| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Malaysia Soy-Based Chemicals Market Size 2024 |

USD 62.84 Million |

| Malaysia Soy-Based Chemicals Market, CAGR |

7.60% |

| Malaysia Soy-Based Chemicals Market Size 2032 |

USD 112.89 Million |

Market Overview

The Malaysia Soy-Based Chemicals Market is projected to grow from USD 62.84 million in 2024 to an estimated USD 112.89 million by 2032, with a compound annual growth rate (CAGR) of 7.60% from 2025 to 2032. This growth is driven by increasing demand for sustainable and biodegradable products, as well as advancements in soy processing technologies.

Key drivers include stringent environmental regulations and rising consumer awareness about the harmful emissions from fossil fuels, leading to a shift towards bio-based sources like soy oils. Additionally, easy production of soybeans and increasing government investments for the production of soy-based chemicals are likely to create lucrative opportunities for market players.

Geographically, Malaysia’s strategic location in Southeast Asia and its robust manufacturing sector make it a significant player in the regional soy-based chemicals market. Key players in this market include Cargill, Archer Daniels Midland (ADM), and Bunge, all of which leverage Malaysia’s infrastructure and trade agreements to expand their market presence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Malaysia Soy-Based Chemicals Market is projected to grow from USD 62.84 million in 2024 to an estimated USD 112.89 million by 2032, with a compound annual growth rate (CAGR) of 7.60% from 2025 to 2032.

- The Global Soy-Based Chemicals Market is projected to grow from USD 28,996.80 million in 2024 to USD 52,069.72 million by 2032, with a CAGR of 7.59% from 2025 to 2032.

- Key drivers include increasing consumer awareness about environmental sustainability, strict government regulations, and the growing adoption of soy-based chemicals in industrial applications.

- Challenges include raw material supply volatility, as Malaysia depends on soybean imports, and a limited understanding among consumers about the benefits of soy-based products.

- There is a significant shift towards eco-friendly alternatives in packaging, automotive, and personal care products, boosting the adoption of soy-based chemicals.

- Malaysian government policies and incentives supporting green technologies are driving further investments in the soy-based chemicals sector.

- The Central Region, with its strong industrial base, holds a dominant market share, followed by the Northern and Southern regions, which are also key contributors.

- Major players like Wilmar International, IOI Corporation, and Sime Darby Oils lead the market, focusing on innovation and sustainability to capture increasing demand.

Market Drivers

Growing Demand for Sustainable and Biodegradable Products

The increasing global emphasis on environmental sustainability has significantly influenced Malaysia’s adoption of soy-based chemicals. As industries face mounting pressure to reduce carbon footprints and comply with stringent environmental regulations, there’s a marked shift towards bio-based alternatives. Soy-based chemicals, derived from renewable resources, offer a compelling solution by serving as eco-friendly substitutes for petroleum-based products. This transition not only aligns with global sustainability goals but also caters to the rising consumer preference for products that are both effective and environmentally responsible. In Malaysia, this trend is evident across various sectors, including packaging, personal care, and industrial applications, where the demand for biodegradable and non-toxic chemicals is on the rise. The nation’s commitment to reducing its reliance on fossil fuels further propels the growth of the soy-based chemicals market, positioning it as a pivotal player in the region’s green transition.

Health and Safety Concerns with Conventional Chemicals

Conventional chemicals, often derived from petroleum, have raised significant health and safety concerns due to their potential toxicity and environmental impact. In Malaysia, this has led to a growing preference for soy-based chemicals, which are perceived as safer and more sustainable alternatives. These bio-based chemicals are increasingly utilized in food processing, cosmetics, and household products, driven by consumer awareness and demand for non-toxic ingredients. For instance, soy lecithin is widely used as an emulsifier in food products due to its natural properties, enhancing the safety profile of these items. The shift towards soy-based chemicals not only addresses health and safety concerns but also aligns with global trends towards cleaner and greener products.

