Market Overview:

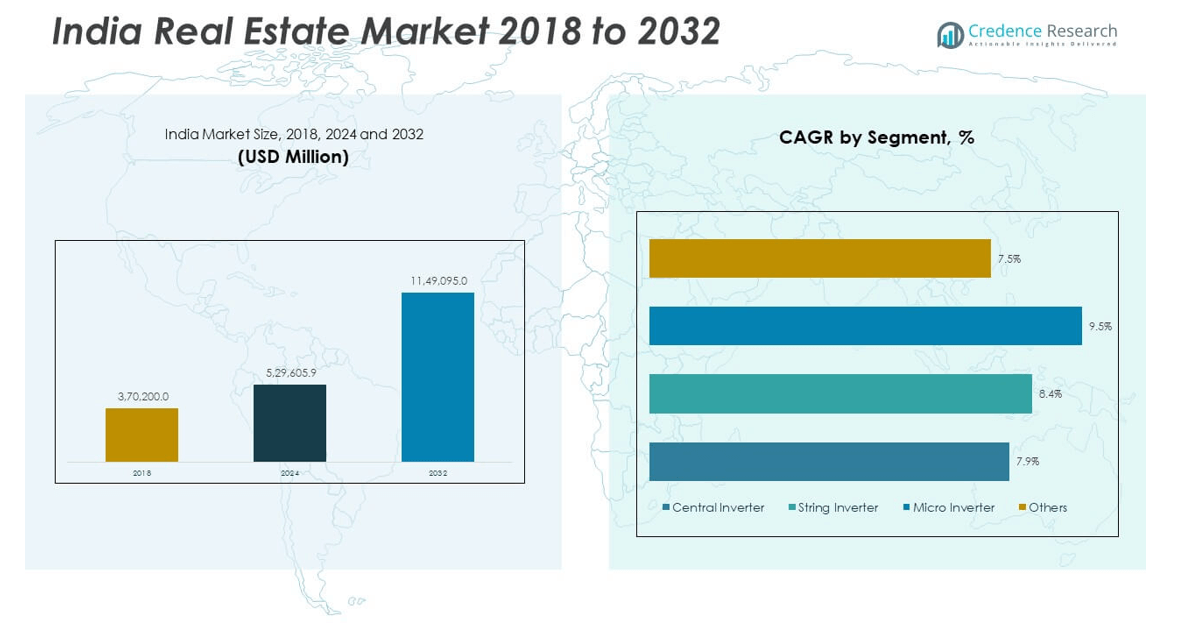

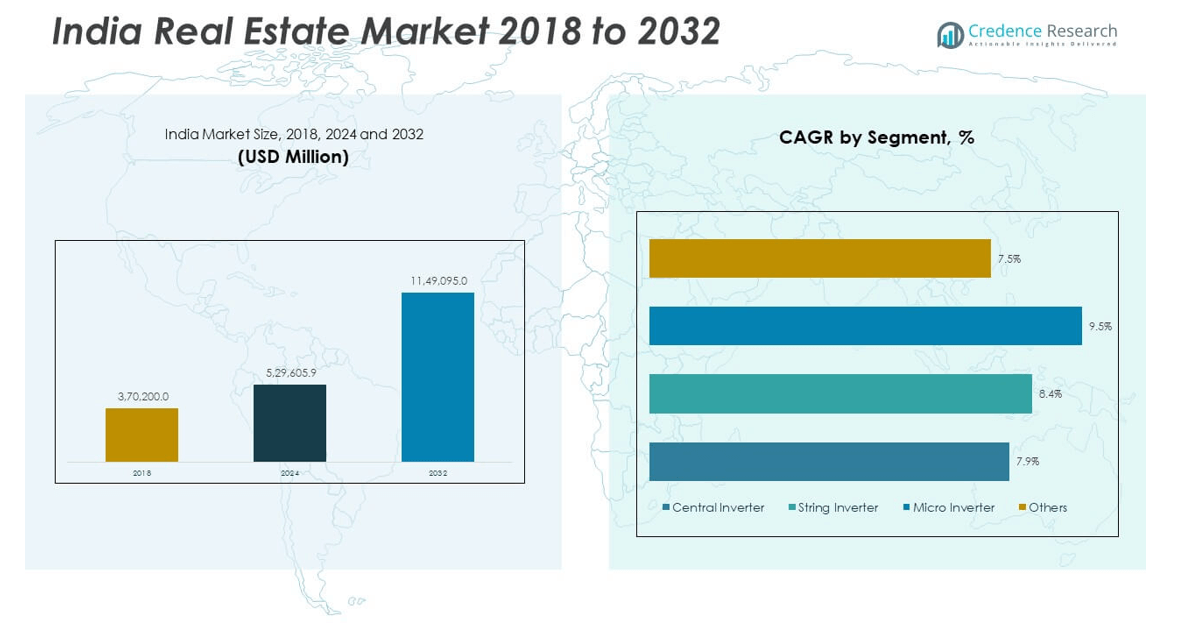

The India Real Estate Market size was valued at USD 3,70,200.0 million in 2018 to USD 5,29,605.9 million in 2024 and is anticipated to reach USD 11,49,095.0 million by 2032, at a CAGR of 10.30% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Real Estate Market Size 2024 |

USD 5,29,605.9 million |

| India Real Estate Market, CAGR |

10.30% |

| India Real Estate Market Size 2032 |

USD 11,49,095.0 million |

The market growth is fueled by rapid urbanization, rising disposable incomes, and government initiatives such as affordable housing schemes and smart city projects. The expanding middle-class population is driving demand for residential spaces, while growth in retail, IT, and manufacturing sectors boosts commercial real estate. Foreign direct investments and reforms such as Real Estate Regulatory Authority (RERA) have strengthened transparency, enhancing investor confidence. Increased adoption of digital platforms for property transactions and the demand for sustainable and energy-efficient buildings are also contributing to market expansion.

Regionally, metropolitan hubs such as Delhi-NCR, Mumbai, and Bengaluru dominate the market due to strong infrastructure, higher employment opportunities, and growing investor activity. Tier-II and Tier-III cities are emerging as high-potential markets, driven by rising affordability, improved connectivity, and expansion of industrial corridors. Southern cities such as Hyderabad and Chennai are gaining traction in the IT and residential segments, while western regions including Pune and Ahmedabad are attracting investments in logistics and industrial real estate. This regional diversification is shaping India into a balanced and opportunity-rich real estate market.

Market Insights:

- The India Real Estate Market size was valued at USD 3,70,200.0 million in 2018, reached USD 5,29,605.9 million in 2024, and is projected to touch USD 11,49,095.0 million by 2032, growing at a CAGR of 10.30% during the forecast period.

