Market Overview:

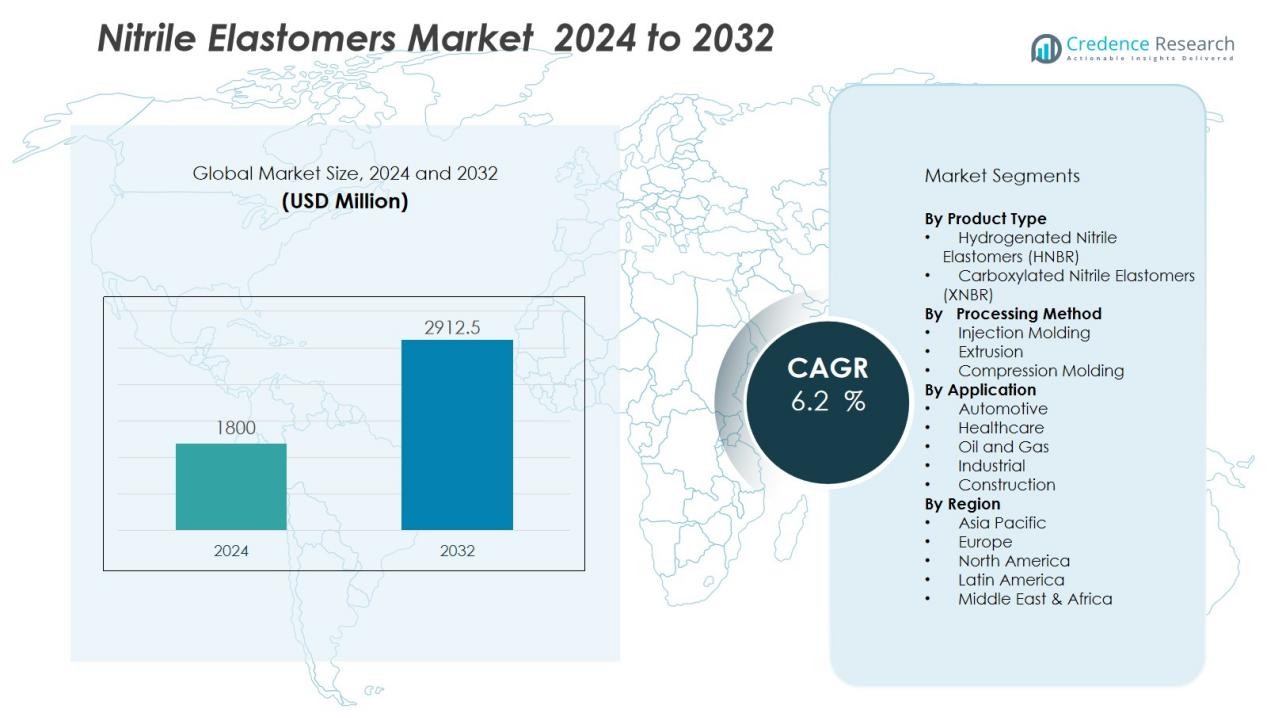

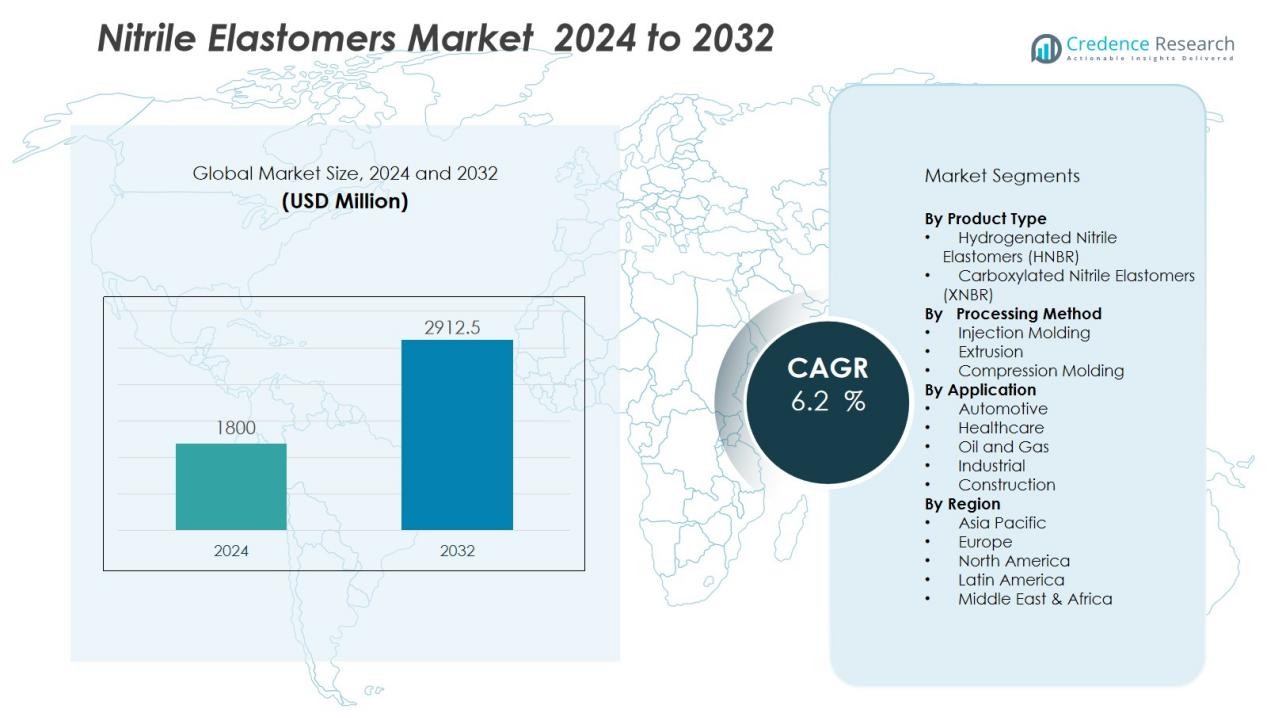

The nitrile elastomers market size was valued at USD 1800 million in 2024 and is anticipated to reach USD 2912.5 million by 2032, at a CAGR of 6.2 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Nitrile Elastomers Market Size 2024 |

USD 1800 Million |

| Nitrile Elastomers Market, CAGR |

6.2 % |

| Nitrile Elastomers Market Size 2032 |

USD 2912.5 Million |

Key growth drivers include increasing use of nitrile elastomers in automotive seals, hoses, and gaskets due to their resistance to fuels and chemicals. The healthcare sector further fuels demand through the production of medical gloves, where hygiene and safety standards continue to rise. Additionally, industrial machinery and construction applications benefit from the elastomers’ heat and abrasion resistance, enhancing product lifespan and performance.

Regionally, Asia Pacific leads the nitrile elastomers market due to strong automotive and manufacturing bases in China, India, and Southeast Asia. North America and Europe follow, with steady growth driven by established automotive industries, healthcare investments, and demand for high-performance elastomer products. Meanwhile, Latin America and the Middle East & Africa are emerging growth regions, supported by industrialization, expanding oil and gas activities, and infrastructure development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The nitrile elastomers market was valued at USD 1,800 million in 2024 and will reach USD 2,912.5 million by 2032.

- Automotive applications dominate demand, with seals, gaskets, hoses, and O-rings driving growth worldwide.

- Healthcare expansion fuels adoption in medical gloves, tubing, and seals, supported by stricter hygiene standards.

- Oil, gas, and industrial machinery sectors rely on nitrile elastomers for resistance to fuels and hydraulic fluids.

- Price volatility of acrylonitrile and butadiene, alongside supply chain disruptions, creates cost challenges.

- Asia Pacific leads with 42% market share, followed by North America at 27% and Europe at 21%.

- Latin America and the Middle East & Africa, contributing 6% and 4% respectively, show long-term growth potential.

