Market Overview:

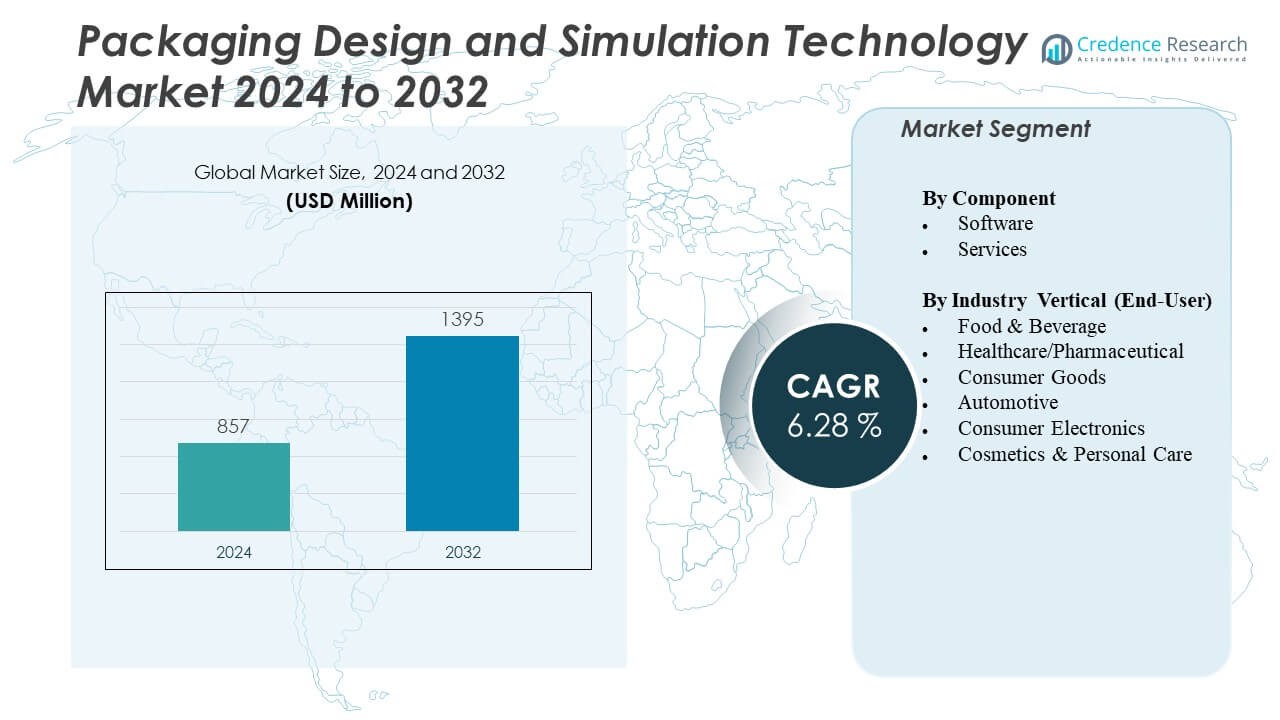

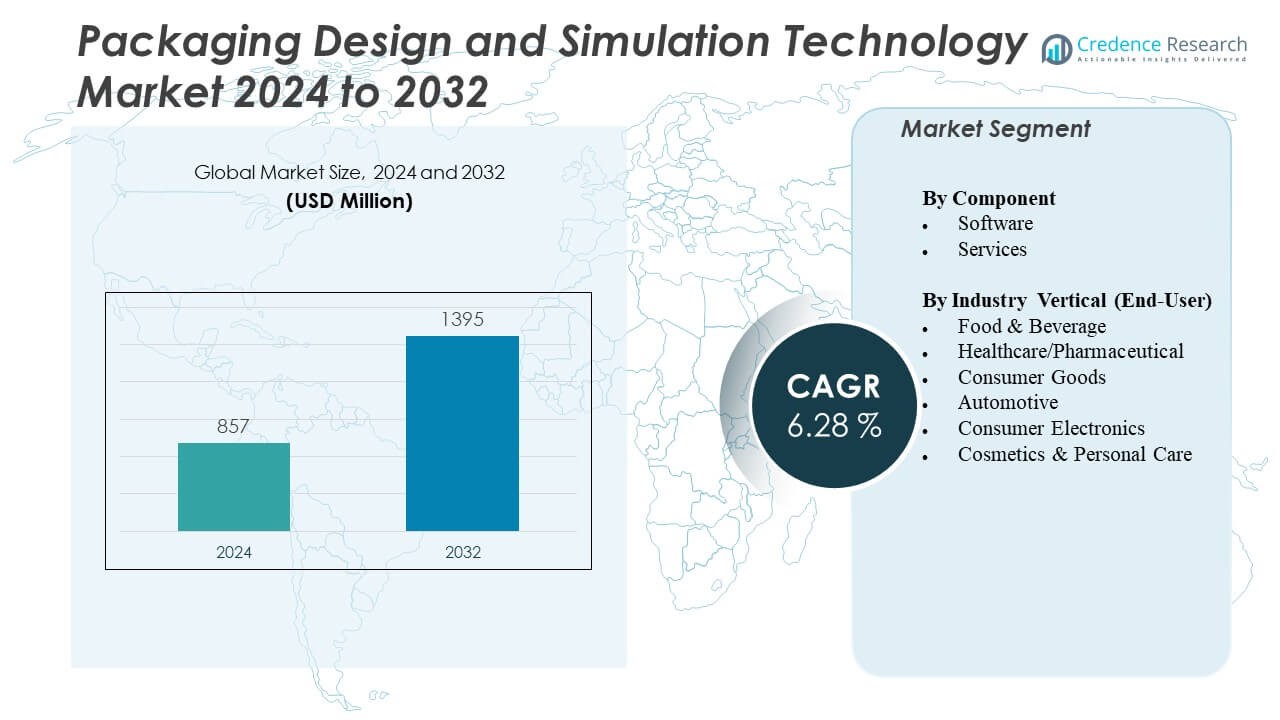

The Packaging Design and Simulation Technology Market is projected to grow from USD 857 million in 2024 to an estimated USD 1395 million by 2032, with a compound annual growth rate (CAGR) of 6.28% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Packaging Design and Simulation Technology Market Size 2024 |

USD 857 Million |

| Packaging Design and Simulation Technology Market, CAGR |

6.28% |

| Packaging Design and Simulation Technology Market Size 2032 |

USD 1395 Million |

The market is witnessing strong momentum due to increasing demand for cost-effective, sustainable, and innovative packaging solutions across industries such as food and beverage, pharmaceuticals, and consumer goods. Companies are actively adopting simulation tools to reduce prototyping costs, improve design efficiency, and ensure structural integrity under various supply chain conditions. The push for sustainability and lightweight packaging has further accelerated the use of digital technologies in packaging design, helping businesses optimize materials and meet regulatory compliance.

North America holds a leading position in the Packaging Design and Simulation Technology Market, driven by advanced manufacturing ecosystems and strong investment in R&D. Europe follows closely, with a focus on sustainability and packaging innovation. The Asia-Pacific region is emerging rapidly, particularly in countries like China, India, and South Korea, due to expanding consumer markets, rising e-commerce activity, and growing awareness among manufacturers about simulation benefits. These regions are investing in automation and digital design tools to enhance packaging efficiency and meet the dynamic demands of end-users.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Packaging Design and Simulation Technology Market was valued at USD 857 million in 2024 and is projected to reach USD 1395 million by 2032, growing at a CAGR of 6.28%.

- Rising demand for cost-efficient, sustainable, and faster packaging development drives widespread adoption of simulation tools.

- Regulatory compliance pressures push manufacturers to adopt digital design tools that ensure accuracy and standardization.

- High initial investment and complexity in software integration limit adoption, particularly among small enterprises.

- North America leads the market with 35.2% share, supported by strong R&D investment and early adoption of digital technologies.

- Europe follows with 29.4% share, driven by sustainability mandates and packaging innovation.