- Rapid urbanization, smart city projects, and large-scale infrastructure investments continue to boost demand across residential, commercial, and industrial real estate segments.

- Expanding middle-class population and rising disposable incomes increase housing demand in both premium and affordable segments.

- Regulatory frameworks like RERA and GST enhance transparency and streamline the sector, improving buyer and investor confidence.

- High construction costs, project delays, and financing hurdles remain significant restraints that impact timely project delivery and affordability.

- Metropolitan hubs including Delhi-NCR, Mumbai, and Bengaluru dominate growth due to strong connectivity, employment generation, and investment appeal.

- Tier-II and Tier-III cities emerge as high-potential markets with rising affordability, industrial expansion, and improved infrastructure networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rapid Urbanization and Expanding Infrastructure Investments:

The India Real Estate Market benefits from strong urbanization trends supported by major infrastructure projects. Metropolitan areas continue to attract both domestic and global investors due to better connectivity and expanding business opportunities. The government’s push for urban renewal programs, metro expansions, and expressway networks improves accessibility and raises property values. Rising migration to tier-I and tier-II cities drives higher demand for both residential and commercial spaces. Affordable housing schemes and urban planning reforms further create long-term growth opportunities. Investment in industrial corridors and smart cities strengthens the ecosystem for sustained development. Growing household incomes and lifestyle aspirations accelerate housing demand in both premium and mid-segment categories. It positions urban centers as critical anchors for future real estate growth.

