Market Overview:

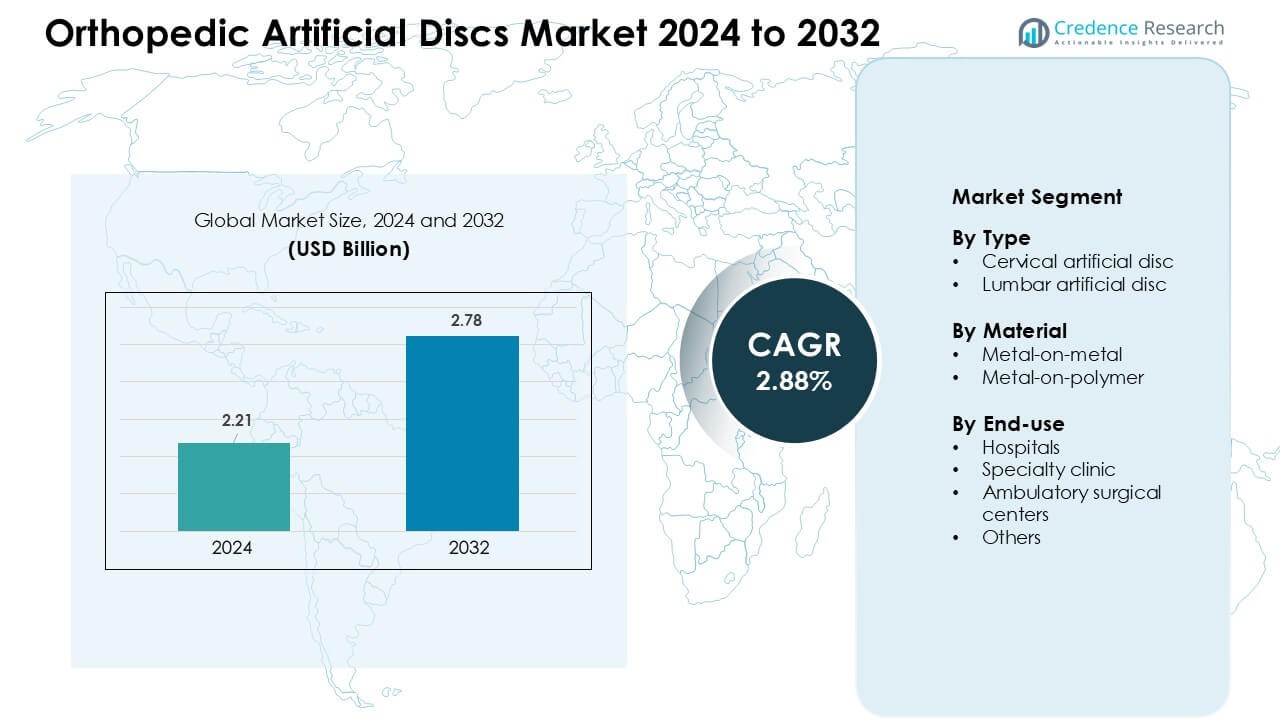

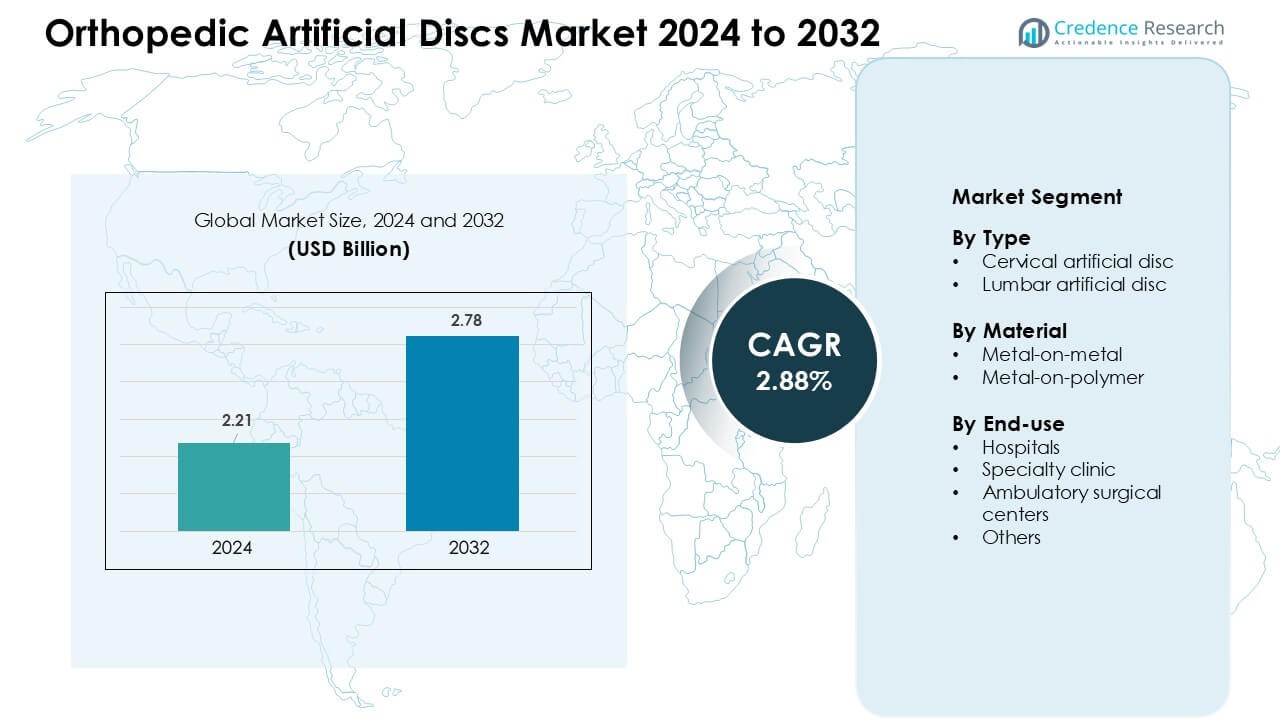

Orthopedic Artificial Discs Market was valued at USD 2.21 billion in 2024 and is anticipated to reach USD 2.78 billion by 2032, growing at a CAGR of 2.88 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Orthopedic Artificial Discs Market Size 2024 |

USD 2.21 Billion |

| Orthopedic Artificial Discs Market, CAGR |

2.88 % |

| Orthopedic Artificial Discs Market Size 2032 |

USD 2.78 Billion |

The Orthopedic Artificial Discs Market is shaped by key players such as Medtronic PLC, NuVasive Inc., Globus Medical Inc., DePuy Synthes Inc. (Johnson & Johnson), Orthofix International NV, B. Braun Melsungen AG, Simplify Medical Inc., Paradigm Spine LLC, AxioMed LLC, and KM Inc. These companies advanced their positions by introducing next-generation cervical and lumbar discs with improved material durability, better motion preservation, and enhanced surgical compatibility. North America led the global market with about 38% share, supported by strong reimbursement coverage, higher procedure volumes, and wider adoption of minimally invasive spine technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Orthopedic Artificial Discs Market reached USD 2.21 billion in 2024 and is projected to hit USD 2.78 billion by 2032, growing at a CAGR of 2.88% during the forecast period.

- Demand grew as rising degenerative disc disease cases and preference for motion-preserving surgery increased adoption, with cervical discs holding the largest share at about 62%.

- Trends included expanding use of minimally invasive disc replacement, improved metal-on-polymer designs, and wider acceptance of outpatient spinal procedures.

- Leading players intensified competition through advanced implant designs and regulatory approvals, while high procedure and implant costs continued to restrict adoption in developing regions.

- North America led the market with nearly 38% share, followed by Europe at about 32%, while Asia-Pacific showed the fastest growth due to rising healthcare investment and improving access to advanced spine surgery.

Market Segmentation Analysis:

By Type

Cervical artificial discs held the leading share in 2024 with about 62%. Surgeons preferred these implants because cervical procedures required shorter recovery time and offered higher motion preservation success. Rising cases of degenerative disc disease in the neck further pushed demand across developed regions. Lumbar discs grew at a slower pace due to higher procedure complexity and limited long-term data, yet adoption improved as newer designs reduced implant wear and improved stability during spinal movement.

- For instance, clinical reviews report that many cervical total disc arthroplasty (TDA) devices provide superior outcomes versus spinal fusion preserving range of motion while delivering reliable pain relief and functional improvement.

