Market Overview:

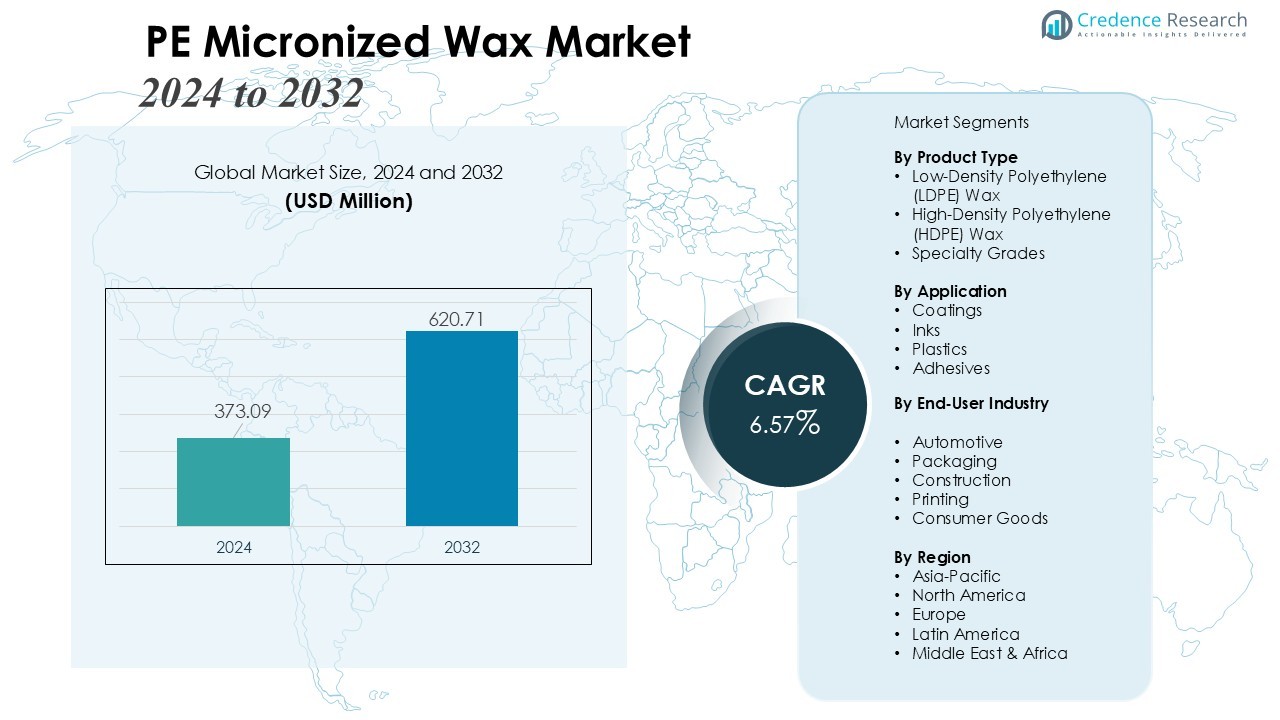

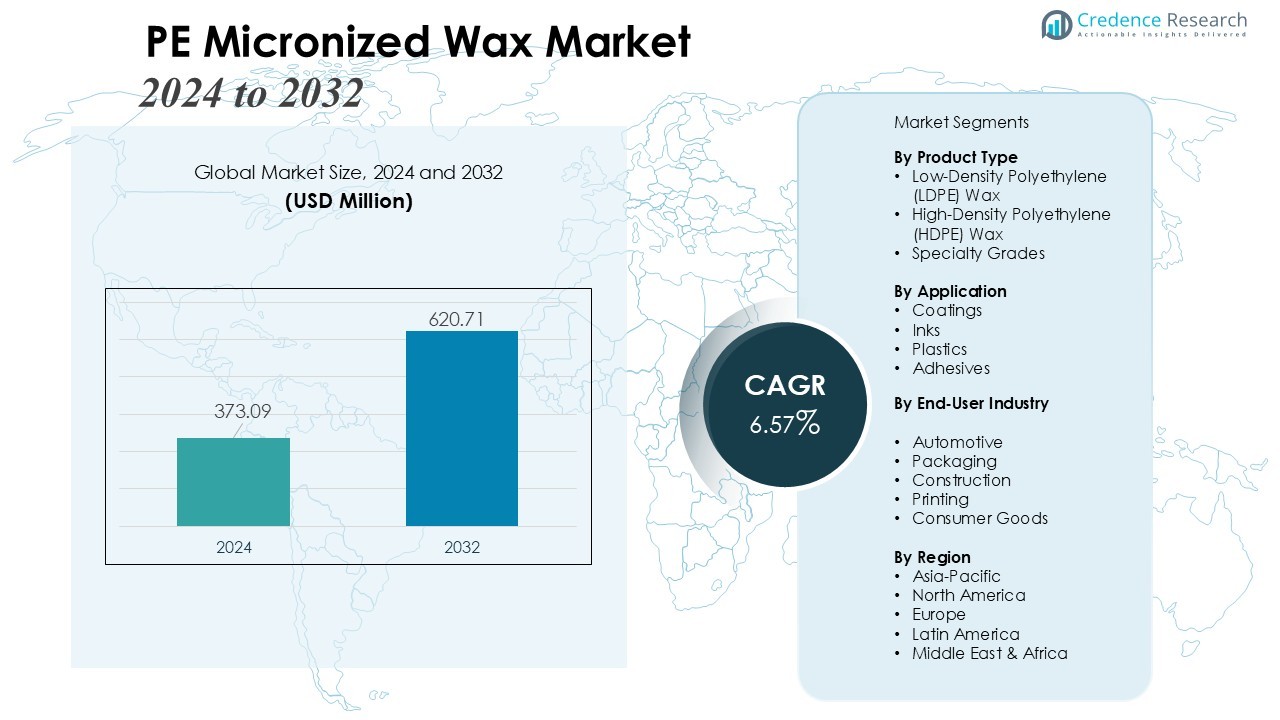

The PE Micronized Wax Market size was valued at USD 373.09 million in 2024 and is anticipated to reach USD 620.71 million by 2032, at a CAGR of 6.57% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| PE Micronized Wax Market Size 2024 |

USD 373.09 Million |

| PE Micronized Wax Market, CAGR |

6.57% |

| PE Micronized Wax Market Size 2032 |

USD 620.71 Million |

Key market drivers include the growing need for high-performance coating formulations, advancements in polymer processing, and wider adoption of specialty additives in automotive, packaging, and industrial manufacturing. The shift toward environmentally compliant and durable surface finishes further increases the use of micronized PE wax in water-based and solvent-based systems. In addition, continuous product innovation and customized wax solutions contribute to broader market penetration.

Regionally, Asia-Pacific remains the dominant market, supported by strong manufacturing activity and rising consumption in China, India, and Southeast Asia. North America and Europe maintain steady demand driven by advanced industrial applications and high-quality coating requirements. Emerging markets in Latin America and the Middle East also show stable growth as industrialization and infrastructure development accelerate.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The PE Micronized Wax Market reached USD 373.09 million in 2024 and is set to grow to USD 620.71 million by 2032, supported by a CAGR of 6.57% during the forecast period.

- Demand strengthens due to the need for high-performance coating systems that offer enhanced durability, surface protection, and premium finishing qualities.

- Advancements in polymer processing and the pursuit of consistent manufacturing outputs expand adoption across plastics, packaging, and engineered materials.

- The printing inks and adhesives sectors boost consumption through requirements for better slip, anti-blocking properties, and rub resistance in high-speed production environments.

- Market challenges include volatility in polyethylene feedstock costs and competition from alternative additives offering superior heat or wear resistance for specific applications.

- Asia-Pacific leads global consumption with a 45% share, while North America holds 25% and Europe accounts for 20%, reflecting strong industrial demand across mature and emerging regions.

- Rising sustainability requirements promote the use of micronized PE wax in eco-friendly, low-VOC, and water-based formulations, creating long-term growth opportunities.

Market Drivers:

Market Drivers:

Rising Demand for High-Performance Coating Additives

The PE Micronized Wax Market benefits from strong adoption in advanced coating systems that require improved durability and surface protection. Manufacturers rely on it to enhance abrasion resistance, slip, and gloss control across industrial, automotive, and architectural coatings. Growing focus on high-quality finishes supports the integration of micronized PE wax into both solvent-based and water-based formulations. The shift toward premium coating performance strengthens long-term demand.

