Market Overview

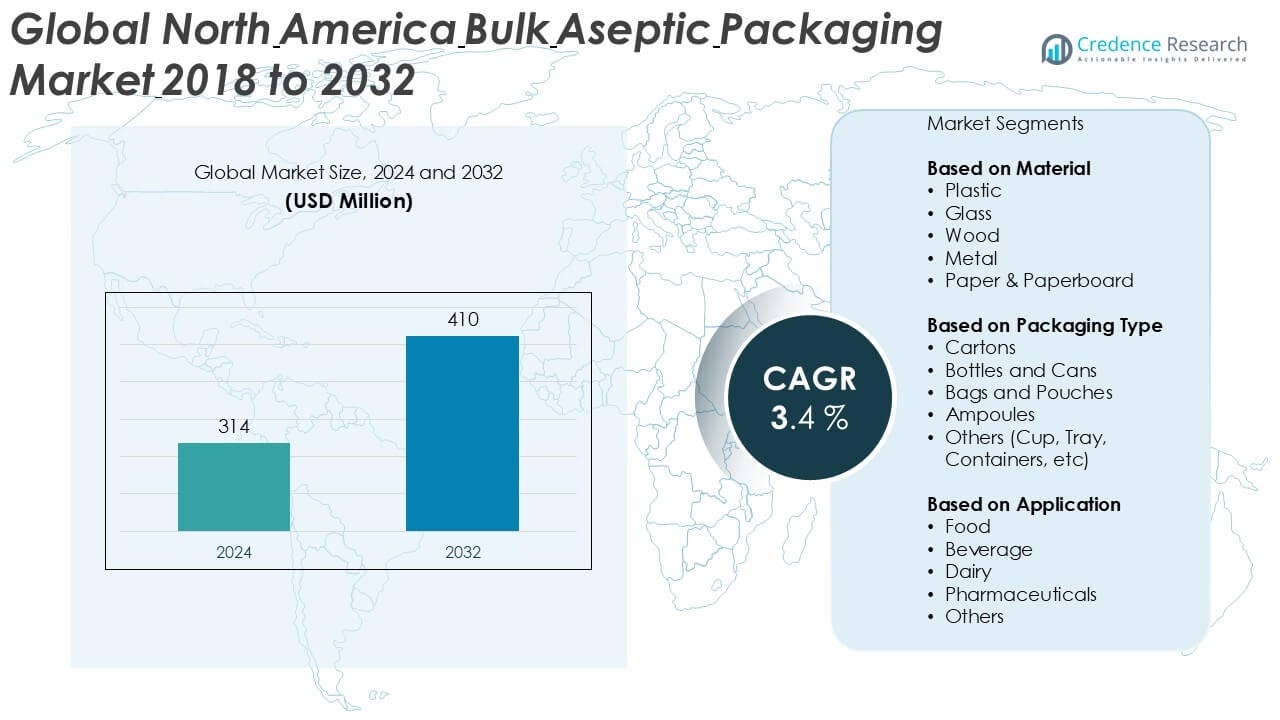

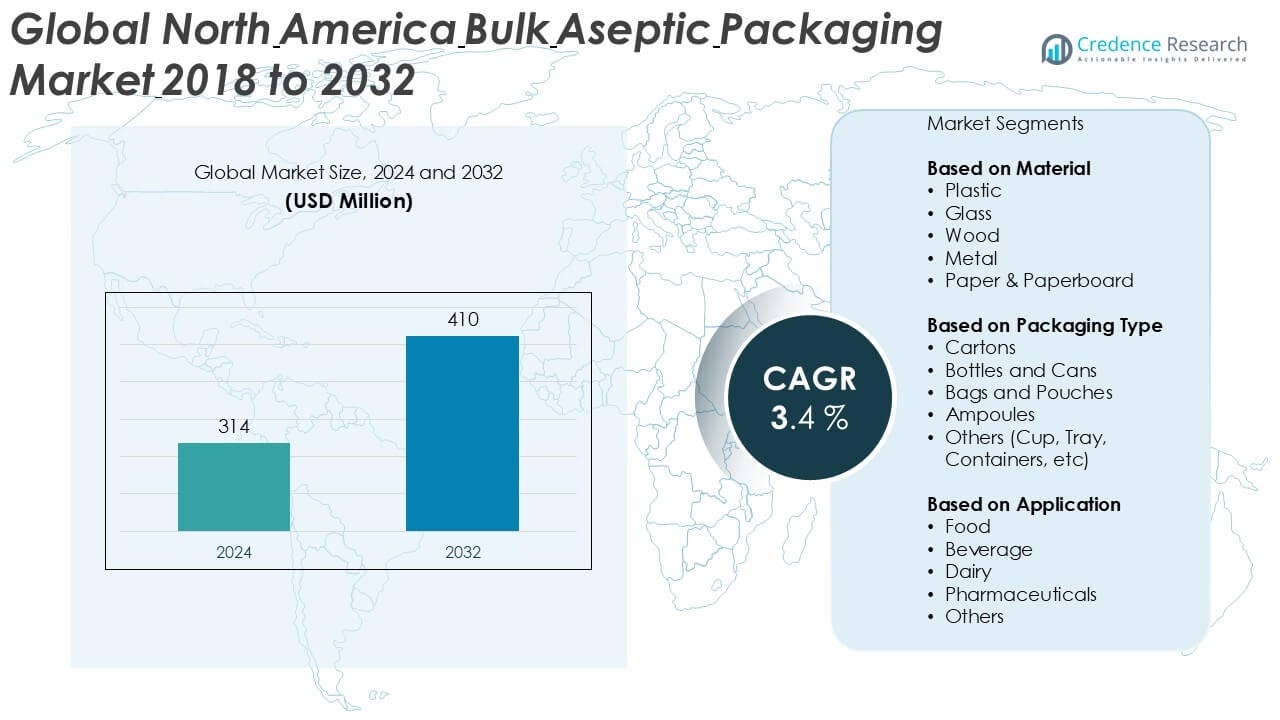

North America Bulk Aseptic Packaging market size was valued at USD 314 million in 2024 and is anticipated to reach USD 410 million by 2032, at a CAGR of 3.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Bulk Aseptic Packaging market Size 2024 |

USD 314 Million |

| North America Bulk Aseptic Packaging market, CAGR |

3.4% |

| North America Bulk Aseptic Packaging market Size 2032 |

USD 410 Million |

The North America Bulk Aseptic Packaging market is led by prominent players such as Tetra Laval International S.A., Amcor Limited, SIG Combibloc Group AG, Sealed Air Corporation, and Robert Bosch GmbH. These companies dominate due to their advanced packaging technologies, robust supply chains, and strong presence across key application sectors like beverages, dairy, and pharmaceuticals. Mid-sized firms including Ecolean AB, ELOPAK Group, and Bemis Company, Inc. are expanding their footprint through sustainable and cost-effective solutions. The United States is the leading region, commanding over 65% of the regional market share in 2024, driven by its mature food and beverage industry, technological infrastructure, and growing demand for shelf-stable products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America Bulk Aseptic Packaging market was valued at USD 314 million in 2024 and is projected to reach USD 410 million by 2032, growing at a CAGR of 3.4% during the forecast period.

- The market is primarily driven by rising demand for shelf-stable food and beverages, growing dairy and pharmaceutical applications, and the need to reduce cold chain logistics costs.

- A key trend includes the shift toward sustainable and recyclable packaging materials, along with the adoption of advanced aseptic filling technologies for enhanced efficiency and sterility.

- The United States holds the largest regional share at over 65%, followed by Canada (20%) and Mexico (15%), while plastic remains the leading material segment due to its durability and cost-effectiveness.

- High initial capital investment and complex regulatory requirements are key restraints limiting the adoption of aseptic packaging technologies, particularly among small and medium-sized enterprises.

Market Segmentation Analysis:

By Material

In the North America Bulk Aseptic Packaging market, plastic emerged as the dominant material segment, accounting for the largest market share in 2024. The widespread use of plastic is driven by its durability, lightweight nature, and cost-effectiveness, making it suitable for high-volume packaging and transportation. Its flexibility in forming various packaging structures also supports its dominance in multiple applications. While glass and metal offer strong barrier properties, their higher costs and weight limit their usage. Meanwhile, paper & paperboard are gaining interest due to sustainability concerns, but plastic continues to lead due to its functional advantages.

- For instance, Amcor Limited produces over 1.2 billion plastic aseptic packaging units annually, leveraging advanced extrusion technologies that reduce material usage by up to 15% without compromising strength.