Market Drivers:

Growing Demand from Automotive and Transportation Industry:

The automotive sector is a major driver for the nitrile elastomers market, with wide use in seals, gaskets, hoses, and O-rings. Its resistance to oils, fuels, and chemicals makes it ideal for modern engines and transmission systems. Rising production of passenger and commercial vehicles across emerging economies strengthens demand. Manufacturers focus on enhancing vehicle durability and efficiency, which further accelerates market growth.

- For instance, Gates Corporation’s Plant Master XTreme™ 501 AR nitrile hose operates reliably at a 501 psi working pressure across a temperature range of –40 °F to 212 °F.

Expanding Applications in Healthcare and Medical Devices:

The healthcare industry plays a critical role in fueling growth of the nitrile elastomers market. It is widely used in disposable medical gloves, tubing, and seals where hygiene and safety are vital. Rising concerns over infection control and strict regulatory standards boost product adoption. Growing investments in healthcare infrastructure and global demand for protective medical equipment increase long-term consumption.

- For instance, in October 2024, Unigloves and KluraLabs introduced the CrossGuard antimicrobial nitrile glove, which eliminates 99.99% of selected bacteria within 60 seconds, enhancing safety in high-risk medical environments.

Rising Demand in Oil, Gas, and Industrial Applications:

Industrial and oil and gas operations strongly support the nitrile elastomers market, given the material’s resistance to fuels, lubricants, and hydraulic fluids. It is preferred for seals, gaskets, and hoses in equipment used in drilling and refining. Growing energy demand and expansion of industrial machinery production across Asia Pacific and the Middle East contribute to market growth. Demand for durable, high-performance materials ensures consistent adoption.

Increasing Focus on Performance, Durability, and Cost Efficiency:

The nitrile elastomers market benefits from its balance of durability, chemical resistance, and affordability compared to alternatives. Industries favor it for long product life and reduced maintenance costs in critical applications. Advancements in manufacturing processes improve elastomer quality and expand use in demanding environments. Rising awareness of operational efficiency and performance optimization across industries further strengthens growth opportunities.

Market Trends:

Rising Adoption of Advanced Formulations and Sustainable Alternatives:

The nitrile elastomers market is witnessing a shift toward advanced formulations that improve performance and expand end-use applications. Manufacturers are focusing on high-performance variants with enhanced resistance to heat, abrasion, and aggressive chemicals. This trend aligns with rising demand from automotive, aerospace, and industrial sectors where reliability is critical. At the same time, sustainability concerns are influencing research into eco-friendly production methods and recyclable elastomer blends. Companies are exploring bio-based alternatives to reduce environmental impact while maintaining durability. These innovations create opportunities for long-term adoption in industries seeking performance and compliance with environmental regulations.

- For instance, Zeon Corporation developed a nitrile butadiene rubber grade that withstands continuous heat exposure up to 150°C, significantly extending component lifespan in automotive sealing applications.

Increasing Integration into Diverse End-Use Sectors:

The nitrile elastomers market continues to expand across healthcare, construction, oil and gas, and consumer goods due to its versatility. It is increasingly used in gloves, seals, and hoses where safety and durability are essential. Global healthcare growth, combined with stricter hygiene standards, ensures consistent demand for nitrile-based medical gloves. In construction and infrastructure, nitrile elastomers find use in flooring, adhesives, and sealants that withstand harsh conditions. Industrial growth across emerging economies further accelerates consumption. Rising customization of elastomer grades tailored for specialized needs highlights a trend toward market diversification and wider industry acceptance.

- For instance, LANXESS’s Baymod® G nitrile rubber achieves a Shore A hardness of 75, providing superior abrasion resistance in industrial gaskets.

Market Challenges Analysis:

Volatility in Raw Material Prices and Supply Chain Constraints:

The nitrile elastomers market faces challenges from fluctuations in raw material prices, particularly acrylonitrile and butadiene. These petrochemical-based inputs are highly sensitive to crude oil price shifts and geopolitical uncertainties. Frequent price swings affect production costs and profitability for manufacturers. It also creates difficulties in maintaining stable supply agreements with end users. Global supply chain disruptions, including transportation delays and shortages, further limit availability. Such factors pressure producers to explore alternative sourcing strategies and long-term supply contracts.

