Market Overview:

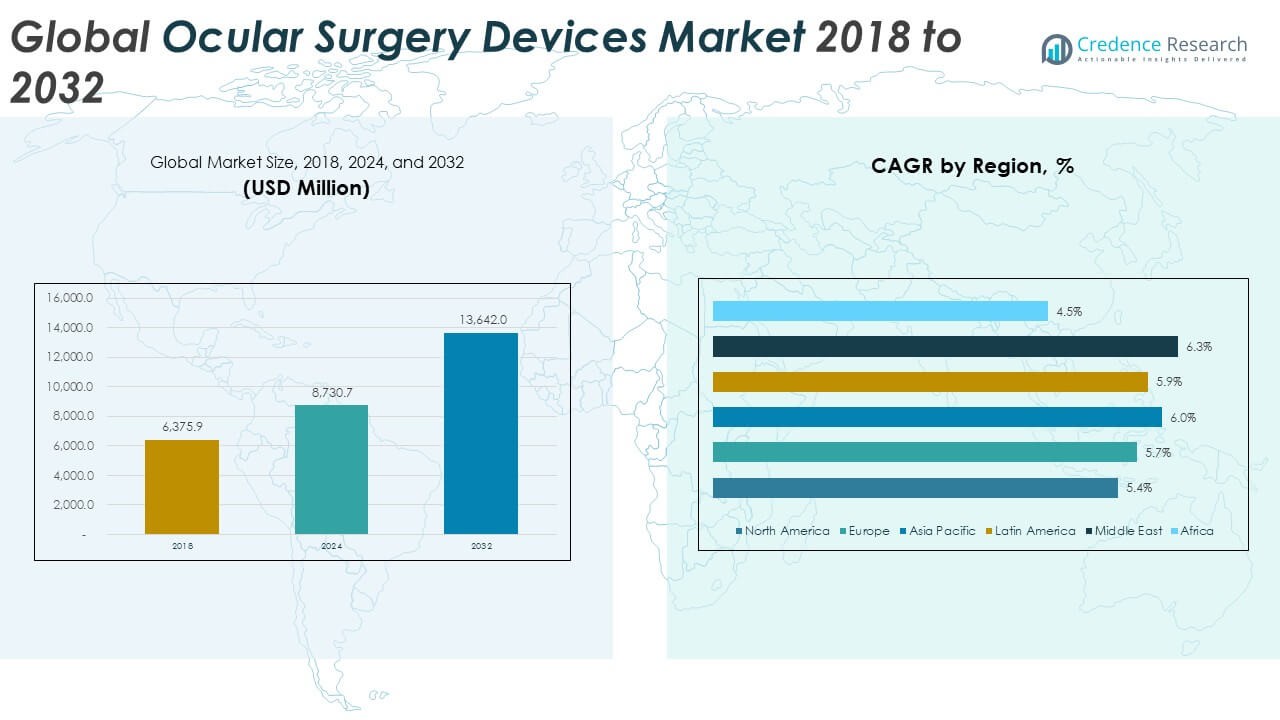

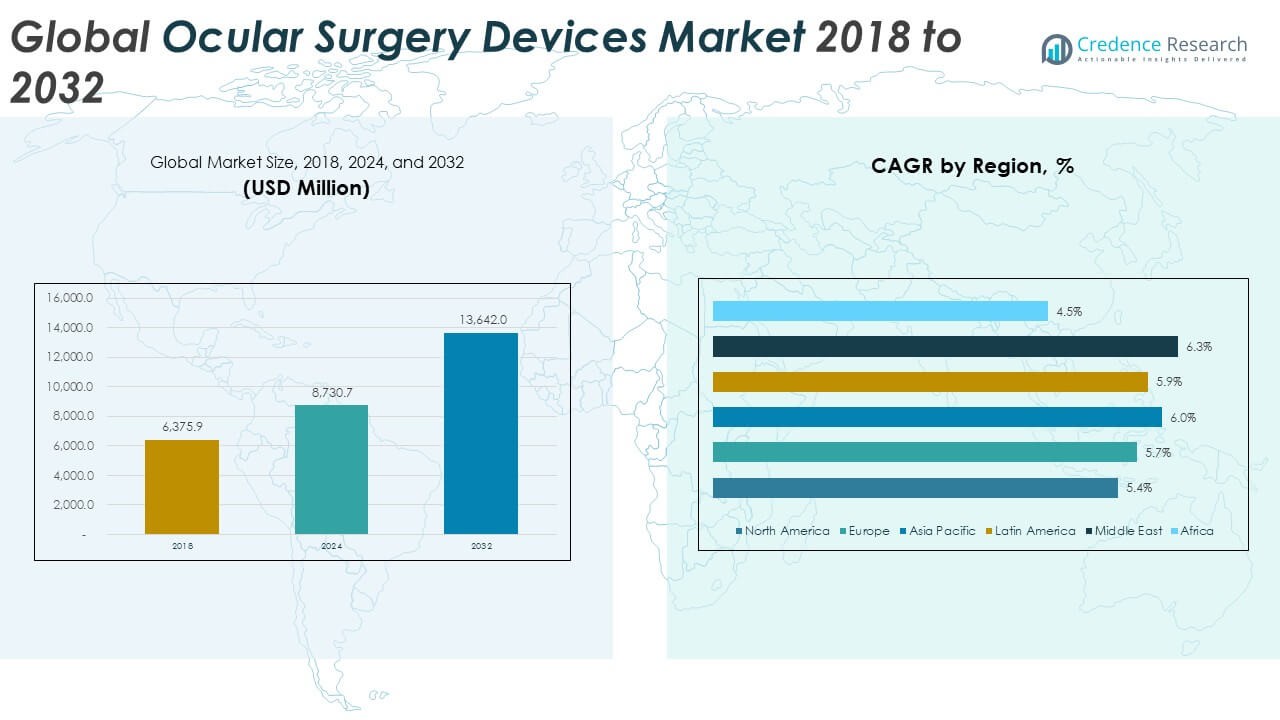

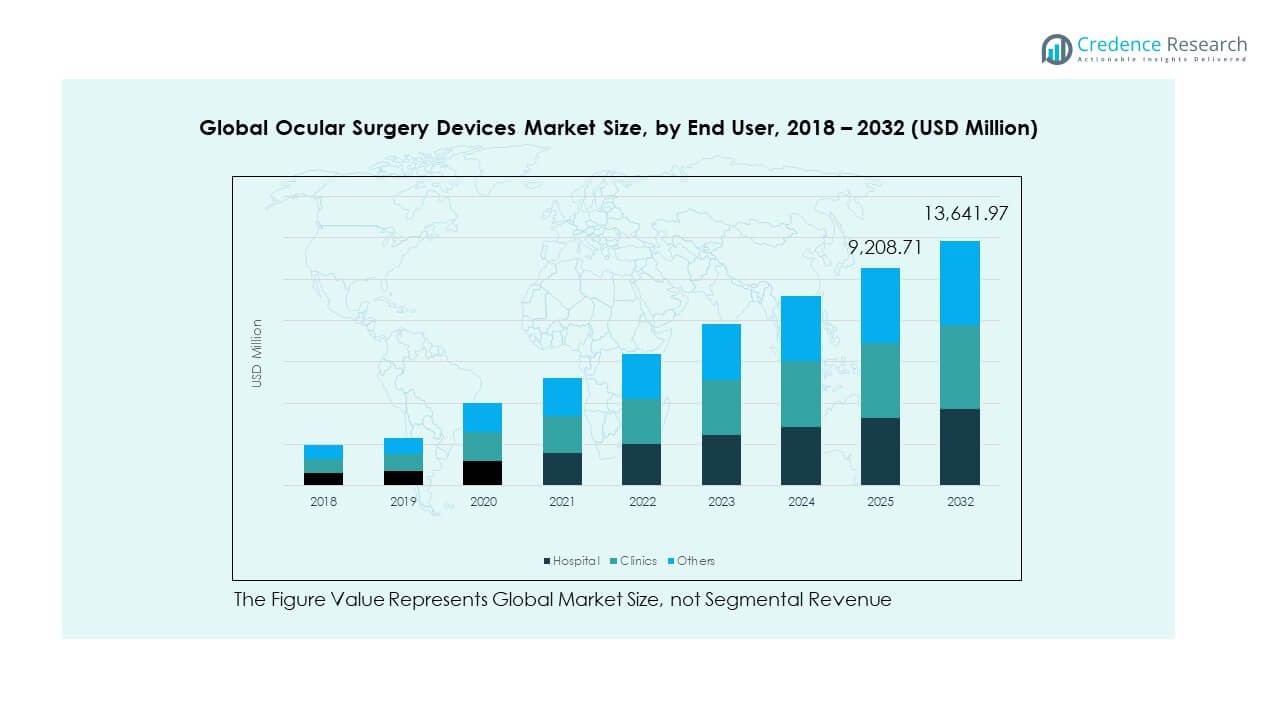

The Global Ocular Surgery Devices Market size was valued at USD 6,375.9 million in 2018 to USD 8,730.7 million in 2024 and is anticipated to reach USD 13,642.0 million by 2032, at a CAGR of 5.77% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ocular Surgery Devices Market Size 2024 |

USD 8,730.7 Million |

| Ocular Surgery Devices Market, CAGR |

5.77% |

| Ocular Surgery Devices Market Size 2032 |

USD 13,642.0 Million |

Market growth is driven by the rising prevalence of cataracts, glaucoma, and refractive disorders. Increasing demand for minimally invasive procedures and technological advancements in surgical tools are also propelling adoption. Aging populations, higher healthcare spending, and awareness about early diagnosis are encouraging more patients to opt for ocular surgeries globally. Continuous innovation in laser and robotic-assisted systems is improving precision and patient outcomes.

