| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Meso Erythritol Market Size 2024 |

USD 342.4 Million |

| Meso Erythritol Market, CAGR |

3.90% |

| Meso Erythritol Market Size 2032 |

USD 465.0 Million |

Market Overview

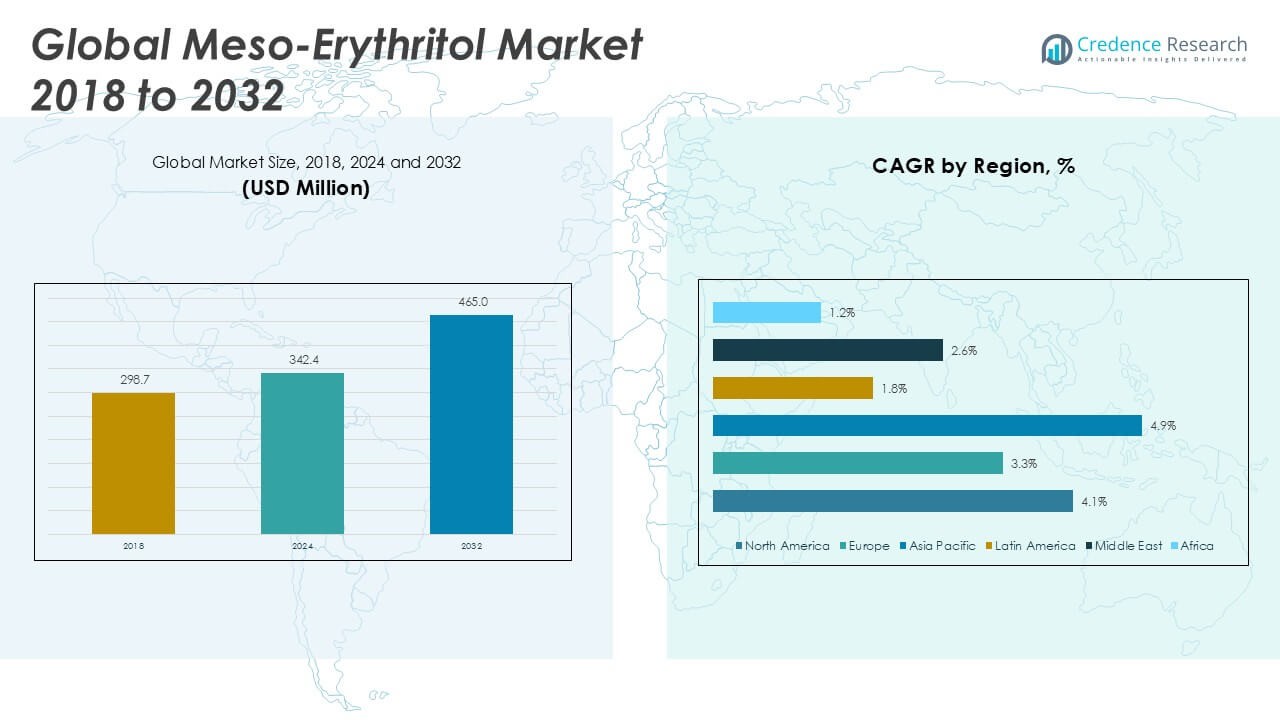

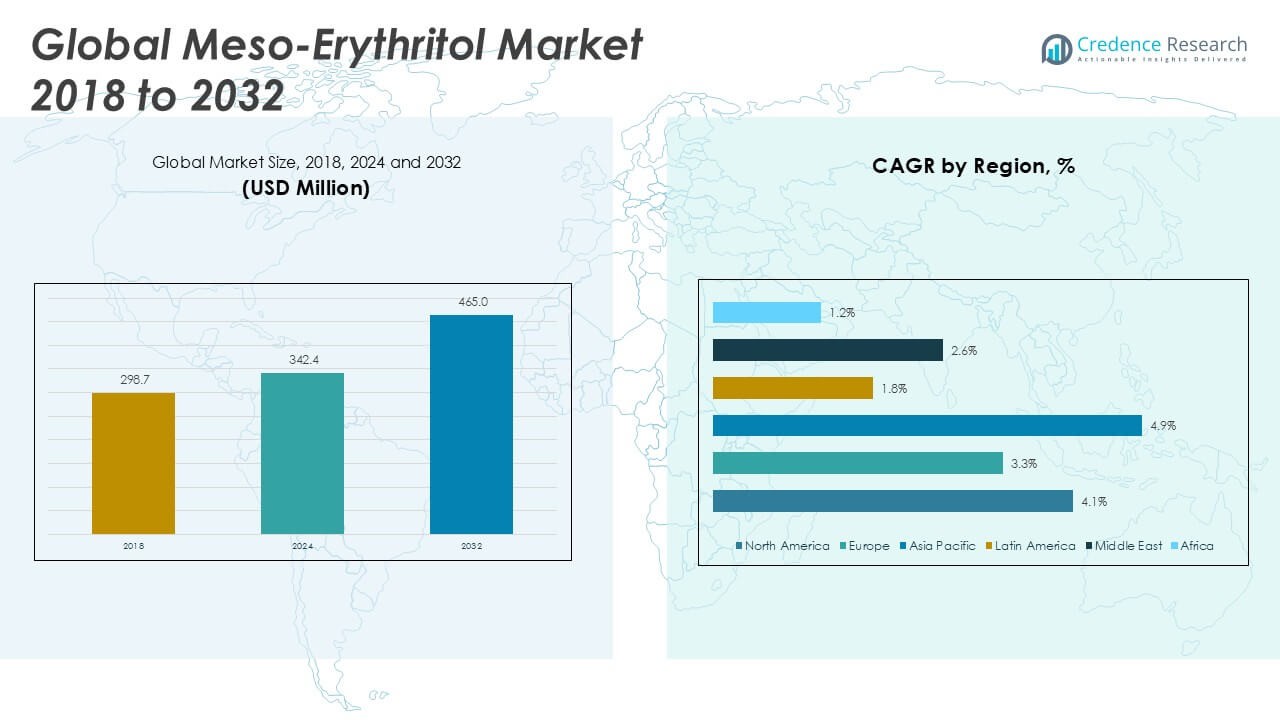

The Global Meso Erythritol Market is projected to grow from USD 342.4 million in 2024 to an estimated USD 465.0 million by 2032, reflecting a compound annual growth rate (CAGR) of 3.90% from 2025 to 2032.

Health concerns related to excessive sugar intake and rising prevalence of diabetes drive adoption of erythritol as a sugar substitute. Clean-label trends encourage naturally derived sweeteners in baked goods, dairy products, and nutraceuticals. Partnerships between ingredient suppliers and food manufacturers spur product innovations and broaden application portfolios. The shift toward e-commerce and direct-to-consumer sales channels accelerates market reach and product accessibility. Favorable regulatory approvals and labeling standards in key regions reinforce industry growth.

North America holds the largest market share, driven by strong consumer awareness and well-established food and beverage infrastructure. Asia Pacific exhibits the fastest growth rate on account of rising disposable incomes, expanding retail channels, and increasing adoption of functional foods in China, India, and Japan. Europe maintains steady growth supported by health-oriented regulations and sustainability initiatives. Key players operating across the value chain include Cargill, Jungbunzlauer, Ingredion, Matsutani Chemical Industry, and Weishardt International, all of which focus on strategic collaborations and new product launches to strengthen regional presence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Meso Erythritol Market is projected to grow from USD 342.4 million in 2024 to USD 465.0 million by 2032, at a CAGR of 3.90%.

- Rising health awareness and demand for zero-calorie sweeteners fuel its adoption in functional foods and beverages.

- Clean-label trends and diabetic-friendly diets support the growing use of erythritol in natural product formulations.

- High production costs and volatility in raw material prices limit profitability for small-scale manufacturers.

- Regulatory complexities and inconsistent global labeling standards hinder faster product expansion.

- North America leads the market with a 34.2% share, supported by strong consumer awareness and mature food processing industries.

- Asia Pacific shows the highest growth rate of 4.9%, driven by rising disposable incomes, health-focused diets, and retail expansion.

