Market Overview:

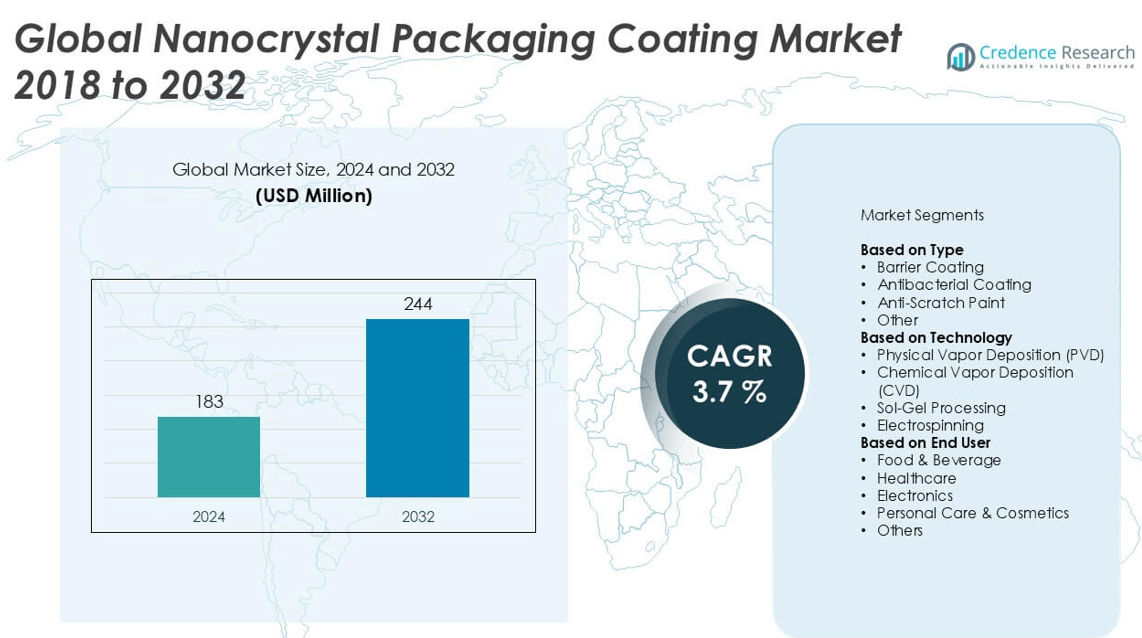

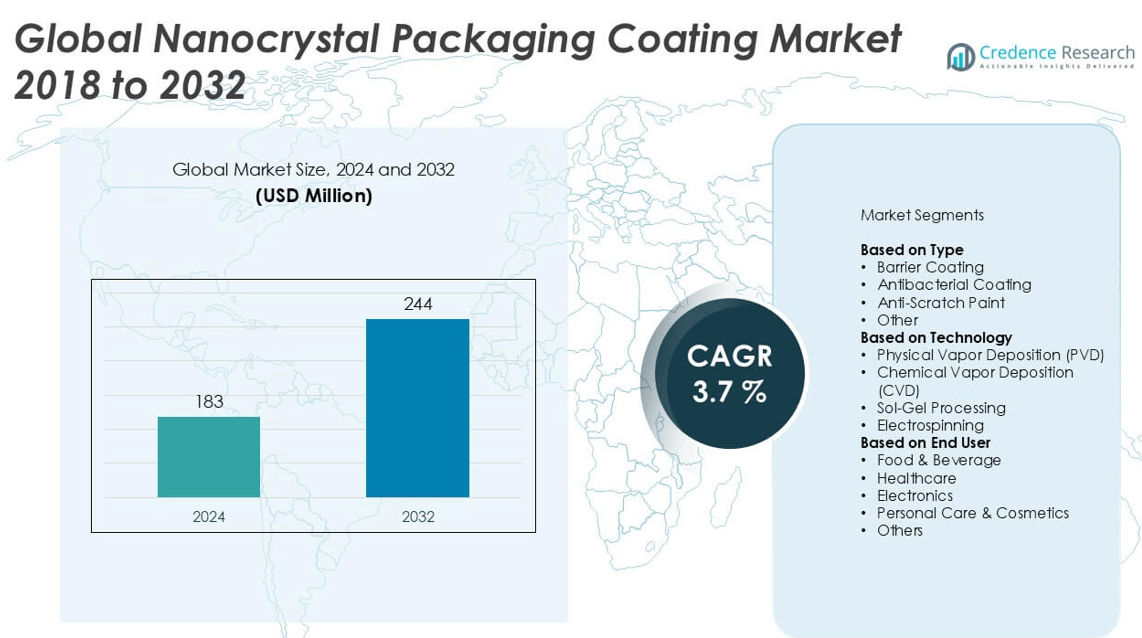

The Nanocrystal Packaging Coating market size was valued at USD 183 million in 2024 and is anticipated to reach USD 244 million by 2032, at a CAGR of 3.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Nanocrystal Packaging Coating Market Size 2024 |

USD 183 million |

| Nanocrystal Packaging Coating Markt, CAGR |

3.7% |

| Nanocrystal Packaging Coating Market Size 2032 |

USD 244 million |

The nanocrystal packaging coating market is led by prominent players such as Mitsubishi Chemical Corporation, DuPont de Nemours, Inc., Dow Chemical Company, and Evonik Industries AG, which collectively hold a substantial share due to their strong R&D, technological expertise, and global reach. Supporting innovation and niche applications, companies like Cima NanoTech Inc., Hybrid Plastics Inc., and Blue Nano Inc. are gaining traction with specialized coating solutions. Regionally, North America leads the global market with a 32% share, driven by advanced manufacturing infrastructure and high adoption across food, healthcare, and personal care sectors. Europe follows with a 28% market share, fueled by sustainability regulations and technological integration.

Market Insights

- The Nanocrystal Packaging Coating market was valued at USD 183 million in 2024 and is projected to reach USD 244 million by 2032, growing at a CAGR of 3.7% during the forecast period.

- Rising demand for sustainable and high-barrier packaging solutions, especially in food and healthcare sectors, is a key driver boosting market growth globally.

- Emerging trends include the integration of smart functionalities and increased use of bio-based nanocrystals to meet environmental and performance demands.

- Major players like DuPont, Dow Chemical Company, Mitsubishi Chemical Corporation, and Evonik Industries AG dominate the market through strong R&D and strategic partnerships, while niche players drive innovation in specialized applications.

- North America leads the market with a 32% share, followed by Europe at 28% and Asia Pacific at 24%; by type, Barrier Coating holds the largest segment share due to its strong protective capabilities and alignment with sustainable packaging requirements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