North America dominates due to advanced healthcare infrastructure, strong R&D capabilities, and widespread adoption of premium surgical devices. Europe follows closely with rising cataract and refractive surgeries supported by public health initiatives. Asia-Pacific is emerging as the fastest-growing region, driven by expanding medical tourism, improving access to eye care, and rising investments in ophthalmic facilities. Latin America and the Middle East are showing gradual growth due to healthcare modernization and awareness initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

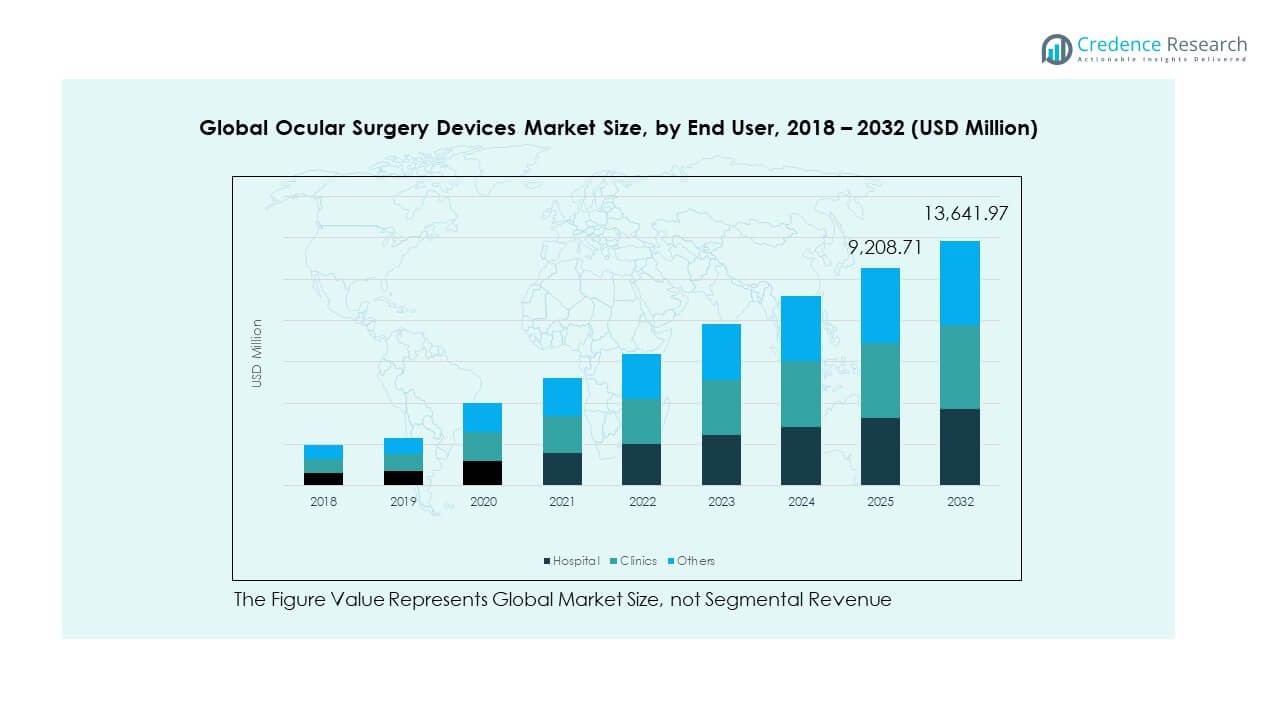

- The Global Ocular Surgery Devices Market size was valued at USD 6,375.9 million in 2018, increased to USD 9,208.71 million in 2024, and is projected to reach USD 13,641.97 million by 2032, growing at a CAGR of 5.77% during the forecast period.

- Asia Pacific holds the largest share at 33%, driven by expanding healthcare infrastructure, high cataract prevalence, and growing investments in ophthalmic technology. Europe follows with 26% due to its strong regulatory frameworks and advanced surgical systems. North America accounts for 23%, supported by innovation, aging population, and early adoption of advanced medical technologies.

- The Middle East is the fastest-growing region, holding a 5% share. Growth is fueled by healthcare modernization, government investment, and increasing prevalence of diabetes-related eye disorders.

- In the end-user segment, hospitals dominate with about 52% share, driven by superior infrastructure, advanced surgical tools, and skilled professionals.

- Clinics account for nearly 33% share, reflecting the shift toward outpatient and day-care ocular surgeries offering faster, cost-effective treatments.

Market Drivers:

Rising Prevalence of Ophthalmic Disorders Driving Demand for Advanced Surgical Solutions

The Global Ocular Surgery Devices Market is witnessing significant growth due to the increasing incidence of cataracts, glaucoma, and refractive errors worldwide. Aging populations in both developed and emerging countries are contributing to higher surgical volumes. Lifestyle factors such as prolonged screen exposure and diabetes are also increasing eye-related complications. It is driving demand for precision-based surgical devices that offer faster recovery and improved safety. Growing awareness about early diagnosis and preventive eye care is expanding the patient base. Healthcare organizations are also investing in advanced equipment to meet the rising treatment demand. These combined factors are creating a strong need for reliable ocular surgical technologies.

