Market Overview

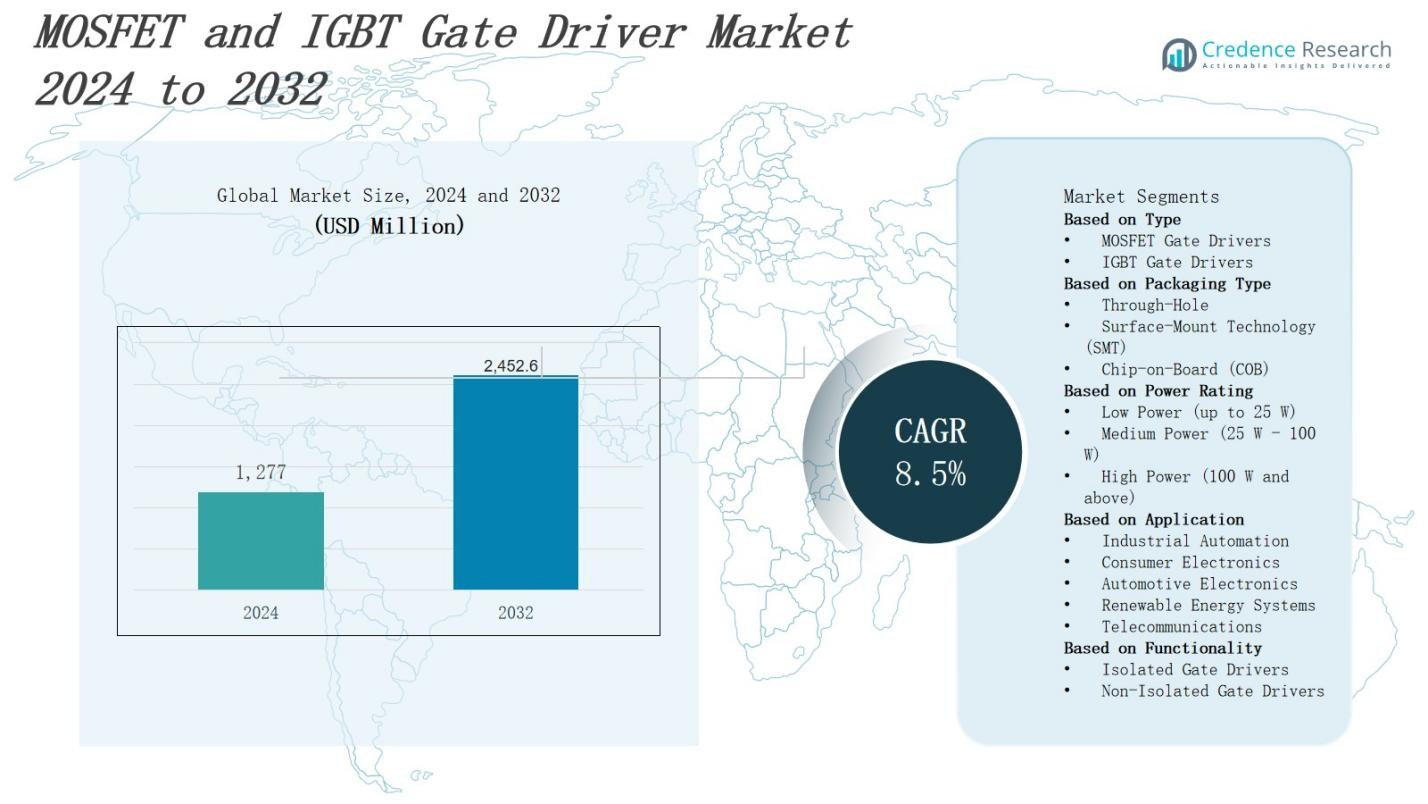

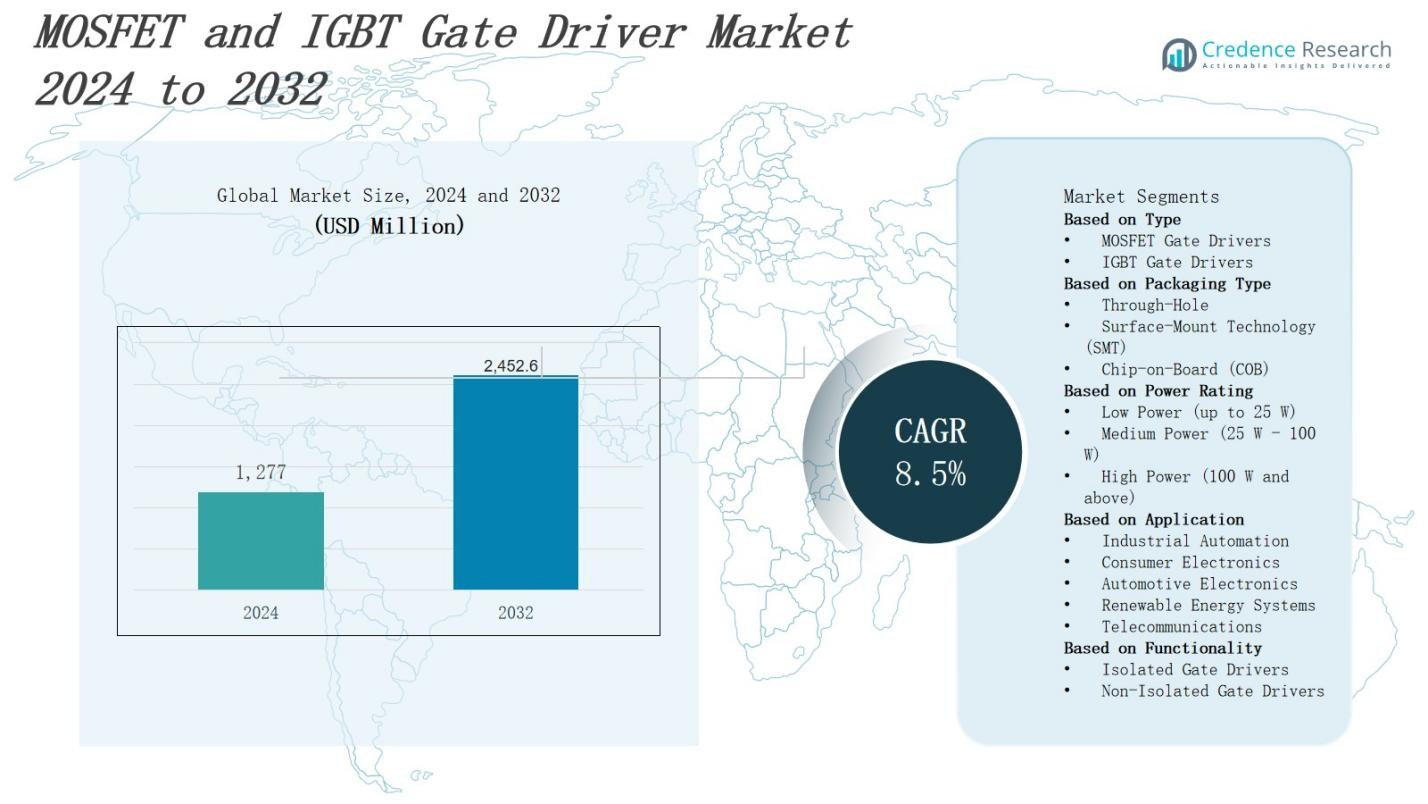

The MOSFET and IGBT gate driver market is projected to grow from USD 1,277 million in 2024 to USD 2,452.6 million by 2032, registering a CAGR of 8.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| MOSFET and IGBT Gate Driver Market Size 2024 |

USD 1,277 Million |

| MOSFET and IGBT Gate Driver Market, CAGR |

8.5% |

| MOSFET and IGBT Gate Driver Market Size 2032 |

USD 2,452.6 Million |

The MOSFET and IGBT gate driver market is driven by the rising adoption of electric vehicles, renewable energy systems, and industrial automation, which demand efficient power management and switching solutions. Increasing integration of wide bandgap semiconductors such as SiC and GaN enhances performance, efficiency, and thermal management, further fueling demand. Growth in consumer electronics, coupled with advancements in high-power density applications, is accelerating market expansion. Emerging trends include the development of compact, high-integration gate driver ICs, adoption of digital control features, and expanding use in aerospace and smart grid applications to improve reliability, speed, and energy efficiency in power electronics systems.

