Market Overview

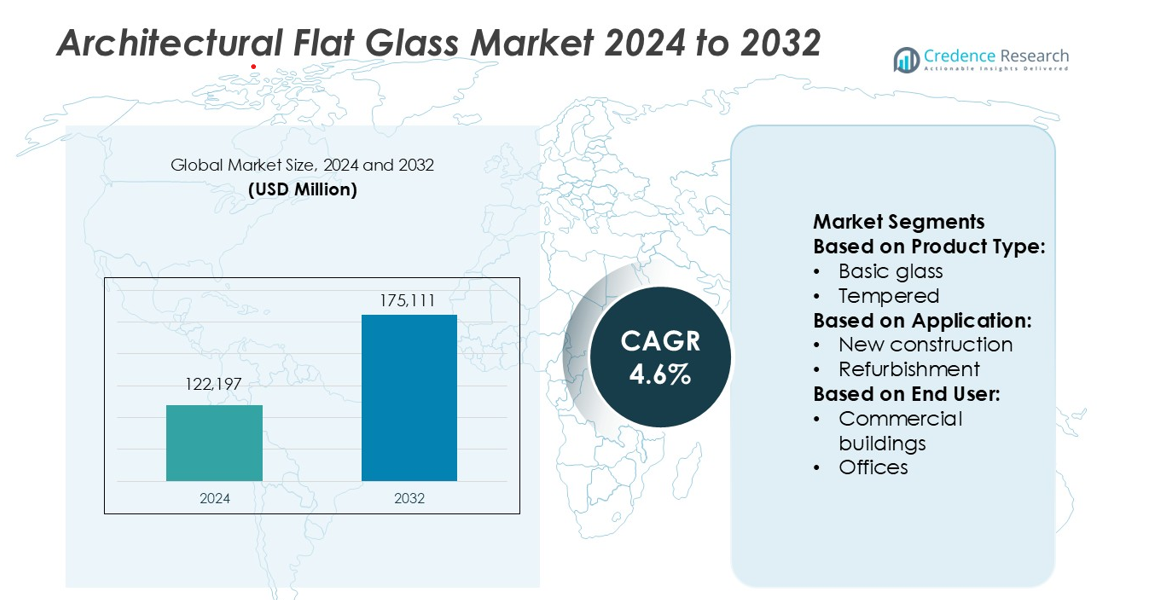

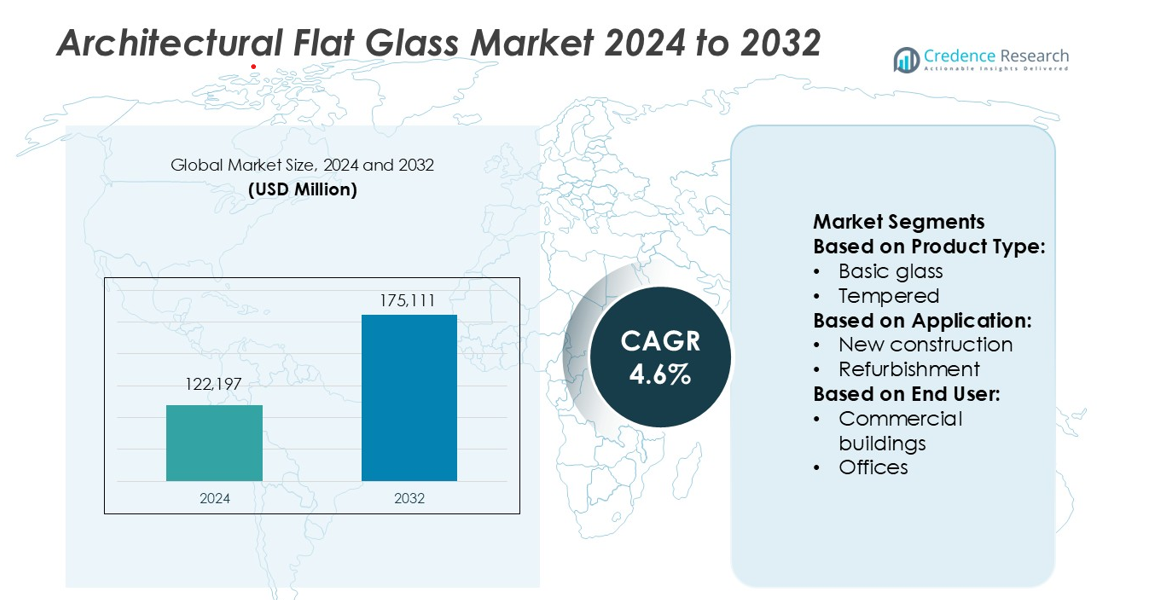

Architectural Flat Glass Market size was valued USD 122,197 million in 2024 and is anticipated to reach USD 175,111 million by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Architectural Flat Glass Market Size 2024 |

USD 122,197 million |

| Architectural Flat Glass Market, CAGR |

4.6% |

| Architectural Flat Glass Market Size 2032 |

USD 175,111 million |

The Architectural Flat Glass Market Cardinal Glass Industries, AGC, NSG Group, Glasfabrik Lamberts, Guardian Industries, China Glass Holdings, Asahi India Glass, Guardian Glass, CSG Holding, and Central Glass are the top players in the Architectural Flat Glass Market, driving innovation and growth globally. These companies focus on expanding production capacity, developing energy-efficient, laminated, and low-emissivity glass, and enhancing distribution networks to strengthen market presence. Strategic initiatives such as mergers, acquisitions, and regional expansions allow them to cater to rising demand across commercial, residential, and infrastructural projects. Asia emerges as the leading region, holding 58.71% market share, fueled by rapid urbanization, large-scale residential and commercial construction, and infrastructure development. The combination of strong regional demand and technological innovation by these key players ensures sustained competitiveness and positions the market for continued growth across both mature and emerging economies.

Market Insights

- The Architectural Flat Glass Market size was valued USD 122,197 million in 2024 and is expected to reach USD 175,111 million by 2032, growing at a CAGR of 4.6%.

- Demand is driven by rapid urbanization, large-scale residential and commercial construction, and increasing focus on energy-efficient and low-emissivity glass solutions.

- Market trends include adoption of smart glass, laminated and coated products, sustainable building practices, and integration of automated façade solutions.

- The competitive landscape is led by Cardinal Glass Industries, AGC, NSG Group, Glasfabrik Lamberts, Guardian Industries, China Glass Holdings, Asahi India Glass, Guardian Glass, CSG Holding, and Central Glass, focusing on technological innovation, production expansion, and regional growth strategies.

- Asia leads with 58.71% market share, followed by North America and Europe, while segments such as insulated and laminated glass dominate due to high demand in commercial, residential, and infrastructural applications, supporting steady market growth across emerging and mature regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The product‑type segment in the architectural flat glass market is led by the insulated glass unit (IGU) sub‑segment, which captured approximately 38.22 % of revenue in 2023.The insulated unit’s dominance stems from strong demand for thermal and acoustic insulation in modern buildings, stringent energy‑efficiency regulations, and growth in high‑rise construction where multi‑pane glazing is required. Other types such as basic glass, tempered, laminated, decorative and “others” (coated, tinted, patterned) contribute but trail insulated units in share. Manufacturers focus investment on advanced insulation, low‑emissivity coatings and multi‑pane systems.

- For instance, Cardinal Glass Industries developed its XL Edge IGU system, featuring stainless steel spacers and argon-filled cavities that achieve a thermal conductivity of 0.026 W/m·K.

By Application

The application segment is dominated by the new‑construction sub‑segment, which held about 44.2 % of market share according to a recent forecast dominance reflects the strong volume of new residential and commercial building projects globally, especially in emerging markets undergoing urbanization and infrastructure expansion. In the new‑construction space, demand is elevated for full‑building glazing solutions, curtain‑walls, windows and energy‑efficient envelopes, all of which drive flat glass consumption. Refurbishment, interior construction and other applications remain relevant but currently account for lesser volumes.

- For instance, AGC Glass introduced its FINEO vacuum-insulating glass unit featuring a vacuum cavity of just 0.1 mm between two glass panes and achieving a U-value of 0.7 W/(m²·K).

By End‑User

Within end‑user segmentation, the residential sub‑segment leads the market with a share of approximately 54.81 % in 2023.This leadership is driven by escalating global housing demand, growth in urban apartment construction, and preferences for glazed façades, balconies and large‑window homes. Residential buildings increasingly incorporate advanced glass (e.g., insulation, smart glazing) to meet energy‑efficiency mandates and consumer aesthetics. The non‑residential (commercial, offices) sector also remains key but currently lags residential in overall consumption of architectural flat glass.

Key Growth Drivers

Rising Construction Activities

The expansion of residential, commercial, and infrastructure projects drives demand for architectural flat glass. Urbanization and modernization initiatives fuel new construction and refurbishment activities. For instance, Saint-Gobain supplied over 120,000 square meters of energy-efficient glass for Europe’s largest commercial complex, supporting structural and aesthetic requirements. High-rise buildings increasingly incorporate glass façades, promoting tempered and laminated variants. This consistent construction growth ensures sustained consumption across glazing, interiors, and exterior applications, thereby reinforcing market expansion and stimulating demand for specialized and high-performance glass products globally.

- For instance, NSG also launched its “Pilkington Mirai™” glass range which achieved a verified embodied-carbon value of 5 kg CO₂/m² for 4 mm glass, compared with ~10.3 kg/m² for standard float glass.

Demand for Energy-Efficient Solutions

Environmental regulations and sustainability goals elevate the adoption of insulated and low-emissivity glass. Builders and developers prioritize energy savings and reduced carbon footprints. For instance, AGC Glass implemented vacuum-insulated panels achieving thermal conductivity as low as 0.004 W/m·K, supporting green building certifications. Such innovations enhance building insulation and reduce energy costs, driving demand among residential and commercial developers. Energy-efficient glass integration strengthens architectural design appeal, promotes compliance with government policies, and positions manufacturers to capitalize on increasing preference for sustainable construction solutions worldwide.

- For instance, Glasfabrik Lamberts offers its LINIT® EcoGlass U-Profiled system which supports glass panels up to 7 metres in length without intermediate support.

Technological Advancements and Customization

Innovation in coatings, laminates, and smart glass technologies enhances product versatility. Features like self-tinting, UV protection, and acoustic control expand application scope. For instance, Guardian Glass launched electrochromic glass capable of switching from 70% light transmission to 5%, offering adaptive daylight control. Advanced fabrication techniques and design flexibility allow tailored solutions for complex architectural projects. These technological advancements support high-value segments, including premium office buildings and luxury residential units, creating growth opportunities for manufacturers focusing on differentiation and value-added offerings in architectural flat glass markets globally.

Key Trends & Opportunities

Integration with Smart Buildings

The trend toward smart buildings opens opportunities for interactive and automated glass systems. Electrochromic, solar, and dynamic glazing enhance energy management and user comfort. For instance, Asahi Glass developed switchable glass integrated with building management systems, allowing automated daylight control and energy optimization. Such integration aligns with increasing smart city initiatives, offering developers innovative solutions for sustainability and occupant convenience. Rising adoption in commercial and residential projects presents growth potential for manufacturers investing in smart glass R&D and tailored solutions for high-performance buildings.

- For instance, Guardian Industries’ SunGuard® SN 75 HT coating delivers visible light transmittance of 75 % in its double-glazed unit (6-16-4 / SunGuard on surface #2) with a U-value of 1.0 W/m²·K.

Growth in Refurbishment Projects

Renovation of aging infrastructure drives demand for architectural flat glass in interior and exterior upgrades. Retrofitting offices, hotels, and residential complexes requires tempered, laminated, and decorative glass. For instance, Pilkington supplied fire-resistant laminated glass for the refurbishment of a 25-story commercial building, enhancing safety and aesthetic appeal. Refurbishment opportunities enable manufacturers to expand market reach beyond new construction and capitalize on the increasing focus on modernized, energy-efficient, and visually appealing building designs globally.

- For instance, CSG Holding reports that its ultra-thin electronic float glass production line can manufacture sheets as thin as 0.15 mm in thickness.

Expansion in Emerging Economies

Rapid urbanization and rising disposable income in Asia-Pacific, Latin America, and the Middle East boost architectural flat glass adoption. New residential complexes and commercial developments drive demand for both functional and decorative glass. For instance, China National Building Material Group delivered 80,000 square meters of insulated and coated glass for mixed-use projects across tier-1 cities. Emerging markets provide a platform for manufacturers to scale operations, introduce innovative glass solutions, and capture growing segments seeking high-performance, aesthetically appealing architectural glazing solutions.

Key Challenges

High Production Costs

Raw material expenses, energy consumption, and technological investments increase manufacturing costs for architectural flat glass. Maintaining quality while controlling expenses remains challenging. For instance, NSG Group reported rising float glass production costs due to increased silica and soda ash prices. Cost pressures limit adoption among price-sensitive developers and restrict margin expansion for manufacturers. Companies must optimize production efficiency, adopt lean manufacturing, and innovate cost-effective solutions to sustain profitability while meeting growing global demand for specialized and high-performance glass products.

Stringent Regulatory Standards

Compliance with building codes, energy-efficiency norms, and safety standards restricts operational flexibility. Variations across countries add complexity for global manufacturers. For instance, Pilkington needed to certify fire-resistant and impact-resistant glass for multiple jurisdictions before deployment. Regulatory compliance increases production time, testing requirements, and documentation costs. Adhering to these standards is essential for market entry and reputation, but navigating diverse regulations poses a persistent challenge, particularly for manufacturers expanding into international markets while offering technologically advanced, customized glass solutions.

Regional Analysis

North America

North America holds 24.8% of the global architectural flat glass market in 2023. Growth is driven by steady commercial and residential construction, refurbishment of older buildings, and rising demand for energy-efficient glass solutions. The region emphasizes high-performance glazing products, including insulated, coated, and laminated glass, to meet sustainability targets and building codes. Strong architectural standards and preference for premium glass in office buildings, malls, and high-end residential projects sustain market activity. Additionally, technological advancements such as smart glass and low-emissivity coatings further enhance market adoption, positioning North America as a key mature and profitable market.

Europe

Europe accounted for 12.88% of the architectural flat glass market in 2023. Market growth is fueled by extensive retrofitting projects, strict energy-efficiency regulations, and rising demand for modern commercial construction. Insulated, laminated, and coated glass solutions are widely specified in office complexes, residential buildings, and public infrastructure. Sustainable building practices and green certifications boost adoption of energy-saving glazing. While construction expansion is moderate compared to Asia, Europe emphasizes quality and high-performance glass, sustaining steady demand. Advanced façade technologies and architectural innovations continue to create opportunities for manufacturers targeting premium segments.

Asia

Asia dominates the market with 58.71% share in 2023, driven by rapid urbanization, large-scale residential projects, and extensive infrastructure development. China and India lead adoption, leveraging insulated, laminated, and low-emissivity glass in modern construction. Growing investment in smart cities, commercial complexes, and high-rise residential towers significantly increases glass consumption. Energy efficiency regulations and façade modernization trends further accelerate adoption. Regional manufacturers focus on producing high-performance architectural glass to meet volume and quality demands. Overall, Asia remains the largest and fastest-growing market due to high construction activity and strong urbanization trends.

