Market overview

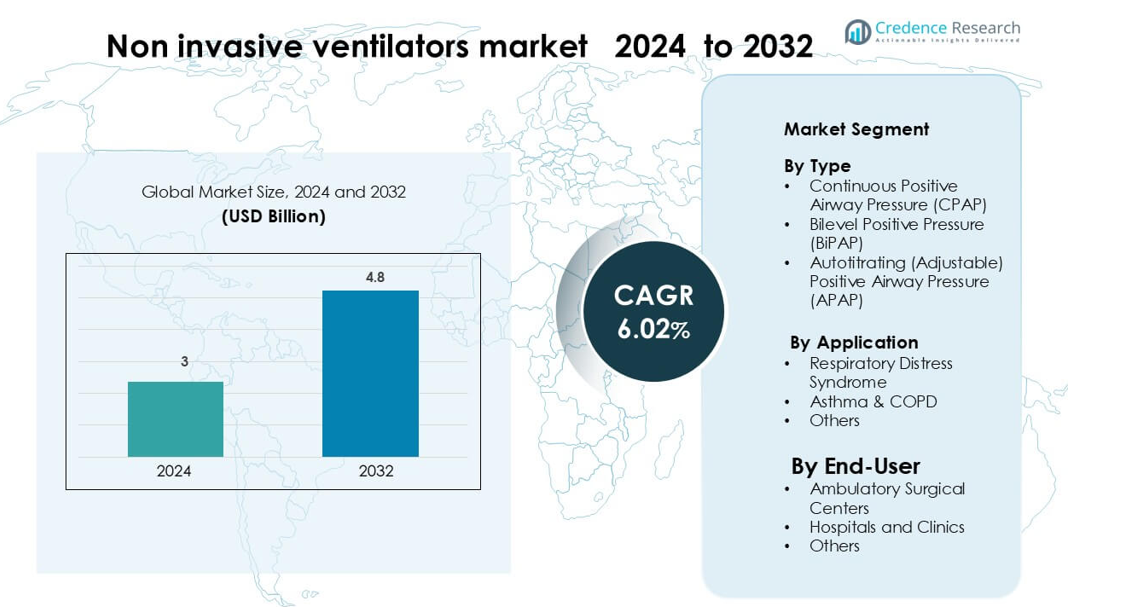

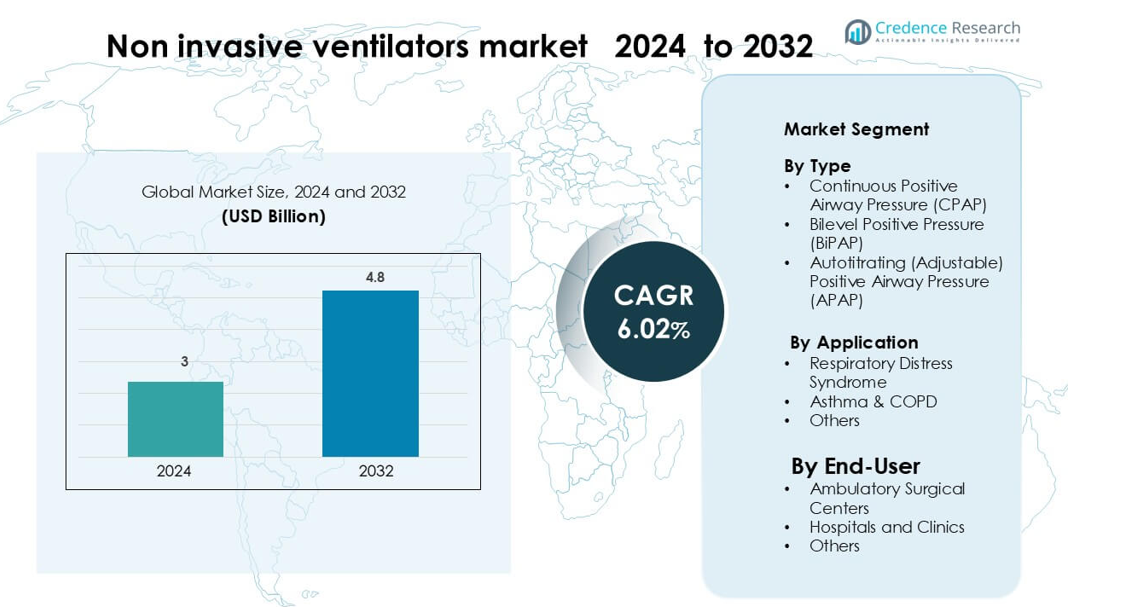

Non-invasive ventilators market was valued at USD 3 billion in 2024 and is anticipated to reach USD 4.8 billion by 2032, growing at a CAGR of 6.02% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Non-invasive Ventilators Market Size 2024 |

USD 3 billion |

| Non-invasive Ventilators Market, CAGR |

6.02% |

| Non-invasive Ventilators Market Size 2032 |

USD 4.8 billion |

The Non-Invasive Ventilators Market is shaped by leading companies such as ResMed Inc., Hamilton Bonaduz AG, Fisher & Paykel Healthcare, Teleflex Incorporated, Respironics, Mindray Medical International Limited, Magnamed, HEYER Medical AG, Airon Corporation, and medin Medical Innovations GmbH. These players compete through advanced ventilation modes, portable system designs, and integrated monitoring features that support both hospital and home-care use. Product reliability and technology upgrades remain key differentiators across clinical settings. North America stands as the leading region, holding about 38% share due to strong respiratory disease prevalence, high adoption of home-care ventilation, and well-developed healthcare infrastructure.

Market Insights

- The Non-Invasive Ventilators Market is valued at USD 3 billion in 2024, projected to reach USD 4.8 billion by 2032, growing at a 6.02% CAGR.

- Rising COPD, asthma, and sleep-apnea cases drive strong device adoption across CPAP and BiPAP systems, with CPAP holding the largest type share at about 49% due to high use in sleep-disordered breathing.

- Trends focus on portable and home-care ventilators, tele-monitoring integration, and automated pressure-adjustment technologies that improve comfort and reduce hospital readmission rates.

