Market Overview:

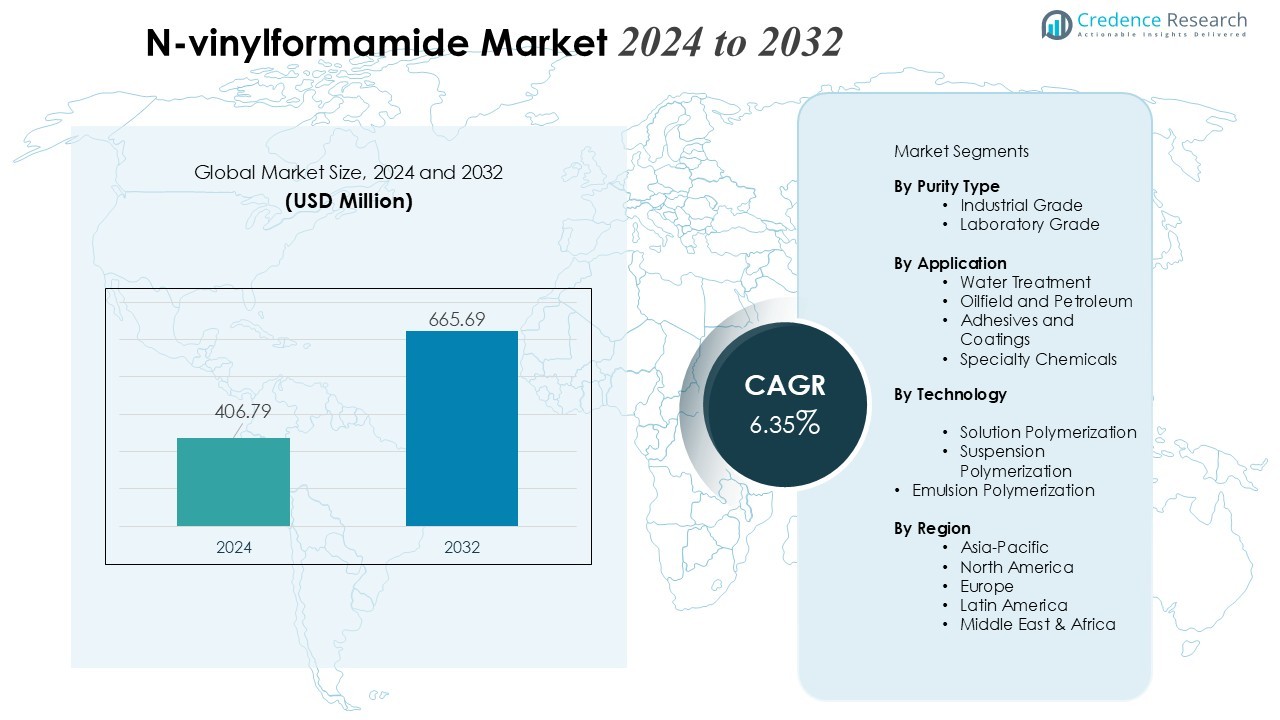

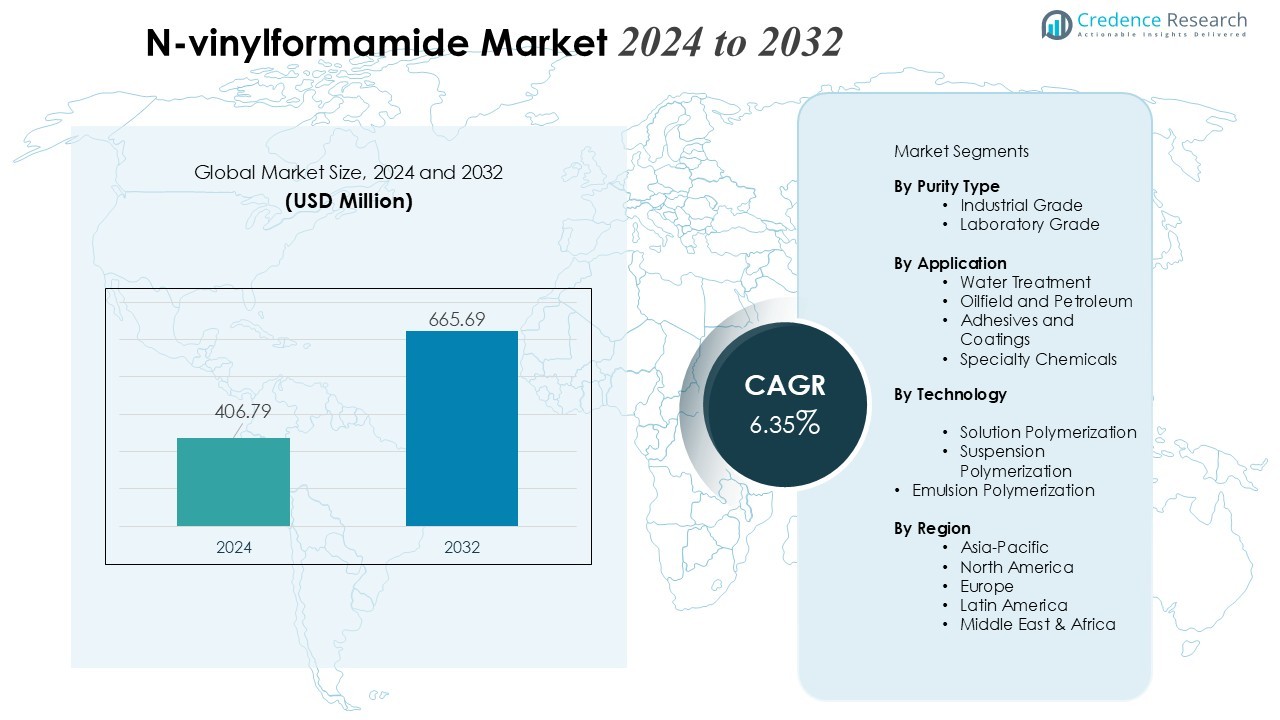

The N-vinylformamide Market size was valued at USD 406.79 million in 2024 and is anticipated to reach USD 665.69 million by 2032, at a CAGR of 6.35% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| N-vinylformamide Market Size 2024 |

USD 406.79 Million |

| N-vinylformamide Market, CAGR |

6.35% |

| N-vinylformamide Market Size 2032 |

USD 665.69 Million |

Key drivers include the growing utilization of NVF in flocculants and coagulants for wastewater treatment, driven by stringent environmental regulations and rising global water treatment needs. Increasing application in the petroleum sector for drilling fluids and enhanced oil recovery also supports market expansion. Additionally, the demand for high-performance adhesives, coatings, and paper-processing chemicals boosts consumption as manufacturers prioritize polymers offering thermal stability, solubility, and low toxicity. Ongoing R&D activities aimed at developing bio-based and sustainable polymer solutions further create new growth avenues.

Regionally, Asia-Pacific dominates the market due to strong chemical manufacturing bases in China, India, and Japan. North America and Europe follow, driven by technological advancements, mature industrial sectors, and increasing investments in specialty polymer development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The N-vinylformamide Market was valued at USD 406.79 million in 2024 and is projected to reach USD 665.69 million by 2032, registering a CAGR of 6.35% during the forecast period.

