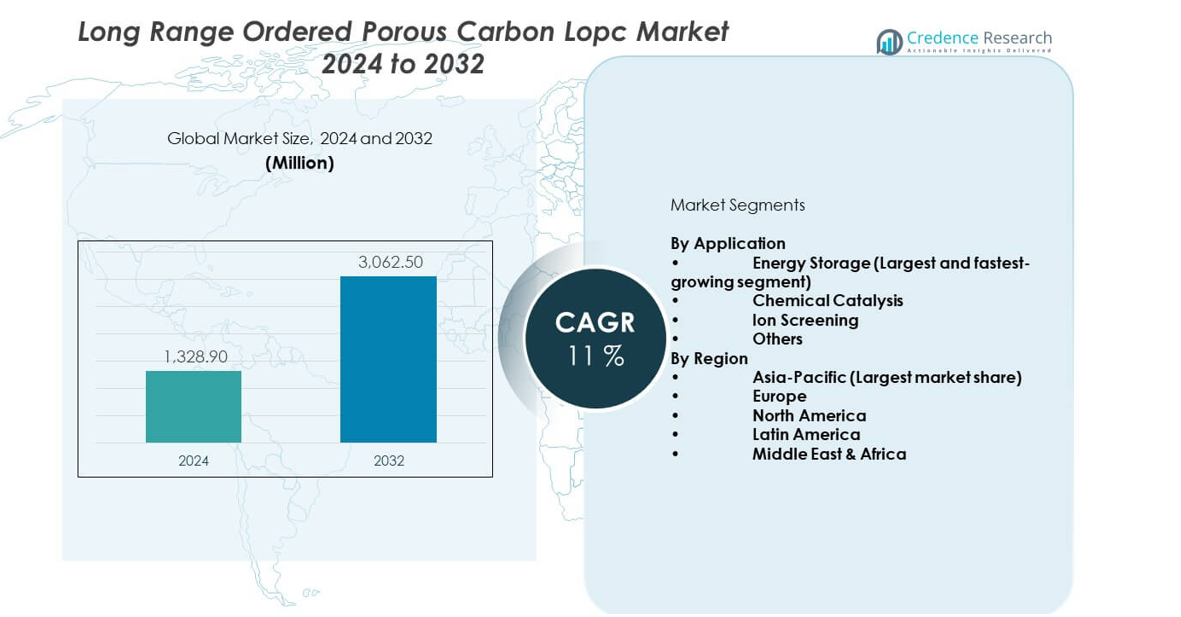

The Long Range Ordered Porous Carbon (LOPC) market is projected to grow from USD 1328.9 million in 2024 to an estimated USD 3062.5 million by 2032, with a CAGR of 11% from 2024 to 2032. Strong demand from energy storage, catalysis, and advanced filtration supports steady expansion across key industries.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Long Range Ordered Porous Carbon (LOPC) Market Size 2024 |

USD 1328.9 million |

| Long Range Ordered Porous Carbon (LOPC) Market, CAGR |

11% |

| Long Range Ordered Porous Carbon (LOPC) Market Size 2032 |

USD 3062.5 million |

The market gains momentum due to rising use of porous carbon in next-generation batteries, supercapacitors, and fuel cells. Manufacturers adopt LOPC to improve charge retention, reaction efficiency, and structural stability. Growing research on ordered nanoporous materials pushes new applications in chemical processing and environmental systems. Automotive and electronics industries use these materials to raise energy density and enhance thermal control. Supportive government programs for clean energy also create new prospects. Producers focus on scalable synthesis and controlled pore architecture to meet advanced performance needs. These factors keep adoption strong across high-tech sectors.

Demand grows across North America, Europe, and Asia Pacific due to strong research ecosystems and industrial capacity. Asia Pacific leads due to rapid growth in electronics, electric mobility, and energy storage manufacturing. Europe expands through strong chemical and material science capabilities, while North America benefits from advanced battery research and early adoption of high-performance materials. Emerging markets in Latin America and the Middle East increase interest as clean-energy programs advance. Diverse industrial bases and innovation clusters shape adoption patterns across all regions.

Market Insights:

- The Long range ordered porous carbon lopc market is valued at USD 1328.9 million in 2024 and is projected to reach USD 3062.5 million by 2032, expanding at a CAGR of 11% during the forecast period.

- Asia-Pacific leads with 42%, followed by Europe at 28% and North America at 22%, supported by strong manufacturing bases, advanced material research, and growing energy storage programs.

- Asia-Pacific is also the fastest-growing region with 42% share, driven by rapid battery production expansion and strong investment in porous carbon technologies.

