Market Overview:

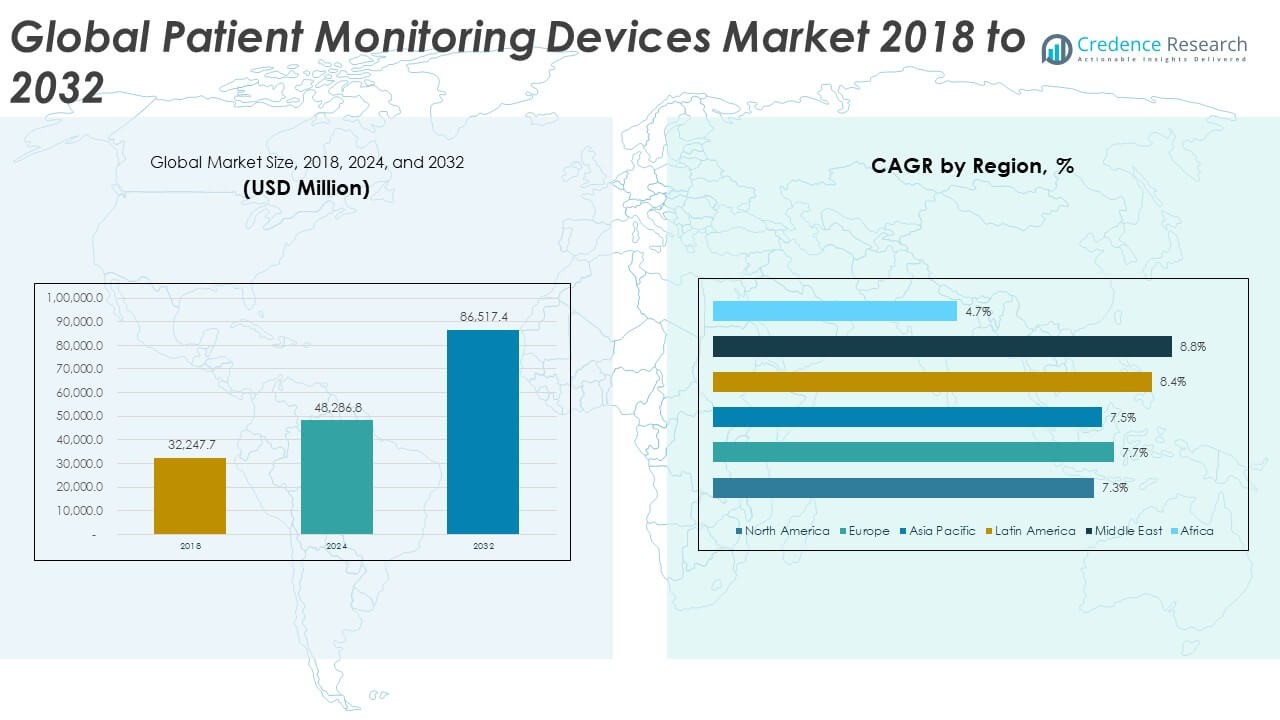

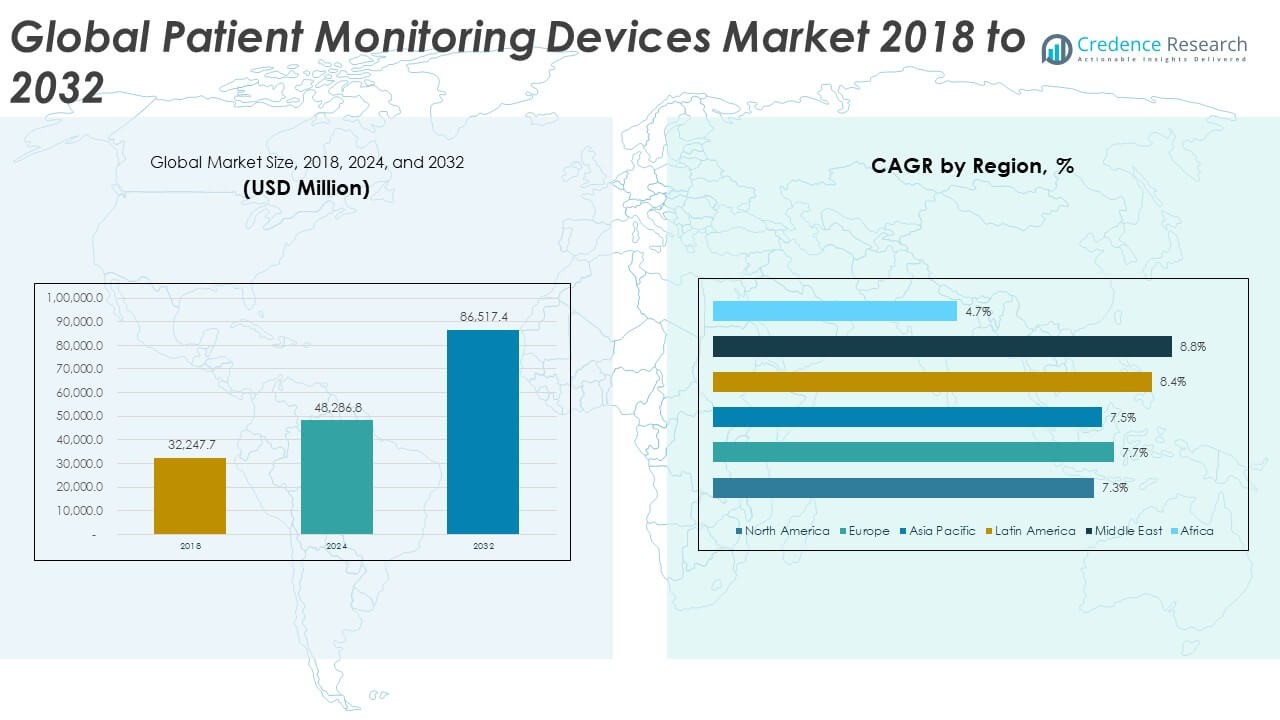

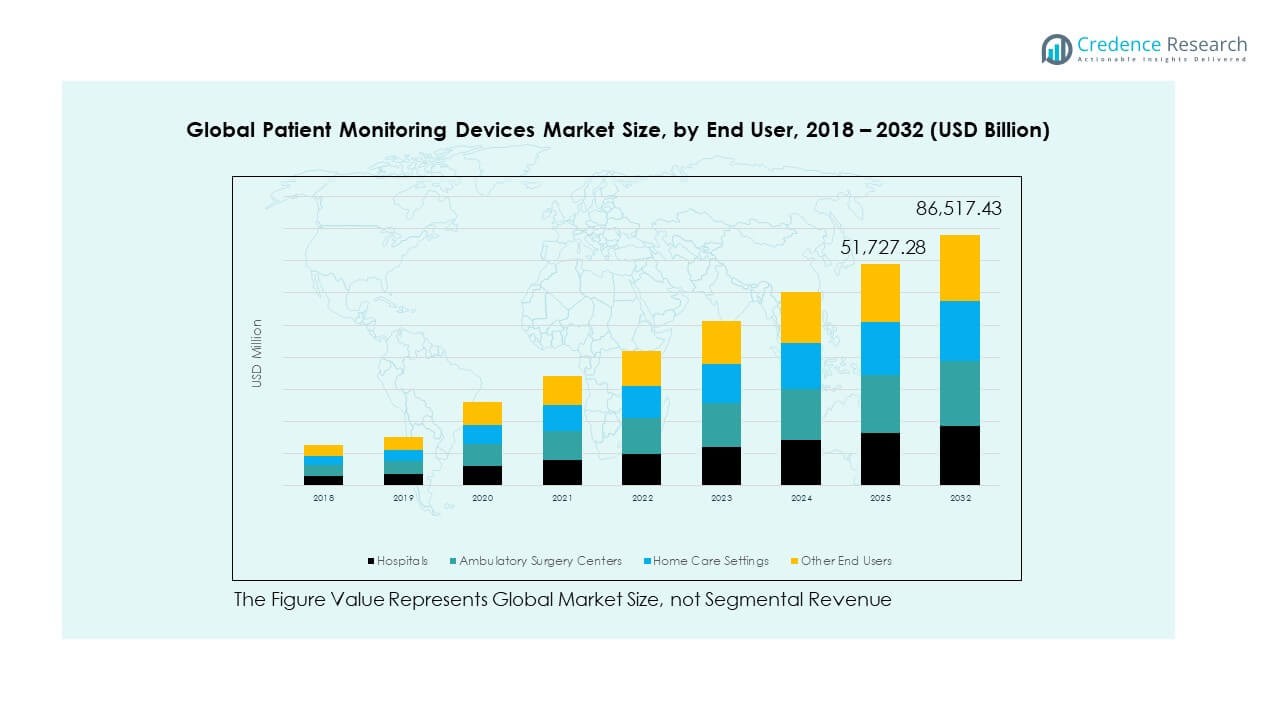

The Global Patient Monitoring Devices Market size was valued at USD 32,247.7 million in 2018 to USD 48,286.8 million in 2024 and is anticipated to reach USD 86,517.4 million by 2032, at a CAGR of 7.62% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Patient Monitoring Devices Market Size 2024 |

USD 48,286.8 Million |

| Patient Monitoring Devices Market, CAGR |

7.62% |

| Patient Monitoring Devices Market Size 2032 |

USD 86,517.4 Million |

The market growth is driven by rising demand for continuous health tracking and remote monitoring solutions. Increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and respiratory conditions fuels adoption across hospitals and homecare settings. The integration of wearable technologies and telehealth platforms enhances patient outcomes, enabling real-time data sharing and early diagnosis. Growing geriatric populations and focus on preventive healthcare also contribute to market expansion.