Environmental Concerns and Competition from Substitute Materials:

The nitrile elastomers market must address growing concerns over environmental sustainability. Conventional nitrile elastomers are not biodegradable and raise disposal challenges, especially in medical and industrial waste streams. Stricter environmental regulations increase compliance costs for manufacturers. It also faces competition from alternative elastomers such as silicone and fluoroelastomers, which offer superior heat and chemical resistance in specific applications. Rising customer preference for greener and high-performance materials further challenges market expansion. To remain competitive, producers must focus on innovation, eco-friendly formulations, and advanced processing methods.

Market Opportunities:

Expansion in Healthcare, Automotive, and Industrial Applications:

The nitrile elastomers market presents strong opportunities through its expanding role in healthcare, automotive, and industrial applications. Rising global healthcare demand supports consistent growth in medical gloves, seals, and tubing. The automotive sector offers further scope as manufacturers require durable materials for fuel systems, gaskets, and hoses. Industrial expansion in Asia Pacific and the Middle East drives demand for equipment components resistant to oils and chemicals. It benefits from increasing investments in infrastructure and energy projects that require reliable sealing and insulation materials. The versatility of nitrile elastomers positions them well across multiple industries.

Innovation in Sustainable and High-Performance Elastomer Grades:

The nitrile elastomers market holds opportunities in sustainable product development and advanced material innovation. Companies are investing in eco-friendly production technologies and exploring bio-based alternatives to meet regulatory and consumer expectations. High-performance formulations with greater heat, wear, and chemical resistance open new applications in aerospace, defense, and electronics. Customized elastomer grades designed for specialized industries create niche growth avenues. It gains further momentum from partnerships and R&D collaborations that support product differentiation. Market participants focusing on sustainability and innovation can strengthen their competitive position in global markets.

Market Segmentation Analysis:

By Product:

The nitrile elastomers market is segmented into hydrogenated nitrile elastomers (HNBR) and carboxylated nitrile elastomers (XNBR). HNBR dominates due to its superior heat, oil, and abrasion resistance, making it suitable for automotive and industrial uses. XNBR is favored for gloves, adhesives, and sealants because of its enhanced tensile strength. Growing demand in medical, automotive, and construction industries strengthens the outlook for both segments. It continues to benefit from increasing preference for durable and cost-effective materials across sectors.

By Processing Method:

The market is segmented into injection molding, extrusion, and compression molding. Injection molding leads the segment due to its efficiency in producing complex automotive and healthcare components. Extrusion supports applications in hoses, seals, and gaskets, widely used in oil and gas equipment. Compression molding serves smaller-scale industrial parts requiring durability and precision. It gains strength from advances in processing technologies that improve product consistency and performance.

- For instance, a Reifenhäuser multilayer flat-film extrusion line achieves an output capacity of 1 700 kg per hour when producing food-grade barrier films, illustrating its high-volume continuous operation.

By Application:

The nitrile elastomers market includes applications in automotive, healthcare, oil and gas, industrial, and construction. Automotive holds the largest share, driven by demand for seals, gaskets, and fuel system components. Healthcare shows strong growth in gloves, tubing, and medical devices with rising safety standards. Oil and gas adopt nitrile elastomers for hoses and seals resistant to fuels and lubricants. Industrial and construction applications expand due to the need for adhesives, flooring, and sealants. It demonstrates wide adoption across sectors where durability and chemical resistance are critical.

- For instance, Parker’s hydrogenated nitrile (HNBR) seals retain their mechanical integrity for over 5,000 hours at 150 °C in sour-gas environments, enabling reliable performance in demanding downhole operations.

