Market Overview

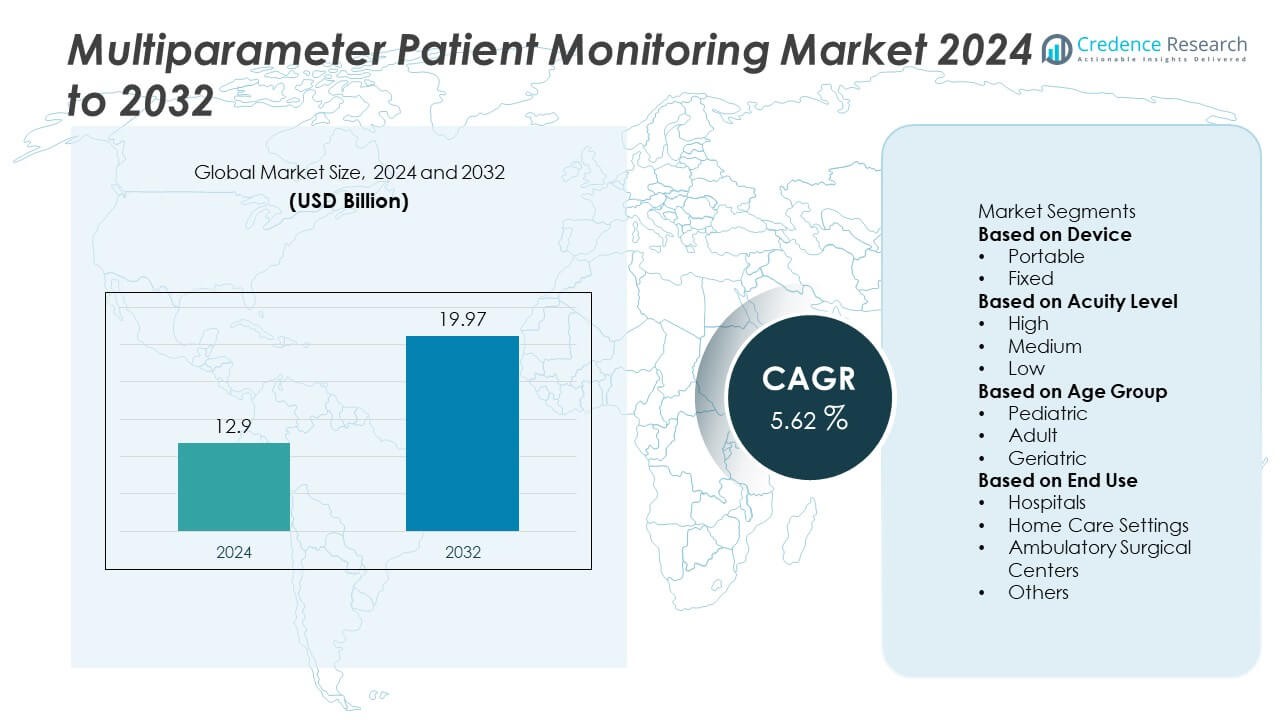

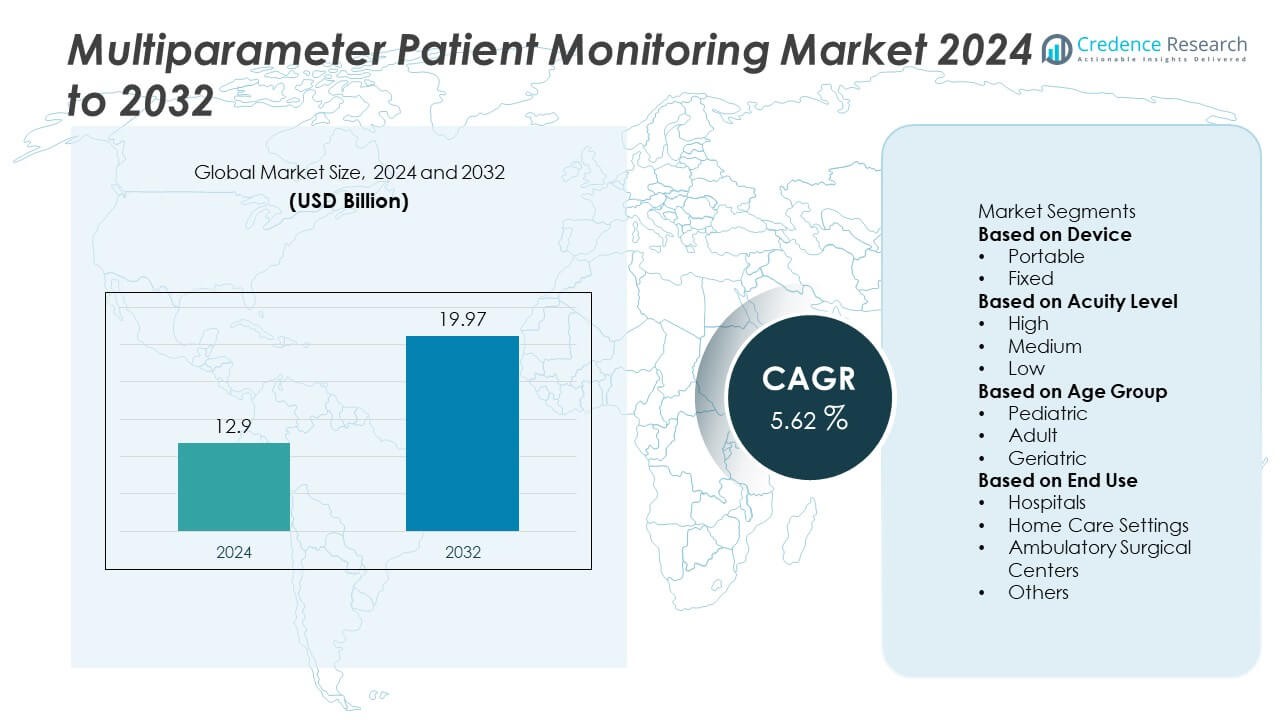

The Multiparameter Patient Monitoring market reached USD 12.9 billion in 2024 and is projected to achieve USD 19.97 billion by 2032. The market is expected to grow at a CAGR of 5.62% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Multiparameter Patient Monitoring Market Size 2024 |

USD 12.9 Billion |

| Multiparameter Patient Monitoring Market, CAGR |

5.62% |

| Multiparameter Patient Monitoring Market Size 2032 |

USD 19.97 Billion |

The Multiparameter Patient Monitoring market is shaped by leading players such as Philips Healthcare, GE HealthCare, Medtronic plc, Nihon Kohden Corporation, Mindray Medical International, Drägerwerk AG & Co. KGaA, Masimo Corporation, Schiller AG, Spacelabs Healthcare, and Baxter International Inc. These companies expand their presence through advanced sensor technologies, wireless connectivity, and integrated platforms that support real-time, high-acuity monitoring across clinical settings. North America leads the market with a 39% share, supported by strong critical care infrastructure and early adoption of connected monitoring systems. Europe follows with 29%, while Asia Pacific holds 23%, driven by rising healthcare investments, expanding hospital networks, and growing demand for portable monitoring solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Multiparameter Patient Monitoring market reached USD 12.9 billion in 2024 and will grow to USD 19.97 billion by 2032 at a 5.62% CAGR, supported by rising demand for advanced clinical monitoring.