By Material

Metal-on-polymer discs dominated the market in 2024 with nearly 68% share. Hospitals adopted these models because the polymer core supported smoother articulation and created lower wear debris. Surgeons also favored them due to reduced revision rates compared with older metal-on-metal systems. Metal-on-metal discs maintained use in select patients needing higher load support, but their share continued to decline as global regulatory bodies tightened scrutiny over metal ion release and long-term biocompatibility.

- For instance, many widely used artificial disc devices such as ProDisc and Mobi‑C use a core of ultra-high molecular weight polyethylene (UHMWPE), a polymer known for resistance to delamination and low-friction articulation when paired with metal endplates, which minimizes abrasive wear compared to early all-metal designs.

By End-use

Hospitals led the end-use segment in 2024 with about 54% share. Large medical centers performed higher procedure volumes and offered advanced imaging, trained spine surgeons, and stronger postoperative care systems. Specialty clinics expanded as minimally invasive spine surgery gained traction, offering faster scheduling and lower procedural costs. Ambulatory surgical centers grew in adoption because patients preferred shorter stays, while other settings remained limited due to lower infrastructure readiness for complex disc replacement procedures.

Key Growth Drivers:

Rising Burden of Degenerative Disc Disorders

Global cases of degenerative disc disease increased as sedentary habits, aging populations, and higher diagnostic access expanded patient identification. The Orthopedic Artificial Discs Market grew as more patients sought motion-preserving alternatives to spinal fusion, which often limited long-term mobility. Cervical disc degeneration rose faster due to prolonged screen use and poor posture, pushing hospitals to adopt disc replacement earlier in the care pathway. Strong clinical evidence showing reduced adjacent segment disease and shorter rehabilitation supported wider use. Manufacturers also introduced implants with improved articulation, which encouraged spine surgeons to replace outdated fusion techniques. These changes created steady demand across both developed and developing regions.

- For instance, recent epidemiological studies link rising rates of intervertebral disc degeneration to lifestyle factors such as sedentary behavior and reduced physical activity, which increase the probability of disc dehydration, loss of elasticity, and collapse the hallmarks of DDD.

Shift Toward Motion-Preserving Spine Procedures

Surgeons increasingly preferred motion-preserving technologies because traditional fusion restricted spine flexibility and raised revision risks. The Orthopedic Artificial Discs Market benefited from this shift, supported by long-term outcome studies showing better neck and lumbar movement after disc replacement. New implant designs reduced wear, improved implant anchoring, and enhanced long-term biomechanical stability. Patient awareness grew through digital health platforms, pushing clinics to offer disc replacement as a first-line surgical option for suitable cases. Insurance approvals expanded in major countries as clinical safety data improved. Wider training programs for minimally invasive spine procedures also boosted adoption, especially in regions investing in modern spine-care infrastructure.

- For instance, patients undergoing Total Disc Replacement (TDR) often experience better mobility and flexibility post-surgery than those with fusion: motion-preserving surgery typically results in shorter hospital stays and quicker return to daily activities.

Advances in Implant Materials and Design Innovation

Material innovation played a central role in expanding the Orthopedic Artificial Discs Market, as manufacturers introduced metal-on-polymer systems with lower wear and enhanced biocompatibility. Polymer cores supported smoother load distribution, reducing revision surgeries and increasing surgeon confidence. Improved 3D-printed endplates enhanced bone integration and reduced implant migration risks. Companies focused on hybrid materials that offered better shock absorption and closer mimicry of natural disc behavior. These innovations aligned with demand for long-lasting implants suited for younger and more active patients. Regulatory approvals for next-generation discs also accelerated adoption and encouraged investment in research focused on durability, soft-tissue compatibility, and kinematic performance.

Key Trends & Opportunities:

Growing Adoption of Minimally Invasive Disc Replacement

Minimally invasive spine surgery continued to grow as hospitals sought faster recovery pathways and lower postoperative complications. The Orthopedic Artificial Discs Market benefited from new surgical tools, smaller incisions, and robotic navigation systems that improved precision. Surgeons favored minimally invasive disc replacement due to reduced blood loss and shorter hospital stays. Patient preference also shifted toward outpatient procedures supported by improved anesthesia and pain-management protocols. These conditions created strong opportunities for companies offering integrated surgical platforms and training programs. Markets in Asia-Pacific and Europe saw rising investment in minimally invasive spine units, which expanded global accessibility.

- For instance, robotic-assisted cervical disc replacement platforms enable placement accuracy within 1–2 mm of the planned trajectory, reducing risk of implant malposition and improving long-term motion outcomes.

Increasing Reimbursement Support in Key Healthcare Markets

Reimbursement expansion created strong opportunities for faster adoption of disc replacement procedures. As long-term outcome data matured, several health systems recognized disc replacement as cost-effective due to fewer revision surgeries compared with fusion. Improved coverage in the U.S., Germany, Japan, and other developed markets increased patient volume and encouraged hospitals to expand spine programs. Private insurers also updated policies to include newer cervical and lumbar disc models with proven clinical performance. This shift improved market stability and helped manufacturers invest more in clinical trials, surgeon training, and global product launches.

- For instance, coverage for cervical total disc replacement (cTDR) for Medicare beneficiaries is determined by individual Medicare Administrative Contractors (MACs) via Local Coverage Determinations (LCDs), which generally approve the procedure for specific criteria based on the clinical evidence demonstrating its effectiveness compared to fusion.

Key Challenges:

High Implant and Procedure Costs

High pricing remained a major challenge in the Orthopedic Artificial Discs Market, especially in developing regions where advanced spine procedures were less accessible. Implant costs, surgical tools, and postoperative care created financial barriers for many patients. Limited reimbursement in emerging markets further slowed adoption, prompting surgeons to rely on more affordable fusion procedures. Smaller clinics struggled with the capital investment needed for advanced imaging and motion-preserving instrumentation. Without broader cost reduction or reimbursement expansion, adoption in cost-sensitive markets continued to lag, limiting global penetration.

Complexity of Clinical Evaluation and Regulatory Approval

Disc replacement devices faced strict regulatory scrutiny due to long-term safety requirements and the need for extensive biomechanical testing. The Orthopedic Artificial Discs Market experienced longer approval timelines as authorities demanded multi-year durability data and postmarket surveillance commitments. Variations in anatomical structure across patient groups added complexity to clinical trials. Surgeons also required extensive training to ensure correct implant positioning, which slowed early adoption in new regions. These regulatory and clinical hurdles increased development costs for manufacturers, delaying product introductions and limiting the number of competitors able to enter the market.

Regional Analysis:

North America

North America led the Orthopedic Artificial Discs Market in 2024 with nearly 38% share. The region benefited from strong adoption of motion-preserving spine procedures and wider insurance coverage for cervical and lumbar disc replacements. High awareness of minimally invasive surgery supported early patient acceptance, while major hospitals invested in advanced imaging and robotic navigation. Manufacturers introduced next-generation implants faster in the U.S. due to clear regulatory pathways. Rising cases of degenerative disc disease linked to aging and sedentary work habits further sustained demand. Strong surgeon training programs continued to strengthen procedure volumes across key spinal care centers.

Europe

Europe held about 32% share in 2024, supported by well-established spine centers and wider access to cervical disc replacement. Germany, France, and the U.K. led adoption as health systems recognized disc replacement as a cost-effective alternative to fusion. Surgeons favored metal-on-polymer implants due to favorable long-term outcomes. Regulatory approvals for new materials expanded choice across major hospitals. Rising aging populations and improved referral systems increased candidate identification for disc replacement. Strong emphasis on minimally invasive approaches and broader reimbursement also supported sustained growth across Western and Northern Europe.

Asia-Pacific

Asia-Pacific accounted for nearly 24% share in 2024 and remained the fastest-growing region. Rising healthcare investment in China, India, South Korea, and Japan improved access to modern spine surgery. Growing middle-class populations increased demand for procedures offering faster recovery and better mobility. Hospitals expanded minimally invasive spine units, while international training programs improved surgeon capability. Increasing rates of disc degeneration linked to sedentary lifestyles also pushed adoption. Local manufacturers entered the market with cost-effective implants, which enhanced availability. Government initiatives to upgrade surgical infrastructure further supported strong long-term growth.

