Market Overview:

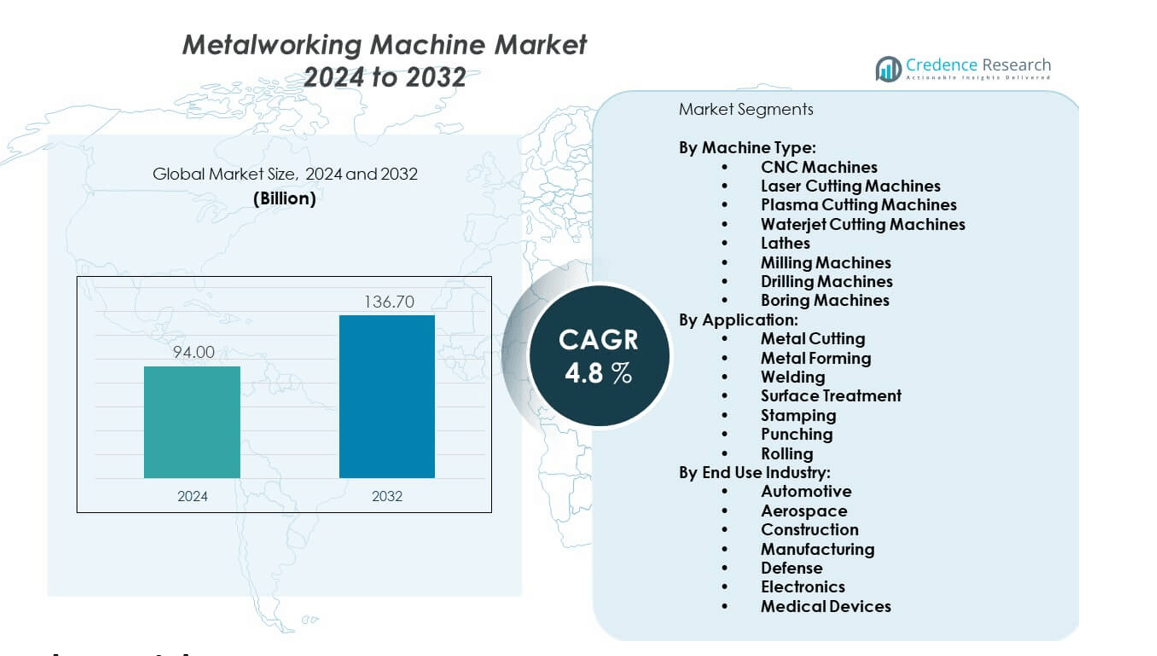

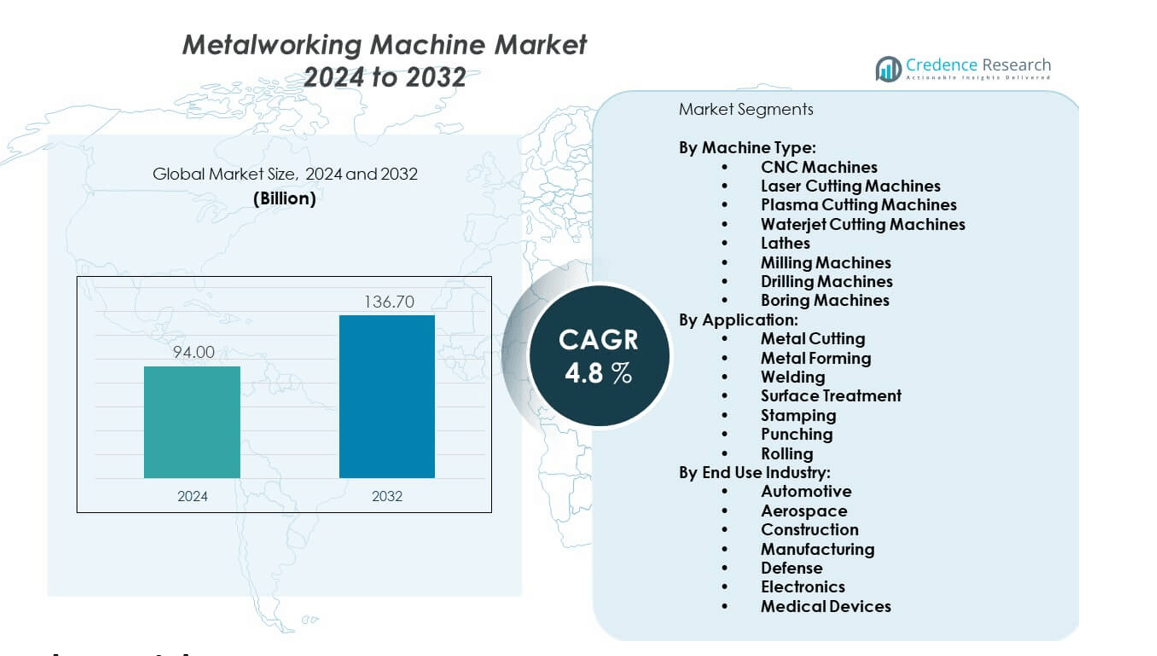

The Metalworking machine market is projected to grow from USD 94 billion in 2024 to an estimated USD 136.7 billion by 2032, registering a compound annual growth rate (CAGR) of 4.8 percent during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Metalworking Machine Market Size 2024 |

USD 94 billion |

| Metalworking Machine Market, CAGR |

4.8% |

| Metalworking Machine Market Size 2032 |

USD 136.7 billion |

The market is propelled by expanding industrialization, rising production volumes, and the need for cost-effective and efficient fabrication processes. Companies are adopting advanced machines to improve productivity, reduce waste, and meet tighter tolerances demanded by end-use sectors. The integration of digital manufacturing technologies, coupled with advancements in robotics and artificial intelligence, enhances accuracy and speeds up production cycles, positioning metalworking machines as essential tools in modern industrial ecosystems.

Geographically, Asia-Pacific leads the market due to its strong manufacturing base in China, Japan, and South Korea, supported by large-scale automotive and electronics production. Europe shows steady growth, driven by advanced engineering and demand from aerospace and precision industries. North America remains a key market due to its established infrastructure and technological adoption, while Latin America and the Middle East are emerging with increased industrialization and infrastructure projects, making them attractive for long-term growth in the sector.

Market Insights:

- The metalworking machine market was valued at USD 94 billion in 2024 and is projected to reach USD 136.7 billion by 2032, growing at a CAGR of 4.8 percent.

- Growth is strongly driven by rising adoption of CNC systems and digital automation across industries.

- Expanding applications in automotive, aerospace, medical devices, and infrastructure support sustained equipment demand.

- High capital investment and the shortage of skilled operators remain key restraints to wider adoption.

- Asia-Pacific leads the market, supported by its strong manufacturing base in China, Japan, and South Korea.

- Europe shows steady demand, particularly from aerospace and precision engineering sectors.

- North America maintains growth momentum through established infrastructure, automation readiness, and continuous technology upgrades.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Automation and Digital Integration in Manufacturing Processes:

The adoption of automation and digital technologies drives strong growth in the metalworking machine market. Manufacturers seek higher productivity and accuracy, pushing investment in CNC and robotic systems. It supports lean production methods by reducing waste and improving consistency in output. The demand for digitally controlled equipment is rising across automotive, aerospace, and precision engineering. Companies integrate advanced software and IoT solutions to monitor operations in real time. This integration enables predictive maintenance and lowers downtime costs. Industrial modernization in emerging economies further fuels machine upgrades. The overall trend secures long-term demand for advanced metalworking machines.

- In April 2025, DMG Mori Co., Ltd. introduced its NLX 2500|700 2nd generation turning center under its Machining Transformation (MX) concept. The machine features high-torque turnMASTER spindles on both left and right with an increased maximum bar capacity of ø 105 mm, up from ø 80 mm in the previous generation.

Expanding Applications Across Multiple End-Use Industries:

The expansion of applications across industries strengthens the growth of the metalworking machine market. Aerospace requires high precision components for safety and performance. Automotive focuses on efficient machining to meet large-scale production needs. Construction and infrastructure sectors demand durable equipment for heavy fabrication work. Electronics and energy sectors rely on precision cutting and shaping for critical parts. It creates steady multi-sector demand that supports market stability. Government-backed infrastructure projects in developing regions further boost orders. The diversity of applications provides resilience against fluctuations in single-sector demand.

- For instance, The control systems include SINUMERIK One and HEIDENHAIN TNC 7 integrated into their CELOS X digital platform, facilitating precision and adaptable workflows for a broad scope of industrial applications.

Rising Investments in Industrialization and Capacity Expansion:

Industrialization in developing regions creates consistent demand in the metalworking machine market. Nations with growing manufacturing hubs are investing heavily in machine tools. Expansion of industrial capacity strengthens the demand for modern equipment with better efficiency. Companies focus on upgrading facilities to align with global quality standards. It creates opportunities for suppliers offering high-performance solutions. Public and private investments in industrial corridors amplify this demand. Export-driven economies rely on advanced machines to meet strict international requirements. The momentum of industrial growth ensures a continuous need for upgraded machining solutions.

