Market Overview

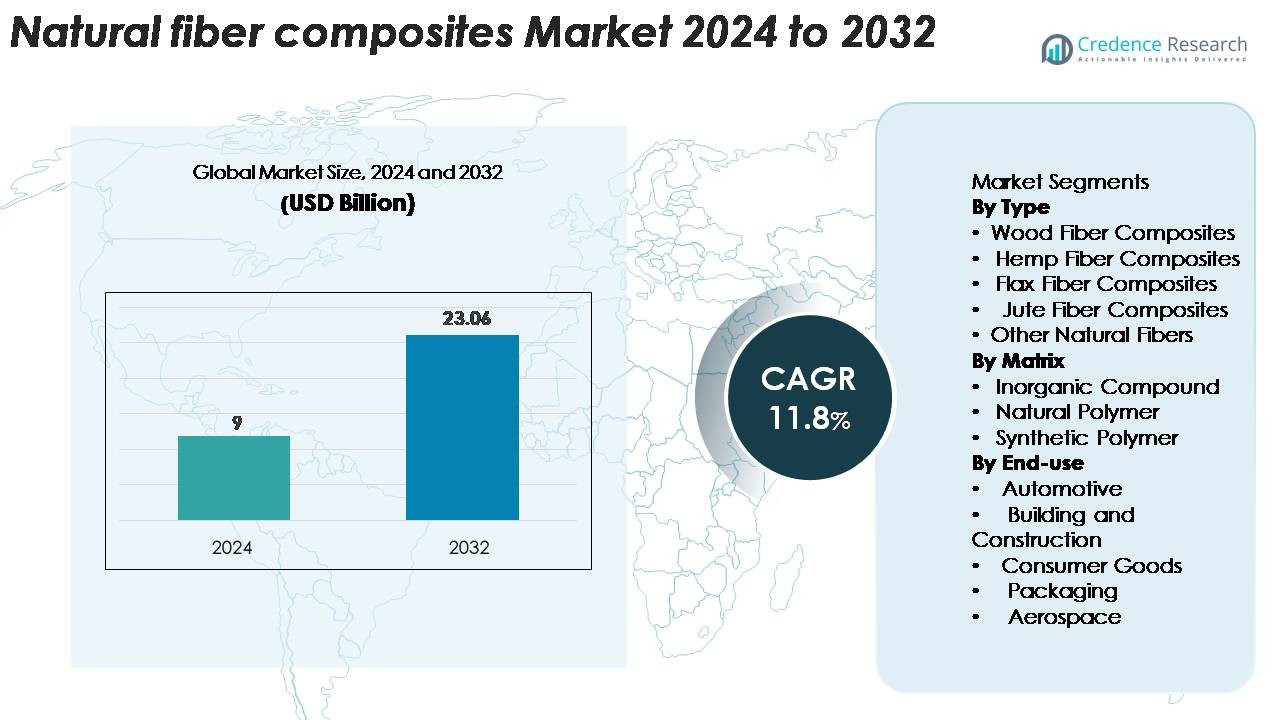

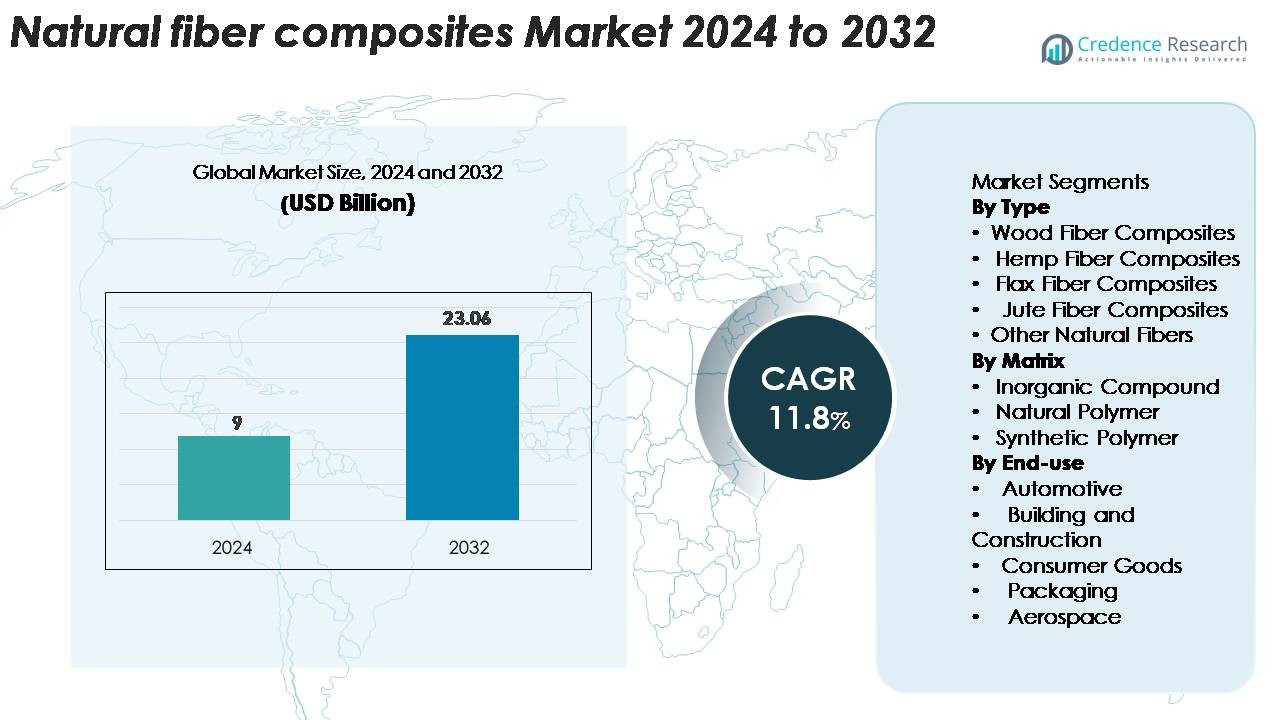

The Natural Fiber Composites Market was valued at USD 9 billion in 2024 and is projected to reach USD 23.06 billion by 2032, growing at a CAGR of 11.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Natural Fiber Composites Market Size 2024 |

USD 9 Billion |

| Natural Fiber Composites Market, CAGR |

11.8% |

| Natural Fiber Composites Market Size 2032 |

USD 23.06 Billion |

North America leads the natural fiber composites market with a 34% share, supported by strong automotive production and mature processing capabilities. Europe follows with a 31% share, driven by stricter sustainability regulations and advanced use of flax and hemp composites. Asia-Pacific holds a 26% share, expanding rapidly due to abundant fiber supply and rising construction activity. Key players such as FlexForm Technologies, UPM Biocomposites, Trex Company, Procotex, JELU-WERK, TECNARO, GreenGran, and Fiberon strengthen global competitiveness through improved compounding technologies and expanded biopolymer integration. Their investments in lightweight, durable, and recyclable composites continue to shape market leadership across these regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The natural fiber composites market reached USD 9 billion in 2024 and is set to reach USD 23.06 billion by 2032 at an 11.8% CAGR.

- The market grows due to rising demand for lightweight, sustainable materials in automotive and construction, with wood fiber composites holding the largest share because of low cost and wide processing compatibility.

- Key trends include expanding adoption of bio-based polymers, improved fiber treatment technologies, and increasing use of hemp, flax, and jute in high-performance applications across mobility and green building.