- Asia-Pacific, holding 24.7% share, is the fastest-growing region due to expanding manufacturing and increased demand for quality packaging.

Market Drivers:

Rising Demand for Cost Optimization and Efficient Time-to-Market Solutions

Manufacturers are investing in packaging simulation tools to minimize costs linked to physical prototyping and repetitive testing. These technologies streamline design validation, enabling quicker iterations and shorter development cycles. The Packaging Design and Simulation Technology Market benefits as firms reduce product launch delays through digital optimization. It supports accurate prediction of material behavior under varying supply chain conditions, improving packaging reliability. Businesses aim to cut costs without compromising product safety, boosting simulation adoption. The shift towards lean product development processes enhances market uptake. The integration of design and simulation accelerates decision-making and reduces time-to-market. The market gains traction among industries requiring agile packaging solutions.

- For instance, Siemens has enabled packaging machines to increase their output by 33% using artificial intelligence and digital twin simulation, significantly accelerating the design validation process and reducing development cycles without additional physical prototyping.

Strict Regulatory Pressure for Packaging Compliance and Sustainability

Global regulatory frameworks are enforcing stricter packaging standards around sustainability, material use, and labeling. Companies must ensure their packaging complies with safety, recyclability, and environmental mandates. The Packaging Design and Simulation Technology Market addresses these demands by enabling early-stage testing for compliance. It allows companies to adjust designs to meet laws across different countries without physical trials. Firms rely on simulation to avoid penalties and reduce rework associated with non-compliant packaging. The technology improves material efficiency, helping meet environmental goals while reducing costs. Simulation tools also facilitate documentation and traceability during audits. Regulatory compliance continues to be a primary market driver.

- For example, Esko’s collaborative design software allows for real-time design reviews and approval tracking, reducing packaging errors and rework through digital documentation and clear compliance traceability.

Growth of E-Commerce and Complex Logistics Driving Robust Packaging Needs

The surge in online retail and global logistics operations demands durable and adaptable packaging designs. Simulation tools evaluate how packaging withstands impacts, vibrations, and climatic conditions during shipping. The Packaging Design and Simulation Technology Market supports businesses seeking reliable performance across varied distribution channels. It enhances package resilience, protecting brand reputation and reducing returns. E-commerce growth intensifies the need for lightweight, high-performance packaging. Simulation enables optimization of both structural and aesthetic design for diverse SKUs. Companies use these tools to meet consumer expectations while managing delivery costs. It helps streamline fulfillment efficiency by aligning packaging with automated handling systems.

Growing Focus on Reducing Material Waste and Enhancing Sustainability

Packaging manufacturers aim to reduce excess material use while ensuring product safety. Simulation tools help achieve this by modeling and testing packaging durability using minimal materials. The Packaging Design and Simulation Technology Market responds to sustainability objectives by promoting lightweight, recyclable, and biodegradable solutions. It enables digital experimentation without physical waste, supporting circular economy initiatives. Companies use it to simulate different material combinations, predicting performance with high accuracy. The approach reduces trial-and-error phases, minimizing material wastage. Simulation also assists in creating eco-label-compliant designs. This driver aligns with consumer preference for sustainable packaging and corporate ESG commitments.

Market Trends:

Integration of AI and Machine Learning for Intelligent Packaging Design

The Packaging Design and Simulation Technology Market is witnessing rapid integration of AI and machine learning for automated design enhancements. These technologies analyze large datasets to optimize design parameters based on past performance metrics. AI-driven platforms generate smarter design suggestions, improving accuracy and reducing development time. Machine learning models predict performance outcomes, enabling iterative improvements with minimal manual intervention. AI also aids in customizing designs to suit specific consumer or regional requirements. It supports scenario modeling for extreme conditions, improving product protection. Firms gain competitive advantages by embedding AI into simulation workflows. AI integration marks a transformative shift in the packaging design lifecycle.

- For instance, Amazon’s application of machine learning in logistics and packaging design led to a 43% reduction in average per-shipment packaging weight from 2015 to 2023, avoiding more than 3 million tonnes of packaging material and eliminating nearly 80,500 tonnes of single-use plastic since 2020.