- Competitive activity remains strong among ResMed, Hamilton Bonaduz, Fisher & Paykel Healthcare, and Mindray, with firms investing in quieter turbines, better masks, and connectivity features while facing restraints from high device cost and limited skilled respiratory technicians.

- Regionally, North America leads with 38% share, followed by Europe at 29%, while Asia-Pacific grows fastest with 24% due to rising pollution-linked respiratory cases and expanding hospital capacity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Continuous Positive Airway Pressure (CPAP) leads the Non-Invasive Ventilators Market with about 49% share. CPAP dominates because many patients with sleep-related breathing disorders need steady pressure support. Rising global cases of obstructive sleep apnea strengthen CPAP use across home-care settings. The BiPAP segment grows due to demand from COPD and neuromuscular patients who need variable pressure levels. APAP adoption also rises as users shift toward automated pressure adjustment systems that improve comfort. Better device portability and quieter motors help all sub-segments gain wider acceptance.

- For instance, ResMed’s AutoSet APAP algorithm is a core technology in its AirSense 11 device, which currently supports over 8.3 million users via its myAir patient-platform

By Application

Asthma & COPD is the leading application segment with nearly 52% share. This category dominates because COPD cases continue to rise, and non-invasive ventilation helps reduce hospital stays and acute flare-ups. Respiratory Distress Syndrome follows due to higher support demand among infants and older adults with weakened lung function. The Others segment grows as clinicians use non-invasive ventilation for postoperative recovery and acute care stabilization. Rising pollution levels and aging demographics drive strong demand across all applications.

- For instance, in a multicenter Chinese study, 512 preterm infants with RDS received early non-invasive ventilation (NIV) via NIPPV, NCPAP, or NHFOV.