North America leads the Global Patient Monitoring Devices Market due to advanced healthcare infrastructure and strong adoption of digital health technologies. Europe follows closely, supported by favorable reimbursement systems and government initiatives promoting remote care. Asia-Pacific is emerging as the fastest-growing region, driven by improving healthcare access, rising awareness of early diagnosis, and increased investment in telemedicine across China, India, and Southeast Asia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Patient Monitoring Devices Market size was valued at USD 32,247.7 million in 2018, reached USD 48,286.8 million in 2024, and is expected to hit USD 86,517.4 million by 2032, growing at a CAGR of 7.62%.

- Asia Pacific holds the largest share at 35%, driven by strong healthcare digitization, population growth, and government support for connected health. Europe follows with 27%, supported by telehealth initiatives and aging demographics, while North America captures 19% due to advanced infrastructure and early technology adoption.

- The Middle East is the fastest-growing region with a CAGR of 8.8%, supported by high investments in smart hospitals, digital transformation, and increased private healthcare spending.

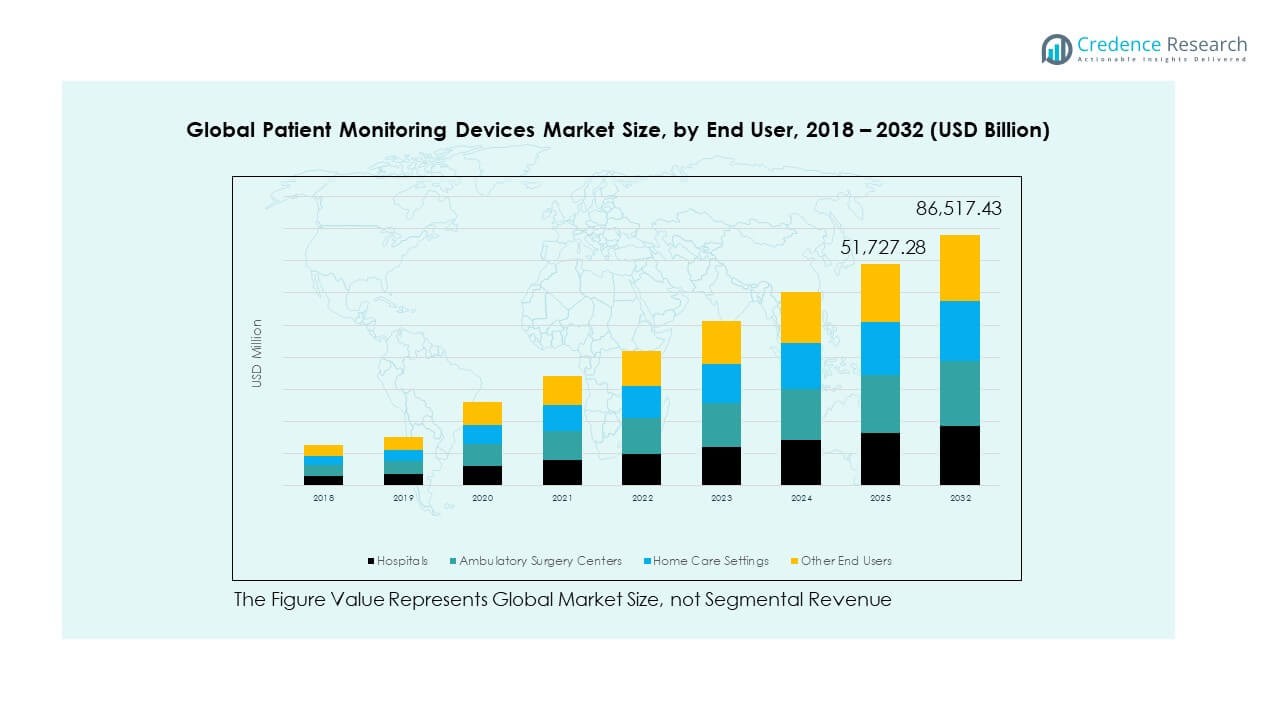

- Hospitals account for the largest share of the market, contributing about 40% of total demand, as they remain primary users of multi-parameter and critical care monitoring systems.

- Home care settings represent roughly 30% of the market, driven by rising telemedicine use, aging populations, and increasing preference for remote, continuous health tracking.

Market Drivers:

Rising Burden of Chronic and Lifestyle Diseases

The Global Patient Monitoring Devices Market is driven by the growing incidence of chronic diseases such as diabetes, hypertension, and cardiovascular disorders. Continuous monitoring solutions support early detection and better disease management. Patients and healthcare providers rely on these devices to track vital signs and treatment responses in real time. The shift from episodic care to preventive monitoring strengthens device adoption. Increased hospital admissions and the need for post-acute care further drive demand. Wearable and portable monitors are improving patient convenience. Growing healthcare spending supports widespread adoption. This trend continues to fuel the overall market expansion.

