Market Overview

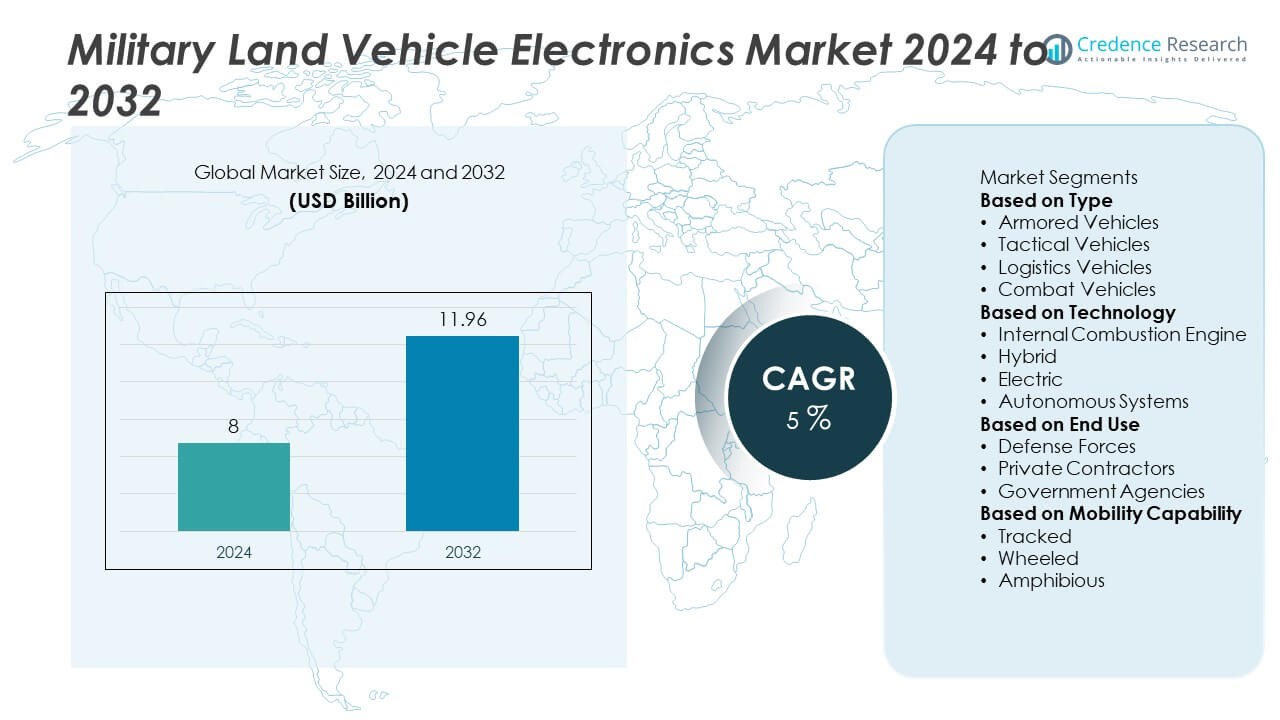

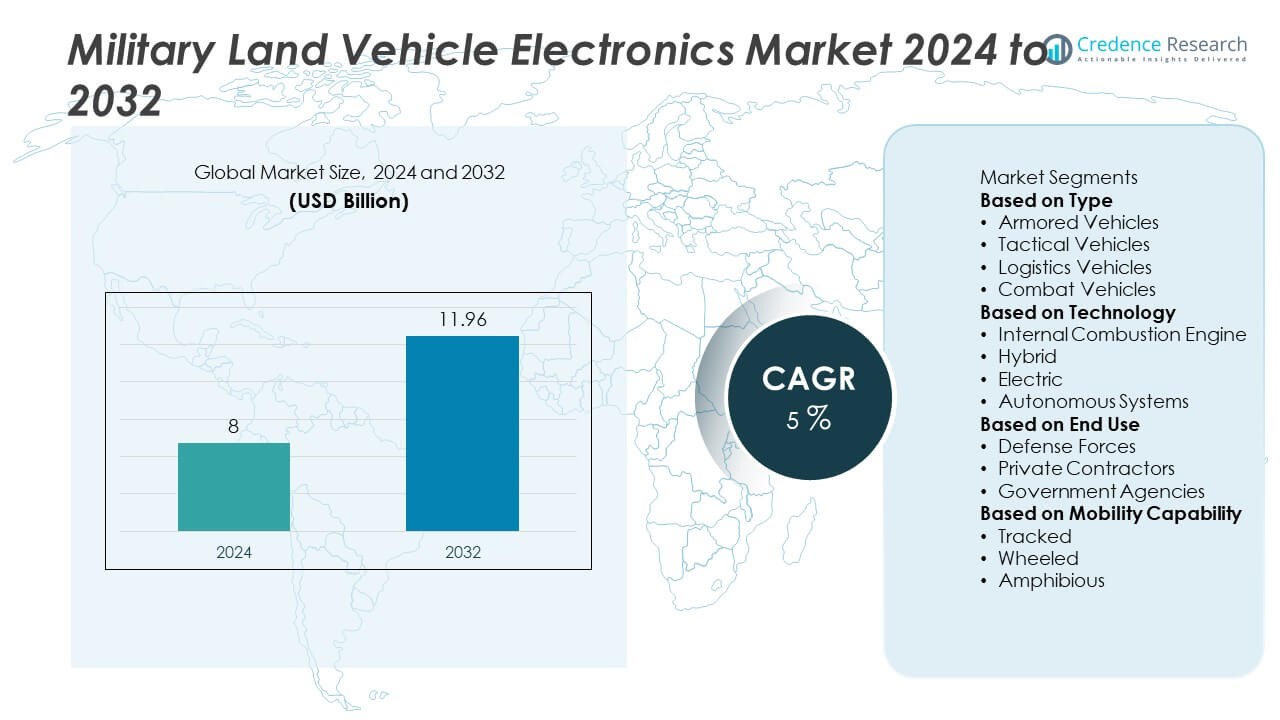

The global military land vehicle electronics market was valued at USD 8 billion in 2024 and is expected to reach USD 11.96 billion by 2032, growing at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Military Land Vehicle Electronics Market Size 2024 |

USD 8 Billion |

| Military Land Vehicle Electronics Market, CAGR |

5% |

| Military Land Vehicle Electronics Market Size 2032 |

USD 11.96 Billion |

The military land vehicle electronics market is led by major players including Leonardo S.p.A., Textron, Rheinmetall, Oshkosh Corporation, Elbit Systems, SAIC, Navistar Defense, KMW, Northrop Grumman, and BAE Systems. These companies focus on delivering advanced vehicle electronics such as communication systems, sensor suites, and autonomous navigation solutions to support modern combat operations. North America dominated the market with 38% share in 2024, driven by large-scale fleet modernization programs and high defense budgets in the U.S. Europe followed with 27% share, supported by NATO-led initiatives and collaborative R&D efforts. Asia-Pacific accounted for 22% share, with strong growth from China, India, and South Korea as they expand armored and tactical vehicle fleets to strengthen defense capabilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The military land vehicle electronics market was valued at USD 8 billion in 2024 and is projected to reach USD 11.96 billion by 2032, growing at a CAGR of 5%.

- Rising defense modernization programs and investments in network-centric warfare drive demand for advanced electronics, including communication, fire control, and vehicle management systems across armored, tactical, and combat vehicles.

- Key trends include electrification of fleets, integration of autonomous navigation systems, and adoption of AI-enabled decision-support tools to improve operational efficiency and reduce crew workload.

- The market is competitive with major players such as Leonardo S.p.A., Textron, Rheinmetall, Oshkosh Corporation, Elbit Systems, and BAE Systems focusing on modular and cyber-secure solutions through partnerships and R&D initiatives.

- North America led with 38% share in 2024, followed by Europe at 27% and Asia-Pacific at 22%, while armored vehicles remained the dominant type segment with over 40% market share globally.