By End-User

Hospitals and Clinics hold the dominant position with around 58% share. These facilities lead because most acute respiratory cases require controlled monitoring and advanced ventilation support. Ambulatory Surgical Centers show steady growth as short-stay procedures increase and centers invest in compact ventilators for safer recovery. The Others category expands due to broader home-care adoption for chronic respiratory patients. Growth across all end-users is driven by rising respiratory disease prevalence, stronger reimbursement support, and better device design that enables faster setup and improved patient comfort.

Key Growth Drivers

Rising Global Prevalence of Respiratory Diseases

The rising prevalence of chronic respiratory disorders acts as a major growth engine for the Non‐Invasive Ventilators Market. COPD cases rise due to smoking, industrial pollution, and aging populations, pushing hospitals to adopt non-invasive support to avoid intubation. Sleep apnea diagnoses increase each year, raising demand for CPAP and APAP systems. Many countries report surges in asthma and post-infection respiratory complications, further expanding device needs. Hospitals rely on non-invasive systems to reduce ICU burden, while home-care adoption increases as chronic patients seek comfortable long-term respiratory support. Better screening programs, population aging, and higher disease awareness create a sustained demand pipeline for advanced non-invasive ventilation technologies.

- For instance, data from the Global Burden of Disease Study (2021) estimates around 260.48 million people globally have asthma.

Accelerating Shift Toward Home-Care Ventilation

Growing preference for home-based respiratory management strongly accelerates market expansion. Patients with COPD, neuromuscular conditions, and sleep-disordered breathing increasingly use portable ventilators outside hospitals. This shift reduces healthcare costs and frees up hospital resources. Modern devices offer quiet operation, longer battery life, and improved humidity control, making them more suitable for daily home use. Remote monitoring tools allow clinicians to supervise therapy without in-person visits, supporting better compliance and reducing readmissions. Insurance providers also promote home care due to lower long-term costs. As aging populations demand continuous respiratory support, home-care ventilation becomes a core market driver with strong adoption prospects across developed and emerging regions.

- For instance, Philips’ BiPAP A40 EFL ventilator offers cloud connectivity via the company’s Care Orchestrator system, allowing health-care providers to monitor patients at home and dynamically adjust settings based on real-time flow limitation detection.

Advancements in Smart and Automated Ventilation Technologies

Technological innovation strengthens the Non-Invasive Ventilators Market as manufacturers integrate automation, AI-driven algorithms, and advanced sensors. Auto-titrating features improve therapy precision for sleep apnea patients by adjusting pressure in real time. Connectivity solutions enable cloud data transfer, remote tracking, and predictive alerts for respiratory decline. Better turbine systems reduce noise and enhance airflow stability, while new mask designs lower leakage and improve user comfort. Hospitals favor advanced models that reduce intubation rates and shorten hospital stays. The push for digital health integration and precise respiratory monitoring encourages investment in next-generation systems. These innovations build confidence among clinicians and accelerate adoption across all care settings.

Key Trends & Opportunities

Expansion of Remote Monitoring and Tele-Ventilation Models

Remote ventilation management emerges as a key market trend as healthcare systems adopt digital monitoring to improve clinical oversight. Many non-invasive ventilators now offer wireless connectivity, allowing clinicians to review breathing patterns and adjust settings without in-person intervention. Tele-ventilation reduces hospital visits, improves therapy adherence, and supports chronic care management for COPD and sleep apnea patients. This model benefits rural regions with limited specialist access. It also creates opportunities for device-makers to integrate cloud dashboards, AI analytics, and automated alert systems. As healthcare digitalization accelerates, remote monitoring becomes a core differentiator and unlocks new service-driven revenue streams.

- For instance, ResMed’s Lumis non-invasive ventilators come with built-in wireless connectivity that streams therapy data (like respiratory rate, leak, and minute ventilation) directly into its AirView cloud platform.

Rising Demand for Portable, Lightweight, and Travel-Friendly Devices

Demand grows for compact ventilators that support mobility, daily activity, and travel. Patients with chronic respiratory issues seek lighter devices with long battery life, simple interfaces, and noise reduction features. Manufacturers respond by designing ergonomic systems that enhance patient independence. Portable CPAP and BiPAP devices gain traction among users who work, travel, or need respiratory support during outdoor activities. This trend improves adherence and attracts new users who earlier avoided bulky systems. It also opens market opportunities in home care, emergency transport, and ambulatory care. As lifestyle-friendly medical devices gain importance, portable non-invasive ventilators remain a major growth opportunity.