- Energy Storage dominates the application landscape with 48% share, driven by strong demand from advanced battery and supercapacitor producers.

- Chemical Catalysis holds 25% share, supported by high surface-area requirements in industrial process optimization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for High-Performance Energy Storage Materials

The Long range ordered porous carbon lopc market gains steady momentum due to rapid adoption in advanced batteries and supercapacitors. Strong pore uniformity supports better ion transport and longer cycle life. Industries deploy these materials to raise power density in next-gen devices. Clean energy programs push producers to refine carbon structures for high efficiency. It supports strong use in electric mobility systems. The automotive sector focuses on stable materials for thermal control. Research groups invest in scalable synthesis for industrial use. Growing investment across energy domains boosts overall market demand.

- For instance, SGL Carbon reports producing high-quality graphite material for lithium-ion battery anodes in double-digit thousands of tons per year to supply global battery gigafactories, underlining industrial-scale demand for engineered carbon electrodes.

Growth in Catalysis and Chemical Processing Applications

The Long range ordered porous carbon lopc market expands due to its rising use in catalytic processes. High surface area supports better reaction speed in industrial systems. Producers adopt controlled pore structures to improve gas diffusion. It allows stable performance under harsh operating environments. Chemical manufacturers integrate these materials to raise yield. Petrochemical firms explore advanced carbon solutions for cleaner conversion cycles. Research centers test new designs for green chemistry processes. Wider adoption in precision catalysis strengthens market momentum.

- For instance, NASA testing showed Calgon’s Ammonasorb II and Chemsorb 1425 from Molecular Products achieved about 20 mg ammonia loading per gram of carbon, around 68% higher than a legacy sorbent on the ISS system, highlighting the efficiency gains achievable with engineered activated carbons in demanding catalytic and adsorption duties.

Advancement in Environmental and Filtration Technologies

The Long range ordered porous carbon lopc market benefits from wider use in adsorption and pollution control systems. Water treatment sectors favor ordered pores for targeted contaminant removal. It ensures faster purification rates in compact units. Air treatment systems integrate these materials for improved particle capture. Industries use carbon structures to meet strict environmental norms. Material engineers enhance pore alignment for consistent output. Municipal services expand projects requiring high-efficiency filtration. These dynamics support broader adoption across environmental sectors.

Technological Innovation and Material Engineering Progress

The Long range ordered porous carbon lopc market grows through stronger R&D efforts in nanostructured carbon engineering. Institutions refine synthesis techniques to improve pore precision. It supports better performance in electronics and sensing devices. Manufacturers scale production to meet industry-grade purity needs. Semiconductor sectors test ordered pores for thermal management. Industrial adopters value repeatable structural integrity. Research groups design new frameworks using metal-free compositions. Expansion of technical capabilities strengthens long-term market visibility.

Market Trends:

Shift Toward Next-Generation Electrode Architectures

The Long range ordered porous carbon lopc market sees a shift toward new electrode designs for faster charge cycles. Advanced frameworks enable improved electrochemical stability. It helps reduce energy loss in demanding operations. Battery developers push for higher porosity control. Supercapacitor makers integrate thinner structures for compact devices. Research centers explore hybrid designs blending carbon with organic materials. Consumer electronics firms adopt new electrode forms for extended runtime. This trend accelerates demand for high-precision porous materials.

- For instance, Skeleton Technologies reports that its curved-graphene-based SkelCap supercapacitor cells deliver up to four times higher power density than conventional cells and lifetimes beyond one million charge cycles, demonstrating how advanced carbon architectures translate directly into durable, high-power commercial devices.

Rising Integration in Hydrogen and Fuel Cell Systems

The Long range ordered porous carbon lopc market observes strong interest from fuel cell developers. Uniform pores support higher reaction efficiency in membrane units. It allows stable hydrogen flow through engineered pathways. Clean energy projects explore carbon-based catalytic supports. Manufacturers adapt structures for long service life in fuel cell stacks. Government programs promote research on efficient fuel systems. Material laboratories refine pore geometry for optimal gas handling. Adoption in hydrogen ecosystems continues to expand.

- For instance, graphite composite bipolar plates, such as those sold under SGL Carbon’s SIGRACELL line, have helped proton-exchange membrane fuel cell stacks reach about 1.6 kW output with power densities above 0.37 W/cm² in 1 kW-class systems, proving the value of engineered carbon components in hydrogen platforms.