Technological Advancements in Soy Processing

Advancements in soy processing technologies have significantly enhanced the efficiency and cost-effectiveness of producing soy-based chemicals. In Malaysia, innovations such as enzyme-assisted extraction and fermentation processes have improved yield and purity, making soy-based chemicals more competitive with traditional petroleum-based counterparts. For instance, biocatalysis is being used to convert soy oil into high-value chemicals like fatty acids and alcohols, which serve as key ingredients in various industries, including cosmetics and pharmaceuticals. These technological developments have expanded the range of applications for soy-based chemicals, including in high-performance coatings, adhesives, and biofuels. The continuous evolution of processing techniques ensures a steady supply of high-quality soy-based chemicals, supporting the growth of Malaysia’s green chemical industry.

Government Support and Policy Incentives

The Malaysian government has implemented various policies and initiatives to promote the production and use of bio-based chemicals, including soy-based alternatives. Incentives such as tax breaks, research and development grants, and subsidies for green technology adoption have encouraged both local and international companies to invest in the soy-based chemicals sector. These supportive measures aim to reduce the nation’s dependency on imported fossil fuels and foster a sustainable chemical industry. As a result, Malaysia is positioning itself as a regional hub for the production and export of soy-based chemicals, attracting significant investments and partnerships.

Market Trends

Government Support and Policy Incentives

The Malaysian government is actively promoting the production and use of bio-based chemicals, including soy-based alternatives, through various policies and initiatives. Incentives such as tax breaks, research and development grants, and subsidies for green technology adoption are encouraging both local and international companies to invest in the soy-based chemicals sector. These supportive measures aim to reduce the nation’s dependency on imported fossil fuels and foster a sustainable chemical industry. As a result, Malaysia is positioning itself as a regional hub for the production and export of soy-based chemicals, attracting significant investments and partnerships.

Integration of Soy-Based Chemicals in Food and Feed Industries

The integration of soy-based chemicals into the food and feed industries in Malaysia is gaining momentum. Soy-based ingredients are increasingly being utilized in food products to enhance nutritional value and appeal to health-conscious consumers. In the animal feed sector, soy-based additives are being incorporated to improve feed quality and support the growth of livestock and poultry industries. This trend reflects the broader movement towards plant-based and sustainable ingredients in the food and agriculture sectors, aligning with global shifts towards healthier and more sustainable food systems.

Expansion in Bio-Based Product Applications

Malaysia is witnessing a significant shift towards the adoption of bio-based products, including soy-based chemicals, across various industries. As of 2019, there were 282 biotechnology companies operating in Malaysia, with 43 specifically focused on bioindustrial applications, which include the production of biobased chemicals from renewable sources. Notably, the central region, especially Selangor, hosts the highest concentration of these biotechnology companies, with 101 companies based in Selangor alone. In the food sector, approximately 0.18 million metric tons of imported soybeans were used for food production in 2019/2020, supporting the manufacture of products such as soy drinks, tofu, and tempe. Additionally, Malaysia imported 63 shipments of soy protein concentrate between October 2023 and September 2024, supplied by 16 foreign exporters to 15 Malaysian buyers, reflecting a 186% growth compared to the previous year. These figures underscore the increasing integration of soy-based chemicals and ingredients into packaging, personal care, and industrial applications to meet sustainability and regulatory goals.

Technological Advancements in Soy Processing

Advancements in soy processing technologies are enhancing the efficiency and cost-effectiveness of producing soy-based chemicals in Malaysia. For instance, enzyme-assisted extraction and fermentation processes are being adopted to improve yield and purity, making soy-based chemicals more competitive with traditional petroleum-based products. In the broader context of biotechnology, Malaysia produced 720,410 tonnes of palm biodiesel in 2016, with 235,291 tonnes exported mainly to Europe, 358,586 tonnes used for local B7 blending, and 126,533 tonnes used as oleochemicals, indicating established expertise in bio-based processing technologies. The distribution of biotechnology companies by industry type further highlights the country’s focus: out of 282 companies, 162 are in agricultural biotechnology (AgBiotech), 77 in biomedical, and 43 in bioindustrial sectors, which includes soy processing. This ecosystem supports ongoing innovation and a steady supply of high-quality soy-based chemicals, reinforcing Malaysia’s position in the green chemical industry.