- For instance, the Philips DreamStation Go CPAP device weighs approximately 854 g (device) and its optional overnight lithium-ion battery weighs 696 g, providing up to 13 hours of run time at 10 cm H₂O pressure.

Expanding Use of Non-Invasive Ventilation in Acute and Postoperative Care

Clinicians increasingly use non-invasive ventilation for acute respiratory distress, post-surgery recovery, infectious disease care, and emergency stabilization. Hospitals prefer non-invasive methods to avoid intubation risks such as infections and ventilator-associated complications. Non-invasive ventilation helps stabilize patients quickly and reduces ICU load. Adoption rises in emergency departments, high-dependency units, and step-down wards as hospitals push for early respiratory intervention. This expansion opens opportunities for advanced clinical-grade devices with higher accuracy, real-time sensors, and rapid setup. Broader adoption in acute care strengthens market penetration across both developed and emerging countries.

Key Challenges

High Cost of Advanced Ventilators and Limited Affordability

High purchase costs remain a major barrier, especially in developing regions. Advanced non-invasive ventilators use sophisticated sensor systems, automated pressure adjustment, and connectivity features that raise overall pricing. Many hospitals face budget constraints and delay upgrades. Home-care users also struggle with out-of-pocket expenses when reimbursement support is limited. Import duties and distribution markups further increase device cost in low-income economies. These affordability challenges slow adoption and restrict access for large patient populations. Achieving wider penetration requires cost-optimized models, better reimbursement policies, and local manufacturing expansion.

Shortage of Trained Respiratory Technicians and Operation Complexity

Non-invasive ventilators require correct setup, mask fitting, and parameter tuning, but many healthcare settings lack trained respiratory therapists. Incorrect settings can reduce treatment effectiveness or cause complications. Rural hospitals often rely on general staff without specialized ventilation training. The growing complexity of advanced devices amplifies the challenge, as clinicians must understand modes, triggers, alarms, and monitoring dashboards. Home-care users also need education to manage devices safely. Insufficient training slows adoption and increases the risk of improper use. Expanding training programs and improving device ease-of-use are essential to overcoming this operational barrier.

Regional Analysis

North America

North America leads the Non-Invasive Ventilators Market with about 38% share. Strong adoption comes from high COPD and sleep apnea prevalence, advanced hospital infrastructure, and early use of home-care ventilation. The U.S. drives most demand due to strong reimbursement systems, wide availability of CPAP and BiPAP devices, and rapid integration of remote monitoring. Canada supports growth through aging demographics and rising chronic respiratory conditions. Continuous product innovations and strong presence of global device manufacturers help maintain regional leadership. Expanding tele-ventilation programs further strengthen North America’s position in the market.

Europe

Europe holds nearly 29% share, driven by structured respiratory care programs and strong emphasis on non-invasive ventilation for hospitalization reduction. Germany, the U.K., France, and Italy lead device adoption due to established sleep labs, wider COPD management programs, and well-developed reimbursement coverage. Demand grows across home-care settings as aging populations seek long-term respiratory support. Hospitals increasingly use non-invasive ventilation to manage acute respiratory distress and reduce invasive procedures. EU regulations encouraging high-quality ventilation technologies support stable growth across major countries and emerging Eastern European markets.

Asia-Pacific

Asia-Pacific captures around 24% share and remains the fastest-growing region. Rising COPD cases linked to pollution, smoking, and industrial exposure increase demand for advanced ventilation support. China and India dominate due to large patient bases and expanding hospital capacity. Japan and South Korea contribute high adoption through strong technological infrastructure and wider diagnosis of sleep-disordered breathing. Growing investment in home-care devices and improving healthcare access drive rapid expansion. Manufacturers gain opportunities through low-cost production and rising awareness of non-invasive ventilation benefits across developing markets.

