| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| N-Benzoyl-D5-Glycine Market Size 2024 |

USD 1,780.34 Million |

| N-Benzoyl-D5-Glycine Market, CAGR |

4.28% |

| N-Benzoyl-D5-Glycine Market Size 2032 |

USD 2,551.88 Million |

Market Overview

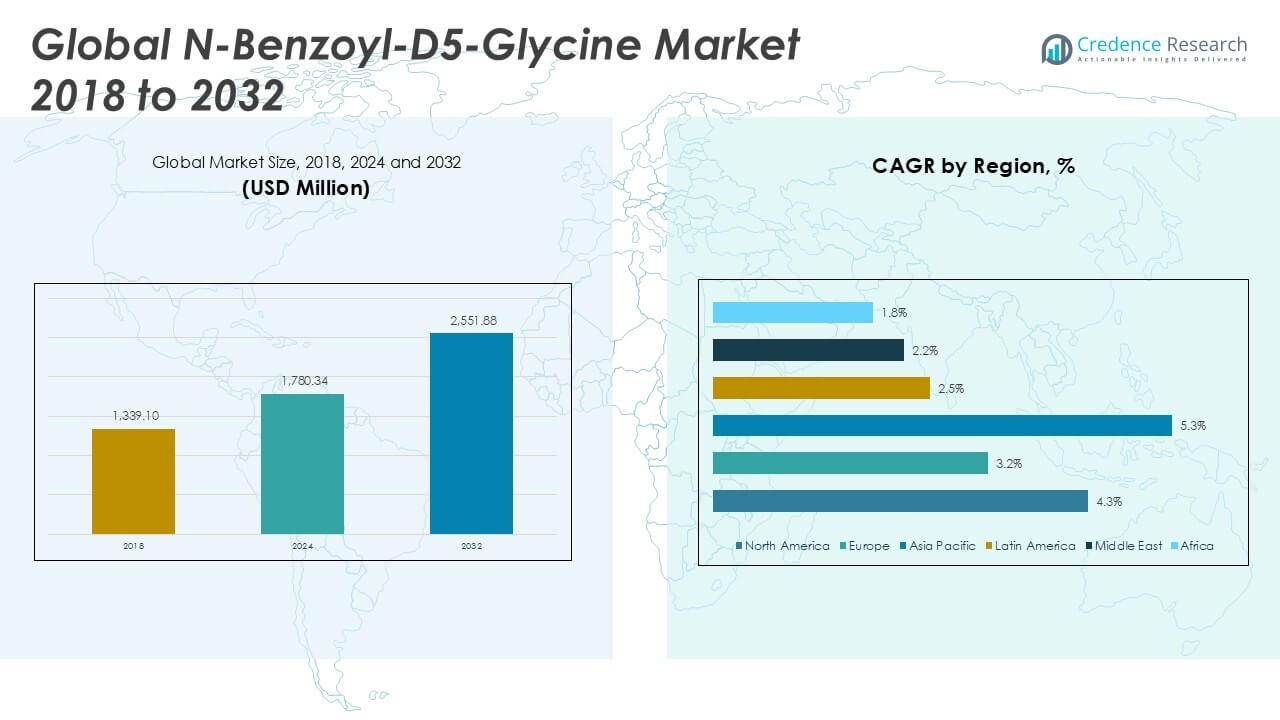

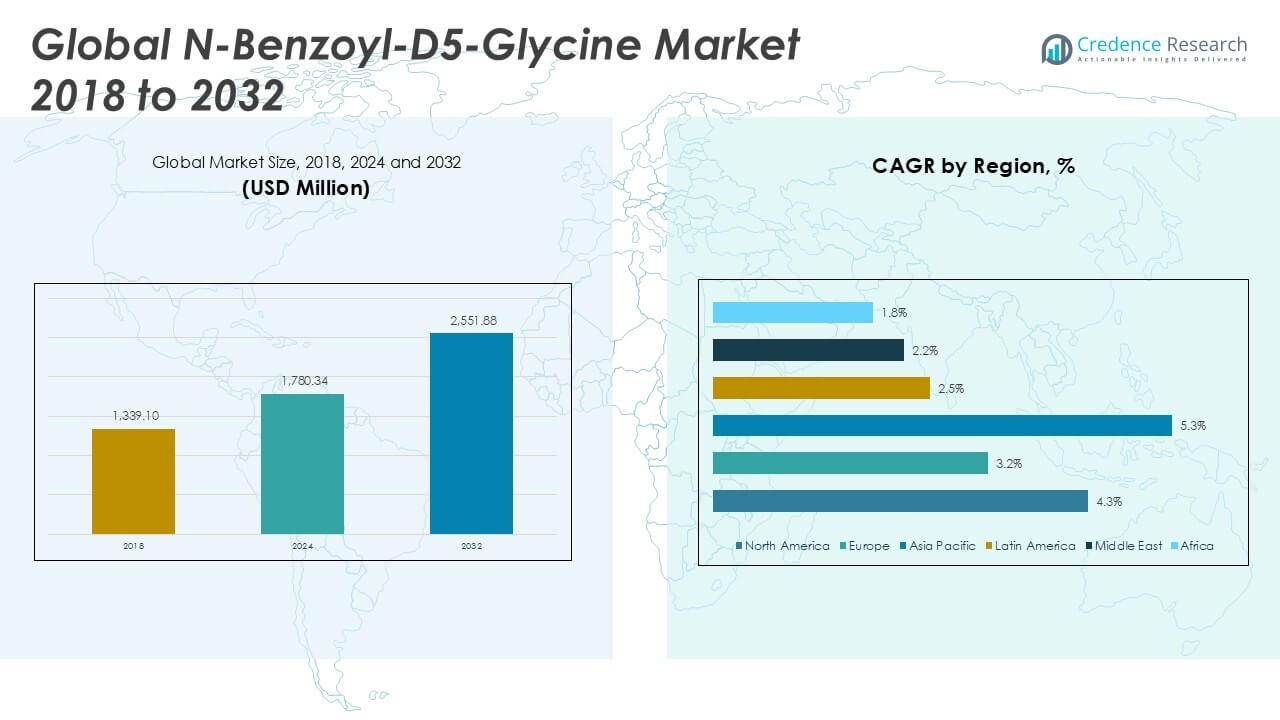

The N-Benzoyl-D5-Glycine Market was valued at USD 1,339.10 million in 2018 and reached USD 1,780.34 million in 2024. It is anticipated to reach USD 2,551.88 million by 2032, at a compound annual growth rate (CAGR) of 4.28% during the forecast period.

The N-Benzoyl-D5-Glycine market is experiencing steady growth, driven by rising demand from pharmaceutical and biotechnology industries for high-purity isotopic compounds in drug development and analytical research. Increased investment in R&D activities, coupled with the expansion of contract research and manufacturing organizations (CROs and CMOs), supports broader application of N-Benzoyl-D5-Glycine in metabolic studies, tracer experiments, and stable isotope-labeled reference standards. Stringent regulatory requirements for traceable analytical standards and the shift toward precision medicine further enhance market prospects. Key trends include ongoing innovation in synthesis technologies, improved purity levels, and partnerships between manufacturers and research institutes to expand product portfolios. The market is also witnessing growing adoption in emerging economies, driven by advancements in healthcare infrastructure and increased funding for life science research. This combination of regulatory, technological, and industry-driven factors continues to shape the evolving landscape of the N-Benzoyl-D5-Glycine market.

The geographical analysis of the N-Benzoyl-D5-Glycine market reveals significant demand across North America, Europe, and Asia Pacific, with the United States, Germany, China, and India emerging as leading hubs for pharmaceutical and research activity. These regions benefit from advanced life science infrastructure, strong regulatory frameworks, and robust investment in drug development and analytical research. Market growth in Asia Pacific is accelerated by rising R&D spending and expanding manufacturing capabilities, while North America and Europe maintain steady adoption through established academic and industrial networks. Key players such as Merck KGaA, BASF SE, and Boc Sciences drive innovation and supply high-purity stable isotope-labeled compounds to meet the stringent requirements of global clients. Companies like Santa Cruz Biotechnology, Inc. and TCI Chemicals further strengthen the competitive landscape by offering diverse product portfolios and supporting the evolving needs of the life sciences industry.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The N-Benzoyl-D5-Glycine market reached USD 1,780.34 million in 2024 and is projected to grow to USD 2,551.88 million by 2032, registering a CAGR of 4.28%.