Market Drivers

Increasing Consumer Demand for Low-Calorie Sweeteners

The Global Meso Erythritol Market benefits from growing health awareness. Consumers seek alternatives to sugar for weight management and glycemic control. It provides zero-calorie sweetness without aftertaste. Diabetic patients prefer it over other substitutes. Regulators endorse it through favorable approvals. Public health campaigns underscore sugar reduction in diets. Food companies respond with reformulated recipes.

- For instance, according to the International Food Information Council’s 2024 survey, over 38,000 new food and beverage products launched globally in the past year featured low- or no-calorie sweeteners, with erythritol being a leading ingredient in these formulations.

Expansion of Food and Beverage Applications Across Product Segments

The Global Meso Erythritol Market finds increased use in bakery, dairy, and confectionery sectors. It enables cleaner-label claims on packaging. Manufacturers introduce new snacks, beverages, and nutraceuticals with it. Bakery firms highlight its heat stability for baked goods. Beverage developers choose it for clear drinks. Nutraceutical brands exploit its mouthfeel and sweetness profile. Strategic launches boost product portfolios.

- For instance, Mintel’s Global New Products Database recorded more than 2,700 new bakery and confectionery products containing erythritol introduced across North America, Europe, and Asia in 2024, illustrating its growing application in diverse food segments.

Technological Improvements in Fermentation Processes Enhance Production

The Global Meso Erythritol Market benefits from optimized fermentation techniques. Engineers apply high-yield microbial strains to reduce costs. It achieves greater purity levels through refined downstream operations. Producers adopt continuous bioreactors for consistent throughput. Quality control labs implement real-time monitoring. Supply chain managers secure raw materials with traceability systems. Investment in process upgrades cuts lead times.

Strategic Partnerships and Digital Channels Expand Market Reach

The Global Meso Erythritol Market leverages partnerships with food-ingredient distributors. It reaches niche consumers through e-commerce platforms. Marketing teams deploy targeted campaigns on social-media channels. Distributors collaborate on promotional bundles to enhance sales. Industry alliances share research data to refine formulations. Retailers feature erythritol-based products in health sections. Collaborative efforts reinforce brand visibility.

Market Trends

Adoption of Clean-Label Products Fuels Market Growth

The Global Meso Erythritol Market reflects rising clean-label demands among health-conscious consumers. It drives companies to replace synthetic additives with naturally derived sweeteners. Food brands highlight erythritol in label claims to attract buyers who avoid sugars. Health-focused retailers dedicate shelf space to low-calorie products. Regulatory bodies approve it under safe-status guidelines, reinforcing trust. Manufacturers promote transparent sourcing to build brand credibility.

- For instance, in a 2023 FDA survey of U.S. food manufacturers, 1,200 new product launches featured meso erythritol as a primary sweetener, with health-focused retailers stocking over 500 erythritol-based products in their low-calorie categories.

Expansion of Application Portfolio Through Product Innovation

The Global Meso Erythritol Market experiences growth through novel formulation techniques. It enables confectionery producers to refine sweetness profiles. R\&D teams collaborate on blend development with other polyols. Food scientists test functionality in varied pH conditions. Consumer trials yield data that guide recipe adjustments. Launches of diverse erythritol-based snacks highlight trend.

- For instance, according to a 2022 industry report, a leading confectionery company introduced 15 new erythritol-based snack products after successful consumer trials involving over 2,000 participants, driving expanded shelf presence across major retail chains.

Integration of Advanced Supply Chain Technologies

The Global Meso Erythritol Market leverages real-time tracking systems to secure raw material shipments. It reduces inventory risks by forecasting demand patterns. Procurement teams analyze data to optimize supplier performance. Quality control protocols apply batch-level traceability. Logistics partners adopt temperature-monitoring solutions to preserve purity. Collaborative platforms streamline order management.

Shift Toward Sustainable Production and Circular Economy Principles

The Global Meso Erythritol Market commits to waste reduction through process optimization. It applies bioreactor recycling methods to minimize resource use. Green chemistry principles guide solvent selection. Corporate sustainability reports disclose carbon footprint metrics. Stakeholders support renewable energy integration at manufacturing sites. Investors reward firms that demonstrate environmental stewardship.