Growing Middle-Class Demand and Shifts in Lifestyle Preferences:

The expanding middle-class population acts as a core driver of growth in the India Real Estate Market. Consumers are now prioritizing ownership of modern homes with advanced amenities and security features. Shifts in lifestyle patterns create demand for integrated townships and gated communities. Young professionals and nuclear families prefer compact yet high-quality housing located near employment hubs. Rising disposable incomes enable aspirational buyers to consider luxury apartments and branded residences. Retail real estate also benefits from lifestyle-driven demand for malls, multiplexes, and shopping districts. Commercial projects in IT and business parks attract both domestic companies and multinational corporations. It ensures steady momentum for both residential and commercial segments across regions.

- For instance, Godrej Properties launched the “Godrej Athena” project in Bengaluru with over a dozen smart amenities and achieved 95% pre-booking of its units within the first three months of launch in 2025. Oberoi Realty delivered over 2,500 luxury apartments integrated with IoT-enabled smart home features, while Brigade Group reported in FY2025 that more than 75% of its city-center township sales were to first-time urban nuclear families seeking compact, tech-enabled homes.

Regulatory Reforms and Enhanced Transparency Measures:

The India Real Estate Market experiences accelerated growth due to strong policy reforms and regulatory frameworks. The implementation of RERA enforces accountability and instills confidence in buyers and investors. GST rationalizes taxation across the sector, streamlining processes for both developers and purchasers. Foreign direct investment policies open new opportunities for global capital inflows. Policy incentives for affordable housing reduce entry barriers for developers and buyers. These reforms create a transparent, efficient, and sustainable growth environment. Developers are adopting ethical practices to align with the strengthened compliance requirements. Buyers increasingly trust the regulated ecosystem, fueling greater market participation. It ensures long-term credibility and stability for the sector.

Expanding Commercial Sector and Rise of Organized Retail:

The India Real Estate Market gains traction from the expanding commercial sector and large-scale retail investments. IT hubs, co-working spaces, and corporate campuses fuel rising demand for grade-A office spaces. Retail real estate benefits from the entry of international brands and expansion of shopping centers. E-commerce companies invest heavily in logistics and warehousing facilities, boosting industrial real estate. Strong demand for organized retail hubs drives mixed-use developments that combine shopping, leisure, and housing. Developers are focusing on integrated projects that cater to both professional and consumer needs. The rise of corporate campuses in metro and tier-II cities generates consistent demand for commercial assets. It strengthens investor interest and enhances the sector’s overall dynamism.

Market Trends:

Adoption of Digital Platforms and Virtual Property Transactions:

The India Real Estate Market is undergoing a digital transformation with wider adoption of online property platforms. Buyers and investors rely on virtual tours, 3D walkthroughs, and AI-enabled tools to evaluate projects remotely. Real estate portals enhance decision-making with transparent data on pricing, legal clearances, and neighborhood analysis. Developers are integrating digital marketing strategies to target specific customer segments. The pandemic accelerated the use of digital tools, making online engagement a permanent feature of property buying. Digital mortgage processing and automated verification further streamline property ownership. Virtual transactions attract younger buyers who prefer seamless digital experiences. It creates a competitive advantage for developers with robust online platforms.

- For instance, Lodha Group saw 48% of new flat bookings for its Mumbai launches in 2025 completed through digital platforms offering full virtual tours and online contracts. NoBroker processed more than 220,000 verified online property transactions between April 2024 and March 2025, leveraging AI for pricing, legal validation, and remote documentation.

Sustainability and Eco-Friendly Housing Developments:

The India Real Estate Market embraces sustainability by integrating green designs and energy-efficient technologies. Developers focus on LEED-certified projects and eco-friendly construction practices. Rising consumer awareness about environmental impact drives demand for solar power, rainwater harvesting, and energy-efficient appliances. Institutional investors favor sustainable projects, recognizing their long-term value and lower operational costs. Builders are introducing recyclable materials and innovative building methods that reduce environmental footprint. Government policies encourage green buildings with tax incentives and regulatory support. Eco-friendly housing resonates strongly with young professionals and environmentally conscious buyers. It positions sustainability as a defining trend shaping the future of real estate projects.

