Market Overview

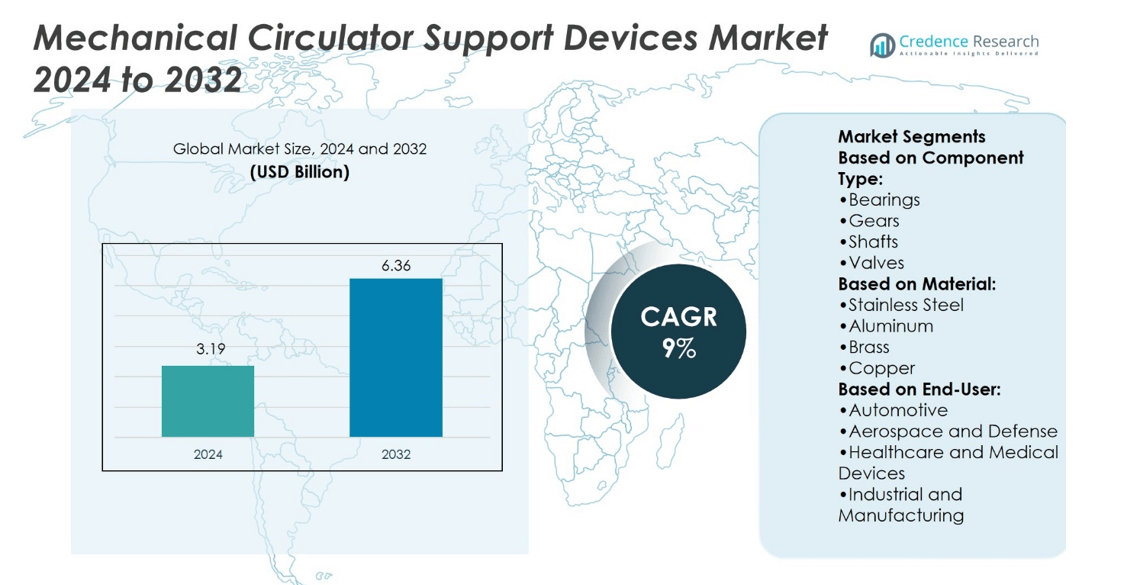

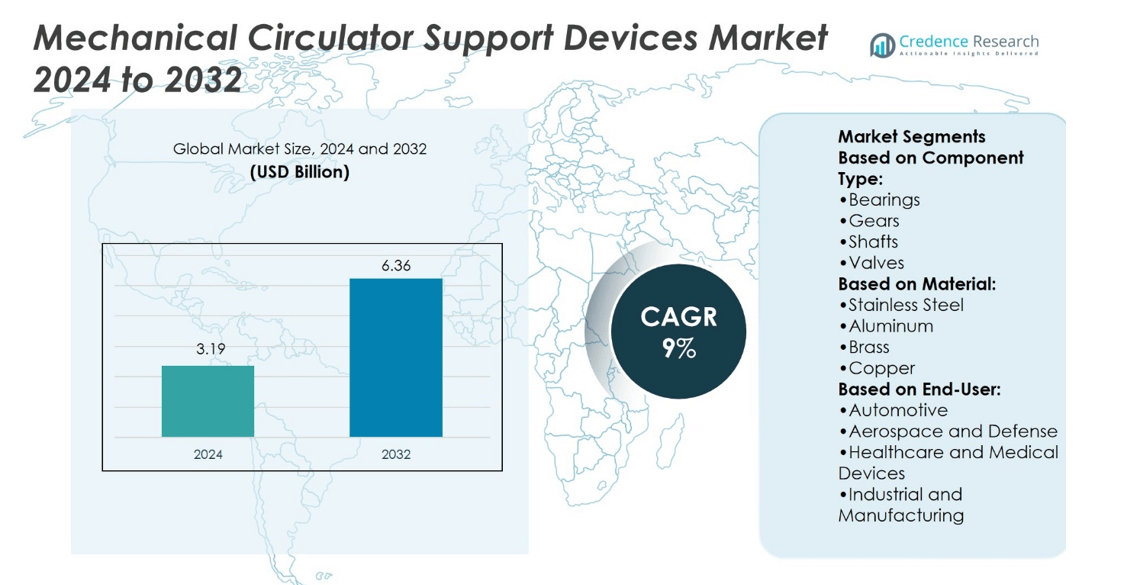

Mechanical Circulator Support Devices Market size was valued at USD 3.19 billion in 2024 and is anticipated to reach USD 6.36 billion by 2032, at a CAGR of 9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mechanical Circulator Support Devices Market Size 2024 |