- Growing adoption of NVF in flocculants and coagulants for wastewater treatment drives demand, supported by strict environmental regulations and increasing global water treatment needs.

- Expanding applications in the petroleum sector, including drilling fluids and enhanced oil recovery, contribute significantly to market growth.

- Rising demand for high-performance adhesives, coatings, and paper-processing chemicals supports NVF consumption due to its thermal stability, solubility, and low toxicity.

- Asia-Pacific dominates the market with 45% share, led by China, India, and Japan, benefiting from strong chemical manufacturing bases and industrial expansion.

- North America holds 25% of the global market, supported by technological advancements, R&D investments, and adoption of NVF in specialty chemicals and oilfield applications.

- Europe and the Rest of the World contribute 20% and 10% respectively, driven by sustainability initiatives, regulatory compliance, and growing industrial infrastructure development.

Market Drivers:

Market Drivers:

Rising Demand for High-Performance Polymers in Industrial Applications

The N-vinylformamide market benefits from the increasing need for high-performance polymers across diverse industrial sectors. It plays a crucial role in producing poly(N-vinylformamide) and poly(N-vinylamine) derivatives, which offer thermal stability, water solubility, and low toxicity. Industries such as paper processing, adhesives, and coatings rely on NVF-based polymers for enhanced material performance. Growing adoption in specialty chemical formulations drives consistent demand. Manufacturers emphasize its versatility to meet stringent product quality standards.

