Market Overview:

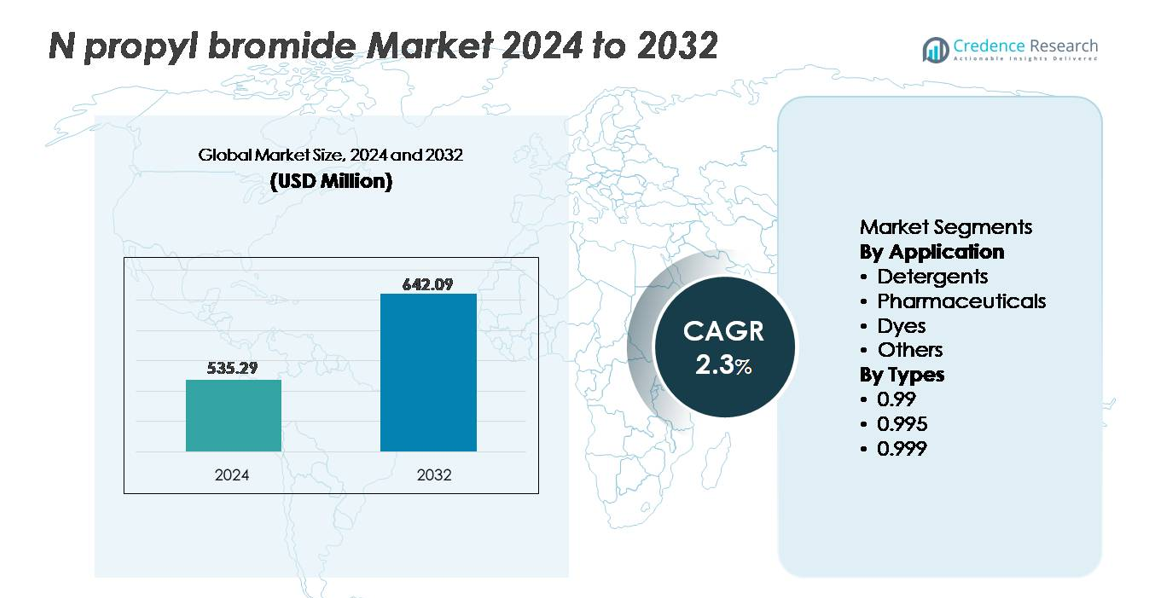

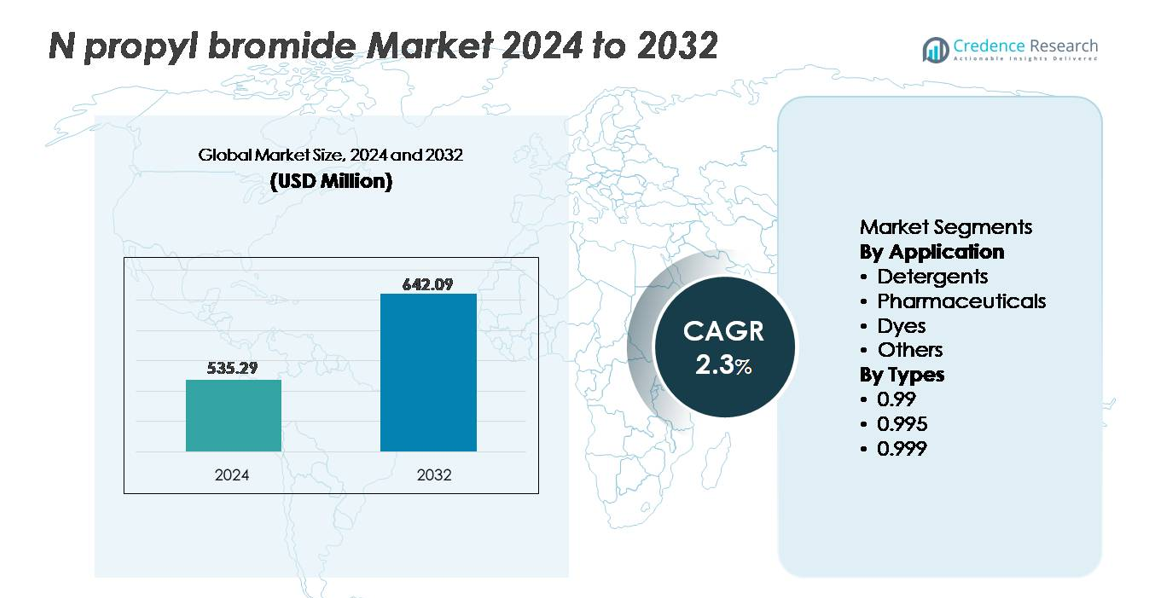

The N-Propyl Bromide market was valued at USD 535.29 million in 2024 and is projected to reach USD 642.09 million by 2032, advancing at a CAGR of 2.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| N-Propyl Bromide Market Size 2024 |

USD 535.29 million |

| N-Propyl Bromide Market, CAGR |

2.3% |

| N-Propyl Bromide Market Size 2032 |

USD 642.09 million |

The N-propyl bromide market is shaped by a diverse group of international and regional producers, including Tongcheng Medicine Technology, Shandong Moris Tech, Albemarle, Solaris Chemtech (SCIL), Shenrunfa, ICL, Longsheng Chemical, Lanxess, Shouguang Fukang Pharmaceutical, and Weifang Longwei Industrial. These companies compete through product purity differentiation, strategic distribution partnerships, and alignment with industrial cleaning and chemical synthesis requirements. Asia-Pacific leads the market with approximately 34% share, driven by its expanding pharmaceutical and electronics manufacturing ecosystem, followed by North America and Europe with strong adoption in precision cleaning, aerospace, and specialty chemical applications.

Market Insights:

- The N-propyl bromide market was valued at USD 535.29 million in 2024 and is projected to reach USD 642.09 million by 2032, registering a CAGR of 2.30% during the forecast period.

- Market growth is driven by increasing demand in industrial cleaning and degreasing applications, particularly from aerospace, automotive, and electronics manufacturing, where precision solvent performance supports stringent efficiency and quality requirements.

- Trends include a shift toward optimized solvent formulations, adoption of controlled-emission systems, and opportunities in developing manufacturing hubs that require consistent and scalable chemical intermediates.

- The competitive landscape features global and regional manufacturers focusing on purity grade differentiation, cost efficiency, and distribution alliances, while addressing sustainability expectations and regulatory compliance.

