Market Overview:

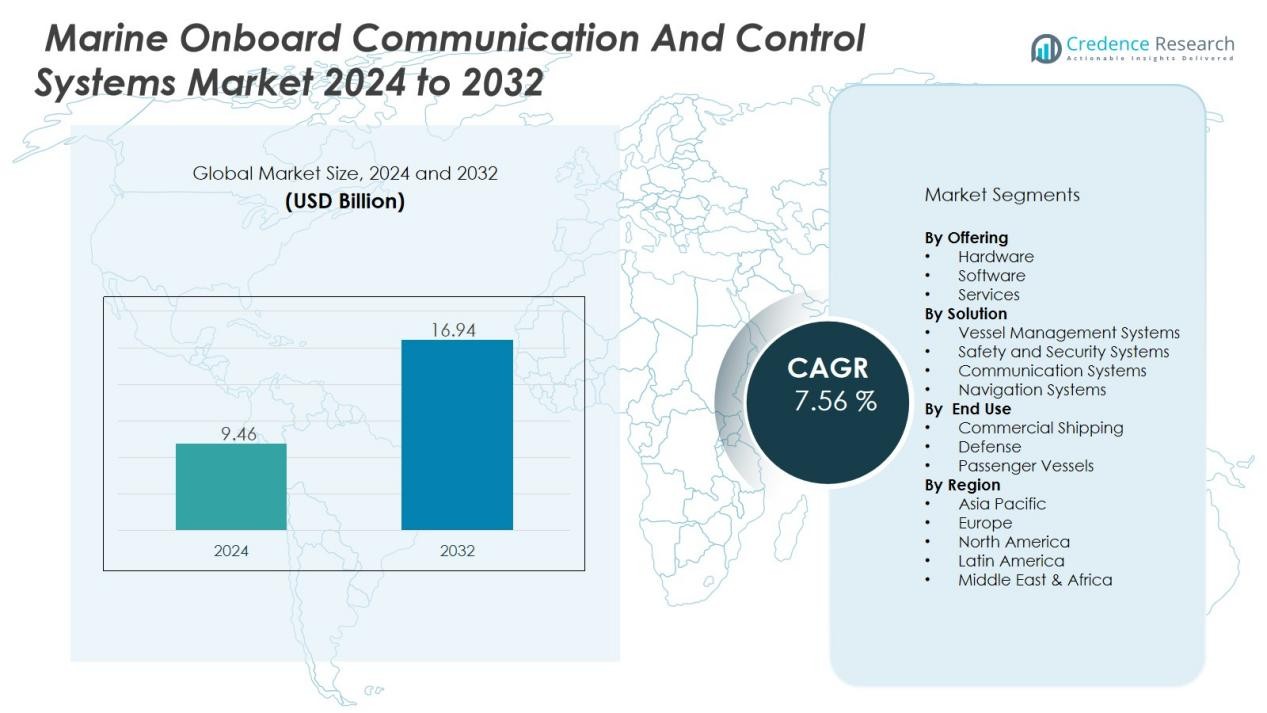

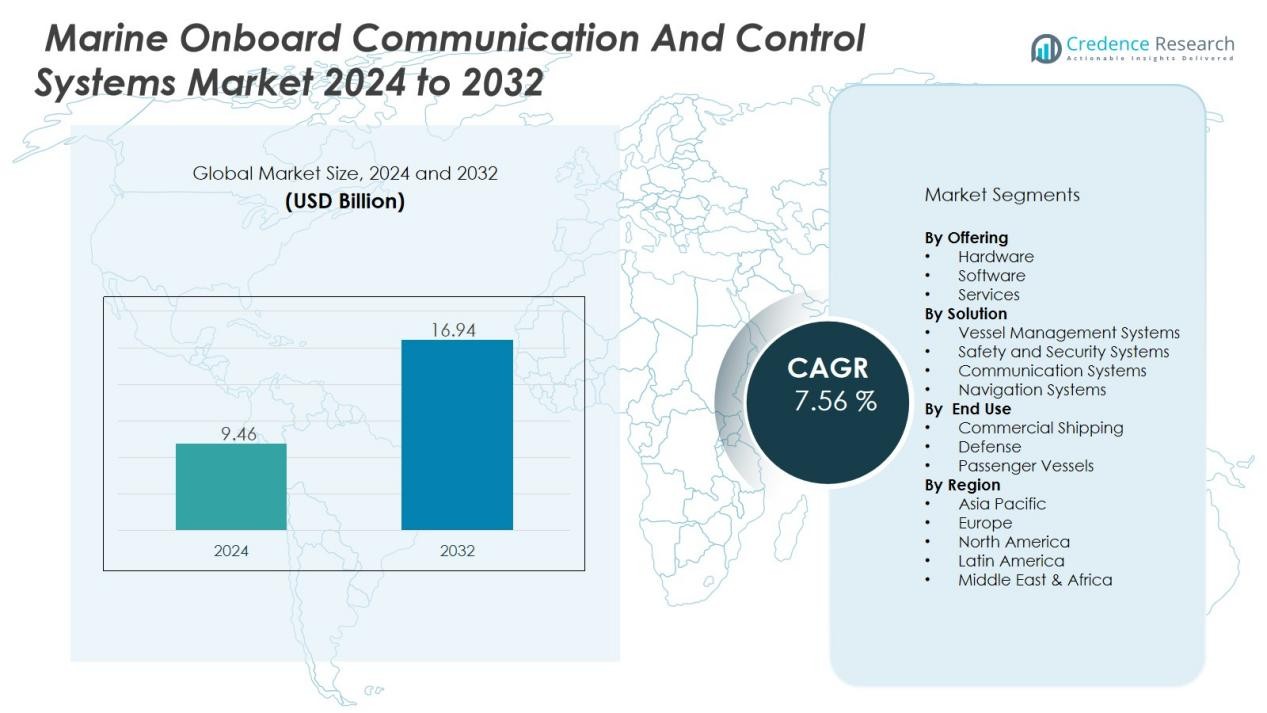

The Marine Onboard Communication and Control Systems Market size was valued at USD 9.46 billion in 2024 and is anticipated to reach USD 16.94 billion by 2032, at a CAGR of 7.56 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Marine Onboard Communication and Control Systems Market Size 2024 |

USD 9.46 Billion |

| Marine Onboard Communication and Control Systems Market, CAGR |

7.56 % |

| Marine Onboard Communication and Control Systems Market Size 2032 |

USD 16.94 Billion |

Key drivers shaping this market include the adoption of integrated communication systems that ensure real-time connectivity between vessels and shore operations. Rising focus on crew safety, efficient vessel management, and compliance with maritime safety standards are propelling investments in advanced control systems. In addition, the growing need for operational efficiency, reduced human error, and the integration of IoT, satellite communication, and AI-based monitoring tools are further supporting market momentum.

Regionally, North America leads the market due to strong naval modernization programs and commercial shipping upgrades. Europe follows with demand driven by stringent maritime safety regulations and advanced shipbuilding infrastructure. Asia-Pacific is the fastest-growing region, supported by the expansion of seaborne trade in China, South Korea, and Japan. The Middle East, Africa, and Latin America present emerging opportunities, fueled by offshore exploration projects and increasing investments in commercial shipping.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The marine onboard communication and control systems market was valued at USD 9.46 billion in 2024 and is projected to reach USD 16.94 billion by 2032, growing at a CAGR of 7.56%.

- Strict maritime safety standards and regulations such as SOLAS and GMDSS are driving adoption of reliable onboard systems to reduce human error and improve crew safety.

- Digitalization and automation are gaining momentum, enabling real-time monitoring, predictive maintenance, and efficient vessel operations across global fleets.

- Expanding global trade and ongoing fleet modernization efforts are increasing demand for advanced communication and navigation solutions that ensure reliable connectivity.

- Integration of IoT, satellite communication, and AI-based tools is transforming vessel management with enhanced route optimization, fuel monitoring, and safety performance.

