Market Overview

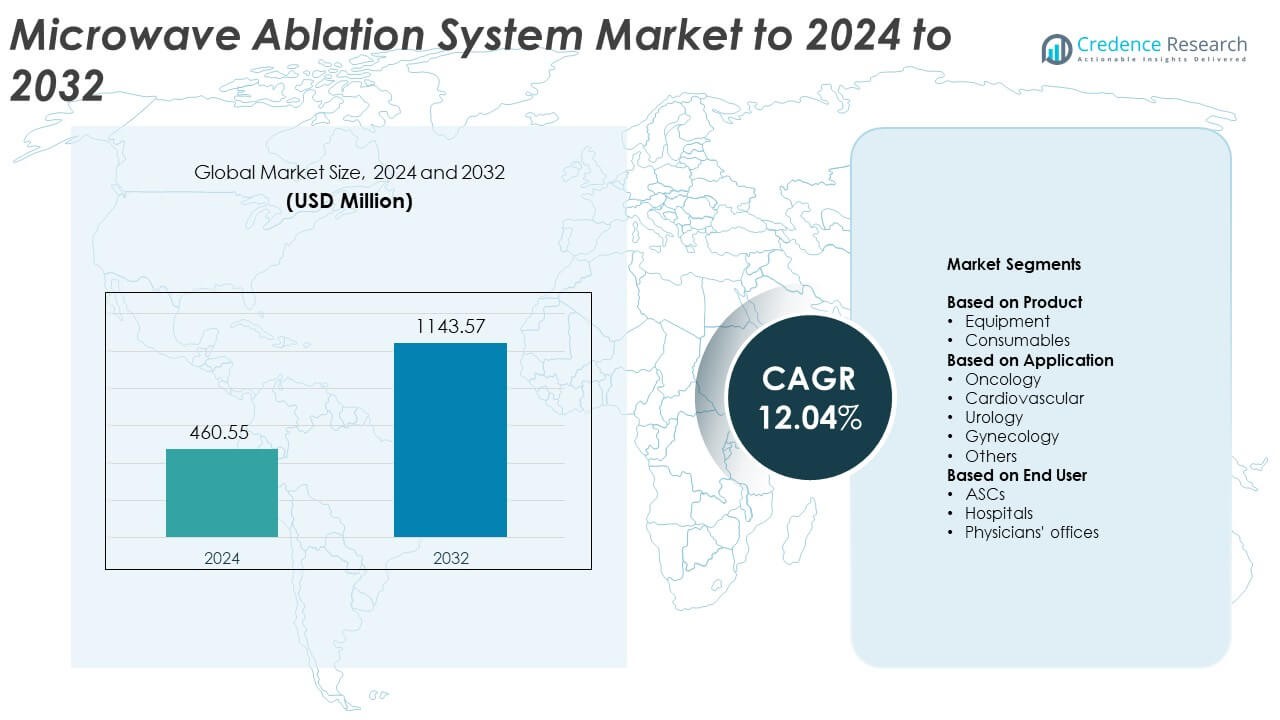

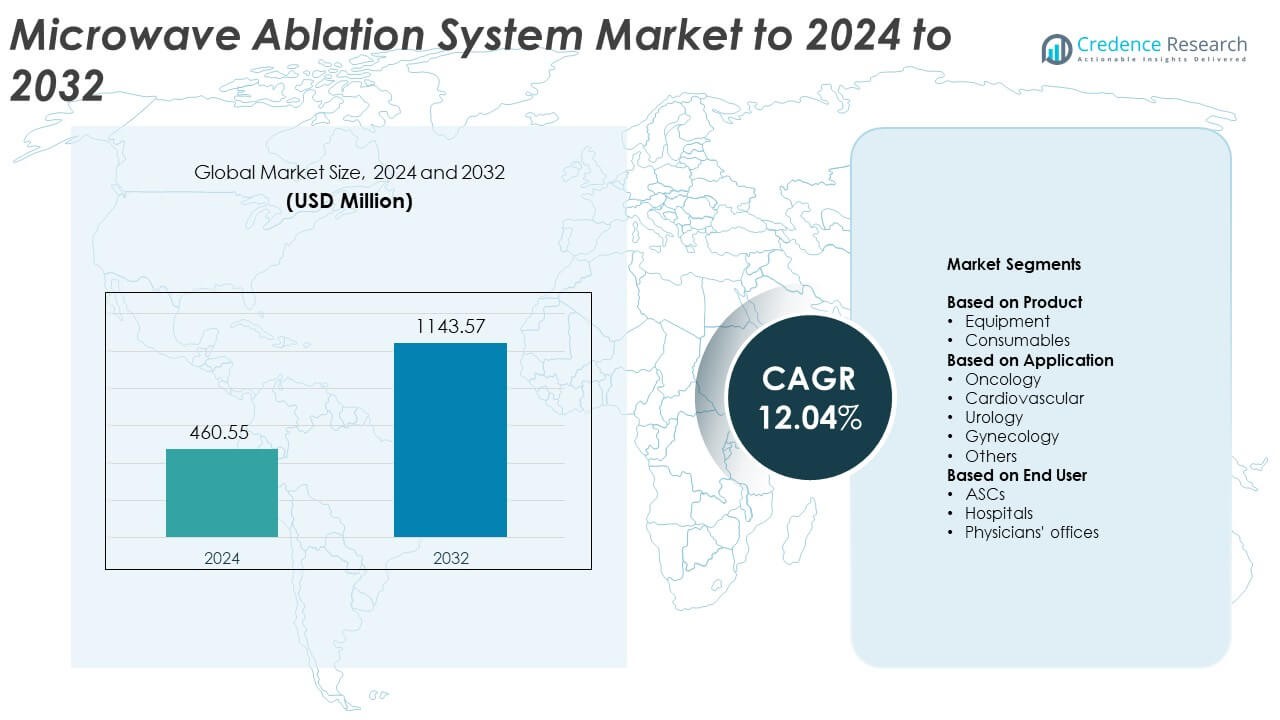

Microwave Ablation System Market size was valued USD 460.55 million in 2024 and is anticipated to reach USD 1143.57 million by 2032, at a CAGR of 12.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Microwave Ablation System Market Size 2024 |

USD 460.55 Million |

| Microwave Ablation System Market, CAGR |

12.04% |

| Microwave Ablation System Market Size 2032 |

USD 1143.57 Million |

The microwave ablation system market is shaped by major players such as Varian Medical Systems, Inc., HUBER+SUHNER, Emblation Ltd., Terumo Corporation, SympleSurgical Inc., Johnson & Johnson Services, Inc., MedWaves, Inc., AngioDynamics, Mermaid Medical, and Medtronic. These companies compete through advanced generators, improved antenna designs, and stronger integration with image-guided platforms. North America led the global market in 2024 with about 38% share, supported by high cancer treatment volume, strong reimbursement, and rapid adoption of minimally invasive procedures. Europe held the second-largest share, while Asia Pacific expanded quickly with rising healthcare investment and broader access to ablation technologies.

Market Insights

- The microwave ablation system market reached USD 460.55 million in 2024 and is projected to hit USD 1143.57 million by 2032, advancing at a CAGR of 12.04%.

• Strong demand rises from the oncology segment, which held nearly 71% share in 2024 due to wider adoption of minimally invasive tumor treatment supported by improved imaging accuracy.

• Key trends include rapid use of AI-enabled planning tools, growing adoption of portable generators, and expansion into non-oncology applications such as thyroid and urology care.

• Competition strengthens as leading companies invest in advanced antennas, efficient generators, and software-guided ablation systems that enhance precision and reduce procedure time across hospital networks.

