Market Overview:

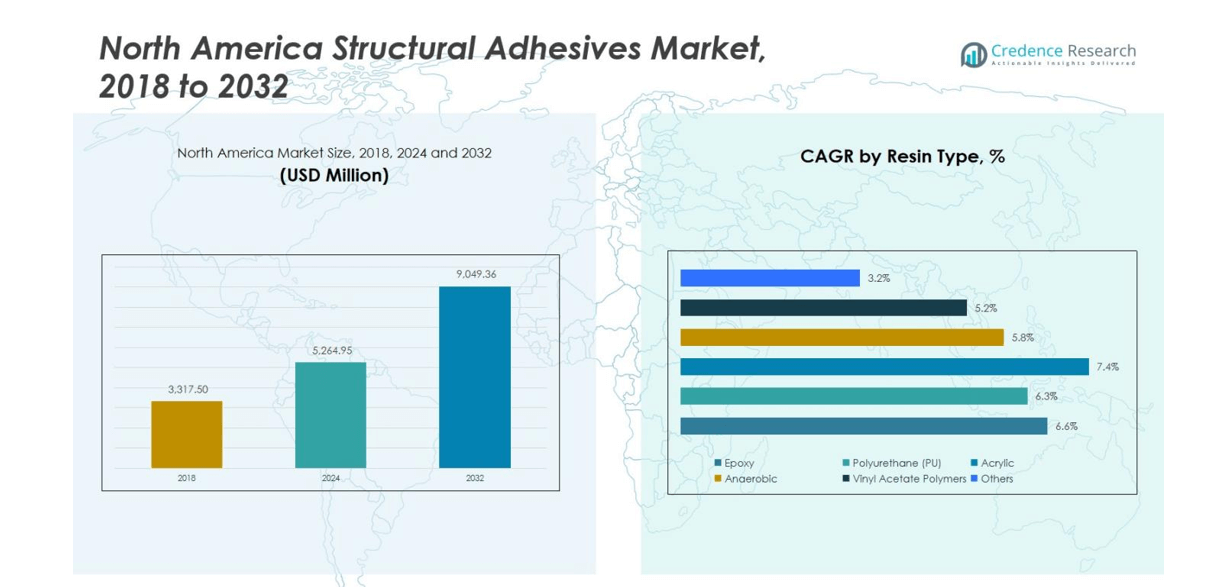

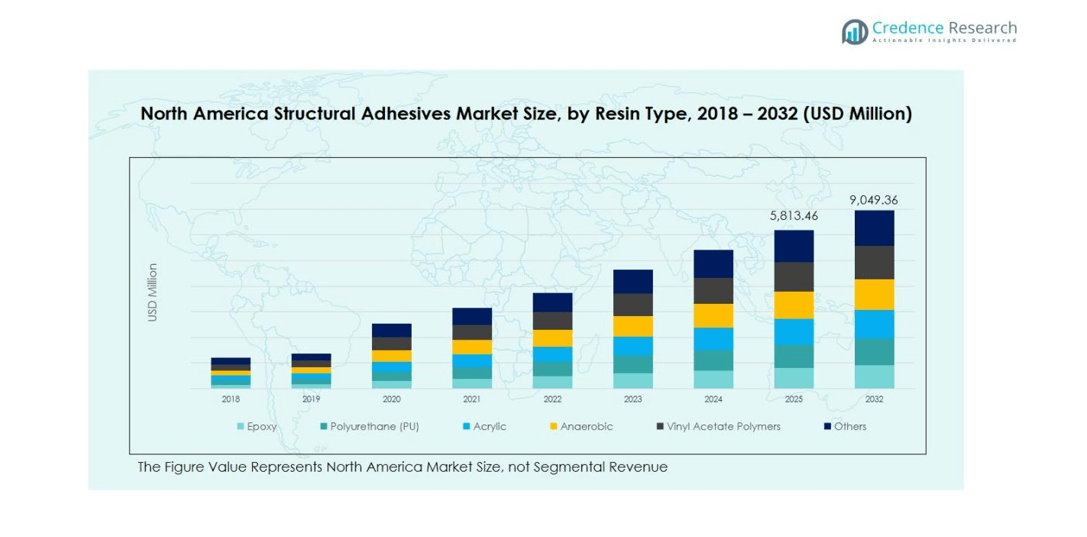

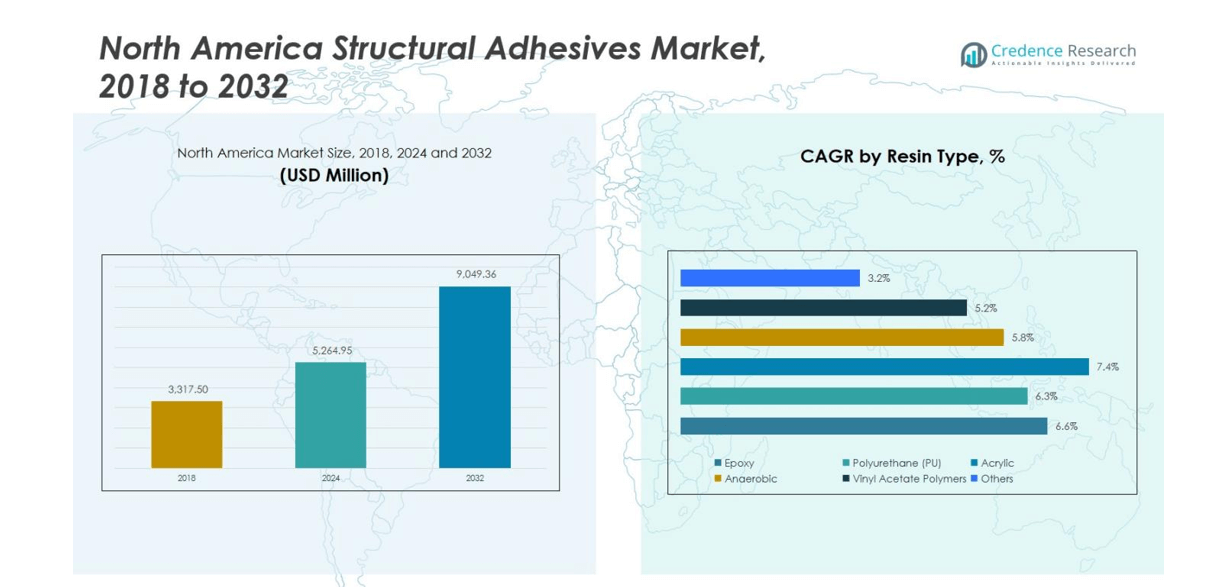

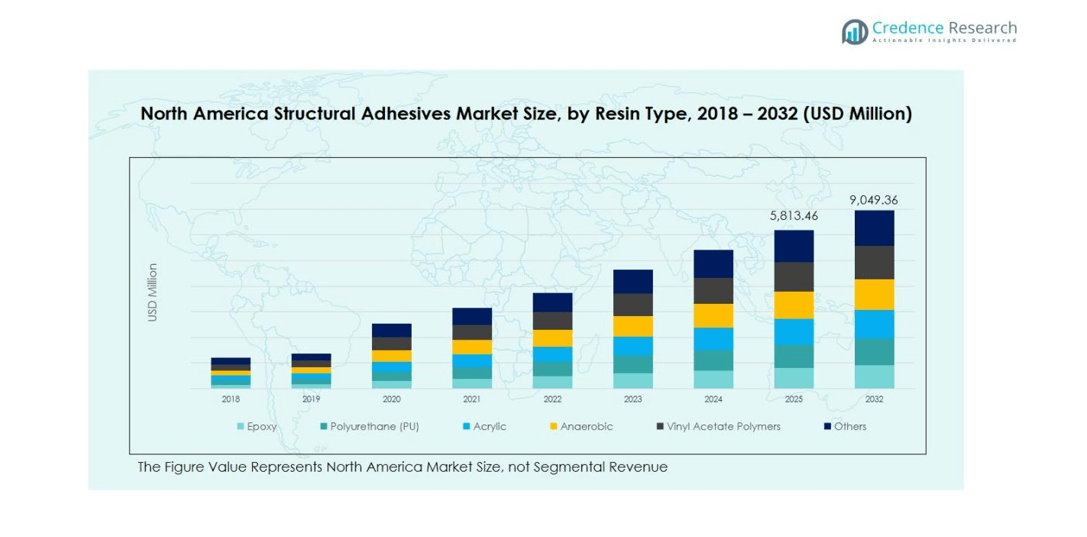

The North America Structural Adhesives Market size was valued at USD 3,317.50 million in 2018, reaching USD 5,264.95 million in 2024, and is anticipated to attain USD 9,049.36 million by 2032, growing at a CAGR of 6.53% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Structural Adhesives Market Size 2024 |

USD 5,264.95 million |

| North America Structural Adhesives Market, CAGR |

6.53% |

| North America Structural Adhesives Market Size 2032 |

USD 9,049.36 million |

The North America Structural Adhesives Market is dominated by leading players such as 3M Company, H.B. Fuller Company, Henkel AG & Co. KGaA, Huntsman Corporation, Dow Inc., Illinois Tool Works Inc., RPM International Inc., Ashland Global Holdings Inc., L&L Products Inc., and Lord Corporation. These companies compete through continuous product innovation, strategic acquisitions, and development of high-performance, low-VOC, and environmentally sustainable adhesives. They focus on enhancing bonding strength, chemical resistance, and curing efficiency to meet the demands