USD 3.19 billion |

| Mechanical Circulator Support Devices Market, CAGR |

9% |

| Mechanical Circulator Support Devices Market Size 2032 |

USD 6.36 billion |

The Mechanical Circulator Support Devices Market is driven by the growing prevalence of cardiovascular diseases, rising demand for advanced treatment options, and the shortage of donor organs that increases reliance on mechanical support. It benefits from strong investments in healthcare infrastructure, favorable reimbursement policies, and expanding awareness among physicians and patients. Technological progress in miniaturization, biocompatibility, and remote monitoring strengthens clinical adoption while enhancing patient outcomes. It also reflects a clear trend toward destination therapy, digital health integration, and long-term support solutions, positioning mechanical circulatory devices as a cornerstone in the future of advanced cardiac care.

The Mechanical Circulator Support Devices Market shows strong geographical presence, with North America leading due to advanced healthcare infrastructure, followed by Europe with supportive regulatory frameworks and Asia-Pacific as the fastest-growing region. Latin America and the Middle East & Africa demonstrate gradual adoption driven by healthcare investments. Key players focus on innovation, clinical trials, and global expansion to strengthen market reach. It highlights a competitive landscape where established leaders and emerging companies shape the future of advanced cardiac care solutions.

Market Insights

- Mechanical Circulator Support Devices Market size was valued at USD 3.19 billion in 2024 and is expected to reach USD 6.36 billion by 2032, at a CAGR of 9%.

- Rising prevalence of cardiovascular diseases and shortage of donor organs drive strong demand for advanced circulatory support.

- Technological progress in miniaturization, durability, and remote monitoring supports wider clinical adoption.

- Competition intensifies as companies focus on innovation, clinical trials, and global expansion strategies.

- High device costs and complex regulatory approval processes remain key restraints.

- North America leads due to advanced healthcare systems, Europe follows with strong regulations, while Asia-Pacific emerges as the fastest-growing region.

- Latin America and Middle East & Africa show gradual adoption, supported by healthcare investments and partnerships with global players.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Prevalence of Cardiovascular Diseases Driving Device Demand

The growing incidence of cardiovascular diseases significantly fuels the expansion of the Mechanical Circulator Support Devices Market. Aging populations, sedentary lifestyles, and rising cases of heart failure create an urgent demand for advanced treatment solutions. It offers an effective option to sustain patients awaiting transplants or those ineligible for surgery. Hospitals and cardiac centers increasingly rely on these devices to manage high-risk patients. Clinical preference for mechanical support reflects its ability to reduce mortality rates. It continues to be viewed as a life-saving intervention in critical care settings.

- For instance, Abbott reported in 2021 that more than 33,000 patients worldwide had been implanted with its HeartMate 3 left ventricular assist device (LVAD), reflecting the scale of adoption of mechanical support systems in addressing advanced heart failure.

Technological Advancements Enhancing Clinical Outcomes

Rapid innovation in circulatory support technologies plays a pivotal role in strengthening the market. The integration of smaller, durable, and more efficient devices enables longer support periods with fewer complications. It enhances patient mobility, reduces infection risks, and supports minimally invasive procedures. Manufacturers focus on improving battery life, biocompatibility, and monitoring capabilities. Such progress improves the quality of care while addressing concerns over device longevity. It supports both acute and chronic care scenarios across diverse patient populations.

- For instance, Medtronic HVAD System, one of the smallest commercially available ventricular assist devices, was implanted in more than 20,000 patients worldwide before its discontinuation in 2021, highlighting the scale of technological adoption aimed at improving long-term clinical outcomes.

Expanding Adoption in Bridge-to-Transplant and Destination Therapy

The Mechanical Circulator Support Devices Market benefits from increasing adoption in bridge-to-transplant and destination therapy applications. Rising organ shortages intensify the need for reliable long-term support systems. It provides critical stability for patients awaiting donor hearts, while also serving as permanent therapy for those not eligible for transplants. Broader clinical acceptance encourages greater investment in specialized facilities. Physicians recognize its role in extending survival rates and improving quality of life. It remains central to addressing global gaps in cardiac treatment availability.

