Market Overview:

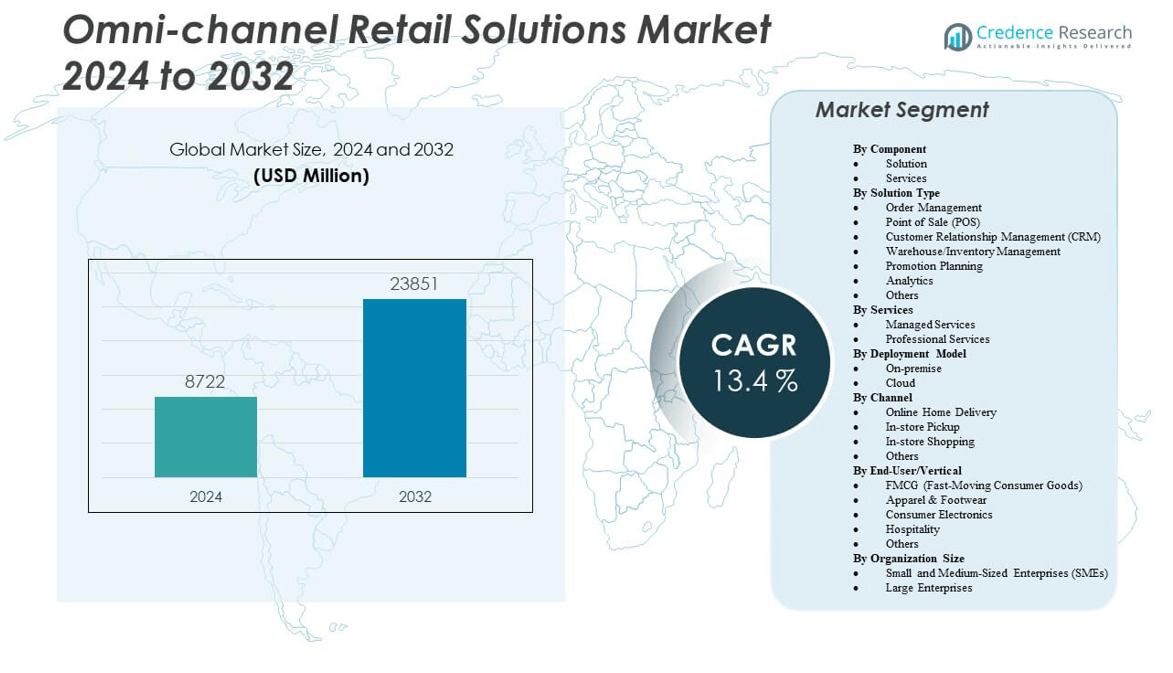

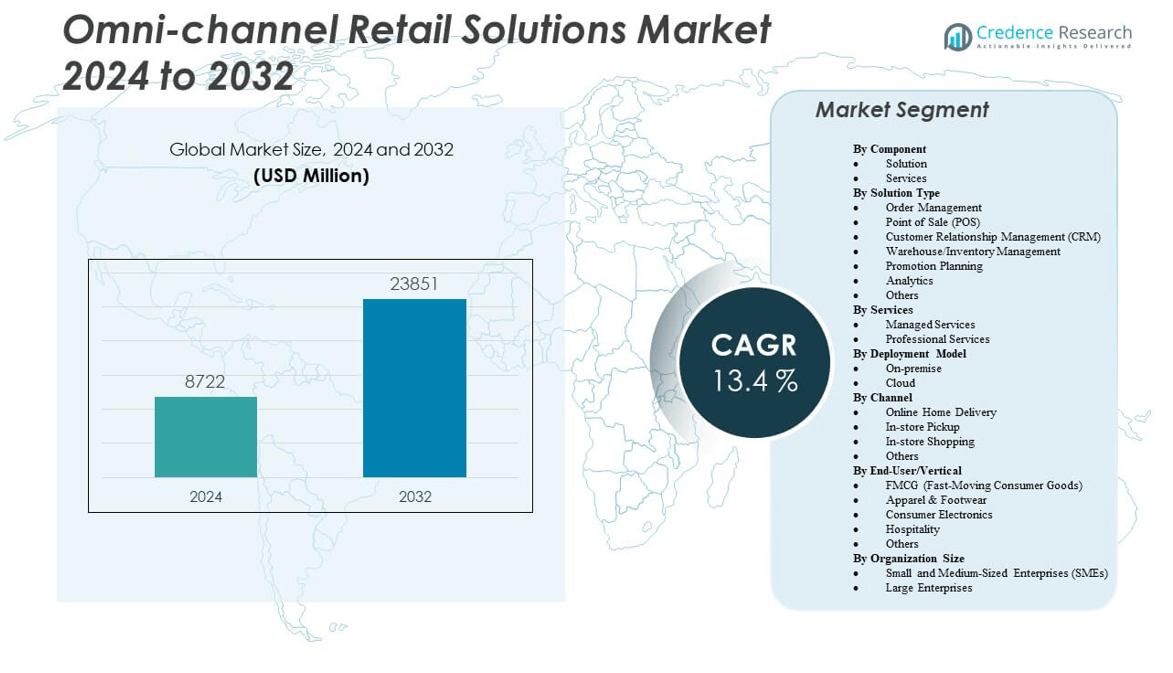

The Omni-channel Retail Solutions Market is projected to grow from USD 8,722 million in 2024 to an estimated USD 23,851 million by 2032, with a compound annual growth rate (CAGR) of 13.4% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Omni-channel Retail Solutions Market Size 2024 |

USD 8,722 million |

| Omni-channel Retail Solutions Market, CAGR |

13.4% |

| Omni-channel Retail Solutions Market Size 2032 |

USD 23,851 million |

The market is witnessing robust growth driven by retailers’ increasing focus on delivering seamless customer experiences across physical and digital touchpoints. Rising consumer expectations for personalized and consistent engagement across channels have prompted businesses to invest in integrated platforms. These solutions streamline inventory, unify customer data, and enable real-time analytics, empowering retailers to make data-driven decisions. Advancements in cloud computing, AI, and mobile commerce have further accelerated the adoption of omni-channel retail strategies among both large enterprises and SMEs.

Regionally, North America leads the Omni-channel Retail Solutions Market due to its mature e-commerce landscape and high digital adoption across retail sectors. Europe follows closely, supported by a strong focus on customer-centric retail transformation. Asia-Pacific is emerging as a fast-growing region, fueled by expanding internet penetration, smartphone usage, and a growing middle-class population. Countries like China and India are rapidly modernizing retail infrastructures, making them key growth hubs. Meanwhile, Latin America and the Middle East are gradually embracing omni-channel strategies, driven by rising urbanization and evolving consumer behavior.

Market Insights:

- The Omni-channel Retail Solutions Market is projected to grow from USD 8,722 million in 2024 to USD 23,851 million by 2032, registering a CAGR of 13.4% during the forecast period.

- Rising demand for integrated customer experiences across physical and digital retail channels continues to drive market adoption.

- The proliferation of AI, analytics, and cloud-based platforms is enabling retailers to streamline operations and improve customer targeting.

- High implementation and integration costs pose challenges, especially for SMEs with limited IT budgets and legacy infrastructure.

- North America leads the market share due to early technology adoption and advanced retail ecosystems, followed by Europe.

- Asia-Pacific is emerging as the fastest-growing region, driven by expanding e-commerce, mobile usage, and urban consumer trends.

- Market growth is moderated by concerns around data privacy, cybersecurity, and regulatory compliance across multi-channel systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Consumer Expectations for Seamless Shopping Experiences

Modern consumers demand a unified and personalized shopping experience across digital and physical platforms. This shift in behavior drives retailers to implement integrated solutions that ensure real-time inventory visibility, consistent pricing, and synchronized promotions. The growing reliance on smartphones and social commerce further increases demand for platforms that offer multi-channel interactions. The Omni-channel Retail Solutions Market addresses this need by enabling seamless transitions between online and offline retail channels. It supports businesses in retaining customers by minimizing friction across shopping touchpoints. High customer engagement levels and improved brand loyalty are strong motivators for market growth. Retailers are now prioritizing technologies that close gaps between physical and digital store experiences.

Technological Advancements Enabling Real-Time Data Synchronization

Retailers are leveraging cloud-based systems, AI, and IoT to streamline operations across sales channels. These technologies allow businesses to centralize data, track customer behavior, and predict demand more accurately. Real-time analytics improve decision-making, helping brands tailor offerings based on current trends and customer preferences. The Omni-channel Retail Solutions Market benefits from this shift by offering scalable platforms that support automation and predictive intelligence. It improves stock management and enhances the in-store and online experience through unified dashboards. Machine learning algorithms help segment customers for targeted marketing campaigns. Efficient CRM integration further contributes to this trend. Retailers adopting such innovations gain a competitive edge in delivering timely services.

- Machine learning models are increasingly embedded on POS terminals. For example, Microsoft’s Phi-3-mini (3.8B parameters) is a compact language model designed for on-device inference in resource-constrained environments, enabling predictive capabilities while reducing reliance on cloud connectivity.

Growing E-commerce Penetration Across Developing Economies

Rapid internet access expansion and smartphone adoption in emerging markets are accelerating digital retail adoption. Consumers in these regions increasingly explore hybrid shopping models, blending online research with in-store purchases. This behavioral change pushes local and global retailers to implement omni-channel capabilities. The Omni-channel Retail Solutions Market is expanding across Asia-Pacific, Latin America, and parts of the Middle East due to this shift. It enables retailers to connect with untapped consumer segments through mobile apps, digital wallets, and localized interfaces. This expansion also creates a need for language-agnostic systems and agile deployment. Retailers investing in market-specific customization tools gain early mover advantages. Demand from Tier 2 and Tier 3 cities reinforces this growth trend.

- For instance, Jabong.com reported in recent years that 60% of its revenue originated from smaller towns, and Indonesia’s BliBli found over a third of its 2.5 million customers are based in rural areas

Need for Centralized Inventory and Supply Chain Visibility

Retail supply chains have become increasingly complex with multi-location warehousing and fulfillment demands. Businesses must optimize logistics across storefronts, online orders, and return processes. Centralized inventory systems enable faster response times, reduce overstocking, and improve delivery accuracy. The Omni-channel Retail Solutions Market helps streamline inventory across touchpoints with synchronized ERP and warehouse management systems. It supports better demand forecasting by consolidating data from all platforms. Real-time insights allow quicker replenishment and dynamic pricing decisions. Retailers adopting these systems reduce operational inefficiencies. Streamlined logistics lead to higher customer satisfaction and lower fulfillment costs.

Market Trends:

Integration of Augmented Reality and Virtual Shopping Interfaces

Retailers are incorporating AR and VR to enhance digital shopping experiences, allowing consumers to visualize products in real-life environments. AR tools support virtual try-ons for apparel, makeup, and furniture, boosting confidence in purchase decisions. Virtual showrooms provide immersive brand experiences without physical presence. The Omni-channel Retail Solutions Market aligns with this trend by embedding interactive modules into mobile apps and websites. It helps brands replicate in-store ambiance through digital channels. These interfaces increase dwell time and conversion rates. Businesses deploying AR gain an innovative brand image. This trend is especially pronounced in fashion, cosmetics, and home décor sectors.

- For example, IKEA Place enables users to virtually place over 2,000 true-to-scale 3D furniture models in their homes using real-time camera mapping and ARKit-based spatial detection, automatically scaled with around 98% accuracy.

Rise of Voice Commerce and Conversational Shopping

Voice-enabled shopping assistants and chatbots are transforming how customers interact with retail platforms. Consumers increasingly rely on smart speakers and digital assistants to search for products, track orders, and receive personalized suggestions. The Omni-channel Retail Solutions Market incorporates voice commerce by enabling voice recognition integration into mobile and web interfaces. It supports natural language queries and faster checkout processes. Conversational interfaces drive customer engagement, especially in mobile-first economies. Retailers adopting this trend reduce dependency on manual customer service. Voice commerce also opens accessibility for visually impaired users, expanding inclusivity in digital retail.

- For instance, Walmart’s voice ordering service, developed in partnership with Google Assistant, processes more than 200,000 distinct product requests per day, using contextual processing to enable hands-free shopping, order tracking, and recurring list management.

Expansion of Click-and-Collect and BOPIS Models

Buy Online, Pick-up In Store (BOPIS) has emerged as a preferred fulfillment model for time-sensitive consumers. Retailers offering flexible pickup options reduce delivery timelines and increase foot traffic to physical stores. The Omni-channel Retail Solutions Market supports this shift by integrating backend logistics with POS and e-commerce platforms. It helps automate order routing, pickup notifications, and curbside delivery options. BOPIS enhances inventory turnover by merging digital demand with in-store availability. Retailers implementing this model improve operational agility. High adoption in urban centers has made click-and-collect a staple in omni-channel retail design.

Adoption of Hyper-Personalized Marketing Campaigns

Retailers are increasingly leveraging first-party data to design hyper-personalized marketing strategies. These campaigns focus on individualized product recommendations, dynamic pricing, and behavior-based outreach. The Omni-channel Retail Solutions Market enables such personalization through AI-powered customer profiling and real-time analytics. It empowers marketers to create context-aware campaigns across email, SMS, app, and in-store touchpoints. Hyper-personalization increases customer retention and average order value. It also reduces ad spend by targeting only relevant segments. Retailers using this approach gain deeper customer insights and improved ROI on marketing efforts.

Market Challenges Analysis:

Complexity of Integrating Legacy Systems with Modern Solutions

Many traditional retailers still operate on outdated IT infrastructure, making it difficult to implement modern omni-channel platforms. Integrating legacy POS systems, inventory tools, and CRM databases into cloud-based ecosystems requires substantial customization. The Omni-channel Retail Solutions Market faces barriers when retailers hesitate to overhaul their backend due to cost or operational disruptions. It complicates data consistency across platforms and hinders real-time synchronization. Migration processes often face delays or errors, especially when systems lack standardized APIs. Staff training on new platforms adds to operational strain. Businesses with tight budgets avoid large-scale transformation, limiting market expansion.

Data Security Concerns and Regulatory Compliance Burdens

Omni-channel operations generate large volumes of customer data across physical and digital channels. Ensuring privacy, security, and compliance with data protection regulations becomes a significant concern. The Omni-channel Retail Solutions Market experiences constraints when retailers fail to meet evolving standards like GDPR or CCPA. Breach incidents erode customer trust and invite penalties. Securing APIs, encrypting transactions, and managing data across multi-vendor systems are technically demanding. Small and mid-sized enterprises often lack robust cybersecurity protocols. These challenges slow adoption, especially in regions with strict legal frameworks.

Market Opportunities:

Emerging Demand from Mid-Sized and Regional Retailers

While large retailers have been early adopters, mid-sized and regional businesses are now seeking omni-channel solutions to remain competitive. These retailers need scalable, affordable platforms tailored to their operational size and customer base. The Omni-channel Retail Solutions Market can capitalize on this shift by offering modular solutions with flexible pricing. It allows regional players to digitize gradually without major capital investment. Cloud-hosted models and SaaS subscriptions lower entry barriers. Vendors offering localized support and integration services can penetrate deeper into Tier 2 and Tier 3 markets. This demand presents a large untapped growth avenue.

Growth Potential in AI-Driven Customer Engagement Platforms

AI-powered customer engagement tools are gaining traction across retail verticals. These systems offer real-time decision support, predictive analytics, and intelligent automation across touchpoints. The Omni-channel Retail Solutions Market can expand by integrating advanced AI tools into CRM, loyalty programs, and supply chain management systems. AI enables accurate demand forecasting, sentiment analysis, and churn prediction. Retailers leveraging AI reduce marketing inefficiencies and improve operational outcomes. Vendors who incorporate low-code or no-code customization into AI platforms can attract non-technical users. This creates new revenue streams and product differentiation in a competitive landscape.

Market Segmentation Analysis:

By component is divided into solutions and services. The solutions segment dominates due to strong demand for unified platforms that manage sales, inventory, and customer interactions across channels. Services also play a critical role, with businesses relying on support for system integration, updates, and performance optimization.

- For example, Walmart employs an advanced unified commerce infrastructure, integrating e-commerce, mobile app usage, and in-store systems into a cohesive retail ecosystem. This enables synchronized customer experiences, real-time inventory updates, and services like Buy Online–Pick Up In Store (BOPIS) and Scan & Go—leveraging data from nearly 5,000 U.S. stores across digital and physical channels.

By solution type, key segments include order management, point of sale (POS), and customer relationship management (CRM), each vital for delivering seamless shopping experiences. Warehouse and inventory management systems help improve stock accuracy, while promotion planning and analytics enable personalized offers and strategic insights.

By services, managed services are gaining popularity as they help maintain continuous system performance and minimize downtime. Professional services remain essential for deploying complex solutions, offering consulting, customization, and training support tailored to individual retailer needs.

By deployment model includes on-premise and cloud. The cloud segment is expanding rapidly due to its cost efficiency, scalability, and accessibility, making it the preferred choice for both SMEs and large enterprises.

- For example, Shopify Plus supports tens of thousands of high-volume merchants with a cloud-native platform that scales in real time during peak events like Black Friday–Cyber Monday. In 2023, Shopify merchants generated $9.3 billion in sales over the BFCM weekend, with the platform handling up to 58 million requests per minute without service interruption.

By channel, the market covers online home delivery, in-store pickup, and in-store shopping. Retailers increasingly invest in solutions that connect these touchpoints, allowing customers to switch seamlessly between digital and physical experiences.

By end-user or vertical, major segments include FMCG, apparel and footwear, consumer electronics, and hospitality. Each sector seeks to improve customer retention and sales through personalized, connected retail journeys.

By organization size, both small and medium-sized enterprises (SMEs) and large enterprises contribute to market growth. SMEs seek agile, scalable solutions, while large enterprises invest in advanced, integrated systems for enterprise-wide visibility.

Segmentation:

By Component

By Solution Type

- Order Management

- Point of Sale (POS)

- Customer Relationship Management (CRM)

- Warehouse/Inventory Management

- Promotion Planning

- Analytics

- Others

By Services

- Managed Services

- Professional Services

By Deployment Model

By Channel

- Online Home Delivery

- In-store Pickup

- In-store Shopping

- Others

By End-User/Vertical

- FMCG (Fast-Moving Consumer Goods)

- Apparel & Footwear

- Consumer Electronics

- Hospitality

- Others

By Organization Size

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America leads the Omni-channel Retail Solutions Market with a market share of 36%. The region benefits from early adoption of advanced retail technologies and a highly digitized consumer base. Strong e-commerce penetration and mature retail infrastructure drive the demand for integrated platforms. Major retailers such as Walmart, Amazon, and Target have heavily invested in omni-channel capabilities, including real-time inventory tracking and seamless checkout systems. Cloud-based CRM and AI-driven personalization tools are widely deployed across the U.S. and Canada. It continues to expand through strategic partnerships and acquisitions among technology providers and retail giants.

Europe holds the second-largest share in the Omni-channel Retail Solutions Market at 28%. Retailers across the UK, Germany, and France are prioritizing customer-centric digital strategies and unified commerce platforms. Strict data protection regulations like GDPR have encouraged the deployment of secure omni-channel systems. European consumers show strong preference for click-and-collect and mobile-first shopping, fueling demand for integrated apps and loyalty programs. Leading retailers in fashion and consumer electronics have adopted AI-based tools for targeted promotions and customer journey mapping. It maintains growth through regional innovation hubs and rising investment in AI and analytics.

Asia-Pacific accounts for 24% of the global Omni-channel Retail Solutions Market and represents the fastest-growing region. Rapid urbanization, increasing smartphone usage, and rising internet penetration support digital retail transformation in countries like China, India, Japan, and South Korea. Retailers in this region are leveraging mobile apps, QR-based payments, and social commerce to engage digitally savvy consumers. The market is expanding through government support for digital infrastructure and high consumer demand for personalized experiences. It attracts global tech vendors looking to tap into its vast retail base. Local players are also developing scalable omni-channel platforms tailored to regional languages and behaviors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- NCR Corporation

- Diebold Nixdorf, Inc.

- Infosys Limited

- Toshiba Corporation

- Oracle Corporation

- SAP SE

- IBM Corporation

- Cognizant Technology Solutions Corporation

- Salesforce, Inc.

- Infor Global Solutions, Inc. (Infor, Inc.)

- Microsoft

- Adobe

- Manhattan Associates

Competitive Analysis:

The Omni-channel Retail Solutions Market features intense competition among global technology providers, software vendors, and retail system integrators. Major players such as Oracle, SAP, IBM, Microsoft, Salesforce, and Adobe dominate through comprehensive product portfolios and continuous innovation. These companies invest heavily in AI, cloud, and analytics to enhance personalization, customer engagement, and backend integration. Mid-sized firms like Manhattan Associates and Infor compete by offering niche solutions tailored for specific retail segments. Strategic partnerships, acquisitions, and geographic expansions are common approaches to strengthen market presence. The Omni-channel Retail Solutions Market encourages innovation through robust R&D and collaboration with retail chains. It rewards vendors who can offer scalable, customizable platforms that enable real-time data sharing and seamless user experiences. The market remains dynamic with evolving consumer preferences and rapid technological advancements.

Recent Developments:

- IBM Corporation, in July 2025, launched the IBM Power11 a next-generation AI-ready server tailored for industries handling data-intensive workloads, such as retail, banking, and telecom. Power11 is engineered for real-time AI inference, reliability, and energy efficiency to support always-on enterprise operations, matching the complex needs of omni-channel retail strategies

- In May 2025, Diebold Nixdorf expanded its U.S.-based retail technology production in North Canton, Ohio. This move aimed to bolster its capabilities for manufacturing self-service checkouts and kiosk systems, notably producing self-ordering kiosks for partner Tillster to serve major QSR chains.

- In late May 2025, Infosys Limited launched over 200 enterprise AI agents as part of its Topaz AI offerings, in collaboration with Google Cloud. These agents are designed to boost enterprise efficiency across sectors like healthcare and finance, fortifying Infosys’s reach in omni-channel digital transformations.

- In January 2025, NCR Corporation unveiled advancements in its self-checkout offerings with the NCR Voyix Halo Checkout solution, integrating Everseen’s vision AI and product recognition technology to optimize the checkout experience for retailers.

Market Concentration & Characteristics:

The Omni-channel Retail Solutions Market is moderately concentrated, with a mix of global leaders and specialized regional vendors. It is characterized by high innovation, rapid technology upgrades, and strong customer service requirements. The market favors players offering integrated, cloud-based platforms with AI, analytics, and mobile capabilities. Retailers demand flexible, scalable systems to meet changing consumer behaviors and fulfillment models. Competitive differentiation relies on omnichannel depth, system interoperability, and user experience optimization. It attracts continuous investment in automation and customer journey analytics. Vendors with strong implementation support and industry-specific customization gain a distinct edge. The market continues to evolve with rising demand for personalization and real-time data-driven engagement.

Report Coverage:

The research report offers an in-depth analysis based on Component, Solution Type, Services, Deployment Model, Channel, End-User/Vertical and Organization Size, It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will experience strong growth driven by evolving consumer expectations and digital transformation.

- AI-powered analytics will be widely adopted to personalize customer experiences across all retail channels.

- Cloud-native omni-channel platforms will dominate due to their scalability, flexibility, and ease of integration.

- Unified commerce strategies will increase demand for real-time synchronization of inventory, orders, and customer data.

- Social commerce will drive vendors to embed real-time engagement and seamless checkout tools.

- Mobile-first retail strategies will expand rapidly in emerging markets with high smartphone penetration.

- Strategic alliances between tech providers and retailers will accelerate the development of advanced capabilities.

- Voice and conversational commerce will transform customer interactions with intuitive and fast service options.

- Data security and compliance will become essential as omni-channel systems manage sensitive customer information.

- Retailers will adopt modular, AR- and VR-enabled solutions to support phased digital transformation and enhance user experiences.