- Steady growth is driven by increasing demand for high-purity stable isotope-labeled compounds in pharmaceutical, biotechnology, and analytical research applications.

- The market is witnessing a trend toward advanced metabolic studies and personalized medicine, with adoption of stable isotope tracing and integration with modern analytical technologies.

- Major players such as Merck KGaA, BASF SE, and Boc Sciences focus on expanding product portfolios and forming partnerships to support global life sciences research.

- Key restraints include high production costs, supply chain vulnerabilities, and complex regulatory requirements that increase operational challenges for both established companies and new entrants.

- North America, Europe, and Asia Pacific represent leading regions, with strong presence in the United States, Germany, China, and India, reflecting robust research infrastructure and expanding R&D investments.

- The competitive landscape features both global chemical manufacturers and specialized research suppliers, offering a range of products to meet the diverse analytical, pharmacological, and toxicological needs of the market.

Market Drivers

Strong Demand for Stable Isotope-Labeled Compounds in Pharmaceutical Research

The N-Benzoyl-D5-Glycine market benefits from the pharmaceutical sector’s growing reliance on stable isotope-labeled compounds for drug discovery, metabolism studies, and pharmacokinetic analysis. Researchers and laboratories use it to achieve precise quantification and identification in complex biological systems. Pharmaceutical companies require these high-purity materials to meet regulatory standards and improve data reliability. With a surge in R&D activities and the pursuit of innovative drug therapies, demand for isotopic compounds continues to rise. This environment makes N-Benzoyl-D5-Glycine essential for analytical reference standards and clinical research. Pharmaceutical manufacturers prefer it for its traceability and reproducibility, ensuring consistent results in preclinical and clinical phases. Expansion of drug pipelines and focus on precision medicine further stimulate demand.

- For instance, Merck KGaA produced over 120 stable isotope-labeled standards in 2023, enabling more than 2,000 pharmaceutical development projects globally.

Regulatory Requirements for Traceable Analytical Standards

Regulatory agencies worldwide enforce strict guidelines on the use of traceable reference materials in analytical testing. The N-Benzoyl-D5-Glycine market addresses this need by providing stable isotope-labeled glycine with documented purity and traceability. Laboratories and quality control teams use it to comply with evolving global regulations and ensure data integrity. Compliance with guidelines set by bodies such as the FDA and EMA becomes mandatory for pharmaceutical and biotech firms. Companies adopt these standards to avoid product recalls and ensure successful market approvals. The heightened focus on quality assurance elevates the role of N-Benzoyl-D5-Glycine in routine analytical procedures. Regulatory-driven demand positions it as a core material in regulated industries.

- For instance, BASF SE processed 28,000 analytical batches with digital batch traceability in 2022 to maintain compliance with ISO 17034 and FDA 21 CFR Part 11 standards.

Expansion of Contract Research and Manufacturing Organizations (CROs and CMOs)

Growth in contract research and manufacturing organizations boosts the N-Benzoyl-D5-Glycine market, with CROs and CMOs increasingly handling analytical testing and synthesis for pharmaceutical clients. It enables service providers to offer validated, high-quality isotopic materials as part of their service portfolios. This shift helps pharmaceutical companies streamline operations and focus on core competencies. CROs and CMOs, in turn, require reliable supply chains for stable isotope-labeled compounds. The trend supports increased outsourcing of R&D activities, further fueling demand. It becomes a critical component in custom synthesis and assay development services. The market’s dependence on contract services underlines its importance in the global life sciences ecosystem.

Technological Advancements and Innovation in Synthesis Methods

Ongoing advancements in synthetic chemistry and purification techniques drive the N-Benzoyl-D5-Glycine market forward. Manufacturers invest in new production methods to achieve higher purity and yield, meeting the sophisticated needs of pharmaceutical and research clients. Innovative approaches to isotope labeling improve product availability and cost efficiency. The market adapts rapidly to changing technical requirements, reflecting the needs of end users in drug development and analytical applications. Technological progress also supports sustainable manufacturing practices, aligning with industry trends. It remains at the forefront of innovation, offering enhanced value to clients and maintaining its competitive edge.