Market Challenges

Volatility in Raw Material Supply and Pricing

Malaysia’s reliance on imported soybeans—primarily from countries like Brazil and the United States—poses a significant challenge to the soy-based chemicals market. Factors such as erratic weather patterns, crop diseases, and geopolitical tensions in key soybean-producing regions can disrupt supply chains, leading to price volatility. For instance, in the first eight months of 2023, Malaysia imported 0.17 million tons of soybeans from Brazil and 0.12 million tons from the United States, totaling 0.3 million tons. Fluctuations in global soybean production directly impact the cost and availability of soy-based raw materials, affecting the production costs of soy-based chemicals in Malaysia. This dependency on external sources makes the market susceptible to external shocks, potentially hindering the growth and stability of the industry.

Limited Consumer Awareness and Market Education

Despite the environmental benefits of soy-based chemicals, there remains a limited understanding among Malaysian consumers regarding their advantages and applications. This knowledge gap can impede the adoption of soy-based products, as consumers may be hesitant to switch from conventional options without clear information on the benefits. Addressing this challenge requires targeted educational campaigns and marketing strategies to raise awareness about the sustainability and efficacy of soy-based chemicals, thereby fostering consumer confidence and driving market growth.

Market Opportunities

Expansion into Bio-Based Plastics and Industrial Applications

Malaysia’s soy-based chemicals market is poised to capitalize on the growing global demand for sustainable materials, particularly in the bio-based plastics sector. As industries worldwide seek alternatives to petroleum-derived products, soy-based chemicals offer a renewable and biodegradable solution. This shift is driven by increasing environmental regulations and consumer awareness regarding sustainability. In Malaysia, the government’s support for green initiatives and investment in sustainable technologies further bolster this opportunity. By leveraging its strategic location and robust manufacturing infrastructure, Malaysia can position itself as a key player in the production and export of soy-based industrial products, catering to both domestic and international markets.

Integration into Food, Feed, and Nutraceutical Sectors

The integration of soy-based chemicals into Malaysia’s food, animal feed, and nutraceutical industries presents a significant growth opportunity. With rising health consciousness among consumers and a shift towards plant-based diets, soy-derived ingredients are gaining popularity for their nutritional benefits. In the animal feed sector, soy-based additives enhance feed quality and support sustainable livestock farming practices. Additionally, the nutraceutical industry is exploring soy-based compounds for their potential health benefits, including cholesterol reduction and hormonal balance. Malaysia’s established food processing industry and growing research capabilities provide a conducive environment for the development and commercialization of soy-based products, aligning with global trends towards health and sustainability.

