| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Marzipan Market Size 2024 |

USD 1,563.0 million |

| Marzipan Market, CAGR |

3.80% |

| Marzipan Market Size 2032 |

USD 2,106.4 million |

Market Overview

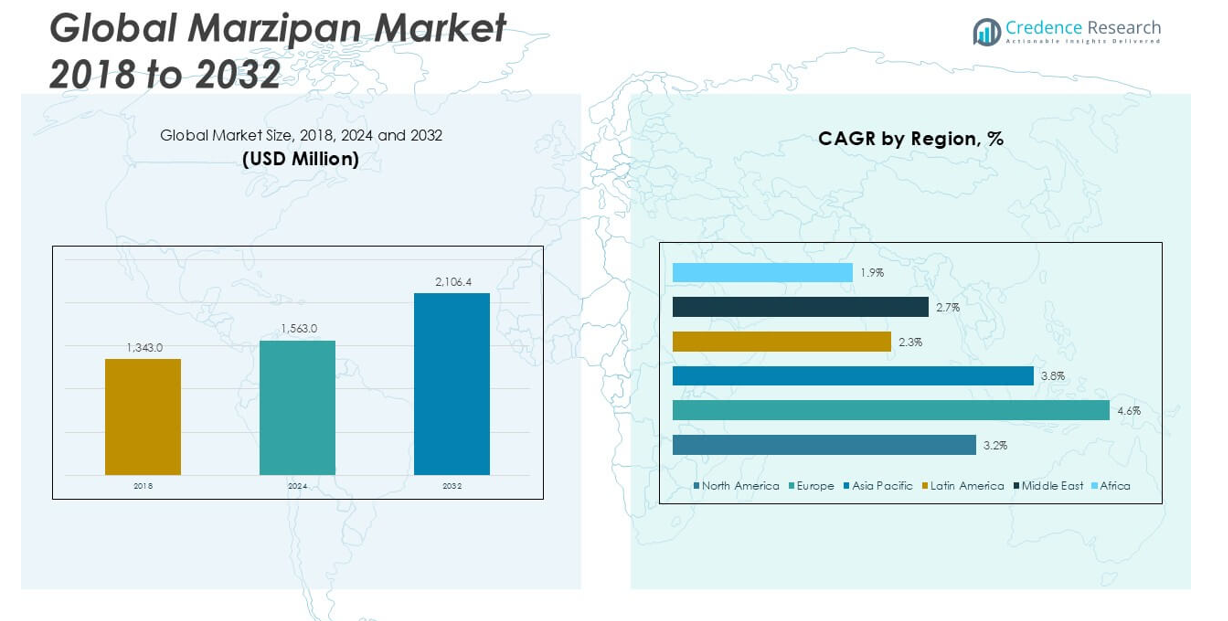

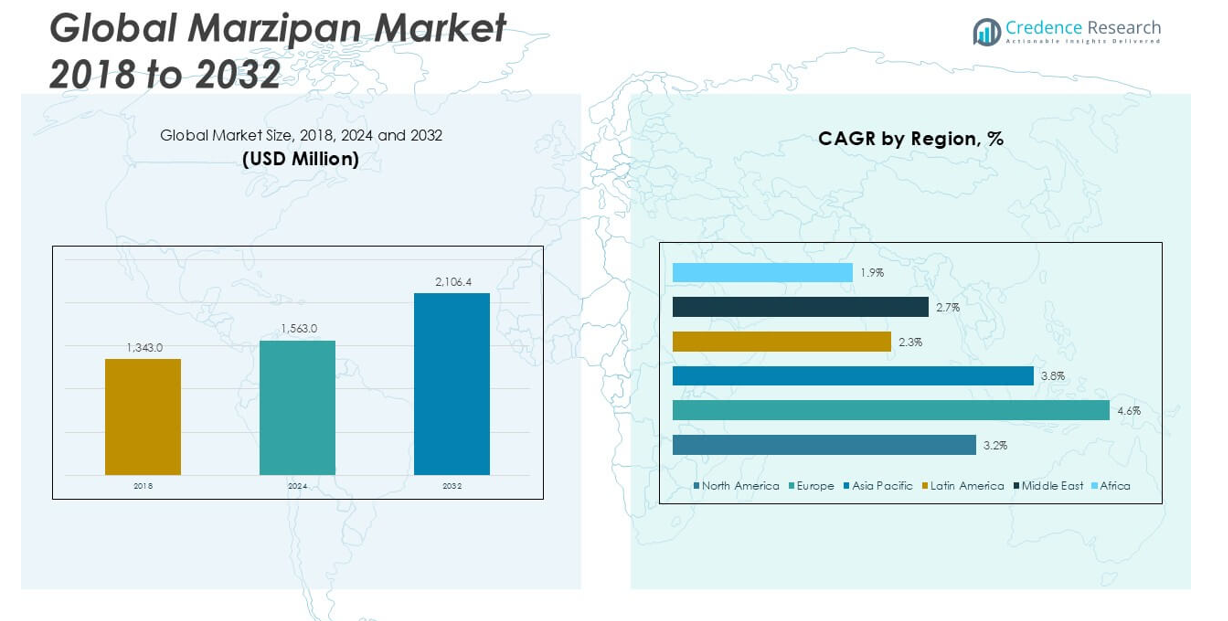

The Marzipan market size was valued at USD 1,343.0 million in 2018, reached USD 1,563.0 million in 2024, and is anticipated to reach USD 2,106.4 million by 2032, growing at a CAGR of 3.80% during the forecast period.

The marzipan market is led by key players such as Niederegger, Zentis GmbH & Co. KG, Odense Marcipan A/S, Renshaw (British Bakels), and Lubeca (Lübecker Marzipan-Fabrik), all of which have established strong global brand presence and diverse product portfolios. These companies focus on innovation, seasonal product launches, and premium quality to sustain their competitive edge. Europe dominates the marzipan market, accounting for approximately 46.8% of the global market share in 2024, driven by traditional consumption patterns and strong demand during festive seasons. North America and Asia Pacific follow, contributing significantly to market growth through expanding confectionery sectors and rising consumer preference for premium sweets.

Market Insights

- The global marzipan market was valued at USD 1,563.0 million in 2024 and is projected to reach USD 2,106.4 million by 2032, growing at a CAGR of 3.80% during the forecast period.

- Increasing demand for premium confectionery and rising consumer preference for natural, plant-based ingredients are driving the market growth globally.

- Product innovation, flavor diversification, and growing online retail channels are key trends shaping the marzipan market, with companies focusing on seasonal and customized offerings.

- The market faces challenges such as high raw material costs, particularly almonds, along with shelf-life and storage limitations that impact distribution and profitability.

- Europe holds the largest market share at around 46.8% in 2024, followed by North America and Asia Pacific; by product type, finished marzipan products dominate due to their convenience and popularity in direct consumption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