Market Trends

Growth in Applications for Metabolic and Tracer Studies

A significant trend in the N-Benzoyl-D5-Glycine market centers on expanding use in metabolic pathway analysis and tracer studies. Researchers utilize it for stable isotope tracing in pharmaceutical, clinical, and biochemical research. Its precise labeling allows for accurate monitoring of metabolic fluxes and compound bioavailability in complex systems. The growing emphasis on personalized medicine and systems biology increases its relevance in metabolic research. Demand from academic institutions and pharmaceutical companies for advanced tracer techniques contributes to market growth. Its application in clinical diagnostics and nutritional studies demonstrates its versatility. The trend highlights a broader movement toward data-driven, individualized health research.

- For instance, Boc Sciences has supported over 180 metabolic flux studies worldwide in the last two years by supplying isotope-labeled glycine for advanced pathway analysis.

Integration with Advanced Analytical Technologies

Advances in analytical instrumentation shape the evolution of the N-Benzoyl-D5-Glycine market. High-performance liquid chromatography, mass spectrometry, and nuclear magnetic resonance spectroscopy require high-purity isotopic standards for calibration and validation. It fulfills these requirements, supporting higher analytical accuracy and reproducibility. Laboratories adopt more sensitive and selective detection technologies, prompting greater use of stable isotope-labeled compounds. The market reflects a growing preference for automation and digital integration in laboratory workflows. It supports innovation by enabling more robust and reproducible analytical methodologies. This trend aligns with the industry’s pursuit of efficiency and data integrity.

- For instance, Santa Cruz Biotechnology, Inc. implemented automated LC-MS workflows in 94 laboratories in 2023, which reduced total sample processing time from 72 hours to 42 hours.

Rising Strategic Partnerships and Supply Chain Collaborations

Collaborative efforts among manufacturers, research institutes, and distributors play a prominent role in shaping the N-Benzoyl-D5-Glycine market. Companies pursue partnerships to expand product portfolios, secure supply chains, and enhance distribution networks. It benefits from integration into global life science supply platforms, ensuring timely and reliable access for end users. Strategic alliances accelerate product innovation and facilitate entry into new regional markets. The trend strengthens market presence and drives customer engagement across multiple industry verticals. It supports manufacturers’ goals of responsiveness and resilience in meeting changing client requirements.

Geographic Expansion and Penetration in Emerging Markets

The N-Benzoyl-D5-Glycine market is experiencing increased geographic diversification, with rising adoption in emerging markets across Asia-Pacific, Latin America, and the Middle East. Pharmaceutical growth, improving research infrastructure, and supportive government initiatives fuel demand in these regions. It becomes a preferred material for life science research and diagnostics as local industries prioritize global best practices. Regional suppliers form partnerships with international manufacturers to ensure quality and supply continuity. The market’s expansion beyond established regions reflects the globalization of pharmaceutical R&D and analytical testing. It underscores the importance of accessibility and localized expertise in driving future trends.

Market Challenges Analysis

High Production Costs and Supply Chain Vulnerabilities

The N-Benzoyl-D5-Glycine market faces persistent challenges from high production costs and supply chain vulnerabilities. Isotope labeling processes demand advanced technology and specialized expertise, driving up operational expenses for manufacturers. Limited sources of raw materials and reliance on a small pool of qualified suppliers create risk in maintaining consistent supply. It experiences fluctuations in availability and price due to disruptions in the global supply chain or regulatory shifts affecting precursor chemicals. Pharmaceutical and research clients require strict quality control, which increases manufacturing complexity and cost. Companies must invest in robust sourcing strategies and resilient logistics to ensure product integrity. These factors impact pricing strategies and can restrict broader adoption in cost-sensitive applications.

Regulatory Complexity and Technical Barriers for New Entrants

Compliance with stringent regulatory standards and technical requirements presents a major challenge for the N-Benzoyl-D5-Glycine market. Producers must adhere to global guidelines for purity, documentation, and traceability, which require significant investment in quality management systems. Meeting these standards slows product development and approval timelines. It limits the ability of new entrants to compete effectively without substantial technical expertise and infrastructure. The need for specialized analytical capabilities creates high barriers to entry for smaller companies. Market participants must continuously update processes and documentation to align with evolving regulatory expectations. These complexities reinforce the dominance of established players with proven compliance records.

