| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Middle East & Africa Industrial Solvents Market Size 2024 |

USD 703.61 Million |

| Middle East & Africa Industrial Solvents Market, CAGR |

4.66% |

| Middle East & Africa Industrial Solvents Market Size 2032 |

USD 1,012.82 Million |

Market Overview

Middle East & Africa Industrial Solvents Market size was valued at USD 703.61 million in 2024 and is anticipated to reach USD 1,012.82 million by 2032, at a CAGR of 4.66% during the forecast period (2024-2032).

The Middle East & Africa industrial solvents market is driven by robust industrial growth, particularly in the chemicals, automotive, and manufacturing sectors. The increasing demand for solvents in the production of paints, coatings, pharmaceuticals, and agrochemicals is a key factor fueling market expansion. Additionally, the region’s growing construction activities and industrialization are boosting the demand for coatings and adhesives, further enhancing solvent consumption. The adoption of sustainable and eco-friendly solvent alternatives is another significant trend, driven by stricter environmental regulations and rising consumer preference for greener solutions. Innovations in solvent formulations aimed at improving efficiency and reducing environmental impact are also gaining momentum. Furthermore, the increasing demand for high-performance solvents, particularly in emerging economies within the region, is contributing to market growth. These factors, combined with the expansion of the chemical processing industry, are expected to sustain a positive growth trajectory for the market over the forecast period.

The Middle East & Africa industrial solvents market is shaped by key players across various regions, each contributing to the growth of the sector. In the Gulf Cooperation Council (GCC) countries like Saudi Arabia, the UAE, and Qatar, industrial solvents are in high demand due to rapid infrastructure development, a booming construction sector, and the expansion of manufacturing industries. South Africa, as the industrial hub of Sub-Saharan Africa, plays a significant role, driven by the chemicals, automotive, and agriculture sectors. Major companies such as Dow Inc., ExxonMobil, Eastman Chemical, and Huntsman Corporation lead the market, offering a wide range of solvents tailored to industries like paints, coatings, pharmaceuticals, and automotive. These companies, along with regional players, are focusing on technological advancements and sustainable solutions to meet the growing demand across diverse industries, further expanding their presence in the MEA region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Middle East & Africa industrial solvents market was valued at USD 703.61 million in 2024 and is expected to reach USD 1,012.82 million by 2032, growing at a CAGR of 4.66% from 2024 to 2032.

- The global industrial solvents market was valued at USD 34,660.50 million in 2024 and is expected to reach USD 60,647.79 million by 2032, growing at a CAGR of 7.24% during the forecast period (2024-2032).

- Industrial growth in sectors like construction, automotive, and chemicals is driving increased demand for solvents in the region.

- The shift towards sustainable and eco-friendly solvents is a significant market trend, driven by stricter environmental regulations.

- Major players like Dow Inc., ExxonMobil, and Huntsman Corporation dominate the market, focusing on product innovation and regional expansion.

- Volatility in raw material prices and supply chain disruptions are key market restraints that could impact growth.

- The UAE, Saudi Arabia, and South Africa are key regional markets, with Saudi Arabia holding the largest market share.

- Emerging industries, particularly in renewable energy and electronics, present new opportunities for solvent applications.