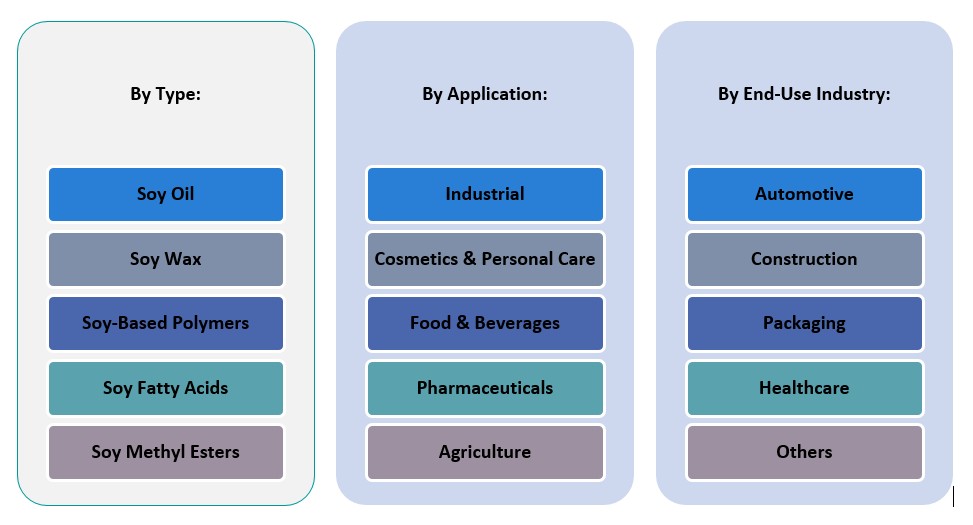

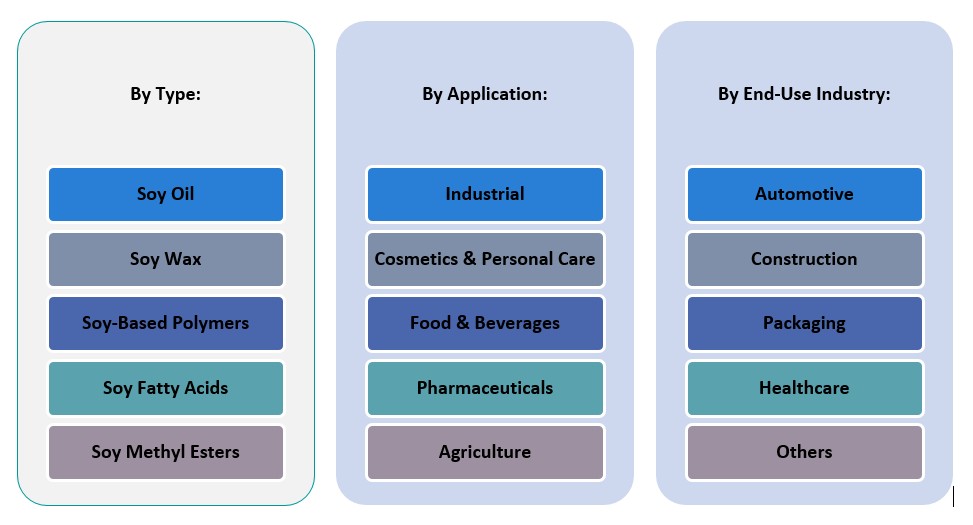

Market Segmentation Analysis

By Type:

The soy-based chemicals market in Malaysia is diverse, with key products including Soy Oil, Soy Wax, Soy-Based Polymers, Soy Fatty Acids, and Soy Methyl Esters. Soy Oil is one of the most widely used products, primarily for food, industrial, and cosmetic applications. It is favored for its healthy properties, including being rich in polyunsaturated fats and beneficial fatty acids. Soy Wax is gaining significant traction in the production of candles and eco-friendly products due to its biodegradable nature. It is increasingly preferred over paraffin wax in green consumer markets. Soy-Based Polymers find use in packaging, automotive parts, and consumer goods. These polymers are a renewable alternative to petroleum-based plastics, aligning with sustainability goals across industries. Soy Fatty Acids are crucial in manufacturing soaps, cosmetics, and surfactants. Their versatility makes them valuable for both industrial and consumer products. Soy Methyl Esters are used in biodiesel production and as solvents in various chemical processes, supporting cleaner energy alternatives.

By Application:

The application segment highlights the broad range of industries utilizing soy-based chemicals. In Industrial applications, soy-based chemicals are utilized for manufacturing paints, coatings, and lubricants, thanks to their biodegradability and low toxicity. The Cosmetics & Personal Care sector increasingly incorporates soy-based ingredients due to their moisturizing properties, particularly in skincare products. Food & Beverages applications involve using soy-based chemicals as emulsifiers, preservatives, and functional ingredients, enhancing product quality while meeting the demand for plant-based ingredients. The Pharmaceuticals sector leverages soy-based compounds in drug formulations, particularly for their natural properties and efficacy in treating conditions such as high cholesterol and hormonal imbalances. In Agriculture, soy-based chemicals are used in the production of pesticides, herbicides, and plant growth regulators.

Segments

Based on Type

- Soy Oil

- Soy Wax

- Soy-Based Polymers

- Soy Fatty Acids

- Soy Methyl Esters

Based on Application

- Industrial

- Cosmetics & Personal Care

- Food & Beverages

- Pharmaceuticals

- Agriculture

Based on End Use Industry

- Automotive

- Construction

- Packaging

- Healthcare

- Others

Based on Region

- Central Region

- Northern Region

- Southern Region

- East Coast Region

Regional Analysis

Central Region (60%)

Central Region, encompassing Kuala Lumpur and Selangor, which together account for approximately 60% of the market share. This dominance is attributed to the region’s robust industrial infrastructure, including manufacturing hubs for personal care products, food processing, and biodiesel production. Additionally, the presence of key industry players and research institutions in this area fosters innovation and market growth.