- For instance, Philips launched its IntelliVue MX750 patient monitor, which offers real-time monitoring of up to 12 vital sign waves per display and supports wireless hospital integration with 19-inch full HD touchscreen, enhancing care for thousands of ICU patients each month in critical hospital networks.

Growing Adoption of Telemedicine and Remote Patient Care

Telemedicine platforms are transforming healthcare delivery by connecting patients and clinicians through digital tools. The demand for remote monitoring devices has surged due to convenience, reduced hospital visits, and pandemic-driven healthcare shifts. The integration of cloud-based data systems enables accurate and secure patient tracking. Hospitals and homecare settings are adopting IoT-enabled monitors for real-time feedback. Remote monitoring enhances efficiency and improves long-term outcomes. It supports cost-effective chronic care management, particularly for elderly and rural populations. Rising smartphone use and connectivity improvements strengthen accessibility. These advancements continue to propel industry growth.

- For instance, Medtronic CareLink SmartSync™, a tablet-powered cardiac device manager, enables Bluetooth-based wireless monitoring for almost all Medtronic cardiac implants, allowing hospitals to remotely interrogate patient devices and manage care efficiently from any setting.

Technological Advancements Enhancing Diagnostic Accuracy

Innovation in sensor technology, wireless communication, and artificial intelligence is revolutionizing patient monitoring. The market benefits from AI-driven analytics that enable predictive insights and clinical decision support. Enhanced device accuracy reduces diagnostic errors and supports continuous assessment. Integration with electronic health records streamlines patient management and improves care coordination. The use of miniaturized sensors increases comfort and portability. Smart wearables and implantable monitors enhance compliance and usability. These technologies allow healthcare providers to intervene earlier in critical cases. Continuous research investment sustains rapid product evolution and market momentum.

Increasing Aging Population and Home Healthcare Demand

Rising life expectancy and growing geriatric populations are creating strong demand for home-based care solutions. The elderly often require constant health supervision for chronic conditions and mobility limitations. Portable and user-friendly devices support independence and comfort at home. Healthcare systems encourage remote monitoring to reduce hospital readmissions and operational costs. It enhances quality of life while maintaining medical oversight. Governments and insurers promote homecare adoption through reimbursement programs. The shift toward value-based care strengthens the relevance of monitoring systems. This demographic trend remains a central growth factor for the market.

Market Trends:

Integration of Artificial Intelligence and Predictive Analytics

The Global Patient Monitoring Devices Market is witnessing strong adoption of AI and data analytics tools. These technologies enable advanced pattern recognition and real-time clinical alerts. Predictive analytics help in anticipating health deterioration and guiding timely intervention. AI algorithms enhance the interpretation of ECGs, oxygen saturation, and glucose levels. Hospitals use analytics platforms to optimize workflows and personalize treatment. Integration with digital health records simplifies data exchange. Continuous development of machine learning models is refining accuracy and usability. This digital evolution strengthens the market’s innovation landscape.

- For instance, GE HealthCare announced its intention to introduce the Edison Digital Health Platform in 2022, integrating clinical workflow and AI tools for aggregated analysis. The platform supports actionable insights from millions of patient data points and enables hospitals to deploy predictive algorithms for early intervention and workflow optimization.

Expansion of Wearable and Wireless Monitoring Technologies

Wearable devices are transforming how patients track health parameters daily. Lightweight, wireless, and sensor-based monitors increase comfort and mobility. The convenience of continuous monitoring supports preventive care and patient engagement. Sports, fitness, and wellness applications further expand consumer adoption. Hospitals are adopting connected wearables to observe outpatients remotely. The use of Bluetooth and cloud connectivity ensures seamless data transmission. These innovations bridge gaps between personal and clinical monitoring. The trend promotes integration of consumer electronics with professional healthcare devices.

- For instance, the Apple Watch Series 9, released in September 2023, provides heart rate and blood oxygen measurements using photoplethysmography technology. The heart rate sensor is considered accurate for resting heart rate, though less consistent during intense exercise. However, due to a patent dispute with Masimo, new Apple Watch Series 9 units sold in the U.S. initially had the blood oxygen feature disabled.

Shift Toward Personalized and Real-Time Healthcare

Personalized medicine is influencing the design of monitoring systems worldwide. Devices now collect real-time data tailored to individual health profiles. Advanced biosensors measure vital signs with improved accuracy and contextual insights. Real-time updates allow immediate clinical responses to health fluctuations. Patients gain greater control over treatment through self-monitoring applications. This approach supports precision-based healthcare delivery. Hospitals and diagnostic centers benefit from continuous feedback loops. The personalization trend aligns closely with the digital transformation of global healthcare systems.