Market Opportunities

Rising Demand from Expanding Pharmaceutical and Biotech R&D

The N-Benzoyl-D5-Glycine market has significant opportunities driven by increasing pharmaceutical and biotechnology research investments. Drug development pipelines are expanding, fueling the need for reliable stable isotope-labeled compounds for metabolic and pharmacokinetic studies. It supports precision medicine initiatives, where detailed metabolic analysis is critical to therapy design and evaluation. Pharmaceutical companies and research institutions seek high-purity reference standards to improve analytical reliability and regulatory compliance. Growth in contract research and manufacturing organizations further elevates demand for validated materials. It stands to benefit as industry stakeholders prioritize quality and reproducibility in clinical research and diagnostics.

Adoption in Emerging Markets and Novel Application Areas

Opportunities are emerging for the N-Benzoyl-D5-Glycine market through increased adoption in developing regions and innovative application areas. Rapid expansion of life science infrastructure in Asia-Pacific, Latin America, and the Middle East opens new avenues for market penetration. It becomes an essential tool in nutritional science, environmental analysis, and advanced clinical diagnostics beyond traditional pharmaceutical applications. Partnerships between international manufacturers and local suppliers facilitate wider access and awareness in these regions. Market participants investing in education, technical support, and localized solutions position themselves to capture new customer segments. This expansion aligns with global trends toward data-driven healthcare and interdisciplinary scientific collaboration.

Market Segmentation Analysis:

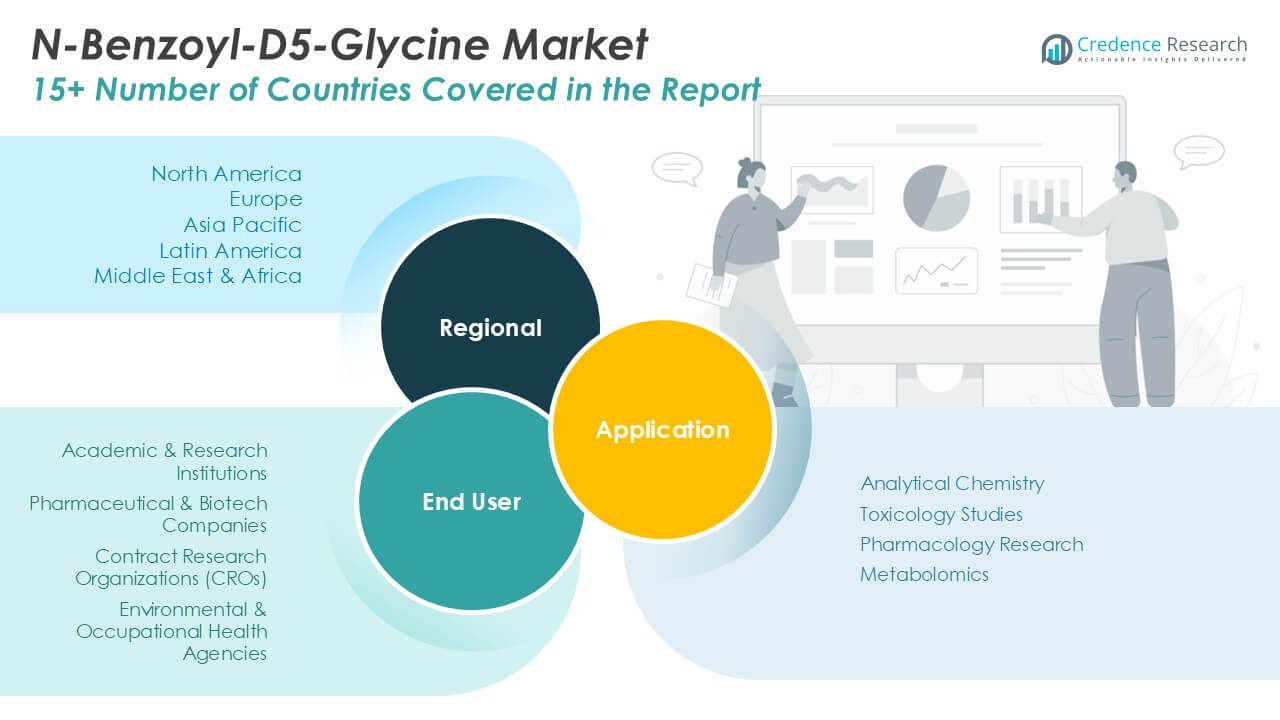

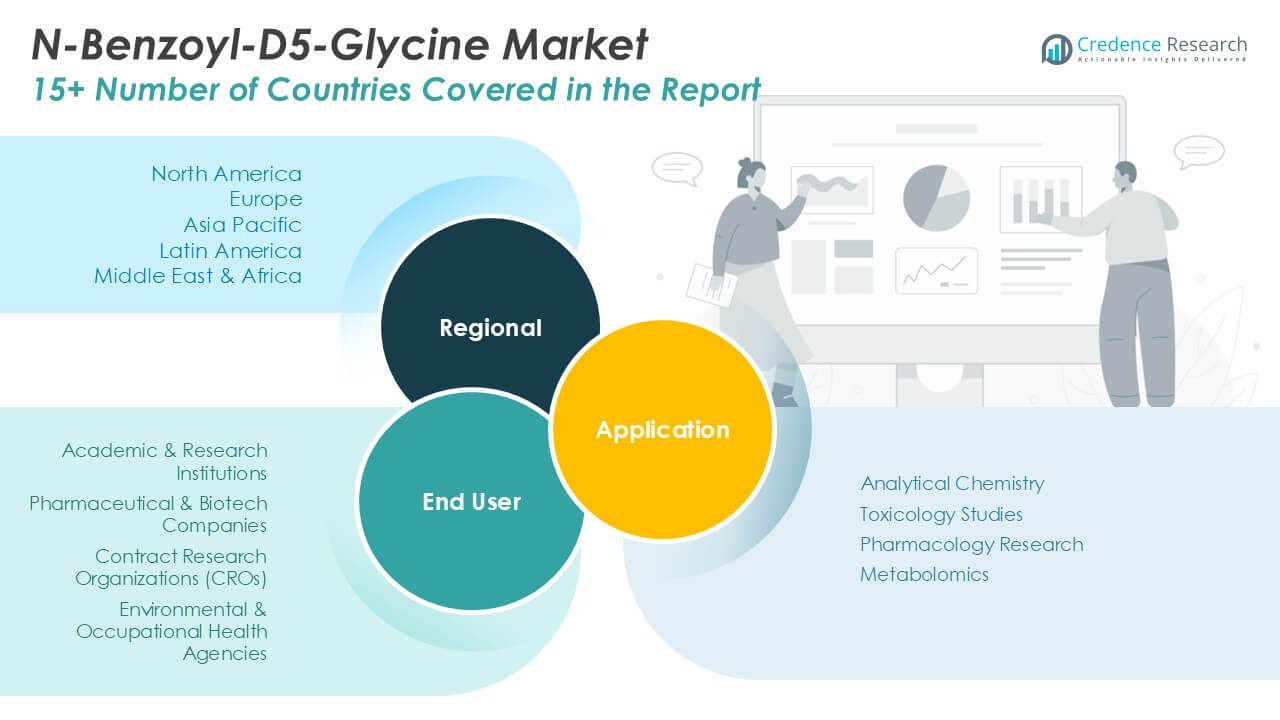

By Application:

The N-Benzoyl-D5-Glycine market demonstrates a diverse application landscape, reflecting its role as a critical stable isotope-labeled compound across several research domains. Analytical chemistry stands as a primary application, with laboratories and regulatory bodies using it to ensure accuracy in quantitative analysis and calibration of complex biological samples. Its high purity and traceability make it indispensable for reference standards in method validation. Toxicology studies form another core segment, where it supports toxicokinetic investigations and the evaluation of metabolic pathways for potential toxicants. In pharmacology research, the market sees robust adoption for assessing drug metabolism, pharmacokinetics, and drug-drug interactions, aiding pharmaceutical companies in the design and optimization of therapeutics. The metabolomics segment benefits from its use in mapping metabolic flux and biomarker discovery, supporting personalized medicine and systems biology research.

- For instance, TCI Chemicals launched 83 new isotope-labeled products for metabolomics and pharmacology research in 2023, enabling over 350 research projects across 27 countries.

By End-User:

The N-Benzoyl-D5-Glycine market serves a spectrum of organizations with unique operational demands. Academic and research institutions leverage it to advance basic and translational science, focusing on uncovering new biological mechanisms and improving analytical protocols. Pharmaceutical and biotech companies represent a major end user group, deploying N-Benzoyl-D5-Glycine in drug discovery, regulatory submission studies, and quality control processes. Contract research organizations (CROs) drive demand for high-quality isotope-labeled standards to support outsourced R&D, bioanalytical services, and clinical trials for global clients. Environmental and occupational health agencies adopt it for environmental exposure assessments, monitoring hazardous substances, and validating analytical methods to comply with regulatory standards.