of automotive, aerospace, and construction industries. The United States is the leading region in the market, accounting for 65% of the North America Structural Adhesives Market in 2024, driven by strong industrial infrastructure, significant R&D investments, and rapid adoption of adhesives in lightweight vehicle components and advanced manufacturing processes. This leadership position reinforces the country’s role as a key hub for technological advancements in adhesive solutions.

Market Insights

- The North America Structural Adhesives Market was valued at USD 5,264.95 million in 2024 and is projected to reach USD 9,049.36 million by 2032, growing at a CAGR of 6.53%.

- Rising demand for lightweight materials in automotive and aerospace sectors and expanding construction and infrastructure projects are driving the adoption of structural adhesives across North America.

- Key trends include the growing use of water-based and low-VOC adhesives, increased adoption in electric vehicle manufacturing, and development of high-performance, eco-friendly formulations. The epoxy resin segment held 42% of the market in 2024, while metal substrates accounted for 39% of the share.

- The competitive landscape is led by 3M Company, H.B. Fuller, Henkel AG & Co. KGaA, Huntsman Corporation, Dow Inc., and other major players, focusing on innovation, acquisitions, and customized solutions for industrial applications.

- The United States dominated the regional market with 65% share, followed by Canada at 20% and Mexico at 15%, reflecting strong industrial activity and adoption of advanced adhesive technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Resin Type

Epoxy resins dominated the North America structural adhesives market in 2024, accounting for 42% of the total share. Their superior mechanical strength, chemical resistance, and strong adhesion to diverse substrates make them ideal for high-performance applications in aerospace, automotive, and construction sectors. Polyurethane (PU) and acrylic adhesives follow, driven by their flexibility and impact resistance. Increasing demand for lightweight vehicles and advanced composites continues to fuel epoxy’s leadership, while ongoing R&D in hybrid resin formulations enhances durability and performance across multiple end-use industries.

- For instance, BASF SE developed high-performance epoxy resins used in aerospace sector adhesives, meeting rigorous durability and thermal resistance standards.