Report Scope

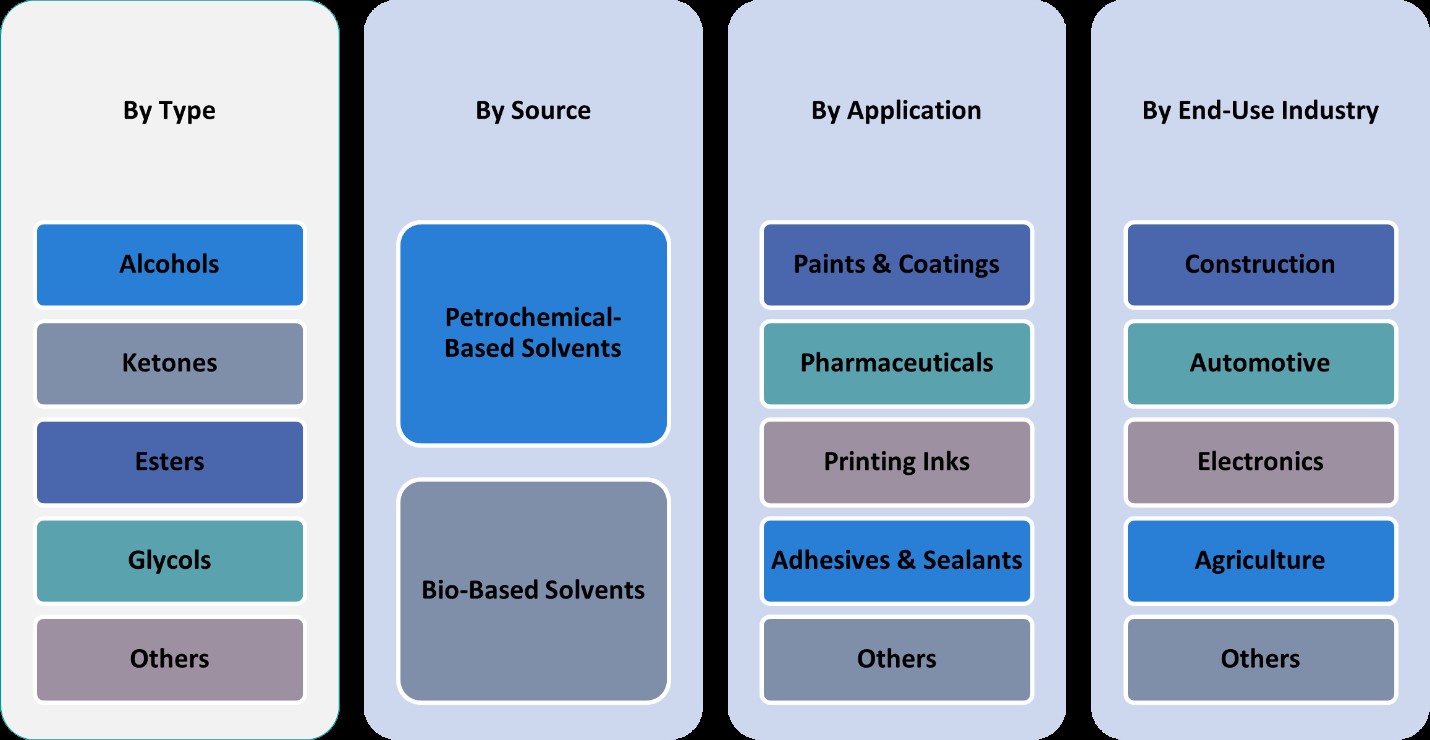

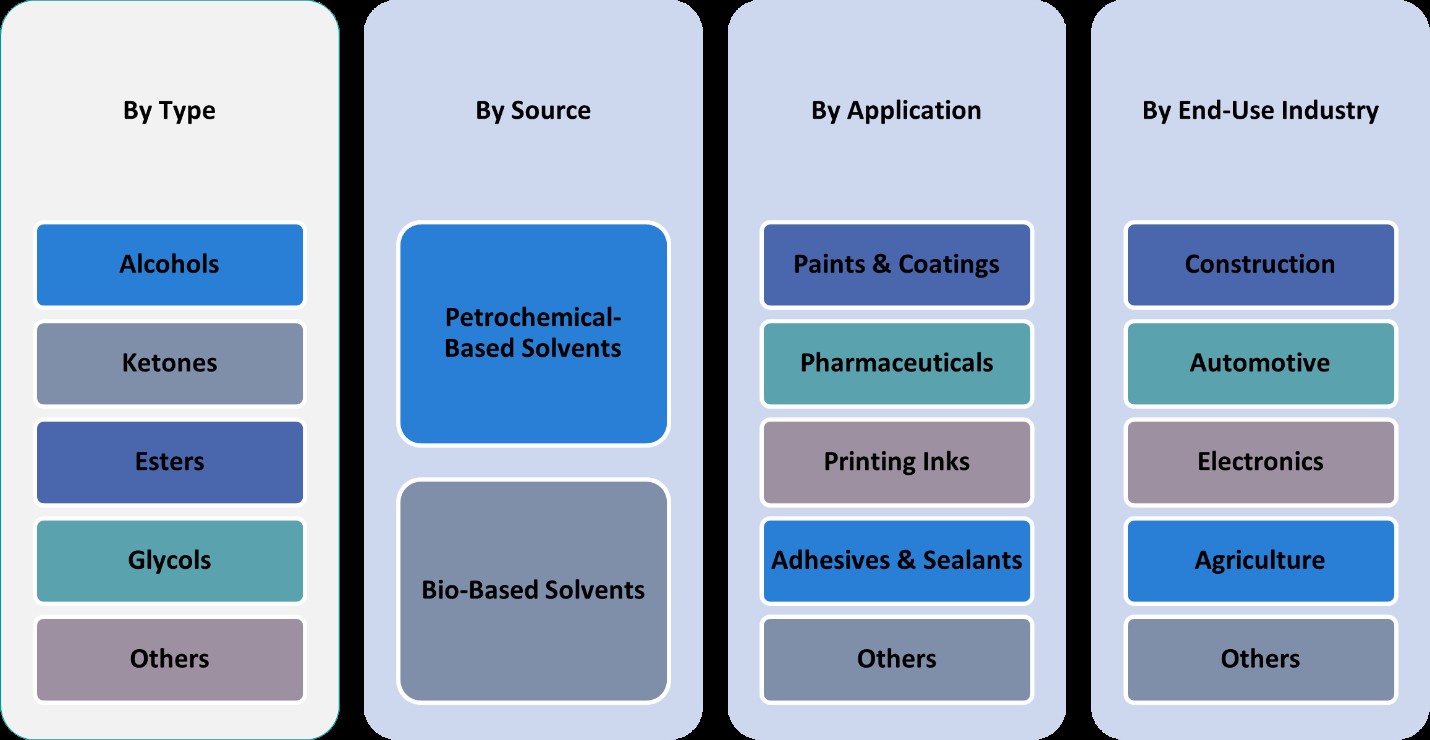

This report segments the Middle East & Africa Industrial Solvents Market as follows:

Market Drivers

Industrial Growth and Infrastructure Development

The industrial growth in the Middle East & Africa (MEA) region is one of the primary drivers of the industrial solvents market. Rapid urbanization and infrastructure development, especially in countries like the UAE, Saudi Arabia, and South Africa, are creating significant demand for construction materials such as paints, coatings, adhesives, and sealants. These products heavily rely on industrial solvents for their formulation and application. As new industrial projects, real estate developments, and infrastructural upgrades take shape across the region, the demand for industrial solvents used in coatings and adhesives is expected to continue to rise. This trend is particularly evident in the ongoing development of smart cities, transportation networks, and large-scale construction initiatives across the region, further fueling the demand for industrial solvents.

Growth of the Chemical and Pharmaceutical Industries

The expansion of the chemical and pharmaceutical sectors in the MEA region is a significant factor driving the demand for industrial solvents. Industrial solvents are essential in the formulation and manufacturing processes of various chemical products, including paints, coatings, agrochemicals, and specialty chemicals. For instance, the Middle East and Africa pharmaceutical solvent market has reported steady growth due to rising healthcare demands and advancements in drug development. As the region continues to modernize its chemical processing infrastructure and increase its production capacity, the consumption of industrial solvents grows proportionally. The pharmaceutical industry, in particular, has seen a boost due to rising healthcare demands and advancements in drug development. Solvents are crucial for the synthesis and formulation of pharmaceutical products, from active pharmaceutical ingredients (APIs) to the final drug delivery forms. As both industries expand, industrial solvents remain indispensable, contributing to the market’s overall growth in the region.