Regulatory Focus on Data Security and Device Interoperability

Regulatory bodies are emphasizing data integrity, cybersecurity, and interoperability among patient monitoring systems. Strict compliance requirements ensure safe transmission of patient information. Manufacturers are prioritizing encrypted communication and secure cloud storage. Interoperable systems support seamless integration with hospital information networks. Governments worldwide are updating guidelines for connected medical devices. These frameworks strengthen trust in digital health infrastructure. Companies investing in compliance and cybersecurity are gaining competitive advantage. This regulatory alignment supports sustainable market growth and technological reliability.

Market Challenges Analysis:

High Cost of Advanced Monitoring Systems and Integration Barriers

The Global Patient Monitoring Devices Market faces cost-related challenges limiting adoption in low-income and resource-constrained settings. Advanced systems integrating IoT, AI, and wireless technologies often require substantial investment. Hospitals and clinics with limited budgets struggle to upgrade legacy systems. Integration with existing IT infrastructure can be complex and time-consuming. Maintenance and software updates add recurring costs for healthcare providers. The high cost of continuous monitoring devices restricts homecare adoption in emerging economies. Limited insurance coverage in several regions slows market penetration. Addressing affordability and interoperability remains essential for broader utilization.

Data Privacy Concerns and Lack of Skilled Healthcare Professionals

The rise of connected monitoring devices increases vulnerability to data breaches and cybersecurity threats. Patients and providers express concerns about unauthorized access to health information. Healthcare institutions face regulatory scrutiny over data protection measures. The shortage of skilled professionals capable of managing advanced digital tools hampers efficiency. Training programs and standardization remain inadequate in many healthcare systems. Connectivity disruptions and device malfunctions can affect reliability. These factors reduce confidence among patients and practitioners. Overcoming such technical and human resource challenges is crucial for sustained market confidence.

Market Opportunities:

Rising Investments in Telehealth and Digital Healthcare Infrastructure

The Global Patient Monitoring Devices Market is gaining opportunities from the global expansion of telehealth networks. Governments and private players are funding digital healthcare projects and virtual care programs. Increased investment in broadband and cloud infrastructure enables remote access to healthcare services. Partnerships between device manufacturers and telemedicine platforms are growing. Rural and underserved regions present strong potential for connected care solutions. These initiatives support scalable healthcare delivery and long-term cost efficiency. The digital shift is creating new revenue channels for monitoring system providers.

Emergence of AI-Based Predictive and Preventive Healthcare Solutions

AI-powered diagnostic and predictive monitoring tools are creating new business opportunities. Continuous algorithmic improvements enhance detection accuracy and reduce false alerts. Startups and established firms are focusing on smart wearable solutions with multi-parameter analysis. The integration of AI with IoT devices strengthens real-time intervention capabilities. Healthcare providers can improve treatment planning using continuous data streams. Expanding adoption in home healthcare and chronic disease management broadens application scope. The innovation pipeline ensures ongoing opportunities for device differentiation and competitive growth.