The MOSFET and IGBT gate driver market spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with Asia-Pacific holding the largest share, followed by North America and Europe. Growth is driven by electric mobility, renewable energy, and industrial automation across these regions. Key players include STMicroelectronics, Power Integrations Inc., ROHM Semiconductor, Broadcom Inc., Renesas Electronics Corporation, Analog Devices Inc., Powerex (BC Hydro), Toshiba Corporation, Microchip Technology Inc., NXP Semiconductors, Infineon Technologies AG, Semtech Corporation, and Vishay Intertechnology, all focusing on innovation and strategic collaborations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The MOSFET and IGBT gate driver market will grow from USD 1,277 million in 2024 to USD 2,452.6 million by 2032, at a CAGR of 8.5% during the forecast period.

- Rising demand in electric vehicles, renewable energy systems, and industrial automation drives adoption of efficient power management and switching solutions.

- Integration of SiC and GaN semiconductors enhances efficiency, thermal management, and switching performance in high-power applications.

- Growth in consumer electronics and high-performance computing boosts demand for compact, high-integration gate driver ICs.

- Key challenges include complex design requirements, high manufacturing costs, and supply chain disruptions impacting component availability.

- Asia-Pacific holds 38% share, followed by North America at 27%, Europe at 24%, Latin America at 6%, and Middle East & Africa at 5%.

- Major players include STMicroelectronics, Power Integrations Inc., ROHM Semiconductor, Broadcom Inc., Renesas Electronics Corporation, Analog Devices Inc., Powerex (BC Hydro), Toshiba Corporation, Microchip Technology Inc., NXP Semiconductors, Infineon Technologies AG, Semtech Corporation, and Vishay Intertechnology.

Market Drivers

Rising Adoption in Electric Vehicles and Renewable Energy Applications

The MOSFET and IGBT gate driver market is gaining momentum from the rapid growth of electric vehicles (EVs) and renewable energy infrastructure. It supports efficient high-voltage switching and precise control, essential for EV powertrains, solar inverters, and wind energy systems. Increasing government incentives for clean transportation and green energy projects strengthens demand. Manufacturers are focusing on enhancing efficiency, thermal performance, and compactness to meet stringent performance standards and operational reliability in these expanding sectors.

- For instance, Infineon Technologies designs IGBT gate drivers used in EV traction inverters to improve energy efficiency and extend battery life, supporting electric powertrains with high-voltage switching needs.

Advancements in Wide Bandgap Semiconductor Integration

Integration of wide bandgap semiconductors such as silicon carbide (SiC) and gallium nitride (GaN) is transforming the MOSFET and IGBT gate driver market. It enables higher efficiency, faster switching speeds, and superior thermal management, making devices suitable for demanding high-power density applications. Industries are adopting these technologies for reduced energy loss and improved system performance. This technological shift is encouraging innovation in driver designs to maximize the benefits of these advanced semiconductor materials.

Growing Industrial Automation and Smart Infrastructure Deploymen

Industrial automation, robotics, and smart infrastructure projects are fueling the expansion of the MOSFET and IGBT gate driver market. It delivers precise switching control required for variable frequency drives, motor control systems, and power supplies in automated environments. The rise in Industry 4.0 adoption, coupled with investments in smart factories, drives demand for robust, reliable gate drivers. Manufacturers are developing intelligent driver solutions that improve system monitoring, enhance efficiency, and extend operational lifecycles in industrial applications.

- For instance, Texas Instruments supplies gate drivers extensively used in automated manufacturing equipment to extend the operational life of power modules.

Expanding Consumer Electronics and High-Performance Power Applications

The surge in consumer electronics and high-performance computing devices is contributing to growth in the MOSFET and IGBT gate driver market. It supports miniaturized, efficient power delivery systems for products such as laptops, gaming consoles, and telecom equipment. Increasing demand for low power consumption and compact design in electronic devices accelerates innovation in driver ICs. The trend toward higher integration and multifunctional capabilities is shaping next-generation solutions to meet evolving application needs.

Market Trends

Increasing Shift Toward Wide Bandgap Device Compatibility

A key trend in the MOSFET and IGBT gate driver market is the growing compatibility with wide bandgap devices such as silicon carbide (SiC) and gallium nitride (GaN). It allows for higher switching frequencies, reduced conduction losses, and improved thermal efficiency. Manufacturers are designing gate drivers with optimized voltage ranges and protection features to suit these materials. This shift is enabling smaller, more efficient power conversion systems across automotive, renewable energy, and industrial sectors.