- For Instance, Micronized PE waxes, including those from BASF like Luwax AF 32 mikropulver, enhance scratch and abrasion resistance in coatings such as powder coatings.

Expanding Use in Plastics and Polymer Processing

Growing emphasis on processing efficiency and product consistency supports the use of micronized PE wax in plastics manufacturing. The market leverages its ability to improve melt flow, reduce friction, and support uniform dispersion in polymer matrices. Demand rises from sectors such as packaging, consumer goods, and engineered plastics where stable processing conditions remain essential. The PE Micronized Wax Market gains momentum from innovation in polymer technologies and rising production volumes.

- For instance, the addition of maleic anhydride grafted PE wax (such as a Clariant product) to MH/LLDPE composites significantly enhances the interfacial bonding between the filler and the matrix, which generally results in improved tensile strength and elongation at break.

Increased Application in Printing Inks and Adhesives

The printing inks and adhesives sectors drive significant consumption due to the wax’s performance benefits. It enhances rub resistance, anti-blocking behavior, and slip without compromising clarity or adhesion. Modern packaging and label printing standards require materials that deliver consistent results at high production speeds. The PE Micronized Wax Market responds to this need through tailored grades that support diverse flexographic, gravure, and digital printing processes.

Regulatory Push Toward Safer and Sustainable Formulations

Stricter environmental policies encourage manufacturers to adopt safer and more stable additive solutions. Micronized PE wax supports compliance efforts due to its low toxicity, clean formulation profile, and compatibility with eco-friendly systems. Demand rises from industries that prioritize regulatory alignment, durability, and reduced emissions. The PE Micronized Wax Market benefits from this shift toward sustainable production practices and high-performance material standards.

Market Trends:

Growing Shift Toward High-Performance and Specialty Formulations

The PE Micronized Wax Market observes a clear transition toward high-performance and specialty grades tailored for advanced industrial needs. Formulators prefer engineered waxes that offer controlled particle size, improved thermal stability, and enhanced compatibility with modern coating and ink systems. Demand increases for grades that support premium finishes, low-VOC coatings, and precision surface modification. It aligns with the market’s move toward materials that provide consistent performance across diverse applications. Manufacturers expand their portfolios to meet requirements in automotive coatings, wood finishes, and high-speed printing lines. Companies invest in R&D to refine production technologies that deliver tighter quality standards. Adoption of specialty additives strengthens the position of high-value wax solutions in global markets.

- For instance, Clariant’s micronized PE wax achieves a particle size distribution of 2-10 micrometers, enabling superior dispersion in coatings.

Rising Adoption of Sustainable, Low-Emission, and Water-Based Systems

The PE Micronized Wax Market benefits from the growing momentum behind sustainable and low-emission product development. Regulatory pressure and industry preference drive a shift toward water-based and eco-friendly formulations that rely on micronized PE wax for performance enhancement. It enables improved durability, scratch resistance, and processing stability without compromising environmental expectations. Manufacturers focus on producing cleaner-grade waxes that meet evolving safety and sustainability criteria. Growing demand for materials compatible with green coatings, recyclable packaging, and advanced ink technologies supports wider adoption. Companies strengthen supply chains to ensure reliable access to compliant raw materials. Expansion of sustainable product lines reinforces the long-term market direction toward eco-conscious innovation.

- For Instance, Clariant’s Licomont PE-based additives can be jet milled to very fine particle sizes (with D90 particle sizes potentially achievable around sub-5 µm) for use as high-performance synthetic wax additives in eco-coatings and other applications.

Market Challenges Analysis:

Volatile Raw Material Costs and Supply Chain Constraints

The PE Micronized Wax Market faces challenges linked to fluctuations in raw material prices and supply chain inconsistencies. Price variations in polyethylene feedstock influence production costs and limit the ability of manufacturers to maintain stable pricing. It creates pressure on margins for small and mid-sized producers that rely on predictable procurement conditions. Supply chain disruptions, freight delays, and limited availability of high-grade inputs restrict production planning. Companies must invest in strategic sourcing and inventory management to reduce exposure to volatility. Market participants navigate these constraints to sustain product quality and delivery commitments.