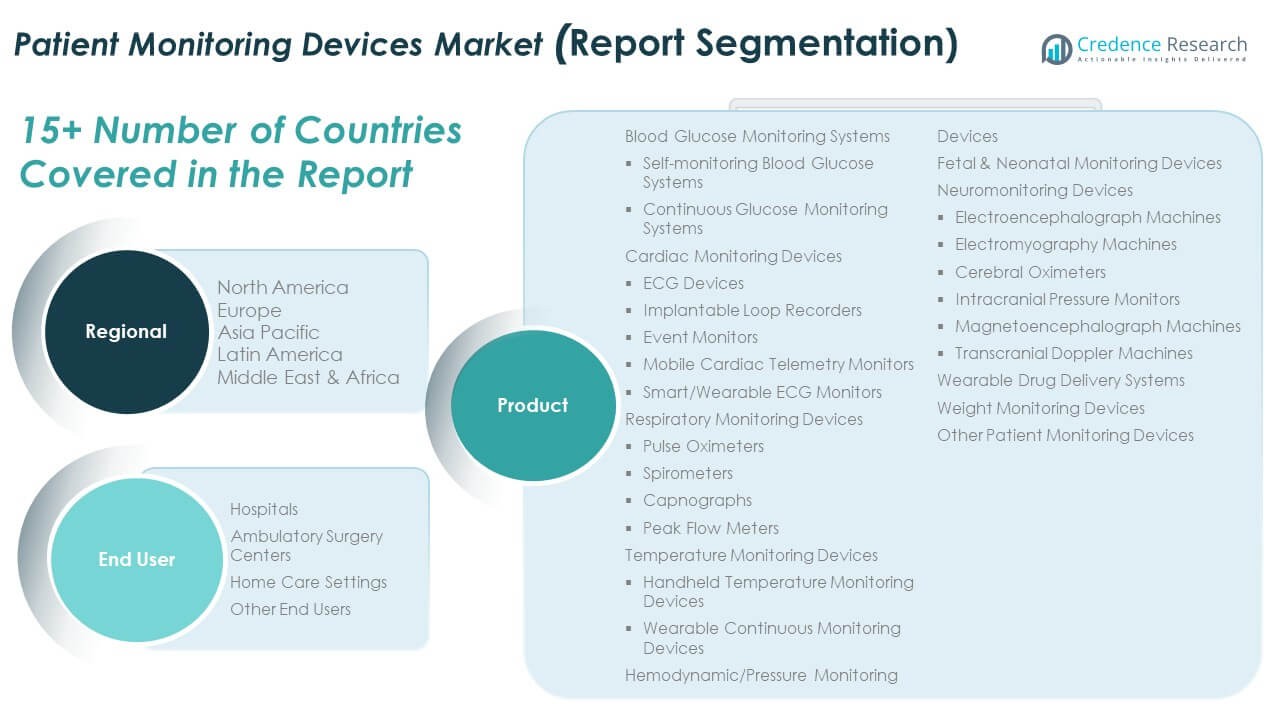

Market Segmentation Analysis:

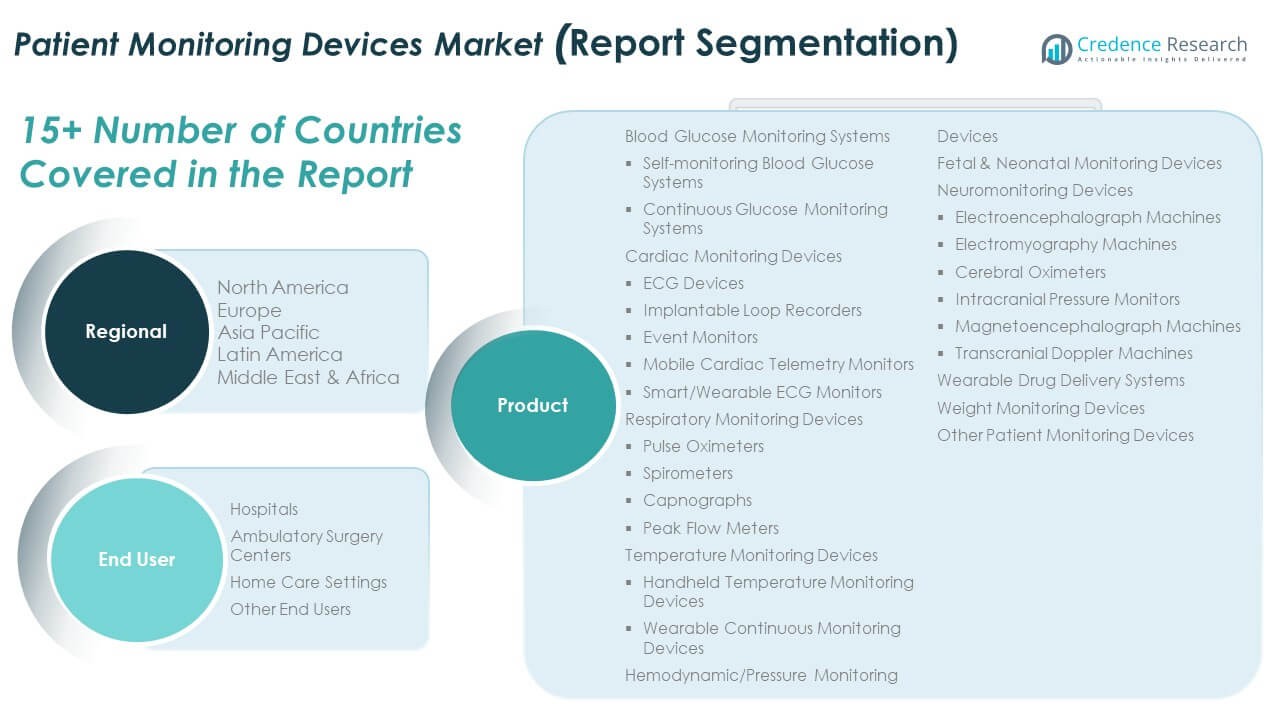

Product Segment

The Global Patient Monitoring Devices Market is segmented into blood glucose monitoring systems, cardiac monitoring devices, respiratory monitoring devices, temperature monitoring devices, hemodynamic or pressure monitoring devices, fetal and neonatal monitoring devices, neuromonitoring devices, wearable drug delivery systems, weight monitoring devices, and other monitoring systems. Cardiac and blood glucose monitoring systems hold significant market share due to the high prevalence of cardiovascular and diabetic conditions. Respiratory and temperature monitoring devices are gaining traction with the growing demand for critical care and infection control solutions. Neuromonitoring and wearable drug delivery systems are emerging as high-growth categories supported by innovation in wearable technologies and wireless integration.

- For instance, Abbott’s FreeStyle Libre 3 system, cleared by the FDA in 2023, provides continuous glucose readings every minute with a mean absolute relative difference (MARD) of 7.8% for accuracy, and has been adopted by over 4 million diabetes patients worldwide for minute-level tracking and direct cloud integration.