Increased Exploration of Carbon for Sensor and Diagnostic Platforms

The Long range ordered porous carbon lopc market expands through new applications in sensors and analytical devices. High surface area improves detection accuracy. It supports stable signal output in compact platforms. Medical device firms adopt ordered pores for diagnostic reliability. Laboratories develop prototypes using uniform carbon patterns. Environmental sensors use these materials for rapid response. Micro-scale integration becomes easier due to structural consistency. Broader innovation supports rising interest across advanced sensing sectors.

Focus on Sustainable and Low-Emission Carbon Production

The Long range ordered porous carbon lopc market sees stronger emphasis on sustainable production routes. Companies test biomass-derived carbon for eco-friendly material streams. It helps reduce dependency on fossil feedstocks. Cleaner synthesis methods limit industrial emissions. Research groups examine low-temperature processes for energy saving. Producers highlight environmentally safe binder systems. Markets respond well to green carbon technologies. These practices create new pathways for compliant and responsible manufacturing.

Market Challenges Analysis:

High Production Complexity and Limited Industrial Scalability

The Long range ordered porous carbon lopc market faces challenges linked to complex synthesis routes. Precision pore alignment needs controlled conditions that raise costs. It creates barriers for mass-scale output. Manufacturers struggle with consistent structural replication across batches. Equipment requirements increase operational expenses. Smaller firms face difficulty entering the sector. Technical skill shortages slow adoption in some regions. These issues limit rapid expansion across cost-sensitive markets.

Regulatory Pressure and Competition from Alternative Materials

The Long range ordered porous carbon lopc market also experiences pressure from evolving regulatory frameworks. Environmental rules demand cleaner production cycles. It pushes producers to redesign processes for compliance. Competing materials challenge market share in some applications. Ceramics, metal oxides, and hybrid composites gain traction in high-temperature systems. Supply chain disruptions affect raw material availability. Firms must invest heavily in R&D to remain competitive. This adds complexity across the value chain.

Market Opportunities:

Expansion into Advanced Energy and Industrial Platforms

The Long range ordered porous carbon lopc market holds strong opportunities across energy storage and industrial systems. High uniformity supports advanced battery chemistries. It helps developers build devices with better endurance. Fuel cell firms test these structures for stable hydrogen pathways. Water and air treatment sectors seek porous carbon for new purification modules. Electronics producers explore upgrades in thermal control. These combined shifts open new commercial streams for innovative suppliers.

Growth Potential in Biotech, Sensors, and Sustainable Materials

The Long range ordered porous carbon lopc market also sees rising opportunities in biotech and sensing domains. Bio-platforms explore carbon for stable assay performance. It strengthens diagnostic reliability in compact tools. Climate-driven policies support sustainable carbon sourcing. Manufacturers align with green targets to attract long-term clients. Research institutions continue to test new pore architectures. These advancements create diverse future growth channels across emerging sectors.

Market Segmentation Analysis:

By Application

The Long range ordered porous carbon lopc market shows strong momentum across diverse industrial uses, with energy storage holding the largest and fastest-growing share. Demand rises due to the material’s uniform pore structure, which supports higher charge efficiency and stable cycling in advanced battery and supercapacitor systems. It enables improved ion mobility, making the segment a preferred choice for electric mobility and grid-level storage. Chemical catalysis follows with steady use, driven by high surface area and controlled pore alignment that support precise reaction pathways in industrial settings. Ion screening gains traction in separation, purification, and analytical platforms due to reliable molecular selectivity and structural stability. The others segment includes environmental filtration, sensing, and specialty material applications, which benefit from research on new pore designs and scalable synthesis methods. Together, these segments support broad adoption across high-tech, energy, and industrial sectors.

- For instance, Calgon Carbon’s WS-480 pelletized activated carbon is qualified to control VOC and hydrocarbon emissions at contaminant concentrations above 2,000 ppmv in gas-phase systems, while the company’s broader portfolio supports air, water, and process purification across thousands of industrial installations worldwide, underlining how filtration and separation uses complement energy and catalytic demand.

Segmentation:

By Application

- Energy Storage (Largest and fastest-growing segment)

- Chemical Catalysis

- Ion Screening

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific

The Long range ordered porous carbon lopc market sees Asia-Pacific leading with a 42% market share driven by strong manufacturing strength and rapid expansion in energy storage technologies. China, Japan, and South Korea invest in high-performance electrode materials for electric mobility and grid systems. It supports large-scale deployment in batteries, supercapacitors, and hydrogen programs across major economies. Research clusters in Japan and China refine pore engineering and improve carbon precision for industrial use. Strong electronics production boosts material adoption in sensing and filtration platforms. Growing clean-energy policies and industrial upgrades reinforce regional leadership. The region maintains steady demand due to wide application diversity.