By Substrate

The metal substrate segment held the largest share of 39% in the North America structural adhesives market in 2024. Structural adhesives are increasingly replacing traditional fastening methods in metal bonding for automotive, aerospace, and industrial equipment manufacturing. The composite substrate segment is also gaining traction, supported by the rising use of carbon fiber-reinforced materials in lightweight vehicle and aircraft production. The metal segment’s dominance is attributed to its strength, corrosion resistance, and ability to sustain load-bearing applications in demanding operational environments.

- For instance, Master Bond epoxy adhesives are widely used in aerospace bonding applications for metals like aluminum and titanium, offering exceptional strength, corrosion resistance, and compliance with strict standards such as NASA low outgassing and Boeing specifications.

By Technology

Water-based structural adhesives accounted for 45% of the North American market share in 2024, surpassing solvent-based systems due to stricter environmental regulations and the growing adoption of low-VOC formulations. Manufacturers are increasingly developing high-performance water-based adhesives that match the strength and durability of solvent-based counterparts while offering enhanced sustainability. The solvent-based segment retains demand in niche industrial uses where rapid curing is essential. The shift toward eco-friendly production and safer workplace environments remains a key driver for the water-based technology segment’s continued growth.

Key Growth Drivers

Rising Demand for Lightweight Materials

The growing focus on lightweight materials in the automotive and aerospace industries is a major driver of the North America Structural Adhesives Market. Manufacturers are increasingly replacing traditional welding and mechanical fastening methods with high-performance adhesives to reduce vehicle weight, improve fuel efficiency, and enhance structural integrity. Structural adhesives enable bonding of dissimilar materials such as metals and composites, supporting the production of durable, lightweight components. This trend aligns with the regional shift toward electric vehicles and sustainable mobility solutions, further boosting demand across key manufacturing sectors.

- For instance, 3M’s structural adhesives are used in automotive body-in-white (BIW) applications to bond high-strength steel and aluminum, enabling lighter vehicle structures without sacrificing strength.

Expansion of the Construction and Infrastructure Sector

The steady expansion of the construction and infrastructure sector across North America significantly contributes to market growth. Structural adhesives are widely used for bonding metals, composites, and plastics in architectural panels, structural glazing, and prefabricated components. Rising investments in residential, commercial, and industrial projects, coupled with the adoption of energy-efficient construction practices, drive adhesive usage. Their superior bonding strength, weather resistance, and long-term durability make them preferred materials for modern building applications, aligning with the region’s growing focus on sustainable and high-performance infrastructure solutions.

- For instance, 3M Structural Adhesive is extensively used in curtain wall systems on high-rise buildings, providing secure, weather-resistant bonds that withstand wind loads and temperature fluctuations, ultimately reducing labor costs and installation time.

Technological Advancements in Adhesive Formulations

Ongoing innovations in adhesive chemistry and formulation technology are driving market growth across North America. Manufacturers are investing in the development of eco-friendly, low-VOC, and high-strength structural adhesives to meet stringent environmental and safety standards. Advancements such as rapid-curing systems, hybrid adhesives, and enhanced thermal stability expand their applicability in challenging environments. These innovations not only improve performance and sustainability but also reduce processing times and operational costs for end users, making advanced adhesive technologies a cornerstone of next-generation manufacturing and assembly operations.

Key Trends & Opportunities

Opportunity in Electric Vehicle (EV) Manufacturing

The rapid expansion of the electric vehicle sector presents a promising growth opportunity for the North America Structural Adhesives Market. Adhesives play a crucial role in bonding lightweight materials, battery modules, and structural components while enhancing crash resistance and noise reduction. As EV manufacturers emphasize vehicle efficiency and extended battery life, the demand for advanced adhesives with superior thermal and mechanical properties continues to rise. Increasing government incentives for EV adoption further support market expansion, encouraging innovation in adhesive technologies tailored for electric mobility applications.

- For instance, 3M offers two-part epoxy, acrylic, and urethane structural adhesives specifically designed for EV battery applications, such as bonding battery trays and module side panels. Their products reduce assembly time and eliminate the need for heavy mechanical fasteners by providing strong adhesion to various substrates without distortion or corrosion.