- For instance, Alcon launched the Clareon PanOptix Pro intraocular lens in May 2025, introducing ENLIGHTEN NXT optical technology that delivers 94% light utilization and half the light scatter compared to previous models, with clinical studies supporting high patient satisfaction rates for the PanOptix platform.

Technological Advancements in Surgical Instruments and Robotics Enhancing Efficiency

Continuous innovation in laser-assisted technologies, micro-incision tools, and robotic systems is improving the efficiency of ophthalmic surgeries. The Global Ocular Surgery Devices Market benefits from manufacturers focusing on compact, energy-efficient, and AI-enabled systems. It is leading to greater precision in cataract removal, corneal correction, and retinal surgeries. Minimally invasive techniques are reducing recovery time and postoperative complications. Integration of imaging guidance and smart sensors is improving surgical accuracy. Surgeons are increasingly adopting advanced platforms that provide better visualization and control. The focus on innovation is enhancing overall clinical outcomes and expanding procedural capabilities in ophthalmology.

- For instance, Johnson & Johnson Vision’s VERITAS Vision System features hybrid fluidics technology that minimizes post-occlusion surge, enhancing chamber stability, and provides dual pump systems for optimized lens extraction, enabling surgeons to adapt real-time during cataract surgeries with measurable safety and efficiency improvements.

Increasing Healthcare Spending and Insurance Coverage Expanding Accessibility

Rising global healthcare expenditure and expanding insurance coverage are enabling more patients to access advanced ocular treatments. The Global Ocular Surgery Devices Market is benefitting from government programs that promote affordable ophthalmic care. It is supporting hospitals and specialty clinics in upgrading surgical infrastructure. Public-private collaborations are also improving access to high-quality procedures in developing nations. Growing disposable incomes are encouraging patients to opt for elective and cosmetic eye surgeries. Healthcare providers are investing in cost-effective solutions to serve larger populations. These efforts are strengthening the global adoption of ocular surgery devices across both public and private sectors.

Growing Demand for Outpatient and Ambulatory Eye Surgeries Supporting Market Growth

The shift toward outpatient procedures is transforming the way eye surgeries are performed. The Global Ocular Surgery Devices Market is expanding as ambulatory surgical centers become preferred treatment locations. It is driven by cost advantages, faster recovery, and shorter hospital stays. Portable and easy-to-use devices are making such facilities more efficient and scalable. The demand for flexible and automated systems supports the growing trend of same-day eye surgeries. Patient preference for convenience and reduced waiting times is fueling the need for compact and versatile instruments. These evolving care models are boosting device sales across developed and emerging healthcare systems.

Market Trends:

Integration of Artificial Intelligence and Digital Imaging Transforming Surgical Precision

Artificial intelligence and digital imaging technologies are redefining ocular surgery capabilities. The Global Ocular Surgery Devices Market is adapting rapidly to AI-assisted diagnostic and surgical tools. It is enabling real-time decision-making, improved accuracy, and enhanced patient outcomes. AI-based algorithms help in predicting surgical risks and optimizing procedural planning. Digital visualization tools support detailed mapping of the eye structure, assisting surgeons in complex procedures. Cloud-based data platforms are also facilitating remote consultation and image sharing. These innovations are strengthening the precision and reliability of modern ocular surgery systems.

- For instance, in 2025 Zeiss launched AI-powered CIRRUS PathFinder and integrated FORUM workflow modules that automate diagnostics, plan advanced surgical procedures, and have empowered more than 12 million SMILE and SMILE pro refractive surgeries while improving predictability outcomes through personalized nomogram creation.

Increasing Preference for Minimally Invasive and Micro-Incision Procedures

Patient preference for less invasive procedures is reshaping ophthalmic device design. The Global Ocular Surgery Devices Market is experiencing rising adoption of micro-incision cataract surgery and femtosecond laser technology. It is reducing surgical trauma, shortening recovery periods, and improving visual outcomes. Device manufacturers are focusing on ergonomically designed instruments for enhanced handling and precision. Disposable surgical kits and smaller tools are gaining popularity in ambulatory settings. Demand for faster, safer, and painless surgeries continues to guide innovation. These developments are making eye care more patient-centric and efficient.

- For instance, Bausch + Lomb’s Stellaris Elite System supports both anterior and posterior eye surgeries, features 1.8 mm micro-incision instrumentation, and utilizes hypersonic vitrectomy for retinal procedures, providing surgeons customizable settings and improved tissue management for faster, less traumatic recoveries.

