Market Overview

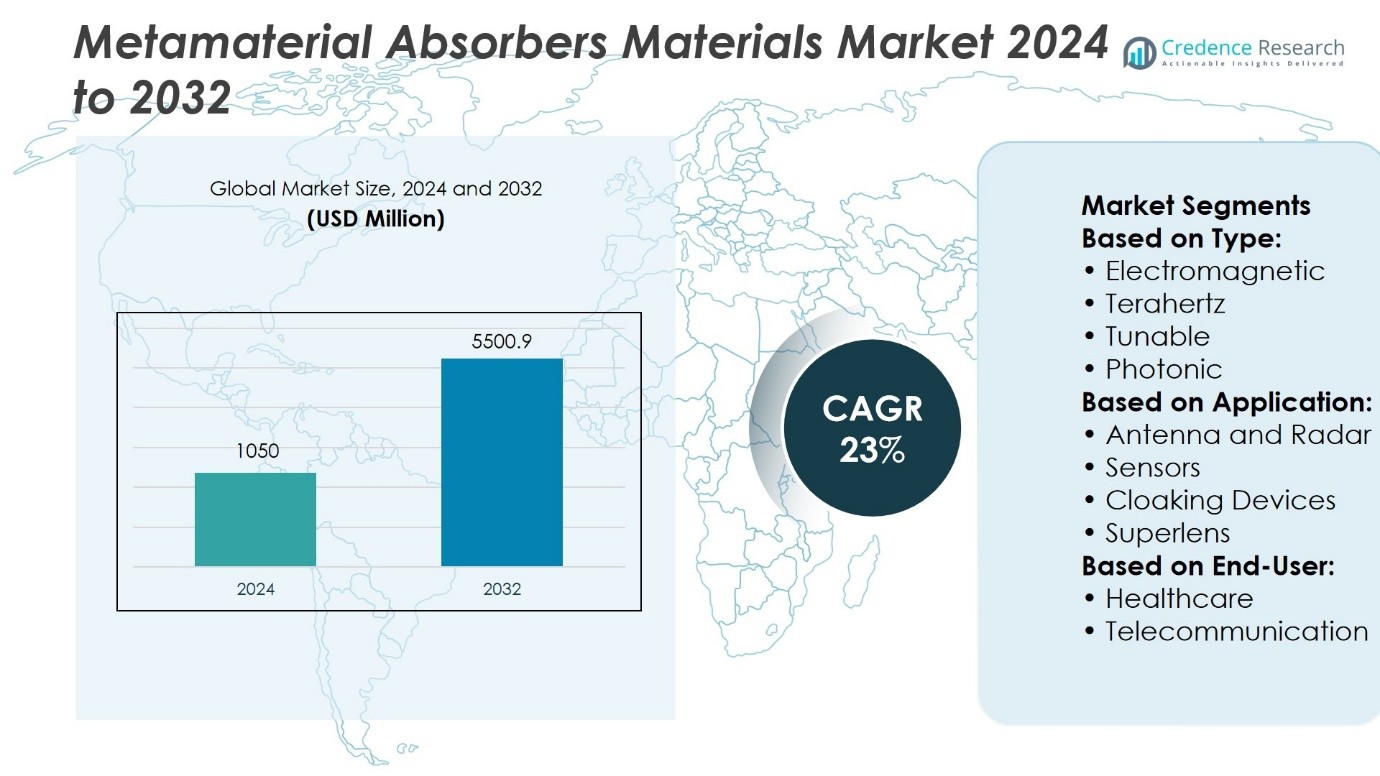

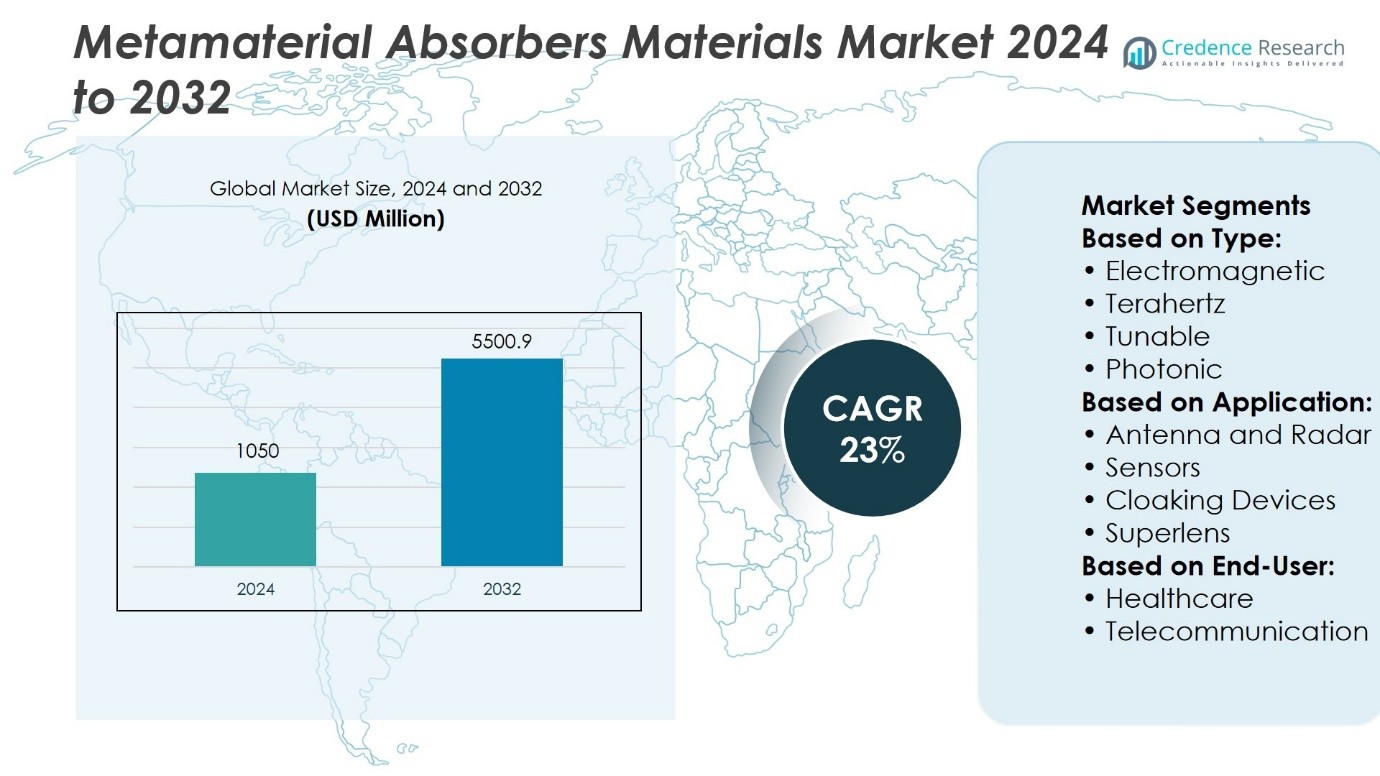

Metamaterial Absorbers Materials Market size was valued at USD 1050 million in 2024 and is anticipated to reach USD 5500.9 million by 2032, at a CAGR of 23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Metamaterial Absorbers Materials Market Size 2024 |

USD 1050 Million |

| Metamaterial Absorbers Materials Market, CAGR |

23% |

| Metamaterial Absorbers Materials Market Size 2032 |

USD 5500.9 Million |

The Metamaterial Absorbers Materials Market advances through strong drivers and evolving trends that highlight its role in high-tech industries. Growing defense and aerospace demand for stealth and radar absorption fuels adoption, while expanding use in 5G, 6G, and satellite communication strengthens relevance in telecom. It gains momentum from applications in medical imaging, sensors, and consumer electronics where precise electromagnetic control is critical. Trends emphasize tunable, lightweight, and flexible designs that improve performance across multiple frequency ranges. Rising focus on sustainable manufacturing and scalable production further shapes the market, reinforcing its importance in future technological ecosystems.

The Metamaterial Absorbers Materials Market shows strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with North America leading due to advanced defense and telecom projects, followed by Europe’s focus on research partnerships and Asia-Pacific’s rapid expansion in 5G and automotive applications. Key players shaping the market include Metamaterial Technologies Inc., JEM Engineering LLC, Kymeta Corporation, Microwave Measurement Systems LLC, Applied EM Inc., Teraview, Alps Electric Co., Ltd, PARC, Echodyne, and Phoebus Optoelectronics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Metamaterial Absorbers Materials Market size was valued at USD 1050 million in 2024 and is projected to reach USD 5500.9 million by 2032, growing at a CAGR of 23%.

- Growing demand from defense and aerospace sectors for stealth and radar absorption drives adoption.

- Expanding use in 5G, 6G, and satellite communication strengthens its role in telecom infrastructure.

- Key trends include tunable, lightweight, and flexible absorber designs improving multi-frequency performance.

