| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America RFID Market Size 2024 |

USD 5,046.74 Million |

| North America RFID Market, CAGR |

10.1% |

| North America RFID Market Size 2032 |

USD 12,018.56 Million |

Market Overview

The North America RFID Market is projected to grow from USD 5,046.74 million in 2024 to an estimated USD 12,018.56 million by 2032, with a compound annual growth rate (CAGR) of 10.1% from 2025 to 2032. This robust growth trajectory highlights the increasing adoption of Radio-Frequency Identification (RFID) technology across multiple industries, including logistics, retail, healthcare, and manufacturing.

The North America RFID Market benefits from strong demand for contactless identification, driven by the rise in e-commerce and omnichannel retail strategies. Companies are integrating RFID to streamline supply chains and mitigate losses due to theft or misplacement. In the healthcare sector, RFID enhances patient safety, inventory control, and equipment tracking. Market trends also indicate a shift towards passive RFID systems and cloud-based infrastructure for real-time monitoring. Additionally, the growing popularity of wearable technology and smart labels contributes to ongoing innovation and product diversification within the RFID ecosystem.

Geographically, the United States dominates the regional market, supported by extensive technological infrastructure and early adoption across verticals. Canada also plays a growing role, particularly in the healthcare and transportation sectors. Key players operating in the North America RFID market include Zebra Technologies Corporation, Honeywell International Inc., Impinj Inc., Avery Dennison Corporation, and HID Global Corporation, each contributing to market expansion through strategic innovation and partnerships.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America RFID market is projected to grow from USD5,046.74 million in 2024 to USD12,018.56 million by 2032, with a CAGR of 10.1% from 2025 to 2032, driven by increasing RFID adoption in multiple sectors.

- The Global RFID Market is projected to grow from USD 14,378.18 million in 2024 to an estimated USD 34,461.82 million by 2032, with a compound annual growth rate (CAGR) of 10.2% from 2025 to 2032.

- Key drivers include the growing need for automation, real-time data analytics, and enhanced supply chain visibility, particularly in logistics, healthcare, retail, and manufacturing industries.

- High initial investment and integration costs for RFID systems, along with potential privacy concerns related to data security, remain significant challenges to broader market adoption.

- The U.S. leads the North American RFID market, supported by strong technological infrastructure and early adoption in key sectors like retail, healthcare, and logistics.

- Canada’s RFID market is also growing, with increasing adoption in healthcare, transportation, and supply chain automation, driven by government initiatives and industry demands for efficiency.

- Innovations such as passive RFID systems, cloud-based infrastructure, and integration with IoT platforms are improving RFID system performance and fueling market growth.

- RFID is widely used for asset tracking, inventory management, and enhancing customer experience, with particular growth seen in e-commerce, retail, and healthcare sectors.

