Market Overview

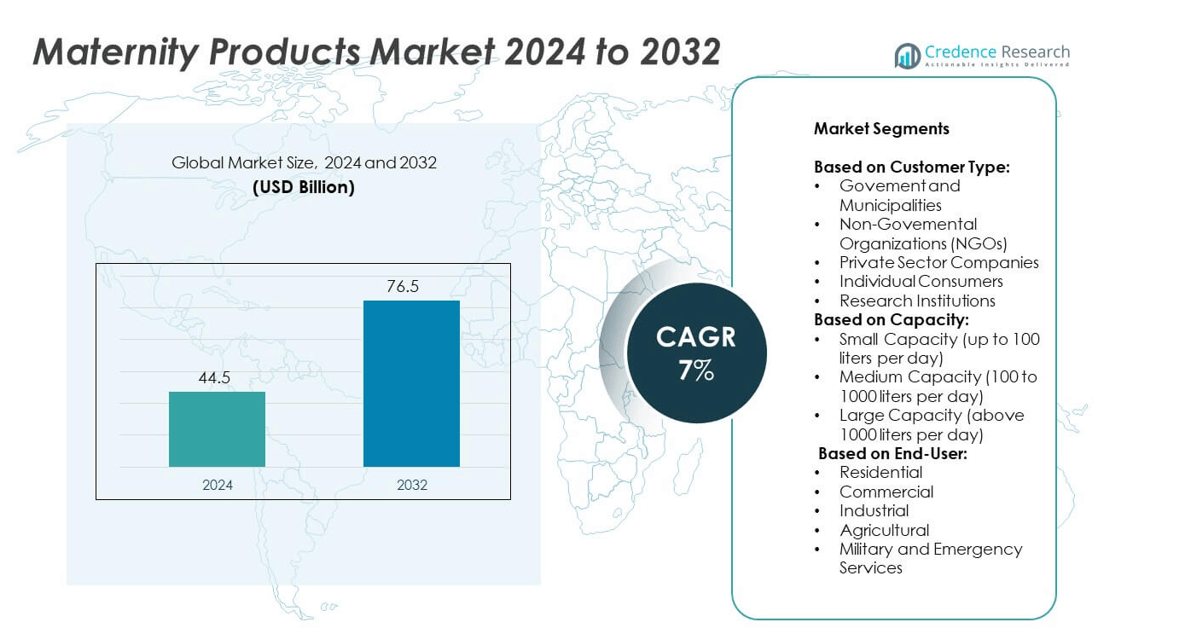

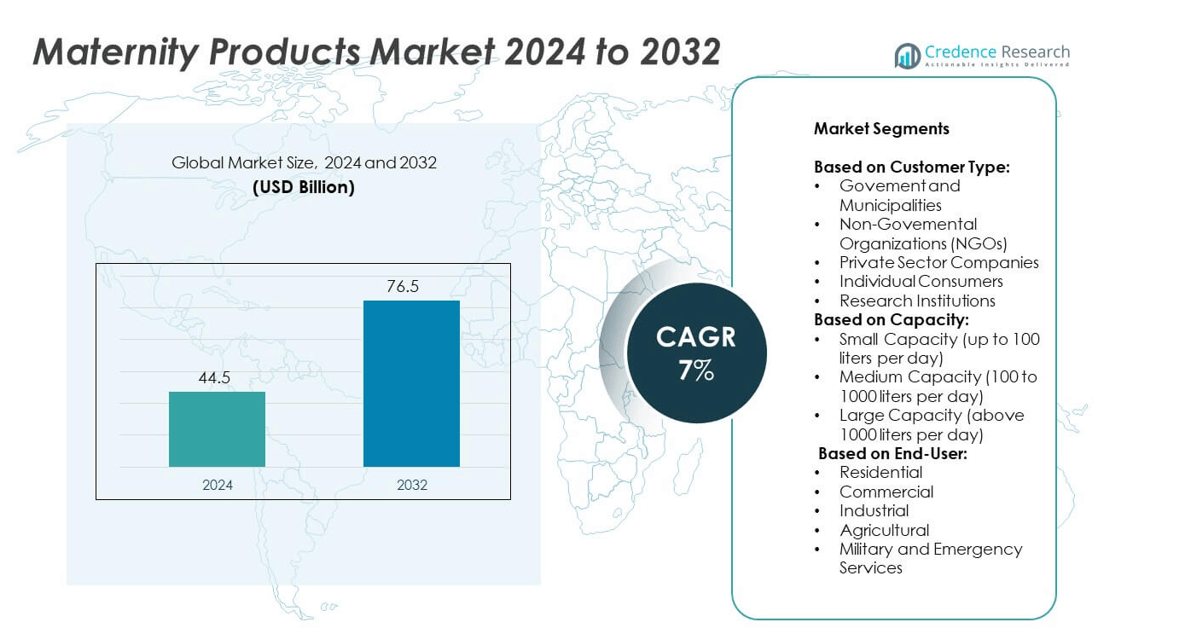

Maternity Products Market size was valued at USD 44.5 billion in 2024 and is anticipated to reach USD 76.5 billion by 2032, at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Maternity Products Market Size 2024 |

USD 44.5 billion |

| Maternity Products Market, CAGR |

7% |

| Maternity Products Market Size 2032 |

USD 76.5 billion |

The Maternity Products market is driven by rising awareness of maternal health, growing demand for organic and eco-friendly solutions, and continuous product innovation. It benefits from increasing consumer preferences for safe, premium-quality products and the integration of smart technologies such as wearable health devices and app-enabled care tools. Expanding e-commerce platforms and personalized offerings enhance accessibility and engagement. Emerging markets show strong growth potential due to improving healthcare infrastructure, while sustainability trends continue to influence purchasing decisions globally.

North America leads the Maternity Products market due to advanced healthcare systems, high consumer awareness, and strong demand for premium solutions. Asia Pacific shows rapid growth supported by rising urbanization, expanding middle-class populations, and increasing online retail adoption. Europe focuses on sustainable and dermatologically tested products, driving steady adoption across diverse segments. Key players shaping the market include HATCH, Seraphine, ASOS, and A Pea in the Pod, offering innovative, eco-friendly, and technology-driven maternity solutions to meet evolving consumer preferences globally.

Market Insights

- The Maternity Products market was valued at USD 44.5 billion in 2024 and is projected to reach USD 76.5 billion by 2032, growing at a CAGR of 7% during the forecast period.