By Packaging Type:

Cartons held the largest share among packaging types in the North America bulk aseptic packaging market, favored for their high compatibility with liquid products and eco-friendly image. Their ability to extend shelf life without refrigeration supports their usage in beverages and dairy segments. Cartons are also preferred for their ease of stacking and transportation. Bottles and cans remain relevant due to their familiarity in consumer packaging, while bags and pouches are gaining traction in institutional and industrial settings for bulk handling. Ampoules and other types such as cups and trays contribute to niche segments like pharmaceuticals and foodservice.

- For instance, Tetra Laval International S.A. processes over 45 billion cartons globally each year using aseptic carton technology that extends shelf life up to 6 months without preservatives or refrigeration.

By Application:

The beverage segment led the market in 2024, capturing the highest share in the North America bulk aseptic packaging market. The increasing consumption of fruit juices, plant-based drinks, and functional beverages requiring long shelf life without preservatives has significantly boosted aseptic packaging in this segment. Dairy followed closely, driven by the demand for shelf-stable milk and yogurt products. The food segment, including sauces and soups, also benefits from aseptic solutions to maintain freshness. Meanwhile, pharmaceuticals leverage aseptic packaging for sterile delivery, though on a smaller scale. Overall, beverages remain the top contributor due to their high volume and perishability.

Key Growth Drivers

Rising Demand for Extended Shelf Life Products

The growing consumer preference for shelf-stable food and beverages without preservatives is a major driver for the North America bulk aseptic packaging market. Aseptic packaging allows products to be stored for longer periods without refrigeration, reducing distribution costs and food waste. This is particularly beneficial for beverages, dairy, and ready-to-eat meals, where long shelf life improves logistical flexibility. As manufacturers focus on expanding product reach across distant markets, the need for aseptic packaging solutions continues to grow, reinforcing its importance in the region’s packaging landscape.

- For instance, SIG Combibloc Group AG’s aseptic filling lines have enabled manufacturers to produce over 1.5 billion liters of shelf-stable beverages annually in North America, with product shelf life extended up to 12 months.

Growth in Beverage and Dairy Processing Industries

The expanding beverage and dairy processing sectors in North America significantly contribute to the growth of bulk aseptic packaging. The rising consumption of health drinks, fruit juices, plant-based milk, and other dairy products has driven demand for packaging that ensures product safety and stability. Aseptic packaging provides the necessary sterile environment to maintain nutritional value and freshness. As producers focus on scaling output while maintaining quality standards, aseptic packaging solutions have become essential, particularly in high-volume manufacturing and cross-regional distribution.

- For instance, Ecolean AB’s lightweight plastic packaging solutions are used in over 400 million units annually in North America, supporting plant-based milk producers with shelf lives of up to 9 months.

Emphasis on Reducing Cold Chain Dependency

Cost pressures and sustainability concerns have led companies to reduce their reliance on cold chain logistics. Aseptic packaging eliminates the need for refrigeration during transportation and storage, which significantly reduces energy consumption and operational costs. This driver is particularly relevant in North America, where long-distance transport across states is common. By enabling ambient storage, aseptic solutions help manufacturers optimize supply chain efficiency while aligning with environmental goals, making it a strategic advantage in the packaging industry.

Key Trends & Opportunities

Sustainable Packaging Innovations

Sustainability has become a key trend influencing aseptic packaging development in North America. Manufacturers are increasingly adopting recyclable and biodegradable materials, such as paper-based laminates and bio-based plastics, to meet environmental regulations and consumer expectations. This shift creates opportunities for packaging providers to innovate eco-friendly aseptic solutions without compromising barrier performance. Companies investing in sustainable technologies are better positioned to gain competitive advantage, particularly as retailers and brands push for greener supply chain practices.

- For instance, DS Smith launched a paper-based aseptic carton packaging line capable of processing over 250 million units per year, featuring a recyclable design that reduces plastic usage by 30%.

Technological Advancements in Filling Equipment

The integration of advanced aseptic filling technologies has opened new avenues for market growth. Modern systems offer improved sterility assurance, faster filling speeds, and flexibility for handling multiple product types and packaging formats. These advancements enhance operational efficiency and reduce downtime in manufacturing facilities. The trend also supports small and mid-sized producers who seek cost-effective and scalable aseptic solutions. As equipment becomes more accessible, it encourages wider adoption across industries, further expanding market potential.

- For instance, Robert Bosch GmbH supplies aseptic filling machines capable of filling up to 24,000 units per hour with automated sterilization processes that reduce changeover times by 20%.