Strong Healthcare Investments and Reimbursement Support

Rising healthcare spending and favorable reimbursement frameworks provide strong support for market growth. Governments and private insurers recognize the importance of covering advanced cardiac therapies. It encourages hospitals to expand their adoption of circulatory assist technologies. Emerging economies invest heavily in improving cardiac care infrastructure, creating fresh opportunities. Global collaborations between manufacturers and healthcare providers accelerate device availability. It ensures broader patient access, positioning circulatory support as a critical component of modern cardiology care.

Market Trends

Growing Integration of Miniaturized and Portable Devices

The Mechanical Circulator Support Devices Market reflects a strong trend toward miniaturization and portability. Manufacturers prioritize compact designs that improve patient mobility and comfort. It reduces hospital stays by enabling out-of-hospital care and rehabilitation. Smaller devices also simplify surgical procedures and minimize trauma. Patient preference for less invasive solutions supports adoption across both developed and emerging markets. It aligns with the demand for efficient, patient-friendly cardiac care systems.

- For instance, Berlin Heart has successfully implanted its EXCOR® Pediatric ventricular assist device in more than 2,000 children worldwide, demonstrating how miniaturized mechanical support solutions address critical needs in pediatric and mobility-focused patient care.

Increasing Shift Toward Long-Term and Destination Therapy

The industry shows a rising trend of devices being used for long-term support and destination therapy. With organ shortages and rising heart failure prevalence, reliance on permanent mechanical support is expanding. It ensures survival and improved quality of life for patients not eligible for transplant. Physicians now recommend these devices as standard therapy in advanced cases. Growth in specialized programs and training encourages wider clinical use. It positions destination therapy as a defining trend for future cardiac care.

- For instance, Schaeffler reported producing more than 80 million precision engine and transmission components annually that are used in advanced medical pump and drive applications, supporting the durability and reliability required for long-term mechanical circulatory support technologies.

Integration of Digital Health and Remote Monitoring Capabilities

Digital innovation shapes the next phase of the Mechanical Circulator Support Devices Market. Advanced monitoring tools provide real-time data for physicians to track patient outcomes. It enhances safety by detecting complications early and allowing timely intervention. Wireless connectivity and AI-driven analytics improve decision-making in both acute and chronic care. Device makers focus on integrating remote management features into their systems. It supports telemedicine adoption and strengthens the continuum of patient care.

Expanding Clinical Trials and Regulatory Approvals Worldwide

The market shows strong momentum through growing clinical research and regulatory clearances. Manufacturers invest heavily in trials that prove safety, durability, and patient benefit. It builds confidence among healthcare providers and accelerates device adoption. Approvals across multiple regions expand the global footprint of leading players. Regulatory agencies support innovation by fast-tracking critical cardiac technologies. It ensures broader access and establishes a strong pathway for next-generation circulatory support solutions.

Market Challenges Analysis

High Cost and Limited Accessibility Restrict Wider Adoption

The Mechanical Circulator Support Devices Market faces significant challenges due to high acquisition and maintenance costs. Advanced circulatory devices require substantial investment from hospitals, making access difficult in resource-constrained regions. It often places a financial burden on patients despite supportive reimbursement policies. Limited infrastructure in emerging economies further slows adoption of these technologies. Skilled surgical teams and specialized facilities remain concentrated in developed countries, creating uneven access to care. It reinforces the gap between demand for advanced therapies and their availability.

Clinical Risks and Complex Regulatory Pathways Delay Market Expansion

Clinical complications remain a major challenge in this industry. The use of circulatory support devices can lead to infections, thrombosis, and device malfunction, which demand intensive monitoring. It raises concerns among healthcare providers and patients regarding long-term safety. Strict and lengthy regulatory processes further slow the entry of innovative devices into global markets. Manufacturers face high research costs and uncertain approval timelines. It creates a barrier for smaller firms while limiting the speed of technological adoption worldwide.

Market Opportunities

Expanding Demand for Advanced Cardiac Care in Emerging Economies

The Mechanical Circulator Support Devices Market holds strong opportunities in fast-growing healthcare systems across Asia-Pacific, Latin America, and the Middle East. Rising investments in hospital infrastructure and cardiac specialty centers create a favorable environment for adoption. It benefits from increasing awareness of advanced therapies among physicians and patients in these regions. Expanding health insurance coverage and government-backed cardiac programs support affordability and access. Collaborations between global manufacturers and regional healthcare providers enhance distribution networks. It enables wider penetration of life-saving technologies into underserved markets.

