Market Overview:

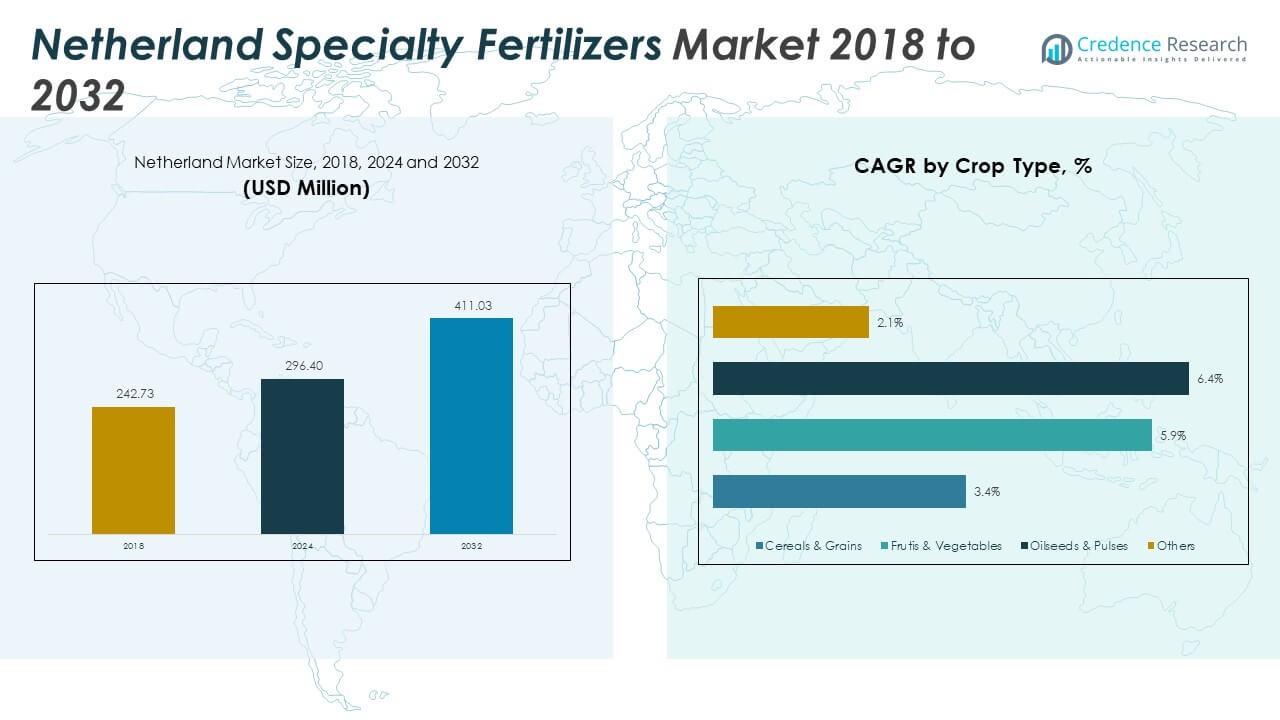

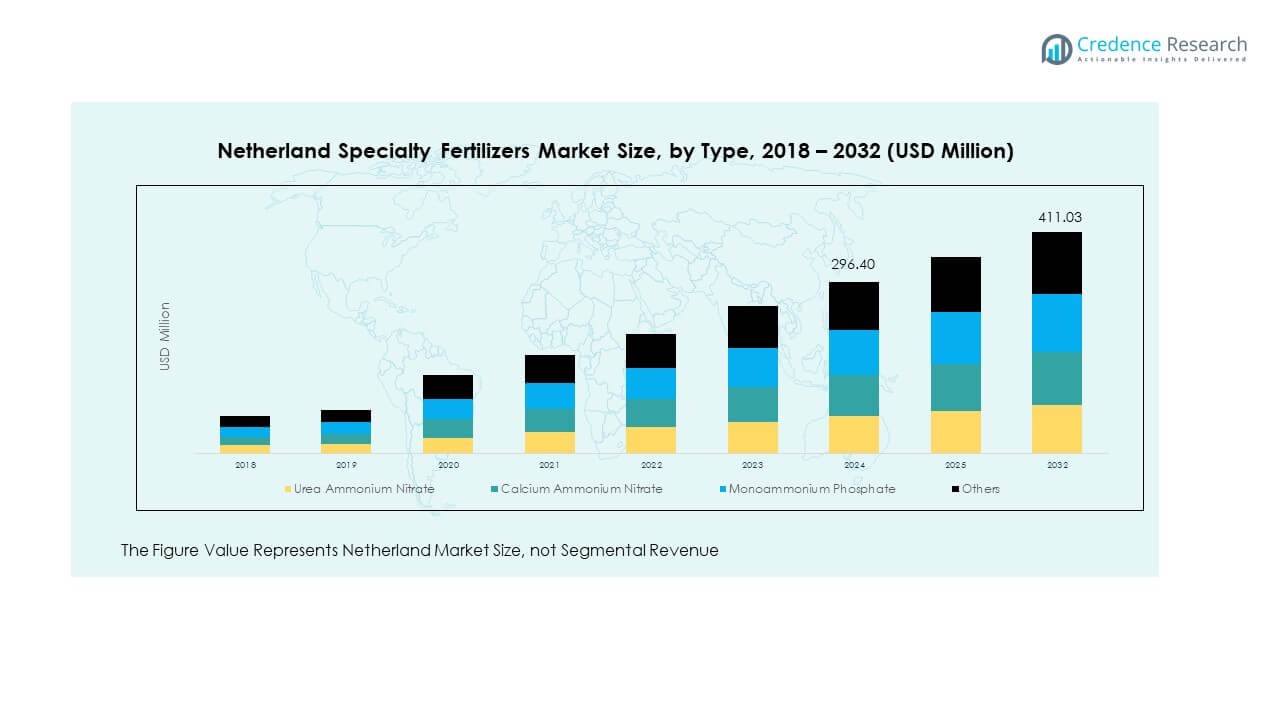

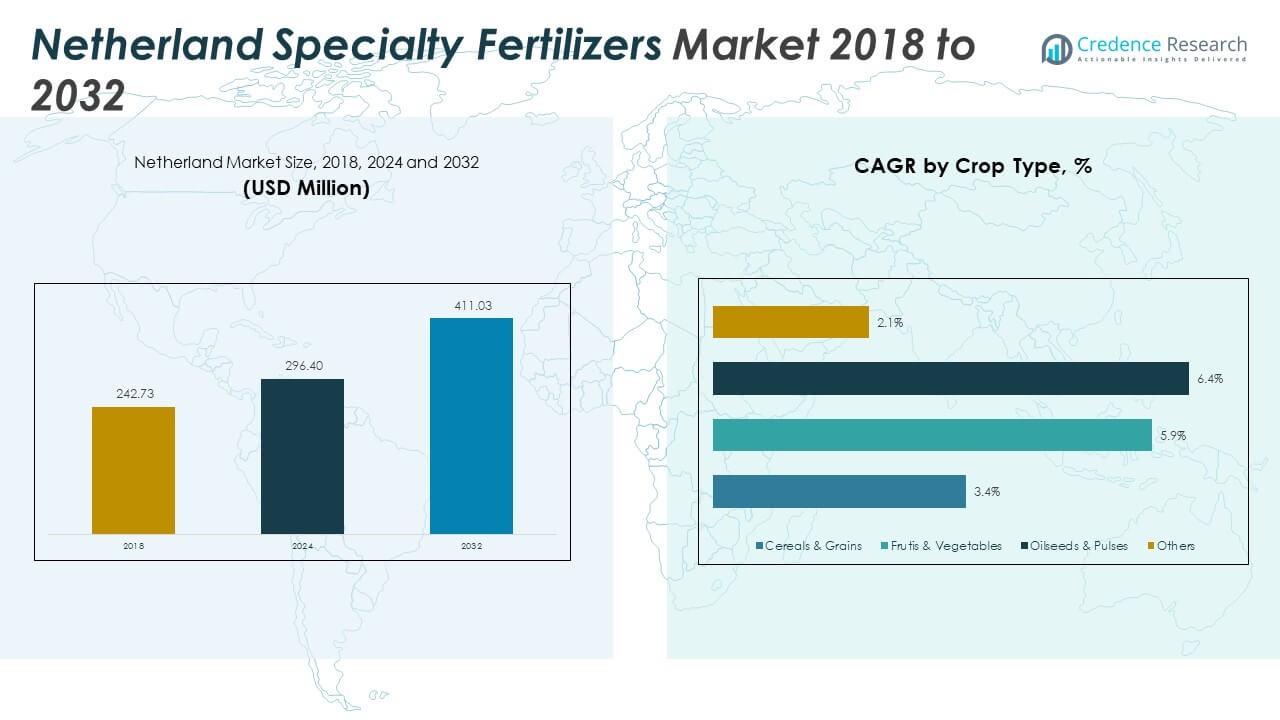

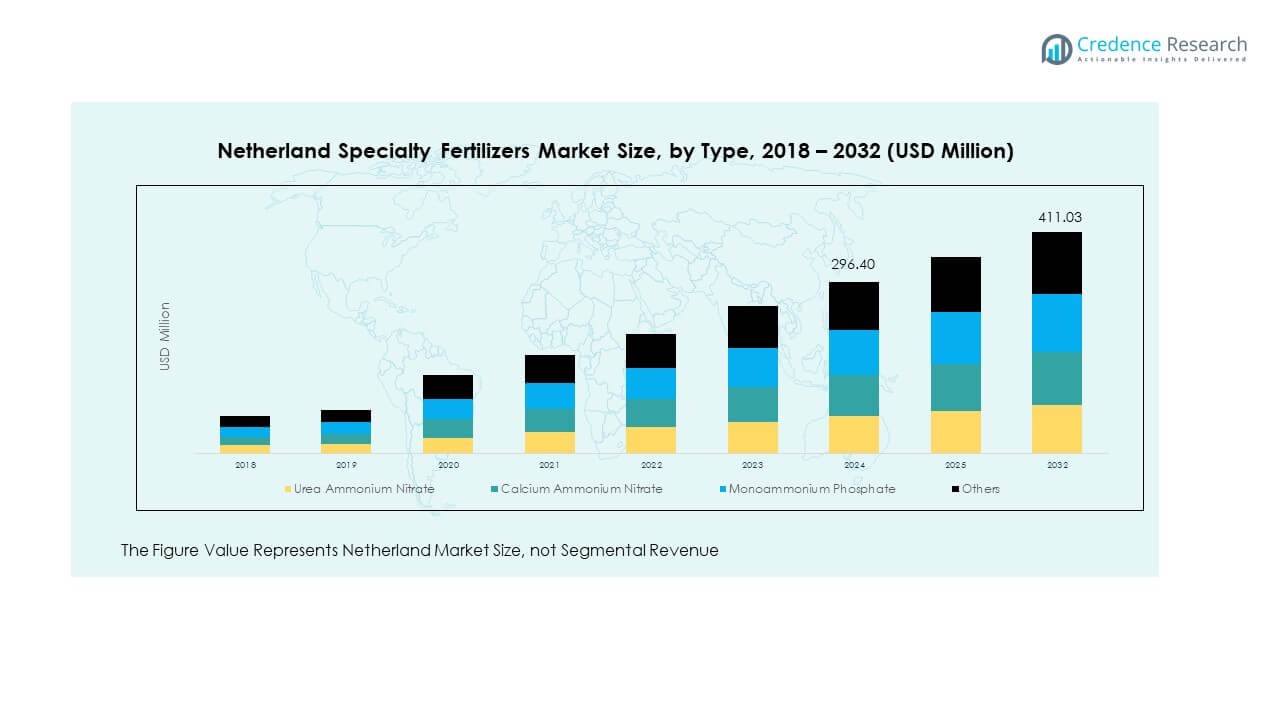

The Netherlands Specialty Fertilizers Market size was valued at USD 242.73 million in 2018 to USD 296.40 million in 2024 and is anticipated to reach USD 411.03 million by 2032, at a CAGR of 4.17% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Netherlands Specialty Fertilizers Market Size 2024 |

USD 296.40 Million |

| Netherlands Specialty Fertilizers Market, CAGR |

4.17% |

| Netherlands Specialty Fertilizers Market Size 2032 |

USD 411.03 Million |

Market growth is strongly driven by the country’s focus on precision farming, sustainable agriculture, and advanced horticulture practices. Farmers adopt controlled-release, water-soluble, and micronutrient-rich fertilizers to improve nutrient efficiency while reducing environmental impact. The government’s strict regulations on emissions and resource management encourage the use of eco-friendly fertilizers, while greenhouse cultivation further supports high demand. Strong R&D and technological innovation among fertilizer producers enhance efficiency, aligning with evolving agricultural needs in the Netherlands.