Report Scope

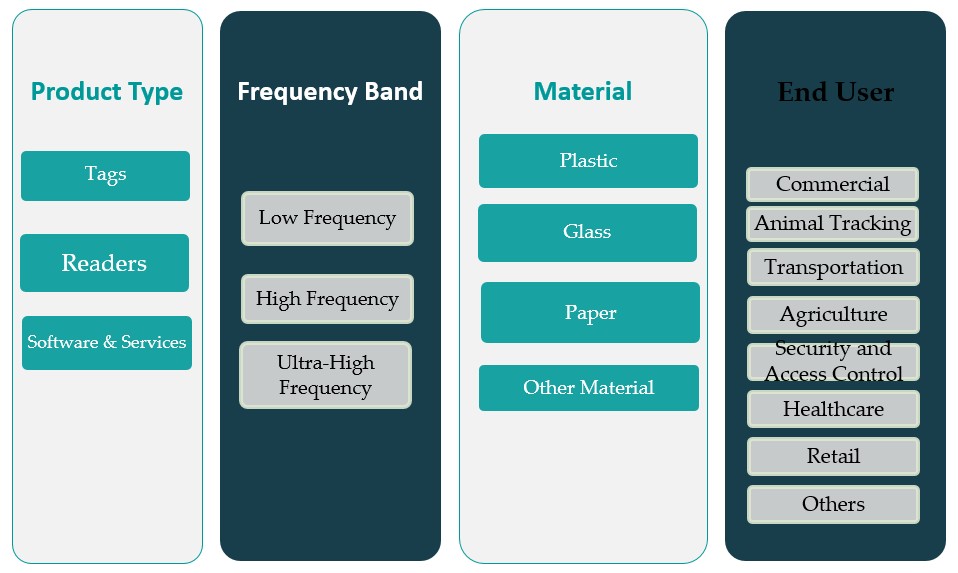

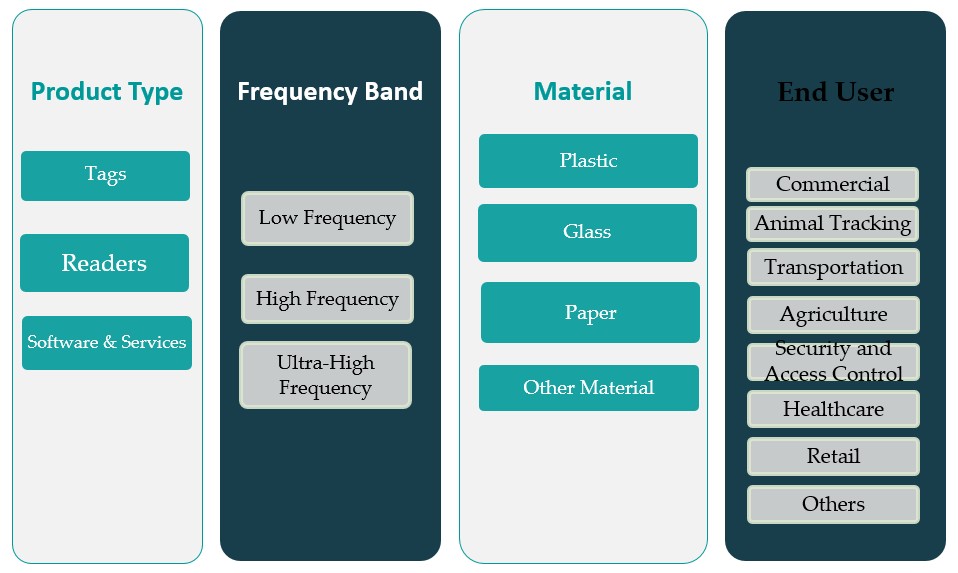

This report segments the North America RFID Market as follows:

Market Drivers

Increasing Demand for Automation and Operational Efficiency

The demand for automation across various industries is one of the primary drivers of the North America RFID market. Organizations in sectors such as retail, logistics, healthcare, and manufacturing are increasingly adopting RFID technology to streamline operations, improve inventory management, and reduce human error. RFID systems offer real-time tracking, enhancing the accuracy of asset and inventory management, which is particularly beneficial for large-scale supply chains. By automating inventory management, RFID helps companies reduce operational costs, avoid stockouts or overstocking, and improve order fulfillment accuracy. For instance, Terso Solutions, Inc. deployed their RAIN RFID solutions in over 1,000 healthcare facilities in the U.S., helping hospitals track patient information and medical records. This efficiency is crucial in today’s fast-paced business environment where companies strive for quicker turnaround times, cost savings, and optimized resource utilization. Additionally, RFID technology reduces the need for manual data entry, leading to improved employee productivity and allowing businesses to scale operations with ease.

Growth in E-commerce and Omnichannel Retail Strategies

The surge in e-commerce has significantly boosted the demand for RFID technology in North America. Retailers are increasingly adopting RFID to improve inventory visibility across various channels, enabling them to offer seamless omnichannel shopping experiences. The rise in online shopping has created a need for real-time tracking of goods, and RFID provides an efficient solution for stock management and product tracking from warehouses to stores or direct to consumers. RFID systems provide retailers with real-time data, enhancing their ability to respond quickly to demand changes, optimize stock levels, and improve customer satisfaction by ensuring that products are available for purchase both online and in-store. For instance, RFID adoption in North American retail has helped businesses reduce stock discrepancies and improve inventory accuracy. Furthermore, RFID aids in loss prevention, offering detailed insight into inventory movements, and helping retailers detect shrinkage or theft. The ability to track products across all points of the supply chain enhances the overall shopping experience, making RFID an essential component of modern retail strategies.