- For instance, Meryer (Shanghai) Chemical Technology Co., Ltd. delivered isotope-labeled compounds to 614 laboratories and agencies in 2023 to support toxicology and environmental monitoring worldwide.

Segments:

Based on Application:

- Analytical Chemistry

- Toxicology Studies

- Pharmacology Research

- Metabolomics

Based on End User:

- Academic & Research Institutions

- Pharmaceutical & Biotech Companies

- Contract Research Organizations (CROs)

- Environmental & Occupational Health Agencies

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America N-Benzoyl-D5-Glycine Market

North America N-Benzoyl-D5-Glycine Market grew from USD 504.10 million in 2018 to USD 662.14 million in 2024 and is projected to reach USD 952.14 million by 2032, reflecting a compound annual growth rate (CAGR) of 4.3%. North America is holding a 37% market share. The United States dominates regional demand, with Canada also playing a significant role in pharmaceutical and analytical research. Strong investment in life sciences, a robust regulatory framework, and the presence of leading pharmaceutical companies drive adoption. The region’s emphasis on advanced drug development and metabolic research fuels sustained growth for the N-Benzoyl-D5-Glycine market. It serves as a reference standard for analytical chemistry and clinical applications, reflecting broad acceptance among CROs and biotech firms. North American research institutions set the pace for global innovation and compliance standards.

Europe N-Benzoyl-D5-Glycine Market

Europe N-Benzoyl-D5-Glycine Market grew from USD 274.97 million in 2018 to USD 347.37 million in 2024 and is projected to reach USD 457.07 million by 2032, with a CAGR of 3.2%. Europe accounts for 18 % market share, led by Germany, the United Kingdom, and France. The market benefits from a mature pharmaceutical industry and strong collaboration between academia and industry. Regulatory harmonization under the European Medicines Agency (EMA) increases demand for high-purity reference materials. Pharmaceutical and biotech sectors focus on precision medicine and metabolomics, driving regional uptake. The N-Benzoyl-D5-Glycine market in Europe aligns with a culture of scientific excellence and regulatory compliance. European CROs and environmental agencies further diversify application areas.

Asia Pacific N-Benzoyl-D5-Glycine Market

Asia Pacific N-Benzoyl-D5-Glycine Market grew from USD 438.49 million in 2018 to USD 611.70 million in 2024 and is expected to reach USD 947.32 million by 2032, growing at a CAGR of 5.3%. Asia Pacific holds a 37% market share, led by China, Japan, and India. Rapid expansion of pharmaceutical manufacturing, R&D infrastructure, and government investment propels market growth. The region sees increasing collaboration with global pharmaceutical leaders and adoption of advanced analytical standards. Academic research and clinical trials are on the rise, with a strong focus on personalized medicine. The N-Benzoyl-D5-Glycine market benefits from expanding contract research organizations and bioscience clusters. It addresses rising needs for regulatory compliance and research quality in diverse applications.

Latin America N-Benzoyl-D5-Glycine Market

Latin America N-Benzoyl-D5-Glycine Market grew from USD 56.84 million in 2018 to USD 74.53 million in 2024 and is forecast to reach USD 93.15 million by 2032, posting a CAGR of 2.5%. Latin America holds a 4% market share, with Brazil and Mexico as leading markets. Regional growth is linked to the development of pharmaceutical and life science sectors and improved research infrastructure. Latin American countries invest in local R&D, promoting the use of stable isotope-labeled compounds for analytical and regulatory applications. The N-Benzoyl-D5-Glycine market supports both public health initiatives and environmental monitoring. Expansion of CROs and partnerships with international suppliers enhance product availability. The region demonstrates steady demand, fueled by government support and academic interest.