- Rising maternal health awareness and growing demand for safe, organic, and eco-friendly solutions are key drivers supporting market expansion.

- Increasing adoption of personalized maternity care products, smart wearables, and app-integrated healthcare tools highlights evolving consumer preferences.

- The competitive landscape features prominent players such as HATCH, Seraphine, ASOS, A Pea in the Pod, Gap, and H&M Mama focusing on innovation, premium quality, and sustainable manufacturing.

- High product costs, limited affordability in developing regions, and regulatory complexities act as significant restraints affecting broader market penetration.

- North America dominates due to advanced healthcare infrastructure and strong retail networks, while Asia Pacific shows the fastest growth driven by rising disposable incomes, urbanization, and e-commerce expansion.

- Europe focuses on sustainable and dermatologically safe offerings, Latin America benefits from growing maternal health awareness, and the Middle East & Africa demonstrate potential through improving healthcare systems and gradual demand for premium maternity solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Focus on Maternal Health and Wellness

The Maternity Products market experiences strong growth due to increasing awareness of maternal health and wellness. Expectant mothers seek products that ensure safety, comfort, and care throughout pregnancy. It benefits from rising healthcare campaigns promoting prenatal and postnatal health. Growing access to information through digital platforms drives demand for specialized solutions. Consumers prefer products tested for quality and compliance with international safety standards. Governments and healthcare institutions emphasize early care solutions, further expanding product adoption.