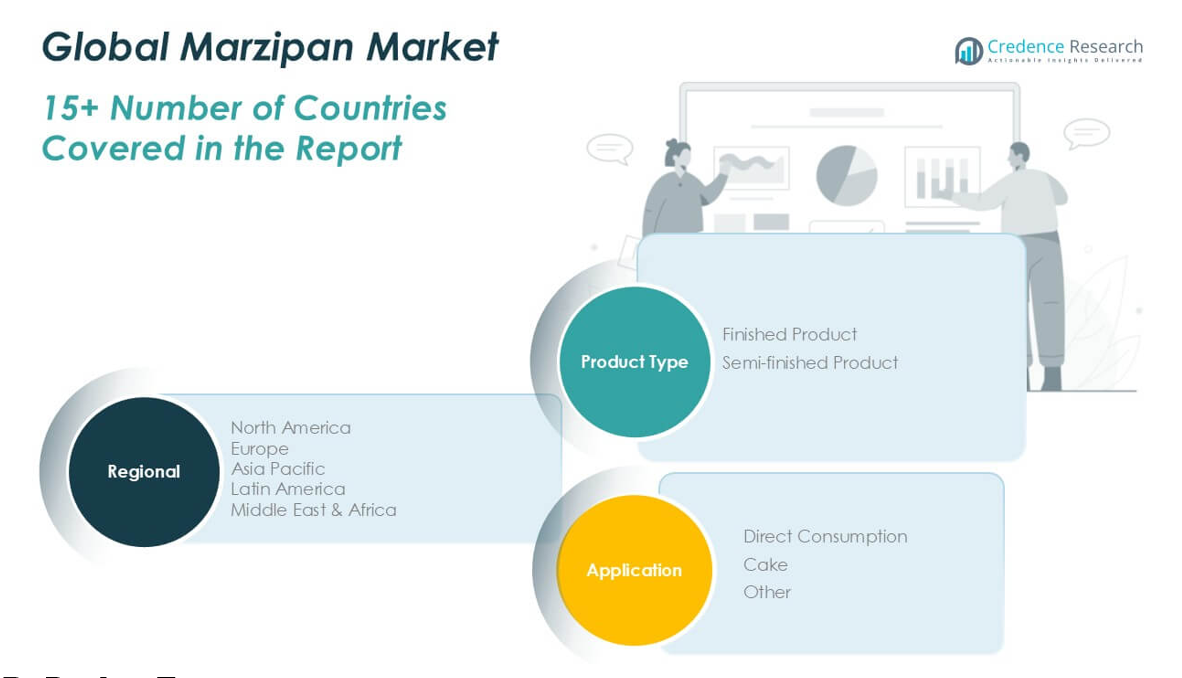

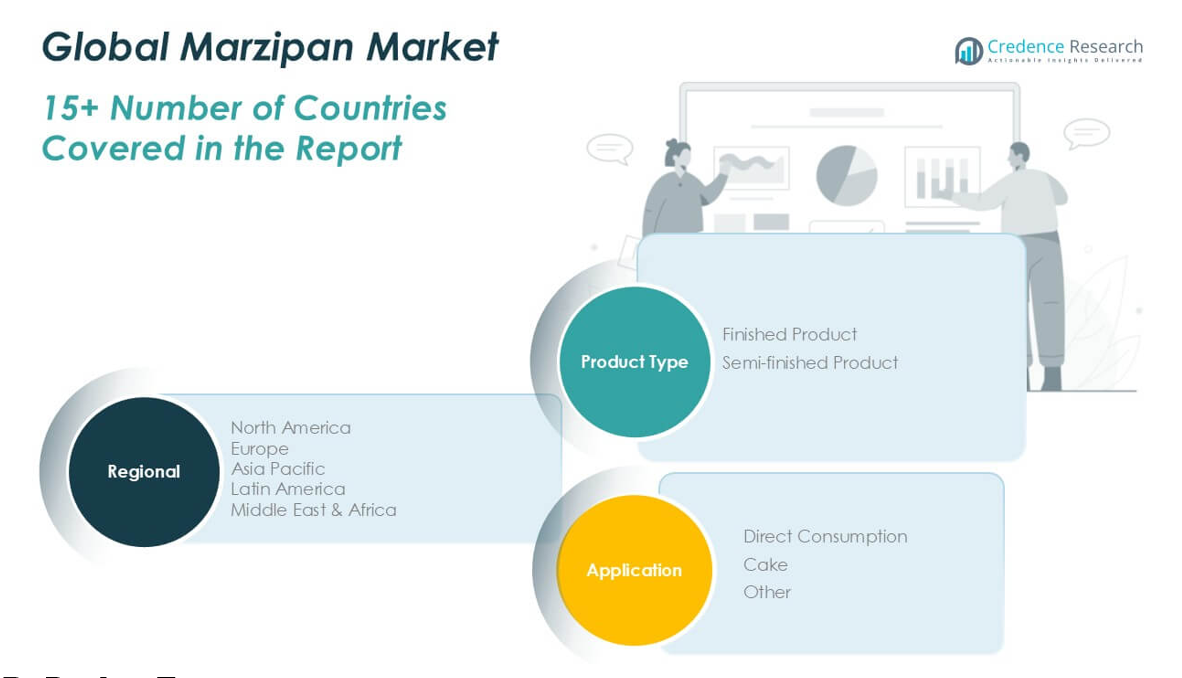

Market Segmentation Analysis:

By Product Type

The finished product segment holds the dominant share in the marzipan market, accounting for a significant portion of total revenue. This dominance is driven by the high consumer preference for ready-to-eat and attractively packaged marzipan products, which are widely used in confectionery and festive offerings. The convenience, aesthetic appeal, and easy availability of finished marzipan products in supermarkets and specialty stores further boost demand. The semi-finished product segment holds a smaller share compared to finished products but shows steady growth driven by rising demand from the bakery and foodservice industries. These products are primarily used as ingredients in cake decorations, pastries, and confectionery items, allowing for customization and flexibility in application. The growth of artisanal bakeries and increasing consumer interest in personalized desserts are key factors supporting this segment. Food manufacturers prefer semi-finished marzipan for its adaptability in large-scale production and its role in expanding product portfolios with innovative flavors and forms.