Market Segmentation Analysis:

By Type

Armored vehicles dominated the military land vehicle electronics market in 2024, capturing over 40% share. Their dominance is driven by rising demand for advanced situational awareness, communication systems, and fire control solutions in modernized armored fleets. Nations are upgrading main battle tanks and infantry fighting vehicles with integrated digital displays, threat detection sensors, and active protection systems to enhance battlefield survivability. Growing cross-border tensions and the need for rapid deployment platforms are boosting procurement programs worldwide, supporting sustained investment in electronic systems for armored vehicles over the forecast period.

- For instance, Rheinmetall’s Electronic Solutions division reported a 46% sales increase in the first half of 2025, driven by major framework contracts for advanced electronic suites, such as the German Army’s TaWAN communication system and Future Soldier systems.

By Technology

Internal combustion engine platforms held the largest share, accounting for over 65% of the market in 2024. Their widespread use is supported by proven reliability, compatibility with existing logistics infrastructure, and lower acquisition costs. Military fleets continue to rely on diesel-powered systems for tactical and combat missions, driving demand for robust electronic controls and power management units. However, hybrid and electric technologies are gaining momentum due to fuel efficiency and lower thermal signatures, with many programs investing in electrification for future platforms to meet sustainability and stealth requirements.

- For instance, AM General began delivering the upgraded Joint Light Tactical Vehicle (JLTV) A2 to the U.S. military in 2025, which features enhanced components, though it does not include a hybrid-electric powertrain.

By End Use

Defense forces led the market, representing over 70% share in 2024, as they remain the primary buyers of land vehicle electronics for fleet modernization and operational readiness. Governments allocate significant budgets for upgrading command-and-control systems, navigation modules, and cyber-secure communication solutions to maintain superiority in complex battlefields. Private contractors and government agencies follow, focusing on logistics support, peacekeeping, and homeland security applications. Rising adoption of advanced training simulators and mission planning software further supports steady demand from defense forces across major military programs globally.

Key Growth Drivers

Rising Defense Modernization Programs

Governments are prioritizing fleet upgrades and new procurements to improve combat readiness. Modernization programs focus on advanced communication systems, digital targeting solutions, and electronic warfare protection. Countries such as the U.S., India, and NATO members invest in network-centric warfare capabilities. This push increases demand for ruggedized electronics, vehicle management systems, and real-time data-sharing modules. Increased funding for R&D ensures continuous innovation, strengthening adoption of advanced vehicle electronics across armored, tactical, and logistics platforms during the forecast period.

- For instance, BAE Systems continues to produce and upgrade M2A4 Bradley Fighting Vehicles for the U.S. Army, a platform equipped with digitized electronics for enhanced network capabilities and survivability.

Adoption of Autonomous and AI-Driven Systems

The military sector is rapidly adopting autonomous navigation and AI-enabled systems for land vehicles. These technologies improve mission effectiveness, reduce crew workload, and minimize risks in hostile environments. Unmanned ground vehicles are used for reconnaissance, explosive ordnance disposal, and logistics missions. AI-powered decision-support tools enable faster threat analysis and route optimization. Governments are supporting programs to integrate semi-autonomous capabilities into armored fleets, driving demand for sensors, LiDAR, and control electronics for reliable operations.

- For instance, Science Applications International Corp. (SAIC) developed a demonstrator for a next-generation Advanced Reconnaissance Vehicle (ARV) that incorporates a hybrid vehicle architecture and cutting-edge sensor and AI-based technologies to improve situational awareness and mission capabilities for the U.S. Marine Corps.

Demand for Cybersecurity and Secure Communications

Cyber threats in modern warfare have intensified the need for secure, encrypted communications in military vehicles. Electronic systems are designed with hardened networks and cyber-resilient architectures. Defense agencies invest in technologies that protect data confidentiality and mission integrity under electronic warfare conditions. Secure GPS, anti-jamming systems, and cryptographic key management are now standard. This focus on cybersecurity drives demand for advanced electronic modules, ensuring mission-critical systems remain protected and operational across combat scenarios.

