Market Overview

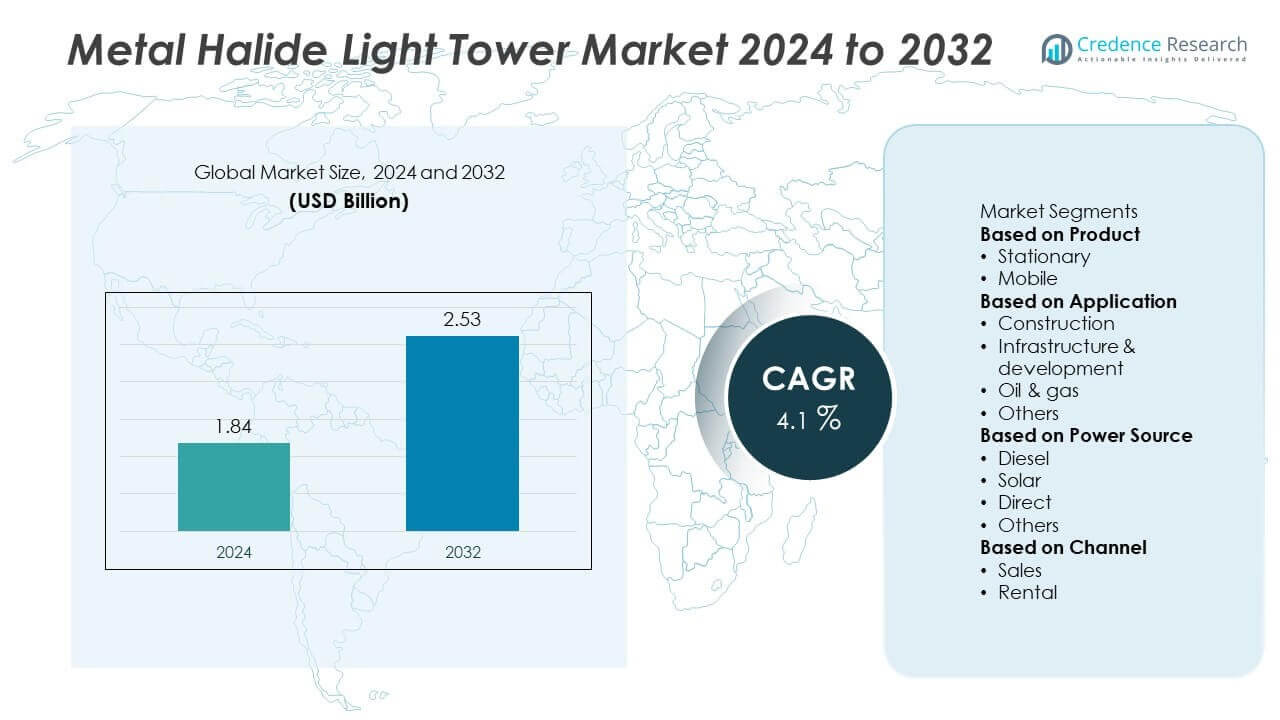

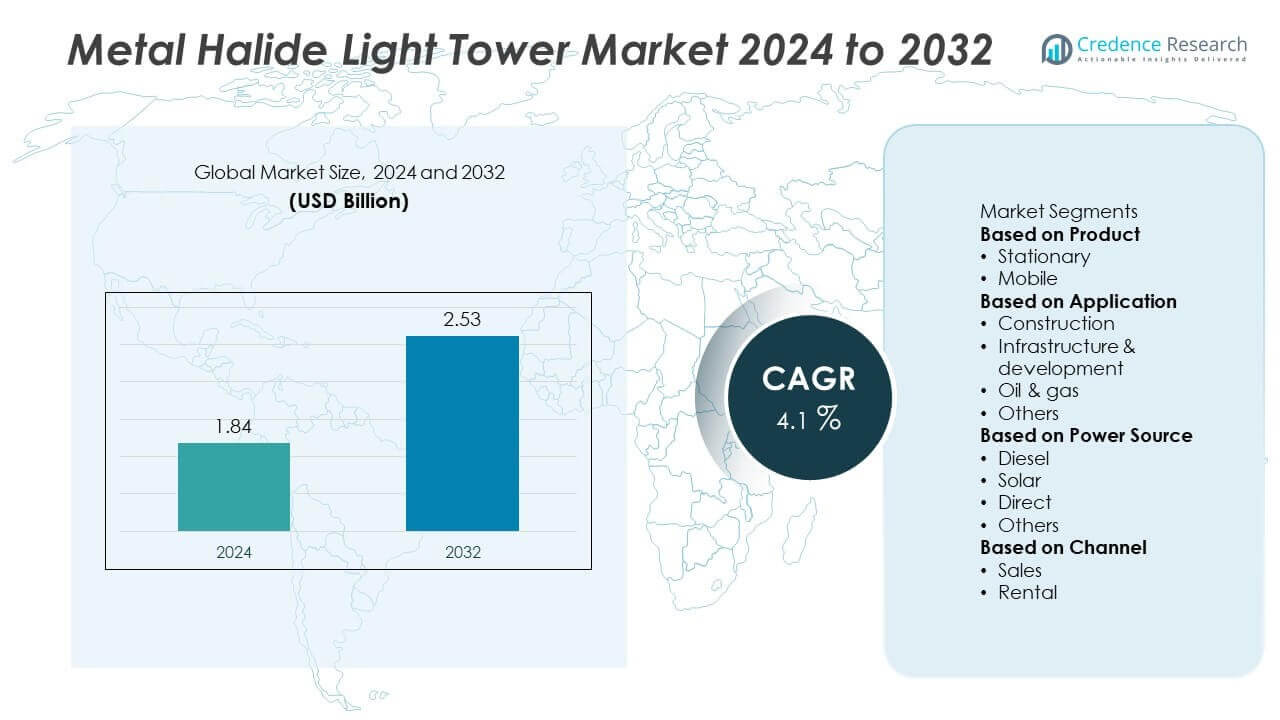

Metal Halide Light Tower Market size was valued at USD 1.84 billion in 2024 and is anticipated to reach USD 2.53 billion by 2032, growing at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Metal Halide Light Tower Market Size 2024 |

USD 1.84 Billion |

| Metal Halide Light Tower Market, CAGR |

4.1% |

| Metal Halide Light Tower Market Size 2032 |

USD 2.53 Billion |

The Metal Halide Light Tower Market grows with rising demand from construction, mining, and emergency services that require high-intensity lighting in off-grid and night-time operations. Governments invest in infrastructure development, roadworks, and energy projects, boosting equipment usage across regions.

Asia Pacific leads the Metal Halide Light Tower Market due to rapid infrastructure growth, mining expansion, and ongoing construction across India, China, and Southeast Asia. North America follows with steady demand from oilfields, utility projects, and government emergency preparedness programs. Europe maintains consistent usage driven by roadwork, public infrastructure upgrades, and regulatory-compliant lighting equipment across Germany, the UK, and France. Latin America and the Middle East & Africa show growing demand from energy, mining, and civil protection sectors, supported by rental markets and cross-border infrastructure investments. Market growth varies by region, depending on weather, terrain, fuel access, and project scale. Users prefer mobile, high-lumen systems that perform reliably under harsh conditions. Key players such as Atlas Copco, Generac Power Systems, Doosan Portable Power, and Caterpillar supply a wide range of metal halide light towers tailored for industrial, construction, and emergency lighting applications, focusing on durability, run time, and field-ready performance.

Market Insights

- Metal Halide Light Tower Market was valued at USD 1.84 billion in 2024 and is expected to reach USD 2.53 billion by 2032, growing at a CAGR of 4.1%.

- Growth in construction, mining, and infrastructure development projects drives strong demand for mobile lighting solutions.

- Users prefer high-lumen, trailer-mounted, and multi-mast towers that offer wide coverage and easy transport.

- Key players such as Atlas Copco, Generac Power Systems, Doosan Portable Power, and Caterpillar compete by offering rugged, fuel-efficient units with long runtime.