- For instance, Niederegger increased its finished marzipan praline output to 12 million units annually following automation of its packaging line in 2022.

By Application

The direct consumption segment leads the marzipan market by application, capturing a substantial market share. Consumers increasingly prefer marzipan as a standalone snack or sweet treat due to its rich almond flavor and soft texture. The rising health consciousness has also contributed to this trend, as marzipan is often perceived as a healthier alternative to sugar-based confections. The cake segment is a significant contributor to the marzipan market, driven by its widespread use as cake coverings and decorative elements, particularly in wedding and festive cakes. Marzipan’s pliability and ability to retain intricate shapes make it highly favored in cake artistry. The demand is further fueled by increasing consumer interest in customized and themed cakes for celebrations.

- For instance, JF Renshaw introduced fruit‑infused marzipan bars in 2024, selling over 800,000 units and capturing new snack‑oriented consumers.

Market Overview

Rising Demand for Premium Confectionery Products

The growing consumer preference for high-quality, artisanal, and premium confectionery is a major driver in the marzipan market. Consumers are increasingly willing to pay for superior taste, attractive packaging, and unique flavor profiles. Marzipan, often positioned as a luxurious sweet, benefits from this shift towards indulgent and gift-oriented confectionery. Seasonal festivals, weddings, and special occasions further fuel demand for premium marzipan products, with manufacturers expanding their offerings to meet evolving consumer tastes and to tap into lucrative gifting markets.

- For instance, Zentis introduced 12.5 kg freeze‑thaw stable marzipan blocks in 2023, contributing to a 15,000‑tonne rise in foodservice paste orders that year.

Expansion of Bakery and Foodservice Industries

The rapid growth of the global bakery and foodservice industries significantly drives marzipan consumption, particularly in the semi-finished product segment. Bakeries, cafes, and restaurants frequently use marzipan for cake decoration, pastry fillings, and dessert embellishments. The increasing number of specialty cake shops and rising consumer interest in customized desserts enhance marzipan’s market presence. Additionally, the expansion of foodservice chains and their creative dessert menus are creating consistent demand for marzipan as a versatile, high-quality ingredient.

- For example, Zentis processed 176,641 tonnes in 2023 and designed blocks that streamlined customization.

Increasing Popularity of Plant-Based and Natural Ingredients

Consumers are showing strong preference for natural, plant-based ingredients in confectionery products, which aligns well with marzipan’s almond-based composition. The shift towards clean-label products and growing health awareness make marzipan an attractive alternative to artificial sweets. Its simple ingredient profile, typically free from additives and preservatives, appeals to health-conscious buyers. Manufacturers are leveraging this trend by introducing organic, vegan, and low-sugar marzipan variants, thereby widening their consumer base and strengthening the market’s growth potential.

Key Trends & Opportunities

Product Innovation and Flavor Diversification

There is a rising trend of innovation in marzipan products, with manufacturers introducing diverse flavors, shapes, and packaging to attract modern consumers. Flavor diversification, such as chocolate-covered marzipan, fruit-infused varieties, and creative seasonal offerings, presents strong growth opportunities. These innovations not only cater to changing taste preferences but also allow brands to differentiate themselves in a competitive market. By developing novel marzipan products, companies can target younger demographics and premium segments seeking unique confectionery experiences.

- For instance, JF Renshaw’s 2024 launch of chocolate, pistachio, and raspberry marzipan variants with this line yielding 22,000 additional tonnes in sales .

Growth in Online Retail Channels

The growing penetration of e-commerce is opening new avenues for marzipan market players to reach a broader consumer base. Online platforms offer easy access to a variety of marzipan products, enabling consumers to explore premium, customized, and imported options. Seasonal promotions, gifting solutions, and direct-to-consumer models are increasingly popular in the marzipan segment, driving online sales. The ability to provide detailed product information, customer reviews, and personalized recommendations makes online retail an attractive growth channel for marzipan manufacturers.

- For instance, Zentis reporting 30,000 online marzipan orders in 2023, up from 23,000 in 2022.

Key Challenges

High Raw Material Costs

The marzipan market faces a significant challenge due to the rising costs of raw materials, particularly almonds, which are the primary ingredient. Price volatility in the almond supply chain, driven by fluctuating harvest yields and global demand, directly impacts production costs and profit margins. Small and mid-sized manufacturers are especially vulnerable to these cost pressures. Maintaining product affordability while ensuring quality is becoming increasingly difficult, posing a constraint on market expansion and competitiveness.