Latin America

Latin America captured about 4% share in 2024, driven by gradual adoption of cervical disc replacement in Brazil, Mexico, and Argentina. Growth remained steady as private hospitals invested in advanced spine technologies. However, high procedure costs and limited reimbursement slowed penetration across public health systems. Increasing medical tourism for spine care helped expand volume in select centers. Rising awareness of motion-preserving procedures encouraged more orthopedic surgeons to adopt disc replacement techniques. Continued investment in training and better supply-chain access supported slow but consistent market expansion across major urban regions.

Middle East & Africa

The Middle East & Africa region held nearly 2% share in 2024, reflecting limited access to advanced spine surgery. Wealthier markets like the UAE, Saudi Arabia, and Qatar led adoption due to higher investment in orthopedic centers. Demand grew steadily as degenerative spine disorders increased and patients sought faster recovery options. However, high implant costs and shortage of trained spine surgeons constrained broader use. Africa saw very slow uptake due to limited infrastructure. Ongoing hospital modernization and partnerships with global medical device companies were expected to gradually improve regional availability.

Market Segmentations:

By Type

- Cervical artificial disc

- Lumbar artificial disc

By Material

- Metal-on-metal

- Metal-on-polymer

By End-use

- Hospitals

- Specialty clinic

- Ambulatory surgical centers

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the Orthopedic Artificial Discs Market includes leading companies such as Medtronic PLC, NuVasive Inc., Globus Medical Inc., DePuy Synthes Inc. (Johnson & Johnson), Orthofix International NV, B. Braun Melsungen AG, Simplify Medical Inc., Paradigm Spine LLC, AxioMed LLC, and KM Inc. Competition intensified as firms expanded cervical and lumbar disc portfolios with improved materials, advanced articulation designs, and enhanced biomechanical stability. Companies focused on regulatory approvals, long-term clinical data generation, and surgeon training to strengthen adoption. Motion-preserving technologies gained priority, pushing manufacturers to invest in hybrid materials, 3D-printed endplates, and minimally invasive compatibility. Strategic partnerships with spine centers, mergers, and acquisitions also shaped growth as firms sought global expansion. Strong demand in North America and Europe encouraged continuous product upgrades, while emerging markets created opportunities for cost-effective implant lines.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Medtronic PLC

- NuVasive Inc.

- Globus Medical Inc.

- DePuy Synthes Inc. (Johnson & Johnson)

- Orthofix International NV

- Braun Melsungen AG

- Simplify Medical Inc.

- Paradigm Spine LLC

- AxioMed LLC

- KM Inc.

Recent Developments:

- In November 2025, AxioMed LLC: A peer-reviewed biomechanical study showed that AxioMed Viscoelastic Total Disc Replacement (VTDR) replicates the natural mechanical behaviour of a healthy human lumbar disc, across compression, flexion-extension and shear.

- In October 2025, DePuy Synthes Inc. (Johnson & Johnson) announced plans to separate its orthopaedics business (DePuy Synthes) into a standalone company, a strategic move that will refocus DePuy as a large, independent orthopaedics leader and may accelerate investment/strategy changes across its spine and disc product lines.

- In July 2025, B. Braun’s activL® lumbar disc (Aesculap/B. Braun) had its U.S. rights licensed to Highridge Medical for a U.S. relaunch; Highridge announced it would commence production and bring activL back to the U.S. market later in 2025. This licensing move signals renewed commercial activity around a B. Braun/Aesculap lumbar disc in the U.S. market.

Report Coverage:

The research report offers an in-depth analysis based on Type, Material, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for artificial discs will rise as motion-preserving surgery becomes more common.

- Cervical disc replacement will stay the dominant procedure across major spine centers.

- New implant materials will improve durability and reduce long-term wear issues.

- Minimally invasive disc replacement will expand due to shorter recovery times.

- Surgeons will adopt more robotic and navigation-guided techniques for precision.

- Reimbursement coverage will broaden in developed markets, boosting procedure volumes.

- Emerging markets will see faster adoption as surgical infrastructure improves.

- Younger patients will choose disc replacement over fusion for better mobility.

- Clinical trials will support wider approvals for next-generation lumbar discs.

- Global industry players will invest more in training programs and digital planning tools.