Market Overview:

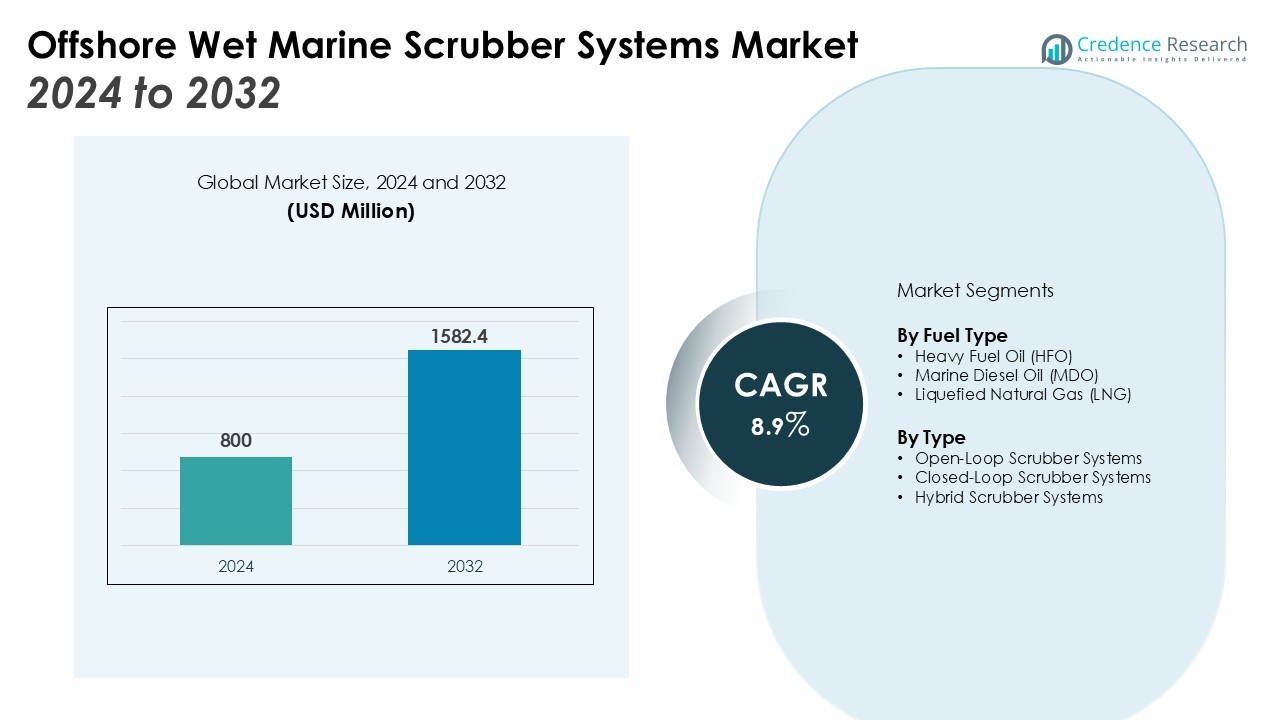

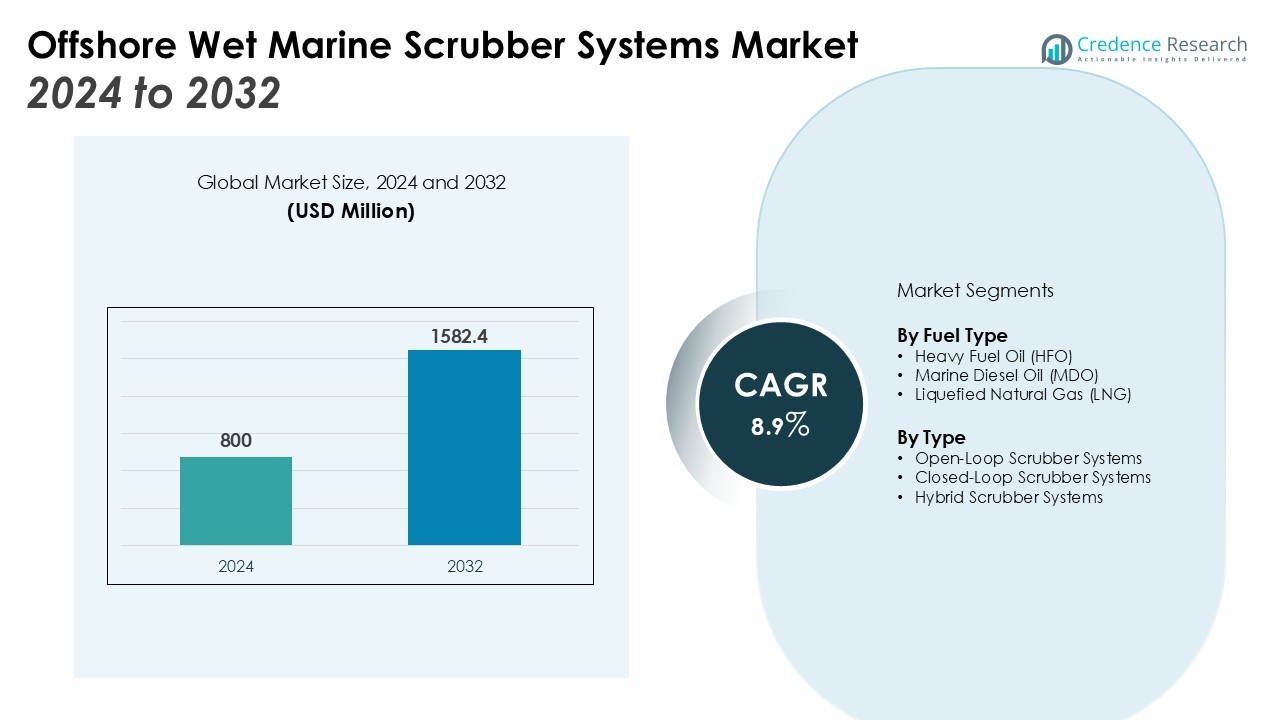

The Offshore Wet Marine Scrubber Systems Market size was valued at USD 800 million in 2024 and is anticipated to reach USD 1582.4 million by 2032, at a CAGR of 8.9% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Offshore Wet Marine Scrubber Systems Market Size 2024 |

USD 800 Million |

| Offshore Wet Marine Scrubber Systems Market, CAGR |

8.9% |

| Offshore Wet Marine Scrubber Systems Market Size 2032 |

USD 1582.4 Million |

Key drivers include increasing retrofitting of existing vessels to meet emission norms, rising adoption of hybrid scrubber systems, and long-term cost advantages over low-sulfur fuels. Furthermore, the growing offshore oil and gas sector, combined with rising global shipping activities, continues to push demand for efficient exhaust gas cleaning systems. Advancements in closed-loop and hybrid wet scrubber technologies are improving operational flexibility, lowering water discharge risks, and enhancing compliance in emission control areas (ECAs).

Regionally, Europe holds a dominant share due to strict regulatory frameworks and early adoption across offshore fleets. North America follows with strong enforcement by the U.S. EPA and significant offshore operations in the Gulf of Mexico. Asia Pacific is emerging as the fastest-growing market, supported by expanding shipbuilding capacity in China, South Korea, and Japan, coupled with rising offshore energy projects. Increasing government incentives for sustainable shipping practices are further reinforcing market adoption across developing regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Offshore Wet Marine Scrubber Systems Market was valued at USD 800 million and will reach USD 1582.4 million by 2032, expanding at a CAGR of 8.9%.

- Europe leads with 42% share due to strict emission norms, advanced retrofit facilities, and early adoption across offshore fleets.

- North America holds 28% share, supported by U.S. EPA enforcement and strong offshore oil and gas activity in the Gulf of Mexico.

- Asia Pacific accounts for 21% share and is the fastest-growing region, driven by shipbuilding capacity and rising offshore projects.

- Retrofitting vessels to comply with IMO 2020 rules and the rising adoption of hybrid systems are key growth drivers.

- High capital costs, operational complexities, and concerns over wash water discharge remain major challenges for operators.

- Advancements in closed-loop technologies and growing incentives for sustainable shipping practices are reinforcing long-term adoption.

Market Drivers:

Stringent International Maritime Regulations Driving Compliance Solutions

The Offshore Wet Marine Scrubber Systems Market is strongly influenced by global emission control policies, including the IMO 2020 sulfur cap, which requires vessels to cut sulfur emissions by 85%. Compliance with such regulations has compelled shipowners to adopt scrubber systems over expensive low-sulfur fuels. Wet scrubbers offer a proven and cost-efficient pathway for meeting emission standards. Their adoption has steadily increased among offshore vessels, particularly tankers and bulk carriers operating in Emission Control Areas (ECAs).