Innovation in Next-Generation Devices and Digital Integration

Continuous innovation in circulatory support devices creates new growth avenues for industry players. Manufacturers focus on next-generation systems that are smaller, biocompatible, and equipped with smart monitoring features. It opens pathways for integrating AI-driven analytics, predictive diagnostics, and telehealth platforms into cardiac care. Demand for portable and patient-friendly solutions encourages expansion into outpatient and home-care settings. Partnerships with technology firms accelerate digital transformation of circulatory support systems. It strengthens long-term opportunities by aligning device development with global trends in personalized and connected healthcare.

Market Segmentation Analysis:

By Component Type

The Mechanical Circulator Support Devices Market demonstrates significant diversity across component types that ensure functionality and reliability of circulatory systems. Bearings and gears dominate due to their critical role in precision movement and durability. It drives demand for high-quality shafts, valves, and couplings that maintain operational efficiency in complex applications. Fasteners, bushings, and housings further support structural stability, while spindles contribute to accurate motion transfer. Specialized components such as cams and clutches provide customization for specific device requirements. It underscores the importance of an integrated component ecosystem in enhancing performance and extending device lifespan.

- For instance, the Timken Company famously supplied more than 15.8 million bearings for U.S. jeeps during World War II—demonstrating the company’s capacity for high-volume, reliable bearing production, a legacy that underpins today’s precision needs in medical circulatory support devices.

By Material

Material selection strongly influences performance, cost, and durability in this market. Stainless steel holds prominence due to its strength, corrosion resistance, and biocompatibility, making it essential for medical-grade devices. Aluminum offers lightweight properties with sufficient strength, increasing its use in portable and efficient systems. Brass and copper support conductivity and precision engineering, while plastics expand opportunities for cost-effective and flexible solutions. It also highlights a rising preference for composites and ceramics that enhance wear resistance and performance. Demand for advanced materials reflects the need for efficiency, longevity, and adaptability in circulatory support devices.

- For instance, Renishaw reported producing over 1,000 cranial implants by 2022 using its additive manufacturing process with medical-grade titanium and stainless steel, demonstrating the scalability of advanced materials for precision-engineered medical support devices.

By End-User

End-user industries shape demand patterns for circulatory support components across multiple sectors. The healthcare and medical devices segment plays a central role, driving innovation in life-saving solutions for cardiovascular treatment. It aligns with growing reliance on mechanical support systems in advanced care settings. Automotive and aerospace demand reflects precision and durability needs in high-performance machinery. Industrial and manufacturing sectors adopt these components for process efficiency, while energy and power industries rely on them to support critical operations. Electronics, electrical, construction, and mining applications further expand their utilization. It demonstrates how broad end-user adoption reinforces market strength and long-term growth potential.

Segments:

Based on Component Type:

- Bearings

- Gears

- Shafts

- Valves

Based on Material:

- Stainless Steel

- Aluminum

- Brass

- Copper

Based on End-User:

- Automotive

- Aerospace and Defense

- Healthcare and Medical Devices

- Industrial and Manufacturing

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America held the largest share of the Mechanical Circulator Support Devices Market, accounting for nearly 38% of global revenue in 2024. The region benefits from strong healthcare infrastructure, high adoption of advanced cardiovascular therapies, and robust reimbursement frameworks. It continues to lead in research and development, with the United States being home to leading manufacturers and top-tier hospitals conducting clinical trials. Rising prevalence of cardiovascular diseases, driven by aging populations and lifestyle-related risk factors, ensures steady demand. Canada complements this growth with significant investments in cardiac care programs and collaborative research initiatives. It reinforces North America’s dominant position by combining technological innovation with early adoption of life-saving circulatory support systems.

Europe

Europe represented approximately 27% of the global market in 2024, making it the second-largest regional contributor. The region benefits from supportive regulatory frameworks, government-backed healthcare systems, and high awareness among physicians regarding advanced circulatory support therapies. It also records strong demand for bridge-to-transplant devices due to persistent organ shortages across several European countries. Germany, France, and the U.K. lead adoption with advanced clinical facilities, while Eastern European nations show rising investments in specialized cardiac centers. Cross-border collaborations and EU-level funding programs further accelerate technological adoption. It ensures Europe remains a key hub for innovation and access to advanced cardiac devices across diverse healthcare systems.