Advancements in Healthcare and Patient Safety

The healthcare sector is increasingly turning to RFID technology to enhance patient safety, streamline inventory management, and ensure the accurate tracking of medical equipment. RFID tags can be used to monitor the location and usage of critical equipment, preventing loss or misplacement of expensive medical devices. RFID also plays a crucial role in ensuring patient safety by accurately tracking patient identification and medication administration, reducing the risk of errors and improving the overall quality of care. In hospitals, RFID systems can track patient beds, IV pumps, and even surgical instruments, ensuring that they are available and properly sterilized. Moreover, RFID systems enable better management of medications, allowing healthcare providers to monitor stock levels, expiration dates, and lot numbers, which is crucial for maintaining compliance with safety standards. The ability to quickly locate equipment and medications ensures that healthcare professionals can provide timely and efficient care. These factors contribute to the growing adoption of RFID in the healthcare industry, where efficiency and patient safety are paramount.

Government and Industry-Specific Regulations Driving RFID Adoption

In addition to technological advancements, government and industry-specific regulations are playing a significant role in driving the adoption of RFID in North America. For instance, regulations in sectors like pharmaceuticals, food safety, and defense are requiring more stringent tracking of products and assets throughout the supply chain. The U.S. Food and Drug Administration (FDA) mandates the use of RFID for tracking pharmaceuticals and medical devices, while the Department of Defense (DoD) requires RFID for tracking shipments and inventory in defense operations. These regulations are compelling businesses to adopt RFID technology to comply with legal requirements, particularly in industries where safety, security, and transparency are essential. Additionally, RFID is becoming a key tool in achieving sustainability goals, as it helps companies optimize their supply chain operations, reducing waste and improving resource utilization. As businesses strive to meet regulatory requirements and align with industry standards, RFID adoption continues to rise, benefiting both compliance and operational efficiency. Government-backed initiatives and regulations are therefore a strong driver for the increased deployment of RFID technologies across various sectors.

Market Trends

Integration of RFID with Internet of Things (IoT) for Enhanced Data Analytics

A significant trend in the North America RFID market is the growing integration of RFID technology with the Internet of Things (IoT). This integration enables businesses to leverage real-time data from RFID tags alongside other IoT-enabled devices, creating a seamless flow of information across various systems. With IoT platforms, RFID data can be processed and analyzed for deeper insights, offering a more comprehensive view of assets, inventory, and operations. For instance, North American retailers implementing IoT-enabled RFID systems have improved inventory accuracy and reduced operational inefficiencies, with some companies reporting a 20% reduction in stock discrepancies. This convergence allows for predictive analytics, automated decision-making, and improved resource optimization. In healthcare, RFID combined with IoT enables the real-time tracking of equipment, medication, and patient movements, providing enhanced care and safety. Hospitals utilizing RFID for asset tracking have seen improvements in equipment utilization and patient safety, with RFID reducing equipment search times by up to 30%. The integration of RFID with IoT platforms facilitates smarter decision-making and greater operational efficiency, positioning the technology as a critical tool in transforming industries across North America.

Rise of Passive RFID Tags and Low-Cost Solutions

Another key trend in the North America RFID market is the rise of passive RFID tags and the push toward more cost-effective solutions. Passive RFID tags, which do not require an internal power source, are becoming increasingly popular due to their lower cost, longer lifespan, and ease of integration into existing infrastructure. These tags are particularly beneficial for large-scale deployments in sectors such as retail, logistics, and manufacturing, where cost efficiency is essential. Reports indicate that passive RFID adoption has led to improved supply chain visibility and reduced operational costs for businesses in North America, with companies experiencing inventory tracking improvements of up to 25%. Advances in passive RFID technology have led to improved performance, with greater read ranges and faster data transmission speeds, making them suitable for a wider range of applications. Companies are adopting these low-cost RFID solutions as part of their strategy to automate operations, improve supply chain visibility, and enhance customer experiences. The ongoing development of passive RFID technology is driving market growth, particularly in industries looking to minimize expenses while maintaining effective asset management.