Growing Focus on Smart Surgical Systems and Automation

The adoption of smart, automated systems is expanding in ophthalmology. The Global Ocular Surgery Devices Market is witnessing strong interest in robotic-assisted devices with integrated imaging and control software. It is enabling surgeons to perform complex procedures with reduced manual effort. Automation enhances consistency, lowers fatigue, and minimizes error rates. Smart feedback systems are improving precision in delicate surgeries such as vitreoretinal and corneal repair. Continuous R&D investments are introducing adaptive systems that can self-adjust based on patient data. These advancements are driving a new era of intelligent ocular surgery platforms.

Sustainability and Reusability Trends Influencing Product Development

Growing awareness of environmental impact is shaping manufacturing practices. The Global Ocular Surgery Devices Market is moving toward sustainable materials and reusable components. It is driving manufacturers to adopt eco-friendly production methods and energy-efficient systems. Regulatory bodies are encouraging reduced medical waste through recyclable device packaging and sterilizable instruments. Hospitals are prioritizing suppliers offering sustainable and durable tools. The shift toward green medical technology aligns with global sustainability goals. These actions are setting new standards for responsible innovation in ophthalmic surgery.

Market Challenges Analysis:

High Cost of Advanced Surgical Devices and Limited Accessibility in Developing Regions

The Global Ocular Surgery Devices Market faces challenges due to the high cost of advanced surgical equipment. It is restricting adoption among small hospitals and clinics, particularly in low-income regions. Many healthcare providers struggle to justify investment in high-priced systems without steady patient flow. Limited access to financing and lack of trained personnel further widen the adoption gap. In developing countries, inadequate insurance coverage discourages patients from opting for premium procedures. Import taxes and distribution inefficiencies also raise product costs. These factors collectively create barriers to market expansion and slow technological penetration.

Regulatory Barriers and Shortage of Skilled Ophthalmic Surgeons

Strict regulatory requirements for device approval create delays in product launches and innovation. The Global Ocular Surgery Devices Market must comply with diverse regional safety and performance standards. It is adding complexity to global distribution strategies and increasing compliance costs. Limited availability of skilled ophthalmic surgeons restricts the number of advanced procedures performed annually. Training requirements for handling new robotic and laser systems are also extensive. Smaller facilities often lack the technical infrastructure to maintain such equipment. This combination of regulatory and skill-related limitations continues to constrain market scalability.

Market Opportunities:

Expansion in Emerging Markets Through Infrastructure Development and Awareness Programs

Rapid healthcare development in emerging economies offers significant growth opportunities. The Global Ocular Surgery Devices Market is poised to benefit from government initiatives improving ophthalmic care infrastructure. It is supported by campaigns promoting eye health awareness and early disease detection. Growing investments in specialty eye hospitals and mobile surgical units are expanding patient access. Partnerships with local distributors are improving product reach in remote regions. These trends open new avenues for manufacturers seeking regional diversification.

Innovation in Smart and Portable Ocular Devices Enhancing Global Adoption

Technological innovation is creating strong opportunities for portable and intelligent ocular devices. The Global Ocular Surgery Devices Market is evolving with compact, battery-powered tools ideal for outpatient and mobile settings. It is allowing healthcare providers to perform high-precision procedures with reduced infrastructure requirements. Integration of smart sensors and digital interfaces supports ease of use and accuracy. Rising demand for affordable, flexible, and scalable surgical solutions ensures sustained market expansion. These advancements are setting the stage for wider adoption across diverse healthcare environments.