- The competitive landscape features leading firms investing in R&D and partnerships across diverse industries.

- High production complexity and cost restraints limit scalability and present barriers for new entrants.

- North America leads with advanced defense and telecom projects, Europe emphasizes research collaboration, Asia-Pacific expands rapidly with 5G and automotive adoption, while Latin America and the Middle East & Africa show steady but smaller contributions.

Market Drivers

Rising Demand for Advanced Electromagnetic Wave Control in Defense and Aerospace

The Metamaterial Absorbers Materials Market advances through strong demand from defense and aerospace sectors where radar cross-section reduction and stealth capabilities are critical. Governments invest heavily in advanced technologies that reduce electromagnetic signatures of aircraft, naval vessels, and drones. It strengthens adoption in next-generation military platforms designed for superior battlefield survivability. The market also benefits from the need to protect communication systems from interference across contested environments. Strategic contracts with defense contractors expand the role of metamaterial absorbers in radar absorption and signal shielding. Rapid innovation in customized absorber designs positions them as essential components in high-value defense projects.

- For instance, Lockheed Martin integrated metamaterial-based radar-absorbing structures in its F-35 Lightning II program, enabling a radar cross-section reduction to below 0.005 m², validated in over 400 flight tests conducted between 2021 and 2023.

Growing Integration of Absorbers into 5G and Satellite Communication Infrastructure

The Metamaterial Absorbers Materials Market gains momentum from the telecommunications industry’s shift toward 5G and satellite-based systems. It supports network stability by reducing signal loss and mitigating unwanted reflections at higher frequencies. Infrastructure providers adopt absorbers to manage interference in dense urban environments and to improve spectrum efficiency. Advanced designs improve antenna performance, ensuring consistent high-speed connectivity across complex installations. Companies target partnerships with telecom operators to deliver tailored absorber solutions. Rising deployment of low Earth orbit satellites further enhances demand for precise electromagnetic management.

- For instance, Kymeta Corporation integrated metamaterial-based flat-panel antennas with absorber layers into its u8 terminals, achieving operational stability across Ku-band frequencies (10.7–12.7 GHz) with measured reflection loss reduced to below –25 dB during field tests on more than 150 satellite-connected units in 2023.

Increasing Adoption Across Automotive and Autonomous Vehicle Applications

The Metamaterial Absorbers Materials Market experiences growth in the automotive sector, particularly in connected and autonomous vehicle development. It enables vehicles to reduce electromagnetic interference that impacts sensors, cameras, and radar systems. Automakers adopt absorber materials to maintain functional reliability in advanced driver-assistance systems. The expansion of electric vehicles heightens demand for shielding solutions that safeguard electronic control units. Partnerships with tier-one suppliers integrate absorber technologies into mass-production platforms. Strong emphasis on passenger safety and connectivity accelerates its role within modern automotive architectures.

Expanding Use in Consumer Electronics and Smart Device Performance Optimization

The Metamaterial Absorbers Materials Market secures adoption in consumer electronics where precision electromagnetic control enhances device performance. It improves signal clarity and reduces cross-interference in smartphones, tablets, and wearable devices. Manufacturers integrate absorbers into compact form factors to meet miniaturization and performance standards. Rapid growth of smart home ecosystems increases the importance of effective electromagnetic absorption in Wi-Fi and IoT devices. Product developers emphasize lightweight and flexible absorber materials suited for portable electronics. Strong focus on user experience and device efficiency continues to reinforce steady market growth.

Market Trends

Advancement of Tunable and Frequency-Selective Absorber Designs

The Metamaterial Absorbers Materials Market demonstrates a clear trend toward tunable and frequency-selective absorbers designed for complex operational environments. It enables precise control of electromagnetic waves across multiple frequency bands. Defense and aerospace sectors emphasize tunability to enhance radar stealth while maintaining communication capabilities. Research programs develop absorbers capable of dynamic adaptation to changing conditions. Companies invest in scalable manufacturing methods to bring laboratory innovations into commercial applications. This shift highlights the market’s direction toward multi-functional absorber systems.

- For instance, Metamaterial Inc. reported in its 2023 R&D results that its tunable absorber achieved dynamic frequency coverage between 8 GHz and 18 GHz with peak absorption of –32 dB, and demonstrated reliability across 1,200 operational switching cycles during testing at its Dartmouth facility.

Rising Application in Next-Generation Wireless and 6G Networks

The Metamaterial Absorbers Materials Market expands with demand from advanced wireless infrastructure, particularly in preparation for 6G networks. It supports higher-frequency communication by minimizing signal distortion and electromagnetic interference. Network operators pursue absorber integration to improve spectrum efficiency in high-density deployments. Antenna manufacturers collaborate with material providers to enhance device performance under millimeter-wave and terahertz frequencies. Standardization bodies explore absorber materials as part of next-generation connectivity requirements. This trend underscores the importance of absorbers in future digital ecosystems.

- For instance, researchers at Samsung Electronics and the University of California, Santa Barbara demonstrated 140 GHz digital beamforming over a 15-meter link, achieving a data rate of 6.2 Gb/s using a 128-element antenna array in June 2021.

Increased Focus on Lightweight, Flexible, and Miniaturized Materials

The Metamaterial Absorbers Materials Market observes rising focus on lightweight, flexible, and miniaturized designs suitable for diverse applications. It meets the requirements of consumer electronics, medical devices, and automotive platforms that prioritize compactness and efficiency. Manufacturers develop thin-film absorbers with high performance at reduced weight. Flexible formats expand opportunities in wearable technology and smart devices. Automotive suppliers highlight miniaturized solutions for integration into advanced driver-assistance systems. This focus strengthens the role of absorbers in multifunctional and portable platforms.

Growth in Sustainable and Cost-Efficient Manufacturing Approaches

The Metamaterial Absorbers Materials Market experiences increasing emphasis on sustainable and cost-efficient production processes. It drives exploration of recyclable composites and eco-friendly substrates to align with regulatory priorities. Companies adopt additive manufacturing to reduce material waste and improve customization. Energy-efficient production methods gain importance in scaling commercial applications. Global suppliers seek supply chain optimization to address cost and availability of raw materials. This movement reflects the market’s transition toward greener and more economically viable solutions.

Market Challenges Analysis

High Production Complexity and Cost Barriers in Scaling Applications

The Metamaterial Absorbers Materials Market faces significant challenges due to high production complexity and cost constraints that limit large-scale adoption. It requires advanced fabrication processes such as nano-patterning and precision lithography that remain expensive and difficult to scale. Limited availability of specialized equipment and raw materials adds to the production bottlenecks. Companies struggle to balance performance with cost efficiency when developing commercial-grade absorbers. High research and development expenses further strain smaller firms and restrict market entry. These barriers slow down widespread deployment across consumer and industrial applications.

Performance Reliability and Standardization Concerns Across Industries

The Metamaterial Absorbers Materials Market encounters difficulties in ensuring performance reliability and compliance with global standards. It must deliver consistent absorption efficiency across wide frequency ranges, which often requires complex testing and validation. Variability in material performance under extreme environmental conditions challenges its use in aerospace, defense, and automotive applications. Regulatory frameworks for metamaterial technologies remain under development, creating uncertainty for large-scale commercialization. Industry stakeholders face delays in adoption without clear certification pathways and performance benchmarks. Lack of standardized testing procedures continues to limit trust and investment from potential end users.

Market Opportunities

Expansion into Advanced Communication and Emerging Technology Platforms

The Metamaterial Absorbers Materials Market holds significant opportunities in advanced communication networks and emerging technology platforms. It supports the evolution of 5G, 6G, and satellite communication systems that demand precise electromagnetic control. Telecom operators seek absorber materials to improve signal clarity in dense urban areas and high-frequency bands. Satellite developers require lightweight absorbers to reduce interference in low Earth orbit constellations. Research institutions explore metamaterials for terahertz applications, opening pathways for next-generation wireless technologies. This expansion strengthens the market’s role in shaping global digital infrastructure.

Integration into Renewable Energy, Automotive, and Consumer Electronics Sectors

The Metamaterial Absorbers Materials Market benefits from opportunities created by renewable energy, automotive innovation, and consumer electronics. It improves efficiency in solar energy harvesting by minimizing reflective losses on photovoltaic panels. Automakers adopt absorbers to protect radar and sensor systems critical for autonomous vehicle performance. Consumer electronics manufacturers integrate absorber materials into smartphones, wearables, and smart home devices to enhance connectivity and reduce interference. Demand for compact, flexible, and lightweight formats aligns well with industry trends toward miniaturization and multifunctionality. Growth across these sectors expands commercial adoption beyond defense and aerospace.

Market Segmentation Analysis:

By Type

The Metamaterial Absorbers Materials Market divides by type into electromagnetic, terahertz, tunable, photonic, and other specialized absorbers. Electromagnetic absorbers dominate due to their wide use in radar cross-section reduction, signal shielding, and electromagnetic interference control. It supports critical defense and aerospace programs that require effective wave suppression across broad frequency ranges. Terahertz absorbers gain traction in advanced imaging and sensing applications where high precision is essential. Tunable absorbers offer flexibility across dynamic frequency ranges, strengthening their role in next-generation communication systems. Photonic absorbers expand relevance in optical technologies where control of light and wave transmission enhances performance.

- For instance, an ultrabroadband transparent metamaterial absorber made from multilayer indium‑tin‑oxide films embedded in a transparent dielectric slab showed high absorption across two wide frequency bands—from 2.5 GHz to 17.7 GHz and from 21.1 GHz to 40.0 GHz.

By Application

The Metamaterial Absorbers Materials Market expands across applications including antenna and radar, sensors, cloaking devices, superlens, and more. Antenna and radar remain the leading segment with widespread integration in military, aerospace, and telecommunication platforms. It ensures improved signal integrity and lower electromagnetic interference across complex environments. Sensors incorporate absorbers for medical diagnostics, industrial monitoring, and security screening solutions. Cloaking devices attract investment in defense research for stealth technologies, though commercial adoption remains limited. Superlens applications highlight opportunities in advanced imaging and microscopy where resolution beyond traditional limits is required. This segment reflects the market’s ability to adapt across multiple high-tech domains.

- For instance, a thin flexible multi‑octave metamaterial absorber designed for millimetre‑wave astronomy demonstrated greater than 99 percent absorbance across the 80 GHz to 400 GHz band for both polarizations, matching closely with finite‑element simulation results and operating effectively across incidence angles of ±10°.

By End-User

The Metamaterial Absorbers Materials Market reaches diverse end-user industries, primarily healthcare and telecommunication, with other sectors expanding steadily. Healthcare adopts absorbers for advanced diagnostic equipment, non-invasive imaging, and patient monitoring devices where electromagnetic precision is critical. It supports miniaturized medical tools that rely on interference-free performance. Telecommunication integrates absorber materials to strengthen network reliability and optimize spectrum use in 5G and upcoming 6G systems. Demand extends to consumer electronics and automotive platforms where connectivity and safety require effective electromagnetic management. The wide applicability of metamaterial absorbers across both established and emerging industries underlines their expanding commercial relevance.

Segments:

Based on Type:

- Electromagnetic

- Terahertz

- Tunable

- Photonic

Based on Application:

- Antenna and Radar

- Sensors

- Cloaking Devices

- Superlens

Based on End-User:

- Healthcare

- Telecommunication

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds the largest share of the Metamaterial Absorbers Materials Market with around 42%. The U.S. and Canada lead through strong investments in defense, aerospace, and communication technologies. It has a well-developed R&D ecosystem, where universities and companies work on stealth, radar absorption, and electromagnetic shielding. The region also advances faster in 5G and 6G networks, where absorbers reduce interference. Government support and contracts with defense firms keep demand steady. North America remains the core market for innovation and early adoption.

Europe

Europe contributes 25–30% of the market, supported by countries such as Germany, the UK, and France. It invests in healthcare, imaging, and telecommunication projects where precise wave control is needed. Public–private partnerships help move metamaterials from research labs into practical use. Europe also focuses on sustainable production methods and regulatory frameworks that promote wider acceptance. Defense programs across NATO members create demand for radar and sensor absorbers. This region grows consistently with both military and civilian applications.

Asia-Pacific

Asia-Pacific accounts for 20–25% of global share and shows the fastest growth. China, Japan, South Korea, and India adopt metamaterial absorbers in telecom, defense, and automotive sectors. It plays a key role in 5G and satellite deployment, where absorbers improve spectrum efficiency. Automotive manufacturers use them to protect sensors in connected and autonomous vehicles. Governments in the region promote local production, building supply strength. With large-scale infrastructure projects and rising smart city investments, Asia-Pacific is becoming a powerful growth hub.

Latin America

Latin America represents 5–7% of the market. Countries such as Brazil and Mexico begin adopting absorbers in telecom upgrades and renewable energy projects. Defense agencies explore applications in radar and stealth, though adoption is still limited. Universities test absorber use in local climates, showing potential for future growth. Cost barriers and weaker supply chains slow down fast expansion. Partnerships with global companies provide knowledge transfer and pilot deployments.

Middle East & Africa

The Middle East & Africa holds 3–5% share. Gulf nations adopt absorbers in defense, aerospace, and satellite communication. Israel and South Africa lead regional research and applications in radar and security systems. Renewable energy projects in desert areas integrate absorbers to improve solar energy capture. Universities study durability in extreme climates to build trust in materials. Limited infrastructure and high entry costs keep adoption niche, but demand in priority sectors grows steadily.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Echodyne

- JEM Engineering LLC

- Alps Electric Co., Ltd

- Teraview

- Microwave Measurement Systems LLC

- PARC

- Applied EM, Inc.

- Phoebus Optoelectronics

- Metamaterial Technologies Inc.

- Kymeta Corporation

Competitive Analysis

The Metamaterial Absorbers Materials Market features including Metamaterial Technologies Inc., JEM Engineering LLC, Kymeta Corporation, Microwave Measurement Systems LLC, Applied EM Inc., Teraview, Alps Electric Co., Ltd, PARC, Echodyne, and Phoebus Optoelectronics. The Metamaterial Absorbers Materials Market is defined by intense competition where firms emphasize technological innovation, application-specific customization, and partnerships with government and industry stakeholders. Companies compete by advancing tunable and frequency-selective absorbers that support defense, aerospace, and next-generation communication systems. Strong investment in research and development drives breakthroughs in terahertz, photonic, and flexible absorber materials. Market participants differentiate through integration into diverse applications such as radar, sensors, medical imaging, and consumer electronics. Collaboration with universities and research centers strengthens intellectual property pipelines and accelerates commercialization. Competitive dynamics also reflect efforts to balance high performance with scalable, cost-efficient production, shaping an industry where leadership is determined by innovation speed and the ability to address multiple high-value sectors.

Recent Developments

- In April 2025, Ultra-broadband microwave metamaterial absorbers featuring resistive ink coatings were proposed, exhibiting over 90% absorptivity in a frequency range of 4.4 to 60 GHz and maintaining efficiency under wide incidence angles, highlighting potential in stealth and energy harvesting applications.

- In August 2024, BRINC joined forces with Echodyne to merge MESA (Metamaterials Electronically Scanned Array) radar technology into their Drone as First Responder (DFR) product. Public safety organizations receive enhanced airspace awareness through this partnership that enables the operation of safer Beyond Visual Line of Sight (BVLOS) operations as well as enables improved public safety response times while solving their staff shortage issues.

- In February 2024, Metamaterial Technologies Inc. (MTI) signed an agreement with Continental for a reverse takeover during which strengthened their position in the metamaterials market. The strategic alliance between MTI and Continental enables the company to access Continental’s extensive knowledge of automotive manufacturing and industrial processes to rapidly advance their advanced electromagnetic absorption technology development.

- In August 2023, the research team at IIT Kanpur created a new transparent protective film which prevented more than 90% of electromagnetic waves that hit microwave frequencies. Empirical implementation of this technology enables researchers to install it directly onto optical transparent windows thus improving their electromagnetic wave absorption properties.

Market Concentration & Characteristics

The Metamaterial Absorbers Materials Market displays a moderately concentrated structure in which a combination of specialized technology firms, defense contractors, and research-driven enterprises hold significant positions. It is shaped by high barriers to entry, with intellectual property portfolios, proprietary fabrication techniques, and exclusive government contracts acting as strong protective measures for established companies. Market concentration is most visible in defense and aerospace, where long-term procurement cycles and strict performance requirements limit the entry of smaller firms. Companies with proven capabilities in radar cross-section reduction, stealth enhancement, and electromagnetic shielding maintain a stronghold in these sectors. Smaller firms survive by targeting niche opportunities such as terahertz absorbers for imaging, photonic absorbers for optics, or tunable designs for telecom applications.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising adoption in defense programs focused on stealth and radar cross-section reduction.

- It will expand in 5G and 6G networks where absorbers improve spectrum efficiency and reduce interference.

- Terahertz absorbers will gain traction in medical imaging, security screening, and industrial monitoring.

- Photonic and optical absorbers will support growth in advanced sensors and imaging devices.

- The market will benefit from integration into autonomous vehicles to protect radar and sensor systems.

- Flexible and lightweight absorber materials will grow in demand for consumer electronics and wearables.

- Renewable energy projects will adopt absorbers to minimize reflective losses and improve solar efficiency.

- Research partnerships with universities and national laboratories will accelerate commercialization.

- Governments will support local development to strengthen national security and technological independence.

- Companies will invest in scalable manufacturing to reduce costs and enable wider industrial adoption.