• North America dominated the market with about 38% share in 2024, followed by Europe at 29%, while Asia Pacific grew quickly with 23% driven by rising cancer burden and upgraded oncology infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Equipment dominated the microwave ablation system market in 2024 with about 64% share. Strong demand came from expanded use of advanced generators and antennas in cancer treatment. Hospitals preferred these systems because they provide stable energy delivery and short procedure time. Consumables grew at a steady rate as repeat use increased for antenna kits, but equipment remained the leading category due to higher replacement cycles and broad adoption in image-guided ablation.

- For instance, Medtronic’s Emprint microwave ablation system was used to treat 56 liver tumors with a median lesion size of 1.4 cm (ranging from 0.4 to 3.7 cm) in a clinical series assessing ablation performance in hepatic malignancies.

By Application

Oncology held the leading position in 2024 with nearly 71% share. Cancer care centers used microwave ablation for liver, lung, kidney, and bone tumors. Doctors selected this method because it offers fast heating, fewer sessions, and minimal blood loss. Other applications such as cardiovascular and urology showed gradual expansion, but oncology stayed dominant as global cancer cases rose and treatment guidelines supported minimally invasive tumor ablation.

- For instance, AngioDynamics’ Solero microwave tissue ablation system is specified to create an ablation zone up to 5 cm in diameter in about 6 minutes at maximum power using a single applicator, supporting treatment of larger liver tumors in oncology practice.

By End User

Hospitals led the end-user segment in 2024 with around 59% share. Large hospital networks adopted microwave ablation systems to manage complex oncology and cardiovascular cases. These facilities favored the technology because it improves accuracy under CT or ultrasound guidance. ASCs and physicians’ offices expanded usage for small lesions and outpatient care, yet hospitals remained ahead due to higher patient volume and stronger investment in image-guided ablation infrastructure.

Key Growth Drivers

Rising Cancer Burden

The surge in global cancer cases drives strong demand for microwave ablation systems. Hospitals and specialty centers prefer this technique because it delivers rapid heating, wider ablation zones, and shorter procedure times than several alternative methods. The technology supports treatment of liver, lung, kidney, and bone tumors, which increases its clinical relevance. Growing patient preference for minimally invasive procedures further accelerates adoption. As cancer screening programs expand, more early-stage lesions qualify for ablation, strengthening long-term demand across developed and emerging regions.

- For instance, in a randomized phase 2 trial of liver malignancies, HS Hospital Service’s AMICA microwave generator operated at 2.45 GHz with a maximum output of 140 W, using standard applications of 3 to 6 minutes at 60 to 80 W in a total of 82 patients (41 in the MWA group), reflecting its use in routine cancer workloads, as documented in published clinical trial results.

Advancements in Image-Guided Technologies

Continuous improvements in CT, MRI, and ultrasound imaging support precise antenna placement and enhance ablation accuracy. These imaging upgrades help doctors monitor tissue temperature, ablation margins, and real-time treatment response. Better visual guidance reduces complication rates and supports adoption in complex tumors located near vital structures. As hospitals upgrade imaging suites, microwave ablation becomes more efficient and safer. The integration of software-based planning tools and automated energy control systems also increases reliability and physician confidence.

- For instance, ultrasound-guided thermal ablation techniques are a recommended alternative option to surgery for symptomatic, solid benign thyroid nodules according to guidelines from the European Thyroid Association, using high-frequency linear probes (typically 7.5 to 12 MHz) for real-time visualization and guidance.

Shift Toward Minimally Invasive Therapies

Healthcare systems favor minimally invasive treatments that reduce hospital stay, recovery time, and procedure-related risk. Microwave ablation aligns with these goals because it provides targeted tumor destruction with small incisions and limited anesthesia needs. Patients benefit from rapid discharge and faster return to routine activities. This shift is also driven by cost optimization, as shorter inpatient time reduces overall treatment expenses. The trend strengthens in markets facing high surgical backlog and limited operating-room capacity.