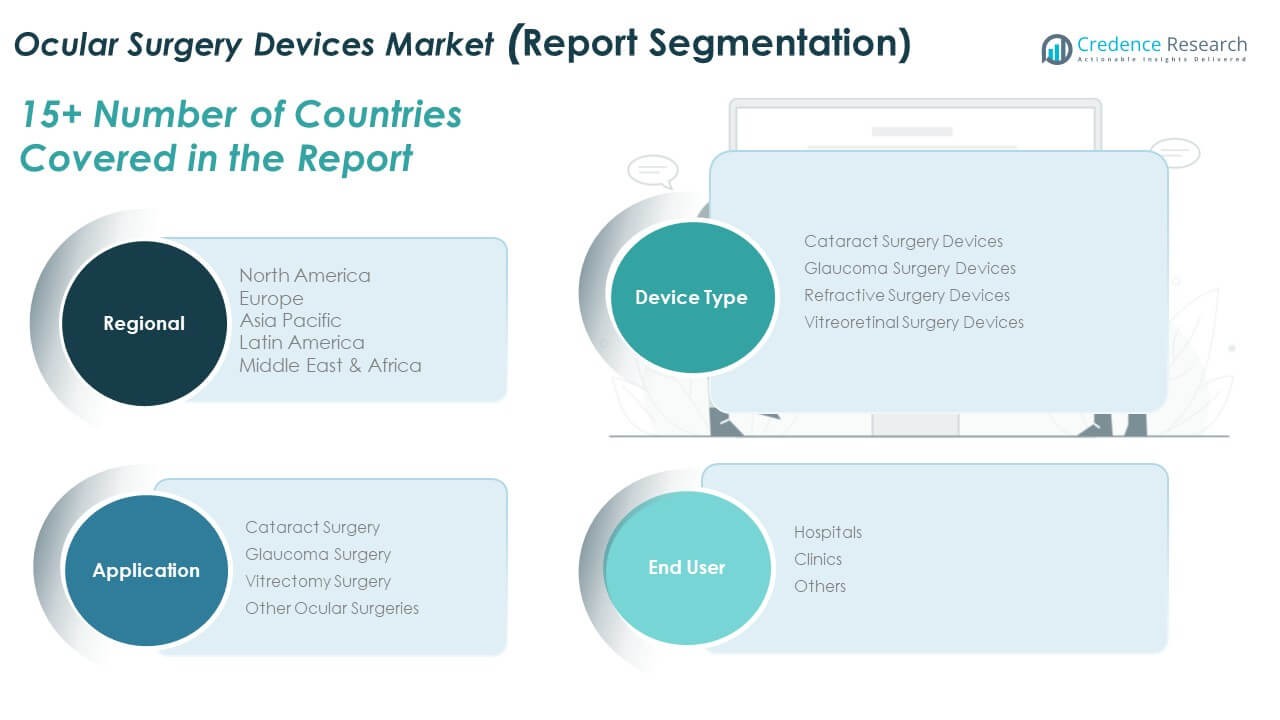

Market Segmentation Analysis:

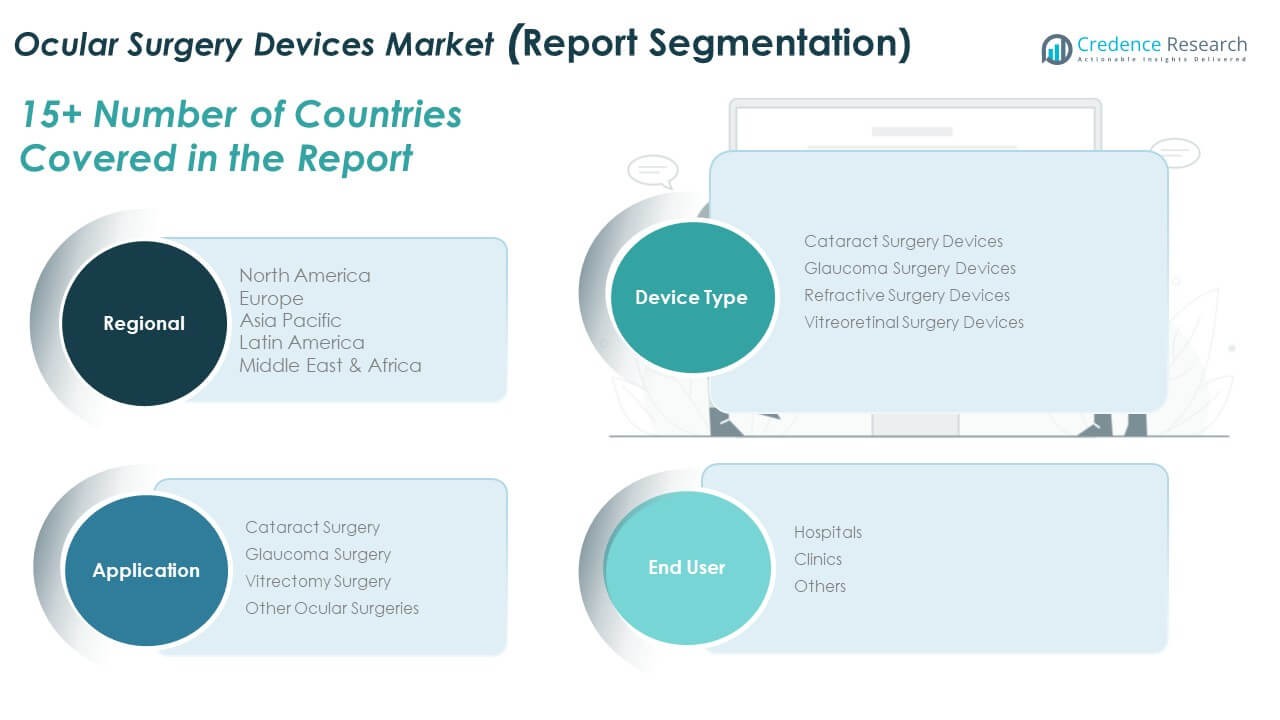

By Device Type

The Global Ocular Surgery Devices Market is segmented into cataract surgery devices, glaucoma surgery devices, refractive surgery devices, and vitreoretinal surgery devices. Cataract surgery devices hold the largest share due to high global prevalence of cataracts and rising demand for advanced intraocular lenses. Glaucoma surgery devices are gaining traction with the increasing cases of ocular hypertension. Refractive surgery devices continue to expand due to the growing adoption of laser-assisted correction procedures. Vitreoretinal surgery devices are advancing rapidly with innovations in micro-surgical systems and illumination tools.