Regionally, the Western Netherlands leads due to its concentration of greenhouse production and horticulture, supported by advanced fertigation practices. Northern and Eastern areas contribute significantly through open-field cultivation of grains, potatoes, and sugar beets, creating steady demand for controlled-release solutions. The Southern Netherlands shows growing adoption in specialty crops and mixed farming, supported by collaborations between farmers and research institutions. Emerging regions in Eastern Europe also influence demand, as Dutch companies expand exports and partnerships, reinforcing the Netherlands’ role as a hub for sustainable specialty fertilizers in Europe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Netherlands Specialty Fertilizers Market was valued at USD 242.73 million in 2018, reached USD 296.40 million in 2024, and is projected to achieve USD 411.03 million by 2032, recording a CAGR of 4.17% during the forecast period.

- Western Netherlands leads with a 42% share due to greenhouse cultivation and export-focused horticulture, while Northern and Eastern Netherlands hold 33% through open-field farming of grains and potatoes. The Southern Netherlands contributes 25%, supported by mixed farming and research-driven crop solutions.

- Eastern Netherlands emerges as the fastest-growing subregion with 33% share, driven by expanding adoption of precision agriculture and sustainable soil management practices in cereal and grain farming.

- By type, blends of NPK account for 28% of the Netherlands Specialty Fertilizers Market, supported by their balanced nutrition profile and versatility across crops.

- Urea ammonium nitrate holds 24% share, showing consistent demand due to its cost-effectiveness and strong role in both fertigation and soil-based applications.

Market Drivers

Rising Focus On Precision Agriculture And Controlled Application Methods To Increase Crop Productivity

Precision agriculture is gaining strong ground in the Netherlands, where farmers rely heavily on data-driven decisions to enhance productivity. The adoption of smart farming techniques requires fertilizers with controlled nutrient release to align with crop requirements. The Netherlands Specialty Fertilizers Market benefits from high demand for solutions that reduce wastage and enhance nutrient uptake efficiency. Controlled-release fertilizers ensure balanced growth, supporting both yield and quality. Farmers focus on sustainability while addressing strict agricultural regulations. This driver also reflects the rising role of digital platforms in farm management. Fertilizer producers continue to design products compatible with precision technologies. It establishes a strong growth pathway for specialty fertilizers in the country.

- For instance, a Wageningen University case study documented that precision nitrogen fertilization in Dutch winter wheat led to a 15–27% reduction in fertilizer inputs without affecting grain yield or protein content, demonstrating the measurable benefits of technology-driven nutrient management.

Increasing Emphasis On Sustainable Farming Practices Supported By Government Policies

Dutch agriculture places significant emphasis on sustainability to reduce environmental pressure while ensuring high-quality production. The Netherlands Specialty Fertilizers Market aligns with this demand by offering eco-friendly formulations that lower nitrogen runoff and greenhouse gas emissions. Government initiatives encourage adoption of advanced fertilizers that contribute to climate goals. Farmers respond by integrating water-soluble and organic-based products into horticulture and greenhouse cultivation. The market is influenced strongly by EU-wide policies promoting greener production. It benefits from subsidies and programs that support sustainable input usage. Local producers design solutions to balance productivity with ecological responsibility. The regulatory push creates a favorable environment for specialty fertilizers across the sector.

Growing Horticulture And Greenhouse Cultivation Driving Higher Demand For Specialty Fertilizers

The Netherlands is recognized globally for its extensive horticulture and greenhouse sector, which requires advanced fertilizers. Specialty fertilizers provide tailored solutions to meet the precise nutritional needs of high-value crops. The Netherlands Specialty Fertilizers Market gains traction by supporting diverse applications ranging from flowers to vegetables. Controlled water-soluble products optimize growth cycles in greenhouse environments. Farmers adopt micronutrient blends to enhance product quality and shelf life. Export-oriented cultivation encourages growers to focus on premium yields and global standards. It increases dependency on specialty fertilizers that ensure consistent performance. This expansion in horticulture and greenhouse activities serves as a consistent growth driver.