- Leading players such as FlexForm Technologies, UPM Biocomposites, Trex Company, Procotex, TECNARO, and Fiberon compete through stronger compounding capabilities and broader natural fiber sourcing.

- North America leads with 34%, Europe follows with 31%, and Asia-Pacific holds 26%, while automotive remains the dominant end-use segment due to strong lightweighting requirements across major OEMs.

Market Segmentation Analysis:

By Type

Wood fiber composites lead this segment with a strong share due to their wide use in automotive panels, decking, and interior components. Their durability, easier processing, and lower cost strengthen adoption across large-volume applications. Hemp and flax fibers expand steadily because manufacturers value their higher tensile strength for lightweight structural parts. Jute fibers grow in packaging and low-cost molded goods. Other natural fibers serve niche uses where specific stiffness or thermal traits are required. Rising demand for sustainable and recyclable materials continues to support the dominance of wood-based composites in mass-market industries.

- For instance, Trex Company operates manufacturing facilities in Virginia, Nevada, and Arkansas that contribute to its total manufacturing capacity of over $2 billion in sales annually, demonstrating the massive scale enabled by wood-fiber composite systems.

By Matrix

Synthetic polymer matrices dominate this segment with the largest share, driven by their strong mechanical performance and compatibility with high-volume production. Polypropylene and polyethylene remain preferred choices for automotive and consumer goods due to their strength-to-weight ratio and processing ease. Natural polymer matrices grow in food-grade and biodegradable applications, while inorganic compounds support heat-resistant components. The leadership of synthetic polymers is reinforced by mature supply chains and stable molding processes, allowing manufacturers to scale natural fiber composite production while meeting durability and safety standards.