- For instance, NIDEK launched the YC-200 S plus YAG and SLT Laser System featuring a 1.6 mJ plasma threshold for precise energy delivery, dual rotatable aiming beams for enhanced targeting, and an SLT-NAVI display that allows real-time tracking of treatments for improved glaucoma and refractive procedures.

By Application

The market is categorized into cataract surgery, glaucoma surgery, vitrectomy surgery, and other ocular surgeries. Cataract surgery remains dominant due to technological progress and a higher aging population. Glaucoma surgery contributes significantly, supported by early detection and minimally invasive techniques. Vitrectomy surgery is growing with the rise in retinal disorders and diabetic eye complications. Other ocular surgeries, including corneal and refractive procedures, are showing consistent adoption driven by improved treatment outcomes.

- For instance, Topcon’s 3D OCT-1 Maestro integrates automated optical coherence tomography with fundus photography and rapid scan speeds, delivering high-resolution cross-sectional images and supporting over 50,000 A-scans/sec—aiding diagnosis and surgical guidance in vitrectomy and diabetic retinopathy management.

By End User

Based on end user, the market includes hospitals, clinics, and others. Hospitals account for the majority share owing to advanced infrastructure, skilled professionals, and comprehensive treatment capabilities. Clinics represent a growing segment driven by cost-effective surgical options and convenience for patients. Other settings, including specialized eye care centers, are expanding with the increasing preference for outpatient and day-care surgeries. It reflects the market’s adaptability to evolving patient needs and care models.

Segmentation:

By Device Type

- Cataract Surgery Devices

- Glaucoma Surgery Devices

- Refractive Surgery Devices

- Vitreoretinal Surgery Devices

By Application

- Cataract Surgery

- Glaucoma Surgery

- Vitrectomy Surgery

- Other Ocular Surgeries

By End User

By Region

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Regional Analysis:

North America

The North America Global Ocular Surgery Devices Market size was valued at USD 1,509.16 million in 2018 to USD 2,029.14 million in 2024 and is anticipated to reach USD 3,092.63 million by 2032, at a CAGR of 5.4% during the forecast period. North America holds nearly 23% of the global market share, supported by advanced healthcare infrastructure and strong adoption of innovative surgical devices. The region benefits from widespread insurance coverage and a growing elderly population prone to cataract and glaucoma. It is driven by high investments in R&D, continuous product innovation, and favorable reimbursement policies. The U.S. leads regional growth with its strong presence of key manufacturers and advanced surgical centers. Canada shows steady progress with increasing awareness and public healthcare funding. Rising preference for outpatient procedures and robotic-assisted surgeries continues to strengthen market performance across the region.

Europe

The Europe Global Ocular Surgery Devices Market size was valued at USD 1,686.41 million in 2018 to USD 2,300.29 million in 2024 and is anticipated to reach USD 3,575.56 million by 2032, at a CAGR of 5.7% during the forecast period. Europe accounts for nearly 26% of the total market share, supported by high-quality ophthalmic care and technological innovation. The region’s growth is driven by an aging population and strong government initiatives promoting early diagnosis. It is benefiting from well-established healthcare systems and availability of specialized eye care facilities. Germany, France, and the U.K. remain the largest contributors due to their strong R&D ecosystems and device manufacturing capabilities. Rising demand for laser-assisted procedures and premium intraocular lenses is influencing product advancements. Increasing collaborations between hospitals and device manufacturers are enhancing access to advanced surgical systems.

Asia Pacific

The Asia Pacific Global Ocular Surgery Devices Market size was valued at USD 2,047.92 million in 2018 to USD 2,846.96 million in 2024 and is anticipated to reach USD 4,537.32 million by 2032, at a CAGR of 6.0% during the forecast period. Asia Pacific dominates with approximately 33% market share, representing the fastest-growing regional segment. Expanding healthcare infrastructure and rising awareness of ophthalmic diseases are key factors driving growth. It is supported by the increasing prevalence of cataracts and refractive disorders across populous nations such as China and India. Japan and South Korea are leading in technology adoption, while Southeast Asia shows rapid improvements in access to eye care. Growing medical tourism and affordability of surgeries attract patients from Western countries. Continuous government investments in public health programs are further stimulating regional market expansion.

Latin America

The Latin America Global Ocular Surgery Devices Market size was valued at USD 687.32 million in 2018 to USD 945.29 million in 2024 and is anticipated to reach USD 1,485.61 million by 2032, at a CAGR of 5.9% during the forecast period. Latin America contributes nearly 11% to the global market share, led by Brazil and Mexico. The region is witnessing rising adoption of modern surgical devices due to growing healthcare access and awareness. It is supported by the expansion of private healthcare facilities and partnerships with international device manufacturers. Public health programs are helping reduce the prevalence of preventable blindness. Urbanization and lifestyle changes are also contributing to an increase in ocular conditions. Efforts to improve affordability and training for ophthalmologists are enhancing overall surgical capabilities.