- For Instance, BASF is a major global producer of N-vinylformamide (NVF) and its derivatives, which are widely adopted in specialty chemical formulations, including those for adhesives and paper-strengthening applications.

Expansion of Wastewater Treatment and Environmental Regulations

Environmental regulations worldwide drive the use of N-vinylformamide in wastewater treatment solutions. It forms effective flocculants and coagulants that improve water purification efficiency. Rising industrial effluent and municipal wastewater volumes create substantial demand for polymers that ensure regulatory compliance. Treatment plants increasingly adopt NVF derivatives for their performance in removing suspended solids and contaminants. This regulatory pressure directly supports the market’s growth trajectory.

- For Instance, Certain high-performance synthetic polymers are widely used as flocculants in industrial water treatment to remove suspended solids. For instance, high-molecular-weight polyacrylamide (PAM) and polyethyleneimine (PEI) based polymers are highly effective and can achieve a significant reduction of suspended solids in effluent processing, often in the range of 90-98% in optimized conditions.

Growth in Oilfield and Petroleum Sector Applications

The petroleum and oilfield industries increasingly utilize N-vinylformamide for drilling fluids and enhanced oil recovery processes. It improves viscosity control and polymer stability under high-temperature and high-pressure conditions. Demand for efficient oil extraction techniques encourages adoption of NVF-based polymers. Operators seek materials that enhance productivity while maintaining operational safety. This sector represents a significant contributor to overall market expansion.

Innovation in Specialty Adhesives and Coatings

NVF drives innovation in specialty adhesives, coatings, and paper-processing chemicals due to its unique polymer properties. It enables manufacturers to develop products with superior adhesion, moisture resistance, and chemical stability. Rising requirements for sustainable and high-performance materials support its broader application. Companies leverage NVF to differentiate product offerings in competitive markets. This ongoing innovation underpins consistent market growth.

Market Trends:

Adoption of Advanced Polymeric Solutions in Emerging Industrial Applications

The N-vinylformamide market experiences significant growth through the adoption of advanced polymeric solutions across various industries. It supports the development of high-performance polymers used in water treatment, adhesives, and specialty coatings, enhancing product efficiency and durability. Manufacturers increasingly explore NVF-based derivatives for their unique combination of solubility, thermal stability, and low toxicity. Rising demand from paper processing, textile, and construction sectors drives its application in innovative formulations. Research initiatives focus on optimizing polymer performance to meet stringent industrial standards. This trend reflects a shift toward materials that provide both functional and sustainable advantages. The market continues to expand as industries prioritize polymers capable of improving operational performance and regulatory compliance.

- For Instance, Sigma-Aldrich supplies basic chemicals, such as N-vinylformamide (NVF) monomer, used by researchers, the company does not offer a specific commercial ‘NVF copolymer’ membrane product that inherently guarantees 85% adsorption efficiency for organic micropollutants.

Expansion into Sustainable and High-Performance Chemical Formulations

Sustainability and performance remain critical trends influencing the N-vinylformamide market. It contributes to the creation of eco-friendly polymers that reduce environmental impact without compromising functionality. Manufacturers invest in bio-based NVF derivatives and novel chemical processes to meet rising demand for greener alternatives. The material’s ability to enhance efficiency in wastewater treatment and oilfield applications positions it as a preferred choice in high-value sectors. Companies integrate NVF into coatings, adhesives, and specialty chemicals to deliver superior product properties. This trend underscores the market’s focus on combining environmental responsibility with technological advancement. Rising awareness of sustainable practices strengthens the long-term adoption of NVF-based solutions.

- For Instance, SNF licensed proprietary N-vinylformamide (NVF) manufacturing technology from Mitsubishi Chemical Corporation (MCC) to produce polyvinylamine (PVAm) polymers, which act as strength resins to boost paper strength and improve recyclability.

Market Challenges Analysis:

High Production Costs and Limited Availability of Raw Materials

The N-vinylformamide market faces challenges due to the high production costs associated with its synthesis. It requires specialized raw materials and precise manufacturing processes, which increase overall expenses. Limited availability of high-purity precursors can restrict large-scale production and affect supply consistency. Manufacturers encounter operational difficulties in maintaining cost efficiency while meeting quality standards. This cost factor can limit adoption in price-sensitive industries. Companies must invest in advanced production technologies to optimize yields and reduce expenses. Market growth may slow if raw material constraints persist.