- For instance, Rohm Semiconductor has launched gate driver ICs specifically designed for SiC and GaN devices that support high-speed switching and elevated voltage levels, which are critical for electric vehicles and industrial power supplies.

Rising Demand for High Integration and Smart Control Features

Gate drivers are evolving to incorporate high integration and smart control functionalities, enabling compact designs with multiple built-in protections. In the MOSFET and IGBT gate driver market, this trend supports enhanced fault detection, thermal monitoring, and energy optimization. It caters to the demand for smaller form factors in EVs, industrial drives, and consumer electronics. This development reduces the need for external components, streamlines PCB design, and improves overall system reliability and efficiency.

Expansion in Fast-Charging and Power Conversion Applications

The increasing deployment of fast-charging infrastructure and high-efficiency power conversion systems is driving new opportunities in the MOSFET and IGBT gate driver market. It delivers the precise switching and high-voltage capabilities required for quick energy transfer. Demand is rising in EV charging stations, renewable energy converters, and UPS systems. The push for reduced charging times and improved conversion efficiency is accelerating the adoption of advanced gate driver technologies with robust safety mechanisms.

- For instance, Renesas has introduced a new gate driver IC designed for EV inverters with a 3.75kVrms isolator and high common-mode transient immunity, supporting power devices with up to 1200V withstand voltage for rapid and safe switching in automotive and power conversion applications.

Growing Adoption in Harsh and Mission-Critical Environments

Manufacturers are developing gate drivers capable of operating reliably in harsh and mission-critical environments. The MOSFET and IGBT gate driver market is witnessing an emphasis on extended temperature ranges, enhanced isolation, and higher surge tolerance. It ensures stable performance in aerospace, defense, and offshore energy applications. The focus on ruggedized, high-reliability designs is expanding the application scope, meeting stringent industry requirements while enabling deployment in challenging operational conditions worldwide.

Market Challenges Analysis

Complex Design Requirements and Integration Limitations

The MOSFET and IGBT gate driver market faces challenges due to the complex design requirements of modern high-power and high-frequency applications. It demands precise control, low latency, and robust protection features, making development cycles longer and costlier. Compatibility with wide bandgap devices introduces additional engineering complexities, such as managing gate voltages and preventing device overstress. Limited expertise in advanced driver design can slow adoption. Meeting diverse application standards across automotive, industrial, and aerospace sectors further increases design and compliance difficulties.

High Cost Pressures and Supply Chain Vulnerabilities

Price competitiveness and supply chain constraints are significant challenges in the MOSFET and IGBT gate driver market. It must balance performance and reliability with cost-efficiency to meet customer demands, particularly in price-sensitive markets. Fluctuations in raw material availability and semiconductor shortages disrupt production schedules and increase lead times. Rising manufacturing costs, driven by advanced packaging and integration requirements, put pressure on margins. The dependence on specialized components and fabrication facilities increases exposure to global supply chain risks and geopolitical uncertainties.

Market Opportunities

Expansion in Electric Mobility and Renewable Energy Infrastructure

The MOSFET and IGBT gate driver market holds significant growth potential with the rapid expansion of electric mobility and renewable energy projects. It enables efficient, high-speed switching essential for EV powertrains, charging stations, and energy storage systems. Governments worldwide are investing heavily in clean transportation and solar and wind energy infrastructure, creating strong demand for advanced gate drivers. The push toward higher efficiency, reduced energy losses, and compact power modules strengthens opportunities for innovative designs in these sectors.

Emergence of Smart Power Electronics and Industry 4.0 Applications

The evolution of Industry 4.0 and smart power electronics is opening new avenues for the MOSFET and IGBT gate driver market. It supports intelligent control, predictive maintenance, and enhanced energy optimization in automated manufacturing, robotics, and smart grids. The growing need for compact, integrated solutions with advanced monitoring capabilities drives R&D investments. Opportunities are emerging in aerospace, defense, and harsh-environment applications where rugged, high-reliability gate drivers can address mission-critical power conversion challenges.