- High installation costs, integration challenges with older vessels, and growing cybersecurity threats remain key obstacles to widespread adoption.

- North America holds 32% share, Europe 28%, and Asia-Pacific 27%, while Latin America, the Middle East, and Africa collectively account for 13% of the market, highlighting global adoption with strong regional opportunities.

Market Drivers:

Growing Need for Safety and Regulatory Compliance :

The marine onboard communication and control systems market is driven by strict international maritime safety standards. Ship operators are adopting advanced systems to reduce human error and improve crew safety. Compliance with regulations such as SOLAS and GMDSS supports investments in reliable onboard communication tools. It creates consistent demand across commercial, defense, and passenger vessels.

- For instance, Siemens’ Siship IMAC was installed on a series of seven AIDA Cruises vessels, including AIDAsol, a 71,304 gross tonnage ship with around 1,096 cabins built by Meyer Werft.

Rising Adoption of Digitalization and Automation in Shipping:

Shipping companies are embracing digital technologies to improve operational efficiency and decision-making. The integration of automation and control systems allows real-time monitoring and streamlined vessel operations. It supports predictive maintenance, reduces downtime, and enhances fuel efficiency. The shift toward smart shipping solutions strengthens adoption across fleets worldwide.

- For Instance, The shift toward smart shipping solutions strengthens adoption across fleets worldwide, with Maersk digitally connecting over 700 vessels globally through its IoT and communication systems.

Expanding Global Trade and Growing Fleet Modernization:

The marine onboard communication and control systems market benefits from the growth in international trade and cargo movement. Shipbuilders and fleet owners are upgrading vessels with advanced communication and navigation systems. It ensures reliable connectivity, even in remote oceanic routes, and supports logistics efficiency. Fleet modernization programs in both commercial and defense sectors fuel strong demand.

Increasing Role of Advanced Technologies such as IoT and Satellite Communication:

The integration of IoT, satellite communication, and AI-based tools is reshaping onboard communication systems. These technologies enable seamless connectivity between ships and shore, supporting real-time data exchange. It enhances route optimization, fuel monitoring, and safety management. Growing reliance on these advanced solutions continues to accelerate adoption across the industry.

Market Trends:

Integration of Smart and Connected Maritime Technologies:

The marine onboard communication and control systems market is witnessing a major trend toward smart and connected solutions. Shipping operators are deploying integrated platforms that combine navigation, communication, and monitoring functions into unified systems. It reduces operational complexity and enables efficient data-driven decision-making across fleets. Satellite-based broadband, cloud-based analytics, and IoT connectivity are playing critical roles in enhancing real-time vessel performance. Growing adoption of cybersecurity frameworks to safeguard sensitive communication is also shaping system design. The trend is expected to strengthen further with the rise of autonomous and semi-autonomous ships.

- For Instances, Inmarsat’s Fleet Xpress was installed on over 10,000 vessels worldwide as of January 2021, and this number increased to over 14,000 vessels by late 2023.

Rising Demand for Sustainable and Cost-Efficient Operations:

Another key trend is the increasing focus on sustainability and cost efficiency in maritime operations. Shipowners are investing in onboard systems that optimize fuel use and lower emissions. It supports global efforts to meet IMO decarbonization targets while ensuring economic viability. Advanced communication systems are enabling remote diagnostics and predictive maintenance, which help reduce downtime and extend vessel lifespan. Real-time monitoring tools are gaining traction to track compliance with environmental regulations. The growing need for green shipping practices is pushing manufacturers to design eco-friendly and energy-efficient onboard control systems. This trend continues to drive innovation and adoption across the market.

- For instance, Wärtsilä’s ultra-low emissions 31DF dual-fuel engine, trialed on Wasaline’s Aurora Botnia ferry, achieved a 56% reduction in methane emissions at 50% load as verified by VTT in December 2022

Market Challenges Analysis:

High Implementation Costs and Complex Integration:

The marine onboard communication and control systems market faces challenges linked to high installation and maintenance costs. Advanced communication platforms, satellite systems, and integrated control solutions require significant capital investment, limiting adoption among small and mid-sized operators. It becomes more complex when integrating new systems with older vessel infrastructure. Compatibility issues, retrofitting expenses, and training requirements for crew members increase operational burdens. The high cost of continuous upgrades further restricts faster adoption in cost-sensitive markets.