Rising Adoption of Sustainable Adhesive Solutions

Growing environmental awareness and regulatory pressures are accelerating the adoption of sustainable and bio-based structural adhesives across North America. Manufacturers are shifting toward formulations with lower volatile organic compounds (VOCs) and reduced carbon footprints. This trend creates opportunities for the development of water-based and recyclable adhesive systems that meet both performance and sustainability goals. As end-use industries prioritize eco-conscious materials, companies investing in green adhesive technologies are gaining a competitive advantage and strengthening their market position in the evolving industrial landscape.

- For instance, Henkel has launched bio-based polyurethane (PUR) structural adhesives, Loctite HB S ECO and CR 821 ECO, which cut CO2 equivalent emissions by more than 60% compared to fossil-based alternatives while maintaining high performance in load-bearing mass timber construction.

Key Challenges

High Cost of Advanced Adhesive Formulations

The high production and formulation costs of advanced structural adhesives pose a major challenge for widespread adoption, particularly among small and medium manufacturers. Specialized resins, curing agents, and additives contribute to elevated product prices, limiting accessibility for cost-sensitive sectors. Furthermore, the need for precision application and skilled labor adds to overall operational expenses. Although technological innovation aims to reduce costs over time, the initial investment required for premium adhesive solutions remains a restraint for end users seeking affordable bonding alternatives.

Performance Limitations in Extreme Environments

Structural adhesives, while versatile, face performance limitations in extreme temperature and chemical exposure conditions. Certain formulations may degrade or lose bonding strength under prolonged heat, humidity, or solvent exposure, impacting long-term reliability. This challenge is particularly significant in aerospace, oil and gas, and marine applications, where durability under harsh environments is critical. Manufacturers are actively researching advanced resin systems to enhance resistance properties; however, achieving consistent performance across all environmental conditions remains a technical barrier for market expansion.

Regional Analysis

United States

The United States held the largest share of 65% in the North America Structural Adhesives Market in 2024. The market growth is driven by strong demand from automotive, aerospace, and construction industries, where manufacturers increasingly adopt structural adhesives for lightweighting, improved durability, and enhanced energy efficiency. The country’s well-established industrial base and continuous R&D investments in high-performance adhesives support technological innovation. Moreover, the rapid expansion of electric vehicle production and infrastructure development initiatives are strengthening demand, making the U.S. the leading hub for advanced adhesive manufacturing and application across multiple industrial sectors.

Canada

Canada accounted for 20% of the North America Structural Adhesives Market in 2024, supported by rising construction activities, aerospace manufacturing, and renewable energy projects. The country’s focus on sustainable building solutions and adoption of energy-efficient materials drives adhesive usage across construction and industrial applications. Canadian manufacturers are also emphasizing environmentally friendly, water-based formulations to comply with strict emission regulations. Growth in the automotive and wind energy sectors further fuels the need for high-strength bonding materials, while collaborations between manufacturers and research institutions continue to advance innovation in eco-friendly adhesive technologies.

Mexico

Mexico captured 15% of the North America Structural Adhesives Market in 2024, driven by its expanding automotive production base and growing presence of international manufacturing companies. The country benefits from cost-effective labor and proximity to the U.S. market, attracting investments in automotive and electronics assembly operations that heavily rely on structural adhesives. Government initiatives promoting industrial development and export-oriented manufacturing further support market growth. Additionally, the increasing use of adhesives in lightweight vehicle components and industrial manufacturing processes positions Mexico as a fast-emerging contributor to the region’s structural adhesives demand.