Segmentations:

By Product:

- Hydrogenated Nitrile Elastomers (HNBR)

- Carboxylated Nitrile Elastomers (XNBR)

By Processing Method:

- Injection Molding

- Extrusion

- Compression Molding

By Application:

- Automotive

- Healthcare

- Oil and Gas

- Industrial

- Construction

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia Pacific:

Asia Pacific accounts for 42% market share, leading the global nitrile elastomers market. China, India, and Southeast Asia drive demand through strong automotive production, industrial growth, and healthcare expansion. Rising investments in infrastructure and energy projects support higher consumption of nitrile elastomers in seals, gaskets, and hoses. The region benefits from cost-effective raw material availability and a large manufacturing base. Growing healthcare needs also increase demand for nitrile gloves and tubing. It is expected to remain the fastest-growing region due to ongoing industrialization and consumer market expansion.

North America and Europe:

North America holds 27% market share, followed by Europe at 21% in the nitrile elastomers market. Both regions benefit from established automotive industries, healthcare advancements, and industrial applications. Strict regulations on safety and quality standards sustain demand for nitrile gloves, seals, and adhesives. Europe emphasizes sustainable elastomer development, driving innovation in eco-friendly formulations. North America supports growth through investments in healthcare and oil and gas operations. It continues to experience steady demand from industries requiring durable and high-performance materials.

Latin America and Middle East & Africa:

Latin America contributes 6% market share, while the Middle East & Africa accounts for 4% in the nitrile elastomers market. Growth in these regions is supported by rising industrialization, expanding construction projects, and increasing healthcare needs. Oil and gas activities in the Middle East drive demand for elastomers with resistance to fuels and lubricants. Latin America benefits from rising automotive assembly and infrastructure development. Limited domestic production capacity creates opportunities for imports and investments in local manufacturing. It shows strong potential for long-term growth with increasing industrial and healthcare adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Arkema

- Asahi Kasei Corporation

- Nynas AB

- Wacker Chemie

- KBR

- SABIC

- Mitsui Chemicals

- DuPont

- ExxonMobil Chemical

- Repsol

- China Petroleum Chemical Corporation

- LG Chem

- LANXESS

- Competitive Analysis:

The nitrile elastomers market is highly competitive with a mix of global and regional players. Key companies include Arkema, Asahi Kasei Corporation, Nynas AB, Wacker Chemie, KBR, SABIC, Mitsui Chemicals, DuPont, and ExxonMobil Chemical. These companies focus on product innovation, capacity expansion, and strategic partnerships to strengthen market presence. It benefits from rising demand across automotive, healthcare, and oil and gas industries, creating opportunities for established players to diversify offerings. Competitive strategies emphasize development of sustainable and high-performance elastomer grades to meet evolving customer and regulatory requirements. Regional manufacturers aim to capture niche opportunities by offering cost-effective and application-specific solutions. Strong research and development capabilities remain critical for differentiation, especially in high-growth regions such as Asia Pacific. Market leaders continue to focus on efficiency, innovation, and sustainability to maintain long-term growth and competitive advantage.

Recent Developments:

- In December 2024, Arkema finalized the acquisition of Dow’s $250 million flexible packaging laminating adhesives business, enhancing its global presence in flexible packaging adhesives.

- In March 2025, Asahi Kasei Homes acquired 9.88% voting rights in The Global Ltd., forming a business and capital alliance.

- In May 2024, Nynas AB set a production record of 41,690 tonnes for naphthenic specialty products, reflecting strong operational performance.

Report Coverage:

The research report offers an in-depth analysis based on Product, Processing Method, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The nitrile elastomers market will expand with rising adoption in automotive, oil and gas, and healthcare.

- Demand for nitrile gloves will remain strong due to strict hygiene standards and healthcare growth.

- Advancements in high-performance elastomers will create new applications in aerospace, defense, and electronics.

- The market will see rising focus on sustainable and eco-friendly production technologies to meet regulations.

- Industrial growth in Asia Pacific will continue to drive the largest share of global demand.

- North America and Europe will maintain steady consumption, supported by advanced manufacturing and healthcare sectors.

- Manufacturers will invest in bio-based alternatives to address environmental and disposal concerns.

- Partnerships and R&D collaborations will support innovation in customized elastomer grades.

- Expanding infrastructure and energy projects in emerging economies will fuel further adoption.

- The market will strengthen its position through innovation, diversification, and alignment with sustainability goals.