Latin America

Latin America holds roughly 6% share, with Brazil and Mexico leading demand. Growth comes from increasing chronic respiratory diseases and rising hospital investments in advanced ventilation systems. Many healthcare centers expand non-invasive ventilation use to reduce ICU load and manage acute respiratory cases. Adoption grows slowly due to limited reimbursement support in several countries, but home-care demand strengthens as awareness improves. Local distributors play a key role in market expansion. As public and private hospitals upgrade respiratory care infrastructure, Latin America shows steady long-term potential.

Middle East & Africa

The Middle East & Africa region accounts for about 3% share, driven by improving healthcare infrastructure and rising burden of asthma and COPD. Gulf countries, including Saudi Arabia and the UAE, lead adoption due to higher healthcare spending and strong preference for advanced medical equipment. African nations show gradual growth as hospital investments rise and international aid programs support respiratory care. Limited reimbursement and affordability challenges slow wider penetration, but demand grows through increasing diagnosis of sleep apnea and expanding critical-care capacity. The region continues to gain momentum with ongoing healthcare modernization.

Market Segmentations:

By Type

- Continuous Positive Airway Pressure (CPAP)

- Bilevel Positive Pressure (BiPAP)

- Autotitrating (Adjustable) Positive Airway Pressure (APAP)

By Application

- Respiratory Distress Syndrome

- Asthma & COPD

- Others

By End-User

- Ambulatory Surgical Centers

- Hospitals and Clinics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Non-Invasive Ventilators Market features strong participation from global and regional manufacturers focused on advanced respiratory care technologies. Companies such as ResMed Inc., Hamilton Bonaduz AG, Fisher & Paykel Healthcare, Teleflex Incorporated, Respironics, Mindray Medical International Limited, Magnamed, HEYER Medical AG, Airon Corporation, and medin Medical Innovations GmbH compete through innovation in automated pressure adjustment, quieter turbine systems, improved mask designs, and remote monitoring features. Leading players emphasize product reliability, home-care compatibility, and connectivity to strengthen clinical adoption. Partnerships with hospitals, expanded distribution networks, and investments in portable ventilator platforms shape competitive strategies. Many firms also prioritize regulatory approvals, cost-efficient designs, and enhanced patient comfort to differentiate offerings in a market driven by rising respiratory disease burden and growing home-care demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Magnamed

- medin Medical Innovations GmbH

- Airon Corporation

- Mindray Medical International Limited

- Fisher & Paykel Healthcare

- ResMed Inc.

- HEYER Medical AG

- Teleflex Incorporated

- Hamilton Bonaduz AG

- Respironics

Recent Developments

- In December 2024, A registered neonatal clinical trial on haemodynamic changes with different noninvasive respiratory modes selected the MEDIN CNO device, from medin Medical Innovations GmbH, as the standard nasal CPAP platform. The study uses the device to deliver non-invasive respiratory support to preterm infants, reinforcing medin’s position in evidence-based neonatal non-invasive ventilation.

- In January 2024, Inspiration Healthcare Group completed the strategic acquisition of Airon Corporation, a specialist maker of pneumatic life-support ventilators and MACS CPAP systems. Airon’s ventilators and CPAP devices, used for non-invasive support in MRI environments, transport, and emergency medicine for neonates to adults, now sit within a larger global respiratory portfolio.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as COPD, asthma, and sleep-apnea cases continue increasing worldwide.

- Home-care ventilation adoption will expand as patients prefer portable and easy-to-use devices.

- AI-enabled pressure adjustment and smart monitoring will enhance therapy accuracy.

- Remote ventilation management will grow with wider use of telehealth platforms.

- Hospitals will adopt advanced non-invasive systems to reduce invasive ventilation rates.

- Manufacturers will focus on quieter motors, better masks, and improved airflow stability.

- Emerging markets will show strong growth as healthcare infrastructure improves.

- Affordability will increase as companies develop cost-efficient models for wider access.

- Battery-efficient portable ventilators will gain traction among active and travel-oriented users.

- Partnerships between hospitals and device makers will strengthen clinical adoption and service expansion.