High Adoption Of Innovative Fertilizer Formulations To Enhance Efficiency And Minimize Losses

Producers are investing in advanced formulations such as nano-fertilizers, chelated micronutrients, and slow-release variants. These innovations help farmers increase yield while minimizing nutrient loss in soils. The Netherlands Specialty Fertilizers Market reflects a shift towards products that reduce operational costs and improve efficiency. Innovative solutions address challenges of soil depletion and nutrient imbalance in intensive farming systems. Companies invest in R&D to deliver formulations that support evolving farming needs. It drives differentiation in a competitive environment, strengthening market growth. Farmers are drawn to these products for their reliability and measurable benefits. The focus on advanced formulations builds strong confidence in specialty fertilizer adoption.

- For instance, COMPO EXPERT’s NovaTec® granulated fertilizer, containing a nitrification inhibitor (3,4-DMPP), is proven in field trials to increase nitrogen use efficiency in vegetable crops while reducing nitrogen losses to the environment—a result highlighted in published product catalogs and trial summaries

Market Trends

Expanding Role Of Digital Agriculture Platforms In Optimizing Fertilizer Usage

Digital farming tools are being widely adopted across the Netherlands to support precise fertilizer use. The Netherlands Specialty Fertilizers Market adapts by aligning its products with data-based farm management systems. Farmers rely on real-time monitoring platforms that measure soil health and crop nutrition levels. Integration of specialty fertilizers into these platforms enhances decision-making efficiency. Predictive analytics tools identify nutrient deficiencies early, supporting corrective actions. It enables efficient allocation of resources while reducing environmental burden. The trend encourages fertilizer makers to partner with agri-tech firms. This convergence of digital tools and fertilizers marks a transformative phase for the market.

Rising Popularity Of Bio-Based And Organic Specialty Fertilizers Among Consumers

Consumer preference for organic and residue-free food continues to influence farming practices. The Netherlands Specialty Fertilizers Market observes strong demand for bio-based formulations that complement organic cultivation. Farmers seek fertilizers derived from natural inputs to meet certifications and consumer expectations. Organic blends enrich soil structure while supporting eco-label production systems. It enhances the value of Dutch exports, particularly in European markets where organic produce is in high demand. Producers respond by expanding portfolios with eco-certified specialty fertilizers. Greenhouse growers also experiment with biostimulants to improve resilience. This trend positions bio-based solutions as a central pillar in future growth.

- For example, ICL Group began shipments of controlled release fertilizers using its novel eqo.x biodegradable coating technology from its Heerlen, Netherlands production site in May 2024. The product meets anticipated European Union eco-standards for open-field crops, supporting Dutch specialty farmers in transitioning to sustainable fertilization practices. ICL invested $20 million in the local production line, specifically addressing potato and seed onion crops.

Integration Of Smart Sensors And IoT Devices To Support Targeted Fertilizer Application

The use of smart sensors and IoT-enabled systems is reshaping fertilizer application strategies. The Netherlands Specialty Fertilizers Market benefits from the integration of these technologies into everyday farming practices. Sensors monitor soil pH, nutrient levels, and crop requirements in real-time. IoT devices automate the release of nutrients with high precision, reducing over-application risks. Farmers embrace these systems to comply with environmental standards and maximize efficiency. It promotes consistent use of specialty fertilizers designed for sensor-based deployment. Companies invest in partnerships to create fertilizer formulations compatible with smart systems. The integration trend represents a strong technological leap in the sector.

Shift Towards Customized Nutrition Solutions For High-Value Export Crops

Export crops such as vegetables, flowers, and fruits demand consistent quality and strong shelf life. The Netherlands Specialty Fertilizers Market addresses this trend by offering crop-specific nutrition solutions. Customized blends target specific nutrient requirements to maintain competitive advantage in export markets. Farmers adopt solutions tailored to each growth stage, enhancing productivity and resilience. It strengthens the country’s reputation for premium produce across global markets. Fertilizer makers innovate with specialized formulations that optimize both yield and crop uniformity. Export-oriented agriculture drives continuous improvement in fertilizer design. The emphasis on customization supports the unique position of Dutch farming worldwide.

- For instance, Haifa Group’s Poly-Feed Drip, a fully water-soluble NPK line, is widely adopted in Dutch greenhouse and export farming, with micronutrient-enriched blends supporting intensive crop quality across soil and soilless systems.