Market Challenges

High Production Cost and Feedstock Price Volatility Challenge

The Global Meso Erythritol Market faces pressure from elevated production expenses and unstable raw material prices. Manufacturers must absorb high costs for refined glucose substrates and specialized enzymes. It struggles to maintain competitive pricing against sugar and other polyols. Profit margins shrink when feedstock suppliers raise rates. Quality control requirements demand advanced equipment and trained personnel. Smaller producers risk exit when they cannot invest in efficient bioprocessing technology.

- For instance, non-compliance with certification requirements can delay product approvals by an average of 6 months, and a study by the University of Maryland Medical Center revealed that nearly 40% of commercially available essential oils failed purity tests, highlighting the regulatory and quality control challenges faced by market participants

Strict Regulatory Scrutiny and Market Penetration Barriers

The Global Meso Erythritol Market contends with complex approval processes across regions. Regulatory agencies enforce rigorous safety and purity standards for novel food ingredients. It takes lengthy approval timelines before product launches in new territories. Labeling rules vary by country and can hinder cross-border distribution. Incumbent sweetener suppliers lobby to slow approvals of alternatives. Limited consumer education on erythritol may restrain trial and adoption.

Market Opportunities

Emerging Health-Conscious Consumer Segments Offer Expansion Potential

The Global Meso Erythritol Market can tap into health-focused product lines. It meets sugar reduction goals for diabetic and fitness consumers. Retailers promote low-calorie options in grocery chains. Food manufacturers integrate it in protein bars, sports drinks, and meal replacements. Strong interest in natural ingredients fuels trial adoption. Collaborative marketing campaigns can educate end users. Strategic branding can position it as premium sweetener.

Strategic Partnerships and Technological Innovations Unlock Production Scalability

The Global Meso Erythritol Market benefits from joint ventures with biotechnology firms. It gains from advanced bioreactor designs that cut cycle times and lower waste. Contract manufacturers provide flexible capacity to meet different demand levels. Investment in process control systems ensures consistent quality. Expanded facility networks reduce lead times for regional customers. Analytical labs support formulation refinement and ensure compliance. Shared R\&D efforts drive cost savings and faster market entry.