- For instance, Tata Housing has integrated solar power and rainwater harvesting across several projects. Its project Tata Housing Myst (Kasauli) became one of India’s first residential projects with IGBC pre-certified Platinum rating.

Rise of Co-Living and Flexible Housing Models:

The India Real Estate Market sees increasing adoption of co-living spaces driven by millennial and Gen Z preferences. Young professionals migrating to cities prefer cost-efficient, flexible, and community-driven living arrangements. Developers are collaborating with operators to offer shared housing solutions near employment zones. The model caters to affordability concerns while providing modern amenities and digital connectivity. Flexible leasing options appeal to transient workforces and students. Investors find co-living attractive for steady rental yields and lower vacancy rates. Co-living also aligns with cultural shifts toward shared consumption and collaborative lifestyles. It establishes a new growth avenue beyond conventional housing models.

Growth in Mixed-Use and Smart City Developments:

The India Real Estate Market expands through integrated projects combining residential, commercial, and retail functions. Developers are focusing on mixed-use complexes that create self-sustained ecosystems. Smart city initiatives incorporate digital connectivity, intelligent traffic management, and energy efficiency. Residents prefer these projects for convenience, reduced travel times, and enhanced quality of life. Corporates and retailers benefit from proximity to large residential catchments. Investors see mixed-use assets as resilient against market volatility due to diversified revenue streams. Rapid urban expansion makes such developments critical for future-ready cities. It reinforces the role of integrated planning in shaping real estate growth.

Market Challenges Analysis:

High Construction Costs and Delayed Project Deliveries:

The India Real Estate Market faces persistent challenges due to high construction costs and frequent project delays. Rising prices of steel, cement, and labor inflate overall costs for developers. Many projects struggle to maintain profitability while balancing affordability. Delayed government approvals and land acquisition hurdles further prolong timelines. Buyers lose confidence when possession dates extend, creating reputational risks for developers. Stalled projects tie up capital and reduce liquidity across the sector. Developers often face funding shortages as lenders grow cautious about delayed ventures. It creates operational inefficiencies that slow sectoral growth despite rising demand.

Limited Financing Access and Regulatory Complexities:

The India Real Estate Market is also constrained by restricted access to affordable financing and complex regulations. Small and mid-sized developers struggle to secure funding due to stringent lending criteria. Private equity funds often prefer large players, leaving smaller firms undercapitalized. Regulatory compliance with multiple state and central bodies creates administrative burdens. Lengthy approval cycles increase costs and reduce efficiency. Buyers also face financing difficulties due to strict loan-to-value requirements and high interest rates. These limitations restrict participation across consumer and developer segments. It underscores the need for balanced financial support and simplified governance structures.

Market Opportunities:

Rising Demand in Tier-II and Tier-III Cities:

The India Real Estate Market offers opportunities in emerging tier-II and tier-III cities due to improving infrastructure. These cities attract IT parks, logistics hubs, and manufacturing facilities that stimulate real estate growth. Affordable housing demand rises in smaller towns with increasing middle-class populations. Improved highways and regional airports enhance connectivity, boosting investor interest. Developers expand into these cities to capture untapped demand across segments. Rising aspirations among young professionals create momentum for modern housing solutions. Retail and commercial projects also see growing traction in expanding urban clusters. It strengthens the long-term potential of non-metro markets.

Expansion of Industrial and Warehousing Real Estate:

The India Real Estate Market also sees opportunities in the industrial and warehousing segment. E-commerce growth creates large-scale demand for storage and distribution centers. Logistics players invest in modern warehouses with advanced technology and automation. Government initiatives like dedicated freight corridors support this transformation. Manufacturing expansion under “Make in India” drives industrial land requirements. Global firms seek reliable logistics and supply chain infrastructure, encouraging investment. Developers diversify portfolios by including industrial assets for stable returns. It positions warehousing and industrial real estate as growth engines of the sector.