Key Trends & Opportunities

Electrification and Hybridization of Military Fleets

Militaries are adopting hybrid and electric propulsion systems to reduce fuel dependency and thermal signatures. These systems offer quieter operations, improved stealth, and lower lifecycle costs. Manufacturers are developing high-capacity batteries, power electronics, and energy management systems for combat platforms. Electrification creates opportunities for advanced power distribution and control modules, enabling efficient integration of mission payloads and auxiliary systems. This trend aligns with decarbonization goals and enhances operational flexibility during extended missions.

- For instance, Oshkosh Defense unveiled a hybrid-electric JLTV prototype in January 2022, equipped with a lithium-ion battery pack capable of providing silent drive for approximately 30 minutes

Integration of Advanced Sensor Suites

Vehicles are increasingly equipped with LiDAR, radar, and EO/IR cameras to deliver 360° situational awareness. Integrated sensor networks feed data to command systems, allowing faster decision-making and improved survivability. The rising demand for active protection systems and threat detection electronics is driven by evolving anti-armor threats. This trend opens opportunities for suppliers to provide high-speed processors, secure data links, and modular architectures that support upgrades through a vehicle’s service life.

- For instance, Rheinmetall has integrated the StrikeShield APS on its KF41 Lynx IFV, using it in conjunction with advanced electro-optical sensors for 360° coverage and full digital fire-control integration.

Key Challenges

High Development and Integration Costs

Advanced electronics significantly raise acquisition and maintenance costs for military vehicles. Developing rugged systems that meet strict military standards requires extensive testing and certification, which increases program expenses. Budget limitations in some regions slow modernization efforts and delay large-scale adoption of next-generation systems. Suppliers face pressure to deliver cost-efficient yet technologically advanced solutions to win competitive defense contracts and meet procurement cycles.

Complexity of Cybersecurity Implementation

Implementing robust cybersecurity across diverse fleets is a major challenge. Many legacy vehicles lack architecture to support advanced encryption and intrusion detection systems, making retrofits expensive and complex. Evolving cyber threats demand constant updates and monitoring, requiring ongoing investment from defense agencies. Ensuring secure interoperability between allied forces adds further complexity, potentially delaying the deployment of new vehicle electronics and security upgrades.

Regional Analysis

North America

North America held the largest share of the military land vehicle electronics market with 38% share in 2024. The region’s dominance is driven by high defense budgets, strong focus on fleet modernization, and integration of advanced C4ISR systems. The U.S. leads procurement with programs upgrading armored vehicles, tactical fleets, and combat systems with digital communications and active protection technologies. Canada also invests in electronic warfare systems and hybrid vehicle platforms to enhance mobility and operational readiness. Favorable defense policies and strong local manufacturing capabilities support continued growth for vehicle electronics suppliers in this region.

Europe

Europe accounted for 27% share in 2024, driven by rising cross-border tensions and NATO-led modernization efforts. Major countries such as Germany, France, and the U.K. are upgrading main battle tanks and infantry vehicles with advanced targeting systems, cybersecurity solutions, and integrated power management modules. The European Defence Fund supports R&D for autonomous systems and electrification programs. Demand is also growing for sensor fusion and active protection systems to counter evolving threats. Collaboration between domestic suppliers and pan-European defense programs ensures steady adoption of cutting-edge electronic systems across multiple vehicle categories.

Asia-Pacific

Asia-Pacific represented 22% share in 2024, with rapid growth fueled by expanding defense budgets in China, India, South Korea, and Japan. Regional militaries are procuring advanced armored vehicles and deploying smart communication networks to enhance situational awareness. Indigenous manufacturing initiatives such as India’s Make in India and China’s defense modernization programs are boosting demand for locally produced electronics. Increased focus on autonomous platforms and hybrid propulsion solutions is accelerating technology adoption. The region’s geopolitical tensions and border security requirements further support investments in vehicle electronics for combat readiness and mobility enhancement.