- Growth is driven by increasing chronic disease burden and high-acuity admissions, with portable monitors leading the device segment with a 58% share as hospitals adopt mobile and remote monitoring solutions.

- Key trends include the shift toward wireless, wearable, and AI-enabled systems that enhance predictive assessment, streamline workflows, and support continuous, real-time monitoring across care settings.

- The competitive landscape includes major players such as Philips Healthcare, GE HealthCare, Medtronic, Mindray, Nihon Kohden, Drägerwerk, Masimo, Schiller AG, Spacelabs Healthcare, and Baxter, who invest in advanced sensors, interoperability, and data integration capabilities.

- North America leads with a 39% share, followed by Europe at 29% and Asia Pacific at 23%, driven by ICU expansion, rising surgical volumes, and growing adoption of high-acuity monitoring technologies.

Market Segmentation Analysis:

By Device

Portable monitors hold the dominant position in the device segment with a 58% market share, driven by rising adoption of compact, mobile, and battery-efficient systems across emergency care, ambulatory settings, and home healthcare. Healthcare providers prefer portable devices for continuous monitoring during patient transfers and remote assessments. Improvements in wireless connectivity, data integration, and lightweight designs support broader use in both hospitals and outpatient centers. Fixed monitors remain essential in intensive and critical care units where advanced parameters and high-acuity monitoring are required. Overall demand grows as providers prioritize mobility, flexibility, and real-time clinical data access.