- For instance, CR Ocean Engineering’s multistream scrubber system installed on World Direct Shipping’s M/V Queen B III can remove about 5 tons of sulfur dioxide per day from the combined exhaust of the main and auxiliary engines.

Rising Preference for Hybrid and Closed-Loop Scrubber Systems

Ship operators are shifting toward hybrid and closed-loop scrubbers that allow flexibility across varied operating conditions. These systems reduce water discharge challenges while maintaining compliance in stricter regions. The Offshore Wet Marine Scrubber Systems Market benefits from this trend, as hybrid models combine the advantages of open- and closed-loop designs. This shift improves vessel efficiency, strengthens long-term sustainability, and reduces environmental risks for offshore operations.

Growing Offshore Oil and Gas Sector Creating Sustained Demand

The offshore oil and gas industry is expanding, requiring support vessels that comply with global emission norms. This growth stimulates demand for reliable exhaust cleaning technologies, reinforcing the market’s position in marine operations. It is particularly relevant in regions such as the North Sea and Gulf of Mexico, where strict environmental oversight applies. The Offshore Wet Marine Scrubber Systems Market gains momentum as offshore service providers integrate emission-reducing technologies to maintain operational permits and efficiency.

- For instance, Equinor’s Johan Sverdrup Phase 3 project in the Norwegian North Sea aims to sustain a production capacity of 755,000 barrels per day, reflecting the scale of offshore activities that demand advanced emission control systems.

Long-Term Cost Benefits Over Low-Sulfur Fuel Options

The rising cost of low-sulfur fuels encourages ship operators to adopt scrubber technologies. Wet scrubbers enable vessels to continue using heavy fuel oil while meeting emission standards, providing significant cost savings. This economic advantage strengthens investment decisions among shipping companies and offshore operators. The Offshore Wet Marine Scrubber Systems Market remains resilient due to its ability to deliver both regulatory compliance and long-term financial benefits.

Market Trends:

Increasing Integration of Advanced Technologies to Enhance System Efficiency

The Offshore Wet Marine Scrubber Systems Market is experiencing strong momentum with the integration of advanced monitoring, automation, and digital control technologies. These innovations allow ship operators to optimize scrubber operations, monitor emission performance in real time, and reduce manual intervention. It has created a pathway for higher efficiency and lower operational risks, especially in emission control areas. Manufacturers are investing in advanced sensors and automation tools that improve system accuracy and reliability. Digital platforms that connect scrubbers with broader ship management systems are also gaining traction, enabling better decision-making and compliance reporting. This trend strengthens operator confidence and reinforces the role of scrubbers as a long-term compliance solution.

- For instance, Valmet’s DNA automation system, used on more than 100 vessels globally, precisely controls scrubber washwater dosing and monitors sulfur oxide emissions in real time, reducing the need for manual operator adjustments.

Rising Demand for Environmentally Sustainable and Flexible Scrubber Designs

Global pressure for sustainable shipping practices is encouraging the development of scrubber systems that minimize environmental impact. The Offshore Wet Marine Scrubber Systems Market is witnessing a shift toward hybrid and closed-loop designs, which offer flexibility in diverse operating conditions while addressing water discharge concerns. It has increased adoption among offshore vessels operating in regions with stricter environmental enforcement. Manufacturers are focusing on modular, compact, and energy-efficient designs that reduce installation complexity and maintenance needs. These designs help operators achieve compliance while lowering the overall environmental footprint. Continuous innovation in environmentally friendly scrubber technologies is becoming a key differentiator for market players, shaping long-term adoption strategies across global offshore fleets.

- For instance, Wärtsilä’s closed-loop scrubber system manages fresh water consumption at an estimated rate of 0.2 cubic meters per megawatt-hour (m3/MWh) to optimize water usage during scrubbing.

Market Challenges Analysis:

High Capital Costs and Operational Complexities Restraining Adoption

The Offshore Wet Marine Scrubber Systems Market faces challenges due to the high initial investment required for installation. Many shipowners hesitate to retrofit older vessels because the cost often outweighs short-term fuel savings. It also demands regular maintenance, specialized crew training, and operational adjustments, which increase expenses. Complexities in retrofitting large offshore vessels further slow adoption. Smaller operators struggle to justify the financial commitment, creating a barrier to widespread market penetration. These financial and technical hurdles limit adoption despite clear regulatory benefits.