- Asia-Pacific accounts for nearly 34% market share, followed by North America at 32% and Europe at 27%, while the detergents segment holds the largest share among applications, supported by high usage in vapor degreasing and metal cleaning operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

The detergents segment represents the dominant application in the N-propyl bromide market, accounting for the largest share due to its widespread use as a solvent and cleaning agent in industrial degreasing and precision cleaning operations. Rising demand from metal cleaning, automotive maintenance, and aerospace component processing continues to reinforce segment growth. Pharmaceuticals emerge as the fastest-growing application as N-propyl bromide is increasingly adopted for intermediate synthesis. The dyes and other segments remain niche but benefit from expanding chemical manufacturing and developing formulations requiring high-purity brominated compounds.

- For instance, Lanxess Solutions US Inc. reports n-propyl bromide with a boiling point of ≈71°C, water solubility around 25 g per 100 g at 20°C, and density near 1.35 g/mL, enabling effective vapor-phase degreasing for machined components used in aerospace and automotive systems.

By Type

The 0.999 purity grade segment holds the dominant share in the N-propyl bromide market, driven by its suitability for high-specification applications in pharmaceuticals, electronics cleaning, and fine chemical processing. Its demand accelerates with growing regulatory scrutiny favoring higher purity solvents to ensure product consistency and reduced impurities. The 0.995 and 0.99 grades remain cost-effective choices in metal degreasing, industrial cleaning, and general chemical formulations, where ultrahigh purity is non-critical, enabling manufacturers to balance operational performance and procurement costs.

- For instance, Aarnee International documents its pharmaceutical-grade n-propyl bromide with GC purity ≥ 99.9%, moisture content ≤0.10%, and maximum iso-propyl bromide impurity ≤0.05%, ensuring controlled alkylation reactions for API intermediate synthesis and minimizing reaction byproduct formation.