In the Nanocrystal Packaging Coating market, Barrier Coating emerged as the dominant sub-segment, accounting for the largest market share in 2024. This dominance is driven by the increasing demand for moisture, oxygen, and UV barrier solutions, especially in the food and beverage and pharmaceutical industries. These coatings significantly extend product shelf life and maintain quality, which is crucial in perishable goods packaging. Additionally, the rise in sustainable and recyclable packaging solutions further supports the growth of barrier coatings, as they help reduce dependency on multi-layer plastic materials while maintaining functional integrity.

- For instance, Mitsubishi Chemical Corporation developed its nanocomposite barrier coating that reduces oxygen permeability to 0.2 cc/m²/day at 23°C and 50% RH, enabling shelf-life extension by over 90 days for high-moisture food products.

By Technology

Physical Vapor Deposition (PVD) held the largest share among the technology segments due to its superior coating uniformity, adhesion strength, and low environmental impact. PVD technology is extensively used for applying nanocrystal coatings that improve durability, resistance to scratches, and optical clarity in packaging. The rising need for high-performance and eco-friendly coating technologies in electronics and personal care packaging has further fueled its adoption. Moreover, advancements in deposition equipment and cost optimization have broadened its applicability across medium- to high-volume packaging operations, consolidating its leadership position in the market.

- For instance, Bühler Group’s PVD platform achieved coating thickness control within ±2 nanometers and has enabled the production of over 3,000 m² of nanocoated film per production cycle for Constantia Flexibles’ high-barrier packaging lines.

By End User

The Food & Beverage segment led the market by end use, holding the largest share in 2024. This segment’s dominance is driven by the growing consumer demand for extended shelf life, freshness, and safety in packaged food products. Nanocrystal coatings are increasingly used in this industry due to their excellent barrier properties, which prevent contamination and preserve nutritional value. Additionally, the shift toward bio-based and smart packaging to comply with food safety regulations and enhance brand image has encouraged manufacturers to invest in advanced coatings, thus boosting the demand for nanocrystal packaging solutions in this segment.