Cybersecurity Risks and Reliability Concerns in Harsh Environments:

Another challenge stems from growing cybersecurity threats and the demanding conditions of marine environments. Onboard systems rely heavily on digital connectivity, making them vulnerable to cyberattacks that can disrupt navigation and safety. It creates a pressing need for advanced security measures, which increase costs and complexity. Harsh sea conditions also impact the durability and performance of sensitive communication equipment. Reliability concerns arise in remote oceanic routes where connectivity disruptions affect real-time decision-making. These risks slow down widespread adoption and require strong focus on resilience.

Market Opportunities:

Expansion of Smart Shipping and Autonomous Vessels:

The marine onboard communication and control systems market is positioned to benefit from the rise of smart and autonomous shipping. Increasing investments in digital transformation across the maritime sector are creating strong opportunities for advanced onboard systems. It supports automated navigation, real-time monitoring, and remote vessel management, which are critical for future fleets. Growing adoption of AI, IoT, and cloud technologies enhances system functionality and reliability. The demand for integrated solutions that improve safety, reduce costs, and enable predictive maintenance strengthens the market’s long-term growth. Autonomous vessel development provides a significant opening for system providers to innovate.

Growth Potential in Emerging Markets and Offshore Activities:

Another opportunity lies in expanding trade, offshore exploration, and port infrastructure development in emerging regions. Countries in Asia-Pacific, Latin America, and the Middle East are investing in new fleets and modernizing existing vessels. It creates demand for advanced onboard communication and control systems that meet global standards. Offshore oil, gas, and renewable energy projects also require robust communication technologies to ensure safe and efficient operations. The rising need for enhanced connectivity in remote maritime zones fuels adoption of satellite-based solutions. These factors open profitable avenues for companies to expand their regional presence and product portfolios.

Market Segmentation Analysis:

By Offering:

The marine onboard communication and control systems market is segmented into hardware, software, and services. Hardware holds a major share, driven by demand for navigation equipment, antennas, and control panels. Software is expanding rapidly with the integration of IoT, cloud platforms, and AI-based monitoring tools. Services play a vital role in installation, maintenance, and system upgrades, supporting long-term vessel operations. It benefits from rising adoption of managed services to ensure system reliability and compliance.

- For instance, Kongsberg Digital deployed its Vessel Insight Connect platform on four Valemax bulk carriers for Vale in March 2023.

By Solution:

Key solutions include vessel management systems, safety and security systems, communication systems, and navigation systems. Vessel management systems dominate due to their role in improving operational efficiency and reducing downtime. Communication systems are gaining traction with the growing use of satellite-based connectivity and real-time data exchange. Safety and security systems are critical for compliance with global maritime regulations and crew safety. Navigation solutions continue to expand with the development of advanced GPS and radar technologies.

- For instance, ABS Group of Companies Inc. has deployed its ABS Wavesight vessel management platform on more than 5,000 vessels globally, significantly aiding operational optimization and compliance.

By End Use:

End-use segments cover commercial shipping, defense, and passenger vessels. Commercial shipping leads demand, driven by global trade expansion and fleet modernization programs. Defense applications remain strong with naval forces investing in secure communication and control solutions. Passenger vessels such as cruise ships are adopting advanced onboard systems to enhance safety and passenger experience. It ensures steady demand across all categories while supporting growth in diverse maritime applications.

Segmentations:

By Offering:

- Hardware

- Software

- Services

By Solution:

- Vessel Management Systems

- Safety and Security Systems

- Communication Systems

- Navigation Systems

By End Use:

- Commercial Shipping

- Defense

- Passenger Vessels

By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Regional Analysis:

North America and Europe:

North America accounts for 32% share of the marine onboard communication and control systems market, supported by advanced naval and commercial fleets. Europe follows with 28% share, backed by strong shipbuilding industries and strict maritime safety regulations. The United States drives regional demand through naval modernization and commercial shipping upgrades. It benefits from the presence of leading technology providers offering integrated solutions. European countries such as Germany, Norway, and the U.K. emphasize smart shipping and green vessel initiatives. Regulatory pressure to adopt advanced communication and safety systems continues to support growth across both regions.