Key Growth Drivers:

Expanding Demand in Industrial Cleaning and Degreasing Applications

The rise of precision cleaning and industrial degreasing requirements across automotive, aerospace, and electronics manufacturing remains a primary driver for N-propyl bromide. Its solvent properties, low boiling point, and compatibility with metal, composite, and electronic substrates support adoption where residue-free cleaning is essential. Growing production of aircraft components, microelectronic assemblies, and engine blocks strengthens usage in maintenance and fabrication cycles. Additionally, industries continue to replace legacy solvents to achieve higher operational efficiency, while the metalworking and machining sectors adopt N-propyl bromide to improve throughput and precision. The shift to compact and intricate component design increases the need for solvents capable of reaching microstructures without degrading surfaces. This demand aligns with N-propyl bromide’s effectiveness in vapor degreasing systems, reinforcing long-term market utilization as industrial cleaning becomes more complex and safety- and performance-driven.

- For instance, Reliance Specialty Products manufactures n-propyl-bromide (nPB) based solvents and vapor degreasing systems with design features that enhance solvent vapor containment, such as NESHAP-compliant freeboard ratios, to minimize emissions and maintain cleaning consistency for aerospace components. Their nPB product, EnTron-Aero, is approved by Boeing under the BAC 5408 specification.

Rising Pharmaceutical Intermediate Utilization

Growing pharmaceutical production and the increasing complexity of chemical synthesis processes support the rising use of N-propyl bromide as an intermediate and reactant in the formation of active pharmaceutical ingredients. Manufacturers prioritize solvent systems that enable consistent yield, stable reaction pathways, and controlled impurities, making N-propyl bromide a preferred option for specific halogenation and substitution steps. The expansion of generic drug production and active ingredient outsourcing to contract manufacturing organizations drives solvent procurement volumes. Demand also strengthens with diversified API pipelines targeting chronic illness management and specialty therapeutics. As pharmaceutical facilities implement quality-by-design and adopt advanced synthesis platforms, solvent standardization and reaction optimization bolster the continuity of N-propyl bromide usage. Although closely monitored under regulatory frameworks, its suitability in niche synthesis maintains its relevance, especially in formulations requiring precision halide chemistry under controlled reaction environments.

- For instance, LANXESS confirms its “non-stabilized grade” N-propyl bromide, formulated specifically for chemical synthesis, restricting iso-propyl bromide impurity levels to $\le$0.05% and maintaining GC purity above 99.5%, enabling controlled halogen-substitution reactions in API development without side-path isomerization events.

Growth in Chemical Synthesis and Specialty Formulation Manufacturing

N-propyl bromide continues to gain relevance in dyes, adhesives, resins, and specialty chemicals manufacturing due to its role as a feedstock and reaction solvent. Expansion in the coatings and performance materials sectors increases consumption where brominated intermediates are integral to achieving durability, adhesion, and heat-resistant characteristics. The dyes sector benefits from ongoing demand in textiles, printing technologies, and industrial coloration, requiring brominated compounds for formulation enhancements. Specialty chemical producers seek solvents with tailored volatility and reactivity characteristics to ensure consistent batch outcomes. As emerging markets develop chemical production capacity, local manufacturers adopt N-propyl bromide due to availability, familiar industrial performance, and process alignment with existing infrastructure. Despite shifting environmental standards, the chemical processing sector continues to rely on stable halogenated solvents for specific production pathways where alternatives may compromise performance or yield.

Key Trends & Opportunities:

Transition Toward Optimized Formulations and Controlled Emission Solvent Systems

A notable trend is the shift toward controlled emission technologies and closed-loop solvent systems driven by sustainability and workplace safety objectives. Equipment upgrades in solvent recovery, vapor containment, and filtration enable extended solvent lifecycle and reduce operational losses, improving cost efficiency. Manufacturers introduce improved formulations engineered for stability under high-temperature or precision cleaning environments, supporting adoption in electronics, optics, and metal processing sectors. Companies capitalize on opportunities to develop application-specific grades for pharmaceuticals, aerospace, or semiconductor production, where tightening quality assurance creates a demand for predictable, traceable solvent performance. Automation further enhances vapor degreasing operations, feeding long-term growth in advanced manufacturing supply chains seeking repeatable, defect-free outcomes.