- For instance, Braskem’s polypropylene portfolio includes automotive-grade PP resins with melt flow rates reaching up to 80 g/10 min, enabling faster moulding cycles for natural-fiber composite parts.

By End-use

Automotive is the dominant end-use segment with the highest market share, supported by rising demand for lightweight interiors, door panels, trunk liners, and structural reinforcements. Automakers use natural fiber composites to reduce vehicle weight and improve fuel efficiency while meeting sustainability goals. Building and construction grows with increased use in decking, cladding, and insulation materials. Consumer goods adopt these composites for durable, eco-friendly products, while packaging uses them for biodegradable trays and containers. Aerospace adoption remains small but increases for lightweight interior components where sustainability matters.

Key Growth Drivers

Rising Demand for Sustainable and Lightweight Materials

The shift toward eco-friendly manufacturing drives strong adoption of natural fiber composites across automotive, construction, and consumer goods sectors. Manufacturers prefer these materials because they offer lower density, reduced carbon footprint, and improved lifecycle performance compared to glass or carbon fiber alternatives. Automakers adopt natural fibers to meet strict emission and lightweighting standards, enabling fuel savings and improved energy efficiency in electric vehicles. Construction companies use wood and jute composites for decking, cladding, and insulation due to their cost advantage and recyclability. Stringent regulations on plastic waste and pollution further accelerate the transition to bio-based materials. Growing investment in renewable feedstock, combined with consumer preference for greener products, strengthens the position of natural fiber composites as a mainstream alternative. As industries scale sustainability commitments, the demand for lightweight natural composites continues to expand across high-volume end-use sectors.

- For instance, BMW has increased its integration of natural fiber composites into series production, replacing traditional materials to reduce weight and lower CO2 emissions. In its now-discontinued i3 model, for instance, interior trim and door panels were made partly from kenaf fibers to reduce weight and increase the use of renewable raw materials.

Growing Use in Automotive Interior and Structural Components

Automotive manufacturers significantly boost demand for natural fiber composites as they pursue lighter and more energy-efficient vehicle designs. Natural fibers such as wood, hemp, and flax offer strong strength-to-weight ratios, enabling effective replacement of heavier synthetic materials in door panels, dashboards, trunk liners, and reinforcement structures. Their acoustic dampening properties also improve cabin comfort, which makes them valuable for EVs that require noise reduction materials. OEMs integrate these composites to comply with fuel-efficiency standards and sustainability targets across Europe, North America, and Asia. The composites also support faster processing cycles and lower tooling costs, which enhances manufacturing efficiency. As electric vehicles expand globally, the need to offset battery weight strengthens the adoption of lightweight natural fiber components. This driver is further reinforced by supply chain advancements and improved fiber-polymer compatibility, making natural fiber composites a preferred material in next-generation vehicle platforms.

- For instance, BMW integrated natural-fiber composites into the i3 program with each vehicle using roughly 21 kilograms of renewable fibers in interior and structural parts, demonstrating large-scale application in automotive production.

Advancements in Processing Technologies and Material Engineering

Innovations in composite processing techniques strongly support market expansion by enhancing strength, durability, and moisture resistance in natural fiber materials. Improvements in fiber treatment, surface modification, and hybrid reinforcement technologies increase compatibility with synthetic and bio-based polymer matrices. Automation and high-precision molding equipment help manufacturers scale production while maintaining consistent fiber dispersion and mechanical stability. Coupled with advanced coupling agents and resin systems, these technologies unlock new industrial applications that require higher structural reliability. Wood-plastic composites benefit from improved co-extrusion and compounding methods, while hemp and flax composites gain from thermoforming and injection-molding advancements. These technological improvements reduce defects, enhance heat stability, and extend product lifespans, making natural fibers viable for demanding applications such as automotive structural components, construction boards, and high-performance consumer goods. Continuous R&D investments ensure that material quality and performance continue to close the gap with conventional composites.

Key Trends & Opportunities

Rising Adoption of Bio-Based Polymers and Fully Renewable Composites

A major trend shaping the market is the growing shift toward bio-based and biodegradable polymer matrices, driven by global sustainability mandates and consumer expectations for clean materials. Manufacturers experiment with polylactic acid, starch blends, and other natural polymers that pair effectively with hemp, jute, and flax fibers, enabling fully renewable composite systems. These materials appeal to industries such as packaging, consumer electronics, and food service, where circularity and compostability are increasingly important. Rapid growth in biopolymer production capacity across Europe and Asia widens commercial opportunities, while improved mechanical performance makes these bio-composites suitable for semi-structural applications. Companies also explore marine-based and agricultural waste fibers to expand the feedstock base and reduce reliance on conventional sources. This trend supports innovation pipelines and aligns strongly with global moves toward carbon neutrality, unlocking new market segments for natural fiber composite manufacturers.