Rise in Adoption of Cloud-Based Simulation Platforms

Enterprises are shifting towards cloud-hosted packaging design and simulation solutions for scalability and collaboration. Cloud-based platforms offer real-time access to simulation environments across geographies. The Packaging Design and Simulation Technology Market benefits from increased remote work and globalized R&D teams. Cloud platforms enable version control, instant sharing of design files, and integration with digital asset management systems. Users can access high-performance computing for complex simulations without capital-intensive infrastructure. These solutions reduce IT overhead while improving development agility. The flexibility of cloud-based tools accelerates design cycles and strengthens cross-functional coordination. It is driving a fundamental change in simulation software deployment.

- For instance, EUROpack A/S adopted SimScale’s cloud-based simulation tool to validate thermal packaging designs. By leveraging cloud computing, EUROpack was able to run parallel transient thermal simulations on 64 cores, cutting simulation times from 3–4 days (traditional climate chamber testing) down to just 3 hours per case.

Customization of Packaging Designs for Personalization and Brand Identity

Consumer goods companies are emphasizing packaging as a critical branding tool, leading to increased customization efforts. Simulation technology supports this by enabling rapid modeling of diverse formats and structural aesthetics. The Packaging Design and Simulation Technology Market supports brands that pursue differentiated packaging aligned with evolving customer preferences. It helps test unique shapes, colors, and materials while ensuring structural integrity. Simulation tools validate shelf impact and user interaction through virtual prototypes. Companies can experiment with tailored designs without incurring prototyping delays. This trend is reshaping product packaging into a key differentiator. It fuels growth in both consumer and luxury segments.

Expansion of Simulation Use into Sustainability Certifications and Digital Twins

Businesses are expanding simulation usage to support digital twin modeling and sustainability reporting. The Packaging Design and Simulation Technology Market is evolving to accommodate environmental impact analysis within the design phase. Digital twins replicate real-world packaging behavior and life cycle characteristics. These tools simulate end-of-life scenarios, recyclability, and carbon footprint. Companies leverage simulation insights to achieve eco-label certifications and reduce environmental risks. Digital twins also aid predictive maintenance in packaging machinery. This expanded application enables data-driven sustainability strategies. Simulation now plays a role beyond structural validation, serving as a tool for full lifecycle packaging analysis.

Market Challenges Analysis:

High Initial Costs and Complexity in Integration of Simulation Software

Adoption of packaging simulation tools requires substantial upfront investment in software licenses, training, and IT infrastructure. Many small and mid-sized enterprises face budget constraints that limit their ability to implement these solutions effectively. The Packaging Design and Simulation Technology Market encounters resistance from companies unfamiliar with the digital design workflow. It demands skilled personnel to operate the tools and interpret simulation outcomes. The learning curve can delay expected benefits, impacting ROI perceptions. Firms struggle to justify costs without a clear short-term productivity gain. Integration with legacy systems presents additional compatibility challenges. This slows widespread adoption, particularly in cost-sensitive markets.

Data Accuracy and Model Limitations Restrict Simulation Efficacy

Simulation outcomes depend heavily on the accuracy of input data and model fidelity. In real-world environments, packaging materials behave differently under variable conditions. The Packaging Design and Simulation Technology Market must address limitations in simulating complex, multi-material packaging formats. Incorrect data input can lead to flawed designs, causing performance failures during physical handling. It affects user confidence in fully replacing physical prototyping with digital methods. The lack of standardized validation metrics further complicates performance prediction. Simulation vendors must refine material libraries and response algorithms. Without accurate and robust models, simulation cannot deliver the precision required by high-stakes industries.

Market Opportunities:

Rising Demand in Emerging Economies with Expanding Manufacturing Sectors

Emerging economies in Asia, Latin America, and Africa are investing in advanced packaging solutions to support export-led growth. The Packaging Design and Simulation Technology Market has significant opportunity in regions where manufacturing, food processing, and pharmaceuticals are rapidly expanding. It enables businesses to meet international packaging standards and improve product safety during transit. Local companies adopt simulation tools to compete globally by optimizing design without expensive physical trials. Regional governments are encouraging digitalization and quality improvements in production. The demand for efficient, low-cost simulation solutions is increasing in mid-tier enterprises. This market segment remains largely untapped and presents strong growth potential.