Sustainability and Environmental Regulations

Environmental concerns and the rising demand for sustainable products are reshaping the industrial solvents market in the Middle East & Africa. Governments in the region are increasingly enacting regulations that restrict the use of harmful and volatile organic compounds (VOCs) in industrial solvents, creating a push for eco-friendly and low-VOC solvent alternatives. In response, manufacturers are developing green solvents derived from renewable resources, such as bio-based solvents, which align with global sustainability trends and regional environmental standards. The shift towards low-toxicity, biodegradable, and less polluting solvents is not only a regulatory requirement but also a consumer preference. The move to environmentally friendly products is helping companies cater to both regulatory frameworks and market demands, driving innovation and boosting the growth of the industrial solvents market in the region.

Expansion of the Automotive and Electronics Sectors

The automotive and electronics industries are key contributors to the demand for industrial solvents in the Middle East & Africa. With an increase in manufacturing and assembly operations in countries like Morocco, South Africa, and Egypt, the need for industrial solvents in these sectors has surged. For instance, Morocco’s automotive industry has reported rising demand for solvent-based coatings and adhesives due to increased vehicle production and exports. Solvents are vital in automotive manufacturing for processes such as cleaning, degreasing, and paint application. Additionally, in the electronics industry, solvents are used in cleaning and component manufacturing. As the demand for consumer electronics and automobiles continues to grow, particularly in emerging markets within the MEA region, the consumption of industrial solvents will expand. The rising adoption of advanced technologies in automotive design and electronics, coupled with the region’s strategic importance as a manufacturing hub, will continue to drive the growth of the industrial solvents market.

Market Trends

Shift Towards Eco-Friendly and Green Solvents

A key trend in the Middle East & Africa industrial solvents market is the increasing shift towards eco-friendly and green solvents. As environmental regulations become more stringent and consumer demand for sustainable products rises, companies are focusing on developing solvents that are biodegradable, have low toxicity, and release fewer volatile organic compounds (VOCs) into the atmosphere. The growing push for sustainability is driving innovation in bio-based solvents derived from renewable sources like plants, which offer a less harmful alternative to traditional petrochemical-based solvents. This trend is gaining momentum as industries seek to comply with both local and international environmental standards while meeting the rising preference for sustainable solutions among consumers and businesses.

Adoption of High-Performance Solvents

Another prominent trend in the MEA industrial solvents market is the increasing adoption of high-performance solvents. As industries across the region continue to expand, there is a growing need for solvents that offer enhanced efficiency, faster drying times, and improved application properties. For instance, the Middle East & Africa solvent market has reported rising demand for high-performance formulations in automotive coatings and electronics manufacturing. High-performance solvents are particularly in demand in sectors such as automotive, coatings, and electronics, where precision and quality are critical. These solvents help manufacturers improve product durability, appearance, and performance, driving their adoption in industries where higher standards are required. The continued development of specialized solvents that meet these demands is expected to propel this trend throughout the forecast period.

Rising Demand for Solvents in Emerging Industries

The demand for industrial solvents is also rising in emerging industries across the Middle East & Africa. As the region diversifies its economy, industries such as electronics, renewable energy, and aerospace are gaining momentum, leading to a surge in solvent usage. For instance, the Middle East & Africa electronics sector is expanding, increasing reliance on solvents for semiconductor fabrication and component cleaning. In particular, the electronics industry, driven by the production of consumer gadgets, semiconductors, and photovoltaic cells, is increasing its reliance on solvents for cleaning, degreasing, and formulation purposes. The renewable energy sector, particularly solar panel manufacturing, also requires specific solvents for coating and cleaning applications. As these emerging industries grow, they will drive the demand for specialized solvents designed to meet the unique needs of advanced technologies.

Consolidation of Local Manufacturing and Supply Chains

A significant trend shaping the industrial solvents market in the Middle East & Africa is the consolidation of local manufacturing capabilities and the strengthening of supply chains. Many global solvent manufacturers are investing in the region to establish local production plants, reducing dependence on imports and improving supply chain efficiency. This trend is expected to continue as companies seek to take advantage of lower production costs, proximity to key markets, and easier access to raw materials. Strengthening local manufacturing and supply chains not only ensures a more reliable supply of solvents but also aligns with regional economic strategies aimed at boosting local production and reducing reliance on foreign imports. This consolidation is likely to enhance market competition and provide more competitive pricing, further stimulating market growth.