Use of RFID in Sustainable and Green Supply Chains

As sustainability becomes an increasing priority for businesses across North America, RFID technology is playing a crucial role in enabling greener and more sustainable supply chains. RFID allows companies to track the movement of goods more efficiently, reducing waste, optimizing resource allocation, and minimizing energy consumption. By providing accurate, real-time data, RFID helps businesses make better decisions on inventory management, reducing overstocking and waste in production. In industries such as retail, RFID tags help track product lifecycles and ensure proper recycling and disposal of goods, contributing to a circular economy. Furthermore, RFID is also being utilized to track and manage recyclable materials, improving the efficiency of recycling processes. As businesses continue to prioritize sustainability, RFID technology is becoming an essential tool in supporting eco-friendly supply chain practices. Companies are increasingly adopting RFID as a means to not only improve operational efficiency but also meet their environmental sustainability targets.

Adoption of RFID for Enhanced Security and Asset Tracking

The adoption of RFID technology for enhanced security and asset tracking is another prominent trend in the North American RFID market. RFID is increasingly being used in industries such as healthcare, defense, and logistics for tracking high-value assets and ensuring security. RFID-enabled access control systems, for instance, provide secure and efficient management of personnel and equipment in sensitive environments. In the healthcare sector, RFID is used to monitor the location and usage of critical medical devices, preventing theft or unauthorized access. Similarly, in the defense and logistics sectors, RFID technology ensures that valuable equipment and materials are accurately tracked, reducing the risk of loss or theft. The ability to monitor assets in real time, along with RFID’s integration with other security technologies like biometrics and video surveillance, strengthens overall security measures. This trend reflects the growing reliance on RFID technology for improving asset security and reducing risks in high-stakes environments across North America.

Market Challenges

High Initial Investment and Integration Costs

Privacy and Security Concerns

Another significant challenge for the North American RFID market is the growing concern over privacy and security. RFID systems, particularly those that use passive tags, can be vulnerable to unauthorized scanning or tracking of goods and individuals. As RFID technology becomes more pervasive, there are increasing concerns about the unauthorized collection of personal data, particularly in sectors like healthcare and retail, where RFID is used for patient and customer identification. The ability of RFID systems to track assets and people in real time, if not properly managed, could lead to potential misuse or exploitation of data. This raises important questions about data security, compliance with privacy laws, and consumer trust. To address these challenges, RFID system providers must invest in advanced encryption and authentication mechanisms to protect sensitive data. Additionally, there is a need for regulatory frameworks that ensure RFID usage aligns with privacy protection standards and consumer rights. Companies that fail to address these security concerns may face reputational damage, legal risks, and potential customer backlash. Therefore, while RFID technology offers significant operational advantages, businesses must prioritize robust security measures to mitigate risks related to unauthorized access and ensure the privacy of individuals and assets tracked using RFID.

Market Opportunities

Expansion in Healthcare and Pharmaceutical Industries

One of the most significant market opportunities in the North American RFID market lies in the expanding applications within the healthcare and pharmaceutical industries. With increasing demands for patient safety, inventory control, and equipment management, RFID technology has become a critical tool in enhancing operational efficiency and reducing human errors in healthcare settings. Hospitals and medical facilities are increasingly adopting RFID to track medical equipment, monitor patient medications, and ensure compliance with safety standards. The pharmaceutical sector, driven by regulatory requirements for traceability and product authenticity, also represents a promising growth area for RFID adoption. RFID-enabled systems help track the movement of drugs across the supply chain, ensuring that products are stored correctly and preventing the circulation of counterfeit products. As the need for greater transparency and accuracy in healthcare and pharmaceuticals grows, RFID is positioned to play an essential role in transforming these industries. Furthermore, with advancements in RFID technology, including increased tag affordability and better integration with existing systems, the adoption of RFID solutions is expected to rise significantly in these sectors over the coming years.

Growth in Smart Retail and Supply Chain Automation

Another prominent market opportunity is the rapid growth of smart retail and supply chain automation in North America. As retail continues to embrace omnichannel strategies, the need for real-time inventory tracking, enhanced supply chain visibility, and streamlined logistics becomes paramount. RFID technology provides an efficient solution for improving product traceability, reducing shrinkage, and ensuring product availability across various sales channels. Retailers are increasingly adopting RFID to improve customer experiences by providing better stock visibility and enabling faster product replenishment. Additionally, the demand for automated warehousing and distribution centers is on the rise, and RFID plays a key role in facilitating the automation of these processes. With the growth of e-commerce and the continued shift towards automation in logistics, RFID technology is set to become an integral part of the North American retail and supply chain sectors, offering substantial growth opportunities for companies that capitalize on these trends.