- The market faces restraints from growing LED adoption, high operating costs, and stricter emission regulations on diesel-powered systems.

- Asia Pacific leads due to infrastructure expansion in India, China, and Southeast Asia, while North America shows stable use in energy and utility sectors.

- Europe supports the market through regulatory-compliant lighting needs, and Latin America and the Middle East & Africa present growing opportunities through energy, mining, and disaster response programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand from Construction and Infrastructure Projects Drives Equipment Utilization

Large-scale infrastructure development and night-time construction activities create sustained demand for high-output lighting systems. Metal halide light towers provide intense, wide-area illumination, making them essential for highway expansion, bridge repairs, and metro tunneling. The Metal Halide Light Tower Market grows with the increasing number of 24/7 construction schedules across urban and rural zones. It ensures worker safety, equipment visibility, and operational efficiency under low-light conditions. Project contractors rely on these towers for durability, portability, and powerful light coverage. The market benefits from strong public and private investments in infrastructure.

- For instance, Generac’s mobile light tower products, such as the Magnum MLT4060MV with four metal halide lamps, can illuminate an area of up to 7 acres.

Growing Use in Mining and Oil & Gas Operations Expands Product Deployment

Mining and drilling sites often operate in remote, off-grid locations where reliable lighting is crucial. Metal halide towers offer high-lumen output, long throw distances, and resistance to rugged environments. The Metal Halide Light Tower Market gains traction as extractive industries expand across Africa, Latin America, and Asia Pacific. It provides lighting solutions that withstand dust, vibration, and weather extremes in open-pit and underground operations. Energy companies use these towers during exploration, rig setup, and maintenance shifts. Their use reduces downtime and ensures compliance with safety protocols.

- For instance, Atlas Copco supplies LED light towers, such as the HiLight V5+, for demanding industrial applications like mining. A single HiLight V5+ is noted for its fuel efficiency, consuming as little as 0.9 liters per hour in some models, which results in a maximum continuous run time of 88 to 150 hours, depending on the variant.

Emergency Response and Disaster Recovery Applications Support Market Growth

Natural disasters, utility outages, and accident response scenarios require fast-deployable lighting systems. Emergency agencies and disaster response teams use metal halide light towers to restore visibility and conduct rescue operations. The Metal Halide Light Tower Market supports these needs by offering mobile, trailer-mounted units with reliable fuel options. It enables extended run times in areas with no grid connectivity. Governments stock these units for civil defense and emergency preparedness programs. Their robust performance in unpredictable environments supports their role in public safety.

Military Operations and Event Management Add to Product Versatility

Defense forces deploy light towers during field exercises, base construction, and tactical missions. Metal halide models are favored for their reliability and broad coverage in harsh terrains. The Metal Halide Light Tower Market serves defense procurement with ruggedized units that operate in various climates. It also supports event organizers who require temporary, high-intensity lighting for outdoor venues, sports events, and festivals. These towers offer scalable lighting solutions with minimal setup time. Their use spans commercial, industrial, public, and defense sectors, adding flexibility to demand patterns.

Market Trends

Integration of Hybrid Power Sources Supports Energy Efficiency in Off-Grid Sites

Manufacturers now integrate diesel, solar, and battery systems in a single unit to lower fuel consumption. Hybrid-powered metal halide light towers allow users to operate in low-emission or silent modes during specific shifts. The Metal Halide Light Tower Market adapts to sustainability goals without compromising light output or runtime. It supports construction, mining, and emergency sites with flexible power configurations. Hybrid systems reduce generator wear and maintenance costs while extending operational periods. These units are especially valuable in areas with limited fuel access or regulatory noise restrictions.

- For instance, Wacker Neuson manufactures the LTV6K LED light tower, which features a 6kW diesel generator and offers an extended runtime of up to 137 hours on its 45-gallon fuel tank with its LED lights.