Market Overview

Rising Demand for Sustainable Packaging

The increasing global focus on environmental sustainability is a significant driver for the nanocrystal packaging coating market. Consumers and regulatory bodies are pushing for reduced plastic waste and the adoption of eco-friendly materials. Nanocrystal coatings provide high-performance barrier properties while supporting the recyclability and biodegradability of packaging substrates. These coatings reduce the need for multilayer plastic structures, thereby aligning with circular economy goals. As major packaging manufacturers prioritize sustainability, the demand for advanced nanocrystal coatings that meet both performance and environmental criteria continues to accelerate.

- For instance, FKuR Kunststoff GmbH partnered with Fraunhofer UMSICHT to launch cellulose-based nanocrystal coatings that achieved a WVTR (Water Vapor Transmission Rate) of less than 5 g/m²/day on compostable PLA films, meeting EN 13432 industrial compostability standards.

Expansion in the Food and Beverage Industry

The food and beverage industry is witnessing robust growth, particularly in packaged and ready-to-eat products. This expansion drives the need for packaging solutions that ensure product safety, freshness, and extended shelf life. Nanocrystal coatings offer excellent moisture, oxygen, and UV barrier properties, which help preserve food quality without compromising sustainability. Additionally, rising consumer expectations for transparency and smart packaging technologies further support the use of advanced coatings. As global food distribution expands, nanocrystal coatings are becoming essential for maintaining quality across longer supply chains.

- For instance, Huhtamaki Oyj’s nanocoated PET trays for fresh food achieved an oxygen transmission rate (OTR) of below 1 cc/m²/day, which allowed packaged perishable meats to maintain freshness for up to 21 days under refrigerated conditions.

Technological Advancements in Coating Methods

Ongoing innovations in deposition technologies, such as Physical Vapor Deposition (PVD) and Sol-Gel processing, have enhanced the efficiency, cost-effectiveness, and scalability of nanocrystal coatings. These advancements enable uniform, high-performance coatings with better adhesion and functional properties. Improved coating precision and customization have expanded applications across diverse packaging types, including flexible films and rigid containers. Furthermore, research into bio-based nanocrystals and multifunctional coatings continues to unlock new commercial opportunities. This technological progress is fueling adoption in both premium and mass-market packaging sectors, further driving market growth.

Key Trends & Opportunities

Integration of Smart Packaging Features

A growing trend in the nanocrystal packaging coating market is the integration of smart functionalities such as temperature sensitivity, freshness indicators, and antimicrobial activity. These intelligent features enhance consumer engagement and product safety while offering added value to brands. Nanocrystal coatings are being engineered to respond to environmental stimuli or interact with digital tracking systems. This innovation aligns with the demand for real-time monitoring and traceability in supply chains, particularly in food, healthcare, and cosmetics packaging. As smart packaging adoption rises, nanocrystal coatings with embedded functionalities represent a key opportunity.

- For instance, Cima NanoTech Inc. integrated conductive nanonetworks in its coatings that enable real-time RFID and NFC communication with less than 5 Ohms/sq surface resistivity, facilitating smart tag embedding on flexible food-grade packaging films.

Increased Investment in Bio-Based Nanomaterials

There is a rising interest in bio-based nanocrystals derived from renewable resources like cellulose and chitin. These sustainable materials offer comparable barrier properties to synthetic alternatives while reducing environmental impact. As packaging companies shift toward greener alternatives, investment in bio-based nanocrystal coatings has surged. These coatings not only improve shelf life and product safety but also meet stringent environmental regulations. The growing consumer demand for “green” packaging and corporate sustainability commitments is likely to drive further development and commercialization of bio-based nanocrystal solutions.

- For instance, Blue Nano Inc. has developed bio-nanocrystal coatings from chitosan that deliver antimicrobial efficacy against E. coli at bacterial count reductions of up to 6 log CFU/mL after 24 hours, supporting use in active food packaging.