Latin America

Latin America holds 4.77% of the global architectural flat glass market in 2023. Demand is driven by infrastructure development, urbanization, and tourism-related construction, particularly in Brazil, Mexico, and Argentina. Market adoption of high-performance glass remains limited compared to North America and Europe due to cost sensitivity and economic fluctuations. Refurbishment projects and new urban developments, however, offer opportunities for growth. Manufacturers increasingly focus on energy-efficient glass, laminated solutions, and façade applications. While growth is moderate, improving urban infrastructure and modern commercial construction projects provide potential for incremental market expansion in the coming years.

Middle East & Africa

The Middle East & Africa region accounted for 7.32% of the architectural flat glass market in 2023. Mega-projects in Gulf countries, including commercial towers, residential complexes, and large public buildings, drive demand for high-quality façade and architectural glass. Africa’s market is smaller but shows potential growth due to rising urbanization, expanding commercial construction, and infrastructure modernization. Adoption of energy-efficient glass solutions is still at an early stage but is expected to increase as sustainable construction practices gain traction. Manufacturers targeting the region focus on premium glass solutions to meet high-performance and aesthetic requirements in large-scale projects.

Market Segmentations:

By Product Type:

By Application:

- New construction

- Refurbishment

By End User:

- Commercial buildings

- Offices

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Architectural Flat Glass Market players such as Cardinal Glass Industries, AGC, NSG Group, Glasfabrik Lamberts, Guardian Industries, China Glass Holdings, Asahi India Glass, Guardian Glass, CSG Holding, and Central Glass. The Architectural Flat Glass Market is highly competitive, driven by continuous innovation and technological advancements. Companies focus on enhancing energy-efficient, laminated, and low-emissivity glass products to meet growing demand in residential, commercial, and infrastructural projects. Strategic initiatives such as mergers, acquisitions, and regional expansions strengthen market presence and operational efficiency. The adoption of automated manufacturing and smart glazing solutions improves production throughput and product quality. Increasing emphasis on sustainable building practices and green certifications further boosts demand for high-performance architectural glass. Overall, the market competes on innovation, quality, and distribution networks, while catering to evolving architectural trends and regulatory requirements across mature and emerging regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cardinal Glass Industries

- AGC

- NSG Group

- Glasfabrik Lamberts

- Guardian Industries

- China Glass Holdings

- Asahi India Glass

- Guardian Glass

- CSG Holding

- Central Glass

Recent Developments

- In September 2024, AGC Glass Europe and ROSI, entered into a strategic partnership to enhance circularity in the glass industry. This collaboration aims to recycle end-of-life photovoltaic panels into high-purity raw materials for flat glass production, promoting sustainable and low-carbon manufacturing practices. The partnership aligns with AGC’s goals to reduce emissions and environmental impact, while ROSI contributes its expertise in recovering valuable materials from solar panels.

- In April 2024, Vitro’s 2024 Environmental Product Declarations (EPDs) for flat and processed glass indicate its architectural glass products contain just 1,240 kilograms of CO₂ equivalent, which is 13% lower than the industry standard.

- In October 2023, Guardian Glass introduced SunGuard SNX 70+, an advanced triple-silver coated glass designed to meet the architectural sector’s demand for high visible light transmission, a neutral aesthetic, and superior thermal performance.

- In March 2023, Keda Industrial Group announced plans in building an architectural glass plant in Tanzania. The construction of the new plant is aimed at expanding the range of building materials in the African market and growing Keda Industrial’s market share

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of energy-efficient and low-emissivity glass will accelerate across all regions.

- Smart glass and automated façade solutions will see increasing demand in commercial buildings.

- Growth in urbanization and high-rise construction will continue to drive flat glass consumption.

- Retrofit and refurbishment projects in mature markets will support steady market expansion.

- Technological advancements in laminated and coated glass will enhance product performance.

- Sustainable building practices will push the use of environmentally friendly glass solutions.

- Emerging economies will offer significant growth opportunities due to infrastructure development.

- Integration of digital design and Building Information Modeling will streamline glass specification.

- Premium and high-performance glass solutions will gain preference in luxury construction projects.

- Strategic partnerships and regional expansions by manufacturers will strengthen market competitiveness.