Market Segmentation Analysis:

By Type

The MOSFET and IGBT gate driver market is segmented into MOSFET gate drivers and IGBT gate drivers. MOSFET gate drivers dominate applications requiring high switching speeds and low conduction losses, making them ideal for consumer electronics, renewable energy systems, and automotive electronics. IGBT gate drivers cater to high-voltage, high-current applications such as industrial motor drives, rail traction, and power grids. It continues to benefit from the rising demand for efficient, compact, and thermally stable switching solutions across these varied end-use sectors.

- For instance, Texas Instruments offers robust gate driver ICs applied in industrial and automotive sectors, with emphasis on integration and reliability to support high-speed switching and power management in electric vehicles and renewable energy systems.

By Packaging Type

Based on packaging type, the market includes through-hole, surface-mount technology (SMT), and chip-on-board (COB) configurations. Through-hole packaging is preferred in high-power and rugged industrial applications for its durability. SMT offers compactness and compatibility with automated assembly lines, driving adoption in consumer electronics and automotive electronics. COB technology provides high integration and performance efficiency, addressing advanced, space-constrained designs. It creates opportunities for innovation in packaging that balances size, heat dissipation, and electrical performance.

- For instance, COB packaging is used in LED lighting modules and compact sensor arrays in industrial and consumer applications, balancing electrical performance with thermal management.

By Power Rating

In terms of power rating, the market is divided into low power (up to 25 W), medium power (25 W – 100 W), and high power (100 W and above) segments. Low-power gate drivers are prevalent in portable electronics and communication devices. Medium-power drivers cater to industrial control systems, renewable energy converters, and EV chargers. High-power drivers serve heavy-duty applications such as rail transport, grid systems, and aerospace. It reflects a broad application base where tailored power handling capability ensures optimal performance.

Segments:

Based on Type

- MOSFET Gate Drivers

- IGBT Gate Drivers

Based on Packaging Type

- Through-Hole

- Surface-Mount Technology (SMT)

- Chip-on-Board (COB)

Based on Power Rating

- Low Power (up to 25 W)

- Medium Power (25 W – 100 W)

- High Power (100 W and above)

Based on Application

- Industrial Automation

- Consumer Electronics

- Automotive Electronics

- Renewable Energy Systems

- Telecommunications

Based on Functionality

- Isolated Gate Drivers

- Non-Isolated Gate Drivers

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America accounts for 27% of the MOSFET and IGBT gate driver market, driven by strong adoption in electric vehicles, renewable energy systems, and industrial automation. The region benefits from advanced R&D capabilities, established semiconductor manufacturing, and early integration of wide bandgap technologies such as SiC and GaN. It serves key applications in automotive, aerospace, and smart grid infrastructure. Government incentives for clean energy and electrification initiatives further boost demand. The presence of major industry players accelerates innovation and strengthens supply chain resilience across the region.

Europe

Europe holds 24% of the MOSFET and IGBT gate driver market, supported by a strong focus on sustainable energy transition, EV deployment, and industrial modernization. The region’s stringent energy efficiency regulations and climate targets drive adoption in renewable power plants, rail electrification, and factory automation. It benefits from a mature manufacturing base and significant investments in automotive electrification. Collaborations between technology providers and OEMs enhance innovation, while government-backed clean transport projects expand the application scope for advanced gate driver solutions.

Asia-Pacific

Asia-Pacific leads with 38% share of the MOSFET and IGBT gate driver market, fueled by rapid industrialization, large-scale electronics manufacturing, and robust automotive production. Countries like China, Japan, and South Korea drive demand through extensive EV adoption, solar energy expansion, and consumer electronics growth. It benefits from competitive manufacturing costs and a dense network of semiconductor fabrication facilities. Government policies promoting renewable energy and electric mobility create sustained growth momentum, making the region a global hub for power electronics innovation.

Latin America

Latin America represents 6% of the MOSFET and IGBT gate driver market, driven by emerging renewable energy projects, industrial automation, and growing EV penetration in countries such as Brazil and Mexico. It experiences rising demand for efficient power conversion in mining, oil, and manufacturing industries. Infrastructure modernization and regional trade agreements support technology adoption. Local manufacturing remains limited, prompting reliance on imports, yet the expanding investment climate encourages new market entry for global power electronics suppliers.

Middle East & Africa

The Middle East & Africa account for 5% of the MOSFET and IGBT gate driver market, with growth stemming from renewable energy projects, grid modernization, and industrial diversification efforts. It sees rising investments in solar farms, electric transport, and oil-to-electric power conversion systems. Government initiatives to reduce carbon dependency encourage adoption. Limited local semiconductor production creates opportunities for international suppliers, while infrastructure upgrades drive long-term demand for reliable, high-performance gate driver technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- STMicroelectronics

- Power Integrations Inc.