End User Segment

By end user, the market is classified into hospitals, ambulatory surgery centers, home care settings, and other end users. Hospitals dominate due to the need for continuous monitoring in intensive care and surgical units. Ambulatory surgery centers are expanding their adoption of compact and wireless monitoring equipment to enhance procedural safety and recovery management. Home care settings are witnessing rapid growth driven by rising telehealth adoption and increasing demand for remote patient management. The transition toward value-based healthcare and personalized treatment models supports strong growth across all end-user categories, strengthening the market’s long-term outlook.

- For instance, Nihon Kohden launched the Life Scope® G7 patient monitor in the U.S. in October 2022, offering advanced bedside monitoring with a 19-inch touchscreen and configurable drug/pulmonary calculation tools, which are helping hundreds of hospitals nationwide streamline workflows and reduce patient transfer interruptions with multi-bed wireless connectivity.

Segmentation:

- Product Segment

- Blood Glucose Monitoring Systems

- Cardiac Monitoring Devices

- Respiratory Monitoring Devices

- Temperature Monitoring Devices

- Hemodynamic/Pressure Monitoring Devices

- Fetal & Neonatal Monitoring Devices

- Neuromonitoring Devices

- Wearable Drug Delivery Systems

- Weight Monitoring Devices

- Other Patient Monitoring Devices

- End User Segment

- Hospitals

- Ambulatory Surgery Centers

- Home Care Settings

- Other End Users

- Regional Segment

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Regional Analysis:

North America

The North America Global Patient Monitoring Devices Market size was valued at USD 6,378.60 million in 2018 to USD 9,395.93 million in 2024 and is anticipated to reach USD 16,464.27 million by 2032, at a CAGR of 7.3% during the forecast period. North America holds a market share of 19% in the global landscape. The region’s dominance is supported by advanced healthcare infrastructure, high adoption of digital monitoring systems, and increasing prevalence of chronic diseases. Strong reimbursement policies and healthcare digitization initiatives drive the use of wireless and remote monitoring devices. The U.S. leads regional demand with robust investments in telehealth and AI-based medical technologies. Canada and Mexico follow with expanding home healthcare services and growing awareness of preventive monitoring. The region benefits from the presence of key players and early regulatory approvals that accelerate innovation. Continuous product development and data integration capabilities sustain market growth.

Europe

The Europe Global Patient Monitoring Devices Market size was valued at USD 8,619.82 million in 2018 to USD 12,962.95 million in 2024 and is anticipated to reach USD 23,359.71 million by 2032, at a CAGR of 7.7% during the forecast period. Europe accounts for 27% of the global share, driven by supportive healthcare reforms and increased focus on home-based monitoring solutions. The UK, Germany, and France lead regional adoption due to strong hospital infrastructure and government-backed telehealth programs. Rising demand for continuous glucose monitoring and cardiac tracking devices supports market expansion. The region’s aging population further accelerates the use of portable and wearable systems. The European Union’s data protection framework encourages trusted digital adoption among patients. Innovation in wireless technologies and growing investments in AI integration enhance competitiveness. Partnerships between hospitals and technology companies strengthen the region’s digital health ecosystem.

Asia Pacific

The Asia Pacific Global Patient Monitoring Devices Market size was valued at USD 11,502.77 million in 2018 to USD 17,085.26 million in 2024 and is anticipated to reach USD 30,281.10 million by 2032, at a CAGR of 7.5% during the forecast period. Asia Pacific represents 35% of the global share, making it the largest regional market. Rapid urbanization, growing healthcare expenditure, and the expansion of hospital infrastructure drive market demand. China, Japan, and India lead growth, supported by strong investments in digital health technologies and AI-driven diagnostic tools. The rising prevalence of chronic diseases and expanding middle-class population create strong adoption opportunities. Governments are promoting telemedicine and homecare to address healthcare accessibility challenges. Technological advancements in wearable sensors and wireless monitoring are shaping consumer behavior. Local manufacturing initiatives and regulatory modernization are supporting regional self-sufficiency and competitive pricing.

Latin America

The Latin America Global Patient Monitoring Devices Market size was valued at USD 3,440.83 million in 2018 to USD 5,406.75 million in 2024 and is anticipated to reach USD 10,295.57 million by 2032, at a CAGR of 8.4% during the forecast period. Latin America contributes 12% of the global market share, reflecting steady adoption of connected healthcare systems. Brazil and Mexico dominate with increasing healthcare modernization and hospital investments. Public-private collaborations are improving accessibility to monitoring technologies. The expansion of telemedicine during the pandemic accelerated remote patient care adoption. Economic recovery and the growing private healthcare sector are creating favorable conditions for device deployment. Rising awareness of chronic disease management supports growth in home monitoring solutions. Companies are focusing on cost-effective, portable, and easy-to-use devices to reach rural and semi-urban markets. Regulatory reforms and healthcare digitization continue to stimulate market growth.