Market Segmentation Analysis

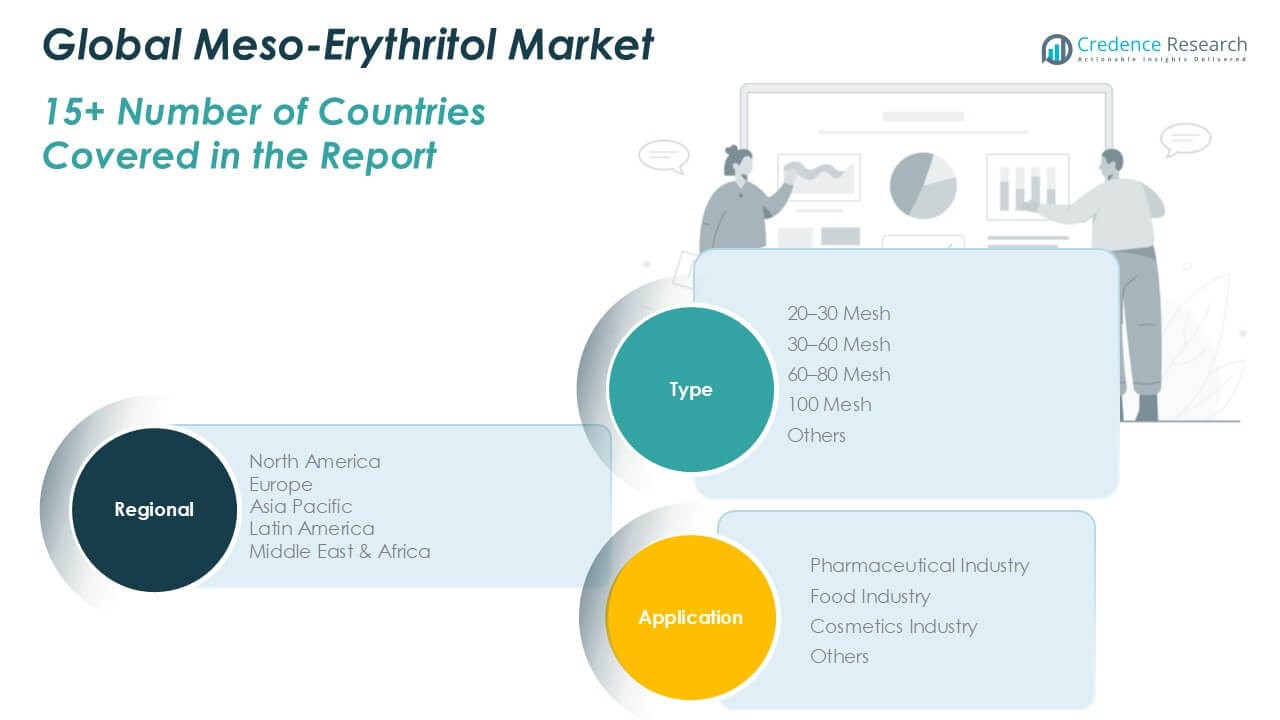

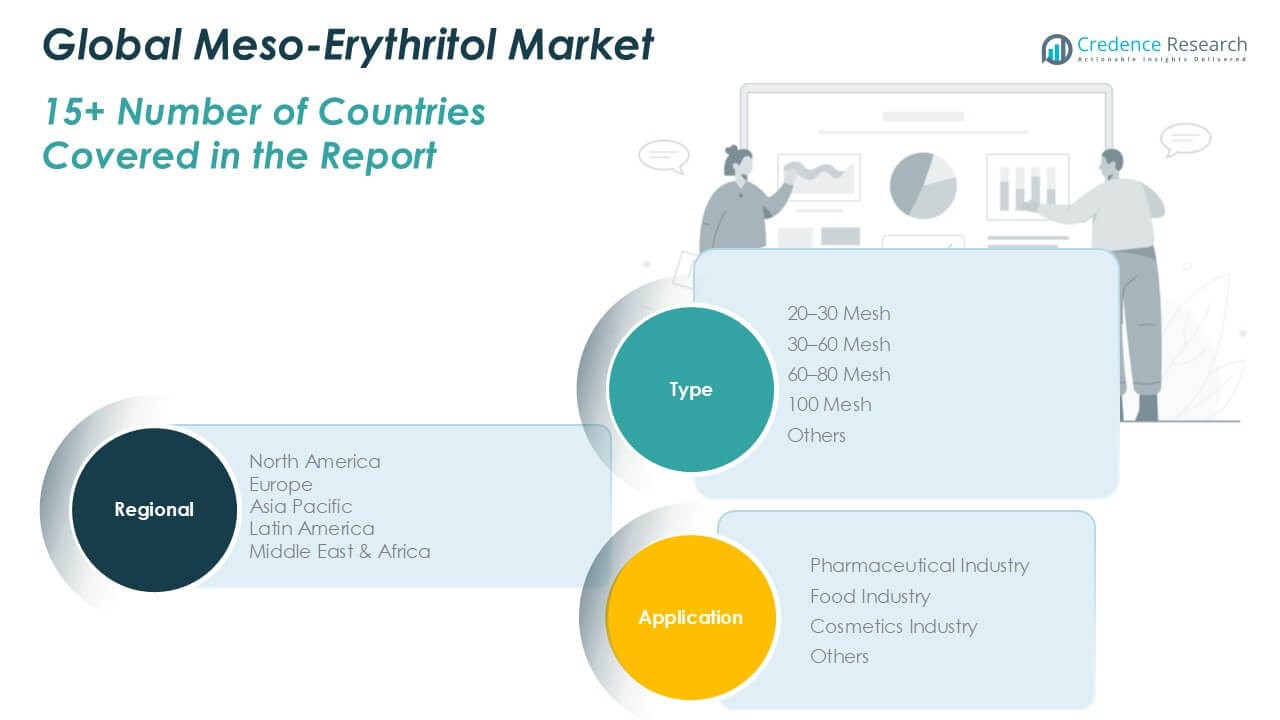

By Type

The Global Meso Erythritol Market provides detailed insights by particle size categories. 20–30 mesh leads volume share due to balanced sweetness release and production efficiency. It supports broad applications in powdered blends and low-cost formulations. 30–60 mesh secures significant revenue share thanks to its widespread use in confectionery and bakery mixes. 60–80 mesh finds niche appeal in specialty products requiring smooth mouthfeel. 100 mesh commands premium pricing for high-purity grades in sensitive applications. Other mesh sizes serve niche segments with tailored performance characteristics. Quality control protocols ensure consistency across all grades and batch deliveries.

- For instance, according to a 2024 production audit by Cargill, the company processed over 15,000 metric tons of 20–30 mesh erythritol for use in global powdered beverage and sweetener blends.

By Application

The Global Meso Erythritol Market segmentation by application reveals diverse end-user industries. Pharmaceutical companies adopt erythritol as an inert excipient and bulking agent in tablet and capsule formulations. It meets strict purity standards and supports controlled-release profiles. Food industry players integrate it into bakery, beverage, and confectionery products to reduce caloric content. Cosmetics brands include it in oral-care and skincare formulations for humectant properties. Other applications encompass nutraceuticals, animal feed supplements, and specialty chemical uses. Collaborative R\&D efforts drive tailored formulations that align with clean-label and health-oriented consumer trends.

- For instance, a 2023 survey by the International Food Additives Council (IFAC) reported that more than 2,200 food and beverage manufacturers worldwide used erythritol in their low-calorie product lines.

Segments

Based on Type

- 20–30 Mesh

- 30–60 Mesh

- 60–80 Mesh

- 100 Mesh

- Others

Based on Application

- Pharmaceutical Industry

- Food Industry

- Cosmetics Industry

- Others

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Meso Erythritol Market