Key Challenges

High Production and Application Costs

Despite their advantages, nanocrystal packaging coatings face cost-related challenges, particularly in large-scale applications. The production of nanocrystals, along with advanced deposition techniques like PVD and CVD, involves significant capital investment and operational expenses. These high costs can limit adoption among small and medium-sized enterprises or low-margin industries. Additionally, scaling up laboratory innovations to industrial production without compromising performance remains a technical hurdle. As a result, price sensitivity may restrict market penetration, especially in cost-competitive sectors like food and personal care packaging.

Regulatory Uncertainty and Safety Concerns

Nanomaterials, including nanocrystals, are subject to evolving regulatory scrutiny due to potential health and environmental risks. Limited data on the long-term impact of nanocoatings and lack of harmonized global standards pose challenges for manufacturers. Regulatory compliance often requires extensive testing and documentation, leading to delays in product commercialization. Moreover, public concerns over the safety of nanomaterials in food-contact packaging may hinder consumer acceptance. Navigating these regulatory complexities remains a barrier to faster adoption, particularly in highly regulated sectors like food and healthcare.

Limited Awareness and Technical Expertise

The nanocrystal packaging coating market also faces challenges related to limited awareness among end users and a shortage of skilled professionals. Many packaging companies are unfamiliar with the benefits and technical requirements of nanocrystal coatings. Additionally, the application of such coatings demands expertise in material science and advanced processing methods, which may not be readily available in all regions. This knowledge gap can slow down technology transfer, limit market education, and hinder the integration of nanocoatings into mainstream packaging lines.

Regional Analysis

North America

North America held a significant share of the nanocrystal packaging coating market in 2024, accounting for approximately 32% of the global market. The region benefits from strong demand across the food and beverage, healthcare, and personal care sectors, driven by consumer preferences for premium, safe, and sustainable packaging. Technological advancements, combined with the presence of key coating manufacturers and research institutions, support innovation and commercialization. The United States leads regional growth due to increasing adoption of smart packaging and regulatory emphasis on sustainable materials. Market expansion is further supported by investments in advanced manufacturing infrastructure.

Europe

Europe captured around 28% of the global nanocrystal packaging coating market in 2024, driven by stringent environmental regulations and strong consumer demand for recyclable and biodegradable packaging. Countries like Germany, France, and the Netherlands are at the forefront of adopting nanocrystal coatings in the food, cosmetics, and pharmaceutical sectors. The European Union’s Green Deal and circular economy initiatives have accelerated the shift toward sustainable packaging technologies. Additionally, a well-established industrial base and R&D ecosystem contribute to product innovation and regional competitiveness, making Europe a key contributor to overall market development.

Asia Pacific

Asia Pacific emerged as the fastest-growing region, holding a 24% share of the global nanocrystal packaging coating market in 2024. Rapid industrialization, urbanization, and rising disposable incomes in countries such as China, India, and Japan are fueling demand for packaged food, cosmetics, and electronic goods. This is driving the adoption of advanced nanocoating technologies that enhance shelf life and product appeal. Furthermore, growing investment in nanotechnology research and favorable government policies supporting sustainable manufacturing strengthen regional market growth. Cost advantages and an expanding consumer base make Asia Pacific a key growth engine in the forecast period.

Latin America

Latin America accounted for approximately 9% of the global nanocrystal packaging coating market in 2024. Growth is primarily driven by increasing demand for sustainable packaging in the food and beverage industry, particularly in Brazil, Mexico, and Argentina. While the region is still in the early stages of adopting nanocoating technologies, gradual infrastructure development and rising awareness of environmental regulations are encouraging local manufacturers to invest in eco-friendly solutions. However, market growth is somewhat restrained by limited access to advanced coating technologies and relatively high production costs.

Middle East & Africa

The Middle East & Africa represented a 7% share of the global nanocrystal packaging coating market in 2024. The market is gradually expanding, supported by developments in the healthcare, food processing, and cosmetics sectors, especially in countries like the UAE and South Africa. Increasing demand for hygienic and long-shelf-life packaging in urban centers is encouraging the use of nanocrystal coatings. However, the region faces challenges such as limited local manufacturing capacity and reliance on imports for advanced materials. Despite these barriers, growing investments in sustainable technologies offer long-term growth potential.