Growth in Sustainable Packaging and Circular Economy Initiatives

Global brands are intensifying efforts to design eco-friendly and recyclable packaging aligned with circular economy goals. The Packaging Design and Simulation Technology Market can support this transition by enabling early-stage design for sustainability performance. It allows companies to model environmental impact, material reduction, and recyclability before production. Businesses leverage simulation to create lightweight packaging that maintains durability and visual appeal. Sustainability certifications often require lifecycle analysis, which simulation can deliver efficiently. This creates new demand from firms pursuing carbon-neutral or plastic-free goals. The push toward sustainable packaging opens long-term opportunities for simulation software providers targeting green innovation.

Market Segmentation Analysis:

By component

In the Packaging Design and Simulation Technology Market, the software segment holds the dominant share due to increasing reliance on advanced digital tools for structural modeling, virtual prototyping, and compliance testing. Businesses adopt software solutions to streamline packaging development, reduce material waste, and accelerate time-to-market. These tools support integration with other enterprise systems, making them a preferred choice across large and mid-sized organizations. The services segment, which includes consulting, technical support, and training, plays a supportive role in maximizing software utility. It assists businesses in customizing solutions, enhancing user proficiency, and maintaining system efficiency.

- For instance, Nestlé implemented Dassault Systèmes’ 3DEXPERIENCE platform, which enabled the virtual development and testing of packaging, reducing their packaging development time by up to 50% compared to traditional methods.

By end-use industries

The food and beverage sector represents the largest share due to strict regulatory packaging requirements and high-volume product cycles. The healthcare and pharmaceutical segment follows, driven by the need for tamper-proof and compliant packaging solutions. The consumer goods and cosmetics & personal care segments actively use design and simulation to improve shelf appeal and material performance. The automotive and consumer electronics sectors adopt simulation to ensure durability and protection in complex logistics environments. The Packaging Design and Simulation Technology Market continues to expand across these verticals with growing emphasis on digital precision, cost control, and sustainability.

- For example, Amcor has leveraged Dassault Systèmes’ SIMULIA tools (part of the 3DEXPERIENCE Platform) to perform virtual simulations of rigid containers, enabling detailed analysis of strain areas and potential failure points throughout the design process.

Segmentation:

By Component

By Industry Vertical (End-User)

- Food & Beverage

- Healthcare/Pharmaceutical

- Consumer Goods

- Automotive

- Consumer Electronics

- Cosmetics & Personal Care

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America holds the leading position in the Packaging Design and Simulation Technology Market, accounting for 35.2% of the global market share. The region benefits from the presence of advanced manufacturing infrastructure and a high concentration of technology-driven packaging companies. Strong adoption of simulation tools in industries such as food and beverage, pharmaceuticals, and consumer goods continues to drive demand. The United States remains the key contributor, supported by significant investment in R&D and early technology adoption. Regulatory frameworks promoting sustainable and safe packaging also strengthen market expansion. It continues to witness steady growth due to high awareness and the pursuit of cost and material efficiency.

Europe captures 29.4% of the global market share and maintains a strong position through its focus on innovation and sustainability. Countries like Germany, France, and the UK lead adoption due to their advanced industrial base and strict packaging regulations. The Packaging Design and Simulation Technology Market in this region is shaped by the circular economy agenda and rising demand for eco-friendly packaging formats. Simulation tools are widely used to reduce material waste and comply with evolving EU directives. The region also supports growth through partnerships between research institutions and packaging solution providers. It leverages digital twins and AI-integrated platforms for greater design precision and regulatory compliance.