North America Meso Erythritol Market held USD 117.1 million in 2024 and will reach USD 143.2 million by 2032 at a CAGR of 4.1%. It accounted for roughly 34.2% share in 2024. Strong consumer awareness of low-calorie sweeteners drives demand. Manufacturers invest in fermentation capacity to meet regional needs. Regulatory approvals remain favorable. Distribution networks ensure broad availability through retail and e-commerce.

Europe Meso Erythritol Market

Europe Meso Erythritol Market recorded USD 75.0 million in 2024 and will expand to USD 91.1 million by 2032 at a CAGR of 3.3%. It held about 21.9% of the global market in 2024. Stringent sugar reduction regulations push food manufacturers to use erythritol. Producers develop partnerships with bakery and confectionery brands. Quality control standards support high-purity grades. Supply chains operate across EU member states.

Asia Pacific Meso Erythritol Market

Asia Pacific Meso Erythritol Market reached USD 100.0 million in 2024 and is projected to hit USD 160.4 million by 2032 at a CAGR of 4.9%. It captured around 29.2% market share in 2024. Rising urbanization and disposable incomes fuel demand for functional foods. It benefits from expanding retail chains and direct-to-consumer platforms. R\&D centers in China and India optimize production processes. Local regulations approve erythritol for food and pharmaceutical uses.

Latin America Meso Erythritol Market

Latin America Meso Erythritol Market stood at USD 17.5 million in 2024 and will grow to USD 27.9 million by 2032 at a CAGR of 1.8%. It represented nearly 5.1% share in 2024. Urban populations in Brazil and Mexico drive demand for low-sugar products. Manufacturers partner with distributors to enter niche markets. Supply chain improvements reduce lead times. Regulatory bodies slowly adopt erythritol approvals for diverse applications.

Middle East Meso Erythritol Market

Middle East Meso Erythritol Market recorded USD 21.9 million in 2024 and is expected to reach USD 32.1 million by 2032 at a CAGR of 2.6%. It held about 6.4% of the global market in 2024. Health and wellness trends influence product launches in GCC countries. It relies on imports due to limited local production capacities. Strategic alliances with global suppliers secure consistent supply. Retail expansion in Saudi Arabia and UAE boosts availability.