Rising Demand for Trailer-Mounted and Towable Light Towers in Mobile Operations

Contractors and field operators prefer mobile light towers that offer easy transportation and rapid setup. Trailer-mounted units with adjustable masts and stabilizers enhance usability across uneven terrain. The Metal Halide Light Tower Market sees steady demand for compact, road-legal designs that support shifting work zones. It allows crews to move lighting assets between projects without dedicated transport equipment. Lightweight frames and fold-down masts improve storage and deployment efficiency. These features improve rental fleet utilization across regions with high infrastructure activity.

- For instance, Allmand’s Maxi-Lite tower includes a 100-gallon (378.5 L) fuel tank and provides 542,000 metal-halide lumens using four 1,250 W lamps. Each unit runs for up to 166.7 hours with a full tank. Trailer-mounted design fits seven units on a 48-ft flatbed

Use of High-Lumen, Multi-Mast Configurations Gains Popularity on Large Job Sites

Users on expansive construction or mining sites need high-output towers that cover wider zones. Manufacturers now offer multi-mast systems with multiple metal halide lamps per tower. The Metal Halide Light Tower Market benefits from product innovation that improves lighting reach and coverage density. It supports better visibility during continuous operations and reduces the need for multiple standalone units. High-lumen towers also reduce shadow zones and improve safety around moving equipment. This trend caters to high-risk, high-volume operational environments.

Emphasis on Durable Construction for Harsh Weather and Industrial Environments

Worksites demand equipment that withstands vibration, dust, rain, and wind exposure without performance drop. Light towers now feature weatherproof enclosures, corrosion-resistant coatings, and heavy-duty trailers. The Metal Halide Light Tower Market addresses user expectations with reinforced builds for extreme field conditions. It ensures minimal service interruptions during storms, flooding, or prolonged outdoor use. These towers maintain structural integrity under load and operate in diverse climate zones. Their durability supports long-term value across high-wear industries.

Market Challenges Analysis

Rising Preference for LED Alternatives Reduces Demand for Metal Halide Units

End-users increasingly shift toward LED light towers due to their longer lifespan, energy efficiency, and faster start-up. LED systems offer reduced maintenance, instant illumination, and lower operating costs over time. The Metal Halide Light Tower Market faces pressure from this transition, especially in developed markets with strong energy regulations. It struggles to compete with LED options in terms of fuel efficiency and light output stability. Users in rental and infrastructure sectors prefer LED models that meet environmental standards and require fewer refueling cycles. This trend limits the replacement rate and slows down new unit procurement.

High Operating Costs and Environmental Regulations Impact Market Growth

Metal halide towers consume more fuel and generate higher heat compared to modern alternatives. Their longer warm-up times and susceptibility to lamp failure raise concerns in continuous-use applications. The Metal Halide Light Tower Market also contends with tightening emissions regulations that restrict diesel-powered equipment. Compliance with Tier 4 and equivalent norms requires engine upgrades or added filtration systems. Smaller rental firms and contractors hesitate to invest in units that may face future regulatory limitations. These barriers reduce adoption in regions prioritizing cleaner, low-noise, and low-emission lighting solutions.

Market Opportunities

Expansion of Infrastructure Projects in Emerging Markets Supports New Deployments

Rapid urbanization and infrastructure growth in Asia Pacific, Latin America, and Africa increase the need for mobile lighting solutions. Governments invest heavily in roads, railways, airports, and energy projects that require extended work hours under limited visibility. The Metal Halide Light Tower Market finds new opportunities by serving contractors and developers in these regions. It offers reliable and cost-effective lighting for job sites without permanent infrastructure. Public-private partnerships and cross-border investments further boost demand for rental and owned equipment. Local dealers and fleet operators seek durable units with minimal maintenance to meet project deadlines.

Rising Demand for Affordable Lighting in Disaster Recovery and Humanitarian Operations

Disaster relief agencies and emergency response units need portable lighting systems that can operate independently of the grid. Metal halide light towers deliver high-intensity illumination suitable for rescue, medical support, and security during natural disasters. The Metal Halide Light Tower Market benefits from procurement by defense, civil protection, and NGOs requiring rugged, fuel-powered units. It serves temporary shelters, field hospitals, and command centers during critical recovery operations. Demand remains stable in regions prone to hurricanes, floods, and earthquakes. These towers offer a practical solution where quick deployment and wide-area lighting are critical.

Market Segmentation Analysis:

By Product:

The Metal Halide Light Tower Market includes products such as manual light towers and hydraulic light towers. Manual towers remain widely used due to their lower cost, mechanical simplicity, and ease of maintenance. These units are favored by small contractors and rental fleet operators seeking basic functionality for low-to-mid-scale operations. Hydraulic towers, on the other hand, are gaining popularity for large-scale industrial applications where fast deployment, height adjustability, and stability are critical. It benefits from hydraulic models offering greater mast extension, rotation control, and durability on uneven terrain. Users select between product types based on frequency of use, project size, and required light coverage.

- For instance, Atlas Copco’s HiLight Z3+ battery-powered hydraulic tower offers an 8-meter (26.25-foot) mast, delivers 3,000 square meters (32,292 ft²) of light coverage, and operates silently for up to 32 hours on battery power.

By Application:

Key application areas include construction, mining, oil and gas, emergency services, and event management. The Metal Halide Light Tower Market sees dominant use in construction sites, especially for night shifts, remote locations, and infrastructure development zones. Mining and oilfield operations require high-lumen output and rugged enclosures that withstand vibration, dust, and temperature extremes. Emergency services use these towers during disaster response, accident recovery, and large-scale public safety operations. Event organizers also deploy them for outdoor gatherings, concerts, and festivals requiring temporary lighting. It continues to support sectors that depend on mobile, high-output lighting for nighttime or low-visibility operations.

- For instance, the Generac MLT6SMDS LED tower, used at multiple large-scale events, outputs 188,000 lumens and covers 25,068 ft². The model runs continuously for up to 206 hours on a single fuel capacity.

By Power Source:

Power sources include diesel-powered, solar-powered, and hybrid light towers. Diesel-powered units hold the largest share of the Metal Halide Light Tower Market due to their high energy output, long runtime, and reliability in off-grid conditions. These towers are well-suited for remote job sites with no access to electrical infrastructure. Hybrid models that combine diesel with battery or solar support are emerging as alternatives that reduce emissions and noise. It sees growing interest in hybrid systems for environmentally sensitive areas and noise-restricted work zones. Solar-powered units remain niche in this market due to metal halide’s high energy demand, but potential exists in lighter-duty applications.

Segments:

Based on Product

Based on Application

- Construction

- Infrastructure & development

- Oil & gas

- Others

Based on Power Source

- Diesel

- Solar

- Direct

- Others

Based on Channel

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

Asia Pacific

Asia Pacific holds the largest share of the Metal Halide Light Tower Market, accounting for approximately 34%. This region experiences high demand due to rapid infrastructure growth, expanding mining activities, and urban development across China, India, Indonesia, and the Philippines. Governments invest heavily in roads, bridges, railways, and smart city projects, all requiring round-the-clock operations. The need for reliable lighting in remote construction zones drives the adoption of mobile light towers. Industrial growth and rising energy projects, particularly in oil and gas-rich nations like China and Malaysia, further support product deployment. It continues to lead the market through large-scale equipment rental businesses and localized manufacturing capabilities.

North America

North America represents about 27% of the Metal Halide Light Tower Market, driven by consistent infrastructure upgrades, oilfield operations, and public safety applications. The United States contributes the largest share within the region due to ongoing highway rehabilitation, commercial construction, and defense-related field activities. Canada’s mining and energy sectors also demand portable lighting systems that support year-round operations in extreme climates. Metal halide units remain preferred in applications that require high-intensity lighting and long runtime in off-grid locations. The region shows steady replacement demand across rental fleets, utilities, and emergency response services. It also focuses on hybrid models to reduce emissions in sensitive environmental zones.