- For instance, Owlet Baby Care has already monitored over 1.7 million babies using its connected nursery products, underscoring consumer trust in technology-enabled maternal and infant wellness solutions

Growing Demand for Organic and Eco-Friendly Products

Consumers are shifting preferences toward organic and eco-friendly maternity solutions, driving innovation and product diversification. It reflects increasing concerns about chemical exposure during pregnancy. Manufacturers focus on introducing toxin-free, natural, and sustainably sourced products to meet evolving demands. Premium-quality offerings like organic creams, biodegradable diapers, and eco-friendly nursing essentials gain market traction. Regulatory certifications for natural ingredients enhance consumer trust. Expanding product portfolios strengthen brand positioning and accelerate adoption across various income groups.

- For instance, GE HealthCare’s Novii+ Wireless Patch System is FDA-cleared for monitoring patients starting at 34 weeks gestation (versus prior 37 weeks), enabling simultaneous fetal heart rate, maternal heart rate, and uterine activity tracking—all while allowing laboring mothers to freely move, bathe, and change positions during antepartum and intrapartum monitoring

Technological Integration in Maternity Care Solutions

The market advances rapidly with technology-driven innovations in maternity products. Smart wearable devices monitor fetal health and provide real-time analytics to improve prenatal care. It benefits from innovations such as automated breast pumps, app-integrated nutrition trackers, and temperature-controlled nursing solutions. Companies invest in R&D to design products that improve convenience and comfort for mothers. Rising partnerships between healthcare providers and tech companies create integrated maternity care ecosystems. Increasing awareness of digitally enabled solutions supports faster adoption.

Expansion of E-Commerce and Changing Retail Preferences

E-commerce platforms significantly influence product accessibility and consumer choices in the Maternity Products market. It benefits from online availability of diverse product categories, competitive pricing, and customer-centric services. Social media campaigns and influencer-driven marketing strengthen brand visibility. Retailers focus on digital-first strategies to target tech-savvy parents seeking convenient shopping options. Subscription-based services for maternity kits and baby care products attract repeat buyers. Rapid urbanization and lifestyle transitions accelerate online product penetration globally.

Market Trends

Increasing Preference for Personalized and Customized Maternity Solutions

The Maternity Products market is witnessing a growing trend toward personalized and customized solutions designed to meet individual maternal needs. It reflects consumer demand for tailored nutrition plans, adjustable maternity wear, and customizable baby care kits. Brands focus on delivering products that suit diverse lifestyles and health conditions. Digital tools enable precise recommendations based on user profiles and medical requirements. Retailers enhance customer experiences by offering curated subscription-based packages. Personalized offerings strengthen brand loyalty and expand long-term consumer engagement.

- For instance, the Novii Patch, used in GE Healthcare’s Novii Wireless Patch System, can remain adhered to the abdomen for up to 48 hours, and once the pod connects, the assembly becomes waterproof, facilitating uninterrupted maternal–fetal monitoring during activities like showering

Rising Adoption of Premium and Luxury Maternity Products

Consumers increasingly favor premium and luxury maternity products driven by rising disposable incomes and shifting lifestyle choices. It benefits from higher spending on designer maternity wear, advanced breast pumps, and high-quality skincare solutions. Global brands introduce exclusive collections targeting urban consumers seeking elevated experiences. Growing social media influence promotes aspirational buying patterns among expectant mothers. Retailers capitalize on this trend through high-end collaborations and limited-edition launches. Expanding demand for superior comfort and aesthetics continues to reshape product portfolios.