Competition from Alternative Additives and Performance Limitations

The PE Micronized Wax Market competes with substitutes such as PTFE waxes, amide waxes, and specialty synthetic additives that offer targeted performance benefits. Some applications require enhanced heat resistance or extreme durability, which limits the suitability of micronized PE wax in specific formulations. It pushes manufacturers to innovate and develop improved grades that address these performance gaps. End-users demand additive solutions that meet strict regulatory and processing requirements, raising expectations for consistency and compatibility. Competitive pressure increases the need for differentiation in value-added features. Producers strengthen technical support and application testing to maintain relevance in evolving markets.

Market Opportunities:

Expansion Across High-Growth Industrial and Specialty Applications

The PE Micronized Wax Market gains strong opportunities from rising demand in coatings, inks, plastics, and adhesives that require enhanced surface performance. Market expansion into automotive refinishing, wood coatings, and metal protection creates new avenues for product adoption. It supports advanced formulations that need controlled particle size, high purity, and improved stability. Growth in flexible packaging and high-speed printing increases the need for wax additives that deliver better rub resistance and slip. Producers can introduce tailored grades for niche applications where performance differentiation is critical. Investment in application-focused R&D strengthens market penetration across diverse end-use sectors.

Rising Demand for Sustainable and Low-Emission Product Solutions

Global movement toward eco-friendly materials opens new opportunities for micronized PE wax in water-based and low-VOC systems. It aligns with industry efforts to reduce emissions while maintaining durability, scratch resistance, and surface quality. Manufacturers can develop cleaner, compliant wax grades that support stringent environmental standards. Growth in sustainable coatings, recyclable packaging, and bio-based product innovation expands the scope of adoption. Companies that enhance supply chain reliability and introduce energy-efficient production methods gain competitive advantages. Increasing preference for sustainable performance additives reinforces long-term market potential.

Market Segmentation Analysis:

By Product Type

The PE Micronized Wax Market is categorized into low-density polyethylene (LDPE) wax, high-density polyethylene (HDPE) wax, and other specialty grades. LDPE wax dominates applications that require superior flexibility, surface smoothness, and dispersion in coatings and inks. HDPE wax is preferred in plastics and polymer processing due to its hardness, thermal stability, and ability to enhance melt flow. Specialty grades address niche requirements in adhesives, high-performance coatings, and customized industrial formulations. It supports manufacturers in delivering application-specific solutions that meet quality and performance standards.

- For instance, Honeywell International Inc. utilizes polyethylene (PE) wax additives, such as its A-C series waxes, in coating and printing ink formulations to improve surface properties like scratch and mar resistance and enhance gloss levels, supporting superior finishes.

By Application

Key applications include coatings, inks, plastics, and adhesives. Coatings benefit from improved gloss, scratch resistance, and slip control, supporting premium finishes in automotive, architectural, and industrial segments. Inks leverage micronized PE wax to enhance rub resistance, reduce blocking, and improve flow characteristics. Plastics and polymer processing utilize it to optimize melt flow, reduce friction, and achieve uniform dispersion. Adhesives incorporate micronized wax to stabilize viscosity, improve application performance, and maintain clarity. The PE Micronized Wax Market strengthens production efficiency and product quality through these versatile applications.

- For instance, Rallychem’s polyethylene wax additives are used in automotive coatings to improve scratch resistance. These additives work by migrating to the surface during film formation, creating a thin protective layer that reduces friction, thereby preserving gloss and enhancing overall surface durability.

By End-User Industry

The market serves diverse industries including automotive, packaging, construction, printing, and consumer goods. Automotive and construction sectors demand durable coatings and protective finishes that rely on high-performance waxes. Packaging and printing industries require waxes for enhanced slip, anti-blocking, and surface protection in high-speed production. Consumer goods utilize it in plastics, adhesives, and specialty products to improve durability and appearance. It ensures consistent quality and regulatory compliance across industries, driving market growth through end-user adoption.