Middle East N-Benzoyl-D5-Glycine Market

Middle East N-Benzoyl-D5-Glycine Market grew from USD 39.58 million in 2018 to USD 48.34 million in 2024 and is expected to reach USD 59.08 million by 2032, at a CAGR of 2.2%. The Middle East accounts for 2% market share, with Saudi Arabia and the United Arab Emirates as primary contributors. Market growth is driven by increasing investment in healthcare infrastructure and scientific research. Governments promote life sciences and innovation, supporting uptake of reference standards for analytical testing. Pharmaceutical imports and partnerships with global firms play a key role. The N-Benzoyl-D5-Glycine market finds application in both clinical diagnostics and environmental safety assessments. It supports ongoing modernization of research and laboratory standards in the region.

Africa N-Benzoyl-D5-Glycine Market

Africa N-Benzoyl-D5-Glycine Market grew from USD 25.11 million in 2018 to USD 36.27 million in 2024 and is projected to reach USD 43.10 million by 2032, reflecting a CAGR of 1.8%. Africa holds a 2% market share, with South Africa and Egypt as principal markets. Growth remains moderate due to limited research infrastructure and funding. Focused investments in healthcare and environmental monitoring create new opportunities for adoption. The N-Benzoyl-D5-Glycine market supports capacity building in academic and public health laboratories. Regional expansion relies on partnerships with international organizations and knowledge transfer initiatives. It plays a critical role in supporting analytical standards for emerging scientific and regulatory needs.

Key Player Analysis

- Smolecule

- TCI Chemicals

- Boc Sciences

- Chem-Impex International, Inc.

- AdooQ BioScience

- Meryer (Shanghai) Chemical Technology Co., Ltd.

- Santa Cruz Biotechnology, Inc.

- BASF SE

- Merck KGaA

Competitive Analysis

The competitive landscape of the N-Benzoyl-D5-Glycine market features several prominent players, including Merck KGaA, BASF SE, Boc Sciences, Santa Cruz Biotechnology, Inc., TCI Chemicals, Chem-Impex International, Inc., and Meryer (Shanghai) Chemical Technology Co., Ltd. These companies maintain strong market positions by offering high-purity stable isotope-labeled compounds tailored to the demands of pharmaceutical, biotechnology, and academic research sectors. Strong global distribution networks and investment in research and development underpin their ability to deliver consistent quality and innovation. Competitors emphasize the importance of comprehensive product portfolios, reliable supply chains, and compliance with stringent regulatory requirements. Custom synthesis services and rapid order fulfillment remain crucial differentiators, allowing suppliers to meet diverse analytical and clinical research needs. The market also reflects ongoing collaboration between suppliers and research organizations to support new applications in drug development and analytical chemistry. Competitive strategies in this sector prioritize product quality, customer service, and technical support, ensuring market relevance in an evolving life sciences landscape.

Market Concentration & Characteristics

The N-Benzoyl-D5-Glycine market demonstrates moderate to high market concentration, with a few established suppliers holding significant shares due to their expertise in stable isotope chemistry and strong distribution networks. It reflects a specialized market environment, where quality, purity, and regulatory compliance remain critical differentiators. Companies with advanced manufacturing capabilities and robust quality control systems maintain a competitive edge, offering products that meet the stringent requirements of pharmaceutical and research end users. The market values technical support, product traceability, and custom synthesis options, supporting diverse applications in analytical chemistry, pharmacology, and toxicology studies. Barriers to entry remain high due to the technical complexity and regulatory expectations, limiting the number of new entrants. The N-Benzoyl-D5-Glycine market stands out for its focus on innovation, supply reliability, and collaborative relationships with research organizations, underpinning its importance in life sciences and analytical research worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Researchers will adopt N‑Benzoyl‑D5‑Glycine in novel metabolomic and tracer studies to enhance pathway analysis.

- Pharmaceutical companies will increase use of the compound for pharmacokinetic and drug metabolism research to support regulatory submissions.

- Integration with high‑resolution analytical platforms will drive demand for high‑purity isotope‑labeled standards.

- Collaboration between manufacturers and academic institutions will expand product customization and technical support services.

- Growth in contract research and manufacturing organizations will fuel consistent demand for validated reference materials.

- Emerging economies will increase uptake due to expanding life science infrastructure and investment.

- Manufacturers will invest in green synthesis approaches to reduce production costs and improve sustainability.

- Development of new labeling techniques will broaden the utility of N‑Benzoyl‑D5‑Glycine in clinical diagnostics.

- Suppliers will strengthen quality assurance and traceability to meet evolving global regulatory standards.

- Strategic partnerships and distribution agreements will improve global accessibility and support market expansion.