- For instance, Reliance Specialty Products reports that its engineered n-propyl-bromide vapor degreasing platforms achieve solvent recovery efficiencies of up to 98% using integrated fractional distillation and refrigerated condensation stages, extending solvent lifecycle and significantly lowering emissions during aerospace maintenance cleaning cycles.

Emerging Opportunities in Developing Manufacturing Hubs

Expansion of chemical, electronics assembly, and precision metal manufacturing across Southeast Asia, Latin America, and parts of Eastern Europe presents significant opportunities for N-propyl bromide suppliers. These regions invest in fabrication and component finishing facilities serving global export markets, increasing solvent consumption in intermediary processes. Lower operational costs and expanding industrial corridors attract international producers, driving demand for reliable supply of processing chemicals. Local regulatory frameworks evolve more gradually compared to mature markets, allowing stakeholders to operate within compliance while building capacity. As SME manufacturers pursue solvent standardization, demand rises for consistent purity grades tailored to diverse applications, positioning N-propyl bromide as a viable near-term option across developing industrial ecosystems.

- For instance, LANXESS supplies stabilized n-propyl bromide engineered for industrial cleaning environments through its global distribution network, leveraging product specifications that include boiling point of 71°C, density about 1.35 g/mL, and water solubility ≈0.25 g per 100 g water, supporting adoption in facilities transitioning from aqueous to vapor-phase degreasing.

Key Challenges:

Evolving Environmental and Occupational Safety Regulations

Regulatory scrutiny related to air emissions, workplace exposure, and environmental persistence presents a major challenge to the long-term adoption of N-propyl bromide. Authorities continue to evaluate its inclusion under controlled substance lists, compelling end users to adopt mitigation technologies or reformulate processes. Compliance costs rise with mandated monitoring, ventilation upgrades, and exposure control programs. These shifts create uncertainty for downstream industries relying on predictable chemical availability. Any future reclassification or tightened usage restrictions could accelerate customers’ transition to alternative solvents, especially in pharmaceuticals and consumer product applications. Regulatory divergence across markets further complicates supply chains, requiring region-specific formulation strategies and risk management planning.

Substitution Risk from Alternative Solvents and Process Technologies

Industries increasingly explore alternative solvents and non-solvent cleaning technologies, posing a competitive challenge to N-propyl bromide. Water-based systems, modified alcohols, and engineered green solvents gain attention as companies seek reduction of hazardous chemical handling. Advanced vapor recovery designs and laser cleaning technologies reduce reliance on chemical agents entirely. End users evaluate substitution not only for compliance alignment but to enhance corporate sustainability commitments and ESG disclosures. As manufacturing sectors adopt digital quality control and robotics, solvent-dependent cleaning steps may be reduced or redesigned, potentially lowering demand. Suppliers must innovate to maintain relevance, focusing on process compatibility, cost-performance balance, and technology integration to address substitution pressures.

Regional Analysis:

North America

North America holds the largest share of the N-propyl bromide market at approximately 32%, driven by strong demand in industrial cleaning, vapor degreasing, and electronics component maintenance. The aerospace and defense manufacturing corridor across the United States remains a major consumption hub due to high precision cleaning requirements. Pharmaceuticals and specialty chemical synthesis further contribute to regional growth. Regulatory evaluations by environmental agencies influence product substitution and technology upgrades, encouraging adoption of controlled emission systems. Canada’s expanding metal fabrication and machining industries also drive demand, reinforcing North America’s position as a high-value, technology-integrated market for N-propyl bromide.

Europe

Europe represents about 27% of the global N-propyl bromide market, led by established manufacturing bases in Germany, Italy, and France. The region sees steady consumption in metal finishing, automotive components, coatings, and chemical synthesis. Environmental regulations encourage solvent recovery technologies, pushing end users toward vapor containment and lifecycle optimization systems. Demand from pharmaceutical intermediate production remains stable as regulatory consistency supports process continuity. Eastern Europe emerges as a cost-competitive manufacturing hub, increasing procurement of industrial solvents. While sustainability policies influence usage patterns, Europe retains a strong installed base that sustains recurring industrial solvent demand.