Market Segmentation Analysis

By Product Type

The North American RFID market is categorized into three primary product types: Tags, Readers, and Software and Services. Tags, which are used for identifying and tracking objects, hold the largest share of the market, owing to their versatility and wide-ranging applications in various sectors like retail, healthcare, and logistics. RFID tags are classified into different types, such as passive, active, and semi-passive, depending on their power source. Passive tags, which are more cost-effective, dominate the market due to their lower price point and suitability for high-volume applications. Readers, the devices used to read the information stored in RFID tags, also represent a significant portion of the market. These readers are used across industries for inventory management, asset tracking, and access control. Software and services in the RFID ecosystem are gaining prominence as organizations increasingly adopt RFID technology for data management, analytics, and integration with existing systems. The demand for software solutions is driven by the need for real-time tracking and data insights that help businesses optimize operations.

By Frequency

The RFID market is further segmented by frequency, which plays a crucial role in determining the range and application of RFID systems. Low Frequency (LF) RFID operates in the 30 kHz to 300 kHz range and is typically used for applications such as animal tracking and access control. However, it has limited range and slower data transfer compared to other frequencies. High Frequency (HF) RFID operates at 13.56 MHz and is widely used in applications like smart cards, library systems, and payment systems. Ultra-High Frequency (UHF) RFID, which operates between 860 MHz to 960 MHz, offers the longest read ranges and is most commonly used in retail inventory management, logistics, and supply chain tracking due to its ability to handle larger volumes of data quickly and over greater distances. UHF RFID is expected to dominate the market in the coming years due to its high efficiency and scalability.

Segments

Based on Product Type

- Tags

- Readers

- Software and Services

Based on Frequency

- Low Frequency

- High Frequency

- Ultra-High Frequency

Based on Material

- Plastic

- Glass

- Paper

- Others

Based on End User

- Commercial

- Animal Tracking

- Transportation

- Agriculture

- Security and Access Control

- Healthcare

- Retail

- Others

Based on Region

Regional Analysis

By Product Type

The North American RFID market is categorized into three primary product types: Tags, Readers, and Software and Services. Tags, which are used for identifying and tracking objects, hold the largest share of the market, owing to their versatility and wide-ranging applications in various sectors like retail, healthcare, and logistics. RFID tags are classified into different types, such as passive, active, and semi-passive, depending on their power source. Passive tags, which are more cost-effective, dominate the market due to their lower price point and suitability for high-volume applications. Readers, the devices used to read the information stored in RFID tags, also represent a significant portion of the market. These readers are used across industries for inventory management, asset tracking, and access control. Software and services in the RFID ecosystem are gaining prominence as organizations increasingly adopt RFID technology for data management, analytics, and integration with existing systems. The demand for software solutions is driven by the need for real-time tracking and data insights that help businesses optimize operations.

By Frequency

The RFID market is further segmented by frequency, which plays a crucial role in determining the range and application of RFID systems. Low Frequency (LF) RFID operates in the 30 kHz to 300 kHz range and is typically used for applications such as animal tracking and access control. However, it has limited range and slower data transfer compared to other frequencies. High Frequency (HF) RFID operates at 13.56 MHz and is widely used in applications like smart cards, library systems, and payment systems. Ultra-High Frequency (UHF) RFID, which operates between 860 MHz to 960 MHz, offers the longest read ranges and is most commonly used in retail inventory management, logistics, and supply chain tracking due to its ability to handle larger volumes of data quickly and over greater distances. UHF RFID is expected to dominate the market in the coming years due to its high efficiency and scalability.

Key players

- Zebra Technologies Corporation

- Honeywell International Inc.

- GAO RFID Inc.

- Avery Dennison Corporation

- HID Global Corporation

- Impinj Inc.

- NXP Semiconductors

- Alien Technology LLC

- Xemelgo Inc.

- Identiv, Inc.

- Jadak

- GlobeRanger Corporation

- ORBCOMM Inc.