Market Challenges Analysis

Regulatory Compliance and Environmental Concerns

One of the primary challenges facing the Middle East & Africa (MEA) industrial solvents market is the increasing complexity of regulatory compliance and environmental concerns. As environmental regulations tighten globally and within the region, manufacturers are under increasing pressure to produce solvents that meet stricter standards for toxicity, VOC emissions, and biodegradability. For instance, Middle Eastern countries are implementing stricter VOC emission regulations, prompting industries to transition toward bio-based solvent solutions. This transition to greener and more sustainable solvents can be costly and require significant investment in research and development. The lack of consistent regulatory frameworks across different MEA countries further complicates compliance, as companies must navigate varying standards and guidelines in each market. These challenges can lead to higher production costs, delays in product development, and increased scrutiny from regulatory authorities, putting additional strain on businesses in the industrial solvents sector.

Volatility of Raw Material Prices and Supply Chain Disruptions

Another significant challenge in the MEA industrial solvents market is the volatility of raw material prices and supply chain disruptions. The majority of industrial solvents are derived from petrochemicals, and fluctuations in global oil prices can directly affect the cost of these raw materials. Additionally, geopolitical instability, particularly in key oil-producing countries in the region, can lead to supply chain disruptions, causing delays in production and increased costs. The reliance on imported raw materials and finished solvents in certain MEA countries further exacerbates these challenges, making it difficult for local manufacturers to maintain consistent production schedules. These factors can lead to unpredictable pricing and supply issues, hindering the growth and stability of the industrial solvents market in the region.

Market Opportunities

The Middle East & Africa industrial solvents market presents significant opportunities driven by the region’s ongoing industrialization and diversification efforts. As countries in the region invest in infrastructure, construction, and manufacturing sectors, the demand for industrial solvents is expected to increase. The continued growth of industries such as automotive, electronics, and chemicals, coupled with the rise in consumer demand for paints, coatings, and adhesives, creates vast potential for market expansion. Additionally, the push towards the adoption of eco-friendly and sustainable products presents a unique opportunity for manufacturers to innovate and offer green solvent solutions, positioning themselves as leaders in the environmentally conscious market. With government support for industrial development and the push towards sustainability, the market is poised for steady growth.

Furthermore, the rise of emerging industries such as renewable energy, electronics, and advanced manufacturing in the MEA region offers new avenues for growth in the industrial solvents market. In particular, the electronics sector’s increasing reliance on solvents for cleaning, degreasing, and formulation purposes provides manufacturers with an opportunity to cater to this growing demand. Similarly, the expansion of the renewable energy industry, especially solar energy production, creates a need for specialized solvents used in the manufacturing and maintenance of solar panels. With the growing diversification of industries and the demand for high-performance, specialized solvents, businesses have an opportunity to capitalize on these trends by offering tailored products that meet the unique requirements of these evolving sectors.

Market Segmentation Analysis:

By Type:

The Middle East & Africa industrial solvents market is diverse, with different solvent types serving various industries. Alcohols, which include ethanol, isopropanol, and methanol, dominate the market due to their versatile application across multiple sectors. Alcohols are primarily used in paints, coatings, and cleaning products, owing to their effectiveness in dissolving a wide range of substances. Ketones, such as acetone and methyl ethyl ketone, also hold a significant market share due to their strong solvency power, making them essential in the pharmaceutical, coatings, and adhesives industries. Esters, including ethyl acetate and butyl acetate, are widely used in paints, coatings, and printing inks due to their fast evaporation rates and excellent ability to dissolve various substances. Glycols, such as ethylene glycol, are key in the production of antifreeze, industrial fluids, and paints. Other types of solvents include hydrocarbons and chlorinated solvents, each serving specific industries based on their unique properties. This diverse range of solvent types ensures that the industrial solvents market can meet the varying demands of industries across the region.