Middle East

The Middle East Global Patient Monitoring Devices Market size was valued at USD 1,399.55 million in 2018 to USD 2,252.93 million in 2024 and is anticipated to reach USD 4,412.39 million by 2032, at a CAGR of 8.8% during the forecast period. The region holds a 5% market share, supported by rapid investments in healthcare innovation and smart hospital development. GCC countries lead with digital transformation initiatives and government-backed telehealth projects. Increased healthcare expenditure and high-income population segments drive premium device adoption. Hospitals are integrating IoT-based monitoring systems to enhance patient outcomes. Israel’s technology ecosystem contributes to advancements in remote and AI-assisted monitoring. The shift toward preventive and precision healthcare fosters continuous device upgrades. Growing collaborations with global medtech companies further enhance innovation capacity. The expanding private healthcare network continues to sustain long-term growth.

Africa

The Africa Global Patient Monitoring Devices Market size was valued at USD 906.16 million in 2018 to USD 1,183.03 million in 2024 and is anticipated to reach USD 1,704.39 million by 2032, at a CAGR of 4.7% during the forecast period. Africa accounts for 2% of the global share, showing steady progress in adopting modern healthcare technologies. Limited healthcare infrastructure and affordability challenges slow penetration in rural areas. South Africa leads the market, supported by private healthcare investment and digital innovation programs. Egypt and Nigeria are emerging with growing interest in telemedicine and home-based monitoring. International aid programs and non-government partnerships are helping bridge equipment shortages. Mobile health platforms are improving access to diagnostics and monitoring in underserved regions. The rise in chronic diseases and focus on maternal and neonatal health are driving gradual device uptake. Market expansion depends on affordability, awareness, and local production capability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Koninklijke Philips N.V.

- Welch Allyn

- GE Healthcare

- Medtronic

- Masimo Corporation

- OMRON Corporation

- Mindray Medical India Pvt. Ltd.

- Narang Medical

- BPL Medical Technologies

- Nihon Kohden

Competitive Analysis:

The Global Patient Monitoring Devices Market is highly competitive, driven by innovation and strong product diversification. It features established multinational corporations and emerging digital health startups. Companies focus on expanding portfolios through wireless, wearable, and AI-enabled devices. Strategic mergers and R&D investments strengthen their technological capabilities. Pricing strategies and product differentiation help maintain customer loyalty in hospitals and homecare markets. North America and Europe dominate due to the presence of major players, while Asia Pacific attracts new entrants through local manufacturing and government support. It continues to evolve with continuous innovation, forming a landscape defined by collaboration, technology integration, and performance-based solutions.

Recent Developments:

- In September 2025, Philips launched a next-generation smart telemetry platform for cardiac monitoring, designed to provide continuous enterprise-wide connectivity, streamline alarm management, and improve workflow automation in hospital patient monitoring. This innovation aims to reduce cognitive overload for frontline teams and improve clinical decision-making across cardiac care settings.

- In September 2025, Baxter, following its acquisition of Hillrom and the Welch Allyn portfolio, launched the Welch Allyn Connex 360 Vital Signs Monitor—a connected patient monitoring platform aimed at advancing hospital workflow and continuous vital sign tracking. The launch reflects Baxter’s strategy to expand into the high-acuity patient monitoring segment post-acquisition. Hillrom acquired Welch Allyn in previous years as part of an ongoing strategy to diversify point-of-care diagnostics and monitoring solutions.

- On June 30, 2025, Medtronic and Philips announced an expanded strategic partnership focused on deploying next-generation patient monitoring technologies. This renewed agreement integrates key Medtronic technologies—including Nellcor pulse oximetry, Microstream capnography, and BIS brain monitoring—into Philips’ multi-parameter devices and streamlines supply bundles for hospitals worldwide.

- In September 2025, Masimo renewed and expanded its multi-year strategic partnership with Philips, expediting the implementation of advanced Masimo monitoring innovations (including SET® pulse oximetry and Radius PPG wearable sensors) into Philips multi-patient monitors and next-gen AI solutions. The deal sets the stage for co-developing artificial intelligence-based measurement technologies and integrated wearable devices to extend their global reach and clinical impact.

Report Coverage:

The research report offers an in-depth analysis based on Product Segment and End User Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing adoption of wearable and wireless monitoring systems.

- Growing integration of AI and predictive analytics in patient management.

- Expansion of remote healthcare and telemedicine infrastructure.

- Rising demand for homecare monitoring in aging populations.

- Continuous product innovation in biosensors and IoT devices.

- Increased focus on cybersecurity and patient data protection.

- Strong market entry of regional manufacturers in Asia and Latin America.

- Strategic partnerships between healthcare providers and device firms.

- Greater emphasis on value-based healthcare delivery models.

- Sustainable growth driven by digitization and connected ecosystems.