Key Trends and Opportunities

Integration of AI and Navigation Software

Developers increasingly integrate AI-assisted planning tools and navigation software to enhance system accuracy. These solutions support automated ablation zone prediction, optimal antenna positioning, and energy modulation. Hospitals adopting digital platforms gain higher consistency across procedures, which improves patient outcomes. The opportunity grows as vendors combine imaging, robotics, and computational modeling into unified ablation workstations. Such integration increases equipment value and expands usage across both oncology and non-oncology cases.

- For instance, ActiViews’ CT-Guide navigation system combines a miniature video camera, registration sticker, and 3D navigation software, and was prospectively tested in 20 patients undergoing CT-guided liver biopsy or ablation, where all procedures achieved satisfactory instrument positioning on CT review with an average target lesion size of 3.1 cm and mean target depth of 8.0 cm.

Rising Use in Outpatient and Ambulatory Settings

Microwave ablation systems continue gaining traction in ASCs and office-based practices as devices become more compact and user-friendly. Growing acceptance of same-day tumor ablation creates strong opportunities for manufacturers offering portable generators and disposable antenna kits. Outpatient expansion reduces procedure cost, improves patient convenience, and allows providers to handle higher case volumes. The trend accelerates in regions with strong reimbursement support for minimally invasive procedures.

- For instance, Urologix’s Targis cooled transurethral microwave therapy system for benign prostatic hyperplasia was evaluated in a randomized study of 94 men (46 of whom received the 60-minute treatment protocol), where the active microwave treatment was delivered during a single session of about 60 minutes, designed for performance with local anesthesia and sedation in an outpatient setting

Expansion into Non-Oncology Applications

Broader clinical research supports the use of microwave ablation in thyroid nodules, varicose veins, benign prostatic hyperplasia, and gynecological conditions. These emerging uses create a sizable opportunity for market expansion beyond traditional oncology. Physicians adopt the technology due to its ability to achieve localized thermal destruction with minimal structural damage. As clinical evidence strengthens, regulatory approvals and expanded guidelines may further boost non-oncology penetration.

Key Challenges

High Capital and Procedure Costs

Microwave ablation generators, antennas, and imaging requirements create a high upfront investment for healthcare facilities. Many centers in developing regions struggle to adopt the technology due to limited budgets and constrained reimbursement. The cost of disposable antenna kits also increases the per-procedure expense, reducing affordability for patients. These financial barriers limit widespread adoption despite strong clinical benefits.

Limited Skilled Professionals

Successful microwave ablation requires experienced radiologists, oncologists, and surgeons trained in image-guided procedures. Several regions face shortages of trained specialists, which restricts safe and effective system use. Limited hands-on training programs and uneven access to advanced imaging further widen the skill gap. This challenge slows adoption in emerging markets and delays expansion into new clinical applications.

Regional Analysis

North America

North America held the leading position in the microwave ablation system market in 2024 with around 38% share. The region benefited from strong adoption in oncology centers, advanced imaging infrastructure, and high use of minimally invasive procedures. Hospitals invested in next-generation generators and software-guided ablation systems to improve accuracy and reduce procedure time. Supportive reimbursement and growing cancer screening programs further strengthened demand. The United States dominated regional usage due to high procedural volume, while Canada showed steady adoption through expanded cancer care networks.

Europe

Europe accounted for roughly 29% share of the microwave ablation system market in 2024. The region showed strong clinical uptake across liver, lung, and renal tumor ablation due to well-established interventional radiology units. Countries such as Germany, France, Italy, and the U.K. invested in image-guided systems to support early-stage cancer treatment. Growing demand for minimally invasive solutions and rising preference for day-care procedures supported wider use. Regulatory approval of advanced antennas and improved hospital budgets further strengthened market performance across Western and Northern Europe.