Short Shelf Life and Storage Constraints

Marzipan’s relatively short shelf life and specific storage requirements present logistical challenges for manufacturers and retailers. Exposure to moisture, temperature variations, and improper packaging can quickly degrade product quality, leading to waste and consumer dissatisfaction. This limits the distribution range, especially in regions with limited cold chain infrastructure. Ensuring product freshness throughout transportation and retail display is essential but often increases handling and storage costs, making market penetration in certain areas more complex.

Intense Market Competition

The marzipan market is highly competitive, with both global and regional players striving to capture consumer attention through pricing, product innovation, and branding. This intense competition often leads to pricing pressures and the need for continuous investment in marketing and product development. Small players face difficulties in gaining shelf space against well-established brands with wider distribution networks. Differentiating products and maintaining brand loyalty in such a saturated environment remains a persistent challenge for new and existing companies.

Regional Analysis

North America

In 2018, the North America marzipan market was valued at USD 310.2 million, contributing approximately 23.1% of the global market share. By 2024, the market grew to USD 334.5 million and is projected to reach USD 404.4 million by 2032, expanding at a CAGR of 3.2% during the forecast period. Growth in this region is driven by increasing demand for premium confectionery and strong seasonal consumption patterns. The market also benefits from widespread availability of marzipan products through organized retail channels, along with growing interest in plant-based and natural ingredient-based sweets.

Europe

Europe held the largest share in the marzipan market in 2018, valued at USD 628.5 million, accounting for approximately 46.8% of the global revenue. By 2024, the market size reached USD 708.0 million and is anticipated to grow to USD 895.2 million by 2032, at a CAGR of 4.6%. Europe’s dominance is supported by deep-rooted marzipan consumption traditions, especially in Germany and Scandinavian countries. The region’s strong confectionery industry, frequent product innovations, and high seasonal demand during Christmas and Easter significantly drive growth, solidifying Europe’s leading position in the global marzipan market.

Asia Pacific

The Asia Pacific marzipan market was valued at USD 204.1 million in 2018, representing around 15.2% of the global market share. By 2024, the market expanded to USD 265.7 million and is expected to reach USD 450.8 million by 2032, growing at a CAGR of 3.8%. Rapid urbanization, rising disposable incomes, and increasing consumer exposure to Western confectionery are key factors fueling growth in this region. Additionally, the growing popularity of customized and decorative cakes in countries like China and Japan is contributing to the rising demand for marzipan as a key bakery ingredient.

Latin America

In 2018, Latin America’s marzipan market size was USD 61.8 million, accounting for approximately 4.6% of the global market. By 2024, it increased to USD 81.3 million and is forecasted to reach USD 126.4 million by 2032, growing at a CAGR of 2.3%. The region’s growth is primarily driven by increasing awareness of international confectionery products and gradual expansion of specialty bakeries. However, limited consumer familiarity and relatively low premium product penetration restrain the market’s pace compared to other regions. Opportunities exist in expanding product variety and increasing availability in urban retail spaces.

Middle East

The Middle East marzipan market was valued at USD 94.0 million in 2018, contributing approximately 7.0% to the global revenue. The market size grew to USD 117.2 million by 2024 and is projected to reach USD 164.3 million by 2032, with a CAGR of 2.7%. The region’s market growth is supported by rising demand for high-quality sweets during religious and festive occasions. The increasing presence of premium confectionery brands and growing consumer interest in European-style desserts are also influencing marzipan adoption. However, cultural preferences for traditional local sweets may limit broader market penetration.

Africa

Africa accounted for around 3.3% of the global marzipan market in 2018, with a market size of USD 44.3 million. By 2024, the market reached USD 56.3 million and is expected to grow to USD 65.3 million by 2032, at a CAGR of 1.9%. Market growth in Africa remains modest due to limited product awareness, lower purchasing power, and underdeveloped retail infrastructure in many countries. However, growing urbanization, exposure to global food trends, and the increasing popularity of Western-style bakeries present gradual growth opportunities for marzipan manufacturers aiming to expand their footprint in the region.

Market Segmentations:

By Product Type:

- Finished Product

- Semi-finished Product

By Application:

- Direct Consumption

- Cake

- Other

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The marzipan market features a moderately fragmented competitive landscape with the presence of several established global and regional players. Key companies such as Niederegger, Zentis GmbH & Co. KG, Odense Marcipan A/S, and Renshaw (British Bakels) dominate the market with strong brand recognition, extensive product portfolios, and well-developed distribution networks. These companies focus on product innovation, seasonal offerings, and premium packaging to maintain their market positions. Strategic initiatives such as mergers, acquisitions, and geographic expansion are commonly adopted to strengthen market presence and tap into emerging regions. Smaller players and local manufacturers compete by offering customized, artisanal marzipan products and targeting niche markets. Additionally, increasing consumer demand for organic, vegan, and low-sugar marzipan is prompting manufacturers to diversify their product lines to cater to evolving preferences. Competitive pricing, product differentiation, and expanding online retail channels are key factors influencing competition, as companies strive to capture a larger share in both traditional and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Niederegger

- Zentis GmbH & Co. KG

- Odense Marcipan A/S

- Bergen Marzipan

- Moll Marzipan GmbH

- Erasmi & Carstens GmbH

- Renshaw (British Bakels)

- Lubeca (Lübecker Marzipan-Fabrik)

- Georgia Nut Company

- Carstens Lübeck GmbH

- LeiV Eriksson Marzipan

- Suedzucker AG

- Tehmag Foods Corporation

- Kalev Chocolate Factory

Recent Developments

- In 2024, ZENTIS responded to global health trends with the launch of a reduced-sugar marzipan variant. Using natural sweeteners, the company managed to cut sugar content by 30% without compromising on flavor. This health-driven innovation resonated with consumers seeking guilt-free indulgence, resulting in a 20% rise in sales.

- In 2024, JF Renshaw introduced an innovative range of flavored marzipan featuring raspberry, chocolate, and pistachio variants. This product diversification aligns with changing consumer preferences for bold and unique taste experiences. The flavored line has been well-received, driving a 22% increase in sales and reinforcing the brand’s commitment to creativity in confectionery.

- In 2023, Marzipan made a strategic move by expanding its distribution network into Japan and South Korea. Tapping into the rising appetite for Western confections in Asia, this expansion contributed to a 15% boost in global sales. The company aims to further strengthen its presence in international markets by leveraging regional tastes and preferences.

- In 2023, Niederegger introduced a vegan marzipan range to address the growing demand for plant-based confectionery. By replacing traditional egg whites with almond milk, the brand successfully catered to health-conscious and vegan consumers. The product line quickly gained popularity, achieving a 25% increase in sales since its debut. This move marks a significant step toward inclusive and modernized product offerings in the marzipan market.

- In 2023, Odense Marcipan rolled out eco-friendly packaging made from recyclable materials. This initiative reflects the brand’s commitment to sustainability and environmental responsibility. The response was overwhelmingly positive, with 40% of surveyed consumers indicating a preference for products with green packaging, underscoring the market’s growing eco-consciousness.

Market Concentration & Characteristics

The Marzipan Market demonstrates moderate market concentration with a mix of global leaders and regional players competing actively. It is characterized by strong brand loyalty, seasonal demand peaks, and a preference for premium and artisanal products. The market favors companies with established distribution networks and diversified product portfolios, enabling them to secure a competitive edge. Product differentiation through flavor variety, organic ingredients, and innovative packaging plays a critical role in attracting consumers. Major players focus on expanding their reach through e-commerce and specialty stores, which helps increase consumer accessibility. Europe remains the largest regional contributor, supported by traditional consumption patterns and high festive season demand. North America and Asia Pacific are growing steadily, driven by increasing consumer awareness and rising interest in premium confectionery. The market faces challenges related to raw material price volatility and shelf-life limitations, requiring companies to balance cost efficiency with quality assurance. It continues to evolve with changing consumer preferences.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Consumer demand will shift toward innovative marzipan flavors and premium variants.

- Manufacturers will expand e-commerce channels to reach broader audiences.

- Artisanal and organic marzipan options will gain traction among health-conscious buyers.

- Seasonal and festive packaging will become more sophisticated to enhance gifting appeal.

- Sustainable sourcing of almonds will emerge as a key focus for brands.

- Product shelf life and storage improvements will enhance distribution efficiency.

- Collaboration between bakeries and marzipan producers will increase for custom applications.

- Emerging markets in Asia and Latin America will offer significant growth opportunities.

- Investments in production automation will improve cost efficiency and consistency.

- Regulatory standards around labeling and ingredient transparency will strengthen market trust.