- RFID Global Solution

- Microchip Technology

Competitive Analysis

The North American RFID market is highly competitive, with several prominent players leading in various segments. Zebra Technologies Corporation and Honeywell International Inc. are among the market leaders, offering comprehensive RFID solutions that cater to a wide range of industries, including retail, healthcare, and logistics. Their strength lies in their extensive product portfolios, strong customer bases, and global presence. Impinj Inc., NXP Semiconductors, and Alien Technology LLC are key players specializing in RFID tags, readers, and chip solutions, capitalizing on technological innovations and providing efficient, scalable solutions for asset tracking and supply chain management. Avery Dennison Corporation and HID Global Corporation focus on providing RFID solutions with a strong emphasis on integration and ease of use, positioning themselves as trusted partners in retail and access control markets. Smaller players like GAO RFID Inc. and Microchip Technology leverage niche technologies to cater to specific market needs, allowing them to remain competitive through specialized offerings and customer-focused strategies.

Recent Developments

- In June 2024, GlobeRanger released iMotion Data Orchestration, a solution that helps businesses manage edge devices such as IoT sensors, RFID readers, and other digital devices, capturing and processing data they generate.

- In February 2023, HID Global highlighted its support for an array of IoT technologies, emphasizing its role in developing RFID devices for various sectors including automotive, manufacturing, logistics, aerospace, and energy.

- On September 27, 2023, Zebra Technologies released its 2023 Global Warehousing Study, revealing that 58% of warehouse decision-makers plan to deploy RFID technology by 2028 to enhance inventory visibility and reduce out-of-stocks.

- In March 2024, Impinj settled a longstanding patent-infringement dispute with NXP Semiconductors, resulting in a one-time payment of $45 million and an annual license fee starting at $15 million in 2024, with incremental increases. Both companies withdrew any ongoing proceedings and signed a patent cross-licensing agreement.

- In April 2024, Identiv announced an agreement to sell certain operations and assets to security solutions provider Vitaprotech for $145 million. This includes divesting its physical security, access card, and identity reader operations. The transaction is expected to close in the third quarter.

- In November 2023, Avery Dennison completed the acquisition of Silver Crystal Group, a company specializing in customized jerseys and apparel for sports organizations.

Market Concentration and Characteristics

The North American RFID market exhibits a moderate to high level of market concentration, with a few key players dominating the industry while also being complemented by numerous smaller firms catering to niche applications. Major players such as Zebra Technologies, Honeywell International, and Impinj hold significant market shares due to their extensive product portfolios, strong customer relationships, and advanced technological innovations. These companies dominate key sectors, including retail, logistics, healthcare, and manufacturing. However, the market also features a wide range of smaller, specialized companies, such as GAO RFID and Alien Technology, which focus on specific product types like RFID tags, readers, and software solutions. This creates a competitive landscape where larger companies benefit from economies of scale and broad service offerings, while smaller players focus on tailored solutions for specific industries. The market is characterized by continuous innovation, with advancements in RFID technology driving efficiency, real-time tracking, and automation across various sectors. The increasing adoption of RFID systems, especially in logistics, retail, and healthcare, continues to attract new entrants, making the market dynamic and evolving.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Frequency, Material, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The healthcare sector is expected to be a significant driver for RFID growth, with increasing demand for patient safety, medical equipment tracking, and inventory management solutions.

- The integration of RFID with Internet of Things (IoT) platforms will enhance real-time data analytics, leading to smarter decision-making and improved operational efficiency across industries.

- As retail and e-commerce grow, RFID will play a pivotal role in inventory management, anti-theft measures, and delivering seamless omnichannel experiences for consumers.

- Ultra-High Frequency (UHF) RFID technology is expected to dominate the market due to its superior range, speed, and efficiency in handling large volumes of data.

- RFID technology is poised to support more sustainable supply chains, helping businesses reduce waste, optimize resource utilization, and track recycling efforts.

- The rise of smart packaging and smart labels will drive RFID adoption, offering companies better product traceability and enhancing customer experience through added interactivity.

- As logistics and warehousing operations become increasingly automated, RFID will be integral to improving asset tracking, shipment visibility, and overall supply chain efficiency.

- Future innovations in RFID tags, such as the development of more durable, lightweight, and cost-effective solutions, will further broaden the range of applications in various industries.

- Stringent regulatory requirements in industries like pharmaceuticals, healthcare, and food safety will continue to drive the adoption of RFID for compliance, traceability, and security purposes.

- The market will see an increase in specialized RFID solutions tailored to specific industries, with smaller firms developing unique applications to meet evolving business needs.