Asia-Pacific

Asia-Pacific accounts for approximately 34% market share, making it the fastest-growing regional market for N-propyl bromide. Expanding electronics assembly, automotive manufacturing, and export-oriented chemical production in China, India, South Korea, and ASEAN nations drive solvent usage in precision cleaning and synthesis applications. Rapid growth of contract manufacturing organizations and generic pharmaceutical production further elevates demand for high-purity grades. Lower adoption barriers and industrial expansion attract global suppliers to strengthen supply chains in the region. Despite evolving regulatory frameworks, cost advantages and large-volume manufacturing activity establish Asia-Pacific as a strategic growth engine for N-propyl bromide.

Latin America

Latin America represents nearly 4% of the global market, driven primarily by industrial cleaning, metal components processing, and emerging pharmaceutical packaging industries. Brazil and Mexico serve as key demand centers, supported by growing automotive component production and chemical processing capabilities. Regional industrialization initiatives and export manufacturing programs create opportunities for niche solvent applications. However, reliance on imported chemical intermediates and exposure to price fluctuations moderate growth. As production facilities modernize and incorporate better solvent handling technologies, N-propyl bromide consumption is expected to remain stable with localized growth pockets.

Middle East & Africa

The Middle East & Africa region holds around 3% market share, supported by developing industrial clusters and growing investments in oilfield chemicals, metal fabrication, and machinery maintenance. The UAE and Saudi Arabia lead demand due to their expanding industrial diversification strategies. Adoption remains concentrated within industrial solvents and specialty formulations. Infrastructure modernization and equipment refurbishment create additional market opportunities. However, regulatory alignment and dependence on external suppliers influence pricing and procurement stability. As industrial zones mature, controlled-use solvent applications are expected to gain traction, positioning the region for gradual market expansion.

Market Segmentations:

By Application

- Detergents

- Pharmaceuticals

- Dyes

- Others

By Types

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the N-propyl bromide market is characterized by a mix of global chemical producers and regional manufacturers focusing on solvent production, pharmaceutical intermediates, and specialty chemical applications. Competition is driven by product purity grades, pricing strategies, and long-term supply agreements with industrial cleaning, electronics, and chemical processing companies. Manufacturers emphasize solvent recovery compatibility, formulation stability, and compliance with evolving environmental regulations to sustain customer retention. Expansion into emerging manufacturing hubs in Asia-Pacific and Latin America forms a key strategy to reduce logistics costs and strengthen distribution networks. Partnerships with technology integrators in vapor degreasing systems support differentiation through performance-focused solutions. Companies operating in this market compete not only on cost and purity but increasingly on sustainability practices, documentation transparency, and the ability to support process optimization in regulatory-strengthened industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Recent Developments:

- In April 2025, Tongcheng Medicine Technology was profiled as a key global supplier of N-propyl bromide in a professional market research publication on the N-propyl bromide market for 2025–2032, confirming its continued active role in high-purity NPB supply and export.

- In 2022, Weifang Longwei Industrial The company reportedly “increased production efficiency through adoption of new catalytic processes.

Report Coverage:

The research report offers an in-depth analysis based on Application, Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will continue to develop in precision cleaning applications across aerospace and electronics manufacturing.

- Pharmaceutical intermediate usage will remain a stable contributor as synthesis pathways retain halogenated reactants.

- Adoption of controlled-emission and solvent recovery technologies will extend lifecycle value for industrial users.

- Regulatory evaluation will influence formulation innovation and alternative solvent positioning.

- Asia-Pacific will maintain its role as the fastest-growing manufacturing hub for solvent-related applications.

- Manufacturers will differentiate through high-purity grades and consistency for sensitive processes.

- Substitution risk will accelerate research into optimized performance-to-safety solvent profiles.

- Closed-loop vapor degreasing systems will become more widely implemented in high-precision industries.

- Strategic supply chain localization will strengthen market access in emerging regions.

- Sustainability reporting and compliance transparency will become decisive factors in supplier selection.