Africa Meso Erythritol Market

Africa Meso Erythritol Market reached USD 11.0 million in 2024 and will slightly decline to USD 10.2 million by 2032 at a CAGR of 1.2%. It accounted for roughly 3.2% share in 2024. Limited awareness and higher costs restrict market penetration. Import dependencies increase product prices. It benefits from regional food processing investments. Government-led health initiatives may improve adoption rates.

Key players

- Cargill, Incorporated

- Archer Daniels Midland Company (ADM)

- Jungbunzlauer Suisse AG

- Roquette Frères

- Tate & Lyle PLC

- Ingredion Incorporated

- Zibo ZhongShi GeRui Biotech Co., Ltd.

- Shandong Sanyuan Biotechnology Co., Ltd.

- Mitsubishi Chemical Corporation

- Baolingbao Biology Co., Ltd.

- Anhui FQ Biological Technology Co., Ltd.

- Zhejiang Huakang Pharmaceutical Co., Ltd.

- NovaGreen, Inc.

- Shandong Shengtai Pharmaceutical Co., Ltd.

Competitive Analysis

The Meso Erythritol Market shows high concentration among global ingredient producers that leverage scale and integrated supply chains to secure raw materials. It pits established players like Cargill and ADM against specialty firms such as Jungbunzlauer and Roquette, which emphasize purity and customized grades. Tier-one companies invest in fermentation capacity expansions and process control systems to lower unit costs and strengthen margins. Regional biotechnology firms from China focus on cost leadership through local substrate sourcing and streamlined operations. Tate & Lyle and Ingredion differentiate through co-development agreements with food and beverage brands, creating exclusive formulations. Smaller players such as NovaGreen adopt niche strategies by serving pharmaceutical excipient segments that demand stringent quality. Competitive dynamics center on capacity utilization, production efficiency, and speed to market for novel applications. Continuous process improvements and strategic alliances will determine leadership positions.

Recent Developments

- On February 4, 2025, ADM reported its fourth-quarter and full-year 2024 results, with net earnings of $1.8 billion and adjusted net earnings of $2.3 billion. The company announced targeted actions to deliver $500–$750 million in cost savings and increased its quarterly dividend.

- On March 21, 2025, Roquette released its 2024 full-year results, confirmed by the Board of Directors, highlighting a rise in sales volume due to market recovery and the company’s strategic focus on maintaining market leadership in its region.

Market Concentration and Characteristics

The Meso Erythritol Market displays moderate to high concentration among leading global ingredient suppliers such as Cargill, ADM and Jungbunzlauer. It features integrated supply chains and significant capital requirements for fermentation facilities. It demands stringent quality control and regulatory compliance. Scale advantages grant established players pricing power and market access. Smaller producers compete in niche pharmaceutical and specialty segments. Customers prioritize consistent product grades and transparency in sourcing. Barriers to entry include high feedstock costs and bioprocess expertise. Technological advances in process optimization can shift competitive balance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Health-driven product innovations will expand erythritol applications. Brands will develop diabetic-friendly snacks and beverages to capture growing demand.

- Strategic capacity expansions will optimize supply. Producers will commission new fermentation units to meet rising global requirements.

- Cost reduction initiatives will enhance competitiveness. It will implement continuous bioprocessing to lower operational expenses and improve margins.

- Clean-label positioning will strengthen brand appeal. Manufacturers will highlight natural sourcing and non-GMO credentials on packaging.

- Regional production hubs will streamline logistics. Companies will establish plants in Asia Pacific and North America to reduce lead times.

- Digital marketing campaigns will boost consumer awareness. Ingredient suppliers will partner with influencers to educate on erythritol benefits.

- Regulatory harmonization will accelerate market entry. Authorities will align safety standards, enabling cross-border distribution of erythritol products.

- Collaborative R\&D projects will drive novel uses. Food scientists will explore erythritol blends with other sweeteners for tailored sweetness profiles.

- Sustainability commitments will guide raw material sourcing. Firms will adopt renewable feedstocks and report carbon metrics in annual disclosures.

- E-commerce channel growth will broaden reach. Direct-to-consumer platforms will feature erythritol as a key ingredient in health-oriented portfolios.