By Application:

In terms of application, the Middle East & Africa industrial solvents market is largely driven by the demand in paints and coatings. Solvents play a critical role in the formulation of paints, coatings, and varnishes used in construction, automotive, and industrial applications. The pharmaceuticals sector also accounts for a substantial share, with solvents being essential for drug formulation, extraction, and purification processes. Printing inks represent another key application, where solvents are necessary for adjusting the viscosity and aiding the drying process of inks used in packaging and commercial printing. Adhesives and sealants are another significant application area, with solvents used to control the viscosity and enhance the adhesive properties of products. Other applications include solvents used in agriculture (pesticides), cleaning products, and chemical manufacturing. As industrial activities continue to grow across the region, these applications will expand, driving further demand for specific solvent types tailored to meet industry needs.

Segments:

Based on Type:

- Alcohols

- Ketones

- Esters

- Glycols

- Others

Based on Application:

- Paints & Coatings

- Pharmaceuticals

- Printing Inks

- Adhesives & Sealants

- Others

Based on End- Use:

- Construction

- Automotive

- Electronics

- Agriculture

- Others

Based on Source:

- Petrochemical-Based Solvents

- Bio-Based Solvents

Based on the Geography:

- Saudi Arabia

- United Arab Emirates (UAE)

- Kuwait

- Qatar

- South Africa

- Rest of MEA

Regional Analysis

Saudi Arabia

Saudi Arabia, with its large industrial base and significant contributions to the chemical and manufacturing sectors, holds the largest market share in the region. The country’s rapid infrastructure development, growth in the automotive sector, and increasing demand for paints and coatings fuel the demand for industrial solvents. As one of the largest economies in the region, Saudi Arabia accounts for approximately 35% of the MEA industrial solvents market, and its industrial activities are expected to continue to drive market expansion over the forecast period.

United Arab Emirates (UAE)

The United Arab Emirates (UAE) follows closely behind, with a strong market share of around 25%. The UAE’s diversified economy, with its focus on construction, automotive, and oil & gas industries, plays a crucial role in the demand for industrial solvents. The country’s push towards becoming a global hub for innovation and technology further supports the demand for specialized solvents in sectors like electronics and renewable energy. Dubai and Abu Dhabi’s rapid urbanization, coupled with the region’s growing focus on sustainable solutions, also contribute to the UAE’s substantial market share.

Kuwait and Qatar

Kuwait and Qatar, together, represent approximately 15% of the total MEA industrial solvents market share. Both countries have seen consistent growth in industrial sectors, driven by the oil and gas industry, construction, and chemicals. Although their market share is smaller compared to Saudi Arabia and the UAE, they are experiencing increased demand for solvents, particularly in sectors like coatings, adhesives, and pharmaceuticals. These nations are also investing in infrastructure projects and diversifying their economies, which will continue to bolster the industrial solvents market in the coming years.

South Africa

South Africa, representing around 12% of the MEA industrial solvents market, is the largest contributor to the market share in Sub-Saharan Africa. As the leading industrial hub in the region, South Africa’s demand for industrial solvents is driven by the chemicals, automotive, and agriculture sectors. The country’s stable industrial base and increasing investments in manufacturing infrastructure further enhance the demand for solvents. The rest of MEA, including emerging markets in Africa, accounts for the remaining 13% of the market. While smaller, these regions are showing promising growth due to industrialization and expanding manufacturing activities. The continued development in regions like Egypt and Morocco is expected to further increase market share in the future.

Key Player Analysis

- Dow Inc.

- ExxonMobil Corporation

- Eastman Chemical Company

- Ashland Middle East & Africa Holdings Inc.

- Huntsman Corporation

- LyondellBasell Industries

- Celanese Corporation

- PPG Industries, Inc.

- Chevron Phillips Chemical Company

- DuPont de Nemours, Inc.

Competitive Analysis

The Middle East & Africa industrial solvents market is highly competitive, with key players such as Dow Inc., ExxonMobil, Eastman Chemical Company, Ashland Middle East & Africa Holdings Inc., Huntsman Corporation, LyondellBasell Industries, Celanese Corporation, PPG Industries, Inc., Chevron Phillips Chemical Company, and DuPont de Nemours, Inc. leading the market. These companies leverage their strong global presence, technological expertise, and diversified product portfolios to capture a significant share of the regional market. Companies are also investing heavily in R&D to introduce specialized solutions tailored to diverse industries such as automotive, coatings, pharmaceuticals, and electronics. Furthermore, enhancing local manufacturing capabilities and supply chain efficiency remains a key focus, with businesses looking to reduce costs and improve market access. Strategic collaborations, mergers, and acquisitions are also common as companies seek to strengthen their regional presence and expand their product portfolios. With growing industrialization in the region and increasing demand for solvents in emerging sectors like renewable energy, the competition is expected to intensify, pushing companies to adopt more innovative and sustainable practices to maintain market leadership.