Europe

Europe holds nearly 21% share of the Metal Halide Light Tower Market, supported by construction activity across Germany, the UK, France, and Eastern European countries. Regional growth is influenced by infrastructure renewal, tunnel works, highway expansions, and events management. Strict emission and noise regulations encourage the adoption of light towers that meet Euro Stage V standards, prompting upgrades in public procurement and fleet operations. Metal halide units remain in use for large-scale civil engineering works that require powerful illumination across wide areas. It also finds demand in government-backed disaster response planning and transport infrastructure projects. Manufacturers in Europe emphasize rugged, weatherproof designs that support long operational cycles.

Latin America

Latin America accounts for approximately 10% of the Metal Halide Light Tower Market. Brazil, Mexico, Chile, and Peru drive demand through mining, energy infrastructure, and commercial building projects. Public lighting needs during power outages or civil emergencies also contribute to regional consumption. The rental segment plays a key role in supplying cost-sensitive contractors with mobile lighting systems. Market participants focus on offering fuel-efficient, low-maintenance units to meet cost and logistics constraints. It holds potential for growth through regional infrastructure plans and increased investment in utility and transportation development.

Middle East & Africa

Middle East & Africa represent close to 8% of the Metal Halide Light Tower Market. Demand comes from oil exploration sites, large-scale construction projects, and government-funded infrastructure initiatives in Saudi Arabia, the UAE, South Africa, and Nigeria. Desert conditions and off-grid operations require durable, long-range lighting equipment with high stability. Metal halide towers meet these requirements and remain widely used in rig sites, military operations, and public event setups. While LED adoption grows slowly, metal halide units retain market relevance due to lower upfront costs and broader availability. It offers moderate growth potential, especially in expanding energy corridors and post-disaster recovery operations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Himoinsa

- Colorado Standby

- Caterpillar

- Aska Equipments

- Doosan Portable Power

- Allmand Bros

- Generac Power Systems

- Chicago Pneumatic

- Atlas Copco

- DMI

Competitive Analysis

The competitive landscape of the Metal Halide Light Tower Market includes key players such as Allmand Bros, Aska Equipments, Atlas Copco, Caterpillar, Chicago Pneumatic, Colorado Standby, DMI, Doosan Portable Power, Generac Power Systems, and Himoinsa. These companies compete by offering durable, high-output lighting systems designed for construction, mining, oilfield, and emergency applications. Manufacturers focus on improving mobility, runtime, and weather resistance to meet diverse operational requirements. Product offerings include trailer-mounted, hydraulic mast, and hybrid-powered towers tailored to remote and off-grid sites. Competitive advantage lies in delivering reliable lighting solutions that comply with environmental regulations and provide easy setup across harsh terrains. Many players invest in rental-ready designs and robust service networks to support equipment uptime. Innovation centers around fuel efficiency, mast height control, and lumen output optimization. Regional expansion, fleet partnerships, and after-sales service remain key strategies to maintain market presence. Companies also tailor units to meet safety and visibility standards for 24/7 field operations.

Recent Developments

- In April 2024, Lind Equipment’s Beacon LED Tower, showcased its products at the ARA show offering an extended 20-foot mast option, providing the same brightness as traditional 4x1000W metal halide towers in a compact, lightweight.

- In March 2024, Himoinsa introduced the AS4006V metal halide lighting tower featuring a manually raised vertical telescopic mast that allows transport of up to 18 units in a 40-foot container.

- In 2024, Himoinsa launch of their advanced AS4006V lighting tower stands out with significant improvements in portability, runtime, and illumination capacity.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Power Source, Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for metal halide light towers will remain stable in infrastructure, mining, and utility projects.

- Construction firms will continue to prefer high-lumen towers for extended night-time operations.

- Hybrid-powered light towers will see increased deployment in noise- and emission-sensitive zones.

- Manufacturers will focus on rugged designs that withstand extreme weather and off-road transport.

- Demand from disaster relief and emergency services will support consistent unit procurement.

- Rental companies will expand fleets with compact, mobile towers for multi-sector use.

- Asia Pacific will drive volume growth with expanding civil engineering and roadwork activities.

- North America will emphasize fleet modernization to meet updated fuel and safety regulations.

- Latin America and Africa will offer growth opportunities in mining and energy corridor projects.

- Metal halide units will retain relevance where cost, brightness, and reliability outweigh energy savings.