- For instance, Wärtsilä delivered its first CCS-ready scrubber systems in 2023 for four 8,200 TEU container vessels, futureproofing regulatory compliance and enabling smoother retrofit to carbon capture technologies later.

Environmental Concerns and Regulatory Uncertainty Impacting Growth

The Offshore Wet Marine Scrubber Systems Market is also constrained by environmental concerns related to wash water discharge and residue handling. Some regions enforce stricter limits on scrubber discharges, reducing flexibility for operators. It creates uncertainty for shipowners, who fear changing rules could affect return on investment. Regulatory differences across regions complicate deployment strategies for global fleets. Environmental advocacy groups continue to question the long-term sustainability of scrubbers compared to alternative solutions. Such concerns place pressure on manufacturers and operators to prove the viability of scrubbers as a lasting compliance option.

- For example, the IMO’s Resolution MEPC.340(77) from 2021 sets standardized guidelines for exhaust gas cleaning systems, including wash water discharge monitoring, helping shipowners align with international environmental criteria.

Market Opportunities:

Expansion of Offshore Energy Projects Creating Strong Growth Potential

The Offshore Wet Marine Scrubber Systems Market holds significant opportunities with the rising number of offshore energy projects worldwide. Growth in offshore oil, gas, and wind operations increases the demand for vessels that comply with strict emission regulations. It creates a steady requirement for scrubber systems across support vessels, drilling rigs, and transport fleets. Operators view scrubbers as a cost-effective compliance solution compared to switching entirely to low-sulfur fuels. Emerging offshore hubs in Asia Pacific and the Middle East offer untapped opportunities for suppliers. The rising scale of offshore activities ensures long-term demand for advanced and reliable exhaust cleaning systems.

Innovation in Eco-Friendly Scrubber Technologies Supporting Market Expansion

Opportunities are expanding with the development of eco-friendly scrubber designs that minimize water discharge and energy use. The Offshore Wet Marine Scrubber Systems Market is benefiting from strong research into hybrid and closed-loop systems that meet stricter environmental standards. It enables operators to achieve compliance while strengthening sustainability goals. Modular and compact systems offer faster installation and broader adoption across both newbuilds and retrofits. Manufacturers investing in next-generation scrubber solutions are positioned to capture demand from environmentally focused operators. This innovation-driven approach presents strong potential for long-term market growth across global offshore fleets.

Market Segmentation Analysis:

By Fuel Type

The Offshore Wet Marine Scrubber Systems Market is segmented by fuel type into heavy fuel oil (HFO), marine diesel oil (MDO), and liquefied natural gas (LNG). Heavy fuel oil dominates due to its lower cost compared to compliant fuels, making scrubbers a practical compliance choice. It allows operators to maintain economic efficiency while meeting international emission standards. Marine diesel oil is used in specific offshore vessels but remains less attractive due to higher costs. LNG is gaining traction, yet its adoption in offshore fleets is limited by infrastructure and storage challenges. The strong reliance on HFO ensures scrubbers remain essential in emission reduction strategies.

- For instance, Wärtsilä installed 35 scrubbers on vessels built at Japan Marine United shipyard, including a 25MW scrubber on a large crude carrier scheduled for 2022 delivery, demonstrating confidence in scrubbers’ effectiveness with high sulfur fuels.

By Type

The market by type is divided into open-loop, closed-loop, and hybrid scrubber systems. Open-loop systems hold significant share due to their lower installation costs and operational simplicity, particularly in areas with less restrictive discharge rules. Closed-loop systems are expanding in regions with strict wash water discharge regulations. Hybrid systems are recording the fastest growth as they provide flexibility to switch between modes depending on operating waters. It offers vessel operators compliance security and operational adaptability in emission control areas. The Offshore Wet Marine Scrubber Systems Market benefits from this shift, as hybrid systems increasingly appeal to global offshore fleets seeking long-term sustainable compliance.

- For instance, Wärtsilä’s hybrid scrubber upgrade installed on four vessels of Color Line removed sulfur oxide emissions while enabling flexible switching between open and closed loop modes for optimized operation.