- For instance, NatureWorks currently operates a single, large-volume bio-based polymer facility in Blair, Nebraska, with an annual PLA output capacity of 150,000 metric tons, which is used in advanced natural-fiber composite formulations.

Expansion of Natural Fiber Composites in High-Value and Emerging Applications

Manufacturers identify new opportunities for natural fiber composites in high-performance and niche applications, driven by advances in resin chemistry, hybrid reinforcement, and multilayer engineering. Aerospace interior components, sports equipment, furniture, electric two-wheelers, and smart consumer products increasingly explore natural fibers for lightweighting and design flexibility. Architectural applications such as façade panels and acoustic systems benefit from superior thermal and sound-absorbing characteristics of natural fiber materials. Branding advantages associated with sustainability also encourage consumer-facing industries to adopt natural composites as premium alternatives. The trend is reinforced by government incentives supporting biomaterials, especially in Europe and Japan. As processing stability improves, manufacturers can target higher-margin products that require durability, precision, and strength. These emerging applications represent a growth opportunity for companies aiming to diversify beyond automotive and construction and expand into specialized performance-driven markets.

· For instance, Lingrove’s Ekoa® flax-fiber composite—used in premium instruments and furniture—features manufacturer-reported claims of a tensile strength of approximately 280 MPa for specific unidirectional applications, confirming the material’s potential for high-performance engineered parts.

Key Challenges

Inconsistent Material Properties and Performance Limitations

Natural fiber composites face challenges due to variability in fiber quality, moisture sensitivity, and limited heat resistance. Fiber characteristics depend on growing conditions, harvesting methods, and processing practices, which makes performance less predictable compared to synthetic reinforcements. Moisture absorption weakens interfacial bonding with polymer matrices and may cause swelling or degradation, limiting use in long-term structural applications. High processing temperatures needed for certain polymers also risk fiber degradation, restricting compatibility with some resin systems. These issues force manufacturers to invest in surface treatments, coupling agents, and controlled processing conditions, increasing production complexity. While technological advances continue, achieving uniform mechanical performance across large-volume production remains a significant barrier for broader industrial adoption.

Supply Chain Constraints and Limited Industrial-Scale Availability

The natural fiber composites market faces supply-side challenges due to inconsistent raw fiber availability, limited industrial processing infrastructure, and regional concentration of fiber cultivation. Agricultural fibers such as flax, hemp, and jute depend on seasonal production cycles, climate variability, and farming economics, which lead to supply fluctuations. Processing facilities capable of producing industrial-grade fibers with controlled specifications remain limited in many regions, restricting scalability. Logistics costs further increase due to bulk material handling requirements and limited regional supply hubs. These constraints hinder stable supply to automotive and construction sectors that rely on predictable, high-volume sourcing. Without broader agricultural support, fiber standardization, and investment in processing capacity, manufacturers may struggle to meet rising demand for natural fiber composites at industrial scale.

Regional Analysis

North America

North America holds the leading position in the natural fiber composites market with a 34% share, driven by strong adoption across automotive interiors, construction panels, and sustainable consumer goods. The United States benefits from advanced compounding facilities and high demand for lightweight materials in electric vehicle platforms. Wood fiber composites dominate regional consumption due to their cost efficiency and wide compatibility with synthetic polymer matrices. Government emphasis on low-emission materials and rising interest in biodegradable alternatives also support market expansion. Growing investment in bio-based manufacturing hubs strengthens North America’s leadership across high-volume applications.

Europe

Europe follows North America with a 31% share, supported by strict sustainability regulations and strong preference for bio-based materials. Germany, France, and the Nordic countries lead due to their advanced automotive industries and active R&D programs in natural polymers. Flax and hemp composites gain strong traction as suppliers expand processing capabilities for semi-structural components. Construction firms adopt natural fiber boards and façade materials to meet green-building certifications. The region’s circular-economy agenda accelerates the shift toward renewable composites, while government-funded innovation programs ensure ongoing material improvements. Europe remains a major hub for high-performance natural fibers.