- For instance, Philips Healthcare introduced its IntelliVue X3 platform with a 1.4 kg portable form factor and a battery life of over 5 hours in basic configuration, allowing uninterrupted transport monitoring. An optional battery extension is available to provide up to 15 hours of run time.

By Acuity Level

High-acuity monitoring leads this segment with a 46% market share, supported by increasing ICU admissions, rising prevalence of severe cardiac and respiratory conditions, and greater demand for continuous, multi-parameter tracking. Hospitals rely on high-acuity systems to monitor hemodynamic stability, ventilation status, and critical organ functions in complex cases. Medium-acuity monitoring expands as step-down units and emergency departments adopt integrated systems that support early detection and timely interventions. Low-acuity monitoring grows steadily in general wards and long-term care facilities. The segment benefits from rising focus on early clinical assessment and rapid response readiness.

- For instance, Drägerwerk upgraded its Infinity Acute Care System to support scalable clinical parameters in real time during critical interventions. The system uses MPod and MCable measurement modules to activate or discontinue parameters as needed, adapting to the patient’s condition.

By Age Group

The adult segment holds the dominant position with a 64% market share, driven by high hospitalization rates, increasing chronic disease burden, and strong demand for continuous monitoring among surgical and critical care patients. Adults account for the largest share of cardiovascular, respiratory, and metabolic disorders, which boosts adoption of advanced multi-parameter systems. Pediatric monitoring expands with improved neonatal and child-specific devices designed for sensitive physiological measurement. The geriatric segment grows rapidly due to aging populations and increased vulnerability to chronic and acute health conditions. Overall growth is supported by expanding clinical needs across all age groups and rising emphasis on real-time patient assessment.

Key Growth Drivers

Increasing Burden of Chronic and Critical Illnesses

Rising prevalence of cardiovascular disorders, respiratory conditions, diabetes, and renal diseases drives strong demand for multiparameter patient monitoring systems. Hospitals depend on continuous tracking of vital signs to support timely interventions and improve patient outcomes. Growth in ICU admissions and emergency cases further strengthens adoption of advanced monitoring tools. Surgical procedures also require real-time monitoring to reduce complications. As chronic illness rates surge across adult and elderly populations, healthcare facilities invest in high-accuracy, integrated monitoring platforms that enhance clinical decision-making and support early detection of deterioration.

- For instance, Medtronic expanded its Nellcor pulse oximetry line with sensors that feature OxiMax signal processing technology for high-risk cardiac and respiratory patients.

Growing Adoption of Remote and Home-Based Monitoring

Healthcare systems increasingly deploy remote monitoring tools to reduce hospital congestion and improve patient management outside clinical settings. Portable multiparameter devices enable real-time tracking of oxygen saturation, ECG, temperature, and blood pressure from home. This shift supports telemedicine expansion and chronic disease management programs. Patients benefit from reduced readmissions and improved convenience, while providers gain continuous data for proactive care. Advancements in wireless connectivity, mobile apps, and cloud-based dashboards accelerate adoption. As home-care demand rises, remote monitoring becomes a key driver of market expansion.

- For instance, Masimo advanced its Radius PPG wearable sensor with Bluetooth Low Energy for remote SpO₂ and pulse rate monitoring, allowing clinicians to stay connected to patients up to 100 feet (~30 meters) away.

Technological Advancements in Integrated Monitoring Systems

Modern multiparameter monitors offer enhanced sensor accuracy, advanced analytics, wireless interoperability, and seamless integration with hospital information systems. AI-powered algorithms assist clinicians by predicting early signs of deterioration and improving responsiveness in high-acuity environments. Compact form factors and energy-efficient designs support broader deployment across emergency teams, ambulatory units, and step-down wards. Interconnected monitoring platforms ensure faster data flow, reduce manual errors, and improve clinical efficiency. Continuous innovation encourages hospitals to upgrade legacy systems and adopt intelligent, multi-parameter solutions across diverse care settings.