Regulatory and Safety Concerns Impacting Market Expansion

Stringent regulatory frameworks and safety concerns present another significant challenge for the N-vinylformamide market. It involves careful handling due to its chemical reactivity and potential health risks during production. Compliance with environmental and occupational safety standards increases operational complexity and costs. Failure to meet regulations can result in penalties or restricted market access in certain regions. These factors may hinder rapid expansion in emerging markets. Manufacturers must implement robust safety protocols and invest in training to ensure compliance. Regulatory hurdles can influence investment decisions and slow market penetration.

Market Opportunities:

Expansion in Water Treatment and Environmental Applications

The N-vinylformamide market presents significant opportunities in water treatment and environmental management. It enables the production of highly efficient flocculants and coagulants that improve wastewater purification and compliance with environmental regulations. Growing industrial effluent and municipal wastewater volumes drive demand for advanced polymeric solutions. Companies can leverage NVF-based derivatives to develop innovative and sustainable treatment chemicals. Rising focus on clean water initiatives worldwide supports market growth. Manufacturers investing in research and formulation improvements can capture new contracts in both developed and emerging regions. This sector offers long-term potential due to persistent environmental challenges.

Emergence of Specialty Polymers for High-Performance Industrial Applications

High-performance industrial applications create another key opportunity for the N-vinylformamide market. It contributes to polymers used in adhesives, coatings, paper processing, and oilfield applications, enhancing product functionality and durability. Increasing demand for polymers with thermal stability, solubility, and low toxicity encourages innovation in NVF derivatives. Companies can expand product portfolios by developing tailored solutions for specific industrial requirements. Growth in the petroleum sector and specialty chemical industries supports broader adoption. Technological advancements in polymer synthesis allow for cost-effective production and improved performance. This trend positions NVF as a strategic material in emerging industrial applications.

Market Segmentation Analysis:

By Purity Type

The N-vinylformamide Market is segmented by purity type into industrial grade and laboratory grade. It experiences high demand for industrial-grade NVF due to its widespread application in water treatment, adhesives, coatings, and paper-processing chemicals. Laboratory-grade NVF serves research and specialty chemical production, supporting small-scale or high-precision formulations. The distinction in purity influences pricing, production processes, and application suitability. Manufacturers prioritize quality control to ensure consistency and performance across different sectors.

- For instance, SNF, a global leader in water treatment chemicals, uses industrial-grade NVF to produce poly(N-vinylformamide)-based flocculants that achieve up to 95% removal efficiency in municipal wastewater treatment plants.

By Application

The market segments by application include water treatment, oilfield and petroleum, adhesives and coatings, and specialty chemicals. It plays a critical role in flocculants and coagulants for wastewater purification, improving efficiency and compliance with environmental regulations. NVF enhances drilling fluids and polymer solutions in oilfield applications, providing thermal stability and viscosity control under demanding conditions. In adhesives and coatings, it contributes to moisture resistance, chemical stability, and improved product performance. Specialty chemicals benefit from NVF’s versatility in producing poly(N-vinylformamide) and poly(N-vinylamine) derivatives.

- For Instance, Conventional primary wastewater treatment processes typically achieve microplastic removal rates in the range of 65% to 74%. Higher removal rates, often exceeding 95% (up to 98%), are generally observed in more advanced tertiary treatment stages, such as those that combine coagulation, sedimentation, and filtration technologies.

By Technology

By technology, the N-vinylformamide Market includes solution polymerization, suspension polymerization, and emulsion polymerization. It adapts to different production techniques to meet application-specific requirements. Solution polymerization is widely employed due to simplicity and high-quality output. Suspension polymerization allows for controlled particle size and improved handling in industrial applications. Emulsion polymerization supports high-efficiency production of water-soluble polymers. Each technology segment drives adoption across diverse industrial applications, reflecting innovation and performance optimization in polymer manufacturing.