Market Challenges Analysis

Strict Environmental Regulations And Rising Compliance Costs Affecting Fertilizer Adoption

The Netherlands Specialty Fertilizers Market faces increasing regulatory scrutiny due to environmental concerns. The government enforces strict rules to reduce nitrogen emissions and protect groundwater quality. Compliance requirements create cost pressures for farmers, making adoption more challenging. It limits the use of conventional fertilizers and pushes demand toward eco-friendly products, though at higher expense. Farmers often face difficulties balancing profitability with adherence to regulations. Smaller growers find compliance especially difficult, slowing adoption in certain areas. The market must adapt by offering affordable sustainable options. Regulatory stringency remains a core challenge influencing fertilizer strategies in the Netherlands.

High Product Costs And Limited Awareness Among Small-Scale Farmers Restricting Adoption

Specialty fertilizers are often priced higher than conventional options, creating a cost barrier for many farmers. The Netherlands Specialty Fertilizers Market experiences slower uptake among small and medium growers. Limited awareness of benefits reduces willingness to shift from traditional inputs. It affects market penetration despite proven efficiency advantages. Larger farms and greenhouse operators adapt quickly, but smaller producers remain hesitant. Companies struggle to communicate long-term value compared to upfront costs. Knowledge gaps in application methods also hinder effective use. This cost and awareness imbalance continues to be a critical obstacle for market expansion.

Market Opportunities

Expanding Demand For Innovative Solutions In Export-Oriented Horticulture And Greenhouse Cultivation

The Netherlands Specialty Fertilizers Market holds significant opportunities in export-driven horticulture and greenhouse industries. Farmers emphasize quality, uniformity, and sustainability to meet global standards. Specialty fertilizers tailored for flowers, vegetables, and fruits strengthen competitive advantage. It supports improved productivity and enhances Dutch exports across Europe and beyond. Innovative products aligned with greenhouse automation systems create higher adoption rates. Companies can leverage this demand to expand specialized portfolios. Growing investment in horticulture ensures long-term opportunity. This sector provides a steady growth platform for advanced fertilizer solutions.

Rising Adoption Of Smart And Sustainable Technologies Across Precision Agriculture

Precision farming offers broad opportunities for specialty fertilizers that integrate with smart systems. The Netherlands Specialty Fertilizers Market benefits from compatibility with IoT devices, drones, and digital platforms. Fertilizer makers can target solutions designed for sensor-controlled application. It encourages higher efficiency and adoption among forward-looking farmers. Sustainable agriculture goals amplify the relevance of innovative nutrient blends. The scope extends to addressing soil health restoration and reduced environmental burden. Collaboration with technology providers enhances growth potential. The alignment of smart agriculture with sustainability creates long-term opportunities for specialty fertilizers in the Netherlands.