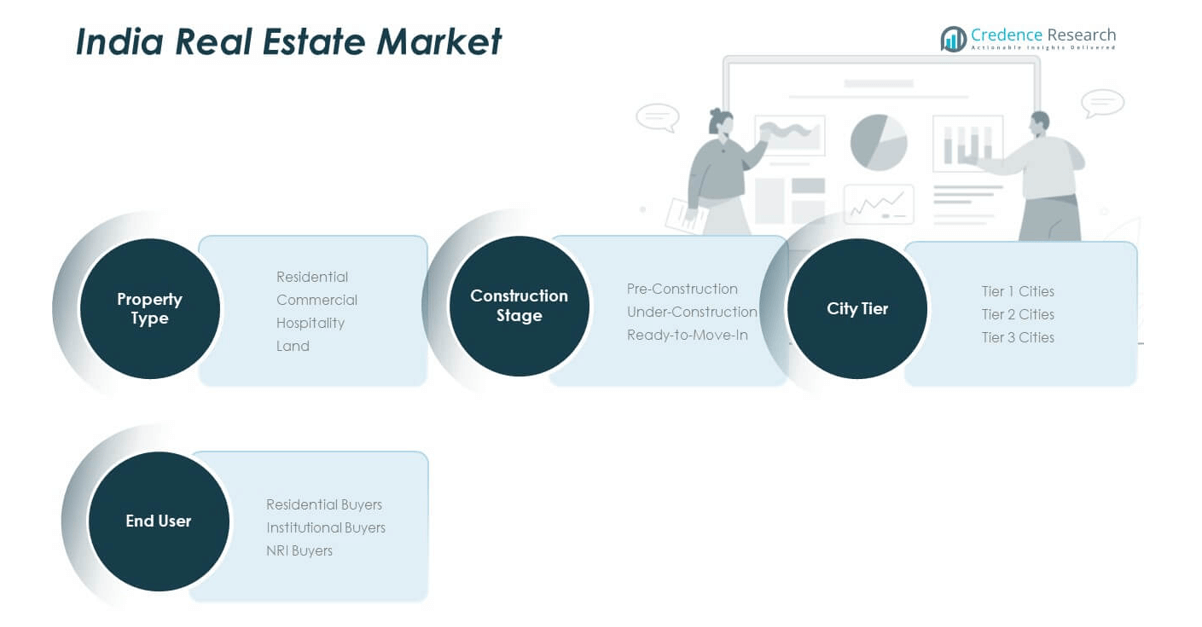

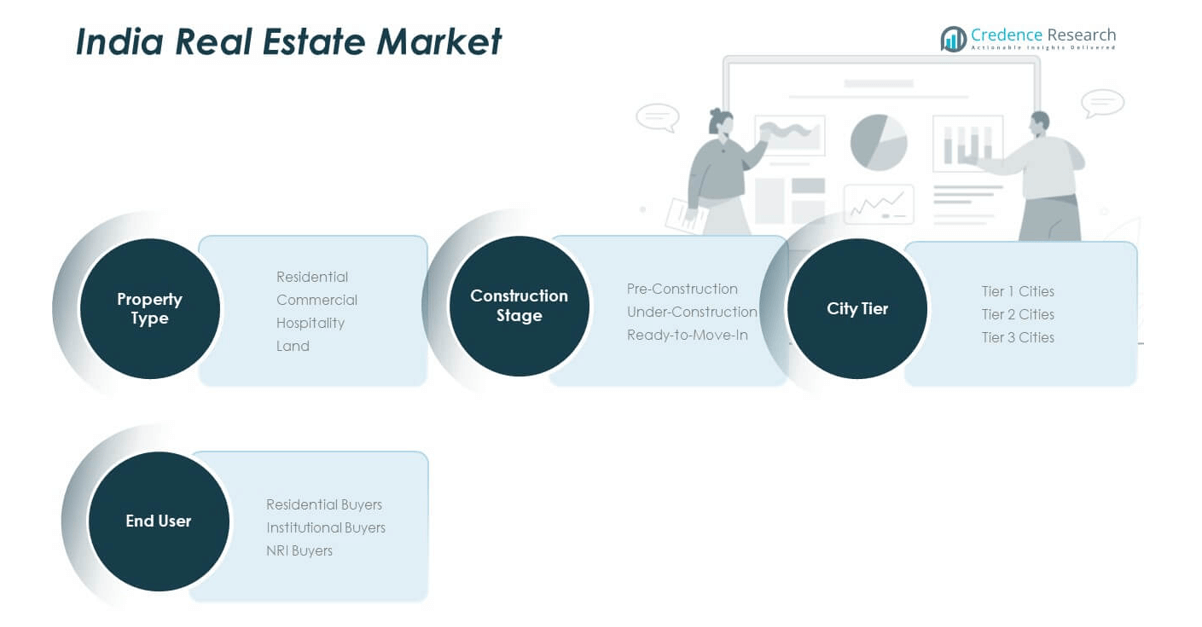

Market Segmentation Analysis:

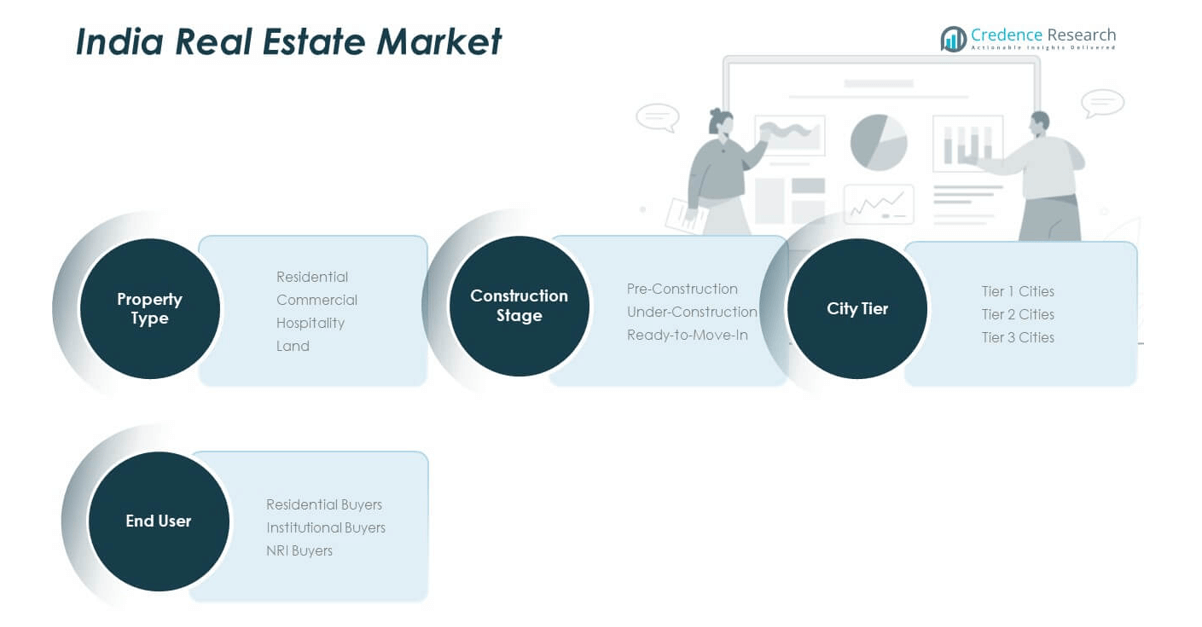

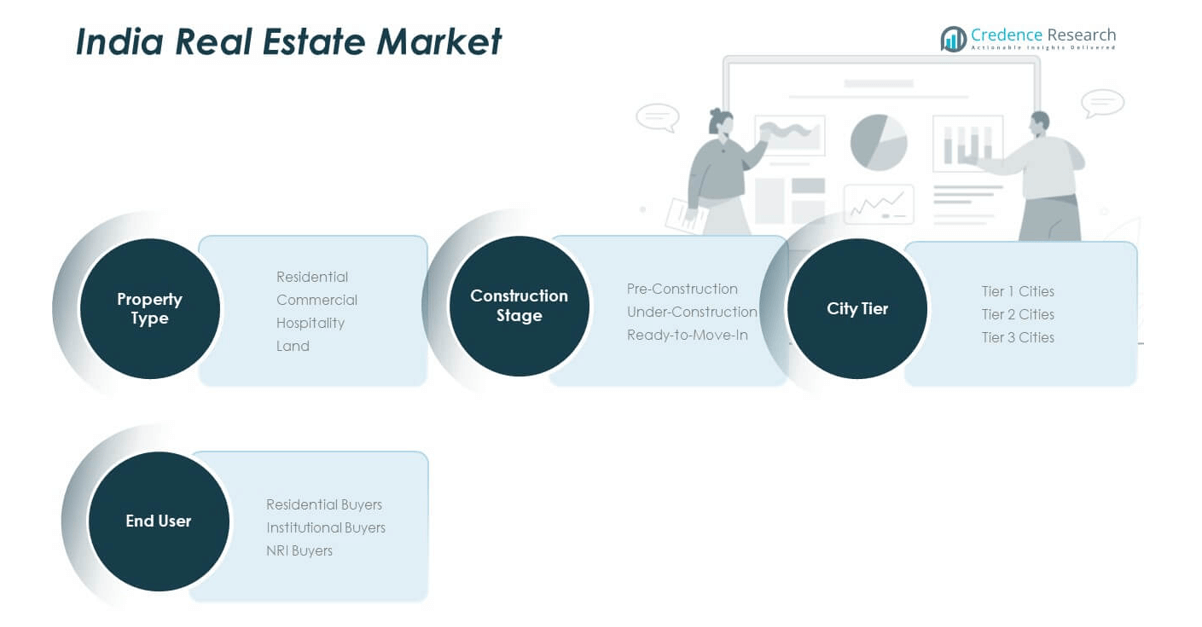

By Property Type

Residential holds the largest share, driven by rising urban housing demand and favorable mortgage access. Commercial assets benefit from corporate expansions and IT parks, while hospitality projects gain traction in tourism-driven regions. Land remains attractive for investors seeking long-term appreciation.

- For instance, Mindspace Business Parks REIT leased over 1.7 million sq ft in Q1 FY25 to global and Indian firms for GCCs and data centres across Mumbai.

By Construction Stage

Pre-construction and under-construction projects draw investors with lower entry points and potential value gains. Ready-to-move-in properties attract end-users prioritizing immediate occupancy, lower risk, and established infrastructure.

By City Tier

Tier 1 cities dominate due to premium projects, advanced infrastructure, and employment opportunities. Tier 2 cities are emerging as high-growth hubs, supported by government policies, rising affordability, and expanding connectivity. Tier 3 cities show gradual growth, primarily through affordable housing and regional development initiatives.

By End-User

Residential buyers form the largest segment, supported by middle-class aspirations and financing availability. Institutional buyers strengthen demand in commercial and retail segments, ensuring stability. NRI buyers focus on luxury housing and metropolitan markets, leveraging currency benefits and long-term returns.

Segmentation:

By Property Type

- Residential

- Commercial

- Hospitality

- Land

By Construction Stage

- Pre-Construction

- Under-Construction