Middle East

The Middle East Global Ocular Surgery Devices Market size was valued at USD 304.77 million in 2018 to USD 429.30 million in 2024 and is anticipated to reach USD 695.74 million by 2032, at a CAGR of 6.3% during the forecast period. The region represents about 5% of the global market share, showing steady growth due to rising investments in healthcare modernization. The market is expanding with the establishment of specialized eye hospitals and clinics. It is driven by increased incidence of diabetes-related eye disorders and improved access to surgical technologies. Gulf Cooperation Council (GCC) countries are leading adoption, supported by high per capita income and strong public healthcare initiatives. Israel and Turkey are emerging centers for advanced ophthalmic innovation and regional exports. The focus on premium surgical systems and growing awareness of early treatment are sustaining market momentum.

Africa

The Africa Global Ocular Surgery Devices Market size was valued at USD 140.27 million in 2018 to USD 179.73 million in 2024 and is anticipated to reach USD 255.10 million by 2032, at a CAGR of 4.5% during the forecast period. Africa holds approximately 2% of the global market share, reflecting gradual but consistent progress. Growth is supported by government-led vision care initiatives and partnerships with global NGOs to improve access. It is challenged by limited infrastructure and a shortage of trained ophthalmic professionals. South Africa leads regional adoption with better healthcare capacity and public-private collaborations. Nigeria, Kenya, and Egypt are witnessing growing awareness and facility upgrades. Efforts to deploy mobile eye care units and teleophthalmology platforms are expanding treatment reach. Rising investments in regional training programs are expected to improve long-term market prospects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Alcon

- Johnson and Johnson Services, Inc.

- Bausch & Lomb Incorporated

- Hoya Corporation

- Oertli Instrumente AG

- Essilor International

- Geuder AG

- SCHWIND

- Topcon

- Nidek

Competitive Analysis:

The Global Ocular Surgery Devices Market is highly competitive, featuring strong participation from established manufacturers and innovative entrants. It is dominated by key players such as Alcon, Johnson & Johnson Services, Bausch & Lomb, Hoya Corporation, and Topcon. Companies focus on product innovation, mergers, and regional expansion to strengthen their global footprint. Technological advancements in micro-surgical tools and digital integration are shaping market competition. Strategic partnerships with hospitals and research institutes help firms enhance clinical efficiency. The industry also witnesses rising investments in R&D to develop minimally invasive and AI-enabled devices. Competitive intensity remains high due to rapid innovation and growing patient demand.

Recent Developments:

- In September 2025, Alcon launched the UNITY® Vitreoretinal Cataract System (VCS) and UNITY® Cataract System (CS), offering transformative innovations designed to elevate efficiency and outcomes in vitreoretinal and cataract surgeries. These advanced systems include UNITY 4D Phaco, HYPERVIT® 30K, and an intelligent fluidics system, enabling surgeons to operate under more physiologic conditions with enhanced precision.

- Bausch & Lomb acquired Elios Vision Inc. in December 2024, gaining access to the ELIOS excimer laser-based, minimally invasive glaucoma surgery (MIGS) technology. This acquisition enhances Bausch & Lomb’s glaucoma treatment portfolio with a novel laser procedure aimed at addressing glaucoma and ocular hypertension alongside cataract surgery.

- Hoya Corporation launched the VisuPro All Day and VisuPro Flex advanced focus spectacle lenses in February and September 2025, targeting young presbyopes. These lenses incorporate Binocular Harmonization Technology and Focus Max Optimization to improve vision clarity and reduce eye strain in early presbyopia patients, especially during near-distance and digital device use.

- Oertli Instrumente AG received FDA 510(k) clearance in July 2024 for its Faros anterior cataract surgery system, which features rapid operational readiness and precision fluid or vacuum control, optimized for efficient surgical workflows in office-based settings.

- EssilorLuxottica announced the acquisition of Optegra clinics in May 2025, a leading ophthalmology platform operating across five key European markets with over 70 eye hospitals and diagnostic centers. This acquisition advances EssilorLuxottica’s med-tech strategy by integrating comprehensive eye care, AI-powered technologies, and surgical treatments in one platform.

Report Coverage:

The research report offers an in-depth analysis based on Device Type, Application, and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for minimally invasive and laser-assisted ocular surgeries will continue to rise.

- Advancements in robotics and AI-based surgical platforms will enhance precision.

- Emerging economies will contribute significantly through healthcare infrastructure development.

- Integration of smart sensors and imaging systems will redefine surgical efficiency.

- Growing awareness about preventive eye care will boost procedure volumes.

- Digital connectivity and teleophthalmology will expand diagnostic accessibility.

- Strategic collaborations between OEMs and clinics will improve global reach.

- Training programs for surgeons will accelerate adoption of new technologies.

- Regulatory harmonization will simplify market entry for global manufacturers.

- Sustainable materials and reusable devices will gain focus to reduce medical waste.