Asia-Pacific:

Asia-Pacific holds 27% share of the marine onboard communication and control systems market, driven by expanding seaborne trade and fleet modernization. China, Japan, and South Korea lead the region with strong investments in advanced shipbuilding infrastructure. India is also increasing focus on digital shipping solutions to support trade expansion. It benefits from government initiatives aimed at strengthening maritime connectivity and logistics efficiency. Growing adoption of IoT, satellite communication, and automation is transforming regional fleets. Rising exports and offshore projects further fuel demand for onboard systems in this region.

Latin America, Middle East, and Africa:

Latin America, the Middle East, and Africa collectively account for 13% share of the marine onboard communication and control systems market, supported by port development and offshore projects. Brazil is driving demand in Latin America through investments in oil and gas exploration. The Middle East shows growth potential with fleets supporting both trade and energy transportation. Africa is witnessing adoption of communication systems to improve maritime safety and connectivity. It creates opportunities for technology providers to expand into underserved markets. Strategic investments in port infrastructure and regional shipping lanes are expected to strengthen adoption in these regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ABB

- Emerson Electric Co.

- Blue Ctrl AS

- Høglund AS

- Honeywell International Inc.

- Jason Marine Group

- INGETEAM, S.A.

- Kongsberg Gruppen ASA

- Moxa Inc.

- SEAM AS

- L3Harris Technologies, Inc.

- Siemens AG

Competitive Analysis:

The marine onboard communication and control systems market is highly competitive, shaped by global technology providers and specialized marine solution companies. Key players include ABB, Emerson Electric Co., Blue Ctrl AS, Høglund AS, Honeywell International Inc., Jason Marine Group, INGETEAM S.A., and Kongsberg Gruppen ASA. It is defined by continuous innovation in automation, digitalization, and secure connectivity solutions. Companies focus on integrating IoT, AI, and satellite technologies to enhance navigation, safety, and efficiency across fleets. Strategic collaborations with shipbuilders and naval authorities support stronger market penetration. Leading firms are also investing in cybersecurity and energy-efficient solutions to align with industry standards and sustainability targets. Competitive intensity remains high, with each player strengthening product portfolios, offering service support, and expanding regional reach to capture growing demand in commercial, defense, and passenger vessel applications.

Recent Developments:

- In March 2025, ABB introduced its Robotic Parcel Induction system, featuring an IRB 2600 robot combined with AI vision for high-throughput mixed parcel induction in logistics.

- In May 2025, ABB previewed its Integrated Vision 2.0 platform and launched its OmniCore controller platform at Automate 2025.

- In January 2023, Eitzen Group became the majority shareholder of Høglund AS through a share issue, reinforcing a commitment to sustainable shipping and future-oriented ship technology.

Report Coverage:

The research report offers an in-depth analysis based on Offering, Solution, End Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Growing demand for integrated communication and control platforms will drive adoption across commercial and defense fleets.

- Digital transformation in shipping will increase reliance on IoT, AI, and satellite-enabled onboard systems.

- Fleet modernization programs will create steady opportunities for advanced navigation and safety communication solutions.

- Autonomous and semi-autonomous vessel development will accelerate the need for next-generation onboard systems.

- Cybersecurity advancements will become central to protecting vessel operations and ensuring data security.

- Sustainability goals and emission reduction targets will push operators toward energy-efficient communication technologies.

- Expansion of offshore oil, gas, and renewable projects will strengthen demand for reliable marine communication systems.

- Regional investments in smart ports and maritime infrastructure will support widespread deployment of advanced solutions.

- Rising global trade and seaborne logistics will ensure consistent adoption of control and monitoring platforms.

- Collaborations between system providers, shipbuilders, and governments will shape innovation and expand market presence.