The Asia-Pacific region accounts for 24.7% of the market share and stands as the fastest-growing regional segment. China, India, Japan, and South Korea are witnessing accelerated adoption of digital simulation technologies across packaging applications. Rapid urbanization, expansion of e-commerce, and industrial automation support strong market momentum. The Packaging Design and Simulation Technology Market in this region benefits from growing consumer product demand and government-led digital transformation initiatives. Local firms are increasingly adopting simulation tools to meet global quality standards and reduce prototyping costs. The rising number of design and innovation centers in Asia-Pacific also strengthens regional capabilities and market potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Esko

- Siemens Digital Industries

- Autodesk

- Dassault Systèmes

- ANSYS

- Packlane

- Altair

- MSC Software

- ESI Group

- Hexagon

- PTC

- GE Digital

- 3D Systems

- Avery Dennison

- Bobst

Competitive Analysis:

The Packaging Design and Simulation Technology Market features strong competition driven by innovation, strategic partnerships, and software integration. Key players like Esko, Siemens Digital Industries, and Dassault Systèmes lead with comprehensive platforms that combine 3D modeling, simulation, and automation. Companies such as Autodesk and ANSYS focus on engineering-grade simulation accuracy and user-friendly design tools. Emerging players like Packlane contribute with customizable, on-demand packaging solutions tailored for e-commerce. Market participants invest in cloud capabilities, AI integration, and sustainable packaging tools to strengthen their portfolios. It fosters a dynamic landscape where differentiation relies on speed, design precision, and ease of integration with existing manufacturing systems.

Recent Developments:

- In May 2025, Autodesk enhanced its Construction Cloud with over 35 new product releases. Most notable for packaging designers are platform-wide workflow improvements: faster photo management, enhanced data regions collaboration, and streamlined approvals. Simultaneously, AutoCAD 2026 introduced AI-driven automation, project-aware support files, and smarter block detection to elevate both 2D and 3D design for packaging and manufacturing teams.

- In April 2025, Siemens Digital Industries Software expanded its Teamcenter X suite, further democratizing SaaS PLM for manufacturers of all sizes. The latest Teamcenter X Essentials version introduces scalable prepackaged solutions to streamline product design, data management, and collaboration across supply chains, supporting complex mechanical and electrical development tasks.

- In February 2025, Altair announced the launch of Altair HyperWorks 2025, emphasizing its commitment to zero-prototype development. The new release integrates artificial intelligence, high-performance computing (HPC), and multiphysics simulation to accelerate sustainable product design and improve scalability. In the same month, Altair and L&T Technology Services inaugurated a joint 5G–6G Wireless Center of Excellence, strengthening their strategic collaboration

Market Concentration & Characteristics:

The Packaging Design and Simulation Technology Market is moderately concentrated, with a few dominant players holding substantial market share due to established customer bases and advanced software ecosystems. It demonstrates high innovation intensity, driven by demand for sustainability, speed, and design flexibility. Cloud deployment, AI-enabled design automation, and simulation for lightweight packaging define the evolving market characteristics. The presence of niche players offering industry-specific tools also supports diversity in offerings and customization. It experiences steady merger and acquisition activity as larger firms expand capabilities. User demand for intuitive interfaces and seamless integration with production workflows continues to shape product development.

Report Coverage:

The research report offers an in-depth analysis based on component and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will witness rising adoption of AI-powered simulation tools to enhance design accuracy and reduce manual intervention.

- Cloud-based platforms will expand, enabling real-time collaboration and remote accessibility across global design teams.

- Integration with digital twin technology will grow, allowing end-to-end packaging lifecycle modeling and performance tracking.

- Demand for sustainable packaging solutions will drive simulation use in optimizing recyclable and biodegradable materials.

- Emerging economies will increasingly implement simulation tools to meet international packaging standards and export requirements.

- Personalized packaging will prompt advanced design simulations for customized formats across fast-moving consumer goods.

- Regulatory compliance will remain a key growth factor, encouraging early-stage virtual testing for global packaging standards.

- Strategic partnerships between software developers and packaging manufacturers will shape innovation pipelines.

- Machine learning applications will improve predictive analysis and shorten simulation-to-production cycles.

- Expansion of simulation in e-commerce packaging will support performance validation for diverse shipping conditions.