Key Challenges

High Initial Capital Investment

One of the primary challenges in the North America bulk aseptic packaging market is the high upfront cost of setting up aseptic processing and packaging systems. The requirement for specialized filling lines, sterile environments, and rigorous quality assurance protocols involves substantial capital expenditure. This can deter small and medium enterprises from entering the market or expanding operations. Despite long-term cost savings from reduced cold chain needs, the initial investment remains a significant barrier to widespread adoption.

Complex Regulatory Compliance

Aseptic packaging in food, dairy, and pharmaceuticals must meet strict regulatory standards imposed by agencies such as the FDA and USDA. Ensuring compliance with sterilization protocols, material safety, and packaging integrity involves complex validation processes. Any deviation can result in recalls or penalties, making regulatory compliance a critical operational challenge. For manufacturers, staying updated with evolving standards while maintaining production efficiency adds pressure, especially as product lines diversify.

Limited Recycling Infrastructure

Although demand for sustainable aseptic packaging is rising, the region still faces limitations in recycling infrastructure for multi-layered materials commonly used in aseptic formats. These packages often consist of layers of plastic, paper, and aluminum, which are difficult to separate and process. This hampers circular economy efforts and may reduce consumer acceptance in environmentally conscious markets. Addressing this challenge requires collaboration between packaging producers, recyclers, and policymakers to develop efficient recycling solutions.

Regional Analysis

United States

The United States holds the largest share in the North America bulk aseptic packaging market, accounting for over 65% of the regional market in 2024. The dominance stems from the country’s well-established food and beverage industry, advanced dairy processing infrastructure, and high demand for shelf-stable products. Growing preference for ready-to-consume beverages, increased adoption of sustainable packaging, and ongoing investments in aseptic technology also support market expansion. Additionally, the U.S. pharmaceutical sector increasingly uses aseptic packaging to maintain sterility standards. The market is expected to continue its growth trajectory as manufacturers seek to reduce cold chain dependency and streamline nationwide distribution.

Canada

Canada accounts for approximately 20% of the North America bulk aseptic packaging market, supported by its growing food processing and dairy sectors. Canadian manufacturers are adopting aseptic packaging to cater to rising consumer demand for preservative-free, shelf-stable products, especially in remote and cold regions where refrigerated logistics can be costly. Regulatory support for sustainable packaging and increasing investments in modern filling and sealing equipment further boost market growth. Moreover, the beverage industry in Canada is rapidly shifting toward plant-based and functional drinks, which require reliable aseptic packaging solutions, creating growth opportunities for packaging suppliers and equipment providers.

Mexico

Mexico contributes around 15% to the North America bulk aseptic packaging market. The country’s expanding food and beverage manufacturing base, along with export-driven dairy and juice production, drives demand for aseptic solutions. Mexican producers increasingly adopt aseptic packaging to improve product shelf life and meet international quality standards, especially in cross-border trade with the U.S. and Latin America. While infrastructural limitations and high capital costs pose challenges, the government’s support for food processing modernization and sustainability initiatives encourages market growth. Continued investment in aseptic technologies is expected to boost Mexico’s market share in the regional landscape over the coming years.

Market Segmentations:

By Material

- Plastic

- Glass

- Wood

- Metal

- Paper & Paperboard

By Packaging Type

- Cartons

- Bottles and Cans

- Bags and Pouches

- Ampoules

- Others (Cup, Tray, Containers, etc)

By Application

- Food

- Beverage

- Dairy

- Pharmaceuticals

- Others

By Geography

Competitive Landscape

The North America bulk aseptic packaging market features a moderately consolidated competitive landscape, with several global and regional players actively competing through innovation, strategic partnerships, and expansion initiatives. Key companies such as Tetra Laval International S.A., Amcor Limited, SIG Combibloc Group AG, and Sealed Air Corporation dominate the market due to their extensive product portfolios, technological capabilities, and established distribution networks. These players focus on enhancing packaging efficiency, sustainability, and shelf-life performance to meet the evolving needs of food, beverage, dairy, and pharmaceutical industries. Mid-sized companies like Ecolean AB, ELOPAK Group, and Bemis Company, Inc. are gaining traction by offering cost-effective and customizable aseptic packaging solutions. Additionally, equipment manufacturers such as Robert Bosch GmbH and Industria Machine Automatiche S.P.A. support market growth by supplying advanced aseptic filling and sealing systems. With rising demand for eco-friendly and high-performance packaging, the market is witnessing increased R&D investment, driving innovation and intensifying competition among participants.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- I. du Pont de Nemours and Company

- SIG Combibloc Group AG

- Robert Bosch GmbH

- Sealed Air Corporation

- DS Smith

- Ecolean AB

- Becton Dickinson and Company

- Amcor Limited

- Industria Machine Automatiche S.P.A

- ELOPAK Group

- Reynolds Group Holding Limited

- Bemis Company, Inc.