Key Trends & Opportunities

Rising Demand for Wireless, Wearable, and Portable Monitoring Devices

The shift toward mobility and patient comfort drives strong interest in wearable and wireless multiparameter monitoring solutions. These devices support uninterrupted monitoring during transport, recovery, and home-based care. Hospitals adopt cable-free systems to reduce clutter, improve workflow efficiency, and support infection-control practices. Wearables offer long-term monitoring for chronic disease management and postoperative recovery. Growth in ambulatory care centers and increased focus on early discharge create further opportunities for portable, lightweight systems. This trend supports a transition toward flexible, patient-centered monitoring models across global healthcare systems.

- For instance, Philips Healthcare’s Biosensor BX100 patch, launched in 2020, is capable of collecting, storing, measuring, and transmitting heart rate and respiratory rate data every minute to support early deterioration detection. This frequency is equivalent to recording 1,440 data points per day.

Expansion of AI-Enabled and Interoperable Monitoring Platforms

AI integration creates new opportunities by enabling predictive analytics, automated alerts, and improved diagnostic accuracy. Interoperable platforms connect seamlessly with electronic health records, telehealth systems, and clinical decision-support tools. These advancements reduce response times and improve coordination across care teams. Hospitals seek unified monitoring systems that consolidate data from multiple devices into a single interface. Increased use of machine learning and cloud analytics drives innovation in continuous risk assessment. As digital transformation accelerates, AI-enabled, interoperable solutions emerge as a major growth avenue for manufacturers.

- For instance, GE HealthCare enhanced its Edison platform with AI models to improve diagnostic accuracy and streamline workflows, which includes applications like the Critical Care Suite for triaging critical cases and AI-based quantitative risk assessment tools for medical imaging.

Key Challenges

High Cost of Advanced Monitoring Systems and Limited Budget Allocation

The cost of multiparameter monitoring devices, software integration, and regular calibration poses challenges for many hospitals, especially in developing regions. Budget constraints limit adoption in smaller facilities that require cost-effective solutions. Maintenance, data management infrastructure, and staff training further increase operational expenses. These financial barriers slow large-scale deployment, particularly in low- and middle-income countries. Manufacturers face pressure to deliver affordable, scalable systems without compromising accuracy or performance. High cost remains a significant barrier to rapid and widespread market penetration.

Data Security Concerns and Integration Difficulties

Increasing reliance on connected monitoring platforms raises concerns about data privacy, cybersecurity risks, and system vulnerabilities. Hospitals must protect sensitive patient data while ensuring uninterrupted data transmission across clinical systems. Integration challenges with legacy infrastructure slow adoption of advanced monitoring solutions. Inconsistent interoperability standards create barriers, requiring customized integration efforts. Technical issues, connectivity gaps, and outdated IT systems reduce efficiency and compromise clinical workflows. These challenges highlight the need for robust cybersecurity frameworks and standardized integration pathways across healthcare environments.

Regional Analysis

North America

North America holds a 39% market share, driven by advanced healthcare infrastructure, high ICU occupancy, and strong adoption of continuous patient monitoring technologies. Hospitals invest heavily in AI-enabled, integrated monitoring systems to support critical care and chronic disease management. The region benefits from strong reimbursement frameworks and widespread use of telehealth platforms that expand remote monitoring capabilities. High prevalence of cardiovascular and respiratory conditions increases the need for multi-parameter tracking in both acute and home-care settings. Leading manufacturers maintain strong distribution networks, supporting ongoing upgrades and large-scale deployments across U.S. and Canadian healthcare facilities.

Europe

Europe accounts for a 29% market share, supported by strong clinical standards, rising demand for high-acuity monitoring, and growing investment in medical technology. Countries such as Germany, the U.K., France, and Italy deploy advanced multiparameter systems across ICUs, emergency departments, and postoperative care units. The region’s aging population and rising chronic disease burden drive continuous monitoring needs. Hospitals prioritize interoperable, data-integrated systems that align with EU regulatory requirements and digital health initiatives. Expansion of telemedicine and remote-care programs further strengthens adoption across public and private healthcare providers.

Asia Pacific

Asia Pacific holds a 23% market share, driven by growing healthcare investments, expanding hospital infrastructure, and rising awareness of early diagnosis and continuous monitoring. China, India, Japan, and South Korea rapidly adopt portable and high-acuity monitors to support overcrowded hospitals and expanding critical care units. Increasing prevalence of chronic diseases, rising surgical volumes, and growing adoption of connected monitoring platforms accelerate demand. Government-backed healthcare modernization programs strengthen technology penetration. The region’s fast-growing geriatric population also boosts the need for long-term, multi-parameter monitoring across acute and home-care settings.