Segmentations:

By Purity Type

- Industrial Grade

- Laboratory Grade

By Application

- Water Treatment

- Oilfield and Petroleum

- Adhesives and Coatings

- Specialty Chemicals

By Technology

- Solution Polymerization

- Suspension Polymerization

- Emulsion Polymerization

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific Leads the Market with Strong Production and Consumption

Asia-Pacific accounts for 45% of the global N-vinylformamide Market, driven by strong chemical manufacturing capabilities and expanding industrial sectors. It experiences high demand across water treatment, adhesives, coatings, and paper-processing applications. Countries such as China, India, and Japan contribute substantially to both production and consumption of NVF-based polymers. Favorable government policies and availability of cost-effective raw materials support manufacturing growth. Industrialization and urbanization further drive the adoption of NVF in specialty applications, prompting regional players to expand production capacity. High domestic consumption combined with export opportunities strengthens the region’s market position.

North America Maintains a Stable Position with Technological Leadership

North America holds 25% of the global N-vinylformamide Market, supported by advanced research capabilities and high-performance polymer applications. It plays a vital role in developing innovative NVF derivatives for oilfield processes, water treatment, and specialty chemicals. The United States and Canada lead regional demand, driven by industrial modernization and strict environmental compliance. Strong regulatory frameworks ensure the use of safe and reliable polymer solutions. Companies invest in R&D to enhance product efficiency and expand industrial applications. Technological expertise and regulatory support reinforce market stability and long-term growth prospects in the region.

Europe and Emerging Regions Drive Growth through Sustainability and Infrastructure

Europe contributes 20% to the global N-vinylformamide Market, driven by sustainability programs and demand for eco-friendly polymer solutions. Germany, France, and the UK lead adoption in adhesives, coatings, and water treatment chemicals that comply with environmental regulations. The Rest of the World, including Latin America and the Middle East, accounts for 10% of the market, showing potential through infrastructure development and expanding industrial activities. It provides opportunities for manufacturers to establish production and distribution networks. Rising focus on environmental management and high-performance polymer solutions supports gradual adoption across these regions.

Key Player Analysis:

- Angene International Limited

- Ashland Global Holdings Inc.

- Avantor, Inc.

- BASF SE

- Merck KGaA

- Santa Cruz Biotechnology, Inc.

- Thermo Fisher Scientific Inc.

- Tokyo Chemical Industry Co., Ltd. (TCI)

- Toronto Research Chemicals Inc.

Competitive Analysis:

The N-vinylformamide Market features a competitive landscape dominated by global and regional chemical manufacturers. It includes key players focusing on capacity expansion, product innovation, and strategic partnerships to strengthen market presence. Companies prioritize development of high-performance NVF derivatives for water treatment, oilfield, adhesives, and specialty chemical applications. Investment in research and development enables firms to enhance polymer efficiency, purity, and sustainability. Regional players in Asia-Pacific leverage cost-effective production and strong domestic demand to compete with established North American and European manufacturers. Strategic collaborations and supply chain optimization further provide a competitive edge. Continuous innovation in NVF-based solutions, combined with compliance with stringent environmental and safety regulations, defines market leadership and drives growth across multiple industrial sectors.

Recent Developments:

- In October 2025, BASF resolved to begin a €1.5 billion share buyback program starting in November 2025 until June 2026, as part of a larger €4 billion buyback to optimize capital structure and return value to shareholders.

- In May 2025, BASF signed an agreement to take over DOMO Chemicals’ 49% share in the Alsachimie joint venture, bolstering its polyamide 6.6 precursors supply for automotive and textiles.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Purity Type, Application, Technology and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and ITALY economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for high-performance polymers will continue to drive the adoption of N-vinylformamide across multiple industries.

- Expansion of wastewater treatment facilities globally will increase the need for NVF-based flocculants and coagulants.

- Growth in oilfield and petroleum applications will support consistent demand for NVF derivatives in drilling fluids and enhanced oil recovery.

- Innovation in adhesives, coatings, and specialty chemicals will create new application opportunities for NVF polymers.

- Increasing focus on sustainable and eco-friendly polymer solutions will encourage development of bio-based NVF derivatives.

- Technological advancements in polymer synthesis and production will improve efficiency and reduce operational costs.

- Regional growth in Asia-Pacific will continue to dominate due to industrial expansion and strong chemical manufacturing infrastructure.

- North America and Europe will maintain steady demand driven by research, regulatory compliance, and industrial modernization.

- Strategic collaborations and partnerships among manufacturers will strengthen global supply chains and enhance market competitiveness.

- Investment in R&D and tailored polymer solutions will enable market players to meet evolving industry requirements and emerging application trends.

Market Drivers:

Market Drivers: