Market Overview

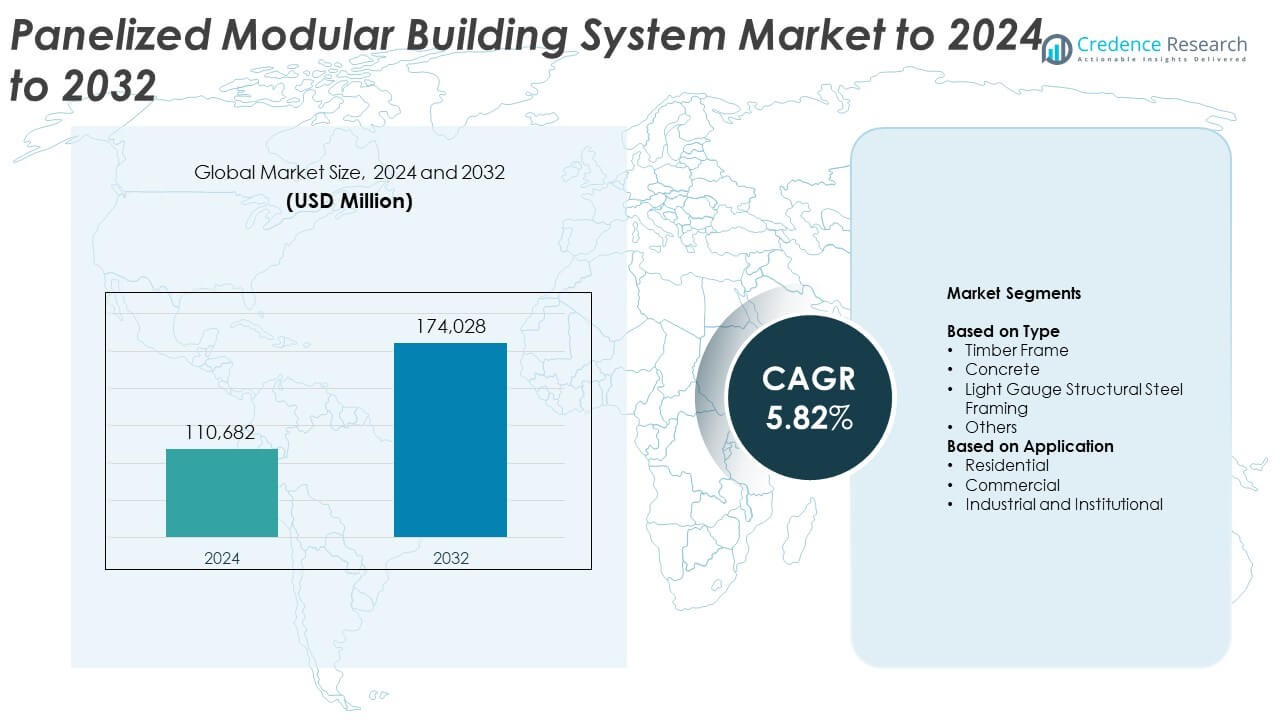

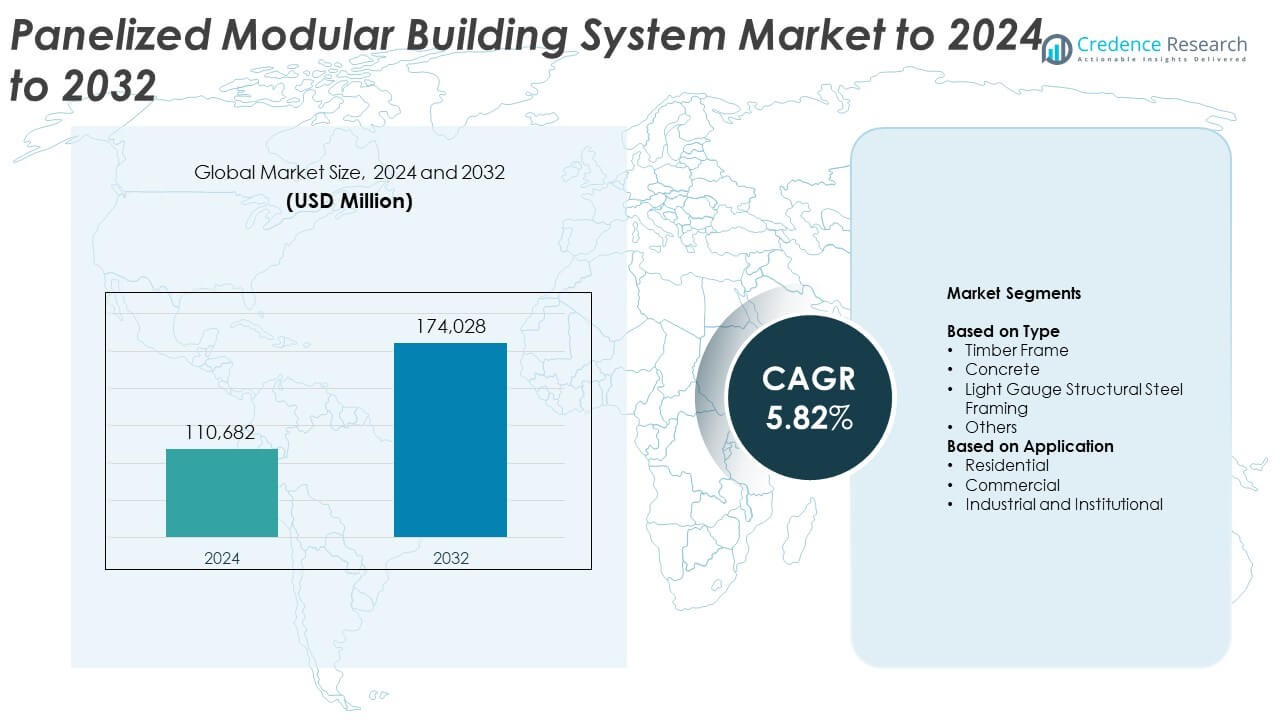

The Panelized Modular Building System Market size was valued USD 110,682 million in 2024 and is anticipated to reach USD 174,028 million by 2032, at a CAGR of 5.82% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Panelized Modular Building System Market Size 2024 |

USD 110,682 Million |

| Panelized Modular Building System Market, CAGR |

5.82% |

| Panelized Modular Building System Market Size 2032 |

USD 174,028 Million |

The panelized modular building system market is led by companies such as Kingspan Timber Solutions (Kingspan Group), Saint-Gobain, Etex Building Performance, Fusion Building Systems, and Vantem. These players focus on sustainable design, energy-efficient materials, and digital fabrication technologies to enhance construction speed and precision. North America dominated the market with a 36.2% share in 2024, supported by strong adoption of prefabricated housing and infrastructure projects. Europe followed with a 28.4% share, driven by strict energy efficiency regulations and green building standards. Asia Pacific continued to expand rapidly, fueled by urbanization and government-led affordable housing programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The panelized modular building system market was valued at USD 110,682 million in 2024 and is projected to reach USD 174,028 million by 2032, growing at a CAGR of 5.82%.

- Increasing demand for sustainable, energy-efficient, and fast-paced construction methods drives market expansion across residential and commercial projects.

- Technological advancements such as BIM integration, automation, and hybrid material systems are transforming modular construction efficiency and scalability.

- The market remains competitive with key players focusing on eco-friendly materials, digital manufacturing, and strategic partnerships to strengthen global presence.

- North America led with a 36.2% share in 2024, followed by Europe at 28.4% and Asia Pacific at 24.1%, while timber frame systems held the dominant 42.6% segment share due to high sustainability and structural performance.

Market Segmentation Analysis:

By Type

The timber frame segment dominated the panelized modular building system market in 2024 with a 42.6% share. Its dominance stems from high demand for sustainable, lightweight, and easy-to-assemble materials. Timber panels enable faster installation and reduced carbon footprint, aligning with green construction practices. Increasing adoption of prefabricated timber modules in residential and commercial buildings enhances efficiency and cost savings. The concrete and light gauge structural steel framing segments are expanding as developers pursue high structural strength, fire resistance, and long service life in large-scale urban projects.

- For instance, Lindbäcks’ Piteå factory produces around 3,500 modules yearly and can deliver 2,600 apartments per year, enabled by automated lines over 42,000 m².

By Application

The residential segment held the largest market share of 49.3% in 2024, driven by growing adoption of prefabricated modular homes in urban and suburban developments. Rising housing demand and cost-efficient construction timelines encourage developers to deploy panelized systems for rapid housing delivery. Energy-efficient wall panels and customizable modular layouts appeal to both affordable and premium housing markets. The commercial and industrial & institutional segments are gaining traction with the rising need for flexible office, healthcare, and educational structures that reduce on-site labor dependency and construction waste.

- For instance, Sekisui House reports a cumulative total of over 2.7 million homes supplied globally as of the fiscal year ending January 31, 2025, and achieved a 96% net-zero energy house ratio in newly-built detached houses in Japan for the fiscal year ended January 31, 2025.

Key Growth Drivers

Rising Demand for Sustainable Construction

Growing environmental awareness is accelerating the use of eco-friendly construction materials. Panelized modular systems reduce waste and carbon emissions compared to traditional methods. Builders prefer these systems for their ability to integrate renewable materials such as timber and recycled steel. Government incentives promoting green building certifications further support market expansion. The trend aligns with net-zero energy goals and sustainable housing initiatives worldwide, driving wider acceptance of modular construction solutions across residential and commercial sectors.

- For instance, Stora Enso’s CLT EPD lists annual CLT capacities of 80,000 m³ (Bad St. Leonhard), 100,000 m³ (Gruvön), 110,000 m³ (Ybbs), and 120,000 m³ (Ždírec), with stored biogenic carbon of −762 kg CO₂e per m³.

Faster Construction and Labor Efficiency

The increasing need for time-efficient construction solutions boosts the adoption of modular systems. Prefabricated panels allow parallel site and factory operations, reducing total build time by up to 50%. This approach minimizes weather-related delays and lowers labor dependency, addressing skilled worker shortages in many regions. Developers favor modular systems for their predictable schedules and lower project costs, which improve overall return on investment. Rapid urbanization and large-scale infrastructure projects continue to reinforce this demand.

- For instance, Tide Construction and Vision Modular installed 1,526 modules at 101 George Street; the 44-storey tower was completed in 35 weeks.

Government Support and Building Standardization

Government-backed programs supporting prefabrication technologies are a major growth enabler. Several countries have integrated modular methods into urban housing policies to meet housing targets faster. Standardized building codes and certification systems are improving trust in panelized systems’ quality and performance. Public procurement policies now encourage modular adoption for healthcare, education, and affordable housing facilities. These measures create a favorable regulatory environment, driving investment in factory-based panel production facilities globally.

Key Trends & Opportunities

Adoption of Smart and Digital Manufacturing

Automation, robotics, and BIM integration are transforming modular panel production. Digital design tools allow precision engineering, reducing rework and material waste. Manufacturers increasingly use IoT-enabled systems for real-time tracking and performance monitoring. These digital capabilities improve collaboration between architects, contractors, and suppliers. The integration of smart technologies enhances customization and scalability, opening new opportunities in large infrastructure and commercial developments.

- For instance, Tecno Fast increased capacity by 2,300 module units of 40 m² each after adding an automated line.

Growing Use of Hybrid Materials

The market is witnessing a shift toward hybrid modular systems that combine timber, steel, and concrete panels. This approach improves load-bearing capacity and thermal performance while maintaining flexibility in design. Hybrid systems are gaining popularity in mid-rise and mixed-use buildings where cost, durability, and sustainability must be balanced. Advancements in material science further enhance fire resistance and acoustic insulation, making these systems viable for broader construction applications.

- For instance, CREE’s timber-concrete composite slabs specify 6–9 m lengths and 2.50–3.00 m widths for standardized panels.

Expansion in Urban Housing and Infrastructure Projects

Urbanization is driving high demand for efficient and affordable housing. Panelized modular systems enable quick assembly of residential blocks and community infrastructure. Governments and private developers are investing in modular solutions to tackle housing shortages and meet population growth. The systems’ scalability supports diverse applications such as student housing, hospitals, and office complexes, creating significant long-term growth opportunities in metropolitan regions.

Key Challenges

High Initial Investment and Setup Costs

Despite cost savings in long-term operations, the initial investment for modular production facilities remains high. Manufacturers require significant capital for machinery, automation, and skilled labor training. This limits entry for small players and affects short-term profitability. Additionally, logistics and transport expenses for large panels can increase project costs. Overcoming these barriers requires financing models and government incentives to support industrial-scale modular manufacturing.

Lack of Awareness and Standardization in Developing Regions

In many emerging markets, traditional construction practices dominate due to limited awareness of modular benefits. The absence of uniform building standards and regulatory frameworks restricts adoption. Contractors often face resistance from clients unfamiliar with off-site construction methods. Limited local supply chains and technical expertise further hinder expansion. Increased education, pilot projects, and collaboration between industry stakeholders are essential to build market confidence and ensure consistent quality adoption.

Regional Analysis

North America

North America held the largest share of 36.2% in the panelized modular building system market in 2024. The region benefits from advanced construction technologies, strong adoption of prefabrication, and rising green building initiatives. The United States leads due to increasing demand for modular housing and commercial infrastructure. Government programs supporting affordable housing and labor shortage mitigation drive further growth. Canada also contributes significantly through eco-friendly building codes and public infrastructure modernization, fostering higher investment in modular panel manufacturing facilities.