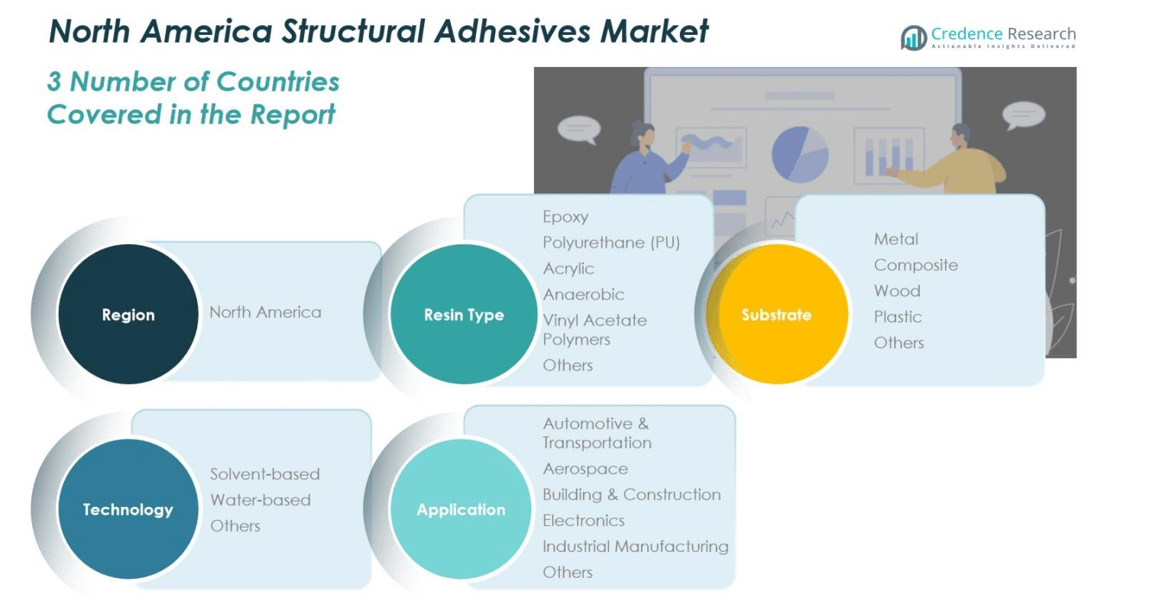

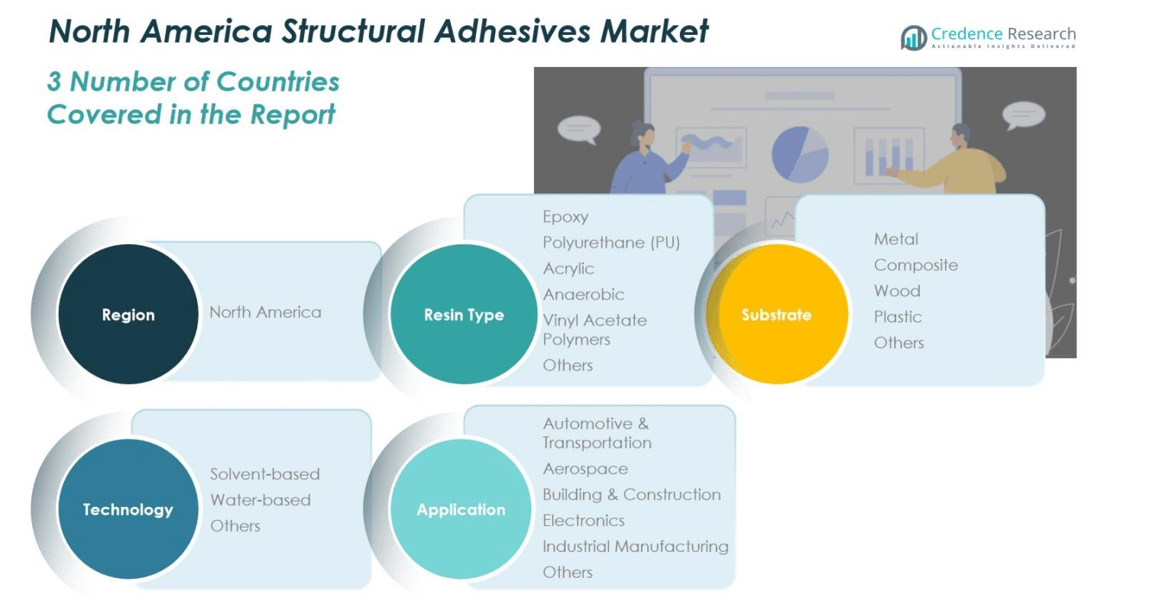

Market Segmentations:

By Resin Type

- Epoxy

- Polyurethane (PU)

- Acrylic

- Anaerobic

- Vinyl Acetate Polymers

- Others

By Substrate

- Metal

- Composite

- Wood

- Plastic

- Others

By Technology

- Solvent-based

- Water-based

- Others

By Application

- Automotive & Transportation

- Aerospace

- Building & Construction

- Electronics

- Industrial Manufacturing

- Others

By Region

Competitive Landscape

The competitive landscape of the North America Structural Adhesives Market is characterized by the presence of major players such as 3M Company, H.B. Fuller Company, Henkel AG & Co. KGaA, Huntsman Corporation, Dow Inc., Illinois Tool Works Inc., RPM International Inc., Ashland Global Holdings Inc., L&L Products Inc., and Lord Corporation. These companies compete through product innovation, strategic acquisitions, and technological advancements to strengthen their market position. The focus remains on developing high-performance, low-VOC, and environmentally sustainable adhesives to meet evolving industrial and regulatory demands. Continuous investment in R&D supports the introduction of advanced resin systems with improved bonding strength, chemical resistance, and faster curing properties. Moreover, partnerships with automotive, aerospace, and construction manufacturers are enhancing customized adhesive solutions for diverse applications. The market also witnesses rising competition from regional players offering cost-effective alternatives, prompting established companies to expand production capabilities and enhance supply chain integration across North America.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- 3M Company

- Ashland Global Holdings Inc.

- B. Fuller Company

- Henkel AG & Co. KGaA

- Illinois Tool Works Inc.

- L&L Products, Inc.

- RPM International Inc.

- Huntsman Corporation

- Lord Corporation

- Dow Inc.

Recent Developments

- In September 2025, 3M Company announced the launch of its new acrylic structural adhesive, Scotch-Weld™ DP8507NS/8507NS, designed to replace the existing DP8407NS/8407NS with enhanced performance for demanding applications.

- In February 2024, Henkel AG & Co. KGaA signed an agreement to acquire Seal for Life Industries LLC, a U.S.-based provider of protective coating and sealing solutions, strengthening Henkel’s presence in infrastructure and industrial markets while expanding its adhesive technologies portfolio.

- In 2025, Huntsman Corporation introduced a reformulated range of ARALDITE® epoxy adhesives that are free from Bisphenol A (BPA) and substances classified as carcinogenic, mutagenic, or reprotoxic, supporting sustainability goals and reducing CO₂ emissions by up to 36%.

Report Coverage

The research report offers an in-depth analysis based on Resin Type, Substrate, Technology, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The North America Structural Adhesives Market is expected to witness steady growth driven by rising demand in automotive and aerospace manufacturing.

- Increasing adoption of lightweight materials will continue to boost the use of high-strength bonding solutions.

- Technological advancements will lead to the development of faster-curing and more durable adhesive formulations.

- The shift toward sustainable and low-VOC adhesives will accelerate due to stricter environmental regulations.

- Expansion of electric vehicle production will create new opportunities for specialized adhesive applications.

- The construction industry will increasingly rely on structural adhesives for energy-efficient and prefabricated building systems.

- Strategic mergers and acquisitions among key players will strengthen regional market presence and product portfolios.

- Advancements in hybrid and smart adhesives will enhance performance in extreme operating conditions.

- Growing collaboration between manufacturers and research institutions will drive innovation and product optimization.

- Increased investment in automation and precision bonding technologies will improve efficiency across end-use industries.