- Jpak Group

- Tetra Laval International S.A.

Recent Developments

- In March 2025, Corvaglia Group, a leading global manufacturer of innovative closure solutions, presents the SabreCap, its first closure for aseptic carton packaging. The SabreCap can be seamlessly integrated into existing carton packaging filling lines without any technical adjustments. It thus offers bottling companies a high degree of flexibility and investment security.

- In March 2025, Syntegon launched a new filling system for RTU syringes at the INTERPHEX 2025 Conference. It highlights aseptic filling, handling, inspection, and capsule filling.

- In September 2024, Tetra Pak collaborated with a leading company in the European juices, nectars, and soft drinks markets to launch the new Tetra Prisma Aseptic 300 Edge beverage carton. This innovative portion package stands out on the shelf, with its distinct look and ergonomic design catering to the preference of modern consumers for taller, slimmer packaging.

- In November 2024, Akums Drugs & Pharmaceuticals, India’s Largest contract development and manufacturing organization (CDMO), and Jagdale Industries (JIL), have collaborated to focus on aseptic manufacturing and subsequent filling in carton packing for the ready-to-drink (RTD) market, targeting an expansive array of health and wellness products.

- In June 2024, Tetra Pak, a global food processing and packaging solutions, announced the inauguration of a cutting-edge facility by Suntado LLC, a contract manufacturer specializing in dairy and beverages in Burley, Idaho. Set to commence operations in June, this facility boasts the capability to process an impressive 1 million pounds of local milk daily. The processed products will include shelf-stable and ESL milk, along with a range of liquid dairy items, the majority of which will be packaged using Tetra Pak’s aseptic cartons.

- In March 2023, Qatar-based leading producer of dairy-based beverages, Balanda, announced a strategic partnership with SIG, a packaging solution provider, in order to bring a new aseptic packaging solution. Under the agreement, companies will be producing aseptic packaging in the form of cartons, especially for white cheese.

Market Concentration & Characteristics

The North America Bulk Aseptic Packaging Market exhibits a moderately concentrated structure dominated by several key global and regional players that hold substantial market shares. Leading companies leverage advanced technologies, extensive distribution networks, and strong relationships with food, beverage, dairy, and pharmaceutical manufacturers to maintain competitive advantages. It features a mix of large multinational corporations and agile mid-sized firms that focus on innovation, sustainability, and cost efficiency to address evolving consumer demands and regulatory requirements. The market’s characteristics include a high emphasis on product quality, sterility assurance, and material versatility, with plastic-based packaging holding a significant portion due to its lightweight and durable nature. The growing demand for extended shelf life and reduced cold chain dependency drives investment in aseptic filling equipment and sustainable packaging solutions. Despite steady growth, barriers such as high initial capital expenditure and stringent regulatory compliance influence market dynamics. Regional variations in consumer preferences and infrastructure also shape the competitive landscape, encouraging players to tailor their offerings. The presence of strong R&D activities and collaborations between packaging manufacturers and equipment suppliers further enhance innovation and market responsiveness. It remains essential for companies to balance operational efficiency with environmental considerations to sustain long-term growth and meet increasing demand for eco-friendly packaging options.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The North America bulk aseptic packaging market will continue to grow steadily due to increasing demand for shelf-stable food and beverage products.

- Manufacturers will invest more in sustainable and recyclable packaging materials to meet environmental regulations and consumer preferences.

- Technological advancements in aseptic filling and sealing equipment will enhance production efficiency and product safety.

- The beverage and dairy sectors will remain key contributors to market expansion in the coming years.

- Reducing dependency on cold chain logistics will drive wider adoption of aseptic packaging solutions.

- Rising consumer awareness about food safety and quality will boost aseptic packaging demand.

- Small and medium-sized enterprises will gradually adopt aseptic packaging as costs decline and technologies become more accessible.

- Regulatory standards will become more stringent, prompting innovation in packaging materials and processes.

- Companies will focus on developing flexible and customizable packaging formats to cater to diverse applications.

- Strategic partnerships and collaborations between packaging manufacturers and technology providers will accelerate market growth.