Europe

Europe accounted for 28.4% of the global market share in 2024, driven by stringent energy efficiency regulations and sustainability targets. Countries such as Germany, the United Kingdom, and the Netherlands are leading adopters of panelized modular systems for residential and public sector buildings. The region’s focus on carbon-neutral construction promotes the use of timber-based and hybrid modular panels. Growing urban redevelopment projects and circular construction practices further encourage the shift toward off-site manufacturing and standardized modular designs across European markets.

Asia Pacific

Asia Pacific captured a 24.1% share of the panelized modular building system market in 2024, supported by rapid urbanization and industrial expansion. China, Japan, and Australia are key contributors, with governments promoting modular construction to address housing shortages and sustainability goals. The region’s construction sector benefits from cost-effective labor and increasing investment in prefabrication plants. Strong demand for quick-to-assemble housing and commercial units boosts the use of concrete and steel-based panel systems across both urban and semi-urban areas.

Latin America

Latin America accounted for a 6.4% share of the panelized modular building system market in 2024. The market is gaining traction through infrastructure modernization and residential construction programs in Brazil, Mexico, and Chile. Government support for cost-efficient building solutions and rising adoption of modular methods in disaster-resilient housing promote growth. However, limited manufacturing infrastructure and regulatory inconsistencies hinder large-scale adoption. Increasing foreign investments and local collaborations are expected to strengthen modular panel production capabilities in the region.

Middle East and Africa

The Middle East and Africa held a 4.9% market share in 2024, with growing adoption of modular systems in commercial and institutional construction. The United Arab Emirates and Saudi Arabia are key markets, supported by mega infrastructure and smart city projects. Rapid population growth and housing initiatives are driving demand for panelized structures offering faster assembly and durability in harsh climates. African nations are gradually adopting modular construction for urban development, aided by international partnerships and technology transfer initiatives.

Market Segmentations:

By Type

- Timber Frame

- Concrete

- Light Gauge Structural Steel Framing

- Others

By Application

- Residential

- Commercial

- Industrial and Institutional

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Key players in the panelized modular building system market include Kingspan Timber Solutions (Kingspan Group), Fusion Building Systems, Saint-Gobain, Walker Timber Engineering, Etex Building Performance, Modern Prefab Systems Pvt. Ltd Inc., Metek Plc, Oregon Timber Frame Ltd, Thorp Precast Ltd, Frame Homes UK, Pinewood Structures, Vantem, Bamcore, and Aviva Capital Partners (ACP). The competitive landscape is characterized by continuous innovation in panel materials, automation technologies, and off-site manufacturing efficiency. Companies are emphasizing sustainable production methods and digital design integration to meet environmental and structural standards. Strategic mergers, capacity expansions, and collaborations with real estate developers are strengthening global footprints. Market participants are also investing in research to enhance thermal insulation, fire resistance, and durability of modular components. Growing demand for green and fast-build construction is encouraging firms to expand modular manufacturing facilities and adopt circular economy models to maintain competitiveness in evolving urban infrastructure markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kingspan Timber Solutions (Kingspan Group)

- Fusion Building Systems

- Saint-Gobain

- Walker Timber Engineering

- Etex Building Performance

- Modern Prefab Systems Pvt. Ltd Inc.

- Metek Plc

- Oregon Timber Frame Ltd

- Thorp Precast Ltd

- Frame Homes UK

- Pinewood Structures

- Vantem

- Bamcore

- Aviva Capital Partners (ACP)

Recent Developments

- In 2024, Bamcore, a leader in green building solutions, introduced MonoShear, an innovative custom panelized framing system designed to transform entry-level one to three-story residential construction.

- In April 2023, Aviva Capital Partners (ACP), Aviva’s in-house capital unit, invested £20 million in TopHat. Aviva Capital Partners invests capital from Aviva’s pension funds, confirming the investment was from a major pension fund.

- In 2023, Vantem, a modular technology company, acquired Affinity Building Systems. The acquisition was indeed intended to expand Vantem’s product portfolio with well-priced, higher energy-efficiency homes.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of modular construction will rise as governments promote sustainable urban housing.

- Integration of automation and robotics will enhance panel manufacturing precision and efficiency.

- Timber-based modular systems will gain traction due to rising eco-friendly building preferences.

- Hybrid modular structures combining steel and concrete will expand in commercial projects.

- Digital technologies like BIM and IoT will streamline design, production, and installation processes.

- Investments in modular factories will increase to meet demand for faster construction timelines.

- Urban redevelopment and infrastructure projects will create steady opportunities for modular solutions.

- Standardization of building codes will improve global acceptance of modular construction practices.

- Energy-efficient and smart modular buildings will become a key trend in modern cities.

- Strategic collaborations between construction firms and technology providers will drive market competitiveness.