Latin America

Latin America represents a 6% market share, supported by rising healthcare modernization efforts in Brazil, Mexico, Argentina, and Chile. Hospitals increasingly adopt multiparameter monitors to improve emergency response, ICU care, and surgical monitoring. Growth in chronic illnesses and improving access to advanced diagnostics further support market expansion. Budget constraints limit high-end system adoption in smaller facilities, but demand for portable and mid-range devices rises steadily. Public-health initiatives aimed at strengthening critical care infrastructure contribute to increased use of integrated monitoring solutions across the region.

Middle East & Africa

Middle East & Africa account for a 3% market share, driven by improving healthcare infrastructure, rising chronic disease prevalence, and growing investments in critical care capacity. Gulf countries such as the UAE and Saudi Arabia lead adoption with strong digital health initiatives and increased funding for ICU upgrades. South Africa and other emerging markets expand use of multiparameter monitors in emergency and surgical units. Limited budgets and uneven technology access slow adoption in some regions, but rising telemedicine penetration and public-health modernization efforts support long-term market growth.

Market Segmentations:

By Device

By Acuity Level

By Age Group

- Pediatric

- Adult

- Geriatric

By End Use

- Hospitals

- Home Care Settings

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features major players such as Philips Healthcare, GE HealthCare, Medtronic plc, Nihon Kohden Corporation, Mindray Medical International, Drägerwerk AG & Co. KGaA, Masimo Corporation, Schiller AG, Spacelabs Healthcare, and Baxter International Inc. These companies strengthen their market position by offering advanced multiparameter monitoring systems with enhanced sensor accuracy, wireless connectivity, and integrated analytics. Leading manufacturers focus on high-acuity ICU monitors, portable devices, and interoperable platforms that support seamless data flow across hospital systems. Strategic partnerships with hospitals, technology providers, and telehealth platforms expand global reach. Continuous R&D investment drives innovations in AI-powered alerts, predictive algorithms, and compact wearable monitors. Companies also prioritize cybersecurity, workflow optimization, and cloud-based data integration to meet growing demand for remote and real-time monitoring. This competitive environment encourages product diversification, faster upgrades, and stronger service networks, helping vendors maintain leadership in a technology-driven and clinically demanding market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Philips Healthcare

- GE HealthCare

- Medtronic plc

- Nihon Kohden Corporation

- Mindray Medical International

- Drägerwerk AG & Co. KGaA

- Masimo Corporation

- Schiller AG

- Spacelabs Healthcare

- Baxter International Inc.

Recent Developments

- In September 2025, Philips Healthcare announced a renewed multi-year strategic collaboration with Masimo Corporation to integrate Masimo’s hardware (including Radius PPG®) directly into Philips’ multi-parameter bedside monitors and wearable monitoring solutions.

- In September 2025, Masimo announced an expansion of its strategic partnership with Philips to include integration of Masimo sensor technology across Philips monitors and next-generation wearable multi-parameter platforms.

- In May 2025, Medtronic plc entered into a distribution agreement in Europe for Corsano™ multi-parameter wearable devices (capable of continuous vital-sign monitoring) to expand its acute care & monitoring portfolio.

Report Coverage

The research report offers an in-depth analysis based on Device, Acuity Level, Age Group, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI-enabled monitoring systems will rise as hospitals prioritize predictive analytics.

- Portable and wearable multiparameter devices will gain wider use in home-care and outpatient settings.

- High-acuity monitoring demand will increase due to growing ICU admissions and complex disease cases.

- Integration with telehealth platforms will expand remote patient management capabilities.

- Hospitals will invest more in interoperable systems that streamline data sharing and clinical workflows.

- Geriatric-focused monitoring solutions will grow as aging populations require continuous assessment.

- Cloud-based monitoring platforms will expand to support real-time data access and decision-making.

- Wireless and cable-free devices will accelerate adoption due to infection-control priorities.

- Vendors will focus on cybersecurity enhancements to protect connected monitoring networks.

- Emerging markets will see stronger adoption as healthcare infrastructure investment continues to rise.