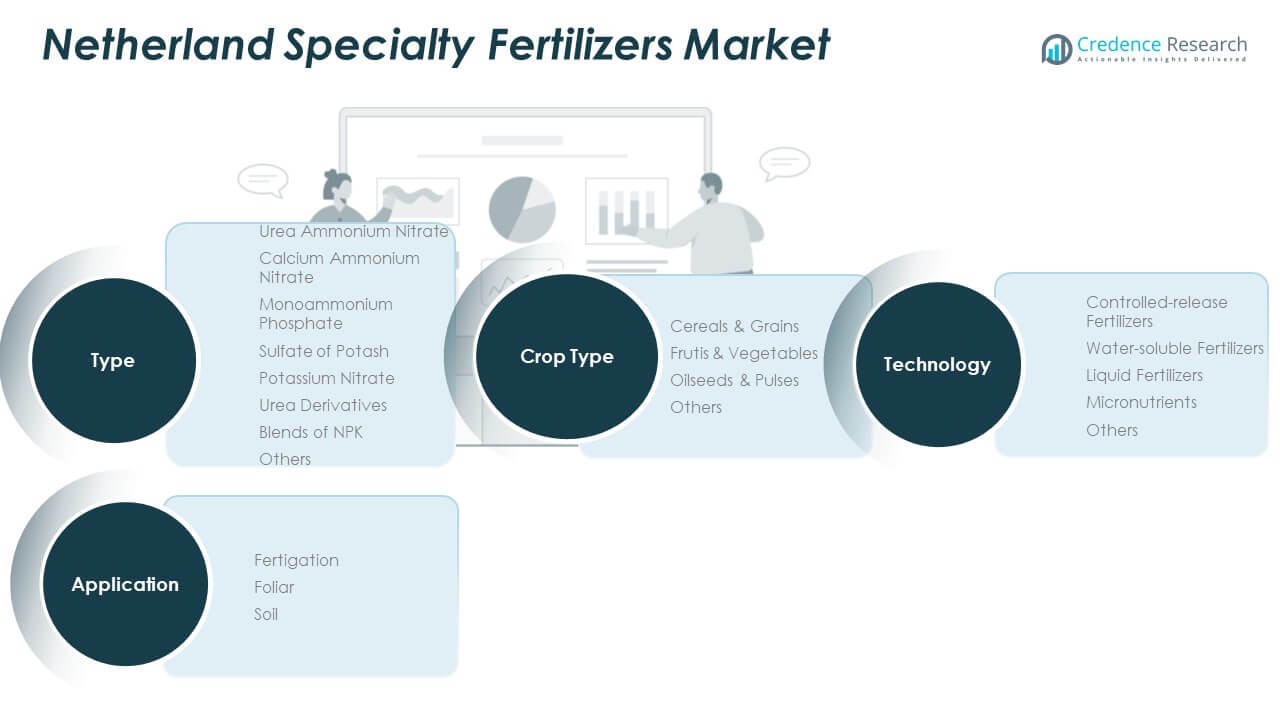

Market Segmentation Analysis

By type, the Netherlands Specialty Fertilizers Market is dominated by blends of NPK and urea ammonium nitrate due to their balanced nutrient profile and wide adaptability across crops. Calcium ammonium nitrate and monoammonium phosphate also hold significant demand, particularly in precision-driven farming systems. Sulfate of potash and potassium nitrate are preferred for high-value horticultural crops that require specific nutrient management. Urea derivatives and other specialized blends support niche cultivation needs, reflecting the market’s focus on tailored solutions.

By application, fertigation leads the market owing to the Netherlands’ advanced greenhouse and horticultural infrastructure, which relies on efficient irrigation-based fertilizer delivery. Foliar applications are widely adopted for their quick crop response and enhanced nutrient absorption. Soil application continues to remain relevant in open-field farming but is gradually shifting toward precision techniques to reduce losses. The Netherlands Specialty Fertilizers Market benefits from the strong integration of advanced application methods that enhance efficiency and crop performance.

By technology, water-soluble fertilizers dominate due to their compatibility with greenhouse cultivation and fertigation systems. Controlled-release fertilizers are gaining traction as farmers seek sustainable, efficient nutrient solutions aligned with European standards. Liquid fertilizers support ease of application and are preferred in intensive horticultural practices, while micronutrients cater to specific crop deficiencies.

- For instance, Van Iperen International highlights in its 2024 catalogue a wide portfolio of water-soluble NPK formulas designed for greenhouse and open-field fertigation, engineered for rapid nutrient uptake and reduced runoff to ensure efficient crop nutrition.

By crop type, fruits and vegetables hold the largest share, driven by export-oriented production. Cereals, grains, pulses, and oilseeds also contribute significantly, supported by regional demand and sustainable cultivation practices.

- For instance, Yara International announced in May 2023 the construction of a new YaraVita specialty crop nutrition plant, aimed at doubling capacity by 2025 to serve global export markets including the Netherlands, delivering advanced biostimulant and nutrient solutions for horticultural crops.

Segmentation

By Type

- Urea Ammonium Nitrate

- Calcium Ammonium Nitrate

- Monoammonium Phosphate

- Sulfate of Potash

- Potassium Nitrate

- Urea Derivatives

- Blends of NPK

- Others

By Application

By Technology

- Controlled-release Fertilizers

- Water-soluble Fertilizers

- Liquid Fertilizers

- Micronutrients

- Others

By Crop Type

- Cereals and Grains

- Pulses and Oilseeds

- Fruits and Vegetables

- Others

Regional Analysis

Western Netherlands

The Western Netherlands leads the Netherlands Specialty Fertilizers Market with a 42% share, driven by intensive greenhouse cultivation and horticulture. This region hosts large-scale production of flowers, fruits, and vegetables for both domestic use and export markets. Farmers focus on precision agriculture, supported by advanced irrigation and fertigation systems, which amplifies demand for water-soluble and controlled-release fertilizers. The strong presence of agri-tech companies further accelerates adoption of innovative formulations. It benefits from government-backed sustainability initiatives targeting reduced emissions and efficient resource use. Export-oriented farming practices reinforce its position as the dominant subregion for specialty fertilizers.