Europe

Europe holds a 28% market share, supported by strong material science capabilities and advanced chemical processing industries. Germany and the Netherlands drive early adoption through research programs focusing on catalytic processes and sustainable carbon manufacturing. It benefits from strict environmental regulations that encourage high-efficiency filtration and clean industrial operations. Energy storage developers use ordered porous carbon for improved cycling stability and safety. Strong activity in hydrogen and fuel cell innovation boosts material use across pilot projects. Collaboration between research institutes and specialty manufacturers strengthens application maturity. Demand stays resilient due to the region’s focus on performance and sustainability.

North America

North America accounts for a 22% market share, driven by strong R&D activity in advanced battery systems and high-performance carbon materials. The United States leads with adoption in defense, aerospace, and next-generation energy platforms. It supports rapid testing of porous carbon for sensors, catalysis, and analytical devices. Universities and national labs expand research on scalable synthesis and controlled pore alignment. Environmental sectors use the material for water treatment and emission control projects. Canada contributes through clean-tech investments and growing interest in sustainable material development. Broad innovation culture and industrial upgrades push steady regional growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Norit Activated Carbon (Netherlands)

- Cabot Corporation (United States)

- Kuraray Co., Ltd. (Japan)

- Calgon Carbon Corporation (United States)

- Carbotech AC (Germany)

- Haycarb PLC (Sri Lanka)

- Desotec (Belgium)

- Activated Carbon Technologies (United States)

- Osaka Gas Chemicals (Japan)

- Fujian Yuanli (China)

- Ingevity (United States)

- Jacobi Carbons

- Jinding Activated Carbon (China)

Competitive Analysis:

The Long range ordered porous carbon lopc market features a balanced mix of global material producers and specialized carbon technology firms. Companies focus on pore engineering, precision processing, and reliable batch consistency to meet advanced application needs. It encourages strong investment in R&D to improve structural alignment and performance stability. Leading manufacturers expand product portfolios to address energy storage, catalysis, and filtration demand. Firms with large-scale production capacity hold a competitive edge in pricing and supply reliability. Strategic collaborations help suppliers access new industrial opportunities. Innovation-driven firms strengthen their position through controlled synthesis, sustainable feedstocks, and tailored pore designs. Market competition remains steady due to diverse application requirements across major sectors.

Recent Developments:

- In November 2025, Cabot Corporation announced that its LITX® 95F conductive carbon, designed for lithium-ion batteries in energy storage systems, was recognized as one of the “Top 10 Exhibits of 2025” at the prestigious China International Import Expo (CIIE) held in Shanghai. This recognition marked a significant achievement as LITX® 95F became the first product from the specialty chemicals sector to receive such distinction, underscoring Cabot’s leadership in enabling next-generation clean energy technologies. Additionally, in July 2025, Cabot Corporation expanded its activated carbon facility in Virginia, strengthening the supply for air and water purification applications. Earlier, in November 2024, the company announced a worldwide price increase for carbon black products sold by its Specialty Carbons Business, effective December 1, 2024, due to inflation impacts on labor, maintenance, and supply chain costs.

- In January 2025, Kuraray announced a long-term contract with the largest private water and wastewater utility company in the United States to provide comprehensive services ranging from the supply of virgin and reactivated carbon to specialized equipment for PFAS treatment. As a global leader in PFAS treatment using activated carbon, Kuraray aims to continue contributing to societal and environmental betterment through 2033. In 2024, Kuraray expanded its virgin activated carbon production capacity in the United States with a new facility becoming operational, alongside major capital investments planned for reactivated carbon to meet the rapid rise in demand driven by tightening PFAS regulations in U.S. drinking water. Furthermore, through its subsidiary Calgon Carbon Corporation, Kuraray has been actively expanding its capabilities globally to address growing environmental challenges.

Report Coverage:

The research report offers an in-depth analysis based on By Application and By Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand rises across energy storage technologies due to stronger focus on battery efficiency.

- Catalysis applications expand in industrial processing through improved pore precision.

- Adoption in ion screening increases across analytical and separation platforms.

- Environmental technologies drive interest in advanced filtration-grade carbon.

- Research groups accelerate innovation in metal-free and sustainable carbon synthesis.

- Manufacturers invest in scalable routes to improve batch consistency.

- Hydrogen and fuel cell projects strengthen material adoption across pilot programs.

- Electronics sectors test new carbon structures for thermal control.

- Clean-tech policies enhance regional demand for engineered porous materials.

- Global supply chains shift toward reliable, high-purity carbon producers.