Market Segmentations:

By Type

- Barrier Coating

- Antibacterial Coating

- Anti-Scratch Paint

- Other

By Technology

- Physical Vapor Deposition (PVD)

- Chemical Vapor Deposition (CVD)

- Sol-Gel Processing

- Electrospinning

By End User

- Food & Beverage

- Healthcare

- Electronics

- Personal Care & Cosmetics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the nanocrystal packaging coating market is characterized by the presence of both global conglomerates and specialized nanotechnology firms actively focusing on innovation, sustainability, and application-specific performance. Key players such as Mitsubishi Chemical Corporation, DuPont de Nemours, Inc., Dow Chemical Company, and Evonik Industries AG dominate the market with robust R&D capabilities, diverse product portfolios, and global distribution networks. These companies are investing in advanced coating technologies and strategic collaborations to enhance product functionality and expand into emerging markets. Meanwhile, niche players like Cima NanoTech Inc., Hybrid Plastics Inc., and Blue Nano Inc. are contributing through proprietary nanomaterial solutions and customization offerings. Partnerships with packaging converters, brand owners, and food manufacturers are increasingly shaping the competitive dynamics. Additionally, a growing focus on bio-based nanocrystals and multifunctional coatings is fostering product differentiation. The market remains moderately consolidated, with innovation speed, regulatory compliance, and sustainable value propositions serving as key differentiators.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cima NanoTech Inc.

- Arkema Group

- Dow Chemical Company

- Blue Nano Inc.

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Hybrid Plastics Inc.

- Mitsubishi Chemical Corporation

- FKuR Kunststoff GmbH

- Constantia Flexibles Group GmbH

- Huhtamaki Oyj

Recent Developments

- In June 2025, DuPont highlighted innovations in advanced materials for electronics and AI, particularly focusing on high barrier and next-generation packaging solutions at the JPCA Show. While “nanocrystal packaging coatings” weren’t explicitly named, DuPont’s research and development aligns with the growing need for high-performance, sustainable coatings in electronic packaging.

- In March 2025, Evonik showcased new high-performance coating additives and solutions at the European Coatings Show 2025, emphasizing innovations for printing ink, adhesives, and packaging. Their factbook highlights ongoing development of specialty additives and polymers relevant to high-barrier, functional coatings, which could include nanocrystal technologies. Direct labeling as “nanocrystal” packaging coatings was not explicit, but their portfolio is aligned with this segment.

- In November 2022, Melodea announced the plans to expand its eco-friendly solution to more areas.

- In April 2022, Nanosys, Inc. collaborated with Nanjing Bready announced the launch of mass production of the world’s first line of completely air-stable, barrier-free, laminated quantum dot film components xQDEF™ Laminate deliver no-compromise quantum dot color and brightness for displays in a new, lower-cost package, expanding the market for quantum dot displays.

Market Concentration & Characteristics

The Nanocrystal Packaging Coating Market exhibits moderate to high market concentration, with a few large multinational corporations holding a significant share alongside several specialized players. It is characterized by strong emphasis on innovation, material performance, and environmental compliance. Leading companies leverage advanced R&D capabilities and established global supply chains to maintain competitive advantages. The market responds quickly to regulatory changes and evolving consumer demands for sustainable and functional packaging. High entry barriers exist due to the complexity of nanomaterial formulation and the capital-intensive nature of coating technologies. It remains technology-driven, where performance attributes such as barrier resistance, antimicrobial activity, and transparency are essential for market adoption.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow due to rising demand for sustainable and high-barrier packaging solutions.

- Food and beverage packaging will remain the leading application segment due to the need for extended shelf life.

- Bio-based nanocrystal coatings will gain popularity as companies shift toward eco-friendly materials.

- Technological advancements in deposition methods will improve scalability and reduce production costs.

- Regulatory support for recyclable and biodegradable packaging will drive adoption across industries.

- Smart packaging integration with nanocrystal coatings will create new opportunities for product differentiation.

- Asia Pacific will emerge as a key growth region due to expanding manufacturing and consumer markets.

- Strategic partnerships between coating developers and packaging manufacturers will increase.

- Healthcare and personal care sectors will adopt nanocrystal coatings for improved product safety and hygiene.

- Investments in R&D will focus on multifunctional coatings offering barrier, antimicrobial, and responsive properties.