- For instance, the Novii Patch weighs approximately 12 g and measures around 190 mm × 155 mm × 12 mm, making it lightweight and low-profile for comfortable wear during labor and monitoring use

Integration of Smart Technology and Digital Platforms

The Maternity Products market is transforming through the adoption of smart technologies and connected devices. It benefits from innovations like app-controlled breast pumps, wearable health trackers, and AI-based pregnancy monitoring solutions. Companies integrate mobile platforms to provide personalized insights and educational content. Online communities and virtual consultations enhance engagement between consumers and healthcare providers. The trend drives greater awareness of maternal health while improving convenience. Accelerated digital transformation strengthens the market’s innovation-driven growth trajectory.

Sustainability and Eco-Conscious Product Development

Sustainability has become a central trend shaping consumer choices in maternity products globally. It drives demand for biodegradable diapers, reusable nursing pads, and eco-friendly maternity clothing. Companies adopt ethical sourcing and sustainable packaging to meet environmental expectations. Certifications validating natural and organic ingredients build stronger consumer confidence. Retailers promote green alternatives through targeted campaigns to attract environmentally aware buyers. The growing preference for sustainable options continues to influence product innovation and market positioning.

Market Challenges Analysis

High Pricing and Limited Affordability Across Emerging Markets

The Maternity Products market faces significant challenges due to high pricing and limited affordability in developing regions. It struggles to reach low and middle-income consumers who prioritize essential healthcare over premium maternity solutions. Elevated production costs from advanced materials and organic formulations drive retail prices higher. Limited insurance coverage and low government subsidies further restrict access to quality products. Regional disparities in purchasing power widen the gap between demand and availability. Brands must adopt cost-efficient manufacturing and localized strategies to enhance market penetration.

Lack of Awareness and Regulatory Complexities

Limited consumer awareness regarding product safety standards and proper maternal care impacts adoption in several regions. The Maternity Products market faces hurdles from inconsistent regulatory frameworks across countries, leading to delays in product approvals and distribution. It encounters challenges with counterfeit goods and unverified alternatives affecting consumer trust. Smaller manufacturers struggle to comply with stringent testing and certification requirements. Healthcare infrastructure limitations in rural areas further slow down product accessibility. Overcoming these barriers requires coordinated efforts between manufacturers, policymakers, and healthcare providers to ensure consistent quality and wider reach.

Market Opportunities

Expansion of Product Innovation and Advanced Healthcare Solutions

The Maternity Products market presents significant opportunities through innovation in product design and healthcare integration. It benefits from advancements in smart maternity wearables, app-connected breastfeeding solutions, and digital prenatal monitoring tools. Growing investments in R&D encourage the launch of multifunctional products that enhance comfort and safety. Manufacturers introduce formulations with natural and dermatologically tested ingredients to meet rising consumer expectations. The increasing collaboration between healthcare providers and product developers strengthens trust and adoption. The shift toward technology-enabled care positions the market for sustained long-term growth.

Rising Demand Across Emerging Economies and E-Commerce Channels

Rapid urbanization and rising disposable incomes in emerging economies create lucrative opportunities for maternity product manufacturers. The Maternity Products market gains from expanding awareness of maternal health and increasing hospital-based recommendations. It benefits from digital platforms that simplify access to a wide range of products at competitive prices. E-commerce marketplaces support smaller brands in reaching underserved regions effectively. Subscription-based models for maternity essentials enhance consumer convenience and retention. The combination of growing demand, online penetration, and evolving retail strategies accelerates market expansion globally.

Market Segmentation Analysis:

By Customer Type:

The Maternity Products market caters to diverse customer groups with varying needs and purchasing patterns. Government and municipalities drive demand through public health initiatives and maternal welfare programs, ensuring wider accessibility. Non-Governmental Organizations (NGOs) focus on supporting underprivileged communities by distributing essential maternity care products. Private sector companies contribute by offering advanced, high-quality products through retail and healthcare partnerships. Individual consumers represent the largest demand group, influenced by lifestyle preferences, brand awareness, and digital access to product information. Research institutions invest in innovative maternity solutions and collaborate with manufacturers to develop safer and more effective products. It benefits from these varied customer dynamics, enhancing overall market growth.

- For instance, Spectra Baby USA’s S1 Plus double electric breast pump is remarkably lightweight at 3 lbs, yet delivers a strong vacuum suction of up to 270 mmHg, combining portability with efficient extraction potential.

By Capacity:

The market is segmented by capacity to meet different usage requirements across consumer groups and organizations. Small-capacity products, handling up to 100 liters per day, are preferred in households and small clinics due to their affordability and convenience. Medium-capacity solutions, ranging from 100 to 1,000 liters per day, serve maternity hospitals, diagnostic centers, and private healthcare facilities. Large-capacity products, exceeding 1,000 liters per day, cater to large-scale operations, including government health programs and bulk procurement needs. It reflects rising demand across both small-scale personal use and high-volume institutional applications, enabling manufacturers to diversify offerings effectively.

- For instance, The Momcozy S12 Pro is a wearable breast pump designed for convenience, offering 7-8 pumping sessions per full charge, a 6 oz capacity per container (though 4 oz is recommended), and 3 modes with 9 adjustable suction levels for a customized pumping experience. Its discreet, hands-free, and wireless design allows for mobility, while the soft, double-sealed flange ensures comfort and leak prevention.

By End-User:

The Maternity Products market addresses multiple end-user segments with tailored solutions. Residential users prefer comfortable, safe, and premium-quality products for personal care. Commercial users, including retail stores and maternity clinics, focus on stocking diverse product categories to meet customer expectations. Industrial applications emerge from large-scale manufacturing units supplying products for hospitals and international markets. Agricultural users adopt maternity healthcare kits and related solutions to support rural maternal care in remote regions. Military and emergency services demand specialized maternity products for deployment-ready healthcare setups. It benefits from growing end-user diversity, driving consistent adoption across various sectors and geographies.

Segments:

Based on Customer Type:

- Govement and Municipalities

- Non-Govemental Organizations (NGOs)

- Private Sector Companies

- Individual Consumers

- Research Institutions

Based on Capacity:

- Small Capacity (up to 100 liters per day)

- Medium Capacity (100 to 1000 liters per day)

- Large Capacity (above 1000 liters per day)

Based on End-User:

- Residential

- Commercial

- Industrial

- Agricultural

- Military and Emergency Services

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America dominates the maternity products market with a share of 35.2% in 2024. The region benefits from advanced healthcare infrastructure, high consumer awareness, and strong adoption of premium maternity solutions. It drives innovation through extensive R&D investments, ensuring the availability of technologically advanced products. Leading brands leverage both physical and digital retail networks to strengthen their presence. High disposable incomes and widespread insurance coverage encourage consumers to spend more on comfort and safety. The strong presence of established players ensures product diversity and faster adoption across urban and suburban markets.

Asia Pacific

Asia Pacific holds a significant share of 34.0% in the global maternity products market in 2024. It experiences rapid growth supported by rising urbanization, expanding middle-class populations, and improving access to maternal healthcare. The region benefits from growing awareness of health and wellness among expecting mothers. Increasing e-commerce penetration allows brands to reach a wider consumer base across both rural and urban areas. Government initiatives promoting maternal care programs contribute to demand acceleration. The presence of local manufacturers alongside international brands drives competitive pricing and product availability.

Europe

Europe accounts for approximately 23.5% of the maternity products market in 2024, maintaining its position as a key region. It shows steady growth due to rising preferences for eco-friendly, dermatologically tested, and premium maternity products. Consumers increasingly demand sustainable and organic solutions that meet stringent quality standards. The region benefits from well-established retail networks and efficient healthcare systems, supporting widespread adoption. Manufacturers focus on high-value products to meet diverse lifestyle preferences. Strategic collaborations between brands and healthcare providers further enhance consumer confidence and product penetration.

Latin America

Latin America represents around 5.3% of the global maternity products market in 2024. It is witnessing increasing demand due to growing awareness of maternal health and rising spending power among middle-income consumers. Urban centers drive online and offline sales, with a focus on affordable and reliable maternity essentials. Local and international brands compete by introducing cost-effective solutions tailored to cultural preferences. Expanding hospital networks and retail partnerships further improve accessibility. Government-led maternal wellness initiatives support broader adoption and strengthen the region’s growth potential.

Middle East & Africa

The Middle East & Africa region holds a smaller share of 2.0% in the global maternity products market in 2024. Demand is rising in urbanized areas where consumers increasingly prefer high-quality and premium maternity solutions. Improvements in healthcare infrastructure and targeted maternal care campaigns support awareness across developing economies. The growing role of local distributors helps brands expand their reach into underserved markets. Manufacturers focus on affordability while maintaining safety and quality standards. Gradual economic development and population growth present untapped opportunities for future market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Seraphine

- Gap

- JoJo Maman Bébé

- HATCH

- Motherhood

- Old Navy

- Isabella Oliver

- The Moms Co.

- Destination

- PinkBlush

- A Pea in the Pod

- ASOS

- H&M Mama

- Frida

- Cake

Competitive Analysis

The maternity products market is highly competitive, with leading players including A Pea in the Pod, ASOS, Cake, Destination, Frida, Gap, H&M Mama, HATCH, Isabella Oliver, JoJo Maman Bébé, Motherhood, Old Navy, PinkBlush, Seraphine, and The Moms Co. Companies focus on delivering innovative, comfortable, and premium-quality products tailored to diverse consumer needs. It benefits from continuous investments in design, material innovation, and eco-friendly manufacturing processes to enhance safety and usability. Brands leverage digital platforms and omnichannel retail strategies to strengthen market presence and reach wider audiences globally. Marketing efforts emphasize personalization, sustainability, and advanced features to attract tech-savvy and health-conscious consumers. Several players expand through strategic collaborations with healthcare providers, subscription-based models, and influencer-driven campaigns to increase visibility and trust. Continuous R&D investment supports the introduction of multifunctional products addressing evolving maternal care needs. The competitive landscape remains dynamic, with brands differentiating themselves through strong product portfolios, seamless customer experiences, and faster adoption of digital commerce channels. Growing consumer preference for premium and organic maternity solutions pushes companies to innovate and diversify offerings, enabling sustained growth and brand positioning in a rapidly evolving market environment.

Recent Developments

- In 2025, Seraphine Entered administration and ceased trading in July 2025; company appointed joint administrators on 7 July 2025 and stopped accepting new orders

- In 2023, HATCH (including HATCH Collective, Motherhood Maternity, A Pea in the Pod, Destination) Raised growth equity funding and established HATCH Collective, taking over operational control of Motherhood Maternity, A Pea in the Pod, and Destination Maternity.

- In April 2022, Frida introduced products that are C-section specific. It launched the Frida Mom C-Section Recovery Kit, which fills the gap in the market by introducing special wear for women after postpartum that offers them pain relief, supports healing, and provides comfortable solutions

Report Coverage

The research report offers an in-depth analysis based on Customer Type, Capacity, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing demand for sustainable and eco-friendly materials will shape product development.

- Increased adoption of smart technology and wearable health devices will streamline prenatal care.

- Personalized maternity solutions will gain traction through data-driven customization.

- E-commerce platforms will drive wider market reach and improve accessibility.

- Subscription-based models will gain popularity for their convenience and consistent engagement.

- Expansion in emerging markets will accelerate through rising income levels and healthcare awareness.

- Collaboration between brands and healthcare providers will enhance trust and product adoption.

- Retailers will invest in omnichannel experiences to connect with consumers seamlessly.

- Manufacturers will focus on multifunctional product designs that adapt to changing maternal needs.

- Government and institutional initiatives promoting maternal wellness will create new growth avenues.