Middle East & Africa

The Middle East & Africa region captured 8% share in 2024, supported by strong procurement of armored and tactical vehicles to address regional security challenges. Countries like Saudi Arabia, UAE, and Israel invest heavily in integrating electronic warfare systems, remote weapon stations, and advanced surveillance modules into land fleets. Defense industrialization initiatives and partnerships with international OEMs strengthen local capabilities. In Africa, modernization efforts are concentrated on upgrading logistics and reconnaissance vehicles to improve mobility in peacekeeping operations. Growing focus on border security and counterterrorism operations drives sustained demand for advanced vehicle electronics.

Latin America

Latin America accounted for 5% share in 2024, with growth driven by military fleet upgrades in Brazil, Mexico, and Colombia. Regional governments are investing in vehicle communication systems, GPS navigation, and digital command solutions to enhance mission coordination. Brazil leads procurement programs, focusing on modular electronics and armored vehicle upgrades under its Army Strategic Program. Rising cross-border crime and internal security operations further boost demand for tactical vehicle electronics. However, budgetary constraints remain a challenge, pushing suppliers to deliver cost-effective systems that meet operational requirements while supporting local industrial participation.

Market Segmentations:

By Type

- Armored Vehicles

- Tactical Vehicles

- Logistics Vehicles

- Combat Vehicles

By Technology

- Internal Combustion Engine

- Hybrid

- Electric

- Autonomous Systems

By End Use

- Defense Forces

- Private Contractors

- Government Agencies

By Mobility Capability

- Tracked

- Wheeled

- Amphibious

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the military land vehicle electronics market is defined by leading players such as Leonardo S.p.A., Textron, Rheinmetall, Oshkosh Corporation, Elbit Systems, SAIC, Navistar Defense, KMW, Northrop Grumman, and BAE Systems. These companies focus on developing advanced vehicle electronics, including digital communication systems, fire control modules, autonomous navigation solutions, and electronic warfare systems to meet evolving battlefield requirements. Strategic initiatives include partnerships with defense agencies, long-term modernization contracts, and investments in R&D for hybrid and autonomous platforms. Many players are expanding production capabilities and upgrading supply chains to meet rising demand for ruggedized, cyber-secure solutions. The competitive environment is shaped by continuous innovation, compliance with strict military standards, and the ability to deliver modular, upgradeable systems that ensure operational flexibility across multiple vehicle classes and mission profiles.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Leonardo S.p.A. (Leonardo DRS) launched AI-enabled RSD-G rugged smart displays for ground vehicles with integrated MOSA compute.

- In July 2025, Leonardo signed a binding agreement to acquire Iveco Defence Vehicles from the Iveco Group for €1.7 billion. This acquisition will strengthen Leonardo’s position as an integrated original equipment manufacturer (OEM) in land defense, combining vehicle chassis expertise with Leonardo’s advanced electronic systems, combat sensors, and remotely operated turrets.

- In May 2025, Northrop Grumman unveiled its next-generation vehicle electronic architecture, featuring AI-enabled predictive diagnostics and secure communications systems designed for integration across wheeled and tracked military vehicles. Initial contracts included integration on over 100 vehicles for allied forces in Europe.

- In January 2025, The German Federal Cartel Office approved the joint venture between Rheinmetall AG and Leonardo, named Leonardo Rheinmetall Military Vehicles (LRMV), headquartered in Rome.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, End Use, Mobility Capability and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced communication and C4ISR systems will continue to rise in modernization programs.

- Hybrid and electric propulsion adoption will grow to enhance efficiency and reduce thermal signatures.

- Autonomous navigation and AI-enabled systems will see wider deployment in tactical and logistics vehicles.

- Cybersecurity integration will remain a priority to protect mission-critical data and networks.

- Sensor fusion and 360° situational awareness systems will become standard across armored fleets.

- Partnerships between defense contractors and governments will expand to accelerate technology development.

- Modular and upgradeable electronic systems will dominate future procurement to extend vehicle life cycles.

- Increased investment in electronic warfare solutions will support survivability in complex battlefields.

- Regional manufacturing and localization initiatives will boost domestic production capabilities in emerging economies.

- Continuous R&D will drive innovation in ruggedized, compact, and energy-efficient electronic components for military vehicles.