Recent Developments

- In April 2025, Eastman announced off-list price increases for several EOD (Ethylene Oxide Derivatives) solvents, including Eastman™ DB Solvent, effective April 7, 2025, reflecting ongoing cost and market pressures.

- In March 2025, BASF reported generating approximately €11 billion in 2024 sales from products launched in the past five years, driven by R&D focused on sustainability, biodegradable materials, and digital transformation. The company filed 1,159 new patents in 2024, with 45% targeting sustainability. R&D investment in 2024 was €2.1 billion, with a similar budget planned for 2025.

- In March and April 2025, Shell is restructuring its global chemicals business to boost profitability and reduce capital spending by 2030. This includes exploring strategic partnerships in the U.S., potentially closing some European assets, and selling existing assets like the Singapore refinery and chemical complex. The company aims to streamline operations, focus on core businesses, and improve returns for shareholders.

- In March 2025, BASF is expanding its production capacity for aminic antioxidants at its Puebla, Mexico site, targeting the growing demand for long-life lubricants. The project is set for completion in 2026.

- In March 2025, ExxonMobil announced a $100 million upgrade to its Baton Rouge, Louisiana plant to produce ultra-high-purity (99.999%) isopropyl alcohol (IPA) for the semiconductor industry by 2027.

- In March 2024, Dow announced plans to invest in new ethylene derivatives capacity-including carbonate solvents-on the U.S. Gulf Coast. This investment, supported by the U.S. Department of Energy, aims to supply carbonate solvents for lithium-ion batteries, supporting the domestic EV and energy storage market. The facility will capture over 90% of CO₂ from ethylene oxide production, aligning with sustainability goals.

Market Concentration & Characteristics

The Middle East & Africa industrial solvents market is moderately concentrated, with a mix of global and regional players competing for market share. The market is characterized by the presence of large multinational corporations that dominate through advanced product offerings, extensive distribution networks, and significant investments in R&D. These companies often leverage economies of scale and technological innovations to maintain a competitive edge. However, regional players also have a strong foothold, particularly in emerging markets, due to their better understanding of local needs, regulatory environments, and the ability to offer tailored solutions. The market is witnessing increasing competition as companies focus on product differentiation, particularly through sustainable and eco-friendly solvent alternatives. As industrialization grows across the MEA region, new entrants are expected to emerge, further intensifying competition. The industry’s dynamics are shaped by a balance between global giants and agile local players, with the emphasis on innovation and sustainability driving market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use, Source and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for industrial solvents in the Middle East & Africa is expected to grow steadily due to ongoing industrialization and infrastructure development.

- Eco-friendly and bio-based solvents will see a significant rise in adoption as industries seek sustainable solutions to meet environmental regulations.

- The expansion of the automotive and construction sectors will continue to drive the demand for solvents used in paints, coatings, and adhesives.

- Increased investments in renewable energy and electronics manufacturing will create new opportunities for specialized solvents in these emerging industries.

- The shift towards high-performance solvents will intensify as industries demand faster drying times, improved efficiency, and enhanced product quality.

- Market players are likely to focus more on R&D to develop advanced solvent formulations that cater to specific regional needs and applications.

- Regulatory pressures to reduce VOC emissions will drive innovation in low-VOC and non-toxic solvents, reshaping product offerings across various industries.

- Local manufacturing and regional supply chains will become increasingly important as companies seek to reduce costs and improve operational efficiency.

- The rise in pharmaceutical production in the region will lead to greater demand for solvents used in drug formulation, purification, and extraction.

- Competitive dynamics in the market will intensify, with both global giants and regional players focusing on product diversification, sustainability, and strategic partnerships.