- ROHM Semiconductor

- Broadcom Inc.

- Renesas Electronics Corporation

- Analog Devices Inc.

- Powerex (BC Hydro)

- Toshiba Corporation

- Microchip Technology Inc.

- NXP Semiconductors

- Infineon Technologies AG

- Semtech Corporation

- Vishay Intertechnology

Competitive Analysis

The MOSFET and IGBT gate driver market is characterized by strong competition among global leaders and niche specialists, each aiming to enhance performance, integration, and application-specific capabilities. It is supported by rising demand from electric vehicles, renewable energy, industrial automation, and high-performance electronics. Key players such as STMicroelectronics, Power Integrations Inc., ROHM Semiconductor, Broadcom Inc., Renesas Electronics Corporation, Analog Devices Inc., and Powerex (BC Hydro) are developing solutions optimized for wide bandgap semiconductors like SiC and GaN to achieve higher efficiency and thermal stability. Toshiba Corporation, Microchip Technology Inc., NXP Semiconductors, Infineon Technologies AG, Semtech Corporation, and Vishay Intertechnology are investing in advanced packaging, integrated protection circuits, and compact designs to meet evolving industry standards. Strategic alliances with OEMs and system integrators, coupled with R&D investments, are enabling these companies to expand market reach and maintain a competitive edge in both established and emerging application sectors.

Recent Developments

- In March 2025, Toshiba Electronic Devices & Storage Corporation introduced the TLP5814H gate driver photocoupler, delivering +6.8A/-4.8A output in a compact SO8L package. Designed with an active Miller clamp function, it is ideal for driving silicon carbide (SiC) MOSFETs in industrial applications.

- In April 2025, Infineon Technologies AG unveiled its CoolSiC™ MOSFET 750 V G2 series, featuring ultra-low R₁₍DS(on)₎ to enhance efficiency and power density for on-board chargers, DC–DC converters, EV charging infrastructure, and solar inverters.

- In January 2025, Renesas Electronics Corporation released its 100 V high-power N-Channel MOSFETs based on the new REXFET-1 wafer process. Models RBA300N10EANS and RBA300N10EHPF offer 30% reduced on-resistance, 40% lower gate-drain charge, and 50% smaller packages, serving motor control, battery management, charging, and EV systems.

- In February 2025, Infineon Technologies AG expanded its EiceDRIVER portfolio with new isolated gate driver ICs tailored for electric vehicles, supporting the latest IGBT and SiC technologies, including the HybridPACK Drive G2 Fusion module.

Market Concentration & Characteristics

The MOSFET and IGBT gate driver market exhibits moderate to high concentration, with a mix of global leaders and specialized regional players competing through technological innovation, product differentiation, and strategic partnerships. It is characterized by strong demand across automotive, renewable energy, industrial automation, and consumer electronics sectors, where efficiency, thermal performance, and integration capabilities are critical. Leading companies focus on compatibility with wide bandgap semiconductors such as SiC and GaN, enabling faster switching speeds and higher power density. The market emphasizes reliability, compact form factors, and advanced protection features to meet stringent application requirements. Supply chain resilience, cost optimization, and R&D investment remain key competitive factors shaping industry dynamics.

Report Coverage

The research report offers an in-depth analysis based on Type, Packaging Type, Power Rating, Application, Functionality and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow with wider adoption of electric mobility and renewable energy infrastructure.

- Integration of SiC and GaN devices will drive innovation in high-efficiency driver solutions.

- Compact and highly integrated gate driver ICs will see higher adoption in space-constrained designs.

- Industrial automation and robotics will continue to create strong demand for reliable switching solutions.

- Smart grid modernization will increase the use of advanced gate driver technologies.

- Consumer electronics growth will boost requirements for low-power, high-performance driver ICs.

- Ruggedized designs will gain importance for aerospace, defense, and harsh environment applications.

- Strategic collaborations between semiconductor makers and OEMs will accelerate new product deployment.

- Packaging innovations will enhance thermal management and device miniaturization.

- Supply chain diversification will become a priority to reduce dependency on limited sources.