Segmentations:

By Fuel Type

- Heavy Fuel Oil (HFO)

- Marine Diesel Oil (MDO)

- Liquefied Natural Gas (LNG)

By Type

- Open-Loop Scrubber Systems

- Closed-Loop Scrubber Systems

- Hybrid Scrubber Systems

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Europe Leading the Market with Strong Regulatory Enforcement

Europe held 42% share of the Offshore Wet Marine Scrubber Systems Market. This dominance reflects strict emission rules and early adoption of scrubber technologies across offshore fleets. The International Maritime Organization’s sulfur cap and regional policies in emission control areas have accelerated system installations. It has driven strong uptake among commercial shipping and offshore service operators. European shipbuilders and retrofit yards provide advanced infrastructure that supports expansion. Norway, Germany, and the Netherlands remain leaders in deploying hybrid and closed-loop scrubbers, reinforcing Europe’s position.

North America Strengthening Market Presence through Compliance and Offshore Activity

North America accounted for 28% share of the Offshore Wet Marine Scrubber Systems Market. This growth is supported by U.S. Environmental Protection Agency enforcement and offshore exploration in the Gulf of Mexico. It creates steady opportunities for retrofit and newbuild vessels across the region. Operators adopt scrubbers to balance compliance with cost efficiency in competitive offshore operations. Strong offshore oil and gas activity ensures consistent system demand. Investment in eco-friendly marine technologies continues to expand market presence in North America.

Asia Pacific Emerging as the Fastest-Growing Regional Market

Asia Pacific represented 21% share of the Offshore Wet Marine Scrubber Systems Market. The region is expected to record the fastest growth due to expanding shipbuilding capacity in China, South Korea, and Japan. It benefits from rising offshore oil, gas, and renewable energy projects. Adoption is further strengthened by regulatory pressure across coastal economies encouraging hybrid scrubber use. Governments in China and South Korea promote sustainable marine practices, boosting installations. Strong industrial capacity combined with growing demand ensures Asia Pacific’s leading growth trajectory.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Duconenv

- Wartsila

- Ecospray Technologies

- ANDRITZ

- Durr Systems

- DuPont Clean Technologies

- Fuji Electric

- Yara Marine Technologies

- Hyundai Heavy Industries

- Valmet

Competitive Analysis:

The Offshore Wet Marine Scrubber Systems Market is highly competitive with established global players and specialized regional firms. Leading companies focus on developing advanced hybrid and closed-loop systems that align with stricter emission rules and sustainability goals. It has created strong competition in product innovation, cost efficiency, and aftersales services. Major players strengthen their position through partnerships with shipbuilders, retrofitting service providers, and offshore fleet operators. Competitive strategies also emphasize modular designs, faster installation, and reduced operating costs to attract offshore operators. Rising demand for eco-friendly technologies drives continuous investment in research and development, allowing manufacturers to differentiate their offerings. The Offshore Wet Marine Scrubber Systems Market reflects an environment where technological advancement, regulatory compliance, and customer support determine leadership. Firms that deliver long-term reliability, compliance security, and cost benefits remain best positioned to capture market growth in a rapidly evolving global offshore sector.

Recent Developments:

- In June 2025, ANDRITZ announced its agreement to acquire the Salico Group, a company specializing in finishing lines for the metal industry.

- In June 2025, Ecospray Technologies launched a new amine-based carbon capture solution designed for the maritime sector.

- In May 2025, Ecospray Technologies completed the installation of two Exhaust Gas Cleaning Systems on the Celestyal Discovery cruise ship.

Report Coverage:

The research report offers an in-depth analysis based on Fuel Type, Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Offshore Wet Marine Scrubber Systems Market will expand as international emission rules tighten further across global shipping routes.

- Hybrid scrubber systems will record higher adoption, offering operators compliance flexibility across multiple regions.

- Digital monitoring and automation will enhance scrubber efficiency, reducing downtime and operational costs.

- Offshore oil and gas projects will continue to drive demand for scrubbers in support vessels and rigs.

- Governments promoting sustainable shipping practices will strengthen system adoption in emerging coastal economies.

- Closed-loop designs will gain momentum where strict wash water discharge restrictions are enforced.

- Retrofitting older offshore fleets will remain a strong revenue stream for manufacturers and service providers.

- Research and development investment will focus on modular, compact, and energy-efficient scrubber technologies.

- Europe will maintain its leadership position while Asia Pacific will emerge as the fastest-growing region.

- Long-term fuel cost advantages from scrubber adoption will reinforce their role as a reliable compliance solution.