Asia-Pacific

Asia-Pacific holds a fast-growing 26% share, driven by rising automotive production, rapid construction expansion, and strong availability of jute, kenaf, and coir fibers. China and India emerge as major consumers as manufacturers look for cost-effective, lightweight composite solutions for vehicles, housing, and household goods. Regional suppliers benefit from abundant agricultural fiber supply and growing investments in polymer processing capacity. Japan and South Korea expand use of natural fiber composites in electric mobility and electronics. Urbanization and sustainability-focused building codes continue to accelerate adoption, making Asia-Pacific the highest-growth region during the forecast period.

Latin America

Latin America accounts for a 6% share, supported by moderate adoption across construction, packaging, and agricultural machinery applications. Brazil leads due to strong availability of sisal and coir fibers, which support cost-effective composite production. The region’s construction sector increasingly uses wood-fiber composites for decking, wall panels, and outdoor structures, driven by durability and lower maintenance requirements. Automotive adoption grows slowly but benefits from regional assembly plants seeking lightweight interior materials. Limited industrial processing capacity remains a barrier, but rising sustainability policies and expanding local fiber supply create long-term opportunities for natural composite manufacturers.

Middle East & Africa

The Middle East & Africa region holds a 3% share, characterized by emerging demand across construction, consumer goods, and packaging sectors. Gulf countries adopt wood-based composites for façade panels and outdoor applications due to resistance to corrosion and humidity. South Africa leads in automotive-related consumption as manufacturers explore lightweight natural fiber alternatives for interior components. Availability of regional fibers such as kenaf and sisal supports small-scale production, but industrial processing infrastructure remains limited. Growing interest in sustainable building materials and government diversification programs is expected to gradually boost regional adoption of natural fiber composites.

Market Segmentations:

By Type

- Wood Fiber Composites

- Hemp Fiber Composites

- Flax Fiber Composites

- Jute Fiber Composites

- Other Natural Fibers

By Matrix

- Inorganic Compound

- Natural Polymer

- Synthetic Polymer

By End-use

- Automotive

- Building and Construction

- Consumer Goods

- Packaging

- Aerospace

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the natural fiber composites market is shaped by a mix of global material producers, specialized composite manufacturers, and regional fiber processors focused on sustainability-driven innovation. Leading companies such as FlexForm Technologies, UPM Biocomposites, Trex Company, Procotex, TECNARO, GreenGran, and Fiberon strengthen their positions through advanced compounding technologies, wider adoption of bio-based polymers, and expanded fiber sourcing networks. Many players invest in improved processing methods, including surface treatments and hybrid reinforcement, to enhance mechanical strength and moisture resistance. Partnerships with automotive OEMs and construction material suppliers accelerate product development and market penetration. Companies also focus on eco-certifications, recyclable formulations, and bio-based resin integration to meet regulatory and consumer expectations. As demand rises across automotive, construction, and consumer goods, competitors aim to scale production, optimize R&D capabilities, and secure reliable natural fiber supply chains.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Trex Company

- GreenCore Composites

- Fiberon LLC

- Tecnaro GmbH

- Procotex Corporation SA

- FlexForm Technologies

- Fiberon Composites

- Green Dot Bioplastics

- UPM-Kymmene Corporation

Recent Developments

- In March 2025, the company rebranded its French subsidiary “Apply Carbon” to “Procotex France” to strengthen its international recycled-fiber business and ramp up composite-grade natural fibre supply.

- In October 2024, Bcomp collaborated with Škoda Motorsport to integrate natural fiber composites into the Škoda Enyaq RS Race and Škoda Fabia RS Rally2. This development resulted in the extensive use of flax composites in the interior and exterior of the rally car, including bumpers, mirror housings, footrests, padel box, leg rests, and gearshift grommets.

Report Coverage

The research report offers an in-depth analysis based on Type, Matrix, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for natural fiber composites will rise as industries shift toward sustainable materials.

- Automotive manufacturers will increase adoption to support lightweighting goals and electric vehicle efficiency.

- Construction applications will expand due to stronger interest in eco-friendly decking, panels, and insulation.

- Advances in bio-based polymers will boost compatibility with natural fibers and expand product performance.

- Processing technologies will improve, enabling better moisture resistance and structural stability.

- Supply chains for hemp, flax, jute, and wood fibers will strengthen through expanded cultivation and processing hubs.

- Consumer goods brands will adopt natural composites to meet green product expectations.

- Hybrid materials combining natural and synthetic fibers will gain momentum in semi-structural uses.

- Regulations targeting carbon reduction and recyclable materials will accelerate market penetration.

- New applications in aerospace, e-mobility, and furniture will emerge as material engineering advances.