- Ready-to-Move-In

By City Tier

- Tier 1 Cities

- Tier 2 Cities

- Tier 3 Cities

By End-User

- Residential Buyers

- Institutional Buyers

- NRI Buyers

Regional Analysis:

North India

North India dominates the India Real Estate Market with an estimated 35% share, led by the National Capital Region (NCR), which includes Delhi, Gurugram, and Noida. Strong demand for both residential and commercial projects in Gurugram and Noida has been driven by infrastructure development, corporate hubs, and proximity to the capital. Delhi NCR continues to attract large-scale investments in premium housing, IT parks, and retail spaces. Rising metro connectivity and upcoming expressways have strengthened investor confidence in this region. It also benefits from strong government focus on affordable housing and smart city projects. The combination of urban expansion and regulatory support positions North India as the most influential regional contributor.

West India

West India holds nearly 30% share of the India Real Estate Market, with Mumbai Metropolitan Region (MMR) and Pune as major growth centers. MMR, being the financial hub of India, attracts significant investments in luxury housing, commercial office spaces, and retail developments. Pune is witnessing rapid growth in IT parks, industrial corridors, and co-living spaces, driven by its expanding technology sector and student population. Gujarat, with cities like Ahmedabad, is also emerging due to smart city projects and industrial clusters. The presence of strong employment opportunities fuels continuous housing demand in this region. It remains a preferred destination for both end-users and institutional investors.