Advancements in Precision Engineering and Material Innovation:

Technological progress in precision engineering is a major driver of the metalworking machine market. Aerospace and defense sectors require components with tighter tolerances. Automotive manufacturers adopt innovative materials that demand advanced cutting solutions. Medical devices rely on machines that deliver ultra-precise fabrication of small parts. It creates strong incentives for continuous machine upgrades. Developments in alloys and composites increase the need for specialized equipment. Research in micro-machining expands the scope of advanced machine tools. Companies across industries prioritize precision to maintain competitiveness. The push for higher performance standards strengthens overall market growth.

Market Trends:

Growing Adoption of Smart Factories and Connected Systems:

Smart factory adoption shapes a key trend in the metalworking machine market. Companies integrate connected systems that improve workflow visibility. IoT-enabled machines transmit real-time performance data for better planning. Artificial intelligence applications optimize tool paths and enhance quality control. It reduces downtime through predictive analysis of failures. Cloud-based platforms allow remote monitoring and machine configuration. Factories aim to increase automation levels by linking equipment across entire production lines. The trend reflects a shift toward integrated digital manufacturing ecosystems.

- For instance, Rapid traverse speeds reach 50 m/min, optimizing flexible, automated production lines linked via IoT for real-time performance management. This technological advancement supports integrated digital manufacturing ecosystems with precision and efficiency.

Expansion of Sustainable and Energy-Efficient Machining Solutions:

Sustainability has emerged as a major trend in the metalworking machine market. Companies design machines with lower power consumption and reduced emissions. Eco-friendly cutting fluids and coolant systems gain preference. It aligns with global initiatives for greener industrial operations. Regulatory pressure accelerates the shift to sustainable production. Manufacturers develop lightweight machine frames to reduce energy loads. Recycling of scrap material is integrated into machining processes. Growing customer demand for sustainable equipment strengthens this transition. The trend ensures a competitive edge for eco-conscious suppliers.

- For instance, Energy efficiency is prioritized through the CELOS X app-based control system and automation options, reflecting the company’s green transformation goals aimed at reducing power consumption and emissions during machining.

Increasing Role of Additive Manufacturing and Hybrid Systems:

Additive manufacturing adoption represents a significant trend in the metalworking machine market. Hybrid systems combining subtractive and additive methods gain traction. It provides flexibility in producing complex components efficiently. Aerospace and medical industries adopt hybrid machines to improve prototyping speed. These solutions reduce material wastage compared to traditional machining. Manufacturers integrate 3D printing to enhance design freedom. Demand for customized machine tools rises alongside additive capabilities. This fusion of technologies broadens the scope of machining processes.

Rising Emphasis on Workforce Upskilling and Automation Balance:

The demand for skilled labor influences trends in the metalworking machine market. Companies face shortages of workers trained in advanced digital equipment. It creates emphasis on workforce development and specialized training programs. Automation balances skill gaps by reducing reliance on manual processes. Educational institutions expand curricula to cover CNC and robotic systems. Industry players invest in training centers for clients and employees. Government initiatives support skill development in industrial hubs. Collaborative approaches between firms and academia address long-term workforce needs. The trend ensures technology adoption does not outpace human capability.

Market Challenges Analysis:

High Capital Costs and Barriers to Adoption:

The high capital requirement remains a major challenge for the metalworking machine market. Small and medium enterprises hesitate to invest in advanced machines due to high upfront expenses. It limits adoption in regions with limited financial support. Many companies face difficulties in securing funding for large-scale upgrades. Leasing and financing options are improving, but accessibility remains uneven. The need for skilled operators further raises operational costs. Maintenance of technologically advanced equipment also adds to expenses. The cost challenge delays adoption among budget-sensitive manufacturers.

Shortage of Skilled Labor and Technological Complexity:

The shortage of skilled labor creates a challenge for the metalworking machine market. Operating CNC and robotic systems requires training and expertise. Many firms in emerging economies face gaps in workforce capabilities. It slows the pace of technology adoption. Technological complexity further raises entry barriers for small-scale firms. Companies must invest in workforce development to address skill shortages. The integration of advanced systems demands continuous upskilling. Without skilled workers, the full potential of machines remains untapped. The skill gap is a persistent obstacle for sustained market expansion.

Market Opportunities:

Expansion in Emerging Economies with Growing Manufacturing Demand:

Expansion into emerging economies presents strong opportunities in the metalworking machine market. Rapid industrialization creates a steady requirement for advanced machining solutions. It allows suppliers to enter markets with high growth potential. Governments in Asia, Latin America, and Africa invest in industrial corridors. Infrastructure development accelerates demand for heavy fabrication machines. Suppliers can benefit by offering cost-effective models tailored to local industries. Rising exports from these regions increase reliance on advanced equipment. The momentum of industrial growth ensures long-term opportunity for global players.

Innovation in Smart and Customizable Machine Solutions:

Innovation in smart technologies creates new opportunities for the metalworking machine market. Integration of IoT and AI enhances efficiency and precision in operations. It helps manufacturers achieve predictive maintenance and real-time monitoring. Customizable machines gain attention from industries seeking flexible solutions. Aerospace, automotive, and medical industries benefit from tailored designs. Growing interest in hybrid systems combining additive and subtractive processes strengthens adoption. Suppliers with innovative portfolios gain competitive advantages. The demand for smart, adaptive solutions expands market opportunities across diverse industries.

Market Segmentation Analysis:

By Machine Type

The metalworking machine market by machine type is led by CNC machines due to their high precision, automation capability, and widespread adoption across industries. Laser cutting machines hold a significant share supported by demand in aerospace and electronics where accuracy is critical. Plasma and waterjet cutting machines are preferred in heavy industries for their ability to process thick materials. It shows steady demand for traditional lathes, milling, drilling, and boring machines, especially in cost-sensitive markets where versatility and affordability remain priorities.

- For example, DMG MORI’s vertical milling machines range from compact units like the DMP 35 to large-scale models like the DMV 185, designed for components longer than 2,000 mm, enabled by advanced controls from SIEMENS, HEIDENHAIN, MITSUBISHI, and FANUC.

By Application

By application, metal cutting dominates the segment, driven by automotive and aerospace requirements for precision components. Metal forming and welding maintain strong use in construction and manufacturing sectors. Surface treatment, stamping, punching, and rolling also see steady adoption across diverse industries. The metalworking machine market benefits from multi-industry reliance on these processes, which support both large-scale production and specialized fabrication needs.

- For instance, The ULTRASONIC 20 linear surpasses µPrecision tolerances with positioning accuracy of 2 µm linear axes and 2 seconds rotary swivel axis accuracy, while ultrasonic superimposition reduces process forces by 50% enabling higher feed rates and longer tool life, critical for advanced materials processing in semiconductor and aerospace sectors.

By End Use Industry

By end-use industry, automotive holds the leading share due to mass production requirements. Aerospace follows with strong demand for precision machining, while construction and manufacturing remain vital contributors. Defense focuses on specialized equipment for advanced materials, and electronics rely on precision cutting for miniaturized components. It gains further traction from medical devices, where accuracy and customization are critical for growth.

By Technology

By technology, computer numerical control technology dominates due to efficiency and integration with digital manufacturing systems. Servo motor technology supports precise motion control, while hydraulic technology remains important in heavy-duty applications. Automation levels continue to shift toward fully automatic solutions, reducing manual dependency and increasing productivity across industries.

Segmentation:

By Machine Type:

- CNC Machines

- Laser Cutting Machines

- Plasma Cutting Machines

- Waterjet Cutting Machines

- Lathes

- Milling Machines

- Drilling Machines

- Boring Machines

By Application:

- Metal Cutting

- Metal Forming

- Welding

- Surface Treatment

- Stamping

- Punching

- Rolling

By End Use Industry:

- Automotive

- Aerospace

- Construction

- Manufacturing

- Defense

- Electronics

- Medical Devices

By Technology:

- Computer Numerical Control Technology

- Servo Motor Technology

- Hydraulic Technology

- Automation Level

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific Dominance

Asia-Pacific holds the largest share of the metalworking machine market with 45 percent. Strong industrial bases in China, Japan, and South Korea drive adoption across automotive, aerospace, and electronics sectors. It benefits from rapid industrialization, expanding infrastructure projects, and government-backed initiatives to strengthen domestic manufacturing capacity. CNC machines and advanced cutting solutions see significant demand in this region. India adds momentum with rising investments in automotive production and industrial corridors. Growing exports of manufactured goods increased reliance on advanced machining systems. The region remains the key growth engine for global suppliers.

Europe’s Strong Engineering Base

Europe accounts for 28 percent of the metalworking machine market, supported by its precision engineering and aerospace industries. Germany, Italy, and France lead adoption of laser and CNC machines for high-performance applications. It reflects a mature market with strong emphasis on technological innovation and energy-efficient solutions. Advanced machinery is also critical to medical device manufacturing and defense production in the region. Regulatory standards encourage sustainable and efficient machine adoption. Demand is supported by strong R&D investments and collaborative industry projects. The European market continues to focus on high-value, precision-driven applications.

North America’s Technological Readiness

North America holds 18 percent of the metalworking machine market, shaped by advanced manufacturing practices and strong infrastructure. The United States leads adoption, supported by aerospace, defense, and automotive industries. It emphasizes integration of digital manufacturing, IoT, and automation technologies to enhance efficiency. Canada contributes with steady growth in construction and energy-related industries. The region shows strong preference for CNC and fully automated machines. Skilled workforce availability and innovation-driven strategies strengthen the market’s position. North America continues to be a hub for advanced machine tool adoption and industrial modernization.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- DMG Mori Co., Ltd.

- Yamazaki Mazak Corporation

- Haas Automation, Inc.

- Doosan Machine Tools Co., Ltd.

- Dalian Machine Tool Group Co., Ltd.

- Hurco Companies, Inc.

- Hardinge, Inc.

- Fives Machining Systems, Inc.

- Kennametal, Inc.

- Amada Co., Ltd.

- Sandvik AB

- TRUMPF Group

- Mitsubishi Heavy Industries Ltd.

- Okuma Corporation

- FANUC

Competitive Analysis:

The metalworking machine market is highly competitive with global players focusing on innovation, automation, and digital integration. Companies such as DMG Mori, Yamazaki Mazak, TRUMPF, and FANUC lead by offering advanced CNC machines, laser cutting systems, and robotic solutions. It is shaped by continuous investments in R&D, mergers, and partnerships aimed at strengthening global reach. Regional players compete by providing cost-effective and versatile machines suited for local industries. The presence of diverse players creates a mix of high-end, precision-driven products and affordable traditional solutions, keeping competition intense across regions.

Recent Developments:

- In July 2025, DMG Mori Co., Ltd. announced eight world premieres in manufacturing solutions that emphasize Machining Transformation (MX). New models include advanced 5-axis simultaneous machining centers like the DMC 55 H Twin, the NLX 2500|1250 universal turning machine, and the NZ DUE TC with two turn-mill spindles. Additionally, DMG Mori introduced the ULTRASONIC 60 Precision that combines 5-axis milling with ultrasonic-assisted precision machining. Alongside these machines, the company showcased automation advancements such as the AMR 1000 driverless transport system designed for autonomous handling of tools and pallets.DMG Mori also highlighted their US-built Powder Bed 3D printer at their 2025 Innovation Days, focusing on additive manufacturing solutions to enhance manufacturing capabilities and efficiency.

- Dalian Machine Tool Group Co., Ltd. held a factory open day event in April 2025 focused on technological breakthroughs in horizontal machining centers. They signed a sales framework contract totaling over 100 million yuan, showcasing new horizontal machining products and highlighting investments in core technologies and market expansion.

- Fives Machining Systems, Inc. demonstrated its expertise in smart automation solutions at Automate 2025, showcasing industrial automation services including TruIVS™ Intelligent Machine Vision Technology for real-time monitoring and AI-powered quality control applications.

Market Concentration & Characteristics:

The metalworking machine market is moderately concentrated, with leading players holding significant influence due to strong technological capabilities and global distribution networks. It reflects a balance between multinational corporations offering advanced, high-performance machines and regional manufacturers catering to cost-sensitive industries. Continuous product innovation, focus on automation, and integration of digital manufacturing technologies characterize the competitive environment. The market shows a mix of high-value specialized equipment and traditional versatile machines, ensuring demand across both developed and emerging economies.

Report Coverage:

The research report offers an in-depth analysis based on By Machine Type, By Application, By End Use Industry, and By Technology. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for CNC and automated machines will dominate industry adoption.

- Laser cutting systems will see strong growth in aerospace and electronics.

- Waterjet and plasma machines will expand in heavy industries and construction.

- Automotive will remain a leading end-use sector for advanced machining.

- Medical devices will gain share due to precision and customization needs.

- Asia-Pacific will continue to drive global growth through industrial expansion.

- Europe will strengthen its base with precision-driven engineering applications.

- North America will advance through integration of digital manufacturing systems.

- Sustainability will shape machine designs with energy-efficient features.

- Hybrid and additive-enabled systems will redefine advanced machining processes.