Segmentations:

By Product Type

- Low-Density Polyethylene (LDPE) Wax

- High-Density Polyethylene (HDPE) Wax

- Specialty Grades

By Application

- Coatings

- Inks

- Plastics

- Adhesives

By End-User Industry

- Automotive

- Packaging

- Construction

- Printing

- Consumer Goods

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Strong Growth Momentum in Asia-Pacific Driven by Industrial Expansion

Asia-Pacific holds 45% market share in the PE Micronized Wax Market. The region maintains the leading position due to strong industrial bases and high consumption across manufacturing sectors. Demand rises from coatings, packaging, plastics, and printing industries supported by expanding production in China, India, and Southeast Asia. It benefits from construction and automotive growth that requires performance-driven coating materials. Investments in local capacity and upgraded processing technologies strengthen regional competitiveness. The availability of cost-efficient raw materials supports continuous adoption in industrial applications.

Steady Demand in North America Supported by Advanced Applications

North America holds 25% market share with stable demand for high-performance micronized wax formulations. The region depends on consistent product quality and compliance with strict regulatory frameworks, driving interest in specialty-grade additives. It supports innovation in automotive refinishing, wood coatings, and engineered plastics where durability and precision remain essential. Growth in low-VOC and sustainable coating demand reinforces the shift toward environmentally aligned wax solutions. Strong R&D capabilities and established manufacturers contribute to a technologically advanced market environment. The region continues to adopt tailored products that meet evolving performance standards.

Consistent Uptake in Europe and Emerging Momentum in Other Regions

Europe holds 20% market share with steady demand supported by stringent quality and environmental regulations. The region integrates micronized PE wax into industrial, architectural, and packaging applications that require compliant and durable materials. It benefits from a mature production ecosystem and strong emphasis on sustainable additive technologies. Latin America and the Middle East & Africa collectively hold 10% market share driven by expanding industrial sectors and rising adoption of surface enhancement additives. Growing investments in manufacturing capacity and modern processing technologies support wider regional integration. These regions create new opportunities for producers seeking diversified global footprints.

Key Player Analysis:

- BASF SE

- Clariant AG

- Honeywell International Inc.

- Mitsui Chemicals, Inc.

- Trecora Resources

- The Lubrizol Corporation

- Westlake Chemical Corporation

- Sasol Limited

- SCG Chemicals Co., Ltd.

- Innospec Inc.

- Micro Powders, Inc.

- Deurex AG

Competitive Analysis:

The PE Micronized Wax Market is highly competitive, driven by both global and regional manufacturers focusing on product innovation, quality, and customer support. Leading players invest in research and development to produce specialty grades that meet specific performance requirements in coatings, plastics, inks, and adhesives. It intensifies competition through customized solutions, regulatory compliance, and sustainable formulations that cater to low-VOC and water-based systems. Companies differentiate themselves by expanding production capacity, improving supply chain efficiency, and forming strategic partnerships with end-users and distributors. Regional players leverage cost-effective production and proximity to growing industrial markets in Asia-Pacific, while North American and European manufacturers focus on high-value specialty waxes and technical service support. Continuous innovation, strong brand reputation, and the ability to address evolving industrial needs define competitive positioning in the market.

Recent Developments:

- In May 2025, Mitsui Chemicals began considering splitting off its Basic & Green Materials business by around 2027 to enable faster decisions, collaborations, and green chemical investments amid challenging market conditions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application, End-User Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and ITALY economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing adoption of high-performance coating formulations will drive sustained demand for micronized PE wax.

- Growth in water-based and low-VOC systems will expand application opportunities across industrial and commercial sectors.

- Continuous product innovation will enable manufacturers to introduce specialty grades tailored to niche requirements.

- Rising demand in plastics and polymer processing will support broader use in packaging, consumer goods, and engineered materials.

- Expansion of the automotive and construction sectors will create opportunities for durable coatings and protective surface finishes.

- Emerging markets in Latin America, the Middle East, and Africa will offer growth potential due to industrialization and infrastructure development.

- Regulatory focus on environmentally safe and sustainable materials will encourage adoption of compliant micronized wax solutions.

- Integration of advanced manufacturing technologies will enhance product consistency, quality, and performance in end-use applications.

- Strategic partnerships and collaborations with end-users will strengthen market presence and technical support capabilities.

- Increasing emphasis on sustainable and recyclable materials in packaging and consumer products will drive long-term adoption of micronized PE wax globally.

Market Drivers:

Market Drivers: