| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mexico Medical Tourism Market Size 2024 |

USD 431.74 Million |

| Mexico Medical Tourism Market, CAGR |

13.06% |

| Mexico Medical Tourism Market Size 2032 |

USD 1,153.02 Million |

Market Overview

Mexico Medical Tourism Market size was valued at USD 431.74 million in 2024 and is anticipated to reach USD 1,153.02 million by 2032, at a CAGR of 13.06% during the forecast period (2024-2032).

The Mexico Medical Tourism market is experiencing significant growth due to cost-effective healthcare services, high-quality treatments, and proximity to the U.S. and Canada. The availability of advanced medical procedures, including cosmetic surgery, dental care, and specialized treatments, at a fraction of the cost in developed nations attracts a large influx of international patients. Additionally, government initiatives to promote medical tourism, along with investments in healthcare infrastructure, further fuel market expansion. The rise of accredited hospitals and multilingual medical staff enhances patient confidence, contributing to the sector’s rapid development. Moreover, increasing awareness through digital marketing and partnerships with medical tourism agencies drive demand. Technological advancements, such as telemedicine and AI-driven patient management, streamline pre- and post-treatment care, improving overall patient experience. The growing trend of wellness tourism, integrating traditional medicine with modern healthcare, also complements market growth, positioning Mexico as a leading destination for medical travelers.

Mexico’s medical tourism industry is concentrated in key cities such as Tijuana, Monterrey, Guadalajara, and Mexico City, which offer advanced healthcare facilities, internationally accredited hospitals, and affordable treatment options. Tijuana is a leading destination due to its proximity to the U.S., attracting patients for dental care, cosmetic surgery, and bariatric procedures. Monterrey and Guadalajara serve as hubs for specialized treatments such as cardiovascular procedures, oncology, and orthopedic surgeries, while Mexico City provides high-end medical care for complex procedures. The market is driven by major healthcare providers, including Hospital Angeles, CMQ Hospitals, Medica Sur, Tijuana Medical Tourism, and Kukulkan Medical Care, along with numerous private clinics catering to international patients. These key players focus on enhancing medical infrastructure, integrating telemedicine, and expanding wellness services to improve patient experience. Mexico’s strategic location, cost-effective treatments, and growing medical expertise continue to strengthen its position as a preferred global medical tourism destination.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Mexico Medical Tourism market was valued at USD 431.74 million in 2024 and is projected to reach USD 1,153.02 million by 2032, growing at a CAGR of 13.06% from 2024 to 2032.

- Increasing demand for affordable, high-quality healthcare and shorter wait times drive medical tourism in Mexico.

- Growing investments in medical infrastructure, international accreditation, and telemedicine enhance patient confidence.

- Rising popularity of dental treatments, cosmetic surgeries, and cardiovascular procedures strengthens market growth.

- Major players, including Hospital Angeles, CMQ Hospitals, and Medica Sur, focus on expanding services and improving patient experience.

- Challenges such as regulatory inconsistencies, safety concerns, and travel barriers pose hurdles to market expansion.

- Key regions like Tijuana, Monterrey, Guadalajara, and Mexico City attract medical tourists due to advanced facilities and accessibility.

Report Scope

This report segments the Mexico Medical Tourism Market as follows:

Market Drivers

Cost-Effective Healthcare Services

Mexico’s medical tourism market is expanding rapidly due to the affordability of its healthcare services compared to the U.S., Canada, and Europe. Patients can save up to 70% on medical procedures, including dental treatments, cosmetic surgeries, orthopedic surgeries, and bariatric procedures. For instance, a gastric sleeve surgery in Mexico costs approximately $4,800, compared to over $20,000 in the U.S., according to Renew Bariatrics. Additionally, transparent pricing structures and package deals, which often include travel, accommodation, and post-operative care, further incentivize medical tourists. The lower cost of labor and operational expenses allows Mexican healthcare providers to offer world-class medical services at competitive prices, making it a preferred destination for international patients.

High-Quality Medical Infrastructure and Skilled Professionals

Mexico boasts a growing number of internationally accredited hospitals and specialized medical centers equipped with cutting-edge technology. For instance, facilities like Galenia Hospital in Cancún and Hospital Angeles in Tijuana hold accreditations from the Joint Commission International (JCI), ensuring adherence to global standards. The country is home to highly skilled doctors, many of whom have received training and certifications from top institutions in the U.S. and Europe. The presence of multilingual medical staff further enhances patient experience, eliminating language barriers and improving communication. These factors collectively build trust and confidence among foreign patients, positioning Mexico as a leading hub for medical tourism.

Strategic Location and Ease of Access

Mexico’s proximity to the U.S. and Canada serves as a key advantage in driving medical tourism. Many North American patients prefer traveling to Mexico due to shorter flight durations, lower travel costs, and visa-free or easy visa processes. Border cities such as Tijuana, Mexicali, and Ciudad Juárez are major medical tourism hubs, offering specialized treatments just a short drive away for U.S. residents. Additionally, the country’s well-developed transportation network, including international airports and medical tourism-friendly infrastructure, ensures smooth patient movement. The availability of medical concierge services further facilitates hassle-free travel, appointment scheduling, and accommodation arrangements, making Mexico a convenient healthcare destination.

Government Initiatives and Medical Tourism Promotion

The Mexican government actively supports medical tourism through regulatory frameworks, healthcare investments, and promotional campaigns. Policies that encourage private sector involvement and foreign investments in healthcare infrastructure have strengthened the industry’s growth. State and federal governments collaborate with hospitals and travel agencies to enhance medical tourism packages, offering tax incentives and streamlined patient processes. Additionally, digital marketing campaigns and partnerships with medical tourism facilitators boost international patient awareness. The integration of wellness tourism, combining traditional therapies with modern medicine, further broadens Mexico’s appeal in the global healthcare market. These strategic efforts collectively reinforce Mexico’s position as a premier medical tourism destination.

Market Trends

Rising Demand for Specialized and Elective Procedures

The Mexico medical tourism market is witnessing a surge in demand for specialized and elective procedures, including cosmetic surgery, bariatric surgery, dental treatments, and orthopedic procedures. For instance, dental clinics in Tijuana offer procedures like dental implants at significantly lower costs compared to the U.S., attracting patients from California and Arizona. Patients from the U.S. and Canada increasingly travel to Mexico for these treatments due to their affordability and shorter wait times. The availability of internationally accredited healthcare facilities and highly skilled professionals further strengthens this trend. Moreover, Mexico’s growing reputation for advanced procedures, such as stem cell therapy, fertility treatments, and regenerative medicine, attracts a broader patient base seeking innovative medical solutions.

Integration of Technology in Patient Care

Technological advancements are transforming the medical tourism landscape in Mexico. For instance, hospitals in Mexico City and Monterrey have adopted telemedicine platforms that allow international patients to consult with doctors before and after their treatments, reducing the need for multiple trips. AI-driven patient management systems enhance efficiency, enabling seamless appointment scheduling, medical record access, and real-time communication with healthcare providers. Additionally, the implementation of robotic-assisted surgeries and minimally invasive procedures improves surgical precision and patient outcomes, further enhancing Mexico’s reputation as a medical tourism hub.

Expansion of Medical Tourism Infrastructure

Mexico is investing heavily in the expansion of its medical tourism infrastructure, with new hospitals, specialty clinics, and wellness centers emerging in key cities. Destinations such as Tijuana, Cancun, Monterrey, and Guadalajara are seeing increased investments in high-quality healthcare facilities tailored to international patients. Many hospitals now offer personalized concierge services, streamlined visa assistance, and luxury recovery accommodations to enhance patient experience. The development of medical clusters—where multiple healthcare facilities operate in close proximity—further strengthens Mexico’s competitiveness in the global medical tourism market.

Growing Popularity of Wellness and Holistic Treatments

In addition to conventional medical treatments, wellness and holistic healthcare services are gaining popularity among medical tourists in Mexico. Many travelers seek alternative therapies such as traditional Mexican medicine, spa treatments, and naturopathy to complement their medical procedures. Integrative wellness programs that combine post-surgical rehabilitation with holistic therapies are becoming a preferred choice for many international patients. As global interest in preventive healthcare and wellness tourism rises, Mexico continues to position itself as a destination offering both medical excellence and holistic well-being solutions.

Market Challenges Analysis

Regulatory and Quality Control Concerns

Despite Mexico’s growing reputation in medical tourism, regulatory inconsistencies and quality control issues pose significant challenges. For instance, while hospitals like Galenia Hospital in Cancún and Hospital Angeles in Tijuana hold international accreditations such as JCI, some smaller clinics operate without strict oversight, raising concerns about patient safety and treatment reliability. Cases of unlicensed practitioners and counterfeit medications further impact the industry’s credibility. Strengthening regulatory enforcement, improving accreditation processes, and ensuring compliance with international healthcare standards are crucial to maintaining Mexico’s position as a trusted medical tourism destination.

Safety Perceptions and Travel-Related Barriers

Concerns about crime and safety in certain regions of Mexico can deter potential medical tourists, particularly those unfamiliar with the country’s healthcare landscape. Negative media coverage on security issues may overshadow Mexico’s high-quality medical services, creating apprehension among international patients. Additionally, logistical barriers such as travel restrictions, visa policies, and insurance coverage limitations can impact patient decisions. Many international insurers do not fully cover treatments abroad, forcing patients to bear out-of-pocket expenses. Addressing security concerns through targeted awareness campaigns, improving medical travel insurance options, and enhancing patient support services can help mitigate these challenges and drive sustained market growth.

Market Opportunities

Mexico’s medical tourism market presents significant opportunities for growth, driven by increasing demand for high-quality yet cost-effective healthcare services. Expanding international accreditation of hospitals and clinics can enhance global patient confidence, attracting a larger pool of medical tourists. Strengthening partnerships between Mexican healthcare providers and international insurance companies can also improve coverage options, making treatments more accessible to foreign patients. Additionally, the integration of telemedicine for pre- and post-operative consultations allows international patients to receive seamless, end-to-end medical care without frequent travel, further boosting Mexico’s appeal as a top medical tourism destination.

Investment in specialized medical services such as fertility treatments, regenerative medicine, and oncology care can further diversify Mexico’s healthcare offerings and attract patients seeking advanced procedures. The development of dedicated medical tourism hubs with integrated wellness resorts, recovery centers, and personalized concierge services can enhance the overall patient experience, fostering long-term industry growth. Additionally, targeted digital marketing campaigns and strategic collaborations with global healthcare facilitators can strengthen Mexico’s market positioning. By addressing existing challenges and leveraging these opportunities, Mexico can solidify its reputation as a premier destination for world-class medical care.

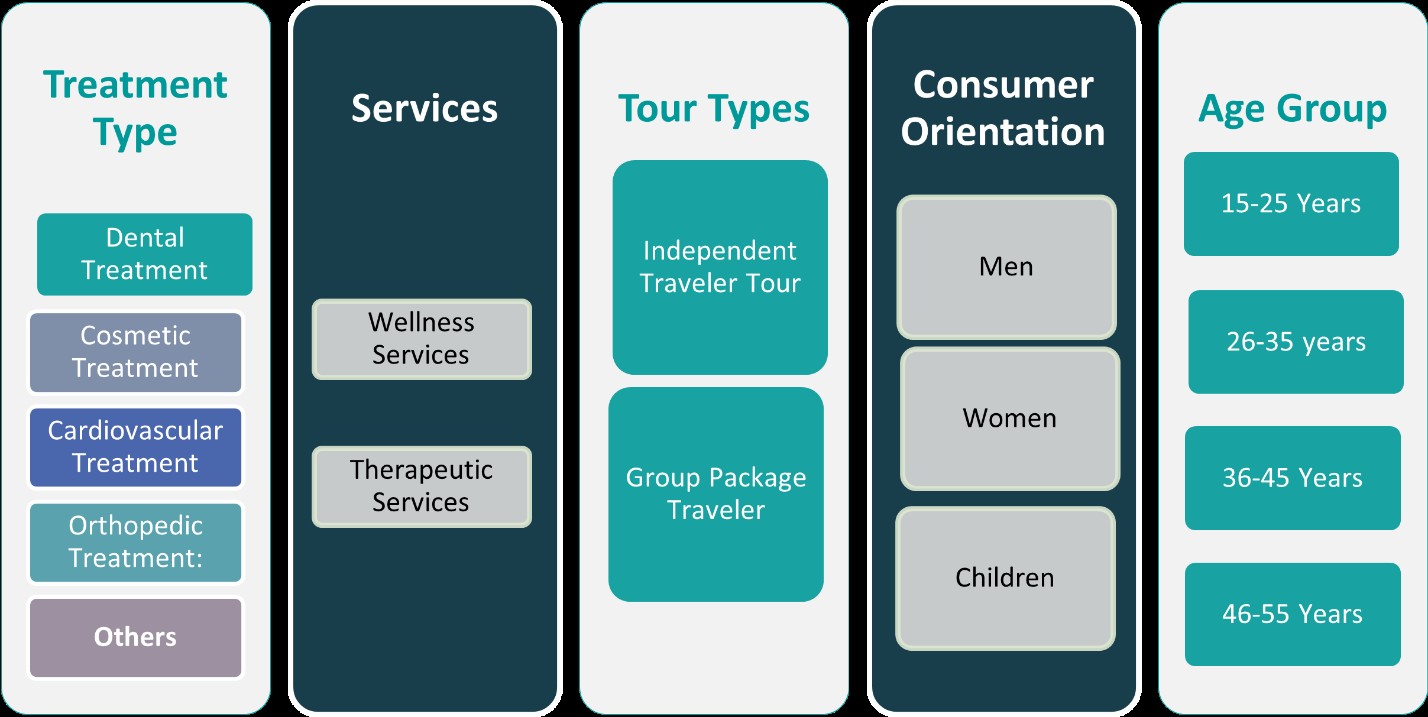

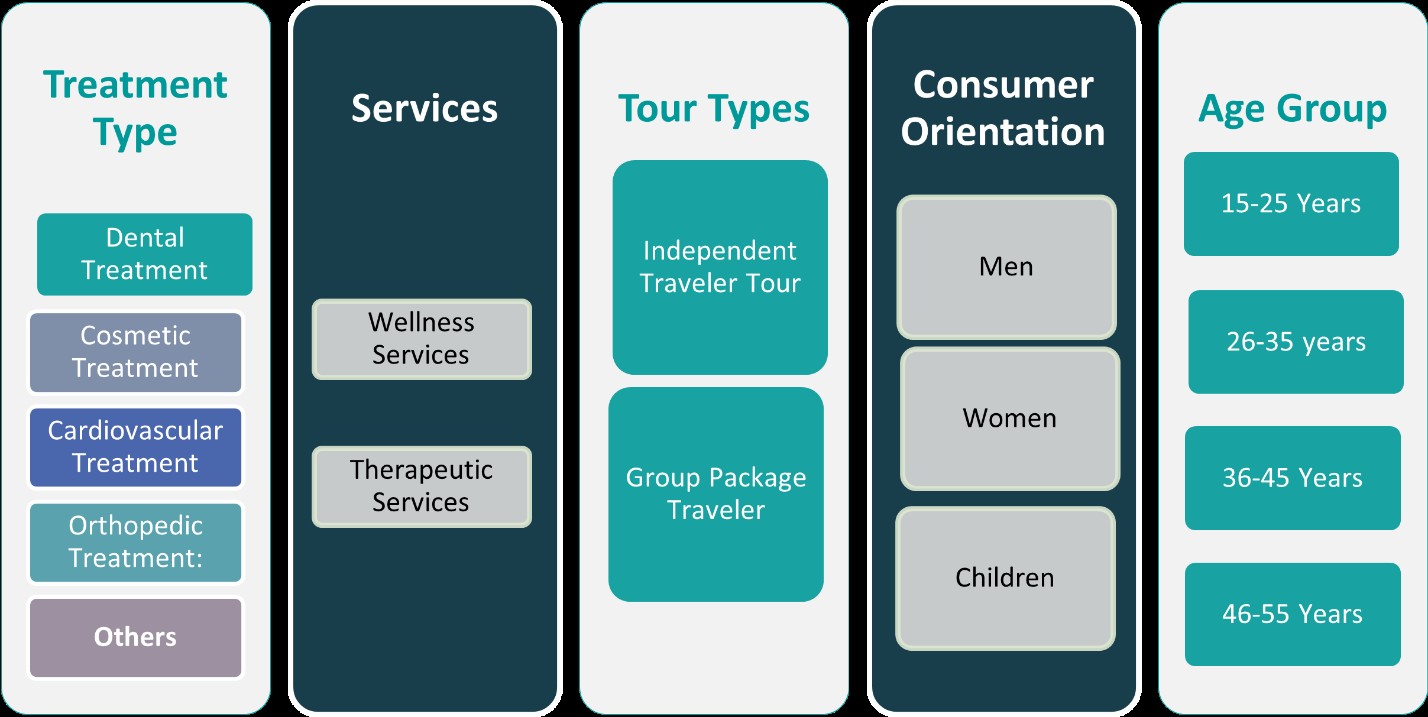

Market Segmentation Analysis:

By Treatment:

The Mexico Medical Tourism market is segmented based on treatment types, with dental treatment and cosmetic procedures being the most sought-after services due to their affordability and high-quality standards. Dental treatments, including implants, veneers, and orthodontic procedures, attract a significant number of international patients, particularly from the U.S. and Canada, where such services are expensive. Cosmetic treatments such as plastic surgery, liposuction, and rhinoplasty also drive substantial medical tourist inflows. Cardiovascular treatments are another key segment, with Mexico offering advanced procedures like angioplasty and heart bypass surgery at a fraction of the cost charged in developed nations. Orthopedic treatments, including joint replacements and spinal surgeries, are gaining traction among older patients seeking affordable and effective solutions for mobility-related conditions. The “Others” category includes fertility treatments, bariatric surgery, and oncology services, which are becoming increasingly popular due to Mexico’s growing expertise in specialized medical fields. These diverse treatment options position Mexico as a leading medical tourism destination.

By Services:

The medical tourism industry in Mexico is also categorized based on services, primarily divided into wellness services and therapeutic services. Wellness services, including holistic healing, spa therapies, and alternative medicine, are gaining popularity among medical tourists seeking integrative healthcare solutions. Many international patients complement their medical procedures with wellness therapies to enhance post-treatment recovery and overall well-being. Therapeutic services, encompassing hospital-based treatments such as surgeries, rehabilitative care, and specialized medical interventions, remain the dominant segment in the market. Mexico’s state-of-the-art medical facilities, skilled healthcare professionals, and internationally accredited hospitals drive the demand for therapeutic services. The increasing adoption of medical concierge services, which assist international patients with travel, accommodation, and treatment coordination, further strengthens Mexico’s medical tourism appeal. By expanding and refining both wellness and therapeutic service offerings, Mexico continues to attract a diverse patient base, reinforcing its reputation as a top global healthcare destination.

Segments:

Based on Treatment:

- Dental Treatment

- Cosmetic Treatment

- Cardiovascular Treatment

- Orthopedic Treatment

- Others

Based on Services:

- Wellness Services

- Therapeutic Services

Based on Tour Type:

- Independent Traveler Tour

- Group Package Traveler

Based on Consumer Orientation:

Based on the Geography:

- Mexico City

- Monterrey

- Guadalajara

- Tijuana

Regional Analysis

Tijuana

Tijuana dominates the Mexico medical tourism market, capturing 40% of the total market share. Its proximity to the U.S. border, particularly to California, makes it the most accessible medical tourism destination for American patients. The city is renowned for dental treatments, cosmetic surgeries, and bariatric procedures, offering cost-effective solutions without compromising quality. Many healthcare facilities in Tijuana are internationally accredited and employ bilingual medical professionals, ensuring seamless communication for international patients. Additionally, Tijuana’s well-developed medical tourism infrastructure, including specialized clinics, luxury recovery centers, and medical travel agencies, enhances patient experience. The city’s rapid growth in regenerative medicine and stem cell therapy further attracts high-value medical tourists seeking advanced treatments.

Monterrey

Monterrey holds a 25% market share in Mexico’s medical tourism industry, positioning itself as a hub for cardiovascular treatments, oncology, and orthopedic procedures. The city is home to some of Mexico’s most prestigious hospitals, many of which are affiliated with international medical institutions. Monterrey’s high standard of healthcare services and advanced medical technology make it a preferred destination for patients seeking specialized and high-risk treatments. Additionally, the city benefits from strong government support and private-sector investments in healthcare, further enhancing its reputation. With an increasing number of international patients, Monterrey continues to expand its healthcare services, including medical tourism packages tailored to foreign visitors.

Guadalajara

Guadalajara accounts for 20% of the medical tourism market in Mexico, known for its expertise in fertility treatments, dental procedures, and reconstructive surgeries. The city’s healthcare industry benefits from a strong research and medical education sector, contributing to high-quality patient care and innovative treatments. Guadalajara’s medical facilities offer competitive pricing and comprehensive treatment plans that attract medical tourists, particularly from the U.S. and Latin America. The city is also expanding its wellness tourism sector, integrating traditional healing practices with modern medicine. Additionally, Guadalajara’s growing investment in healthcare infrastructure, including new hospital expansions and specialized medical centers, further strengthens its position in the medical tourism market.

Mexico City

Mexico City captures 15% of the medical tourism market, serving as a hub for complex medical procedures, including neurosurgery, oncology, and transplant surgeries. The capital city is home to some of the most advanced hospitals in Latin America, many of which are internationally recognized for their medical excellence. Patients seeking high-end medical care often choose Mexico City due to its extensive network of specialists and cutting-edge technology. The city also offers a wide range of wellness and post-operative care services, making it a comprehensive medical tourism destination. While Mexico City faces challenges such as traffic congestion and higher living costs compared to other regions, its superior healthcare standards and availability of highly specialized treatments continue to attract international patients.