South and East India

South India accounts for around 25% share, driven by Bengaluru, Hyderabad, and Chennai. Bengaluru leads in IT-driven residential and commercial real estate demand, while Hyderabad benefits from strong government incentives and rapid infrastructure upgrades. Chennai maintains growth through manufacturing hubs and port-based industries. East India holds a smaller 10% share, led by Kolkata, Bhubaneswar, and Patna, where demand is rising due to urbanization and affordable housing initiatives. Although East India lags in large-scale developments, it shows potential with government-backed infrastructure and industrial projects. Together, South and East India strengthen the geographical diversity of the market by catering to varied consumer and investor segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- DLF Limited

- Godrej Pro

- Oberoi Realty

- perties

- Oberoi Realty

- Prestige Estates Projects Ltd.

- Sobha Limited

- Brigade Group

- Tata Housing

- Lodha Group

- Indiabulls Real Estate

- Puravankara

- Mahindra Lifespace Developers

- Shapoorji Pallonji Real Estate

- L&T Realty

- Raheja Developers

- Hiranandani Group

Competitive Analysis:

The India Real Estate Market is highly competitive, with leading developers such as DLF, Godrej Properties, Oberoi Realty, Prestige Estates, and Lodha Group shaping the landscape. It reflects a mix of established firms with nationwide presence and regional players targeting niche markets. Companies compete on pricing, location, design, and timely delivery, while differentiation strategies focus on sustainability, smart housing, and premium amenities. Institutional investors and foreign capital flows strengthen competition, driving consolidation and strategic partnerships. It remains dynamic, where brand reputation, project execution, and financial strength play a decisive role in capturing market share.

Recent Developments:

- In August 2025, DLF Limited announced the launch of residential and commercial projects worth ₹63 billion across multiple segments in the Indian real estate market. These launches include prime developments in Mumbai with the luxury ‘Westpark’ residential project marking DLF’s re-entry into the city outside its traditional Delhi-NCR base. The company set a target to sell properties worth ₹20,000–22,000 crore during 2025–26, expanding pan-India aspirations.

- In August 2025, Godrej Properties unveiled plans to launch new residential projects worth ₹40,000 crore for the 2025–26 financial year, aiming to boost its market share across major Tier-I cities. In July 2025, Godrej Properties acquired 50 acres of land in Raipur, Chhattisgarh, for a premium plotted residential project near Old Dhamtari Road, marking its entry into the fast-developing corridor and strengthening its footprint in new geographies.

- In April 2025, Oberoi Realty Limited launched Elysian Tower D in Oberoi Garden City, Goregaon, Mumbai. This luxury tower recorded gross bookings of around ₹970 crore for nearly 2.1 lakh sq. ft. of carpet area. The Elysian project is part of Oberoi’s integrated township development, designed for premium urban residences with curated amenities.

Market Concentration & Characteristics:

The India Real Estate Market is moderately concentrated, with a few dominant players controlling significant market share across urban hubs, while regional developers cater to local demand. It is characterized by high capital intensity, cyclical demand patterns, and strong regulatory influence. Competitive differentiation emerges from sustainability practices, digital integration, and large-scale township projects. It remains sensitive to macroeconomic conditions, policy reforms, and consumer sentiment.

Report Coverage:

The research report offers an in-depth analysis based on Property Type and Construction Stage. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for residential housing will accelerate with urbanization and rising income levels.

- Commercial real estate will expand with IT hubs and co-working spaces gaining traction.

- Tier 2 cities will attract investments due to infrastructure growth and affordability.

- NRI participation will strengthen in luxury and metro-based projects.

- Affordable housing will remain a key driver, supported by government initiatives.

- Adoption of green buildings and smart technologies will enhance project value.

- Institutional investment will increase in warehousing, retail, and office segments.

- Consolidation among developers will intensify competition and improve efficiency.

- Policy reforms and RERA enforcement will ensure transparency and accountability.

- Market resilience will depend on economic growth, interest rates, and consumer confidence.