Northern and Eastern Netherlands

The Northern and Eastern Netherlands account for 33% of the market, supported by extensive cereal and grain farming. Specialty fertilizers in this subregion are applied to improve soil nutrient efficiency and address deficiencies in larger open-field cultivation. Farmers emphasize controlled-release and micronutrient solutions to increase productivity in crops like potatoes, sugar beets, and grains. The market is shaped by rising adoption of precision farming techniques to optimize input costs. It reflects strong alignment with EU policies that encourage sustainable soil management practices. Regional cooperatives and agricultural networks support knowledge sharing and technology access, reinforcing fertilizer adoption.

Southern Netherlands

The Southern Netherlands contributes 25% of the market, with demand concentrated in mixed farming systems and specialty crops. This subregion emphasizes pulses, oilseeds, and niche horticultural crops, where customized nutrition solutions gain traction. Specialty fertilizers support both small-scale farms and export-driven production, particularly in high-value fruits and vegetables. Farmers adopt liquid and foliar application methods to maximize crop health and yield. It benefits from collaborations between universities, research institutions, and agribusinesses that advance fertilizer innovation. Regional policies supporting sustainable agriculture ensure continuous opportunities for specialty fertilizer producers across the southern provinces.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Netherlands Specialty Fertilizers Market is shaped by strong competition among global and domestic players focusing on innovation, sustainability, and efficiency. Leading companies such as Van Iperen International, Yara International ASA, ICL Group Ltd., and Haifa Chemicals Ltd. emphasize advanced product formulations tailored for horticulture and greenhouse cultivation. These firms invest in research and development to deliver controlled-release, water-soluble, and micronutrient-rich fertilizers that align with the Netherlands’ sustainability goals. The market is also influenced by local firms like Triferto Fertilizers, which provide customized solutions for regional crop requirements and strengthen distribution networks. It benefits from the competitive dynamics created by major international players including Nutrien Ltd., The Mosaic Company, EuroChem Group AG, and OCP Group. These companies focus on expanding product portfolios and leveraging strategic partnerships to enhance their presence. Product differentiation, coupled with technical support services for farmers, serves as a key competitive edge. Sustainability-driven innovation remains a central theme, with companies advancing bio-based and eco-friendly formulations. The growing importance of digital agriculture tools encourages fertilizer producers to integrate smart solutions into their offerings.

Recent Developments

- In July 2025, Van Iperen International made headlines by receiving approximately 4,900 tons of water-soluble potassium sulfate from Cinis Fertilizer for use in its specialty fertilizers solutions in the Netherlands market. This shipment strengthens Van Iperen’s circular and sustainable fertilizer portfolio, particularly for advanced fertigation applications in local horticulture.

- In June 2025, Koppert Biological Systems signed a five-year exclusive distribution agreement with Amoéba S.A. for a revolutionary biofungicide based on the lysate of amoeba Willaertia magna. The partnership is supported by an €800,000 capital investment and positions Koppert as the exclusive supplier of this environmentally-friendly biocontrol solution for vines and vegetables across eighteen European countries, including the Netherlands. The launch is expected early 2026.

- In September 2022, ICL Specialty Fertilizers introduced an innovative biodegradable coating technology for controlled-release fertilizers (CRF), branded as eqo.x. Product deliveries utilizing this technology began to customers in the Netherlands, supporting compliance with updated European fertilizer standards coming into effect in 2026.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Technology and Crop Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Netherlands Specialty Fertilizers Market will advance through increased integration of precision farming technologies.

- Sustainability goals will drive adoption of eco-friendly and bio-based specialty fertilizer solutions.

- Greenhouse cultivation expansion will boost demand for customized nutrition tailored to high-value crops.

- Innovation in controlled-release and water-soluble formulations will shape product differentiation.

- Collaborations between agri-tech firms and fertilizer producers will accelerate smart farming adoption.

- Regulatory frameworks will continue to encourage sustainable input usage and low-emission practices.

- Export-oriented horticulture will create consistent demand for premium fertilizer solutions.

- R&D investments will enhance efficiency in addressing soil nutrient depletion challenges.

- Farmers will increasingly prefer liquid and foliar applications for faster crop response.

- Competition will intensify, with firms balancing affordability, innovation, and sustainability to gain share.