Key Player Analysis

- Hospital Angeles

- CMQ Hospitals

- Medica Sur

- Tijuana Medical Tourism

- Kukulkan Medical Care

Competitive Analysis

The Mexico Medical Tourism market is highly competitive, with key players such as Hospital Angeles, CMQ Hospitals, Medica Sur, Tijuana Medical Tourism, and Kukulkan Medical Care leading the industry. These healthcare providers focus on offering high-quality, cost-effective treatments to attract international patients, particularly from the U.S. and Canada. Many of these hospitals have obtained international accreditations, ensuring compliance with global healthcare standards and enhancing patient trust. Market leaders continuously invest in advanced medical technologies, telemedicine services, and specialized treatment options such as dental care, cosmetic procedures, cardiovascular treatments, and orthopedic surgeries. Additionally, they focus on providing seamless patient experiences through medical concierge services, multilingual staff, and strategic partnerships with international insurance providers. Competition intensifies as new healthcare facilities expand their capabilities, improving infrastructure and diversifying treatment portfolios. Despite challenges like regulatory inconsistencies and security concerns, strong branding, affordable pricing, and superior healthcare services keep these players ahead in Mexico’s growing medical tourism market.

Recent Developments

- In March 2025, Raffles Medical Group signed a strategic collaboration agreement with Shanghai Renji Hospital to establish a “dual circulation” service system. This partnership aims to promote cross-border healthcare services and position Shanghai as a hub for international medical tourism.

- In March 2025, MOHW Hengchun Tourism Hospital was highlighted as a key player in the global medical tourism market in a report projecting significant growth for the industry. The hospital continues to play a pivotal role in expanding medical tourism opportunities, particularly in Asia.

- In February 2025, Apollo Hospitals emphasized the need for a liberal visa policy to enhance India’s medical tourism sector. The hospital is collaborating with the Indian government on the “Heal in India” initiative to attract international patients and streamline medical visa processes.

- In January 2025, Mount Elizabeth Hospitals unveiled new facilities under “Project Renaissance,” which included expanded wards, upgraded critical care units, and additional single-bedded and negative pressure rooms. This expansion added 62 beds to its capacity and enhanced patient care infrastructure.

Market Concentration & Characteristics

The Mexico Medical Tourism market is moderately concentrated, with a mix of large, internationally accredited hospitals and specialized private clinics catering to foreign patients. Leading healthcare providers such as Hospital Angeles, CMQ Hospitals, Medica Sur, Tijuana Medical Tourism, and Kukulkan Medical Care dominate the industry by offering cost-effective treatments and advanced medical procedures. The market is characterized by high competition, driven by continuous investment in medical technology, infrastructure, and patient care services. Most facilities focus on specialized treatments like dental care, cosmetic surgery, cardiovascular procedures, and orthopedic treatments, attracting a diverse patient base. Additionally, medical tourism hubs in Tijuana, Monterrey, Guadalajara, and Mexico City ensure accessibility for international patients, further strengthening the market’s appeal. The increasing adoption of telemedicine, wellness services, and medical concierge assistance enhances the overall patient experience, making Mexico a preferred destination for medical travelers seeking high-quality yet affordable healthcare solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Treatment, Services, Tour Type, Consumer Orientation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Mexico’s medical tourism industry is expected to grow steadily, driven by increasing demand for affordable healthcare solutions.

- Advancements in medical technology and telemedicine services will enhance patient accessibility and treatment efficiency.

- International accreditation of hospitals and clinics will continue to improve trust and attract more foreign patients.

- Expanding specialized treatments, including regenerative medicine and robotic-assisted surgeries, will strengthen market growth.

- Strategic partnerships with global insurance providers will make medical procedures more accessible to international patients.

- Investments in healthcare infrastructure and training of medical professionals will improve service quality and competitiveness.

- Wellness tourism, including holistic healing and post-operative care, will complement traditional medical treatments.

- Government initiatives and regulatory improvements will streamline medical travel processes and increase patient confidence.

- Rising medical tourism competition from other Latin American countries may drive further innovation and service differentiation.

- Strong marketing strategies and digital platforms will play a crucial role in attracting and retaining international patients.