Asia Pacific

Asia Pacific represented nearly 23% share of the market in 2024 and grew rapidly due to rising cancer incidence and expanding healthcare infrastructure. China, Japan, South Korea, and India increased investment in oncology centers and image-guided therapies. Hospitals adopted microwave ablation systems because they offer faster procedures and shorter recovery time, which helps manage large patient volumes. Local manufacturing growth and favorable government programs improved accessibility. The region also benefited from rising awareness of minimally invasive tumor treatment among patients and physicians.

Latin America

Latin America held close to 6% share in the microwave ablation system market in 2024. Adoption increased as Brazil, Mexico, and Argentina improved cancer detection rates and expanded interventional radiology capabilities. Hospitals favored microwave ablation for liver and lung tumors due to shorter procedure duration and reduced hospitalization needs. Limited budgets slowed penetration in smaller facilities, yet public-private investments supported gradual expansion. Growing training programs for radiologists also improved procedural capability across leading medical centers.

Middle East and Africa

The Middle East and Africa accounted for about 4% share in 2024, driven by rising healthcare modernization across the Gulf countries. Saudi Arabia, the UAE, and Qatar invested in advanced oncology centers that adopted microwave ablation to manage rising cancer cases. Access remained uneven in Africa due to limited imaging technology and high equipment cost. However, gradual improvements in cancer care programs and partnerships with global device suppliers supported wider availability. The region showed steady growth potential as hospitals shifted toward minimally invasive therapies.

Market Segmentations:

By Product

By Application

- Oncology

- Cardiovascular

- Urology

- Gynecology

- Others

By End User

- ASCs

- Hospitals

- Physicians’ offices

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The microwave ablation system market is shaped by leading companies such as Varian Medical Systems, Inc., HUBER+SUHNER, Emblation Ltd., Terumo Corporation, SympleSurgical Inc., Johnson & Johnson Services, Inc., MedWaves, Inc., AngioDynamics, Mermaid Medical, and Medtronic. The competitive environment reflects strong investment in next-generation generators, precision antennas, and software-guided ablation solutions designed to support faster and more controlled energy delivery. Manufacturers focus on improving system integration with CT, MRI, and ultrasound platforms to enhance accuracy in tumor targeting. Many firms expand their portfolios through regulatory approvals, product upgrades, and geographic expansion into high-growth regions. Strategic partnerships with hospitals and oncology centers strengthen clinical adoption, while emphasis on disposable antenna kits increases recurring revenue. Companies also compete on ease of use, portability, ablation zone consistency, and compatibility with minimally invasive workflows, reinforcing steady market advancement.

Key Player Analysis

- Varian Medical Systems, Inc.

- HUBER+SUHNER

- Emblation Ltd.

- Terumo Corporation

- SympleSurgical Inc.

- Johnson & Johnson Services, Inc.

- MedWaves, Inc.

- AngioDynamics

- Mermaid Medical

- Medtronic

Recent Developments

- In 2024, Medtronic received FDA approval for its Affera Mapping and Ablation System with Sphere-9 Catheter.

- In 2024, HUBER+SUHNER continued to supply its extensive range of high-performance connectivity solutions globally, which are utilized across many industries, including medical technology.

- In 2024, Varian received FDA clearance for its IntelliBlate microwave ablation system, which is designed to provide clinicians with enhanced precision, predictability, and control during soft tissue ablation procedures.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as cancer incidence rises and early detection improves.

- Adoption will grow as hospitals upgrade imaging systems for more accurate guidance.

- Outpatient and ambulatory centers will perform more ablation procedures.

- AI-based planning and navigation tools will enhance treatment precision.

- Compact and portable generators will increase use in smaller clinical settings.

- Non-oncology applications will gain wider acceptance across global markets.

- Training programs for interventional radiologists will improve procedural adoption.

- Manufacturers will focus on advanced antenna designs for larger ablation zones.

- Reimbursement improvements in emerging markets will support system penetration.

- Strategic partnerships between hospitals and device makers will accelerate technology integration.