Northern Region (20%)

The Northern Region, comprising Penang and Perak, holds about 20% of the market share. This region is known for its strong agricultural base, particularly in soybean cultivation, which supports the production of soy-based chemicals. The proximity to ports facilitates efficient export activities, contributing to the region’s market share.

Key players

- Wilmar International Limited

- IOI Corporation Berhad

- Godrej Agrovet Ltd.

- PT SMART Tbk

- KLK OLEO

- Shandong Yuwang Industrial Co., Ltd.

- Nihon Emulsion Co., Ltd.

- Fuji Oil Holdings Inc.

- Sime Darby Oils

- Toyo Kagaku Co., Ltd.

Competitive Analysis

The Malaysia Soy-Based Chemicals Market is highly competitive, with leading players focusing on sustainability, innovation, and strategic partnerships to capture market share. Wilmar International Limited and IOI Corporation Berhad are dominant forces in the market, owing to their extensive supply chains, diversified product offerings, and commitment to sustainable practices. KLK OLEO and Sime Darby Oils have also strengthened their market position through significant investments in soy-based product development and increasing their production capacities. Smaller players, such as PT SMART Tbk and Fuji Oil Holdings, focus on niche applications, including soy methyl esters and soy fatty acids, to serve specialized industries. Competitive strategies include enhancing product quality, expanding product portfolios, and capitalizing on government incentives for green technologies. Market dynamics are driven by ongoing research, collaborations, and the rising consumer demand for eco-friendly and sustainable chemicals.

Recent Developments

- On October 7, 2024, Evonik and BASF agreed on the first delivery of biomass-balanced ammonia, achieving a product carbon footprint reduction of over 65%. This collaboration supports Evonik’s sustainable product lines like VESTAMIN IPD eCO and VESTAMID eCO.

- On February 26, 2025, Arkema announced a 15% expansion of its polyvinylidene fluoride (PVDF) production capacity at its Calvert City, Kentucky plant. This $20 million investment aims to meet the growing demand for high-performance resins in electric vehicles and energy storage systems.

- On February 25, 2025, AkzoNobel offered to acquire powder coatings assets and the International Research Center from its subsidiary in India. This move is part of the company’s strategy to focus more on liquid paints and coatings in the Indian market.

- In February 2025, Perstorp Holding AB began ester production at its Amsterdam plant, marking a significant step in expanding its product offerings in the sustainable chemicals sector.

Market Concentration and Characteristics

The Malaysia Soy-Based Chemicals Market exhibits moderate concentration, with a few key players, including Wilmar International Limited, IOI Corporation Berhad, and Sime Darby Oils, commanding a significant share of the market. These major players are well-established, with expansive manufacturing facilities and strong distribution networks, allowing them to dominate the market. However, the market also features several smaller players such as Fuji Oil Holdings Inc. and PT SMART Tbk, which focus on niche applications and specialized products. The market is characterized by a growing demand for sustainable and bio-based chemicals, with increasing investment in research and development to improve product offerings. Additionally, the trend toward eco-friendly alternatives and government support for green technologies is fostering a competitive environment where innovation and sustainability are key factors driving market dynamics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End Use Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Malaysia is poised to increase its production of soy-based plastics, driven by global demand for sustainable packaging solutions.

- The country’s biodiesel sector is expected to expand, utilizing soy methyl esters as a renewable energy source.

- There is a growing adoption of soy-based surfactants in personal care products, aligning with eco-conscious consumer preferences.

- The construction and woodworking industries are increasingly incorporating soy-based adhesives, offering non-toxic and sustainable alternatives.

- Soy-derived compounds are gaining traction in pharmaceutical applications, particularly in drug formulations and delivery systems.

- Companies are investing in R&D to enhance the performance and cost-effectiveness of soy-based chemicals.

- Malaysian government initiatives are promoting the adoption of bio-based chemicals through incentives and subsidies.

- Malaysia aims to become a regional hub for soy-based chemical exports, leveraging its strategic location.

- Rising consumer awareness is driving the demand for products made from renewable and biodegradable materials.

- Upcoming EU deforestation laws may impact Malaysia’s soy exports, necessitating supply chain adjustments.