Asia-Pacific

Asia-Pacific accounted for about 22% of the global market in 2024, reflecting strong momentum from healthcare modernization and rising demand in emerging economies. The region experiences a rapid increase in cardiovascular disease cases, driving urgent demand for advanced treatment options. It benefits from growing government investments in hospital infrastructure and expanding insurance coverage, particularly in China and India. Japan maintains a leadership role with advanced device adoption and research initiatives, while South Korea and Australia continue to strengthen their cardiac care capabilities. Rising disposable incomes and urbanization contribute to a larger patient base requiring advanced circulatory support systems. It positions Asia-Pacific as the fastest-growing market segment, with significant opportunities for both global and regional manufacturers.

Latin America

Latin America held a modest but growing share of about 7% in 2024, supported by improving healthcare systems and rising awareness of advanced cardiac therapies. Brazil and Mexico lead the regional market, with investments in specialized hospitals and growing participation in clinical research. It faces challenges from limited reimbursement frameworks and uneven healthcare access across rural areas, which slow adoption in certain countries. Nevertheless, partnerships with international manufacturers and government-backed healthcare reforms are improving availability. Growing middle-class populations and rising incidence of chronic heart diseases drive demand for circulatory support devices. It ensures Latin America remains a developing but important region for future expansion.

Middle East and Africa

The Middle East and Africa region accounted for nearly 6% of the global market in 2024, reflecting gradual but steady adoption of circulatory support systems. Wealthier Gulf countries, including Saudi Arabia and the UAE, lead investments in advanced cardiac facilities and partnerships with global device makers. It benefits from government-backed healthcare modernization programs that improve access to critical care technologies. However, Africa faces limitations due to inadequate infrastructure and affordability challenges, restricting widespread adoption. Rising prevalence of lifestyle diseases and increasing medical tourism in the Gulf stimulate regional demand. It positions MEA as a region with untapped growth potential, where investments in healthcare access will expand future market opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Mechanical Circulator Support Devices Market players include, Mitsubishi Heavy Industries, Rexnord, NSK, Schaeffler, Hexagon, NTN, JTEKT, Parker Hannifin, SKF, Renishaw. The Mechanical Circulator Support Devices Market is characterized by strong competition, with companies striving to differentiate through technological innovation, reliability, and clinical effectiveness. The market emphasizes continuous development of advanced circulatory support solutions that improve patient survival and quality of life. It reflects rising investment in research, digital integration, and next-generation systems designed for both short-term and long-term applications. Global expansion strategies, clinical trial success, and regulatory approvals play a critical role in shaping competitive strength. It highlights a dynamic landscape where innovation, strategic collaborations, and healthcare infrastructure partnerships determine market leadership and long-term growth potential.

Recent Developments

- In March 2025, Komatsu is set to debut a 4-tonne skid steer loader and a 5-tonne compact track loader at Bauma 2025. The new models are part of the “dash 8” butch and sit between the small and large end of the loader spectrum and are designed for value in the loader segment. Both loaders, designed for the European market, feature increased operator capacity and hydraulic characteristics.

- In October 2024, Nidec Machine Tool Corporation, a Nidec Group company, announced the development of two new global-standard gear grinders, the ZFA160 and ZFA260. These models are designed to meet the global demand for high-precision gear machining.

- In December 2023, Dynamic Fatigue Testing Systems emerged as the newest development in the industrial market. These systems, recently introduced, provide improved capabilities for simulating real-life conditions and evaluating the fatigue resistance of materials and components.

- In April 2023, Bosch BASF Smart Farming and AGCO Corporation together announced that they will integrate and commercialize Smart Spraying technology on Fendt Rogator sprayers, and jointly develop additional, new features.

Report Coverage

The research report offers an in-depth analysis based on Component Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising cases of advanced heart failure worldwide.

- It will gain momentum through increasing adoption of destination therapy.

- Demand will rise for miniaturized and portable circulatory support systems.

- It will benefit from integration of remote monitoring and digital health tools.

- Clinical trials and faster regulatory approvals will accelerate product availability.

- It will see strong opportunities in emerging economies with improving healthcare infrastructure.

- Hospitals will adopt devices more widely due to favorable reimbursement policies.

- It will be shaped by innovation in biocompatible materials and durable components.

- Strategic collaborations between manufacturers and healthcare providers will strengthen market reach.

- It will continue to evolve as a critical part of advanced cardiac care solutions.